A New Variable in the Bitcoin Ecosystem: Will BRC-20 Reshape the Halving Narrative?

TechFlow Selected TechFlow Selected

A New Variable in the Bitcoin Ecosystem: Will BRC-20 Reshape the Halving Narrative?

With the April halving approaching, where will the BRC-20 wave—beginning in 2023—lead Bitcoin?

Author: Web3CN

With the approval of spot Bitcoin ETFs, the next most significant narrative in the crypto world is undoubtedly the fourth Bitcoin halving, expected on April 22, 2024, when block rewards will drop from 6.25 BTC to 3.125 BTC.

As one of the most important narratives in the crypto industry, the "Bitcoin halving" has long served as a confidence booster for the market. Will this cycle follow the same rhythm as previous ones? And what unexpected impacts might the new variables in the Bitcoin ecosystem since 2023 bring?

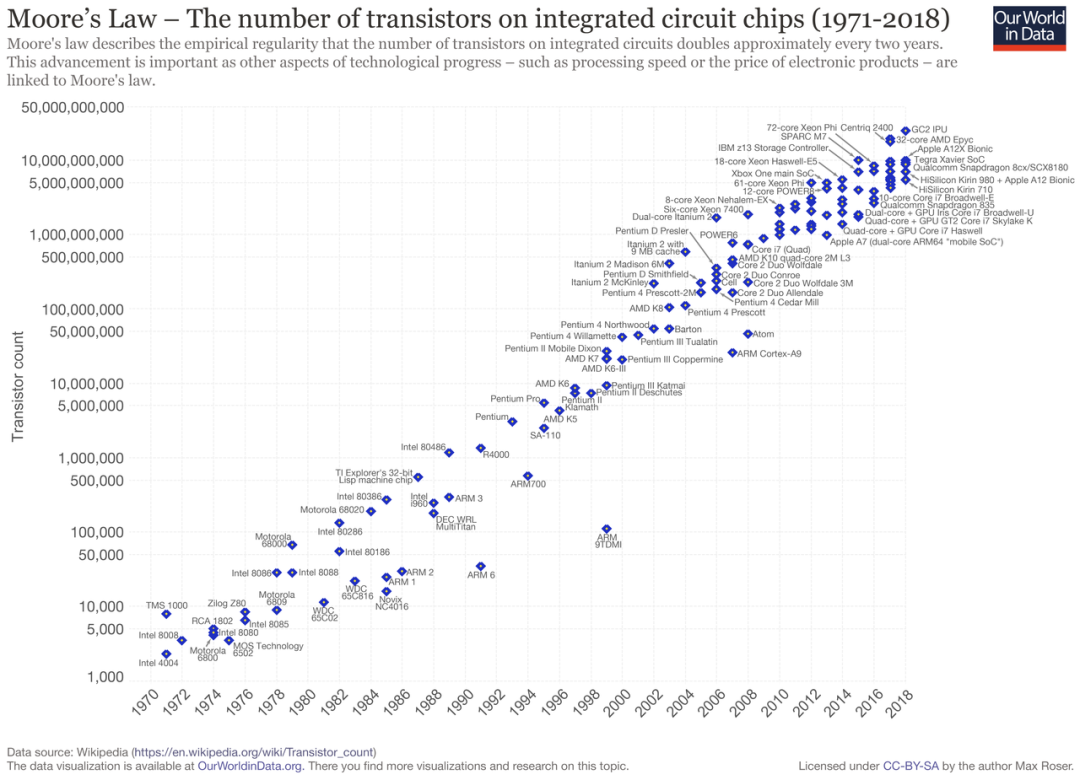

PoW Mining on the “Moore’s Law” Curve

As mentioned in the article "Bitcoin becomes the flag of technology," over decades the growth of "Transistor Count per chip" has followed Moore's Law, showing an astonishingly rapid upward trend visible to the naked eye.

Applied to Bitcoin mining chips and mining hardware, over the past decade as Bitcoin has matured, the pursuit of "the beauty of computing power" under PoW cryptocurrencies like Bitcoin has driven hardware evolution—from CPUs to GPUs, then to FPGAs and ASICs. Chip manufacturing processes have advanced from hundreds of nanometers down to dozens, and now to 7 nanometers or even smaller, gradually approaching physical limits that may soon require quantum-level breakthroughs.

Capital within the industry has always loved betting collectively on "halving events." The bull market from 2018 to 2020 was precisely such a case. Riding this positive momentum, growing hash rate, new hardware, and the upcoming reward halving continue to shape the overall growth of both the industry and Bitcoin itself:

Just yesterday, on February 3, data from BTC.com showed that Bitcoin mining difficulty adjusted at block height 828,576, increasing by 7.33% to 75.5 T, setting yet another all-time high. The current network-wide average hash rate stands at 550.07 EH/s. This 7.33% increase also marks the largest difficulty adjustment since March 2023.

We are now midway through a new halving cycle, with a two-year window until the next Bitcoin halving. This may be the first (or second) time for most current industry participants and investors to personally witness and experience a Bitcoin halving event—an elegant mechanism design destined to leave a lasting impression.

The Historical Cycle of Halvings

For the crypto industry, each halving is indeed a major event. Especially during the first two Bitcoin halving cycles, prices surged tens of times over (in the short term, both halvings were followed by temporary dips after the anticipated bullish news was priced in, but eventually gave way to sustained long-term uptrends).

However, starting with the third halving in 2020, the number of industry participants, market attention, and maturity of supporting infrastructure had significantly improved compared to earlier periods. Bitcoin was no longer confined to niche circles of tech enthusiasts but began interacting more with external factors.

To summarize briefly:

-

Before the first halving, insiders primarily focused on Bitcoin’s potential as electronic cash;

-

During the second halving cycle, attention shifted toward Bitcoin’s role as a payment tool, sparking heated debates (the subsequent BCH fork became nearly the biggest drama in the community);

-

In the third halving cycle, Bitcoin emerged as an alternative asset, with institutional adoption and capital allocation becoming dominant themes;

Therefore, compared to the first two halvings, the third Bitcoin halving attracted unprecedented attention. At the same time, global geopolitical and economic conditions influenced its performance:

Under macroeconomic pressures, just two months before the May 11 halving—on March 12–13—Bitcoin dropped from $7,600, initially falling to $5,500, then breaking key support levels and plunging as low as $3,600. The entire market cap evaporated by $55 billion, with over 20 billion RMB in liquidations across the network—a precise "price halving."

Yet shortly after the May halving, the DeFi summer kicked off a new bull cycle, pushing Bitcoin to nearly $60,000—an almost 20x rise from its pre-halving low.

Overall, based on historical halving patterns, traditionally Bitcoin’s price tends to settle around half of the previous bull market peak at the time of halving—in other words, by April 2024, Bitcoin could hover around $30,000.

Post-halving, a new bull cycle is highly likely. While a tenfold surge may be difficult given today’s larger market size, surpassing the previous cycle’s high of $60,000 remains well within reach.

New Variables in the Bitcoin Ecosystem

At the same time, after three prior halvings—with block rewards now at 6.25 BTC and over 19 million Bitcoins already mined—it’s time to reassess many aspects from a fresh perspective.

Especially beyond this upcoming halving, both the broader industry and Bitcoin itself have seen some notable new variables emerge compared to previous cycles.

Dynamic Game Theory Behind the Halving Mechanism

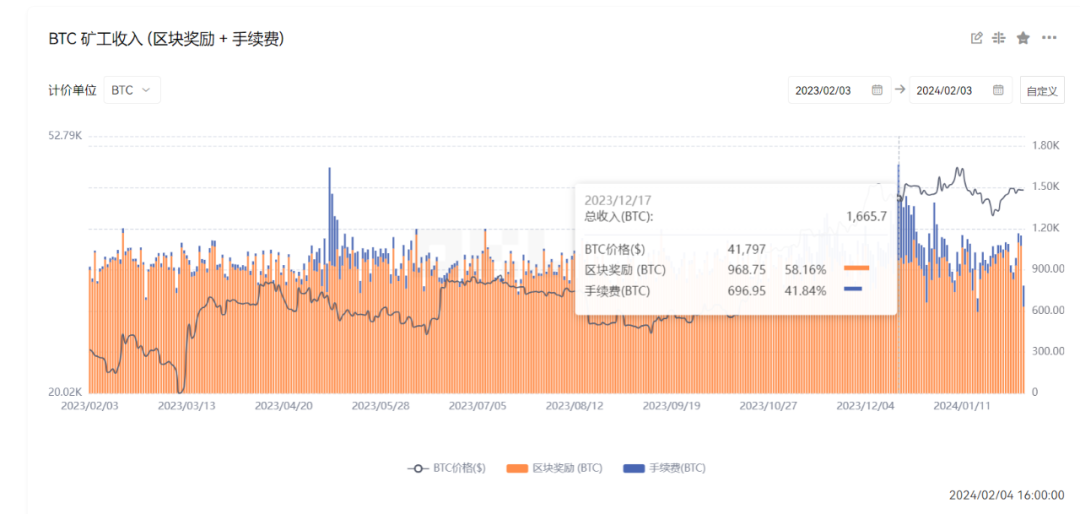

Let’s briefly review the fundamentals of Bitcoin halving: Bitcoin’s mechanism design makes miners critically important—they are the backbone ensuring the system’s transaction operations. Currently, miner income comes from two sources: block rewards and transaction fees.

Initially, block rewards were set at 50 BTC, halving every four years. After three halvings, it’s now at 6.25 BTC, with the next reduction expected in 2024. This process continues until around 2140, when no more block rewards will exist.

Transaction fees, however, will persist indefinitely (similar to Monero, mentioned earlier). Thus, in the future, miner revenue will become singular—solely dependent on fees.

In fact, Bitcoin miners’ fee income has already surpassed block rewards, becoming their primary source of income. This implies that while miners will remain essential, their revenue model will fundamentally shift:

As block rewards gradually decrease toward zero, transaction fees will grow increasingly critical, eventually becoming the only source of income (this is partly why miners advocate for larger blocks: bigger blocks allow more transactions packed within the same timeframe, thus generating higher fees).

While logically, rising fees can offset declining block rewards like a seesaw, excessively high fees hinder Bitcoin’s usability:

Miners need sufficient incentives to maintain the network; users creating value on the network cannot afford prohibitively high fees.

Bitcoin’s economic system constantly fine-tunes itself through feedback loops, perpetually balancing these inherent tensions via dynamic博弈 among stakeholders to achieve equilibrium.

Variables Introduced by BRC20

Since 2023, the flourishing of the Bitcoin ecosystem—especially BRC20—has sparked a new wave of "BitcoinFi," driving internal Bitcoin transactions to record highs and sharply boosting transaction fee revenues.

In particular, protocol innovations like Ordinals, along with leading projects such as ORDI and SATS expanding aggressively, have deeply impacted Bitcoin’s fee structure—most directly reshaping Bitcoin’s economic and incentive models.

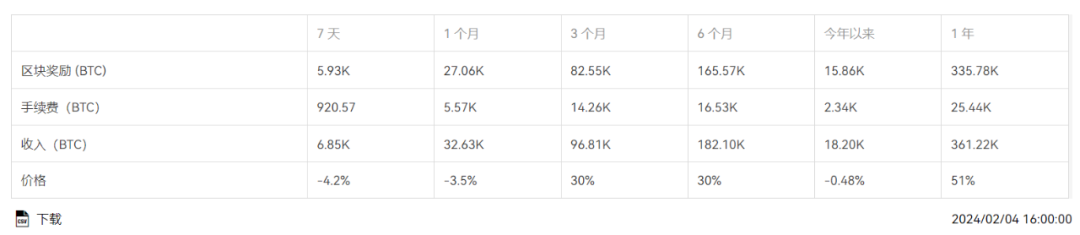

According to the latest Dune data, as of February 4, cumulative fees paid for Ordinal inscriptions exceeded 6,000 BTC—over $250 million.

On December 17, 2023, Bitcoin mining fees hit a five-year high of 696 BTC (approximately $30 million), accounting for over 40% of miners’ total daily revenue.

Historically, miner fee income averaged around only 2%, but over the past three months, the average has surged to over 15%, setting a new record.

As we approach the next halving and block rewards continue to decline toward zero, transaction fees will become progressively more important, ultimately serving as the sole income stream for miners.

The BRC20 boom in 2023 effectively acted as a trial run. Regardless of its ultimate success, this path will draw even greater attention as future halvings unfold.

If previously Bitcoin held only ideological dominance and market cap leadership, the inscription craze has dramatically enriched the diversity of assets within the Bitcoin ecosystem. Human demand for new assets is eternal, and this trend indirectly boosts developer count and user base.

Meanwhile, promising innovations such as the RGB protocol, Slashtags (providing identity, contacts, messaging, and payments for Bitcoin’s Lightning Network), the Impervious browser integrating multiple P2P services, Taro (a Taproot-based asset protocol), and OmniBOLT lightning tokens are all worth watching.

Overall, we are now nearing the end of another halving cycle—a moment that may mark the first (or second) time for most current participants and investors to personally witness a Bitcoin halving event. What happens next—to Bitcoin and this cycle—remains to be seen.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News