Points Craze in Web3: Understanding the Advantages and Challenges of On-Chain Points

TechFlow Selected TechFlow Selected

Points Craze in Web3: Understanding the Advantages and Challenges of On-Chain Points

The remainder of this article aims to illustrate the differences and trade-offs between tokens, off-chain points, and on-chain points.

Authors: Katie Chiou, Graeme Boy

Translation: Luffy, Foresight News

The term that best encapsulates consumer tech in the 2010s is gamification. In retrospect, this seemed inevitable given the technological context of the time. We entered the mobile internet and social era, where nearly everyone carries a networked gaming device—smartphones—in their pockets.

Early gamification trends gave rise to companies that turned everyday activities into games and built thriving businesses around them. They gamified visiting locations (Foursquare, 2009), traffic monitoring (Waze, 2008), language learning (Duolingo, 2011), and countless other examples. These companies realized gamification was an effective strategy for driving user acquisition, engagement, and loyalty.

One common element of gamification is point systems, which convert qualitative progress metrics into quantifiable indicators. Point systems fundamentally serve two purposes: providing binary, clear outcomes (a number going up or down) and easily channeling intrinsic motivation toward extrinsic rewards (benefits, prizes).

Blockchains are a natural infrastructure for point systems because they are designed as universal ledgers of entities with records that can programmatically distribute value to those entities based on certain actions.

Historically, this value has primarily been distributed via tokens on Ethereum—financial assets whose value fluctuates in real-time on public markets. Tokens are powerful tools for identifying, coordinating, and rewarding users who contribute to a network, offering them economic incentives and ownership stakes.

Token incentives have been crucial for blockchain adoption. The promise of token rewards can offset the high costs and risks associated with transacting on L1s like Ethereum. However, this can also create a vicious cycle. High transaction costs mean rewards often flow to users willing to pay high fees (typically profit-driven capital), disadvantaging those less able or risk-averse (often new users).

As blockchain transactions rapidly become cheaper (via L2s and L3s), broader non-financial on-chain activity becomes possible without requiring economic incentives to compensate users. This new paradigm marks the emergence of a novel on-chain primitive used to identify and coordinate participants in complex decentralized networks.

On-chain attestations are methods for identifying and categorizing users, allowing users to self-attest their attributes and vouch for others’. However, attestations have limitations. They are often qualitative, making them difficult to use in environments like blockchains that lack contextual information. For example, comparing the number of kills a player completes in a game is easier than comparing the color of bosses killed. This could be improved by adding more context, and further integration with AI and machine learning advancements may make such analysis easier. Nevertheless, given these constraints, more quantitative forms of proof may be best suited to current blockchain scalability conditions.

We’ve already seen growing experimentation with point systems in crypto, such as Blur Points, which use "order book points" and "lending points" to incentivize specific behaviors and allocate token rewards. More recently, Rainbow began issuing Rainbow Points to reward users for trading within the Rainbow wallet. To date, most of these point experiments have occurred off-chain, making them very similar to Web2-style points.

Beyond traditional point systems, on-chain points offer an intriguing opportunity: using points in a trustless way within blockchains for purposes such as token redemption in ownership distribution, access gating resistant to Sybil attacks, and improving market functionality in DeFi.

The remainder of this article aims to clarify the differences and trade-offs between tokens, off-chain points, and on-chain points, and explore to what extent on-chain points can serve as a new primitive for builders and users—and what advantages and challenges they entail.

Why Points?

Tokens come with many characteristics that must be carefully evaluated before launch, significantly impacting a project’s appeal and token price. These include, but are not limited to:

-

Supply and issuance: Will the token be inflationary or deflationary?

-

Utility: Will the token be used for governance? If so, does holding governance tokens entitle holders to a share of fees generated by the project and control over treasury allocations? Or will the native token serve practical functions—such as becoming the accounting unit for using the product?

-

Value accrual: Are there staking or locking mechanisms? Does the token have a burn mechanism?

-

Distribution: Will tokens be distributed via airdrops or emissions? Will there be a vesting schedule?

In contrast, points are typically non-financial, variable, and controlled by the issuer, meaning point systems can be easily adjusted without immediately affecting market dynamics. Point supply can be infinite, and the ways points are used and redeemed can be modified. Additionally, point tradability is determined by the issuer, whereas tokens are inherently tradable.

This allows project teams to adjust point systems in real time and gather community feedback without fundamentally altering market dynamics, product mechanics, or user behavior—giving them more time to understand and better retain users. When points act as precursors to tokens, they help eliminate the urgency for projects to prematurely define token models and distribution schemes.

Notably, since point systems have already been widely practiced in Web2, they also carry no regulatory risk from a compliance standpoint.

For builders, designing and implementing points is simpler; for users, points are also easier to understand. Given the dynamic nature of token prices, users may struggle to conceptualize a particular token: Should I treat it as an investment or a utility? For instance, imagine an arcade game requiring 0.25 tokens to play. If you know those 0.25 tokens might be worth $10 tomorrow, you’d hesitate before inserting them into the machine.

Points can be viewed as a “meta-currency”—convertible into financial value and influencing usage, but the strength of this conversion can be designed contextually. In this model, point redemption becomes more flexible.

Regarding point utility, redemption options can vary widely, including direct product benefits, project ownership, governance rights, or revenue shares—choices that can be left to users.

Why On-Chain Points?

The more flexible nature of points raises an obvious question: What distinguishes on-chain points from off-chain points? A key tension when considering tokens versus points is that ERC20 tokens maximize composability while minimizing issuer flexibility, whereas off-chain points maximize issuer flexibility while minimizing composability.

Implementing points on-chain rather than off-chain may strike a balance between these extremes—preserving flexibility while retaining the auditability and composability benefits of blockchains.

So what does this actually mean in practice, and why does it matter?

Composability

To some extent, we can view on-chain points as quantitative proofs that people can see and utilize globally. Anyone can issue points on-chain to others, build point systems based on third-party product usage, or integrate local point systems. On-chain points can add new dimensions to a user’s on-chain identity—similar to accumulating other on-chain credentials—and can be integrated into various modular protocols. With this framework, on-chain points can become powerful tools for projects and brands to identify advanced users across products, even attracting potential customers through discounts and airdrops.

Provenance

On-chain points also guarantee provenance and auditability, making transparent both the total allocation of points within a system and the historical record of how they were distributed. This transparency is critical for the community value brought by point systems and for ensuring fairness during distribution.

For example, brands and institutions often collaborate with influencers based on engagement metrics from platforms like YouTube, TikTok, and Instagram. However, these platforms operate their distribution algorithms in black boxes, making it difficult to discern the logic behind the metrics.

Trust Guarantees

Blockchains allow explicit guarantees about a user’s current point balances and redemption options. These guarantees enable secure redemption of points for other on-chain assets with minimal trust assumptions, giving on-chain points unprecedented potential value compared to Web2-style point systems. Without blockchains, point systems would face the same criticisms within the crypto community as Web2 platforms: failing to meet the level of trust commensurate with their claimed value.

Sybil Resistance

Point systems may also influence “airdrop farming” activities in Web3 products. Bots can farm points just as easily as tokens, but point systems can serve as useful communication mechanisms between project teams and early adopters by clearly signaling reward types unrelated to tokens, encouraging specific contributions to a product or network—such as providing liquidity to a protocol or stress-testing certain features.

Community Accountability

Before any redemption mechanism is explicitly disclosed, point distributions can undergo community scrutiny, reducing the risk of post-airdrop disputes. Chain-based point allocations could even be audited via third-party timestamp verification.

Implementation

As previously mentioned, points can be designed for various types of rewards—from discounts and product benefits to project ownership, governance rights, and direct income. Similarly, implementation specifics may vary widely across projects, ranging from attestation-like formats to modified ERC20 tokens or Soulbound tokens. While each approach has its own trade-offs, we’ll outline one possible common workflow: redeemable ERC20 tokens.

While ERC20 tokens are the most composable method for distributing rewards, they usually minimize issuer flexibility and maximize speculation. You can modify them to be non-transferable or infinitely supplied; however, you still face the common confusion between tokens and currency forms.

Redeeming points for ERC20 tokens also involves cost considerations. Each time a user joins or updates their point balance, the transaction cost of transferring ERC20 tokens on-chain can become prohibitively expensive for issuers. Alternatively, you can accumulate points in an off-chain database into a Merkle tree and periodically publish the Merkle root on-chain via a smart contract. When users want to claim tokens, they submit a transaction to the smart contract containing a Merkle proof. Combined with the claiming address and amount, this can be verified against the published Merkle root (this is essentially how Merkle airdrops work). This is a common method for token distribution because it shifts transaction costs from the project to end users, distributing the total cost (potentially millions of dollars) among all token holders.

Stack has built a solution for redeeming points for ERC20 tokens on any EVM chain in a trustless way, offering a cheaper alternative to traditional Merkle airdrops.

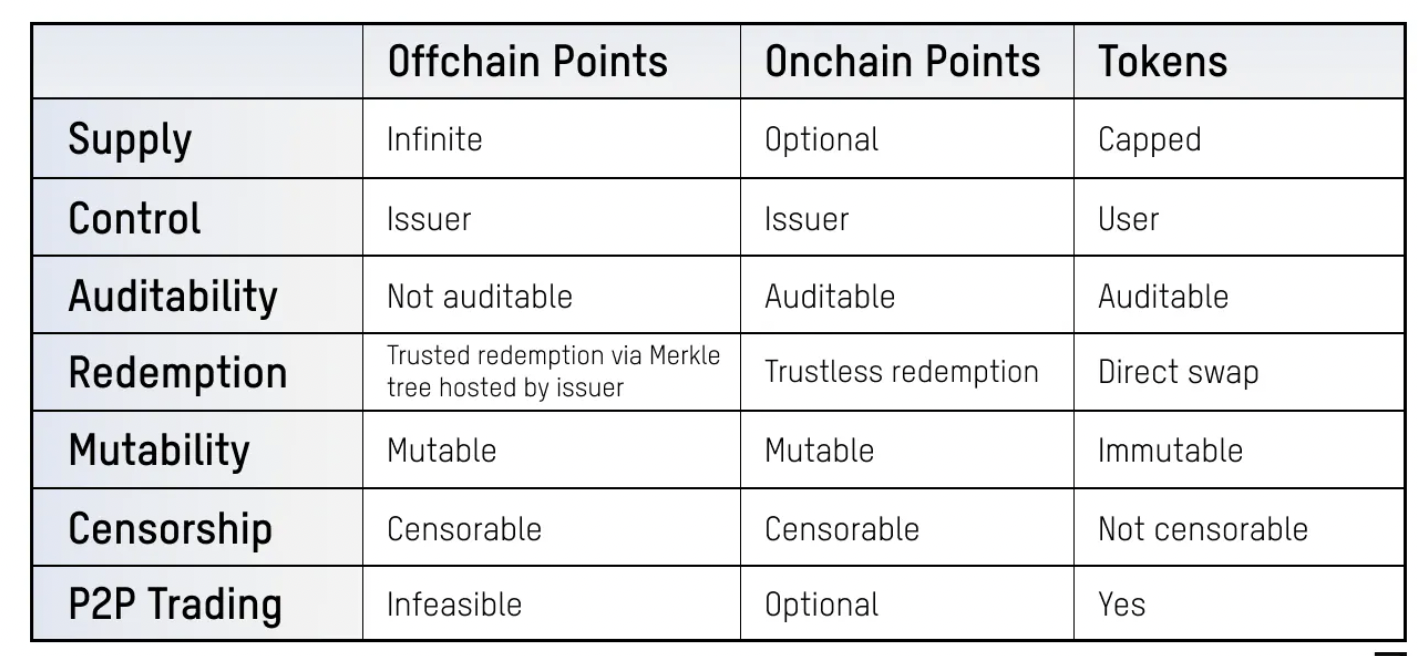

While the exact specifications of a point or token system may vary depending on context, below we provide a general overview of the characteristics of off-chain points, on-chain points, and tokens for reference.

Beyond technical or crypto-specific implementation considerations, creating a point system involves many other critical design decisions. Some ideas include:

The primary goal of a project’s point system should be to encourage product usage—not point accumulation. Ensuring the point program ultimately brings users back into your own product ecosystem is key to successfully launching a points-driven flywheel, rather than encouraging bounty-hunting behavior. This is especially important for sustainability. Value lost through offering rewards must be compensated elsewhere—through more users, higher-value transactions, sales revenue, advertising, etc. Converting points directly into product advantages is particularly helpful for maintaining closed-loop feedback cycles and testing the success of specific features or products. Farcaster Warps is an example: points earned within the app can be gifted to other users or used for discounts when purchasing NFTs within the app. Clear use cases like this reduce the risk of speculative rushes based solely on future financial incentives.

Effective point systems also require intuition about what drives your users and your product. For example, if your users are relatively price-insensitive, discounts may not be compelling; for products benefiting from strong network effects, other levers like personalized or social access/rewards may be more attractive. If your product is driven by session time, frequently dispensing smaller rewards may be more effective than infrequent, high-value rewards.

The Future of Points

The story of gamification is not new. Many case studies show gamification can foster positive user habits, align incentives, and strengthen brand-user loyalty.

Looking ahead, decentralized, user-owned networks will define the next internet. In this on-chain world, gamified points can offer a unique way to identify and reward user behaviors and contributions—more powerful and comprehensive than anything possible in Web2. It’s therefore essential to understand the goals and roles of decentralization and ownership within your product, and design point systems accordingly. While tokens are extremely powerful tools for coordinating and governing these networks, they’ve proven more rigid than initially envisioned. On-chain points represent a promising new primitive that teams can use alongside tokens to explore better paths for user identity, ownership, and incentive alignment. Yet only through careful, intentional use—anchored to these goals—can points truly advance them.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News