Secure Profits, How to Properly Take Profits in a Crypto Bull Market?

TechFlow Selected TechFlow Selected

Secure Profits, How to Properly Take Profits in a Crypto Bull Market?

Nothing goes up forever.

Author: THE DEFI INVESTOR

Translation: TechFlow

Many people made big money in the last bull market, but what truly matters isn't how much you earned.

It's how much profit you can preserve when the inevitable bear market arrives.

Many who succeeded in the previous cycle ultimately lost all their gains due to greed, fear of missing out on future potential returns, or poor exit strategies.

With that in mind, today I’ll share my cryptocurrency profit-taking strategy to maximize profits during this bull market.

Profit-Taking Strategy

Your profit-taking strategy should be tailored based on two factors:

-

Your time horizon

-

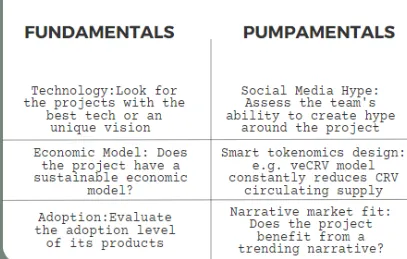

Whether you are a technical trader or a fundamentals-based investor

Most of my capital is allocated to long-term investments, although I occasionally engage in short-term trading based on fundamentals and volatility.

Therefore, in this article, I will focus primarily on my profit-taking strategies for long-term positions and short-term narrative-driven investments.

But before we begin, here’s a tip:

Regardless of whether you're a long-term or short-term investor, avoid becoming a permanently loyal member of any crypto community who never sells, because nothing goes up forever.

The main reason many struggle to take profits is that they emotionally identify with a project’s community and lose objective judgment.

The harsh reality is that 95% of cryptocurrencies eventually fade into oblivion. If you don’t take profits, someone else certainly will.

Short-Term Positions

I establish short-term positions based on crypto narratives I expect to gain significant attention.

When trying to predict such movements, I consider many factors, but the three most important ones are:

-

Social media hype — which projects are trending on crypto Twitter right now?

-

Upcoming catalysts (product launches, multi-chain expansions, etc.)

-

Tokens recently purchased by smart money

I take profits on these positions based on both fundamental and technical factors.

First, the most important thing for a narrative trader to remember is that 90% of hype events ultimately turn into "sell the news" events.

Let’s look at BTC’s price action following the approval of Bitcoin ETFs.

Despite massive inflows into Bitcoin ETFs today, in the short term, the approval itself became a major "sell the news" event.

This may be because the market had already priced in the event due to the intense speculation surrounding it on crypto Twitter.

Therefore, when I buy a token expecting a short-term hold driven by an upcoming catalyst, I usually take partial or even full profits before the catalyst date arrives.

Next, as mentioned above, I also use technical triggers to exit short-term positions.

I’m not an expert in technical analysis, but I believe there are psychological factors behind price attempts to break past previous resistance levels.

For example, here is the FXS price chart.

As seen in the chart above, I’ve marked with blue lines the price levels where the token previously struggled to break through multiple times.

One way to gradually take profits on crypto positions is to mark all key resistance zones of a token and sell a portion of your position each time it reaches a new resistance level.

You can easily do this on TradingView by creating a watchlist containing your current holdings.

Now let’s look at another example.

PENDLE, a token I’ve mentioned multiple times, has recently risen to and surpassed its previous all-time high.

This surge was driven by a sharp increase in Pendle’s TVL, thanks to its new yield-trading pool for Eigenlayer’s liquid restaking tokens.

For tokens like this, entering a price discovery phase and continuously making new highs, you cannot rely solely on the technical triggers I described earlier.

However, there is one strategy you can use: reverse dollar-cost averaging.

Reverse DCA is the opposite of regular DCA — it involves periodically withdrawing a fixed amount from your investment.

For instance, you could sell 20% of your position every week.

It’s not a perfect strategy, but this way, you lock in some profits while still allowing the remainder of your position to benefit from further upside.

Long-Term Positions

When I refer to long-term investments, I don’t mean holding a token for the next five years. Instead, I mean holding until the later stages of the current bull market.

I believe crypto markets will remain cyclical. Therefore, it makes no sense to hold through the bull market only to rebuy at lower prices during the bear market.

I primarily take profits on my long-term positions based on fundamental triggers when I believe the peak of the bull cycle is approaching.

Until then, I simply hold my long-term investments.

I’ve summarized some key top signals from the previous bull market in the chart below:

Other strong top indicators include:

-

On crypto Twitter, you frequently see posts about luxury items and expensive purchases

-

Every low-quality coin surges regardless of fundamentals

-

Google search volume for the term “crypto” spikes to new highs

When these signs start appearing, you can assume we’re in the final stage of the bull market, and it’s time to sell most of your positions.

I plan to apply the reverse DCA strategy when these top signals emerge.

Next, this might sound crazy, but there is actually a technical indicator that has correctly predicted the top of Bitcoin’s last three bull cycles.

That indicator is called the “Pi Cycle,” available on TradingView.

The Pi Cycle top signal is generated by combining two daily moving averages.

When one of these moving averages crosses above the other, the Pi Cycle signals that a historical high for Bitcoin in the current bull cycle has likely been reached (as shown in the chart above).

Based on historical data, the Pi Cycle is by far the most accurate indicator for Bitcoin tops.

Why is this indicator so effective? It remains a mystery, but personally, I plan to take profits on my long-term holdings the next time the Pi Cycle gives a sell signal.

Nobody truly knows what will happen next in financial markets, but in many cases, studying historical data can significantly improve your odds of success.

That’s all for today. I believe we are still far from the top of this bull market. But it’s wise to start planning your profit-taking strategy now.

When the market reaches extreme euphoria, it will be very difficult to convince yourself to take profits if you haven’t prepared an exit plan in advance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News