Kernel Ventures: Outlook on the Broader Ethereum Ecosystem Post-Cancun Upgrade

TechFlow Selected TechFlow Selected

Kernel Ventures: Outlook on the Broader Ethereum Ecosystem Post-Cancun Upgrade

The Ethereum ecosystem is currently undervalued, and the Cancun upgrade could become a signal for Ethereum to start strengthening.

Author: Jerry Luo, Kernel Ventures

TL;DR

-

Ethereum has completed its first three upgrade phases, addressing development barriers, DoS attacks, and the transition to PoS. The current primary upgrade goal is to reduce transaction fees and optimize user experience.

-

Four proposals—EIP-1553, EIP-4788, EIP-5656, and EIP-6780—respectively enable lower inter-contract interaction costs, improved beacon chain access efficiency, reduced data copying costs, and restricted permissions for the SELFDESTRUCT bytecode.

-

EIP-4844 significantly increases Ethereum's TPS and reduces data storage costs by introducing blob-carrying data attached to blocks.

-

The Cancun upgrade brings additional benefits to Ethereum-specific DA within the DA sector, while the Ethereum Foundation currently holds a negative stance toward DA solutions that do not leverage Ethereum at all for data storage.

-

Due to Optimistic Layer2’s more mature development environment and higher demand for Ethereum’s DA layer, the Cancun upgrade may bring relatively greater benefits to this ecosystem.

-

The Cancun upgrade can raise DApp performance ceilings, enabling DApps to approach Web2 app functionality. Fully on-chain games that remain popular and require substantial storage space on Ethereum are worth watching.

-

Currently, the Ethereum ecosystem appears undervalued. The Cancun upgrade could signal the beginning of Ethereum’s resurgence.

1. Ethereum’s Upgrade Journey

From the fake news published by Cointelegraph on October 16 last year about Bitcoin ETF approval to the actual approval on January 11 this year, the entire crypto market experienced sustained growth. As ETFs directly benefit Bitcoin most, Ethereum diverged from Bitcoin during this period: Bitcoin approached nearly $49,000, recovering about two-thirds of its previous bull market peak, whereas Ethereum only reached around $2,700, barely surpassing half of its prior peak. However, since the Bitcoin ETF launch, ETH/BTC has shown significant recovery. Besides anticipation of an upcoming Ethereum ETF, another key factor is the long-delayed Cancun upgrade, which recently announced public testing on the Goerli testnet, signaling imminent progress. Based on current estimates, the Cancun upgrade will not occur before Q1 2024. Aimed at solving low TPS and high transaction fees on Ethereum, it forms part of the Serenity upgrade phase. Prior to Serenity, Ethereum went through Frontier, Homestead, and Metropolis stages, each resolving issues related to development accessibility, DoS attacks, and the PoS transition. Ethereum’s roadmap clearly states that the current goals are achieving “Cheaper Transactions” and “Better User Experience.”

2. Core Content of the Cancun Upgrade

As a decentralized community, Ethereum upgrades originate from developer proposals ultimately approved by the broader Ethereum community. Approved ones become ERCs, while those under discussion or soon-to-be-implemented are known as EIPs. The upcoming Cancun upgrade is expected to implement five EIPs: EIP-1153, EIP-4788, EIP-5656, EIP-6780, and EIP-4844.

2.1 Main Mission: EIP-4844

-

Blob: EIP-4844 introduces a new transaction type called blob—a 125KB data packet. Blobs compress and encode transaction data without permanent storage via CALLDATA bytecode on Ethereum, greatly reducing gas consumption but making them inaccessible directly in the EVM. Post-EIP-4844, each transaction can carry up to two blobs, with a maximum of 16 per block. However, the Ethereum community recommends limiting to eight blobs per block; exceeding this incurs progressively increasing gas fees until reaching the 16-blob cap.

Additionally, EIP-4844 leverages two other core technologies: KZG polynomial commitments and temporary storage, analyzed in detail in our previous article Kernel Ventures: A Deep Dive into DA and Historical Data Layer Design. In summary, EIP-4844 modifies Ethereum’s block capacity and data storage location, significantly boosting mainnet TPS while lowering gas costs.

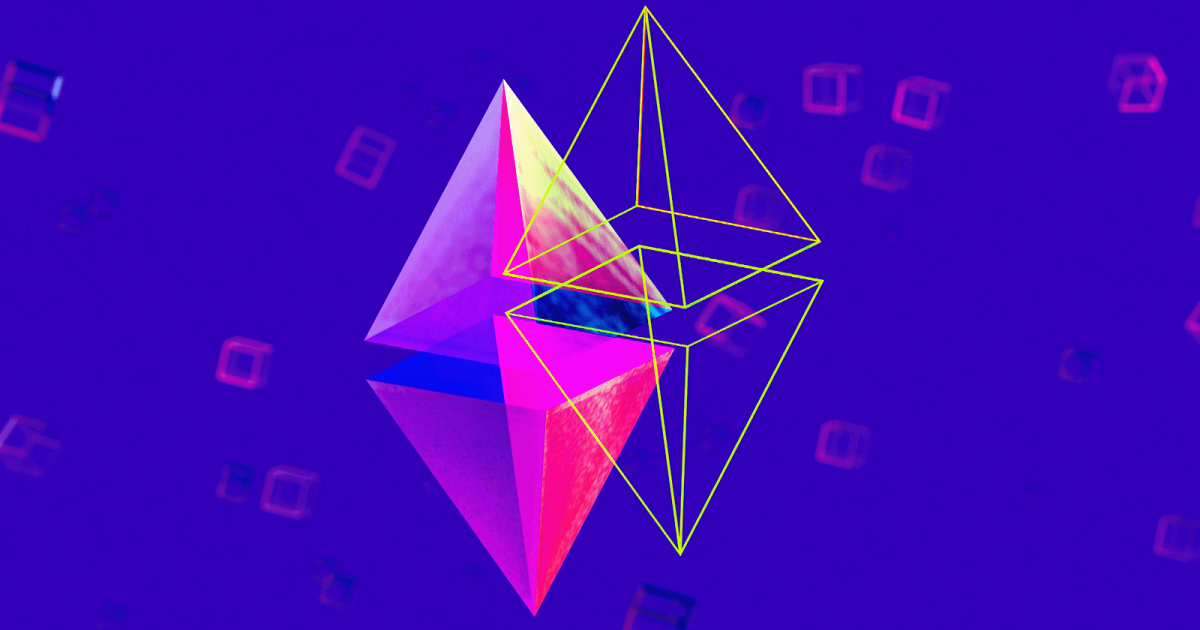

2.2 Side Missions: EIP-1153

EIP-1153: This proposal aims to reduce storage costs during contract interactions. An Ethereum transaction can be broken down into multiple frames created using CALL instructions, potentially involving information transfers across different contracts. State transfer between contracts occurs either through input/output methods (in-memory, low cost but insecure if passing through untrusted third-party contracts) or via SSTORE/SLOAD bytecodes for permanent on-chain storage (secure but expensive). EIP-1153 resolves this by introducing transient storage opcodes TSTORE and TLOAD. Variables stored using these behave like those using SSTORE/SLOAD—immutable during transmission—but disappear after the transaction ends, achieving secure state transfer at relatively low storage cost.

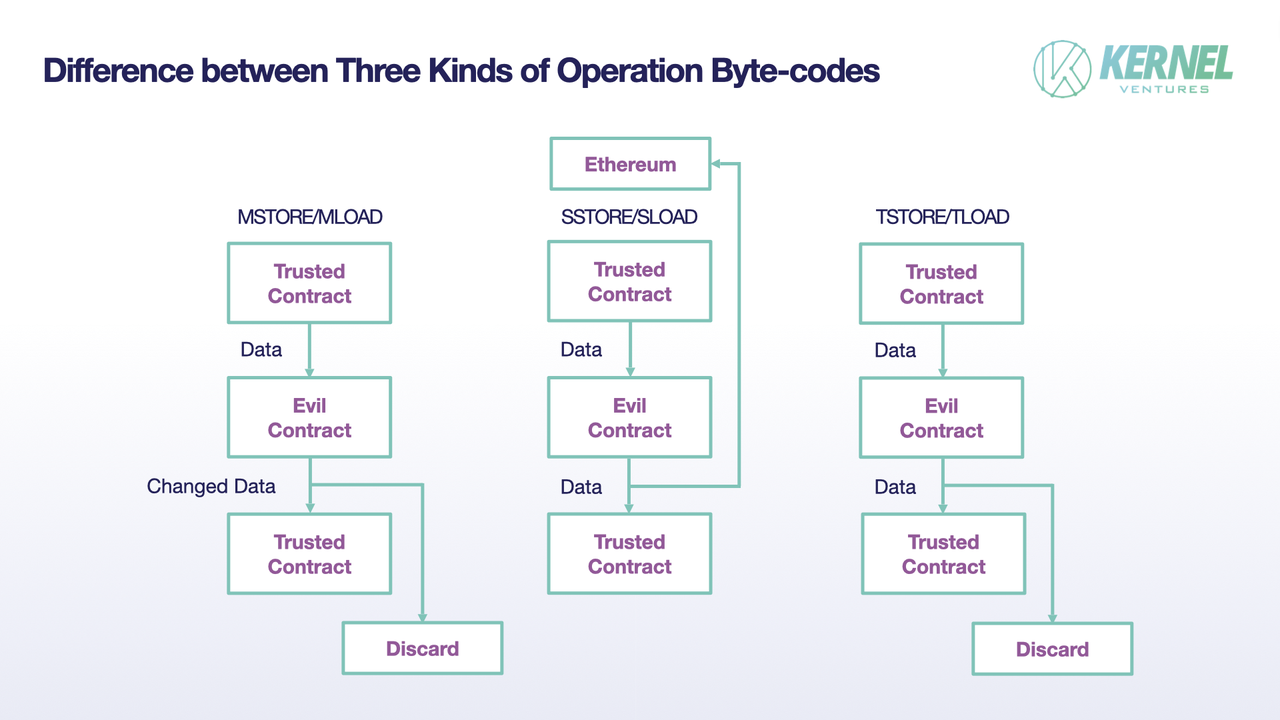

EIP-4788: After Ethereum’s PoS upgrade, each new execution block includes the root of the parent beacon block. Even if earlier roots are lost, reliability remains due to consensus-layer storage. During block creation, frequent requests from EVM to the consensus layer hurt efficiency and create MEV opportunities. Thus, EIP-4788 proposes a dedicated Beacon Root Contract to store recent roots, exposing them to the EVM and dramatically improving data access efficiency.

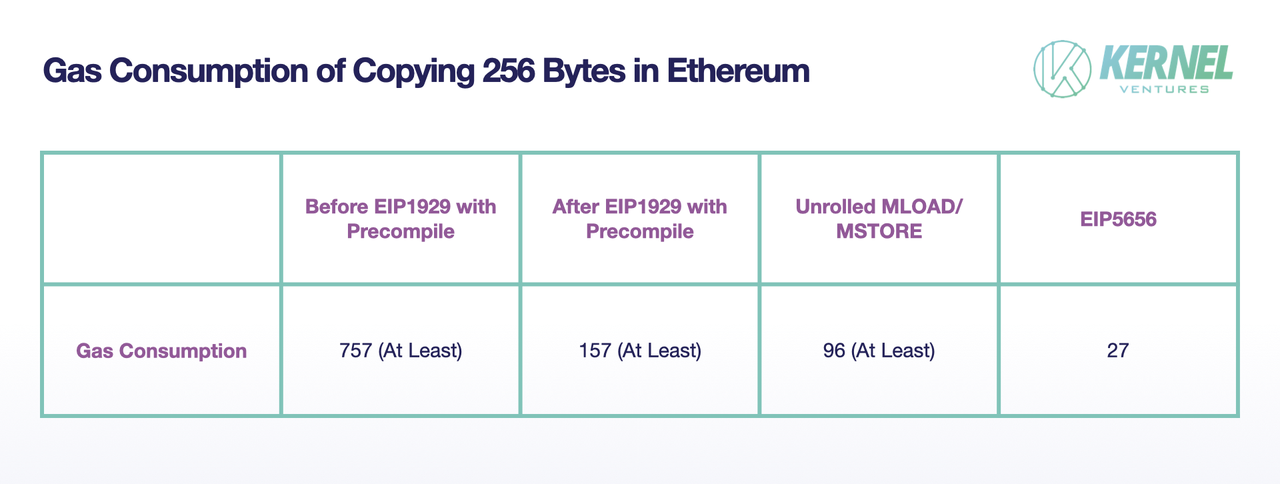

EIP-5656: Copying data in memory is a highly frequent basic operation on Ethereum, yet costly on the EVM. To address this, EIP-5656 introduces the MCOPY opcode for efficient copying on the EVM. MCOPY uses special data structures for short-term storage, including efficient sharding access and object replication. A dedicated MCOPY instruction also provides forward-looking protection against potential changes in CALL instruction gas costs in future Ethereum upgrades.

EIP-6780: In Ethereum, SELFDESTRUCT allows contract destruction, clearing all code and associated state. However, this poses risks in the upcoming Verkle Tree structure. Under Verkle Trees, cleared storage spaces are marked as previously written but empty—indistinguishable during EVM execution—but differ from non-existent operations in generating Verkle Commitments, leading to data verification issues. Therefore, EIP-6780 restricts SELFDESTRUCT to only refund ETH to a specified address, preserving the contract’s code and storage state on Ethereum.

3. Major Sectors After the Cancun Upgrade

3.1 DA Sector

3.1.1 Value Analysis of the Ecosystem

For explanations of DA principles and various DA types, refer to our previous article Kernel Ventures: A Deep Dive into DA and Historical Data Layer Design. For DA projects, revenue comes from users paying for data storage, while expenses stem from maintaining network operation, data persistence, and security. Net value equals revenue minus expenses. To increase value, DA projects must primarily improve storage utilization and attract more users. Additionally, technical improvements such as data compression or sharding reduce expenditures, further enhancing accumulated value.

3.1.2 DA Sector Segmentation

Currently, DA service providers fall into three categories: mainchain-specific DA, modular DA, and storage public chain DA. See Kernel Ventures: A Deep Dive into DA and Historical Data Layer Design for details and distinctions.

3.1.3 Impact of the Cancun Upgrade on DA Projects

-

User Demand: Post-Cancun, Ethereum’s historical transaction data will grow tens of times faster than before, creating greater storage demand. Since the upgraded Ethereum does not enhance storage performance, the mainchain periodically clears old data, naturally shifting long-term storage needs to external DA projects—boosting their user base.

-

Development Direction: Increased historical data will push DA projects to improve interoperability and data exchange efficiency with Ethereum. Cross-chain storage bridges will likely become focal points for modular and storage public chain DAs, while Ethereum-specific DAs must further strengthen compatibility with the mainnet to minimize transmission costs and risks.

3.1.4 Different DA Tracks Under the Cancun Upgrade

While the Cancun upgrade accelerates data growth without changing global synchronized storage, forcing periodic cleanup on the mainchain and delegating long-term data storage, such historical data remains valuable—for airdrops, on-chain analytics, etc. Its underlying value will spark competition among DA projects, with market share determined by data security and storage cost.

-

Mainchain-Specific DA: Current projects like EthStorage mainly serve Ethereum NFTs storing large media files (images, music). Due to high node cluster compatibility with Ethereum, they achieve secure, low-cost data exchange. By storing indexing data on Ethereum smart contracts—without fully脱离 Ethereum—they receive strong support from the Ethereum Foundation. For Ethereum-related storage markets, mainchain-specific DA holds inherent advantages.

-

Storage Public Chain DA and Modular DA: Non-mainchain DA projects struggle to gain competitive edge in historical data storage post-Cancun. However, since dedicated DA solutions remain in testing and not fully deployed, and the Cancun upgrade looms close, modular DA may still dominate this round of data value capture if dedicated DA fails to deliver viable solutions beforehand.

3.1.5 Opportunities in DA Under the Cancun Upgrade

-

EthStorage: Mainchain-based projects like EthStorage stand to benefit most from the Cancun upgrade, warranting close attention pre- and post-upgrade. Recently, following rumors of a possible February 2024 upgrade, EthStorage’s official Twitter became highly active, launching a new website and annual report—clearly ramping up marketing efforts.

Let’s celebrate the reveal of our new website! Please visit http://EthStorage.io to see the brand new design! Meet the Frontier of Scalability Real-time Cost Comparison with Ethereum How EthStorage Works Core Features of EthStorage Applications Enabled by EthStorage

However, comparing the latest site with the 2022 version reveals little functional innovation beyond enhanced frontend visuals and detailed descriptions—the core offerings remain storage and Web3Q domain services. Interested users can claim test tokens via https://galileo.web3q.io/faucet.w3q/faucet.html W3Q to experience EthStorage on Galileo Chain network, requiring either a W3Q domain or an account with over 0.1 ETH. Faucet distribution suggests moderate participation despite increased promotion. Given EthStorage raised $7 million in seed funding in July without visible deployment, the team might be preparing infrastructure launches timed with the Cancun upgrade to maximize visibility.

Celestia: As the leading modular DA project today, Celestia gained early traction during the last bull run, securing initial funding. Over two years, it refined its Rollup model, tokenomics, and tested extensively before launching its mainnet and initial airdrop on October 31, 2023. Its price has steadily risen since listing, recently surpassing $20. With approximately 150 million circulating TIA tokens, its market cap nears $3 billion. Considering the limited audience for blockchain historical storage, TIA’s valuation already exceeds Arweave’s (despite Arweave’s broader monetization) and approaches Filecoin’s—suggesting some overvaluation despite room for growth.

Nevertheless, backed by star status and lingering airdrop enthusiasm, Celestia remains highly watchable if the Cancun upgrade proceeds as planned in Q1. One notable risk: the Ethereum Foundation has repeatedly stated that projects detached from Ethereum’s DA layer cannot be considered Layer2, indicating skepticism toward non-native storage solutions like Celestia. Any official Ethereum Foundation statements around the upgrade could introduce price uncertainty for Celestia.

3.2 Layer2 Sector

3.2.1 Value Analysis of the Ecosystem

With growing user numbers and expanding applications, Ethereum’s low TPS hinders further development, while high transaction fees prevent widespread adoption of complex dApps. Yet migrating existing projects carries huge costs and risks, and no other chain matches Ethereum’s security except perhaps Bitcoin-focused chains. Layer2 emerged to solve these issues by offloading transaction processing and computation to another chain (Layer2), bundling data, verifying via a bridge smart contract on Layer1, and updating state on the mainnet. Layer2 handles execution and validation, relying on Ethereum as a DA layer for compressed transaction data—enabling faster speeds and lower computational costs. Users pay Layer2-specific tokens to execute transactions, while Layer2 operators pay Ethereum for data security. Revenue equals user payments minus Layer1 data security costs. Thus, two factors boost Layer2 earnings: From a revenue perspective, a more active Ethereum ecosystem means more users and developers seeking lower gas and faster transactions, expanding the user base and increasing total transaction volume—and thus operator profits. From a cost-saving angle, reduced Ethereum storage costs lower DA layer fees for Layer2 projects, increasing profitability even with stable transaction volumes.

3.2.2 Layer2 Sector Segmentation

Around 2018, Ethereum Layer2 solutions flourished, including sidechains, Rollups, state channels, and Plasma. However, state channels have been marginalized due to data availability risks and griefing attacks. Plasma remains niche and ranks outside the top 10 Layer2s by TVL. Sidechains, which don’t use Ethereum as a DA layer, are increasingly excluded from the Layer2 definition. This article focuses solely on the dominant Rollup model, analyzing its subcategories: ZKRollup and OpRollup.

Optimistic Rollup

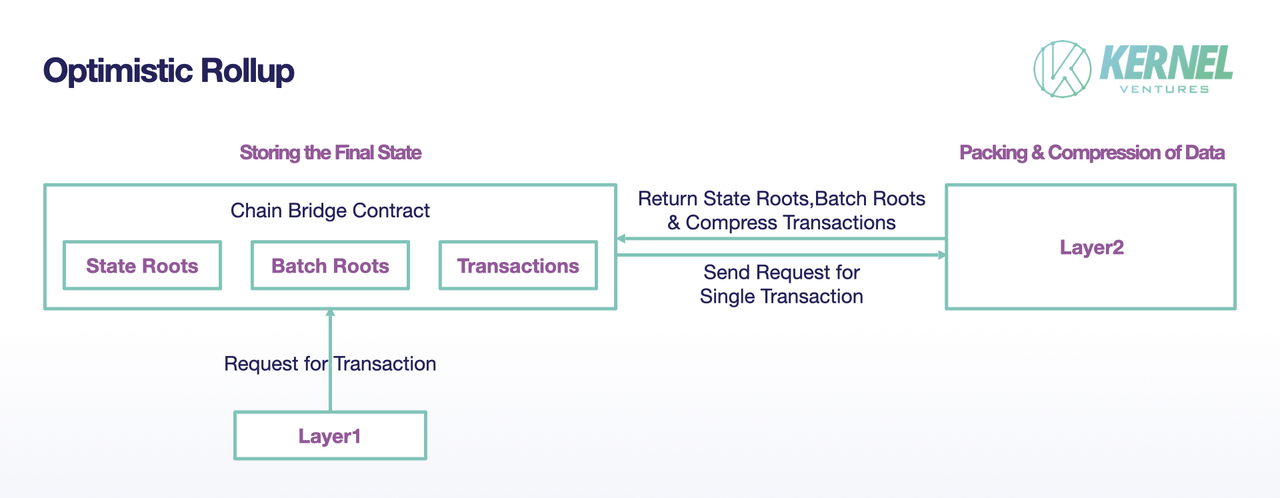

Mechanism: Initially, an Optimistic Rollup chain deploys a bridge contract on Ethereum to interact with the mainnet. Op Layer2 batches user transactions—including latest account state roots, batch roots, and compressed transaction data—and sends them to Ethereum. Currently, this data is stored in the bridge contract as Calldata—less expensive than MPT storage but still a significant overhead, hindering future performance gains for Op Layer2 (Optimistic Rollup Layer2).

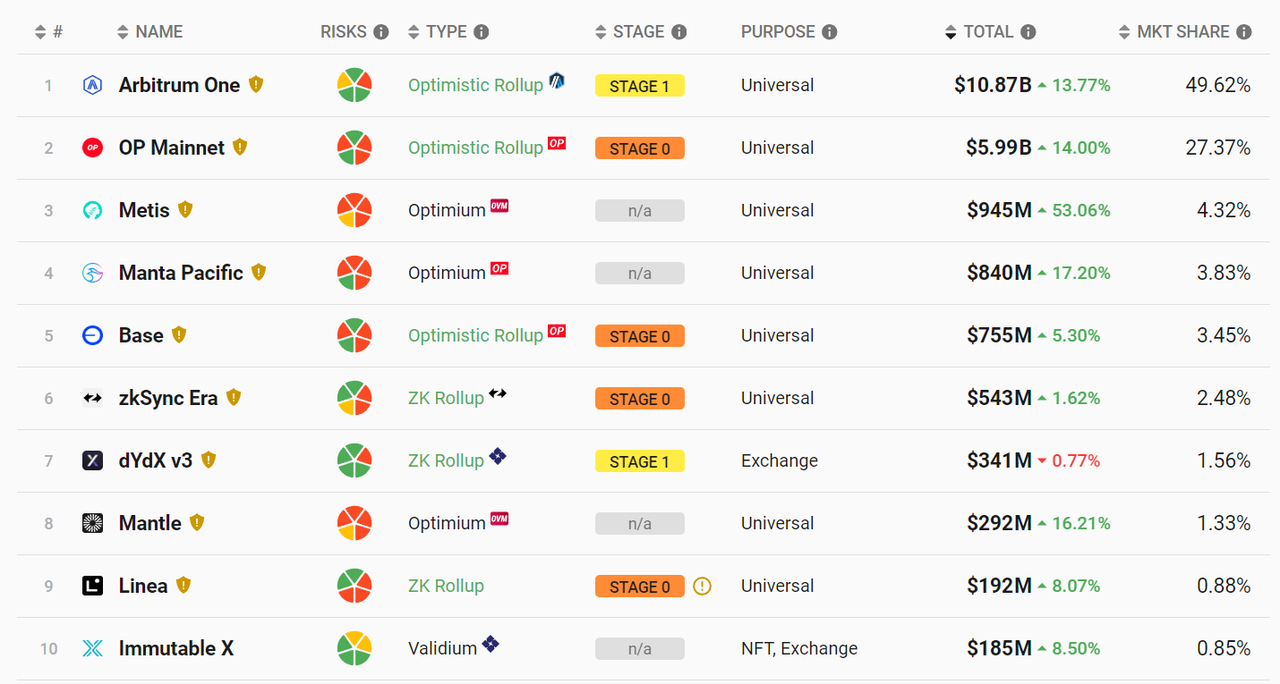

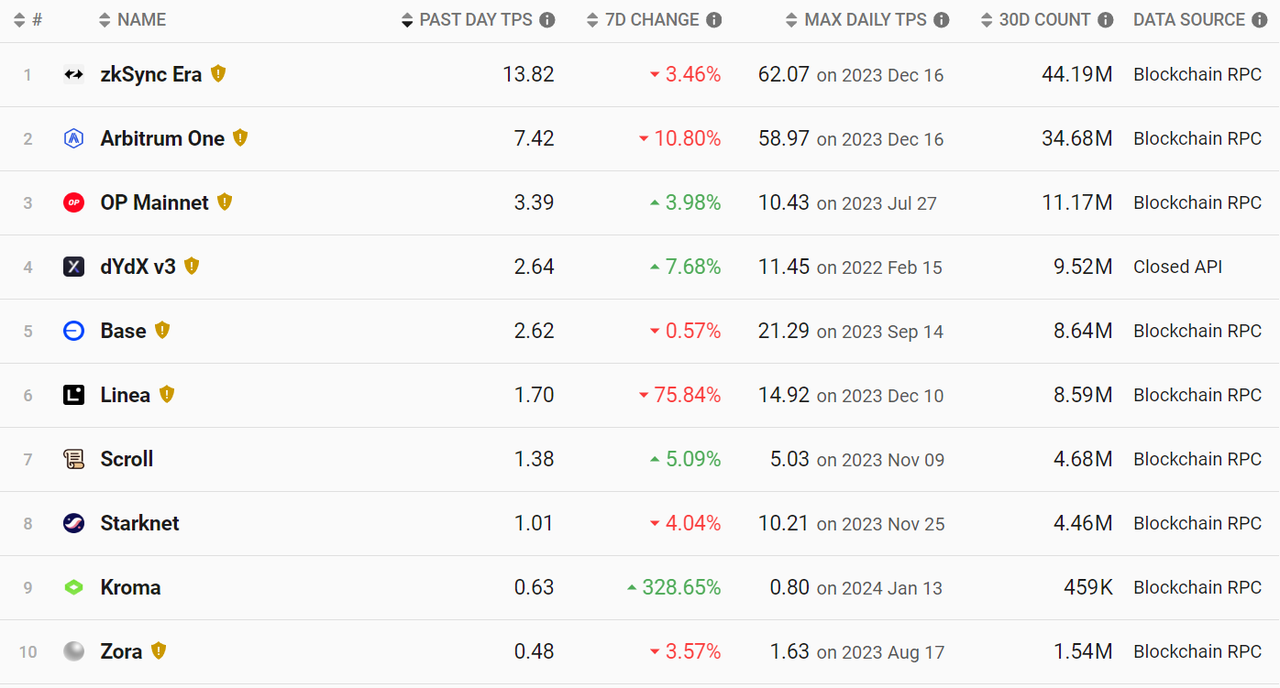

Current Status: Today, Op Layer2 dominates the Layer2 ecosystem. All top-five TVL chains belong to the Optimistic Rollup ecosystem, with Optimism and Arbitrum alone totaling over $16 billion in TVL.

A key reason for Op Rollup’s leadership is its developer-friendly environment, enabling earlier mainnet launches compared to ZK Rollup, attracting DApp developers frustrated by Ethereum’s high fees and low TPS, accelerating migration from Layer1 to Layer2. Moreover, Op Layer2 enjoys higher EVM compatibility, removing migration barriers for Ethereum-native projects. It quickly enabled deployments of major DApps like Uniswap, Sushiswap, and Curve on Layer2, even drawing projects like Worldcoin from Polygon. Today’s Op Layer2 hosts flagship DeFi protocols like Uniswap V3, native DeFi projects like GMX with over $100 million TVL, and SocialFi hits like Friend.tech with over $20 million in fees—achieving both quantity and quality breakthroughs. However, long-term, ZK Layer2 offers higher TPS ceilings and lower per-transaction gas, posing fierce future competition once ZK Rollup matures technologically.

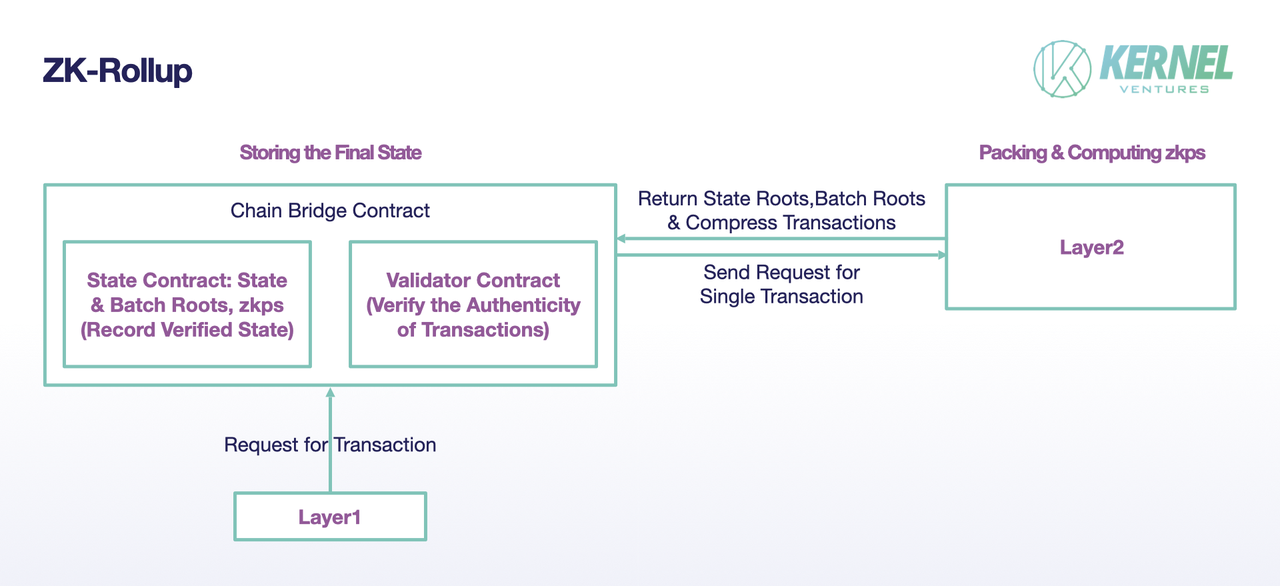

ZK Rollup (Zero-Knowledge Rollup)

Mechanism: ZK Layer2 processes transaction data similarly to Op Layer2—batched on Layer2 and submitted to Layer1 via Calldata. However, ZK Layer2 adds a step: generating a zero-knowledge proof (ZKp). Instead of submitting full transaction data, it returns only the transaction root, batch root, and a ZKp validating transaction legitimacy. These proofs require no challenge window and allow instant state updates on the mainnet upon verification.

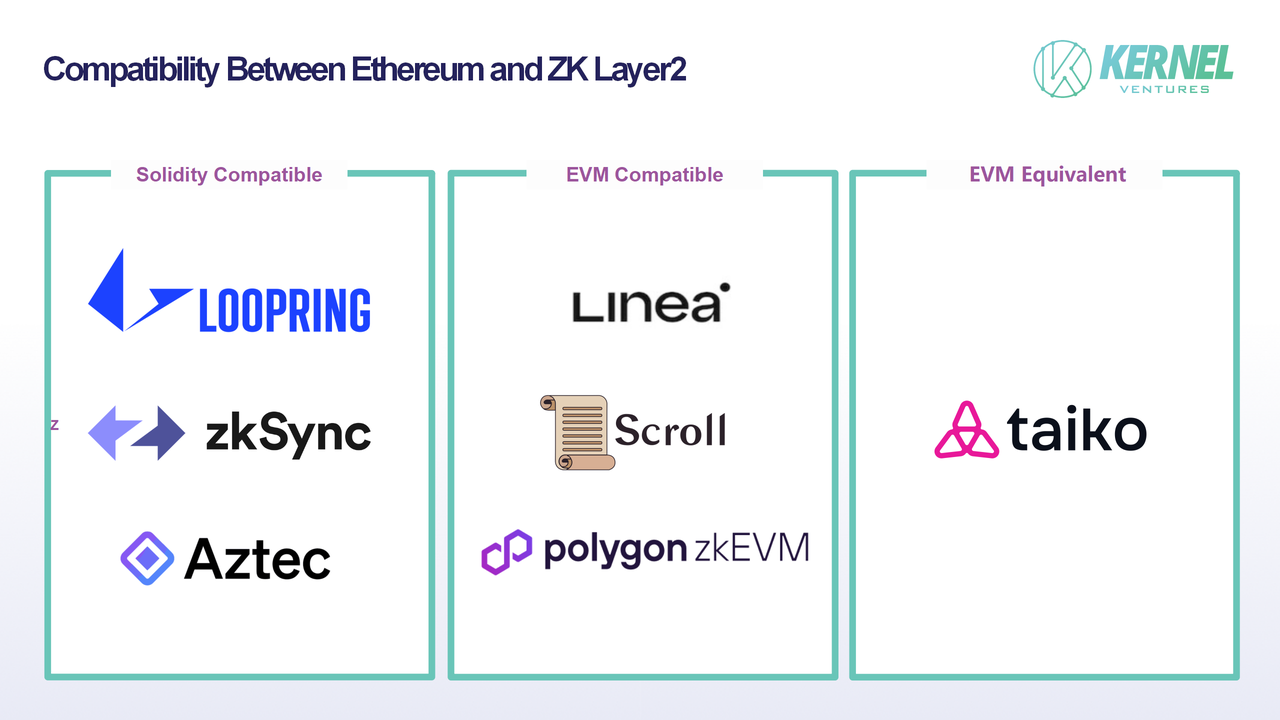

Current Status: ZK Layer2 has grown into the second-largest Layer2 ecosystem, trailing Op Layer2. Among the top 10 Layer2s by TVL, four are ZK-based, though overall they exhibit fragmentation rather than dominance. Despite broad belief in ZK’s potential, adoption remains slow. Early Op Layer2 launches captured developer mindshare and project deployments. Without compelling migration incentives, teams won’t move established, profitable projects. Furthermore, many ZK Layer2s still work on Ethereum compatibility—Linea, a star project, lacks full EVM opcode support, creating development hurdles. Another standout, zkSync, achieves almost no EVM-level compatibility, supporting only certain Ethereum development tools.

Compatibility challenges hinder native project migrations. Due to incomplete bytecode interoperability, teams must modify contract foundations to fit zkEVM—an error-prone, risky process slowing migration. Consequently, most ZK Layer2 projects are native builds, mostly simple DeFi apps like Zigzag and SyncSwap. The quantity and diversity of ZK Layer2 projects await further development. Still, ZK Layer2’s technological edge promises superior performance ceilings if zkEVM-EVM compatibility and ZKp generation algorithms mature. That explains why new ZK Layer2 projects keep emerging—even amid Op Layer2 dominance—offering better-performing alternatives to lure users from incumbent networks. But even if ZK Layer2 perfects its tech someday, if Op Layer2 has built a comprehensive ecosystem with entrenched projects, users and developers may hesitate to migrate despite better performance. Meanwhile, Op Layer2 continues strengthening its position—Optimism open-sourced Op Stack to accelerate fellow Op Layer2 development and improved dispute mechanisms like binary challenging. While ZK Layer2 advances, Op Layer2 doesn’t stand still. Hence, ZK Layer2’s immediate task is accelerating cryptographic algorithm refinement and EVM compatibility to prevent irreversible dependency on the Op Layer2 ecosystem.

3.2.3 Impact of the Cancun Upgrade on Layer2

Transaction Speed: Post-Cancun, a block can carry up to 20 times more data via blobs, keeping block intervals unchanged. Theoretically, Layer2s using Ethereum as both DA and settlement layers could achieve up to 20x higher TPS. Even estimating conservatively at 10x growth, any major Layer2 project would exceed Ethereum’s historical peak transaction speed.

Transaction Fees: A major constraint on Layer2 fee reduction stems from data security payments to Layer1. At current rates, storing 1KB of Calldata in an Ethereum smart contract costs nearly $3. With the Cancun upgrade, Layer2-packaged transaction data will reside as blobs in Ethereum’s consensus layer—costing only about $0.1 to store 1GB for one month—drastically cutting Layer2 operating costs. Layer2 operators will likely pass some savings to users, lowering transaction fees and attracting more participants.

Scalability: The Cancun upgrade impacts Layer2 mainly through transient storage and the new blob data type. Transient storage periodically deletes obsolete states irrelevant to current validation, reducing node storage pressure and accelerating synchronization and node access speeds for both Layer1 and Layer2. Blobs, with their large external capacity and flexible gas-price-based adjustment mechanism, better adapt to fluctuating network traffic—increasing blobs per block during congestion and decreasing when activity drops.

3.2.4 Different Layer2 Tracks Under the Cancun Upgrade

The Cancun upgrade benefits the entire Layer2 ecosystem. Its core change—reducing Ethereum’s data storage costs and increasing per-block capacity—naturally boosts TPS for Layer2s using Ethereum as a DA layer while cutting their Layer1 storage expenses. However, due to differing degrees of reliance on Ethereum’s DA layer, the benefits vary between Op Layer2 and ZK Layer2.

Op Layer2: Because Op Layer2 must record compressed full transaction data on Ethereum, it pays higher fees relative to ZK Layer2. Hence, post-EIP-4844 gas reductions allow Op Layer2 to cut fees more substantially, narrowing its cost disadvantage versus ZK Layer2. Additionally, the overall Ethereum gas decline will attract more participants and developers. Compared to ZK Layer2—which often lacks native tokens and faces EVM compatibility hurdles—more projects and capital will likely flow into Op Layer2, especially strong performers like Arbitrum lately. This could spark a new wave of Op Layer2-led development, particularly benefiting SocialFi and GameFi projects previously hampered by high fees. This period may witness high-quality projects approaching Web2 user experiences emerge on Layer2. If Op secures this development momentum again, it will widen the gap with ZK Layer2, creating formidable obstacles for future追赶.

ZK Layer2: Relative to Op Layer2, ZK Layer2 stores less data on-chain, so

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News