How to Professionally Farm Airdrops in the Year of Airdrops?

TechFlow Selected TechFlow Selected

How to Professionally Farm Airdrops in the Year of Airdrops?

2024 will be the most important year in airdrop history.

By: The DeFi Investor

Translation: TechFlow

This article, written by crypto analyst The DeFi Investor, dives into the 2024 airdrop opportunities and their potential impact on the cryptocurrency market. The author shares strategies for discovering and evaluating airdrop opportunities and analyzes how to leverage these opportunities effectively.

Main Text

I believe 2024 will become the most important year in airdrop history.

If Bitcoin rebounds after its halving as it has historically done, many projects that built up during the bear market may take advantage of improved market conditions to launch their tokens.

For a team behind a tokenless project, announcing an airdrop is the best way to generate buzz.

With that in mind, today I want to share my strategy for identifying and deciding which airdrops are worth positioning for.

The Easiest Way to Discover Airdrop Opportunities

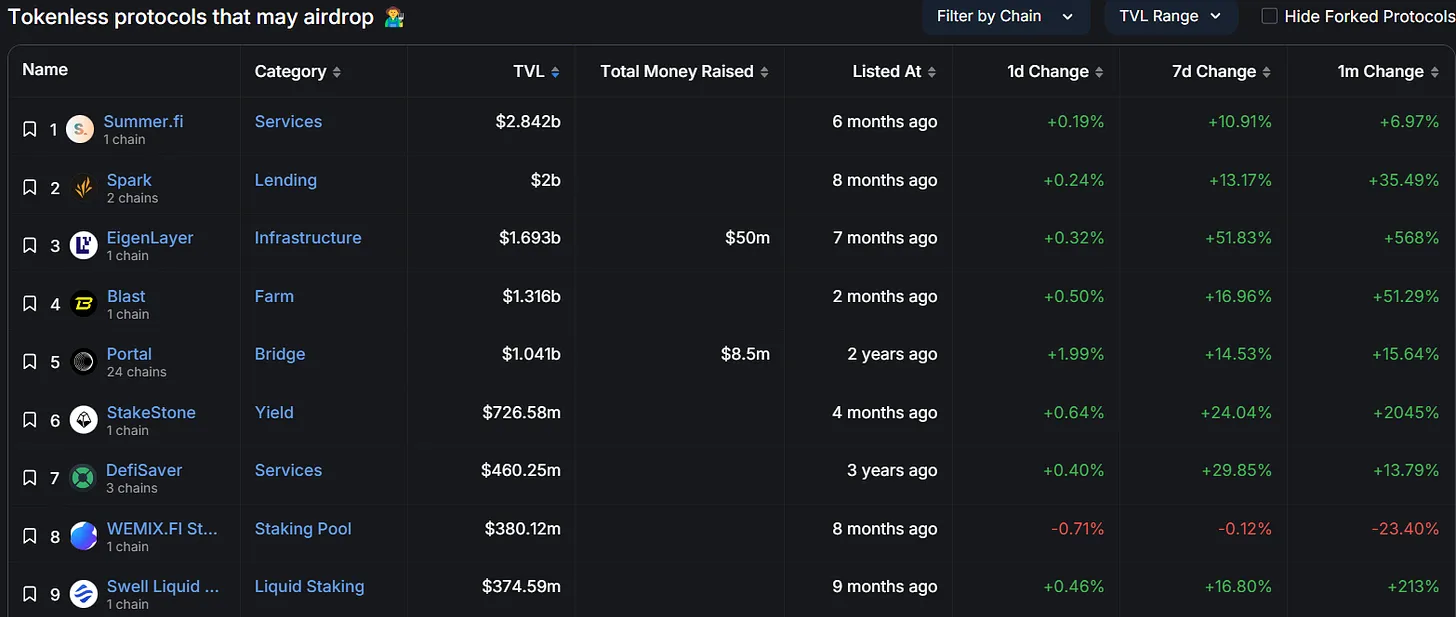

DeFillama offers a very useful free airdrop dashboard.

Here are three steps you can quickly use to get started:

• Visit DeFillama

• Click “DeFi” → Airdrops

• Filter the displayed tokenless protocols by TVL

Afterward, I usually research the protocols shown on the page to identify which might conduct the largest airdrops in the future.

90% of tokenless projects eventually launch a token.

But ideally, you only want to position for airdrops that meet specific criteria ensuring their airdropped tokens won't be worthless.

Therefore, here's what I typically look for in a tokenless protocol:

-

Strong community: The more active a project’s community is on X, the higher the potential valuation of its token. After all, we’re in an attention economy.

-

Funding raised from VCs: The more capital a team has raised in funding rounds, the higher the likely valuation of the protocol’s token at launch.

-

Founded no more than 3 years ago: If a protocol hasn’t launched a token within the first three years of its founding, perhaps they never intend to.

You can assess whether a project has an active community by checking the number of likes and views on posts from its official X account.

Additionally, if a tokenless protocol has a points program, I see this as a positive sign, as it indicates the team plans to reward early adopters.

Another factor worth considering is the protocol’s TVL / total funds raised ratio (if the project raised funds from VCs).

In many cases, the lower this ratio, the more worthwhile the airdrop opportunity.

Token launches from projects with high TVL and significant funding are often highly successful.

Follow the Right People on X

I’ve also started posting more about airdrops on X.

But there are many others who treat airdrops as a full-time job and freely share their knowledge.

These are the people I recommend following to level up your airdrop game.

Some of my favorite X accounts related to airdrops:

I've created a list containing all these resources on X. You can click here to follow the list and check back periodically for the latest airdrop opportunities.

Some Additional Tips and Tricks

Airdrops may seem risk-free, but smart contract vulnerabilities frequently occur in DeFi.

That’s one reason why I try to maximize capital efficiency when participating in airdrops—to ensure the risk/reward ratio is sufficiently attractive.

One way to achieve this is by focusing primarily on "two birds, one stone" strategies—using the same capital to qualify for two airdrops simultaneously.

An excellent example is trading on Syncswap DEX on zkSync.

Neither Syncswap nor zkSync currently have tokens, so by generating trading volume on Syncswap, you can qualify for potential airdrops from both projects.

I’ve detailed some of my favorite two-in-one airdrop strategies here:

Next, a website I use to check whether I’m eligible for any unknown airdrops is Earndrop.

All you need to do is paste your EVM wallet address onto the site, and it will show you if you’re eligible for any unclaimed airdrops.

It’s free to use, and I personally try to paste my wallet address onto the site every few weeks.

My final suggestion is: if your cryptocurrency portfolio is worth over $10,000, consider spreading your funds across multiple wallets.

Many past airdrops have distributed tokens in tiers, so sometimes you can increase your allocation by using 3-4 wallets instead of just one.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News