The Rise and Development of the Inscription Market: A New Era in Web3

TechFlow Selected TechFlow Selected

The Rise and Development of the Inscription Market: A New Era in Web3

This article provides a comprehensive exploration of the development history of the inscriptions market.

Author: BiB Exchange

Abstract: Recent job postings have left us editors envious—OKX’s Web3 Wallet is offering a starting salary of 33k–39k SGD for a Senior Product Manager role, and they’re hiring fellow Web3 professionals. Looking at my own payslip, I can’t help but wonder why wallet developers are earning so much. What’s more, even Binance co-founder HE YI is actively seeking talent for Binance Wallet. Why is this happening? The reason lies behind a fierce competition between Binance and OKX for the “inscriptions” market—by leveraging wallets to unlock inscription liquidity, both aim to attract more users and traffic. This article provides a comprehensive exploration of the inscriptions market, covering BTC protocol inscriptions, multi-chain inscriptions, the rise of Runes, key players, and technological innovations. Our goal is to deliver in-depth analysis on technical foundations, market trends, major challenges, and future outlook.

I. Introduction

Background of the Inscriptions Market Rise

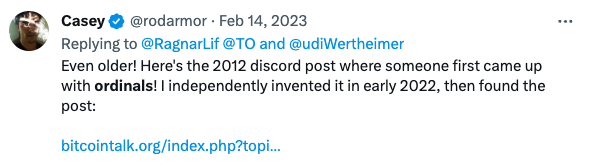

The concept of Ordinals dates back as early as 2012—even though Bitcoin was designed as a "fungible" token, each atomic unit (known as a satoshi) could be assigned a unique serial number. With this serial number, a satoshi could represent more than just its face value (e.g., "colored" Bitcoin, smart property, securities). The serial number consists of two parts: the integer part corresponds to the block number where the satoshi was generated, while the fractional part identifies each individual satoshi. In 2022, Casey launched the Ordinals protocol, effectively unlocking a Pandora's box within the Bitcoin ecosystem.

The Ordinals protocol assigns unique serial numbers to each satoshi, enabling users to inscribe various types of data onto them—including text, images, videos, and 3D models. These unique inscriptions can be permanently stored in Bitcoin wallets and tracked during transactions, exhibiting Bitcoin-like properties such as immutability and decentralization. Casey described the purpose of the Ordinals protocol as preserving something eternal on Bitcoin, with initial applications focused on creating and storing NFT art collections.

This innovation has introduced new possibilities into the Bitcoin ecosystem, making it more diverse and expressive. Users are no longer limited to simple Bitcoin transfers—they can now create, store, and trade unique digital content directly on the Bitcoin blockchain. This advancement has also fueled the growth of the NFT market, transforming Bitcoin into a platform for preserving and distributing digital art and cultural creations. The emergence of the inscriptions market marks an evolution in the Bitcoin ecosystem, offering users greater opportunities for participation and interaction, while injecting fresh vitality into the digital art and creative industries.

Relevance Between Web3 and the Inscriptions Market

The inscriptions market operates on decentralized networks and leverages the interoperability of Web3 platforms to enable free trading and circulation in decentralized markets. Therefore, in the era of Web3, the inscriptions market has rapidly become a significant component of cryptocurrency and blockchain technology.

Firstly, digital identity ownership: Web3 emphasizes user control over their data. In the inscriptions market, each inscription can be linked to a user's digital identity, ensuring creators maintain ownership and control over their works. This aligns with Web3 principles, empowering users to take active roles in managing their digital assets. Secondly, smart contract applications: In the future development of the inscriptions market, smart contracts could manage the creation, sale, and trading of inscriptions, making the entire process more efficient, transparent, and programmable.

II. Major Segments of the Inscriptions Market

The inscriptions market is primarily divided into three segments: NFTs, Bitcoin inscriptions, and multi-chain inscriptions.

NFTs (Non-Fungible Tokens)

The NFT segment plays a crucial role in the inscriptions landscape, encompassing non-fungible tokens from Bitcoin and other blockchains:

Ordinals: This category refers to NFTs inscribed on the Bitcoin blockchain via the Ordinals protocol. They typically include digital artworks, gaming items, collectibles, etc. Notable projects include: Bitcoin Frogs, Node Monkes, ORLDUM (Rudolph Puppet), Goosinals, among others.

BRC-20: This category covers NFTs based on the BRC-20 protocol—a standard within BTC protocol inscriptions that allows for the creation of Ethereum ERC-20-like assets on the Bitcoin network. Example projects include: This Song about NFTs, Mineoral, Blue Wands, Ord Games Arcade, etc.

Others: Beyond Ordinals and BRC-20, there are additional NFT categories such as Atomics Dimit (NFTs traded via AtomicSwap mechanisms), Toothly, FalcãoFam, Atom Dragons.

Bitcoin Inscriptions

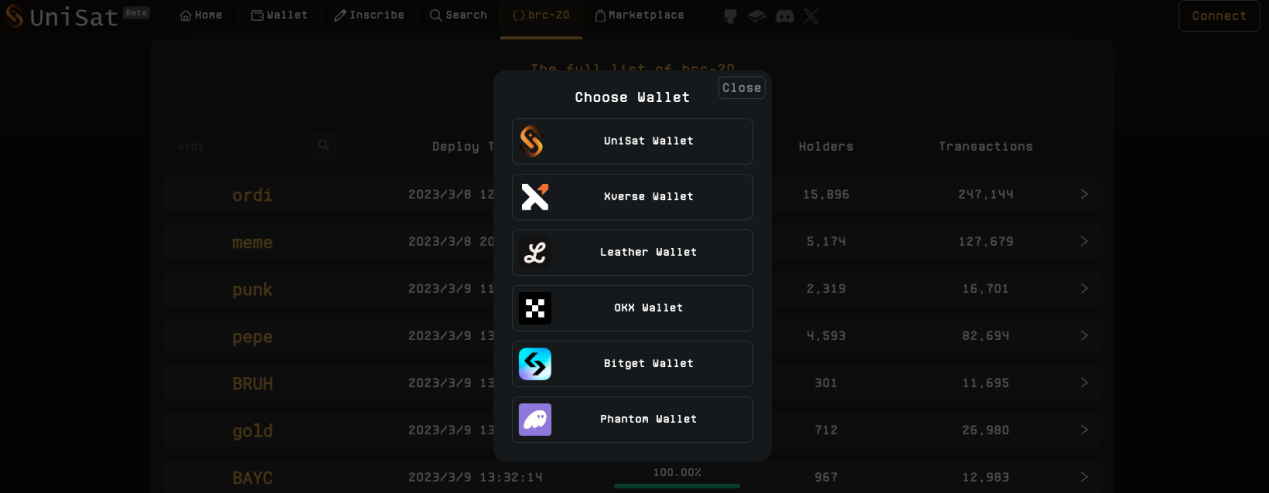

The most commonly seen inscription protocols are primarily BTC protocol inscriptions, dominated by BRC-20 inscriptions on Bitcoin, followed by Ordi, SRC20, ARC20, Runes, etc. BTC protocol inscriptions specifically refer to inscriptions created on the Bitcoin network using different protocols, including the following categories:

-

Ordinals: The foundational type of inscription on the Bitcoin network, achieved by assigning ordinal numbers to each satoshi.

-

BRC-20: A standard built upon Ordinals, used to create token systems similar to ERC-20.

-

BRC-10: Possibly another Bitcoin-based inscription standard.

-

Tap Protocol: A protocol related to the Taproot upgrade, used for inscription creation on the Bitcoin network.

Official websites for each category are listed below:

-

https://unisat.io/brc20 (Ordi)

-

https://openstamp.io/home (SRC20)

-

https://atomicalmarket.com/market/token?ticker=atom (ARC20)

-

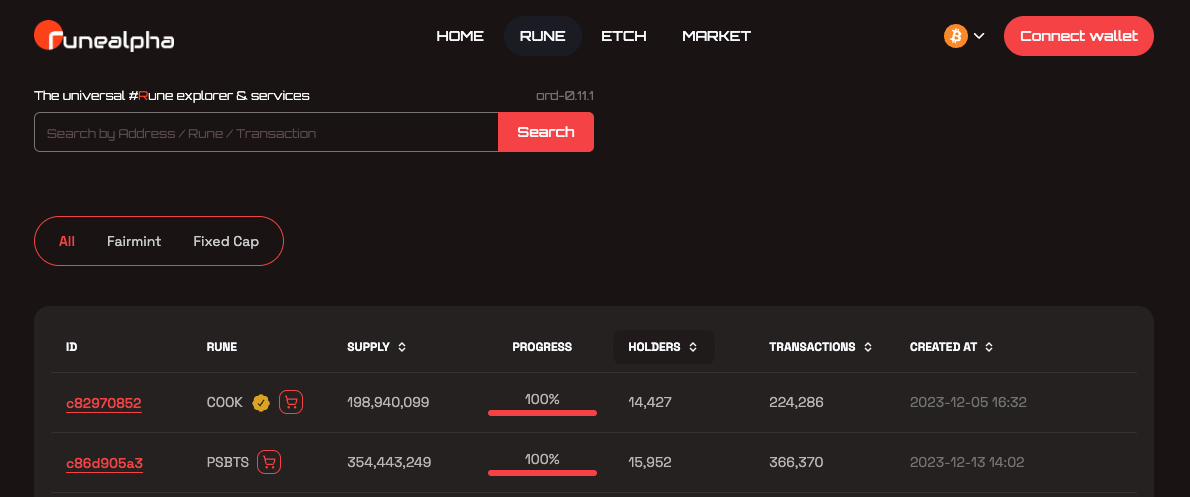

https://runealpha.xyz/runes (Runes)

These categories may further differentiate into specific applications or projects such as launchpads, apps/institutions, etc.

Multi-Chain Inscriptions

Multi-chain inscriptions refer to inscriptions implemented across different blockchains. Public chains like ETHS, SOLs, and AVAV each have their own inscription ecosystems, with nearly every major chain hosting its own inscription projects. Ethereum-based inscriptions include ETHS, IERC-20, SetS, FacetS, etc.; Solana includes SOLS, SLAPP, etc.; Avalanche features AAWS, AVAV, etc. Other EVM-compatible chains also host numerous inscription initiatives, which we won't enumerate here. Additionally, public chains using Move language such as Aptos also support various inscription projects—for example: SAPTS (Aptos), SHOVE (Sui), among others.

III. Development and Impact Across Segments

The inscriptions market comprises several key areas: NFT market development, Bitcoin inscription innovation, and expansion of multi-chain inscriptions. Each segment possesses distinct characteristics and influence, collectively driving overall market growth.

Role and Development of NFTs

NFTs play a vital role within the inscriptions space and are gradually becoming a core component of digital culture and art markets. NFTs赋予 inscriptions unique identities and verifiable ownership. Each NFT is unique, and blockchain technology ensures the uniqueness and indivisibility of digital artworks. Creators and holders can use NFTs to prove ownership within the inscriptions market, guaranteeing authenticity and originality of digital art.

Impact of Bitcoin Inscriptions

The Ordinals protocol has driven prosperity in the inscriptions market. It has made pricing and trading of inscriptions more rational and provided a fair, open platform for creative inscription artists. All of this has contributed to rapid market growth and fostered innovation. Ordinals introduced financial innovations such as auctions, lending, and fractionalization to inscriptions, enriching application scenarios and expanding market potential, thereby enhancing the status of inscriptions as digital assets.

In particular, the rise of inscription protocols like Ordi/Sats/Rats under the BRC-20 framework highlights the evolving role of the inscriptions market within the Bitcoin ecosystem. BTC protocol inscriptions—especially those enabled by innovations in the Ordinals protocol—have brought new possibilities to the Bitcoin ecosystem. This momentum has extended to Bitcoin’s Layer 2 ecosystem, where various scaling solutions, cross-chain protocols, and products have surged in popularity.

Trends and Challenges in Multi-Chain Inscriptions

Technological innovation in the multi-chain inscriptions space is mainly reflected in the evolution of smart contracts. Advancements in cross-chain interoperability, automated contract execution, and programmability could unlock new functionalities and interactions for inscriptions. Creators are increasingly inclined toward meta-inscriptions (NFTs containing other NFTs or digital assets) and composite inscriptions, further increasing diversity and complexity.

However, the multi-chain inscriptions sector faces several serious challenges:

High Transaction Fees: On some major public chains, high transaction fees remain a challenge, especially for small-value inscription transactions. This could lead to user attrition and rising costs for creators. For instance, interacting with or transferring ETH inscriptions might cost tens of dollars per transaction.

Lack of Standardization: Multiple inscription standards exist across different blockchains, potentially causing interoperability issues between ecosystems and increasing technical barriers for developers.

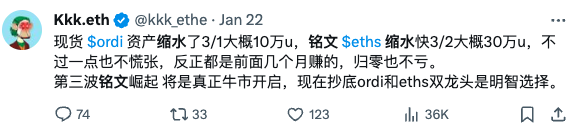

Intense Competition and Price Volatility: As the inscriptions market grows rapidly, competition among public chains and inscription platforms intensifies. Prices are unstable—some influencer-promoted inscriptions have sharply depreciated, leading to significant losses for investors.

IV. The Role of Wallets in the Inscriptions Market

As key participants in the inscriptions market, wallets play a crucial role through their economic models and technological innovations.

Business Models and Revenue Sources

Firstly, storage and management: Users can securely store and manage their inscriptions through wallets, including metadata, proof of ownership, and other relevant information. From within the wallet, users can initiate sales, purchases, and transfers of inscriptions. Interoperability between different inscription markets and platforms enables users to conduct transactions across multiple blockchains using a single wallet, which is particularly important for the multi-chain inscriptions market. Wallets also often serve as gateways to inscription communities, allowing users to connect with various NFT platforms, marketplaces, and social networks to interact with others, participate in auctions, airdrops, and other activities.

Of course, building wallets isn't charity. First comes transaction fees: Wallets facilitate inscription trading and usually charge a fee per transaction. These fees cover underlying blockchain network costs and serve as a revenue stream. Second is NFT marketplace partnerships—this enhances user experience and creates more trading opportunities. Wallets may also generate income through advertising or promoting specific inscription projects. Some collaborate with artists, creators, or brands to feature their work on the platform. Lastly, exchanges may analyze user behavior and market trends to offer data analytics services or insights to users, creators, or market participants—including market makers and exchange counterparties—for a fee.

Wallet Technology Innovation and Development

Rise of Cross-Chain Wallets: With the growth of multi-chain inscriptions, wallets must continuously improve cross-chain capabilities to deliver smoother user experiences and higher transaction efficiency. This may involve innovations in cross-chain bridging and execution. Wallets supporting multiple blockchains will hold a competitive edge.

NFT Marketplace Integration: Deep integration between wallets and NFT marketplaces will be a future trend, enabling seamless user experiences. As inscriptions diversify, wallets may support more NFT standards and allow users to create custom ones, better accommodating various inscription types and use cases.

Social and Project Interaction: Some inscription wallets may enhance social features to encourage user interaction and collaboration, such as co-owned inscriptions, joint creation, and community events.

In short, wallets must continuously innovate, introducing new features to meet growing user demands—such as cross-chain technology, multi-standard integration, meta-inscription support, and social functions. They may also adopt decentralized identity and verification technologies, giving users greater control over their identity data and helping build trust within the inscriptions market.

V. Market Issues and Development Recommendations

Market Problems

Liquidity is currently the most pressing issue in the inscriptions market. Many projects start strong when launching inscriptions but quickly fade into obscurity. This severely damages inscription liquidity, mirroring the decline of many earlier NFT markets. To prevent this, the following issues need addressing:

-

Market Fragmentation: The inscriptions market may be scattered across multiple platforms and chains, leading to fragmented trading and difficulty concentrating liquidity.

-

Inconsistent Standards: Different markets may use varying NFT standards, resulting in incompatibility between platforms and reduced liquidity.

-

High Transaction Costs: Elevated fees on certain blockchains, especially during peak times, can make small-value inscription trades uneconomical, reducing liquidity.

-

Insufficient Market Participants: An inadequate number of buyers and sellers in the inscriptions market can delay trade matching and lower liquidity.

Development Recommendations

Enhance cross-wallet and cross-chain interoperability by improving cross-chain connectivity in the inscriptions market, enabling users to freely trade across different blockchains and boosting overall liquidity. This avoids being confined to a single chain, wallet, or platform.

Standardization: The inscriptions market should advocate for or support a universal NFT standard to ensure easier cross-platform compatibility and circulation. While full standardization may take time, establishing common standards is essential. Platforms can consolidate liquidity pools through mergers or collaborations to enhance overall market liquidity.

Layer 2 Solutions: Adopt Layer 2 solutions such as zkRollups and Optimistic Rollups to reduce transaction fees and increase speed, improving liquidity for small-value inscription trades—especially in BTC inscription markets, preventing users from essentially paying fees to miners without benefit.

Introduce staking-like mechanisms akin to ETH’s PoS, incorporating liquidity mining and reward programs to incentivize users to provide liquidity, attracting more participants and improving market activity.

Community Building and Ecosystem Collaboration: Strengthen community engagement to boost user participation, encouraging sharing, auction involvement, and event attendance to stimulate market vibrancy and liquidity. Offer real-time trading features and market subscription services so users receive timely updates, enabling faster decision-making and trade execution. Collaborate with other ecosystem players—NFT markets, creators, wallets—to jointly advance liquidity and growth across the inscriptions market.

VI. Future Outlook

Market Opportunities

As previously discussed, the inscriptions market faces bottlenecks. Investing in multi-chain inscription platforms allows leveraging opportunities across different blockchain ecosystems while mitigating risks associated with reliance on a single chain. Additional opportunities include:

-

Technology Innovation Platforms: Invest in multi-chain inscription platforms to leverage diverse blockchain ecosystems and reduce single-chain risk.

-

Third-party Inscription Service Providers: Partnerships with other blockchain projects, tech providers, and NFT markets can broaden recognition and support for inscription initiatives.

-

GameFi/SocialFi Narrative Inscriptions: Invest in projects combining NFT technology with games and virtual worlds—an area with high potential to attract large user bases and capital inflows.

Investment Strategies

Adopt diversified investment approaches. Seasoned participants often say, "mint one for protection"—some projects may seem unremarkable initially but could yield unexpected returns. Hence, many veteran investors mint at least one copy as insurance. Diversifying portfolios reduces exposure to specific risks; consider investing across different blockchains, sectors, and standards.

Conduct thorough due diligence (DD). Before investing, deeply research each project’s fundamentals, including team background, technical capability, community support, and vision. Whitepapers, roadmaps, and community feedback are critical references.

Monitor community dynamics and emerging projects. Strong community backing and active social engagement are often indicators of success. Stay updated via social media, forums, and chat groups. Focus on projects featuring novel technologies, innovative functions, standout social interactivity, cross-market integration, cross-chain trading capabilities, and technological breakthroughs. Also watch developments in Bitcoin L2 ecosystems—over 30 Bitcoin L2 solutions already exist, spanning sidechains, rollups, data availability layers, and state channels.

Future Trends of the Inscriptions Market Through Historical Evolution

The current wave of the inscriptions market owes much to the historical rise of the Bitcoin ecosystem. The explosion of Bitcoin NFTs expanded Bitcoin beyond a peer-to-peer electronic cash system into the most valuable NFT infrastructure. Thanks to Bitcoin’s Taproot upgrade and SegWit scaling, more data can now be stored on-chain, supporting the minting, transfer, and burning of NFTs.

Then came anonymous developer domo, who introduced BRC-20 based on the Ordinals protocol—a specific JSON text format that became a standard for issuing meme coins on Bitcoin. BRC-20 quickly ignited the Bitcoin Ordinals space, spawning tens of thousands of inscription tokens.

Next, Casey proposed the Runes protocol, based on the UTXO model, intended as a successor to BRC-20. Arthur launched Atomicals, an improved Ordinals protocol also built on Bitcoin’s UTXO model. Finally, from November to December 2023, inscription capital began spilling from Bitcoin to major EVM public chains, triggering massive trading volumes—some chains even experienced outages.

Looking ahead, market trends may lean toward institutionalization, possibly forming paradigms similar to Binance IEOs, with OKX and Binance wallets becoming central hubs for project launches. Additionally, it’s worth noting the potential of Runes—the recent surge suggests Runes may become the next dominant force. Thus, coexistence and competition among various inscription types and Runes will likely shape future development.

The future trajectory of the inscriptions market will gradually unfold under the combined influence of technological innovation and other factors. Investors, creators, and platforms must closely monitor industry developments and remain agile in responding to market changes. At the project level, beyond continued support for BTC protocol inscriptions, the launch of multi-chain inscriptions and Runes, along with improvements in trading market liquidity, will be key directions for future growth.

VII. Conclusion

In summary, inscriptions combine artistic, collectible, and financial asset attributes. Currently, the inscriptions market remains in its infancy, far from maturity, and suffers from poor trading liquidity. Future successful inscription products will be those capable of delivering sufficient liquidity. We must also remain cautious about speculative bubbles in inscription valuations and focus on meaningful, valuable inscriptions. The inscriptions market undoubtedly holds immense imaginative potential for the future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News