Don't use the fact that too many people are rushing airdrops as an excuse for laziness.

TechFlow Selected TechFlow Selected

Don't use the fact that too many people are rushing airdrops as an excuse for laziness.

I'd bet that roughly 90% of the people reading this article would agree with my point of view.

Author: HUMBLE FARMER ARMY RESEARCH

Translation: TechFlow

Introduction

What psychological barrier prevents us from claiming free yields?

Currently, airdrops have become a hot topic in the crypto space, with many achieving rapid asset growth through low-cost participation.

However, after every major airdrop, we always see people complaining on Crypto Twitter about unfair distribution and then abandoning future airdrop farming. Yet this is a misconception—airdrop farmers are still a minority, and farming remains profitable.

Main Content

Everyone seems to be talking about how to farm airdrops now—can you blame them? Compared to paying $50 in gas fees for swapping assets on the Ethereum mainnet, I've seen people turn $50 into $10,000 by staking $SOL on Jito. This incentivizes new users to learn self-custody and on-chain DeFi, acting as a Trojan horse for cryptocurrency adoption.

We should celebrate this! Small-capital investors finally have a way to achieve 10x–100x portfolio growth without getting sucked into memes, leveraged trading, or FOMO-driven speculation. Yet, it seems that after every major airdrop, we see waves of angry users on Crypto Twitter complaining about flaws in the airdrop distribution mechanism and declaring they'll stop farming airdrops altogether.

Thus, Crypto Twitter appears divided into two groups:

-

Airdrop hunters who rejoice at their generous rewards

-

Those who complain about unequal distribution and claim farming isn't worth it due to future dilution

But if you examine the psychology of the second group, these people would never have farmed airdrops anyway. They're comfortable in their current environment—trading crypto on CEXs—and convince themselves they don't need to learn how to use blockchains. They complain about airdrop farmers and tweet about it, gaining engagement and comfort when strangers online agree with their views.

I’ve decided to call this phenomenon the "Midcurve Airdrop Fallacy."

Midcurve Airdrop Fallacy: The number of people complaining about farming airdrops vastly exceeds the number actually doing it. As a result, individuals mentally assume airdrops will be diluted and choose not to participate—yet they aren’t actually diluting the airdrops they’re complaining about.

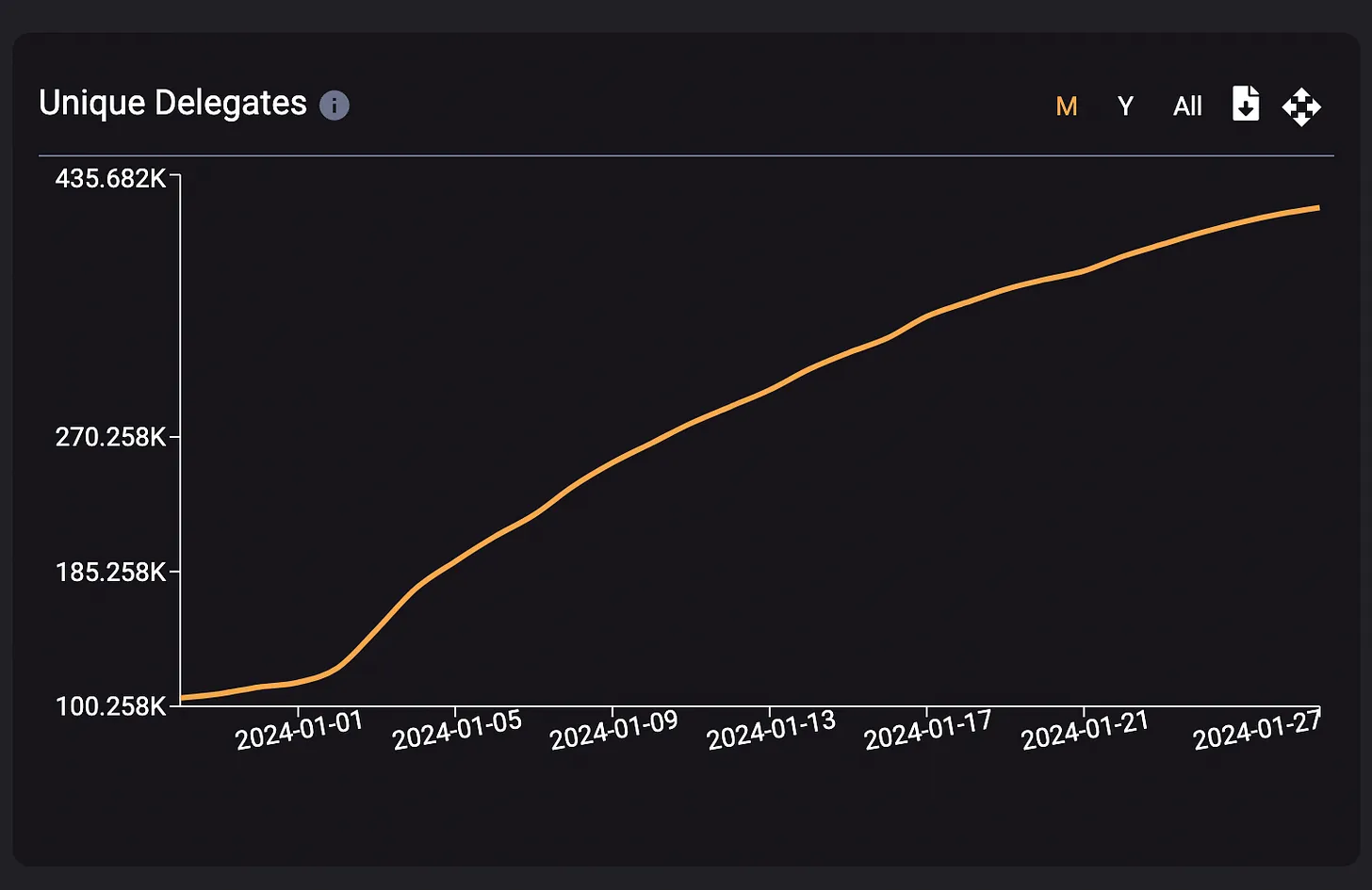

Of course, this doesn't mean future airdrops won't be diluted. Indeed, we can observe rising numbers of Celestia stakers. Similarly, we see increasing wallet counts farming airdrops on Solana. However, I do believe people greatly exaggerate the degree of dilution and underestimate the total scale of all future airdrops combined. What makes an airdrop "diluted"? If we stake $500 worth of $TIA and receive a $500 airdrop, is it diluted? Yes, technically—if not for those new stakers, it could have been a $1,000 airdrop!

Cognitive Dissonance

First, I proudly admit that I myself am a midcurver. In fact, I consider myself an expert on this topic. So I have some credibility when identifying midcurve behavior in others. Actually, there's a simple explanation for all of this: cognitive dissonance.

(Editor’s note: “midcurve” in this article is a coined term describing a psychological fallacy where people refrain from action due to excessive worry over reward dilution)

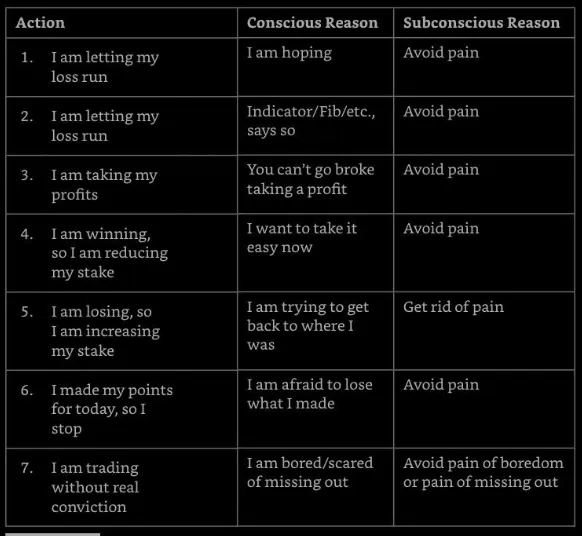

In psychology, cognitive dissonance refers to the mental discomfort experienced when holding two contradictory beliefs or ideas simultaneously. When faced with facts that contradict one’s beliefs, ideals, or values, people often rationalize to resolve the conflict and reduce discomfort.

We subconsciously make suboptimal decisions in markets because we don’t want to feel uncomfortable. Your token doubled? Let’s sell half. Your token dropped 50%? Let’s wait until we break even before selling. The reality is, the market doesn’t care about your cost basis. We sell winning positions because we fear price drops and profit reversal, and we hold losing positions because we fear admitting our investment mistakes.

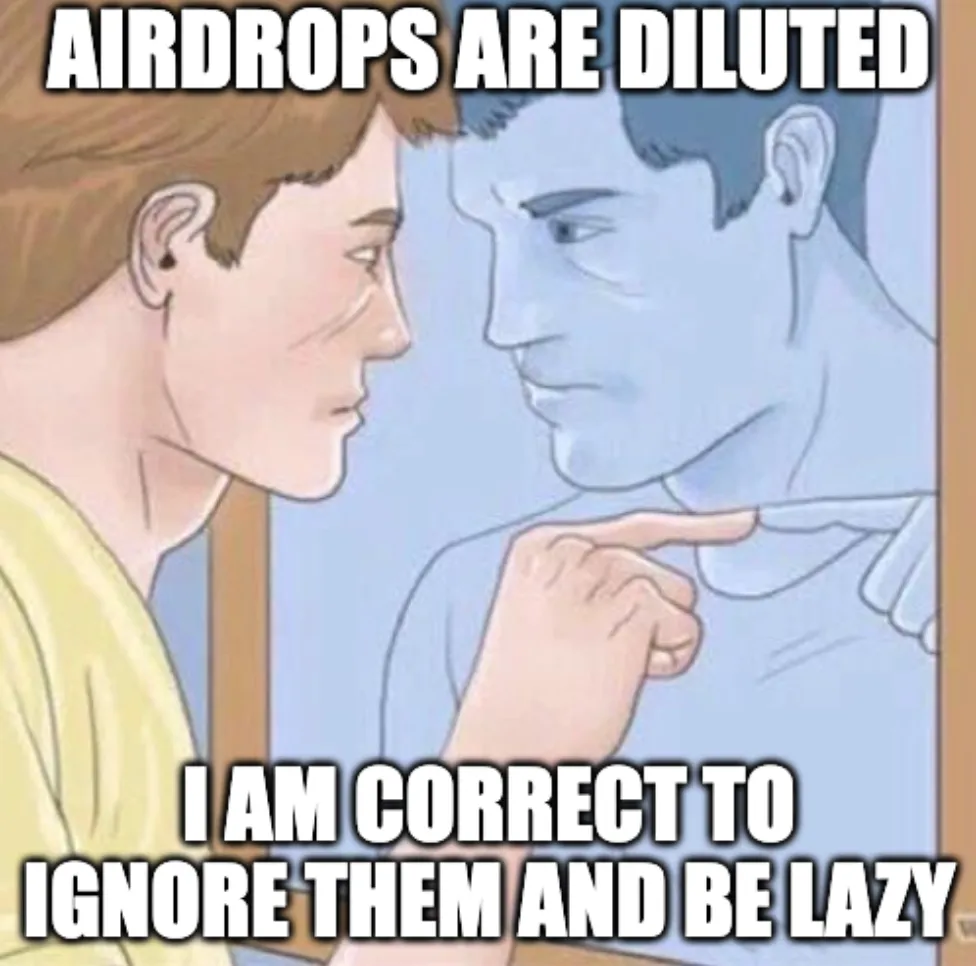

Fear of pain leads to midcurve behavior.

People don’t want to start farming airdrops because they don’t want to buy $TIA at the top. People don’t want to use Solana because they’re used to ETH. “Airdrops will be diluted” is just an excuse people use to justify their laziness.

Conclusion

I believe airdrops will remain profitable in the coming months. I’m also open to the possibility that I might be wrong. I’m not saying you should allocate large amounts of money into anything, but I strongly encourage people to at least give it a try.

Why not stake 1% of your portfolio in TIA? Why not move 1% of your portfolio into the Solana ecosystem to explore potential airdrop opportunities? I guarantee you’ll learn more about Solana by actually using the chain.

I bet 90% of people reading this article will generally agree with me. Unfortunately, only a small fraction will take action, simply because they’re too lazy to download a new wallet and learn a new ecosystem.

That’s exactly why I’m not worried about my airdrops being diluted—because most people won’t take action.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News