Detailed Explanation of the NFT Fractionalization Protocol ERC-404: A Flash in the Pan?

TechFlow Selected TechFlow Selected

Detailed Explanation of the NFT Fractionalization Protocol ERC-404: A Flash in the Pan?

The NFT sector hasn't seen new concepts for a long time. ERC-404 focuses on liquidity issues from the perspective of underlying standards and warrants close attention.

Author: SANYUAN Labs

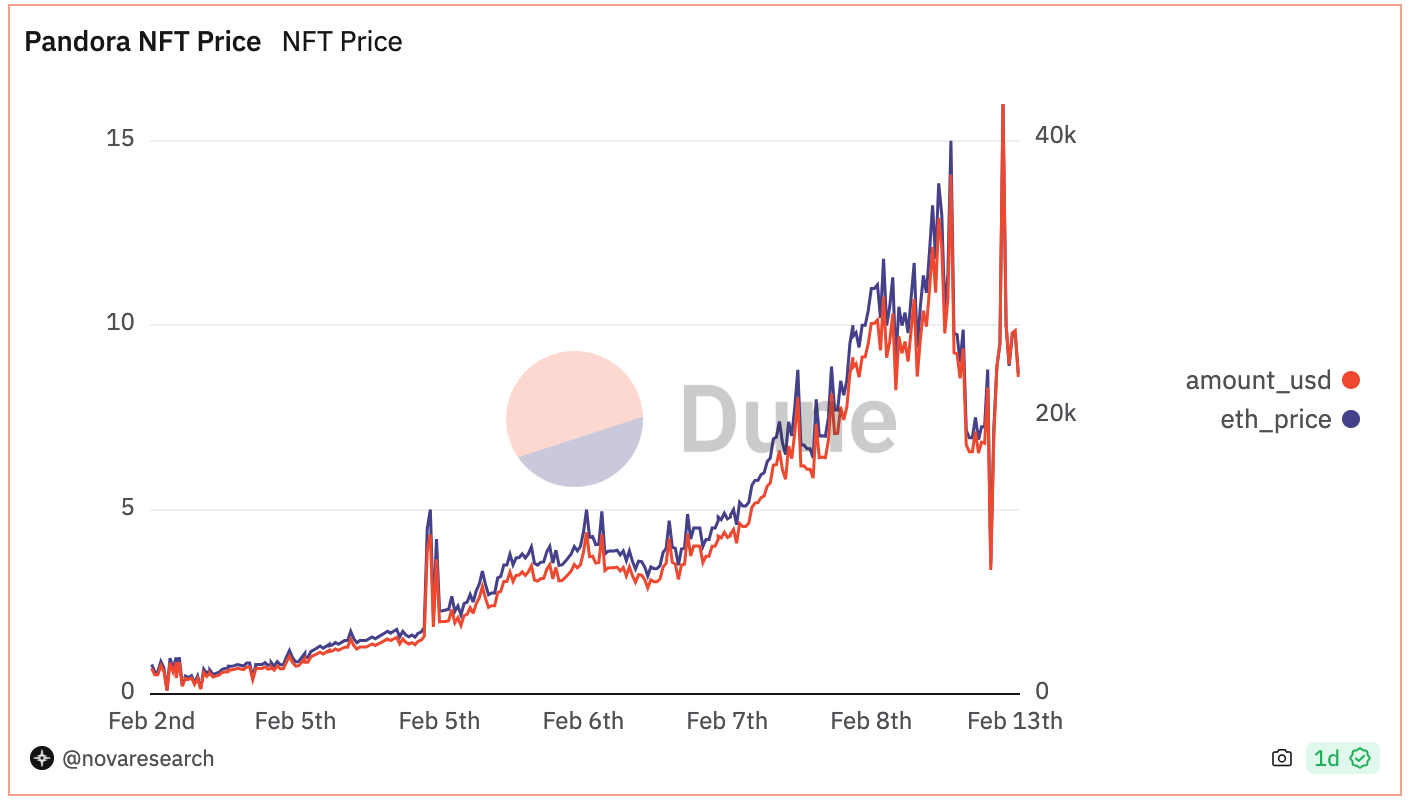

ERC404 attracted significant attention earlier this year, temporarily causing Ethereum gas prices to spike. Currently, $PANDORA has pulled back to over 10,000. With the initial hype now cooling down, it’s a good time to take a rational look at what’s happening.

Pandora_ERC404 introduced ERC404 as a hybrid FT/NFT protocol for NFT fractionalization. Let's start by discussing the evolution of the NFT fragmentation space.

With the arrival of the NFT summer in 2021, blue-chip NFTs such as CryptoPunks and Bored Ape Yacht Club rose to price levels that were out of reach for ordinary users. Liquidity has long been a major pain point for NFTs, making demand for NFT splitting peak during this period—a need recognized early on by many projects.

One early solution was NFT crowdfunding, typically conducted through centralized platforms to jointly purchase NFTs. However, crowdfunding had multiple issues—such as custody of the NFTs and inconvenient exit or transfer mechanisms. This led to the emergence of decentralized NFT fractionalization projects.

These NFT fractionalization protocols used smart contracts to hold NFTs. As early as 2020, NIFTEX proposed an NFT fractionalization model where users could mint shards (fragments). Shard holders would have governance rights over the original NFT. The protocol also introduced a buyout clause—for example, if the minimum threshold for triggering a buyout was set at 10% of shards, a buyer could acquire the NFT by holding more than 10% of the shards and adding the remaining ETH value. However, NIFTEX announced in 2022 that it had been acquired, discontinued its domain, and would not issue a token, gradually fading from view.

Given that NFTs within the same collection can vary significantly in price, some projects considered bundling multiple NFTs from the same series and issuing index tokens (uTokens) through fractionalization, such as Unicly’s uniclyNFT. Unicly also integrated DeFi use cases for its fungible tokens by launching a governance token, $UNIC, and incentivizing liquidity mining to boost uToken liquidity. For NFT redemption, Unicly allowed creators of uTokens to set a threshold; when more than the specified proportion of uToken holders agreed to unlock, the winner of a bidding process would obtain the NFT and compensate uToken holders accordingly. However, trading volume remains minimal. The project raised $10 million in 2021 from Blockchain Capital and Animoca Brands, giving it strong financial backing to survive the bear market. Last month, Unicly announced plans to launch its V3 version deployed on frame.xyz, but activity remains low. Its homepage no longer displays TVL or trading volume data.

Another high-profile project, Fractional, raised about $28 million. It designed two types of vaults—one for single NFT fractionalization and another for multiple NFTs. The person who fractionalizes an NFT is called a curator and earns fees from shard auctions. Additionally, NFT fragment holders can vote on the vault floor price, with the weighted average determining the acquisition price. Anyone holding at least the floor price in value can initiate a vault takeover. Upon successful auction, NFT fragment holders can redeem their ERC20 tokens for ETH. Fractional later rebranded to Tessera, but unfortunately, despite several iterations, Tessera announced last year it would gradually shut down.

Beyond fractionalizing individual NFTs, there’s also an index-based approach, exemplified by NFTX. NFTX groups similar-priced NFTs into vaults and issues corresponding vTokens. The advantage is that holding sufficient vTokens allows random redemption of an NFT from the vault without voting—making deposits and redemptions relatively convenient, though users cannot choose a specific NFT. NFT20 improved upon NFTX by enabling targeted NFT redemptions and enhancing utility for its governance token $MUSE, allocating part of the FT minting fee to $MUSE holders. NFT20 secured $750,000 in funding in 2021.

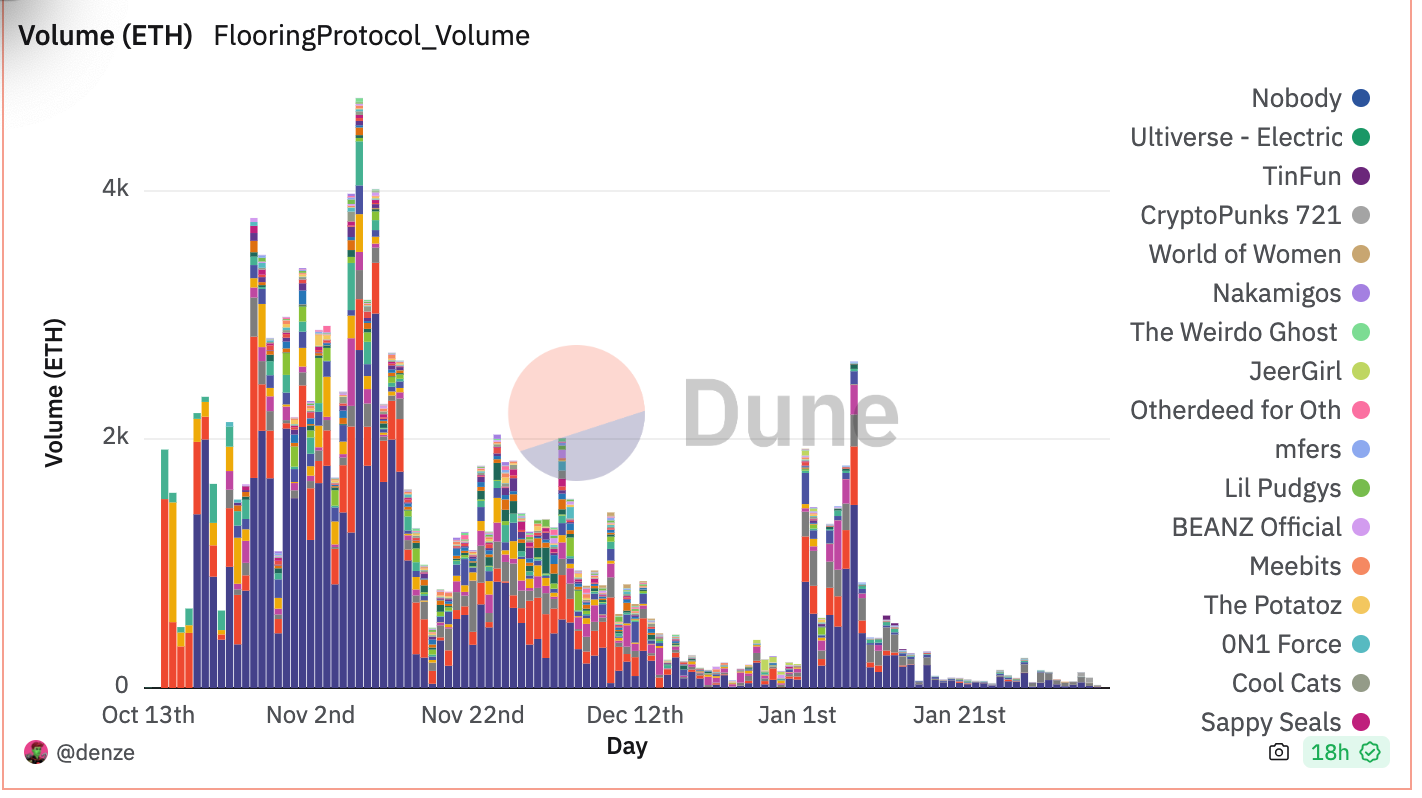

Amid the NFT bear market, while many projects struggled, a new NFT fractionalization project, Flooring Protocol (floorprotocol), launched last year. Flooring Protocol splits high-value NFTs into one million ERC-20 μTokens. μTokens from different NFT collections are not interchangeable, but those from the same collection are uniform. Flooring Protocol offers two modes: Vault and Safebox. Users can deposit an NFT into a Vault to receive one million μTokens, relinquishing ownership of the NFT. Alternatively, they can deposit into a Safebox, selecting a storage duration and staking a certain amount of the platform token FLC (the longer the duration, the more FLC required), receiving one million μTokens and a Safebox Key proving ownership. The Safebox Key can be auctioned or traded. To redeem, Vault mode requires burning one million μTokens corresponding to the NFT collection, but redemption is random. In Safebox mode, users must hold the Safebox Key to reclaim their original NFT, also requiring the burn of one million μTokens. If the Safebox expires, some users may lose the ability to redeem their NFT (though they can reclaim staked FLC). Within 24 hours after expiration, any user can bid on the expired Safebox Key using FLC, paying a 20% fee to the protocol. If no bids occur, any user can unlock the Safebox and claim the NFT by burning one million μTokens.

Currently, the most prominent collection on Flooring is CryptoPunks. After the initial FLC incentive-driven surge, TVL has since dropped to low levels.

It’s clear that current NFT splitting projects generally adopt the method of staking NFTs to issue fungible tokens (FTs), with varying rules for splitting and redemption. Projects issuing governance tokens tend to attract higher short-term interest, but momentum is difficult to sustain, and most only support blue-chip NFTs.

PANDORA introduced a novel approach to NFT fractionalization—the ERC-404 standard. ERC-404 is an experimental token standard where each ERC-404 token is a fungible token paired with one Replicant NFT.

Unlike ERC721 NFTs, Replicant NFTs feature a burn-and-re-mint mechanism triggered whenever a user transfers or trades an ERC-404 token. Whenever an ERC-404 token changes hands, the associated Replicant NFT is affected. For instance, selling an ERC-404 token burns the Replicant NFT in the wallet. During a transfer, the sender’s Replicant NFT is burned and a new one is minted in the receiver’s wallet. Notably, each re-mint refreshes the Replicant NFT’s traits, potentially altering its rarity. Thus, users can repeatedly transfer tokens to refresh NFT attributes. If a user wishes to sell or transfer without changing their Replicant NFT’s traits, they can do so directly on OpenSea (i.e., operating solely on the Replicant NFT).

ERC-404 differs fundamentally from previous NFT splitting models—it addresses fragmentation at the protocol layer. Its remarkable price surge reflects the crypto community’s enthusiasm for innovative concepts. However, it remains in early stages with ample room for improvement, and whether it will become an official EIP proposal remains uncertain.

Last week, Pandora announced it has become a full-fledged entity, leaving open the possibility of future fundraising and partnerships. Recently, it released version V2.1, primarily addressing widespread complaints about high gas fees.

In my opinion, the NFT space hasn’t seen a truly new concept in a long time—especially one tackling liquidity at the foundational standard level. This development deserves close attention. As the protocol matures, we may see broader project adoption and expanded use cases.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News