Five Data Dimensions Analysis: Are the Hyped New L2s Overvalued?

TechFlow Selected TechFlow Selected

Five Data Dimensions Analysis: Are the Hyped New L2s Overvalued?

New L2 valuations have risen to the average level.

Author: Nan Zhi, Odaily Planet Daily

Recently, Layer 2 platform Manta has seen substantial growth in both TVL and token price; ZKF briefly surged to 0.025 USDT but has since halved, though its TVL remains high; several other Layer 2 projects such as zkSync and Linea are also expected to launch their tokens in 2024.

Amid this growing momentum, Odaily Planet Daily analyzes comparative metrics—including TVL and market capitalization—across various Layer 2 platforms to assess relative valuations and identify potential over- or under-valuations.

Comparison of TVL and Market Cap Between New and Established L2s

According to data from L2 BEAT, the top ten Layer 2 platforms by TVL are listed in the table below (with Blast's TVL supplemented using Dune Analytics data). Additionally, Odaily Planet Daily has compiled circulating market caps and fully diluted valuations (FDV) for issued tokens using Coingecko data:

From the table above, several notable characteristics emerge:

-

Only Manta and ZKFair have shown significant TVL increases recently, while other Layer 2 platforms remain relatively stable;

-

Arbitrum and Optimism (OP) maintain a clear lead in TVL, performing above median levels even at their scale;

-

Manta and Blast rank third and fourth respectively among Layer 2 platforms in terms of TVL;

-

Except for Metis, most "established" Layer 2 platforms have similar market cap scales, all in the billions of dollars.

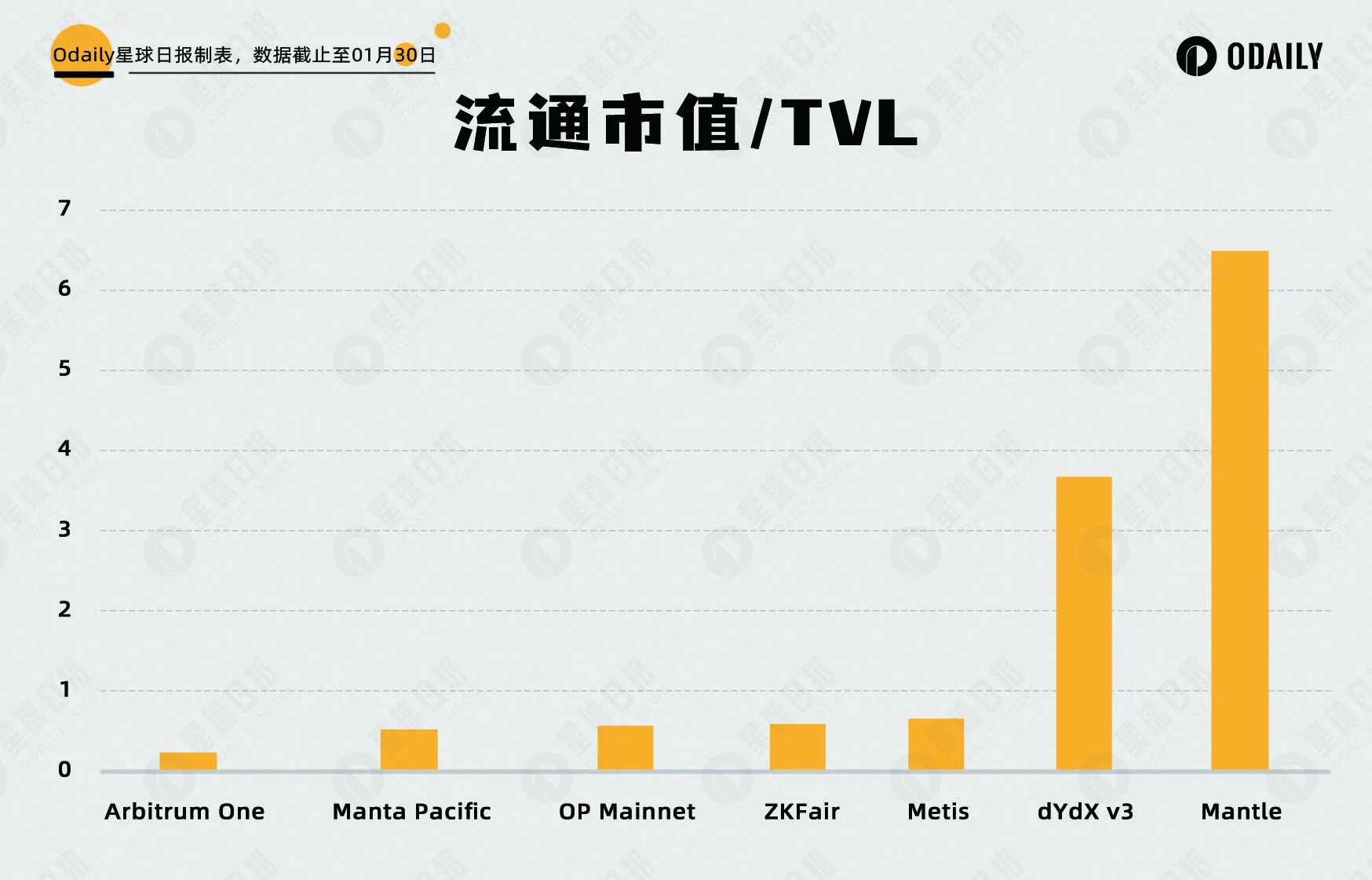

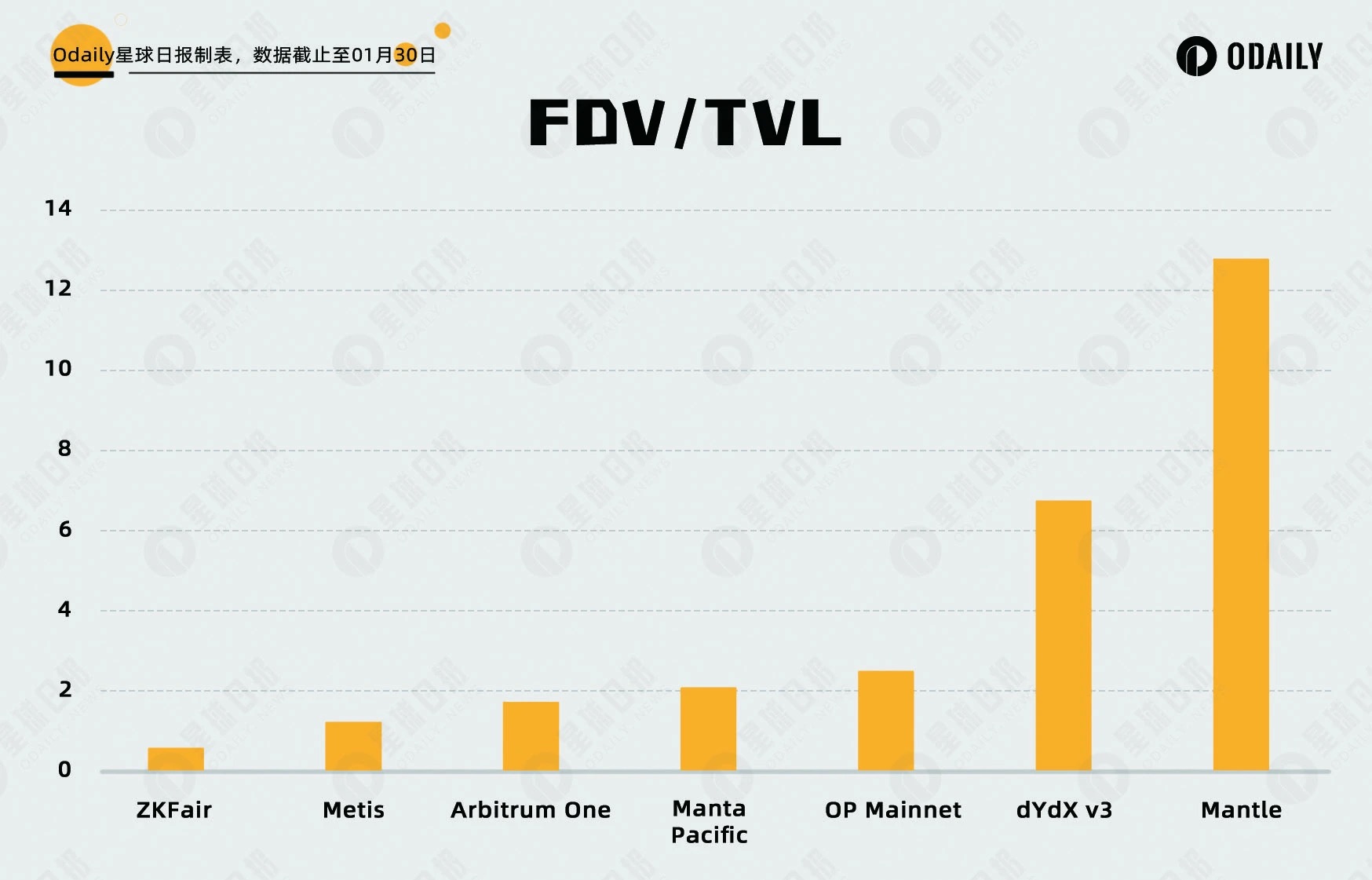

Odaily Planet Daily introduces two valuation metrics here: "Market Cap / TVL" and "FDV / TVL." A higher value indicates relatively greater token overvaluation. The data and rankings are illustrated in the charts below.

It can be observed that despite rapid growth, Manta’s valuation remains within the average range of mainstream Layer 2 platforms, whereas ZKF’s FDV/TVL ratio is significantly lower than other Layer 2s after its price correction.

Comparison of Ecosystem Activity

Based on DefiLlama data, the number of protocols, TVL, and 24-hour DEX trading volume across ecosystems are shown in the following table:

Key observations from the table include:

-

Arbitrum leads significantly across all three metrics—number of protocols, TVL, and trading volume;

-

Arbitrum, OP, and Base have far more protocols than other Layer 2 platforms, while ZKF lags considerably behind.

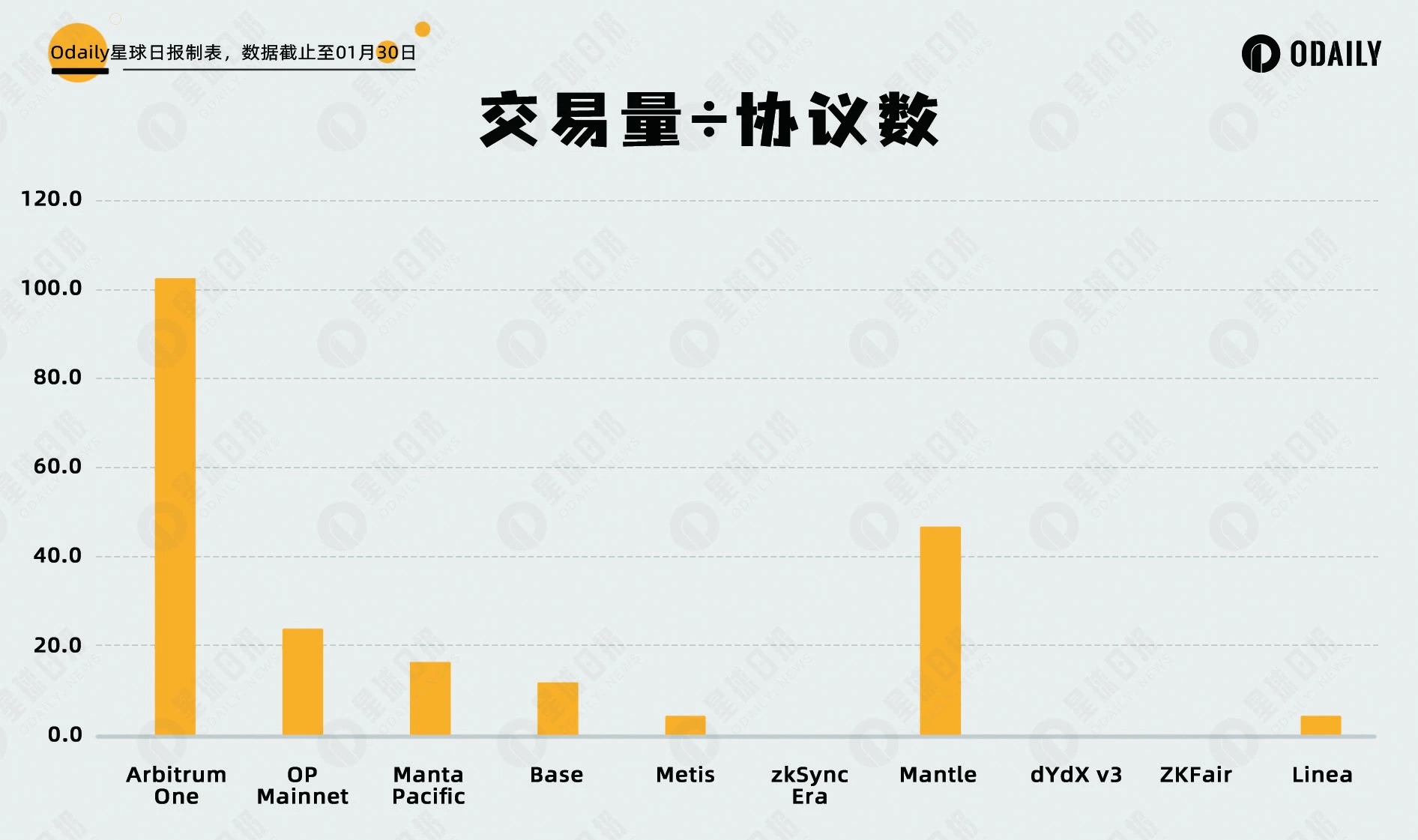

Odaily Planet Daily proposes two additional metrics: "TVL per Protocol" and "Trading Volume per Protocol," which reflect the distribution of funds and user activity across protocols. Lower values indicate more even distribution and no strong user preference toward specific protocols, while higher values may suggest either a standout protocol or concentration of volume through a single protocol.

Conclusion

Based on the data presented, the recent growth of Manta and ZKF represents a reversion toward the average valuation levels of Layer 2 platforms, with both now near the mean. Odaily Planet Daily notes that metrics like TVL are heavily influenced by ecosystem activities and development stages, and thus should not serve as the sole basis for investment decisions. Readers are advised to consider additional data and conduct comprehensive research before making decisions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News