The Truth About Bitcoin, Fully Exposing Common Misconceptions

TechFlow Selected TechFlow Selected

The Truth About Bitcoin, Fully Exposing Common Misconceptions

We're still early.

Author: Yassine Elmandjra

Translator: Yvonne

Last week's events show that despite growing institutional acceptance of Bitcoin, it remains profoundly misunderstood:

-

Jamie Dimon claimed Satoshi controls Bitcoin

-

Vanguard stated Bitcoin is too volatile to be investable

-

UBS claimed Bitcoin has no real-world application value

In this article, I revisit the most common misconceptions about Bitcoin.

We are still very early.

Misconception: Bitcoin is not backed by anything.

Rebuttal: Bitcoin is backed by the most powerful computing network in the world.

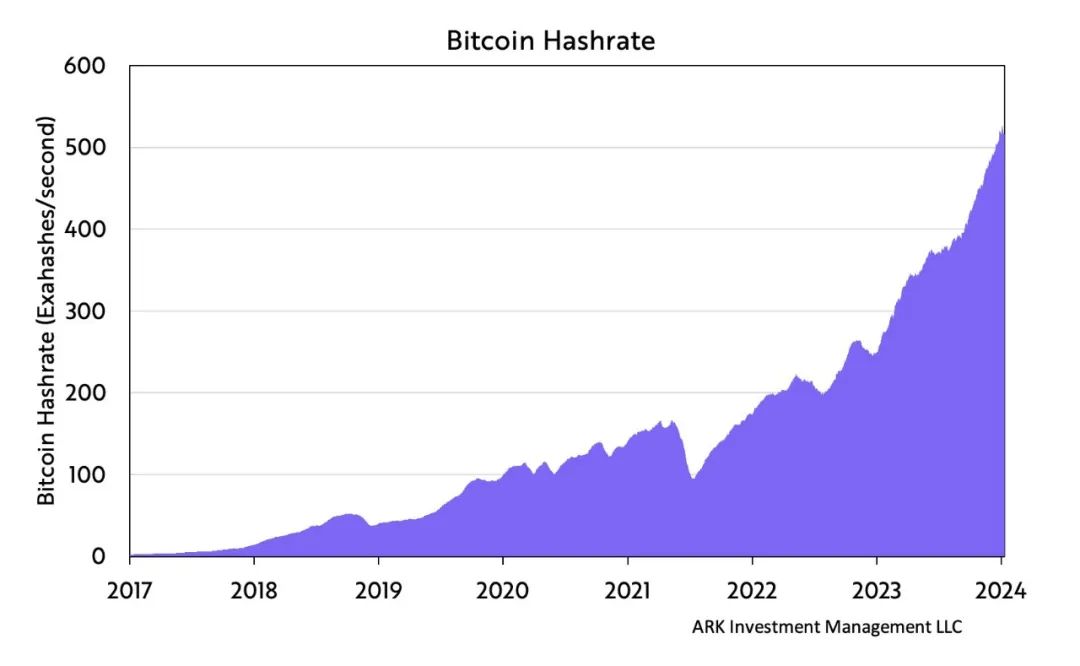

The computational power securing Bitcoin reaches 500 exahashes per second—surpassing the combined total of the world’s largest computing networks. This computing power is not centralized or controlled by any single entity. It is distributed across a global network, ensuring decentralization and resilience against attacks or failures.

Mining Support > Government Support

Misconception: Bitcoin wastes too much electricity.

Rebuttal: The energy consumed by Bitcoin is not wasted. It is deliberately allocated to sustain a network of profound significance for the future of money.

Bitcoin’s energy consumption is an essential design feature that provides necessary security for a decentralized, independent, global, and automated monetary system. Bitcoin mining demands high computational power and incurs significant costs, making any attempt to attack the network extremely impractical.

Moreover, a substantial portion of Bitcoin’s energy consumption comes from renewable sources. The free-market principles of Bitcoin mining strongly incentivize miners to seek cheap electricity, inadvertently guiding them toward more sustainable energy solutions. Many mining operations are strategically located near abundant renewable energy sources. These miners utilize energy that might otherwise remain idle, especially in regions where renewable output fluctuates greatly and does not always align with demand. In such cases, Bitcoin mining can act as a stabilizer for renewable energy grids, providing consistent energy demand and helping fund and support the expansion of renewable infrastructure.

It is also worth noting that the perception of Bitcoin as wasteful largely stems from the directness and visibility of its energy use, which contrasts sharply with the more hidden and diffuse energy costs of other systems, including traditional financial systems.

The energy consumed by Bitcoin mining must be weighed against the intrinsic value of a decentralized, global, secure, transparent, borderless, and politically neutral currency. In this light, Bitcoin’s energy consumption is not waste but an investment in a global financial network that anyone, anywhere, can access without discrimination. It symbolizes a collective commitment to supporting an open global economic system based on free-market principles.

Sorry, skeptics—you can only pick one.

Misconception: Bitcoin processes transactions slowly.

Rebuttal: Bitcoin provides strong transaction settlement assurances.

Bitcoin’s transaction speed reflects its design priorities: security and decentralization.

In a decentralized global monetary system, “transaction speed” is far less meaningful than “transaction finality” as a performance metric. While block time affects initial confirmation speed, it does not guarantee transaction finality. Compared to higher-throughput financial settlement networks, Bitcoin’s decentralized settlement assurance is unparalleled. Measured by time to ensure final completion of a transaction, Bitcoin is the “fastest” blockchain.

Additionally, Bitcoin’s “small” block size balances transaction throughput with the ability of individuals to participate in the network without excessive data requirements. Its 10-minute block interval is also a deliberate design choice, allowing sufficient time for network synchronization and stable transaction validation.

Misconception: Bitcoin is too volatile.

Rebuttal: Bitcoin’s volatility highlights the credibility of its monetary policy.

Volatility is a natural outcome of Bitcoin’s monetary policy. Unlike modern central banks, Bitcoin does not prioritize exchange rate stability. Instead, adhering to a monetary quantity rule, Bitcoin limits the growth of money supply, allows free capital flows, and forgoes exchange rate stability. Therefore, Bitcoin’s price is a function of demand relative to supply.

Bitcoin’s volatility should come as no surprise.

However, over time, Bitcoin’s volatility will gradually decrease. As Bitcoin adoption increases, new marginal demand will represent a smaller proportion of its total network value, thereby reducing the magnitude of price fluctuations. For example, all else being equal, $1 billion in new demand would have a greater impact on Bitcoin’s price when its market cap is $10 billion than when it is $100 billion.

Crucially, we should not dismiss Bitcoin’s potential as a store of value due to volatility, especially since volatility often coincides with significant price appreciation.

Misconception: Bitcoin is used by criminals.

Rebuttal: Bitcoin is censorship-resistant.

Criticizing Bitcoin for facilitating criminal activity is essentially criticizing one of its core value propositions: censorship resistance. As a neutral technology, Bitcoin enables anyone to transact and cannot identify “criminals.” Instead of relying on central authorities to identify participants by name or IP address, Bitcoin distinguishes users through cryptographic keys and addresses, giving it strong censorship-resistant properties. As long as participants pay fees to miners, anyone can transact anytime, anywhere.

If criminal activity on the Bitcoin network could be censored, then all activity could be censored. On the contrary, Bitcoin enables unrestricted value exchange globally. This does not mean Bitcoin is inherently a tool for crime. Compared to Bitcoin, phones, cars, and the internet are equally capable of facilitating criminal activities.

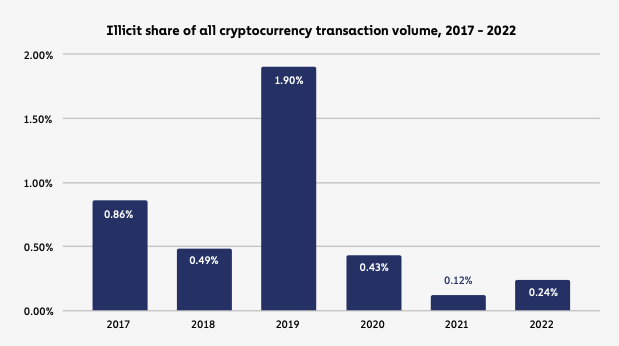

Nevertheless, only a tiny fraction of Bitcoin transactions serve illicit purposes. According to Chainalysis, 0.24% of cryptocurrency transactions were deemed illicit in 2022, averaging less than 0.7% over the past six years.

Misconception: Governments can easily shut down Bitcoin.

Rebuttal: Governments cannot stop Bitcoin. They can only stop themselves from using it.

Bitcoin operates on a global network of computers, making it extremely difficult for any single government or institution to shut it down. The resilience of the Bitcoin network stems from its distributed architecture, with thousands of nodes across different jurisdictions maintaining and validating the blockchain. As long as at least two nodes are running anywhere in the world, Bitcoin will continue to operate.

While governments may regulate or restrict Bitcoin usage within their borders, Bitcoin’s global and decentralized nature makes it practically impossible to fully shut down.

Misconception: Satoshi controls Bitcoin.

Rebuttal: Bitcoin contains a unique system of checks and balances ensuring no individual or entity can control it.

Satoshi does not control Bitcoin. At its core, Bitcoin is software supported by a decentralized network of computer nodes. Its rules are formally codified in the software. Humans are not the ultimate arbiters of truth and cannot unilaterally decide to change its rules. Instead, the nodes that validate transactions also enforce the rules.

Each node follows the same set of rules and is only permitted to join the network if it adheres to them. If a node attempts to break the rules, all other nodes will reject its messages. Proposed software changes are meaningless unless stakeholders choose to accept them. Nodes are spread globally and operate independently; they will not accept actions that compromise integrity. However, nodes are only one part of Bitcoin’s integrity maintenance. Bitcoin features a unique system of checks and balances designed to encourage protocol innovation and upkeep while ensuring any changes align with stakeholder interests.

The cornerstone of this checks-and-balances system is the value of the Bitcoin asset itself, which provides economic incentives for stakeholders to resolve disputes and maintain system integrity. No stakeholder enjoys privileged rights or treatment, but each benefits from Bitcoin’s price appreciation—the network’s primary signaling mechanism. Any change threatening system integrity also threatens Bitcoin’s value. Thus, stakeholders have little incentive to act maliciously.

This system of checks and balances is also why Bitcoin maintains its predictable monetary policy and keeps the total supply capped at 21 million. Arbitrary changes to Bitcoin’s rules are highly unlikely.

Misconception: Bitcoin has no intrinsic value.

Rebuttal: Bitcoin is a contender for global money.

While Bitcoin’s value drivers differ from traditional assets, claiming it has no intrinsic value is incorrect. Bitcoin’s characteristics as a monetary asset form the foundation of its value and indicate its role in the financial world is sustainable, not merely speculative. Bitcoin’s intrinsic value does not stem from cash-flow-based assets but from its unique attributes that align with the historical and modern demands of monetary systems.

Often called “digital gold,” Bitcoin shares many qualities of gold while improving upon them. Bitcoin is both scarce and durable, while also being divisible, verifiable, portable, and transferable. These monetary properties give Bitcoin exceptional utility, potentially driving demand and positioning it as a suitable candidate for a global digital currency.

Misconception: Nobody uses Bitcoin.

Rebuttal: Have you seen the numbers?

-

Cumulative transaction value: $41.6 trillion

-

Cumulative transaction count: 954 million

-

Cumulative miner revenue: $58.8 billion

-

Addresses with non-zero balance: 51.7 million

-

Market cost basis: $4.4 billion

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News