10 Images to Give You the "Eyes of Fire" for a Panoramic Insight into LRT

TechFlow Selected TechFlow Selected

10 Images to Give You the "Eyes of Fire" for a Panoramic Insight into LRT

Where is everyone restaking? Which protocols are most commonly used? What patterns exist in deposit amounts and protocol correlations?

Author: Crypto Koryo

Translation: Frank, Foresight News

The total value locked (TVL) in liquid restaking tokens (LRTs) has reached $3.6 billion, undoubtedly one of the most promising narratives of 2024.

So what are restakers actually doing? How are they allocating their funds? Where are they farming? And which LRT protocols are most frequently used?

To answer these questions, this article provides a comprehensive overview and analysis using 10 exclusive charts on restaker behavior (Note: All data comes from the "LRT whales" dashboard on Dune).

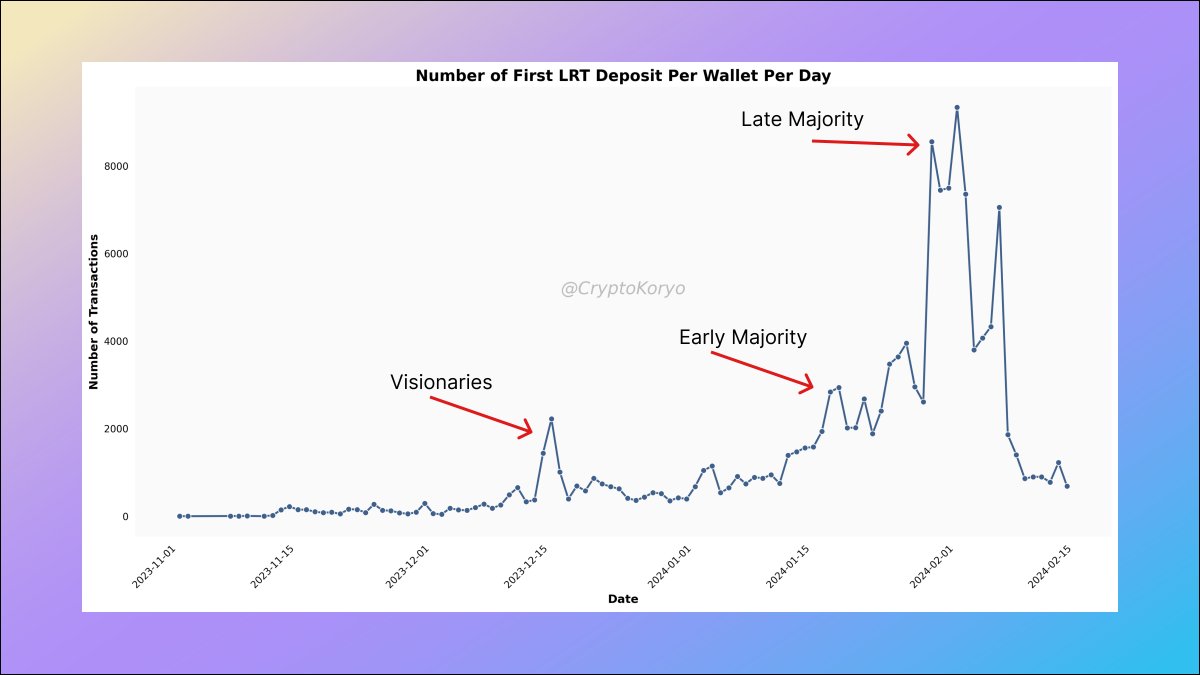

1. Types of Addresses Making First Deposits into LRT Protocols

If we examine all LRT deposit addresses across relevant protocols and analyze the timing concentration of their first LRT deposits, we can identify three waves:

-

Visionaries — December 2023;

-

Early Majority — Late January 2024;

-

Late Majority — Early January 2024.

Incidentally, this is a very common pattern observable during the early development stages of many protocols/narratives.

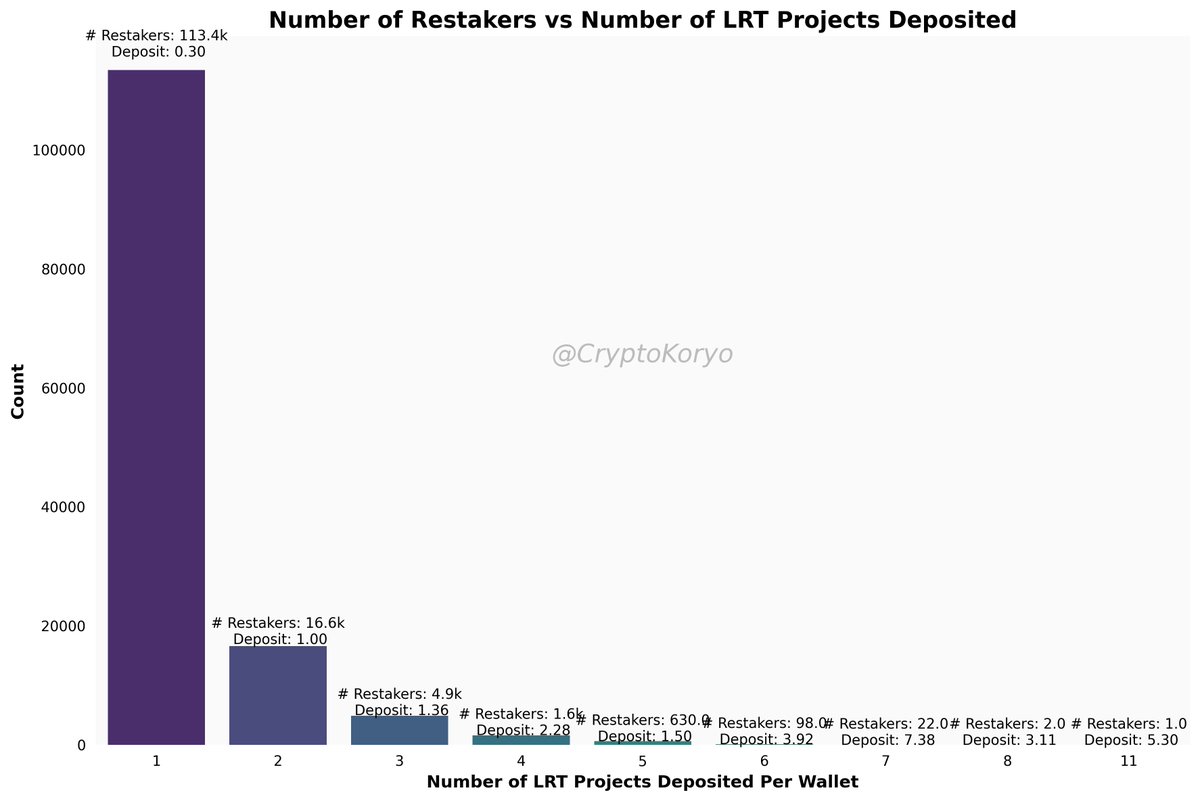

2. Total Number of LRT Deposit Addresses and Deposit Strategies

To date, approximately 140,000 wallet addresses have deposited funds into LRT protocols.

How many protocols have they deposited into, and what is the average (median) deposit amount? The vast majority have deposited into more than one protocol, but each deposit is less than 1 ETH.

Some farmers aiming for airdrops are making as many deposits as possible across LRT protocols—though this remains a minority group and not the most popular farming strategy.

For instance, an address starting with 0xd6d3 has deposited into all 11 LRT protocols.

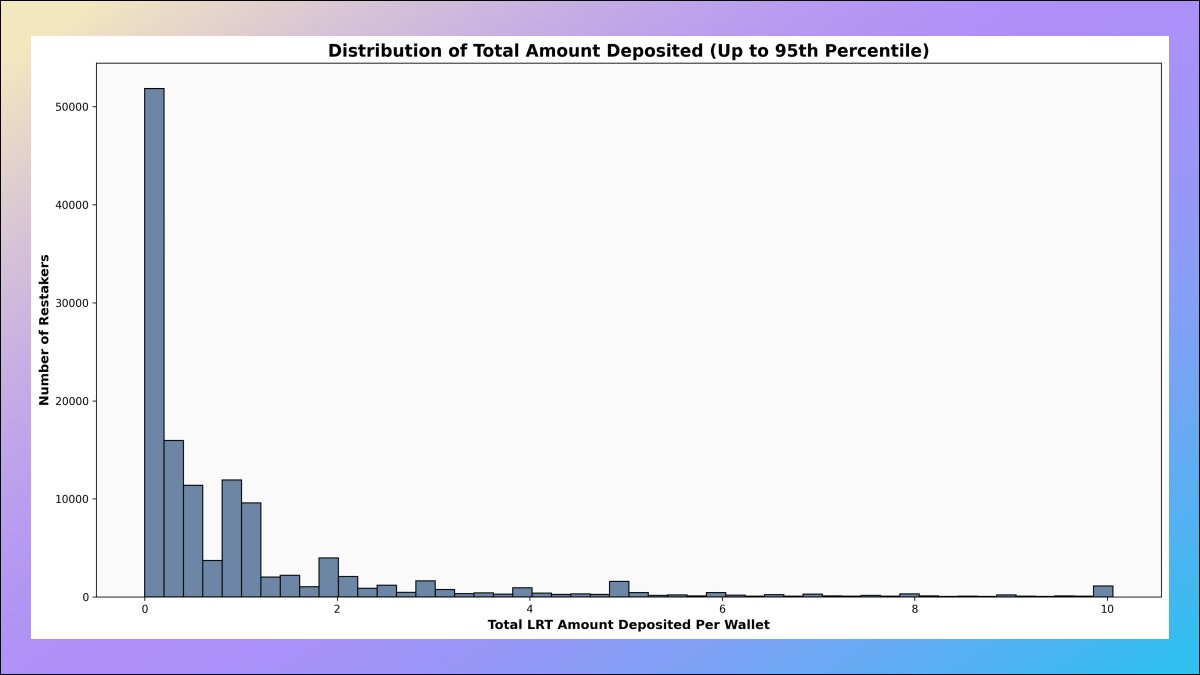

3. Deposit Amounts by Restaking Addresses

How much have restaking addresses deposited?

If we exclude the top 5% of depositors by amount, we find that the vast majority of wallets have deposited less than 2 ETH—these wallets are farming EigenLayer-related airdrops and maximizing their score accumulation.

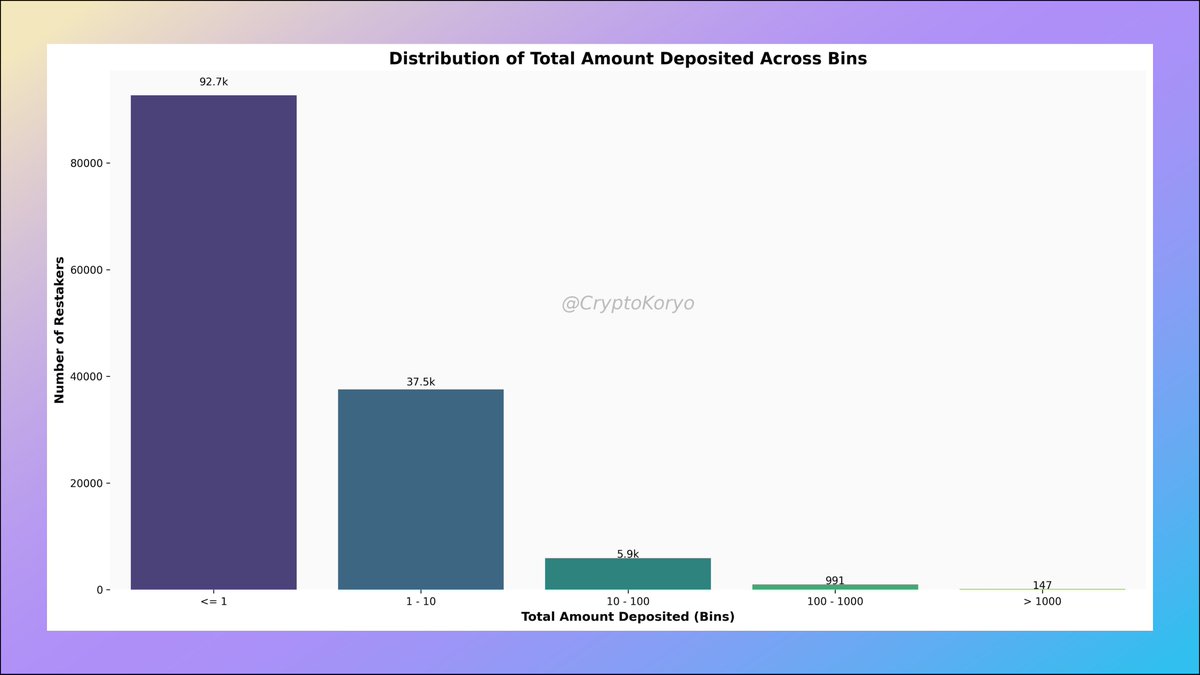

4. Number of Addresses by Deposit Amount Tier

Among them, 147 wallet addresses have deposited over 1,000 ETH into LRT protocols, some belonging to specific protocol-affiliated wallets, while others like analytico.eth have split their deposits across multiple LRT protocols.

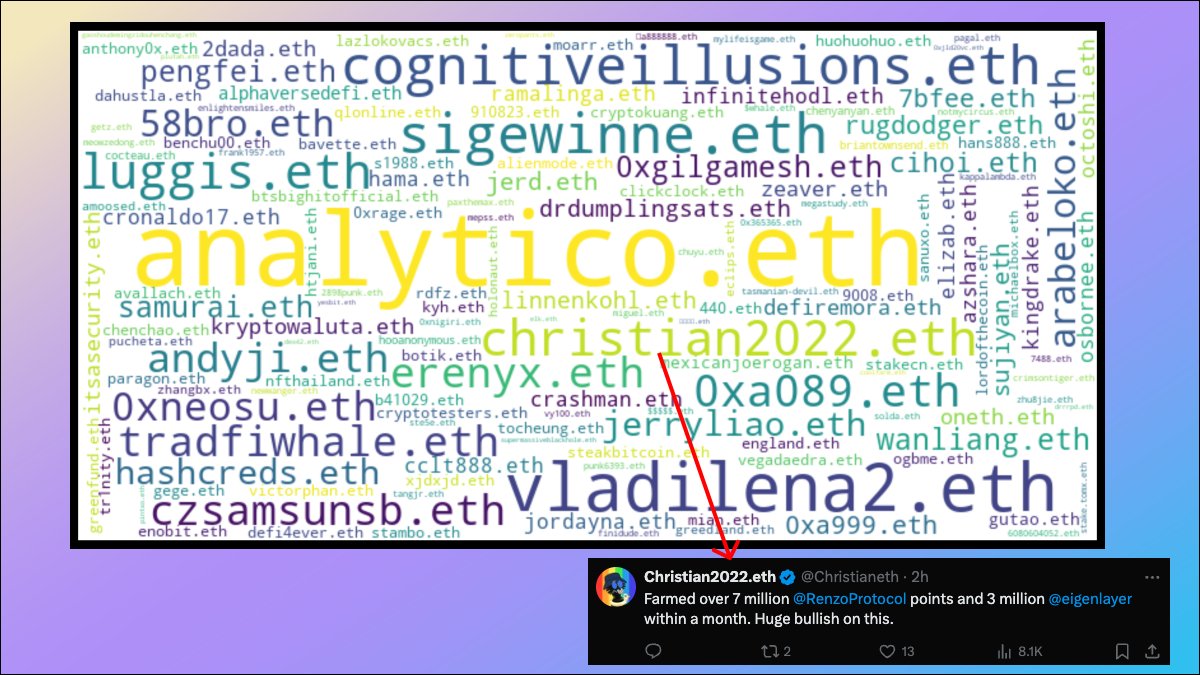

5. ENS Word Cloud of Restaking Addresses

If you follow the LRT narrative, you may already be familiar with some of these whale ENS names (size proportional to total deposit amount):

-

analytico.eth

-

vladilena2.eth

-

Christian2022

-

luggis.eth

-

czsamsunsb.eth

-

58bro.eth

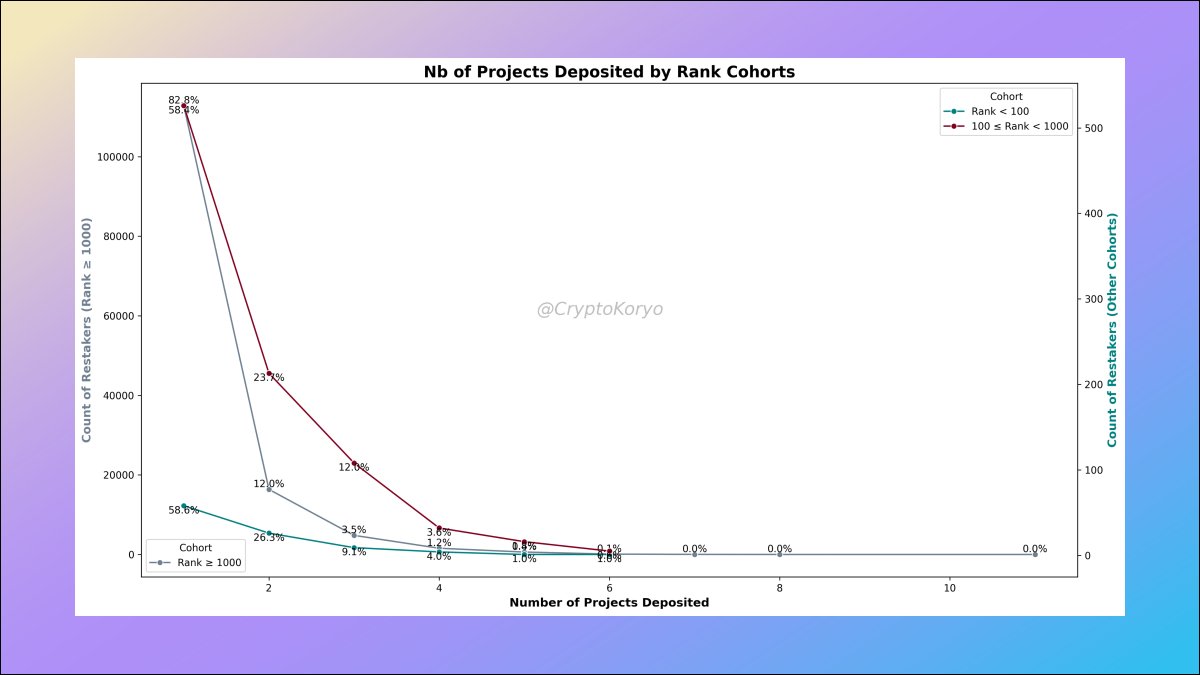

6. Address Analysis by Deposit Amount Ranking

We can rank LRT deposit addresses by total deposit amount and then define different groups based on ranking.

We observe that addresses ranked >1000 typically deposit into more protocols, whereas 94% of addresses ranked <100 deposit into 3 or fewer protocols.

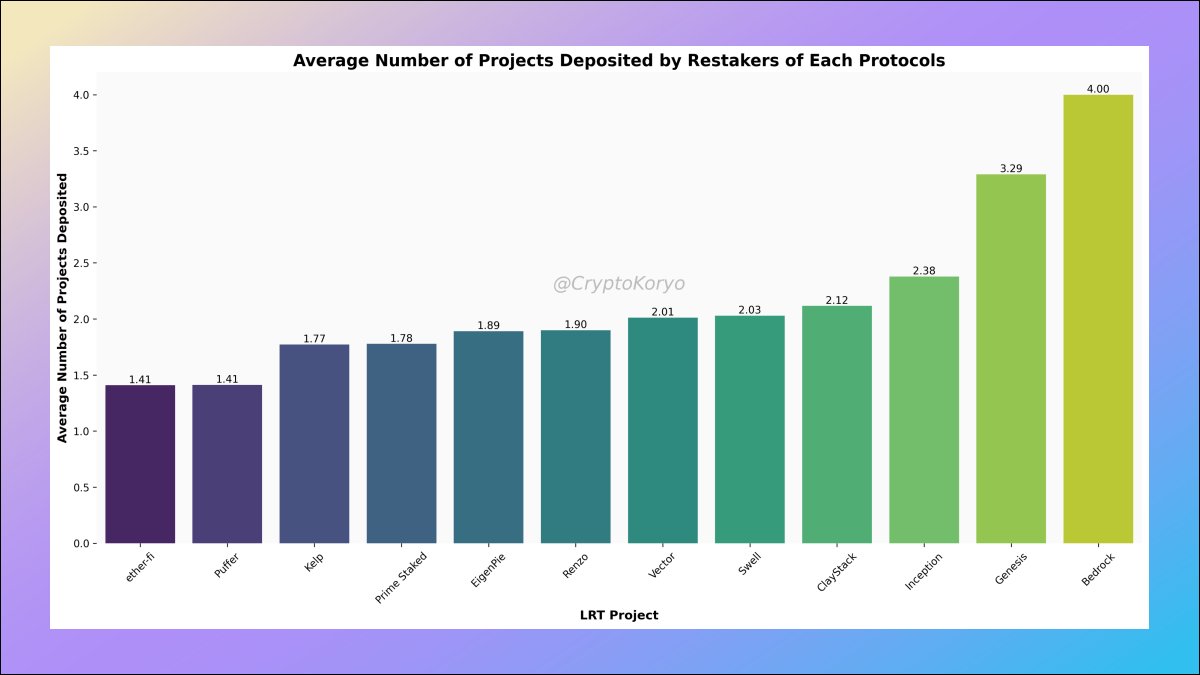

7. Protocol Loyalty

On average, users depositing into ether.fi and Puffer (on average) only restake on 1.41 protocols, indicating strong confidence in these two platforms.

However, users depositing into smaller protocols such as Bedrock, Genesis, and Inception are clearly engaging in distributed farming and diversified staking.

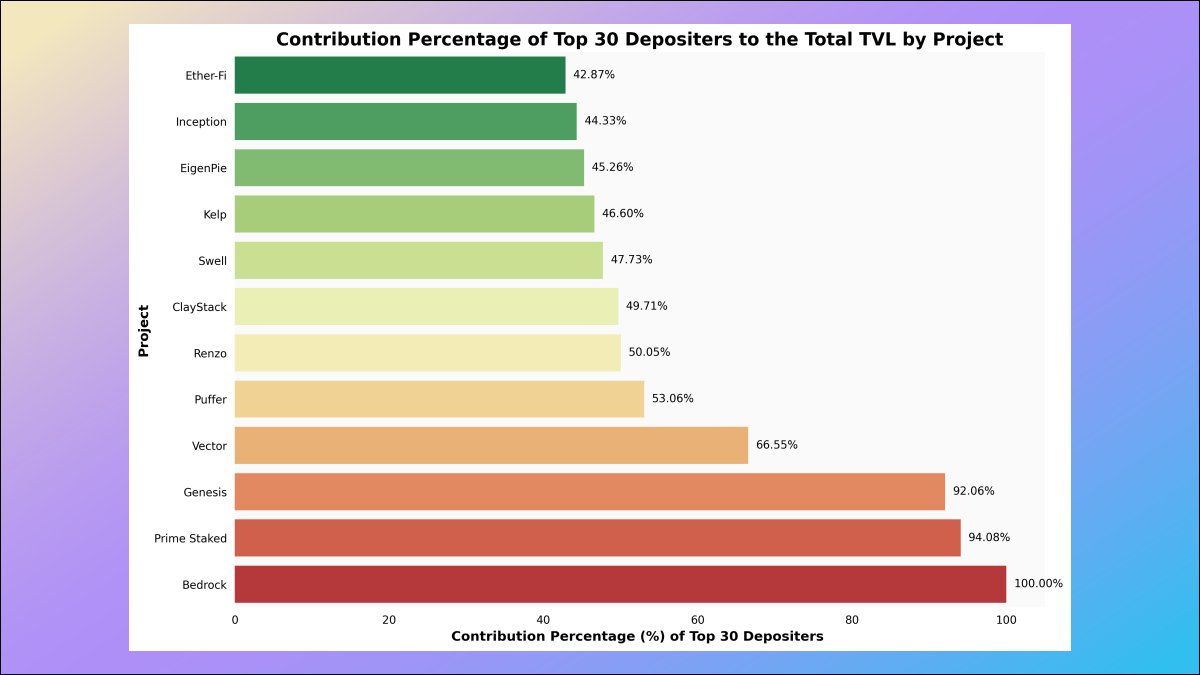

8. Whale Contribution Ratio

This is particularly interesting—we can analyze what percentage of each LST protocol’s total TVL comes from its top 30 depositors. The lower this ratio, the healthier and more decentralized the protocol’s liquidity.

Notably, ether.fi—the largest LRT protocol by TVL—ranks first in decentralization when measured by this metric!

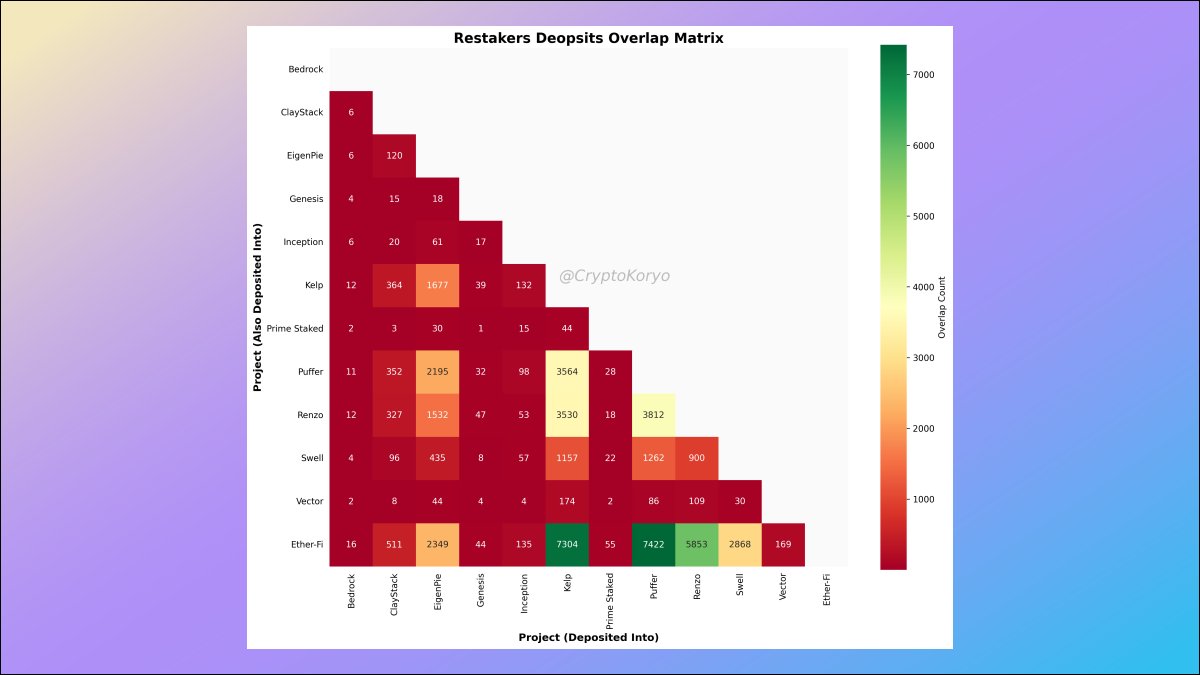

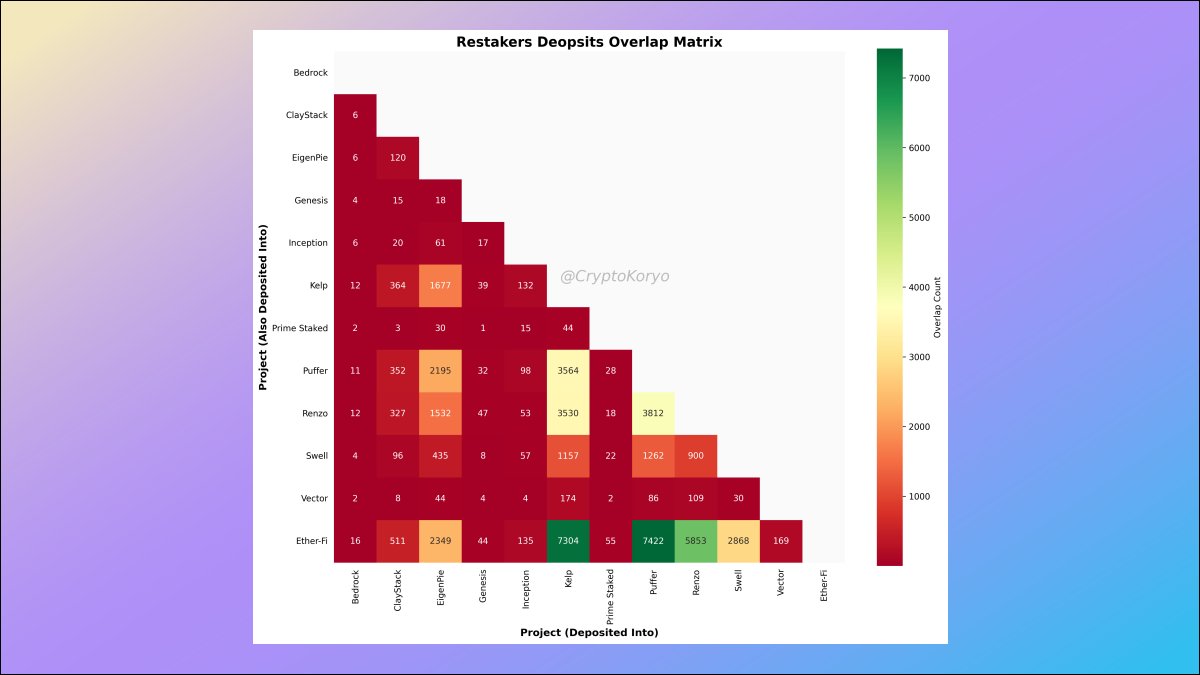

9. Correlation Matrix Among LRT Protocols

Which other LST protocols are commonly used by depositors of a given LST protocol?

Data shows that depositors of ether.fi also tend to deposit into Kelp and Puffer (and vice versa), revealing some interesting correlations.

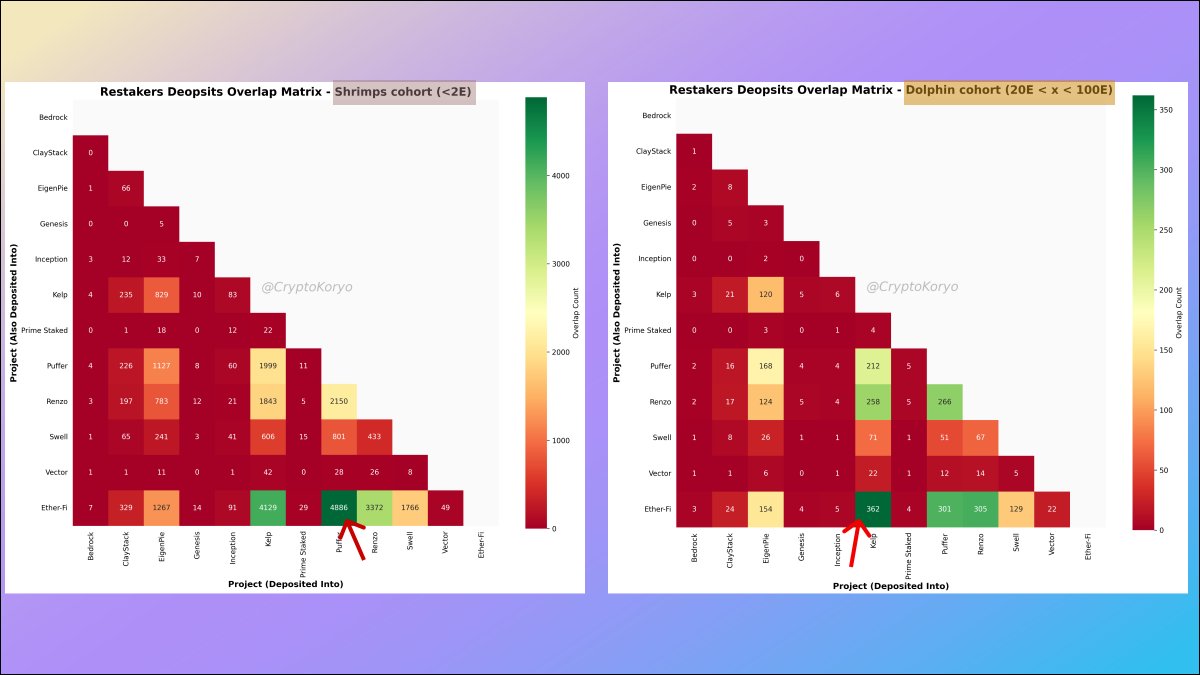

10. Correlation Matrix Across Different Deposit Tiers

We can define different user segments and conduct deeper analysis.

For the Shrimp tier (total deposits under 2 ETH), the most popular associated LRT protocols are ether.fi and Puffer. However, for the Dolphin tier (20 to 100 ETH), the most popular associated LRT protocols are ether.fi and Kelp.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News