STX Staking Guide: Single-Asset, Pooling, or Airdrop Farming—How to Find the Optimal Strategy for Maximizing Returns?

TechFlow Selected TechFlow Selected

STX Staking Guide: Single-Asset, Pooling, or Airdrop Farming—How to Find the Optimal Strategy for Maximizing Returns?

In the wave of Bitcoin's ecosystem expansion, Stacks has already secured its position.

Written by: TechFlow

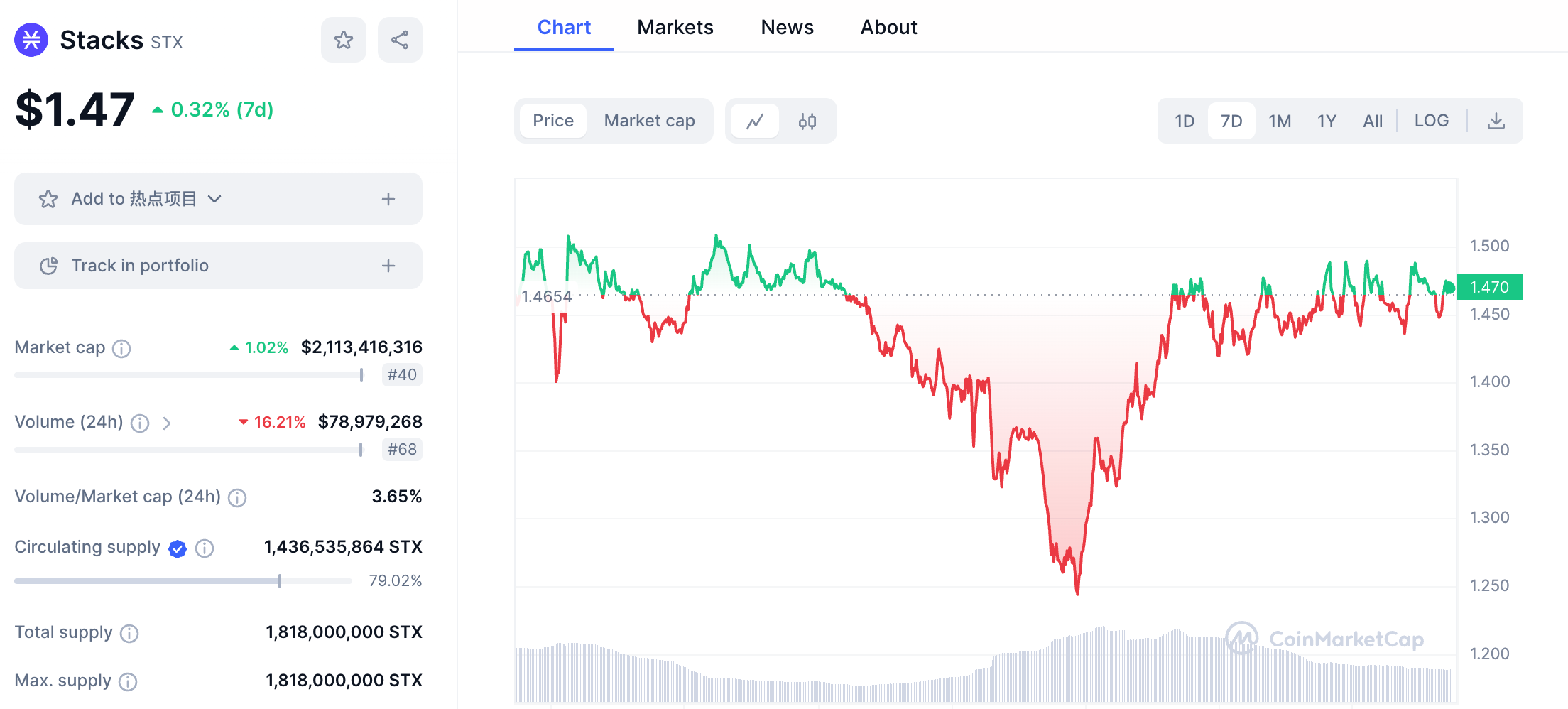

With the approval of Bitcoin spot ETFs, the news has been priced in and the market has begun a short-term downward trend.

However, supported by the upcoming halving event, projects within the Bitcoin ecosystem remain a major focus this year. Among them, Stacks ($STX), the leading Bitcoin Layer 2 project, has already shown signs of recovery in recent market movements.

For those bullish on STX, the project is set to undergo its Nakamoto upgrade in Q1—an anticipated catalyst that makes accumulating low and selling high a solid strategy.

But with price volatility comes uncertain returns—so are there other ways to generate additional yield while holding STX?

Don't forget: Stacks was originally designed to bring DeFi possibilities to BTC.

What many may not realize is that today, holding STX allows you to participate in liquidity pools, single-asset staking, liquid staking, or even gain early access and potential airdrops within the Stacks ecosystem.

Yet compared to Ethereum and other chains, STX staking options remain relatively niche.

If you hold STX and want to maximize your returns, below is a comprehensive overview of all available yield strategies—there’s something here for everyone.

CEX Staking: The Convenient Option

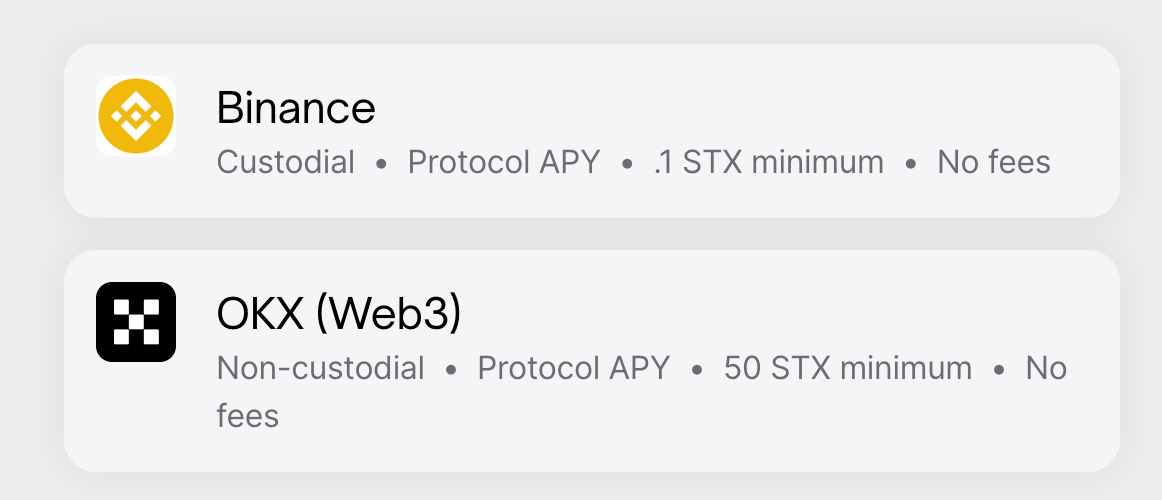

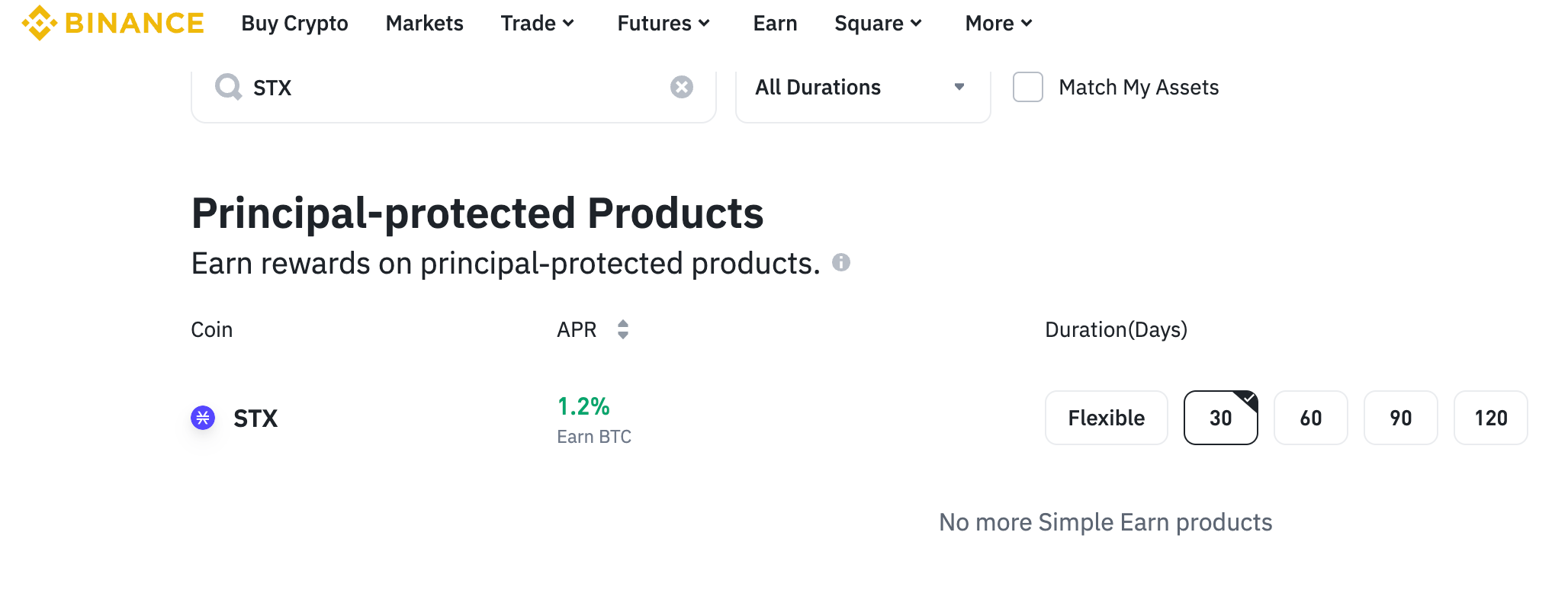

Currently, both Binance and OKX offer direct staking options for STX to earn yield.

For newcomers unfamiliar with on-chain operations or those who prefer convenience, entrusting custody to a CEX can be a viable choice.

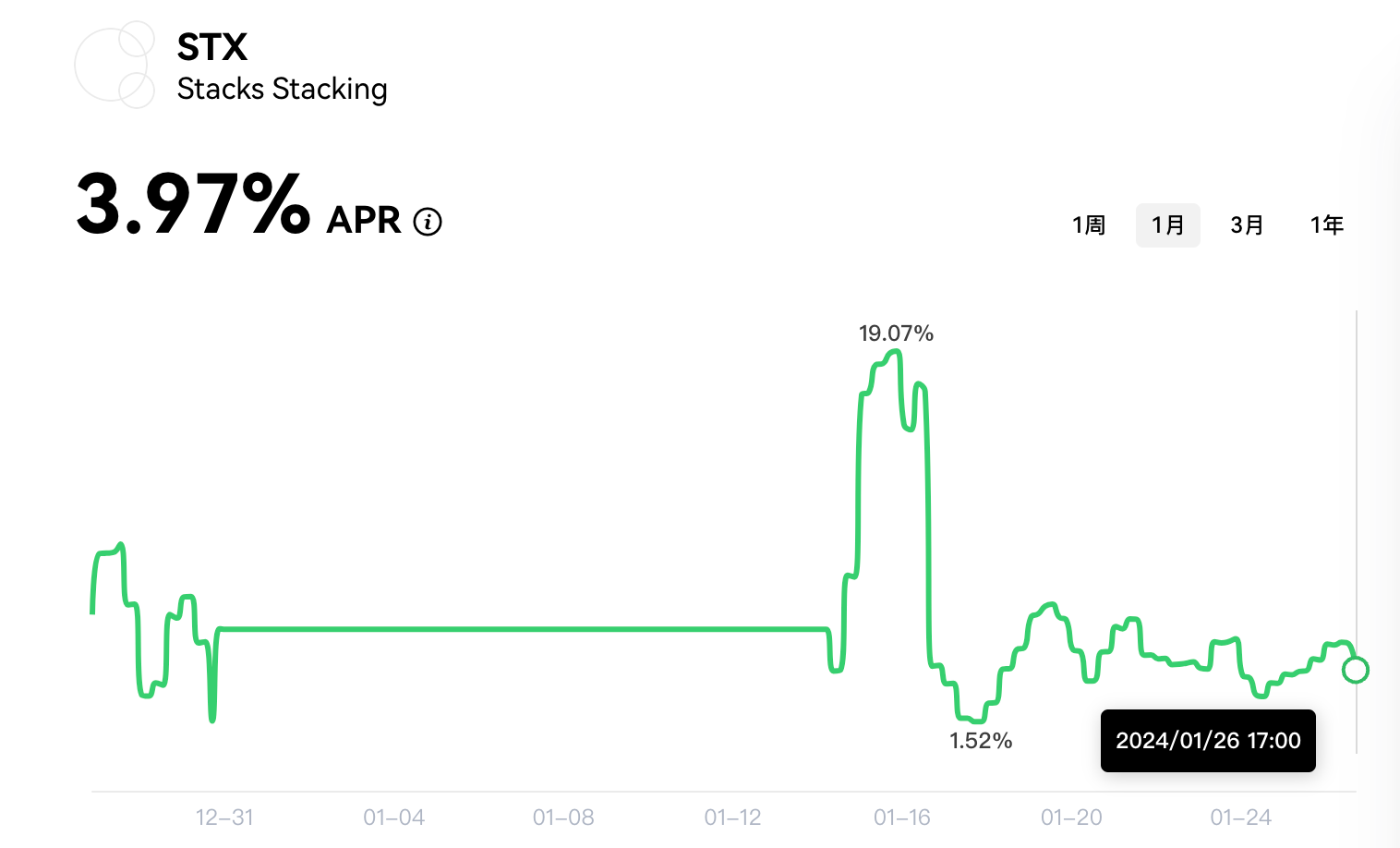

The entry barriers are low: Binance requires only 1 STX, while OKX requires 50. As of writing, their estimated APRs for a 30-day staking period are 1.2% and 3.97%, respectively.

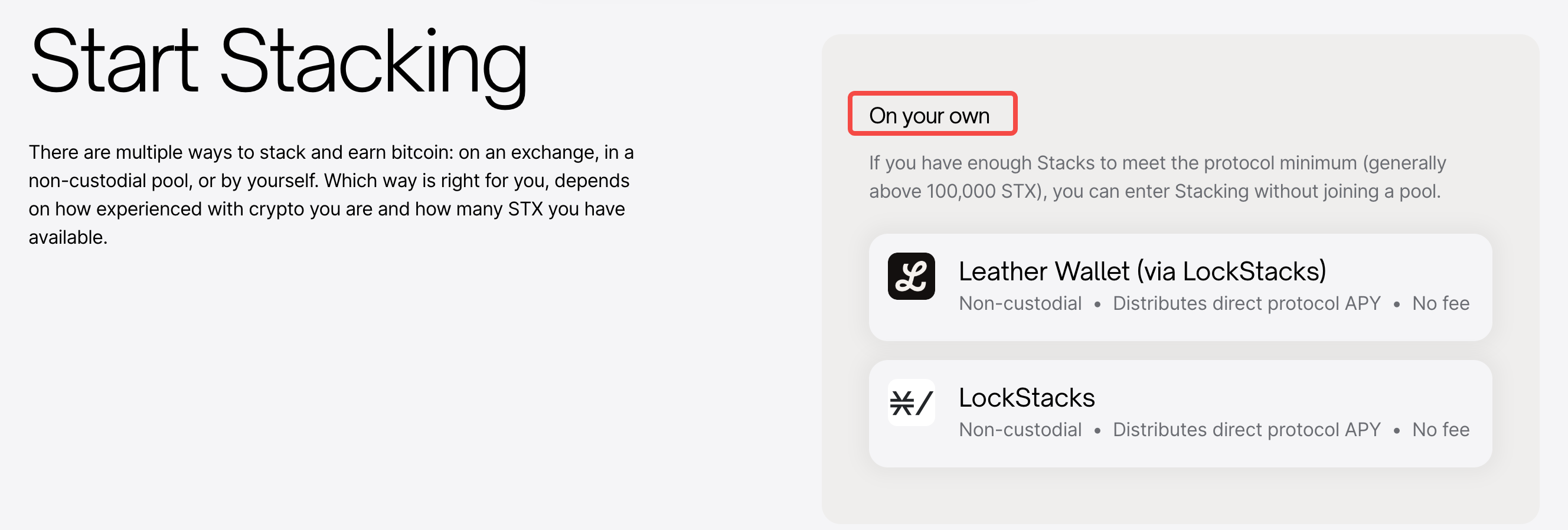

On-Chain Solo Staking: For Large Holders

For on-chain users, STX is often kept in personal wallets. Those who wish to interact directly with the Stacks protocol—without relying on delegation service providers—may prefer solo staking.

The official recommended method is using Leather Wallet + LockStacks.

The former is a self-custodial wallet capable of sending and receiving both STX and BTC, while the latter provides an interface to stake STX directly without third-party intermediaries.

However, this approach comes with a catch—you must be a large holder.

LockStacks clearly states that only users holding 90,000 STX qualify for solo staking. While this threshold may change over time, it's unlikely to drop significantly—similar to Ethereum’s 32 ETH requirement for running a validator node.

According to calculations shared by Twitter user @Mezma00, the APR for solo staking is approximately 7%.

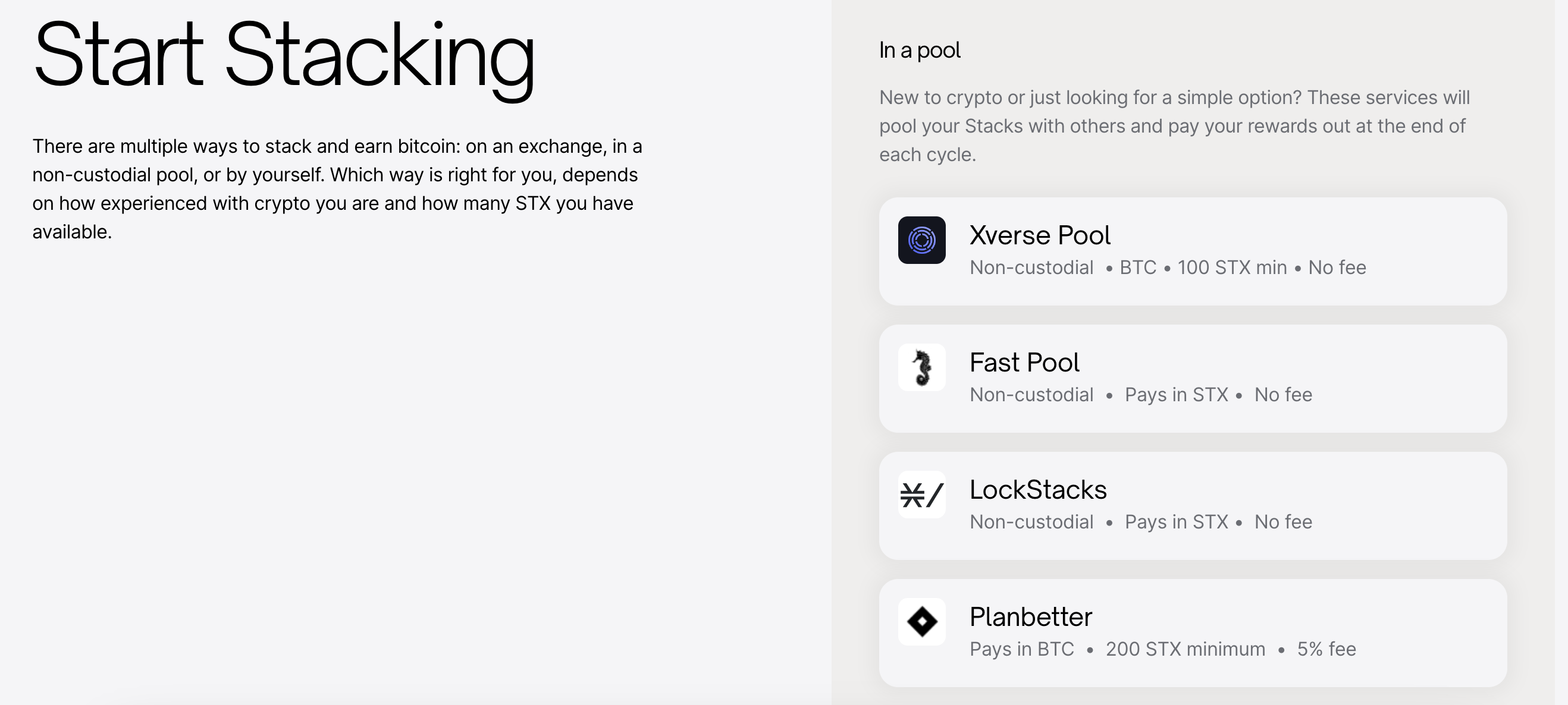

On-Chain Delegated Staking: The Accessible Option

Not a big holder? No problem. Stacks also supports delegated staking, where service providers pool users’ STX for collective staking.

Currently, four main providers offer non-custodial delegated staking services, each with different requirements and reward structures:

-

Xverse Pool: Minimum stake of 100 STX; rewards paid in BTC;

-

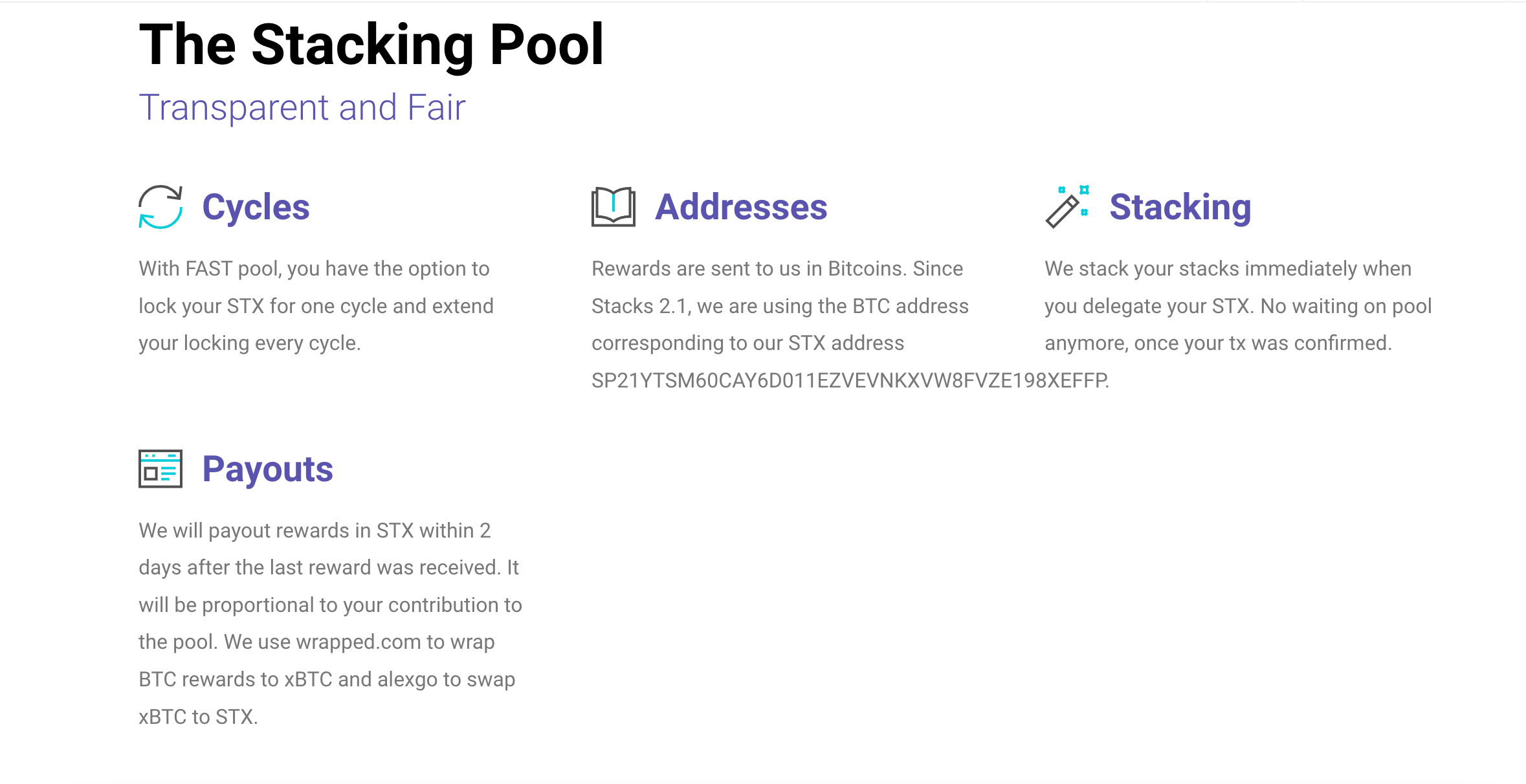

Fast Pool: No minimum stake; rewards paid in STX;

-

LockStacks: As mentioned earlier, supports both solo and delegated staking. No minimum for delegation; rewards in STX;

-

Planbetter: Minimum of 200 STX required, charges a 5% fee on rewards, payouts in BTC.

Overall, platforms offer APRs around 9% when measured in BTC and about 7% in STX.

Considering user experience, requirements, and fees, Fast Pool and LockStacks offer better value.

Liquid Staking: Maximizing Capital Efficiency

Staking STX locks up liquidity, creating opportunity costs.

In Ethereum’s ecosystem, liquid staking solved this long ago—by issuing LSTs (liquid staking tokens like stETH) that can be reused across DeFi for compounded yields.

This model works just as well in the Stacks ecosystem.

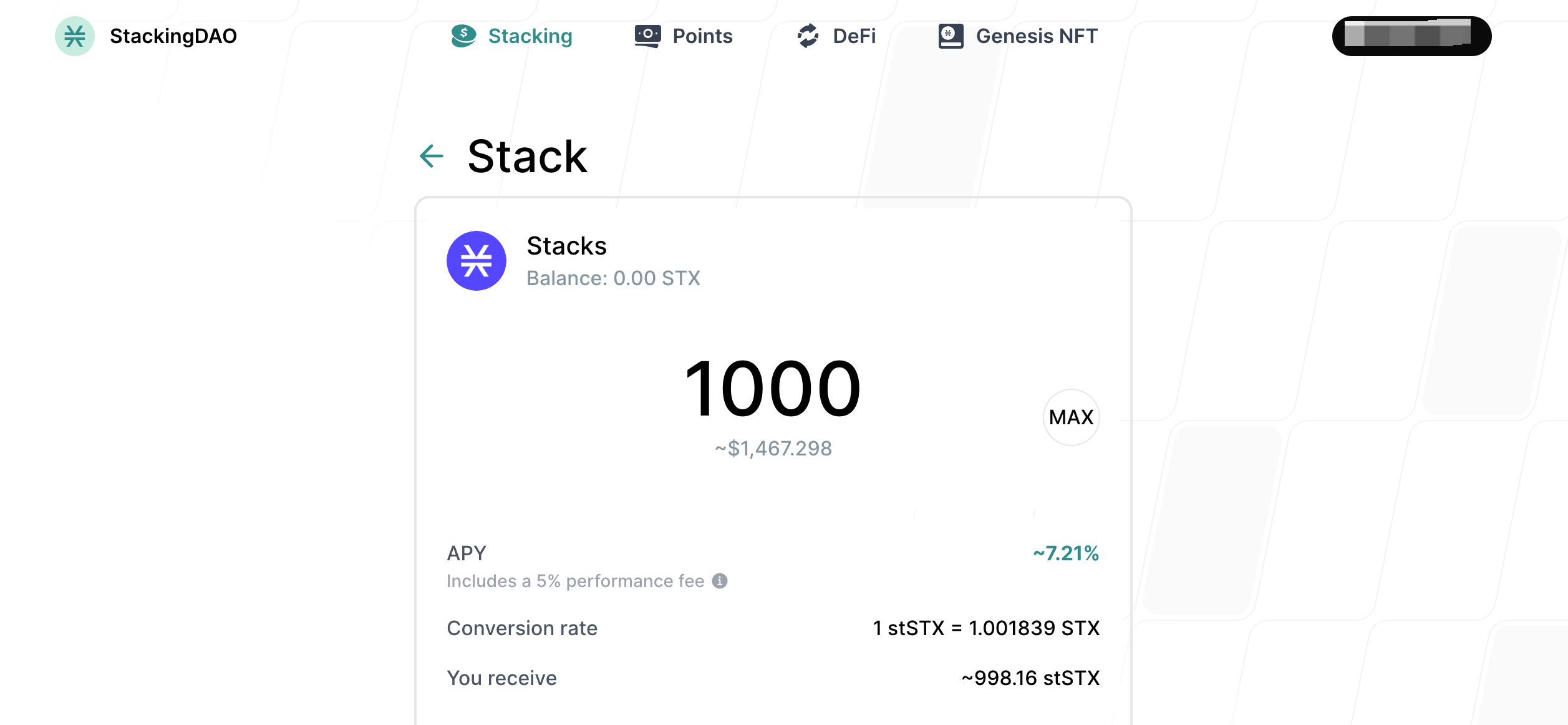

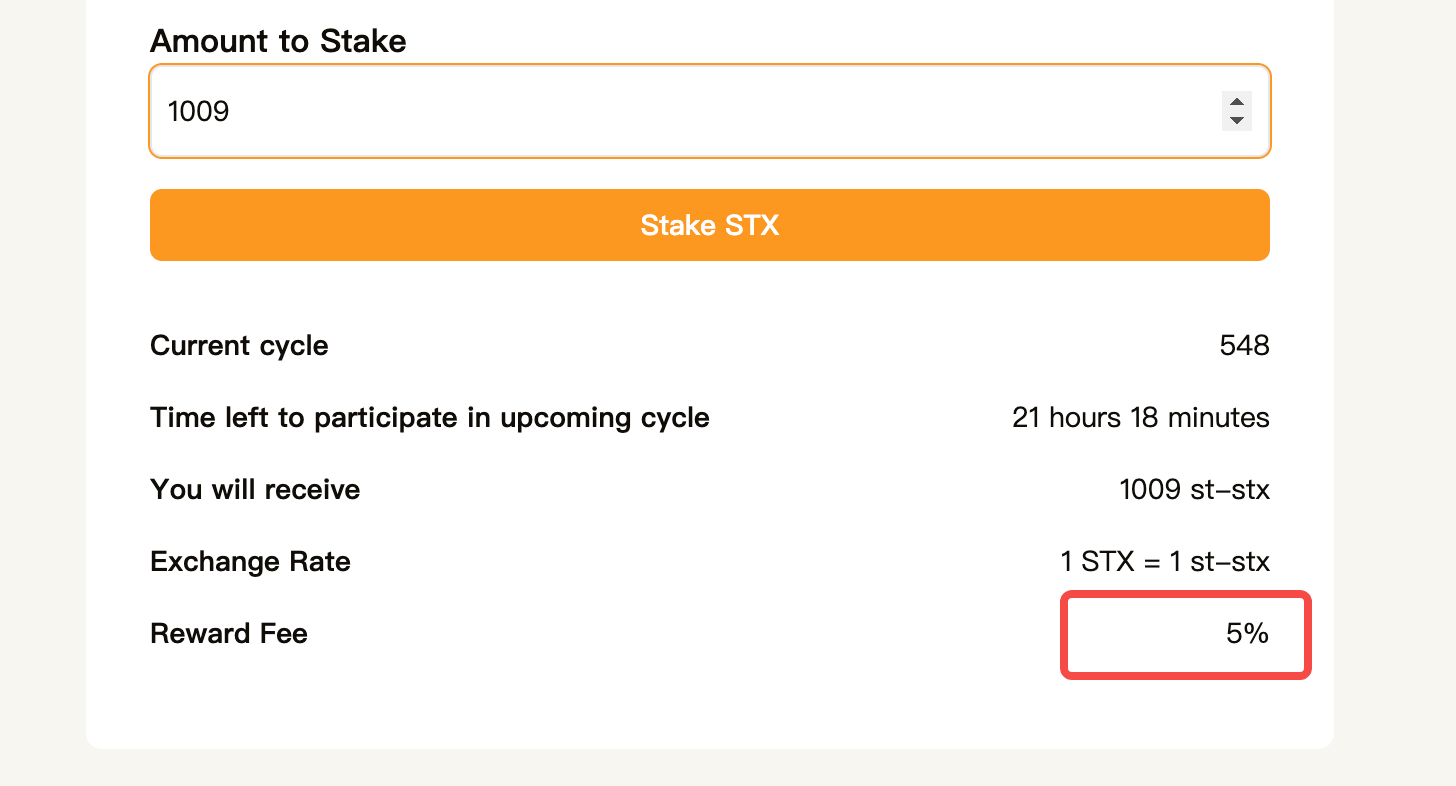

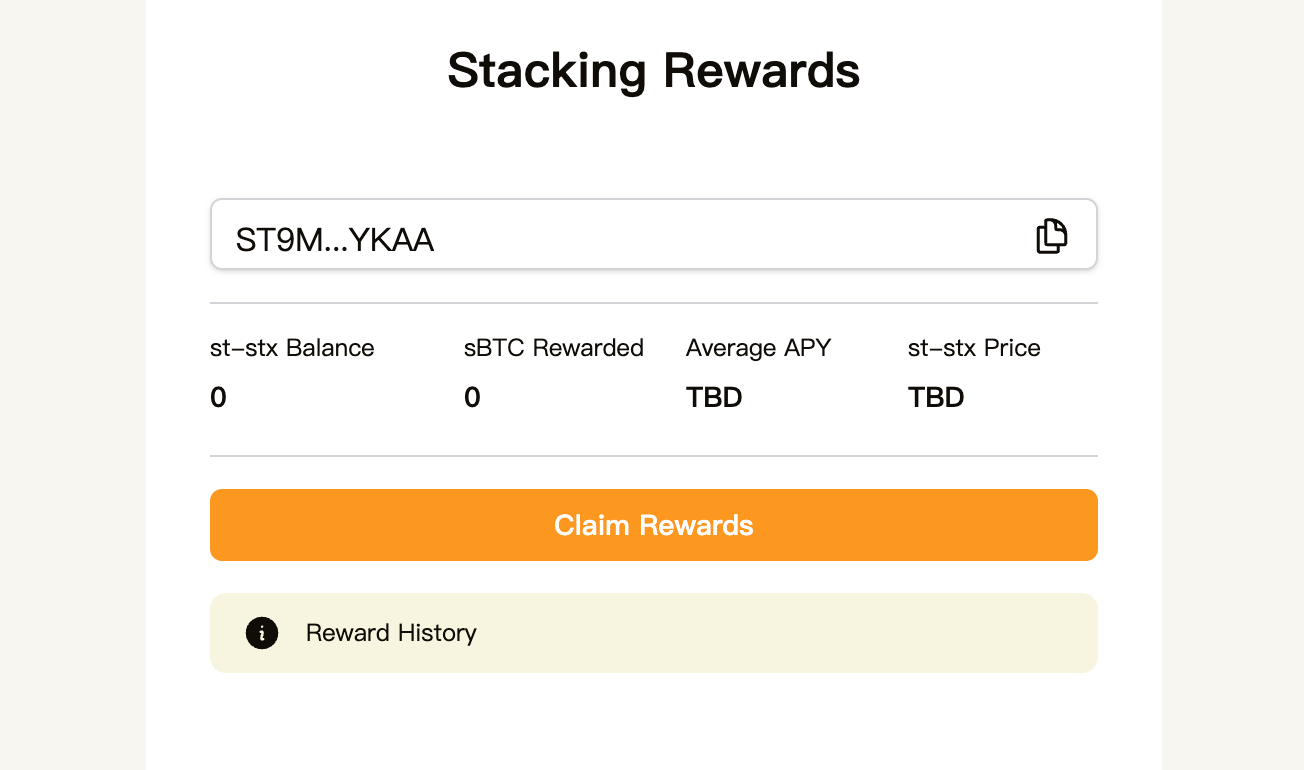

One mature player is StackingDAO, which focuses exclusively on liquid staking within the Stacks ecosystem.

As shown below, users can deposit STX to receive stSTX and earn an APY of approximately 7.21%. Note that you’ll still need a compatible wallet supporting both STX and BTC, such as Leather Wallet mentioned earlier.

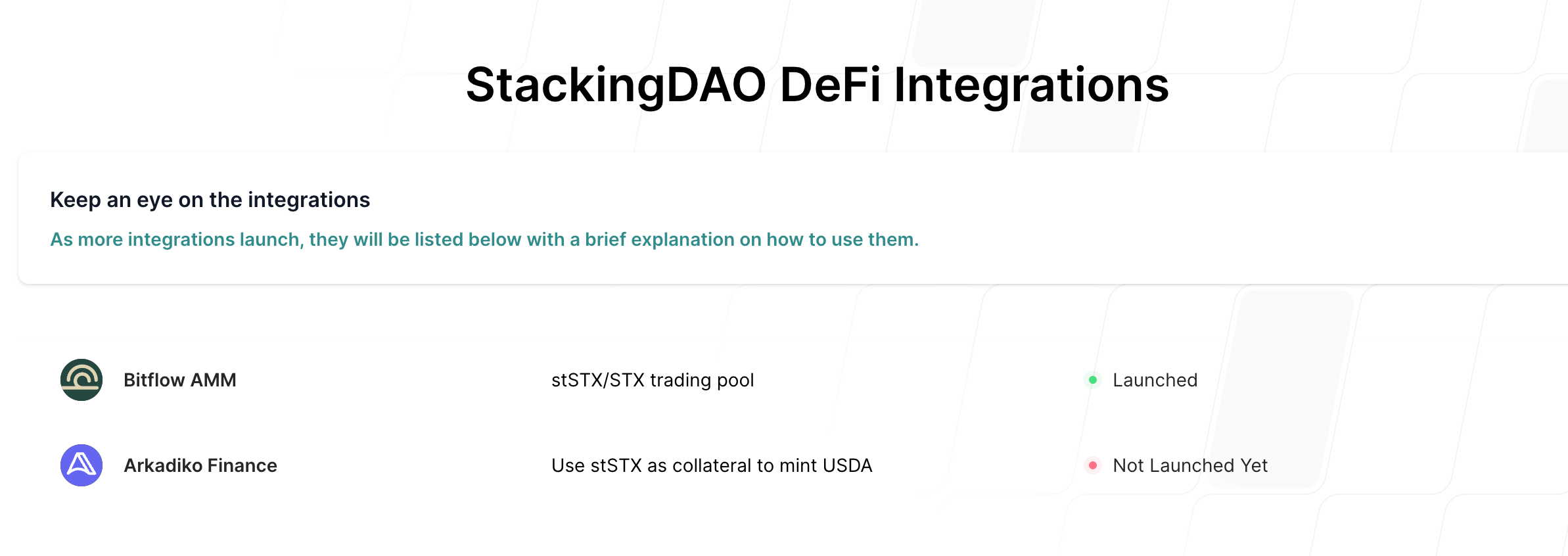

After obtaining stSTX, StackingDAO also offers integrated DeFi features. For example, its Bitflow AMM is live, allowing users to swap, provide liquidity for stSTX/STX pairs, and earn yield via LP tokens—the standard DeFi playbook.

Additionally, a stablecoin project called Arkadiko is under development and will allow users to mint the USD pegged token USDA using stSTX as collateral—a mechanism similar to Lybra Finance and Prisma.

Testnet Participation: A Potential Airdrop Play

Beyond yield generation, two lesser-known liquid staking projects on Stacks could offer future airdrop opportunities: Papaya and LISA.

Let’s start with Papaya.

Papaya offers liquid staking services but currently has limited social media visibility—making it potentially undervalued.

Its v1 testnet is now live. Users can visit the platform to perform liquid staking of STX, receiving stSTX in return, with a base staking reward of 5%.

On top of that, Papaya offers additional BTC-denominated rewards. After staking for a period, users will receive sBTC, a token pegged 1:1 to BTC. However, since the testnet is newly launched, the exact APY remains unknown.

It’s possible sBTC could be reused in other ecosystem protocols for further yield, though adoption and mechanics remain to be seen.

Moreover, according to Papaya’s documentation, participants can earn liquidity mining rewards by staking either sBTC or STX with Papaya, qualifying them for PAPA tokens. The amount of PAPA received will be proportional to the liquidity provided.

While no TGE date has been announced for PAPA, early engagement on the testnet may increase chances of receiving an airdrop.

Another, arguably more promising project is LISA.

Currently, LISA’s website remains conceptual, with its liquid staking service and testnet still under development. Yet expectations are high because LISA is backed by a team from one of Bitcoin’s strongest builder groups—ALEX Lab.

The two teams frequently interact on Twitter, and LISA’s site explicitly credits ALEX as a collaborator.

Given ALEX Lab’s track record—from launching Bitcoin’s first oracle to pioneering a launchpad platform—with rich resources and proven innovation, and considering the strong past performance of the ALEX token,

it’s reasonable to expect aggressive marketing and ecosystem expansion once they enter liquid staking. As a flagship project, LISA would naturally benefit—increasing speculation around a potential LISA token airdrop.

Since LISA’s staking isn’t live yet, users are advised to register their email on the LISA website and stay updated on future developments.

Overall, Stacks has secured its position amid the resurgence of the Bitcoin ecosystem. With multiple projects gaining traction, players of all sizes, experience levels, and preferences now have diverse paths to generate returns.

In this bull cycle, infrastructure development, ecosystem growth, and user participation reinforce each other—sometimes, an early interaction could lead to unexpected rewards.

Adopt an early-mover mindset, choose the highest-yield strategy, and get ready for the next wave of opportunity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News