Blockstream: The Bitcoin OGs Hidden Behind Bitcoin Core

TechFlow Selected TechFlow Selected

Blockstream: The Bitcoin OGs Hidden Behind Bitcoin Core

What role does Blockstream, the company behind El Salvador's Bitcoin bond, actually play in the world of Bitcoin?

Author: Web3CN Editor

In December of last year, the National Bitcoin Office of El Salvador (ONBTC) announced that the Bitcoin bond—known as the "Volcano Bond"—had received approval from El Salvador's Digital Assets Committee and was expected to be issued in the first quarter of 2024. The bond will be launched on the Bitfinex Securities platform.

"Funds raised through the bond issuance will be used to build a city called 'Bitcoin City,' and this bond offering will position El Salvador as a new global financial hub," said Samson Mow, then Chief Strategy Officer at Blockstream, during a gathering for El Salvador’s Bitcoin bond initiative in November 2021.

But what role does Blockstream—the company behind El Salvador’s Bitcoin bond—play in the world of Bitcoin?

Blockstream: Engaging the Full Bitcoin Industry Chain

In August 2021, blockchain infrastructure company Blockstream completed a $210 million Series B funding round and simultaneously acquired Spondoolies, an Israeli ASIC chip design team. This marked Blockstream’s expansion beyond its original software-focused business into upstream segments of the Bitcoin industry chain.

Prior to this, Blockstream's commercial offerings primarily focused on services related to the Bitcoin sidechain “Liquid,” Bitcoin mining, and certain data-related businesses—all aimed at expanding and strengthening the Bitcoin ecosystem.

The “Full Bitcoin Suite” Product Matrix

Blockstream initially focused on enterprise-grade solutions based on the Liquid sidechain, later entering the consumer market by acquiring the Bitcoin wallet Green Wallet.

Additionally, Blockstream maintains several free-to-use products within the Bitcoin ecosystem, including the Blockstream Satellite network (a global Bitcoin full-node satellite broadcast system), the multi-signature wallet Blockstream Green, and the Lightning Network client c-lightning, all continuously updated and improved.

Although Blockstream’s involvement in Bitcoin Core development places it at the forefront of software innovation, the upper reaches of the Bitcoin industry also include mining—the consensus mechanism. Since early 2020, Blockstream has announced its entry into Bitcoin mining operations through partnerships with companies such as Norwegian publicly listed firm Aker, Square, and BlockFi.

Its subsequent launch of the “Blockstream Energy” service aims to help energy producers sell surplus electricity to miners, thereby creating scalable energy demand for power generation projects via Bitcoin mining. This improves generation efficiency and enhances the economics of renewable energy projects globally—especially in remote areas.

From a chip manufacturing perspective, Blockstream also announced during its Series B funding round the acquisition of intellectual property from Spondoolies, a Bitcoin mining hardware manufacturer. Spondoolies’ core team joined Blockstream to focus on ASIC chip design and production, filling a critical gap in Blockstream’s capabilities.

Furthermore, Blockstream introduced the Blockstream Mining Note (BMN)—a tradable Bitcoin mining token available to qualified investors on the Liquid network—with mining facilities located in Georgia, USA, and Quebec, Canada.

With its strategic positioning in the mining sector now complete, Blockstream today covers nearly every dimension of the Bitcoin ecosystem—from development and institutional services to mining—forming a comprehensive product matrix.

The Bitcoin Sidechain: “Liquid”

At the heart of Blockstream’s “full Bitcoin suite” is “Liquid.”

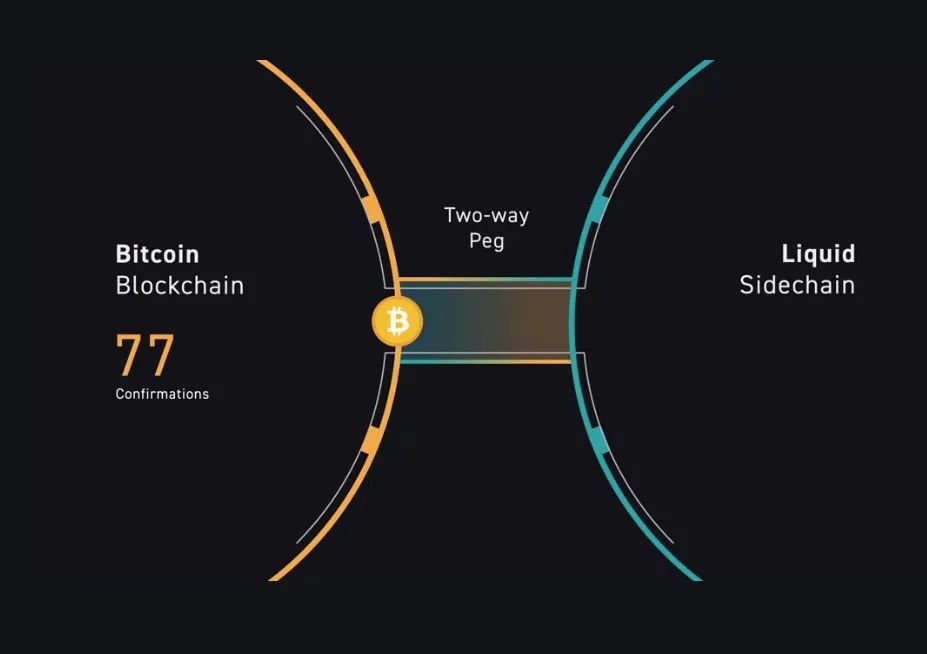

“Liquid” is the very Bitcoin sidechain mentioned earlier—on which El Salvador plans to issue its Bitcoin bonds—and can be simply understood as a “smart contract layer built on Bitcoin.”

As a Layer-2 network for Bitcoin, Liquid enables the issuance of security tokens and other digital assets, aiming to deliver financial products and services over the Bitcoin network and facilitate settlement of financial assets.

Currently, the Bitcoin ecosystem can be broadly divided into four layers:

-

Base Layer (Mainchain): responsible for Bitcoin’s value system, embodying decentralization, security, and the ideological values represented by the Bitcoin community;

-

Layer 2: exemplified by the Lightning Network, focused on enhancing Bitcoin’s payment experience;

-

Sidechains: where smart contract functionality resides, enabling smart contract applications within the Bitcoin ecosystem;

-

Cross-chain bridges: most major public blockchains have brought Bitcoin into their ecosystems via bridges, especially Ethereum, where it powers DeFi applications tied to Bitcoin.

“Liquid” is the cornerstone of Blockstream’s product strategy. While all its products are interconnected, Liquid remains the top priority: “For example, our wallets are ultimately designed to integrate with the Liquid network. So while the wallet itself may generate revenue, our primary goal is growing the Liquid network,” said a Blockstream representative.

Blockstream: The Old Guard of the Bitcoin World

In 2014, Ethereum began its token sale, Mt. Gox suffered its infamous hack, and the Bitcoin community’s scaling debate intensified. The crypto world’s attention was captivated by these pivotal events.

At the same time, Blockstream—founded just months prior—secured $20 million in Series A funding and clearly defined its mission: extending Bitcoin’s protocol-layer capabilities through sidechains.

The company assembled an elite team: led by Adam Back, former HashCash developer; Hammie Hill, an early e-cash pioneer and founder of Zero Knowledge Systems—both HashCash and e-cash being foundational technologies for Bitcoin.

Blockstream also gathered a star-studded development team, including future Bitcoin Core leaders Gregory Maxwell, Jonathan Wilkins, Matt Corallo, and Pieter Wuille; Jorge Timon, lead of the Freicoin project; and Mark Friedenbach, a former NASA engineer, among others.

The Opposition in the Bitcoin Scaling Debate

During the Bitcoin scaling debate, community figures like Gavin Andresen and Bitmain supported increasing the block size, while Blockstream—represented by core developers like Gregory Maxwell—took the opposing stance.

The pro-scaling camp argued that network congestion needed immediate resolution. Without it, growing user adoption would lead to severe transaction delays and skyrocketing fees—an outcome unacceptable for Bitcoin’s ambition as “electronic cash.” Gavin Andresen warned, “Rising Bitcoin transaction fees will push the poor away from Bitcoin.”

The opposition countered that congestion should be solved long-term via Layer 2 networks. They argued that on-chain scaling only offered temporary relief; as more users join, even expanded blocks would soon require further increases—an endless cycle. Thus, they advocated keeping Bitcoin’s block size at 1MB while pushing forward off-chain solutions like Segregated Witness (SegWit) and the Lightning Network.

The conflict between developers and miner representatives centered precisely here—mutual distrust:

Developers distrusted miner representatives, believing mining pools and large mining operators had usurped individual miners’ voices, turning industrial-scale mining into a centralized commercial activity. The rise of “mining oligarchs,” they argued, threatened the decentralized essence of cryptocurrency.

Miner representatives, however, feared that once the Lightning Network matured, most transactions would shift off-chain, eventually leading to absolute centralization dominated by powerful intermediary nodes. In this scenario, the base layer would merely serve as a settlement channel for these central nodes, rendering it inaccessible to ordinary users—a deviation from Satoshi Nakamoto’s original vision.

Later, during attempted reconciliation talks in New York, tensions flared again—Samson Mow, representing Bitcoin Core and Blockstream, was barred from attending.

Subsequent disputes and conflicts need not be recounted in detail; the outcome is well known. With the Pandora’s box of Bitcoin forks like Bitcoin Cash (BCH) opened, there was no turning back.

Controversy Over “Bitcoin Development” vs. “Corporate Organization”

Blockstream has publicly disclosed three rounds of funding: a $21 million seed round in November 2014, a $55 million Series A in February 2016, and a strategic investment from Digital Garage (DG Lab Fund) in November 2017, with undisclosed amount.

It must be clarified that Bitcoin Core is an open-source project responsible for maintaining and releasing the Bitcoin client software (including full-node validation and Bitcoin wallet functions) along with related tools.

A significant number of core developers and contributors to Bitcoin Core are employees of Blockstream, funded by the company to support their development work. This dual role has sparked ongoing controversy regarding Blockstream’s relationship between “Bitcoin development” and “corporate structure”:

On one hand, Blockstream has gathered some of the most talented developers in the Bitcoin community, making vital contributions to daily code development and maintenance.

On the other hand, these developers differ from early Bitcoin core contributors who participated directly in open-source development—they are salaried employees of Blockstream.

Moreover, since Blockstream’s financing and business growth revolve around Layer 2 and other Bitcoin-based products, some community members have begun questioning the independence of Bitcoin’s core developers. Concerns have surfaced:

Core members associated with Blockstream may have lost their objectivity and impartiality, risking turning Bitcoin’s base layer into a mere appendage of Layer 2 systems. Some go so far as to claim, “Blockstream controls Bitcoin’s code.”

Ongoing Rivalry with the Ethereum Community

“True decentralized financial systems cannot be built on Ethereum—only on Bitcoin, the Lightning Network, and Liquid,” said Blockstream, arguably the most influential “KOL organization” within the Bitcoin community. Whether CEO Adam Back or COO Samson Mow, they frequently engage in public criticism of the Ethereum community.

Adam Back once likened Ethereum to a Ponzi scheme in a reply, while Vitalik Buterin responded that Ethereum is on the rise and historical momentum won’t favor Bitcoin maximalists.

Later, during heated debates between Samson Mow and Vitalik Buterin, mutual skepticism escalated: “No one will build any secure (e.g., financial) system on Ethereum. If you want tokens, issue them on Liquid—you’ll thank me later.”

In many ways, behind Blockstream lies the entire saga of the Bitcoin world—the scaling debate, the battle between Lightning Network and sidechain approaches, the ideological clash with competing chains like Ethereum—complex, intertwined, and far from resolved.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News