With numerous restaking projects emerging, how can you choose the right ones to maximize returns?

TechFlow Selected TechFlow Selected

With numerous restaking projects emerging, how can you choose the right ones to maximize returns?

You will become very wealthy, if you don't know, I suggest you read the following content.

Author: ROUTE 2 FI

Translation: TechFlow

Today, let's talk about restaking. EigenLayer points are currently trading over-the-counter on Whales Market at $0.19 per point. If you know what this means, you're going to become very wealthy. If not, I suggest reading the following.

Introduction to rswETH

Currently, native restaking is only accessible to users who own 32 ETH and possess the infrastructure expertise to run a validator. Additionally, restaked ETH is locked within EigenLayer, leaving funds illiquid for users.

Restaked Swell Ether (rswETH) is a native liquid restaking token (LRT) that allows you to earn Pearls (Pearls), EigenLayer points, and future restaking rewards while still enjoying the freedom to participate in DeFi.

You have two ways to earn Pearls and EigenLayer points through Swell and EigenLayer:

-

Hold or provide liquidity (LP) with rswETH on Curve Finance or Maverick Protocol

-

Restake swETH on EigenLayer when deposits open on February 5

Additionally, earning Pearls points contributes toward eligibility for Swell’s Q2 2024 token airdrop.

If you want to enter EigenLayer on Monday, make sure to mint your swETH in advance.

Click here to visit Swell and obtain swETH or rswETH.

Let’s discuss restaking and all the different airdrop and yield options

EigenLayer reopened its cap on February 5, so I’d like to share some thoughts on it and associated risks. As you know, I’m bullish on Ethereum, and restaking is quite appealing.

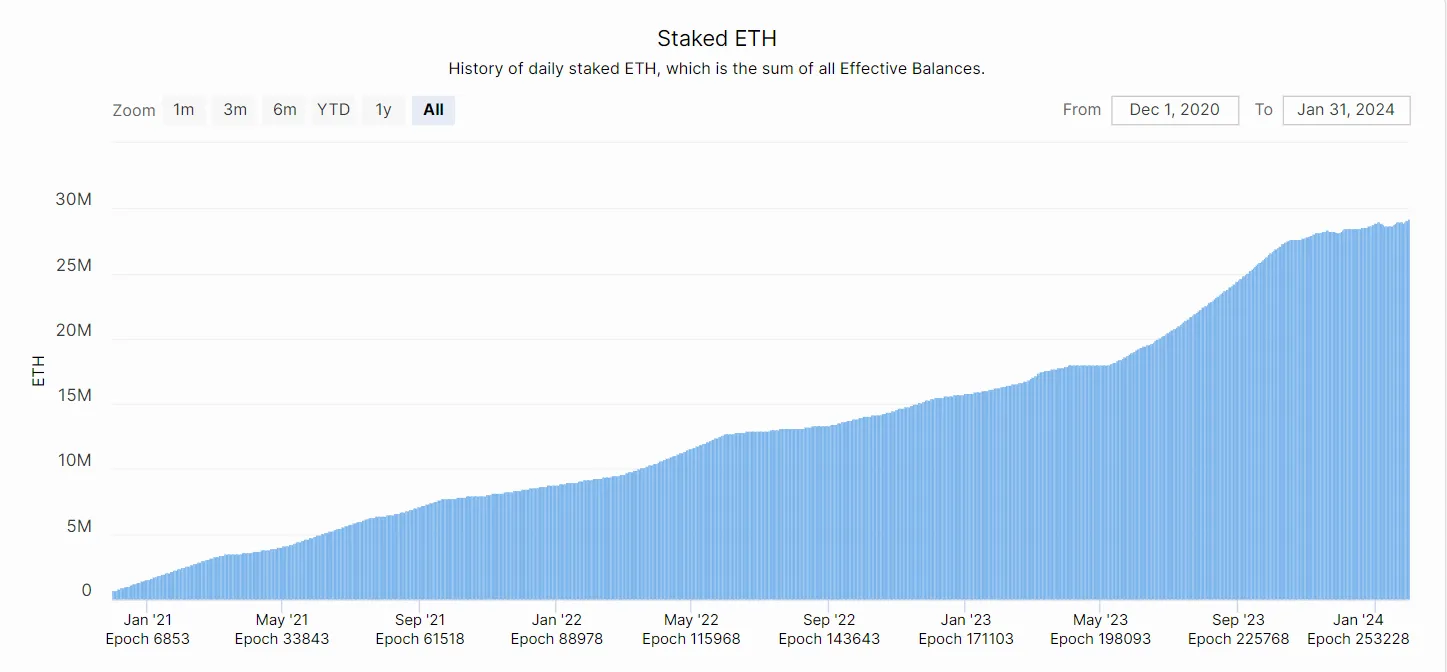

Approximately 1/4 of circulating ETH is staked (out of 120 million total ETH, around 30 million is staked).

This provides immense security for Ethereum and the smart contracts running on it, as attacking the Ethereum consensus system would require a massive amount of ETH.

With the introduction of EigenLayer restaking, Ethereum validators can now use their 32 ETH stake (reusing the same 32 ETH) to secure other protocols. Validators do not need to unstake or add additional capital. EigenLayer enables protocols to access Ethereum’s security via restaking—something previously impossible.

EigenLayer is not a DeFi protocol. It is a platform for bootstrapping new proof-of-stake (PoS) systems. Users cannot engage in financial activities such as swapping or lending directly through EigenLayer contracts.

However, decentralized services built atop EigenLayer—called AVSs (Actively Validated Services)—can themselves be DeFi applications or support critical functions in other DeFi protocols. These AVSs exist outside of EigenLayer contracts.

Additionally, another class of protocols built on EigenLayer are known as Liquid Restaking Protocols (LRTs). They are permissionlessly built on EigenLayer and are particularly relevant to decentralized participants. Examples include Swell Network, Ether.fi, Genesis, Puffer, Kelp, and others.

Swell and EtherFi offer double points through native token airdrops. You can also earn EigenLayer points and KelpDAO miles by restaking stETH or ETHx.

Overview of Different Options

First, we need to distinguish between liquid staking and liquid restaking.

Traditional staking involves locking your assets into a smart contract to support blockchain operations and earn staking rewards.

Liquid staking, on the other hand, allows you to stake your assets via a liquid staking protocol and receive a liquid token representing your staked assets.

Liquid restaking is a method where holders of liquid staking tokens (LSTs) further re-stake their tokens by transferring them into EigenLayer smart contracts.

For more details, Inception published a blog post explaining these differences—click here to read it.

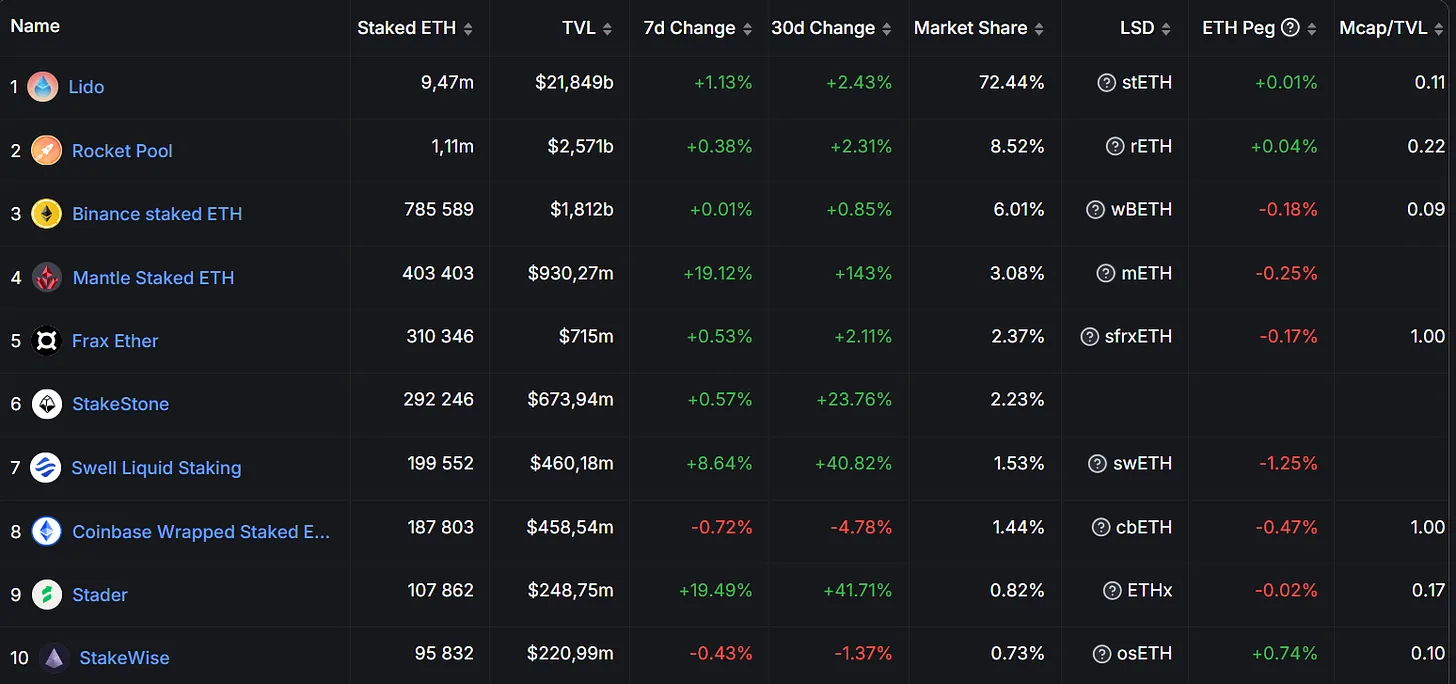

In the DeFiLlama screenshot below, you can see liquid staking protocols such as Lido, RocketPool, Mantle, Frax, and Swell.

In the second screenshot below, you can see liquid restaking protocols such as ether.fi, Puffer, Kelp, Renzo, and others.

In the next section, I’ll outline what I personally believe are currently the most interesting opportunities in LST/LRT space.

For EtherFi (eETH)

-

Deposit ETH → generate eETH + earn EtherFi loyalty points + EigenLayer points. Use eETH to interact with various DeFi protocols and earn additional yields (e.g., Pendle).

For Swell (swETH/rswETH)

-

Deposit ETH into Swell to receive swETH LST → then restake on EigenLayer → ultimately generating a liquid rswETH LRT. Assuming the Pearl reward system remains active unless TGE occurs before the LRT launch. Stake your ETH with Swell to earn "Pearl" airdrop points plus additional rewards through referrals, restaking on EigenLayer, and strategies with DeFi partners.

For Mantle ETH (mETH)

-

Deposit ETH into Mantle LSP (Liquid Staking Protocol) to earn 7.2% APY (promised for the next 2 months, possibly extended). You will receive mETH, which you can hold in your wallet. On Monday, when EigenLayer opens, you can deposit mETH to earn additional EigenLayer rewards. The downside of this approach is no airdrop, since the Mantle token already exists. However, the yield is very high. So you get dual yield + EigenLayer points when joining the pool on Monday.

For Kelp (ETHx):

-

On Kelp, you can choose stETH, ETHx, and sfrxETH. On all assets, you will earn EigenLayer points + Kelp miles (for airdrops). ETHx offers more EigenLayer points than any other LST because Stader (the team behind Kelp) uses treasury ETH to restake on EigenLayer and is gifting those extra EigenLayer points.

For Renzo:

-

Stake ETH and receive ezETH. You will also earn EigenLayer points, Renzo ez points (airdrop), and standard ETH staking rewards.

For EigenPie:

-

For every 1 ETH worth of LST deposited, users earn 1 Eigenpie point per hour. During the initial 15 days, depositors receive a 2x points bonus, rewarding early supporters. These Eigenpie points are key to sharing 10% of the total EGP supply via airdrop and participating in a 60% EGP token IDO at a $3 million FDV.

For Puffer:

-

Deposit stETH & wstETH to earn Puffer + EigenLayer points. Double points are locked until February 9.

-

pufETH is an nLRT (native liquid restaking token). nLRTs generate restaking rewards through native restaking on EigenLayer, where Ethereum PoS validator ETH serves as the staked asset. This distinguishes them from liquid restaking tokens (LRTs). LRTs tokenize LSTs that are restaked within a liquid restaking protocol (LRP). While LRPs generate yield from restaking services, these differ from PoS rewards.

How Should You Choose?

It's a tough choice, as each option has pros and cons depending on your perspective.

If you're an airdrop hunter: Swell, EtherFi, Kelp, Puffer, EigenPie, Renzo

If you want maximum yield: Mantle ETH (mETH), offering 7.2% yield on your ETH + EigenLayer points

If you want “safety”: I put “safety” in quotes because in crypto, no project should ever be considered absolutely safe—even stETH (which saw 70% of its market depeg during summer 2022).

That said, the safest options are likely Lido, RocketPool, and Binance Staked ETH.

I believe Puffer is relatively safe, and I suspect it may come to be seen as one of the safer choices over time.

What I'm Choosing

I'm participating in all airdrop campaigns and holding mETH. Personally, I also enjoy scaling up investments, and the 7.2% APY offered by mETH is quite attractive.

If you’re a decentralized, Ethereum-bullish participant, you could, for example, buy 10 wstETH, deposit into Aave, borrow against it—say 50% of ETH (5 ETH)—then purchase swETH, mETH, ETHx and follow the above strategies to earn airdrops + EigenLayer points.

Also remember, several LRT tokens are即将 launching: Genesis and Inception are two examples. Pendle also offers some decentralized strategies where you can achieve up to 30% returns.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News