NAVI Protocol: Native Token Launch Imminent, the Leading DeFi Protocol on Sui with #1 TVL in the Ecosystem

TechFlow Selected TechFlow Selected

NAVI Protocol: Native Token Launch Imminent, the Leading DeFi Protocol on Sui with #1 TVL in the Ecosystem

Focusing on the billion-dollar LST赛道, the native token is即将 launched, driving the project to new heights.

Author: TechFlow

When discussing the cornerstone of public chain ecosystems, DeFi stands out as the top choice.

The modern financial trading system has continuously evolved and innovated around one central goal: enhancing market liquidity. Under this premise where “liquidity begets dominance,” DeFi serves as the vessel that unlocks liquidity. Within this framework, lending protocols connect token supply and demand via smart contracts, while LSTFi (Liquid Stake Token Finance) simultaneously releases capital liquidity and enables stable, diversified returns. These two sectors are not only seen by many as billion-dollar-scale opportunities but also represent the core pillars of public chain ecosystem development.

In fact, the rise of a strong DeFi project can significantly boost its underlying blockchain. As early as the 2020 DeFi Summer, innovative lending protocols such as MakerDAO, Aave, and Compound solidified Ethereum’s status as the “king of public chains.” Later, Lido emerged to spark an Ethereum LST craze. Such examples abound, all reinforcing the critical role DeFi plays in public chain ecosystem growth.

At the dawn of the current bull market, new public chains like SOL, AVAX, and SUI have seen strong price rallies, setting the stage for a fresh narrative of emerging chain resurgence. Among them, Sui—one of the "Move twins"—stands out due to its technical advantages, impressive fundraising and team background, and immense potential for explosive ecosystem growth. It is widely viewed as a standout investment candidate in the new public chain race.

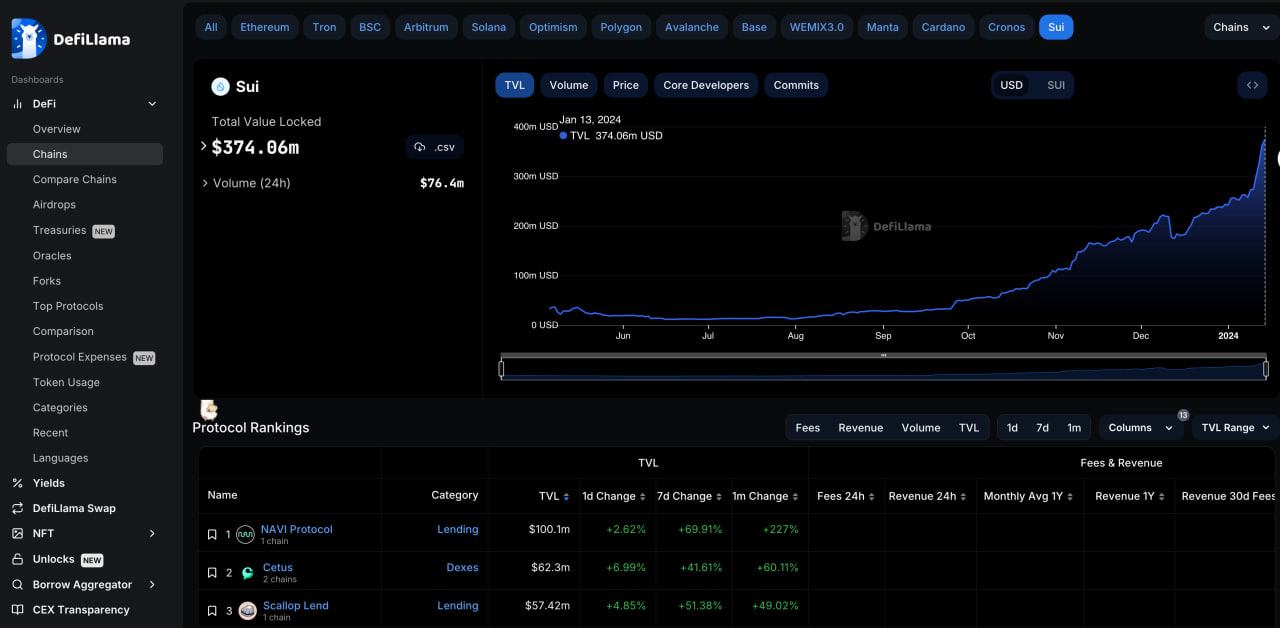

Since the beginning of the year, NAVI Protocol, a native DeFi protocol on Sui, has demonstrated strong momentum—surging 80% in TVL within half a month to become the #1 DeFi project on Sui, and announcing the acquisition of Volo, a leading liquid staking protocol in the Sui ecosystem, to seize the LSTFi market and lay the foundation for becoming a “one-stop liquidity hub” on Sui. Following market trends and historical precedents, NAVI Protocol’s positive impact on the Sui ecosystem has further heightened expectations for both Sui and its flagship lending protocol, NAVI.

This article aims to explore NAVI Protocol—the leading project in the Sui ecosystem—by examining its strengths, recent developments, and the symbiotic relationship between DeFi projects and emerging blockchains, offering insights into the competitive landscape of new public chains and the future trajectory of DeFi during this new bull cycle.

NAVI: The Crown Jewel of Sui's DeFi Ecosystem – TVL Soars 80%, Surpassing $100M at Year-Start

Many first noticed NAVI Protocol due to its remarkable growth since the start of the year: just two weeks ago, NAVI’s TVL had barely surpassed $60 million; within only two weeks, it exceeded $100 million—a 80% increase—with borrowing volume reaching $40 million, accounting for 66% of Sui’s total network borrowing activity.

However, digging deeper reveals that NAVI has maintained this astonishing pace since launch: just six months after going live, NAVI attracted over 760,000 users and became one of the first projects integrated into OKX DeFi Wallet, establishing a deep partnership with OKX.

Image source: naviprotocol.io

Behind these impressive results lies a perfect alignment of timing, infrastructure support, and team excellence:

As the first native liquidity infrastructure on Sui, many view NAVI as an Aave 2.0 equivalent within the Sui ecosystem. Through mechanisms such as over-collateralization, dynamic interest rates, and health factors, NAVI provides users with access to participate in the Sui ecosystem either as liquidity providers or borrowers. Liquidity providers deposit assets into the protocol to earn yield, while borrowers can take out various assets via NAVI, increasing capital efficiency.

For more details about the project, read: NAVI Protocol: The Catalyst Behind Sui's Ecosystem Surge

Timing-wise: With Bitcoin halving approaching and spot Bitcoin ETFs now approved, 2024’s crypto market is seen by many institutions as an open “bull run.” For DeFi—the engine of any bull market—users who have been waiting through the bear phase are now ready to act. For a DeFi project born at the end of a bear market and already having completed initial user and capital accumulation, this transition into a bull market presents the ideal opportunity to shift into high gear.

Infrastructure-wise: Backed and incubated by Mysten Labs, Sui’s official team, NAVI benefits directly from Sui’s high-performance architecture, which delivers seamless user experiences. Sui’s strong focus and investment in DeFi also significantly accelerate NAVI’s growth. On-chain data shows that Sui Foundation, together with NAVI, launched the “Liquidity Xplorer” incentive program, allocating $15 million in SUI tokens over the past six months to reward early depositors with APYs exceeding 20%, attracting more users to participate in NAVI’s lending activities.

The human factor—team excellence—is another key advantage, rooted in NAVI’s exceptional product innovation and marketing capabilities.

In terms of product innovation, the success of any DeFi project hinges on three pillars:

-

Enhancing capital efficiency

-

Ensuring fund security

-

Optimizing user experience

The “Leveraged Vault” feature exemplifies NAVI’s innovative approach to boosting capital efficiency: its automated leverage function meets users’ needs to repeatedly borrow and re-deposit assets to maximize utilization, all through simple, intuitive operations. Low-interest borrowing on certain assets, high-yield farming rewards, and leveraged strategies involving native APY-generating assets (liquid staking tokens and LP tokens) further amplify capital efficiency and user returns.

Regarding fund security, NAVI employs a multi-layered safety strategy based on over-collateralization: The introduction of the Health Factor (Hf) clearly communicates borrowing risks to users. Its innovative “Isolation Mode” requires new assets to be approved by NAVI governance before being eligible as collateral, minimizing risk exposure when participating in new opportunities. Additionally, NAVI enhances user experience through features like its 24/7 notification system powered by Notifi, enabling users to monitor market fluctuations and respond promptly.

On user experience optimization, NAVI consistently prioritizes user feedback and has rolled out several practical features: a reward management dashboard allows users to claim all rewards in one place; the Leaderboard incentivizes engagement with point-based rewards; transaction history lets users review all interactions with NAVI in just a few clicks; and incentive pools further stimulate capital flow across the Sui ecosystem. More community-driven, user-friendly features are under development.

In marketing and operations, NAVI combines ecosystem partnerships, yield incentives, and active social media presence into a powerful growth strategy.

In December, OKX DeFi launched a NAVI yield-boosting campaign, allowing users to stake SUI or USDC into NAVI via OKX DeFi and receive an additional 10% annualized yield. Subsequently, NAVI partnered with OKX Web3 Wallet on an “EARN” campaign, offering 20% APY for CETUS and wETH pools. Furthermore, NAVI is now integrated into the OKX Web3 Wallet plugin, enabling users to lend and borrow crypto assets seamlessly. As a leading exchange, OKX brings massive user traffic, and these deep collaborations help expose NAVI to a broader Web3 audience.

Image source: Twitter @navi_protocol

Beyond that, NAVI remains highly active across social platforms, communities, and AMAs, regularly hosting Giveaways and X-to-Earn events. Through engaging content, fun mechanics, and attractive rewards, NAVI encourages deeper user involvement. According to its Q4 report, NAVI hosted over 10 community events last quarter alone and grew its Twitter following beyond 48,000.

In short, NAVI’s strong market performance didn’t happen by accident—it’s the result of robust product design and strategic marketing groundwork laid well in advance. Now entering 2024, with upcoming milestones including native token launch, the acquisition of Sui-based liquid staking leader Volo, and other roadmap items, NAVI’s growth trajectory is poised to accelerate even further.

Focusing on the Billion-Dollar LST Sector: Native Token Launch Imminent – Propelling NAVI to New Heights

On January 17, 2024, NAVI Protocol announced the acquisition of Volo, a leading liquid staking protocol in the Sui ecosystem, marking its evolution from a lending protocol into a comprehensive “one-stop liquidity solution” combining lending and LSTFi. The merger and transition are expected to complete within a month. The news sparked widespread discussion across the community:

First, acquiring Volo is a major strategic upgrade for NAVI: NAVI already dominates 66% of Sui’s lending market. According to Defillama, Volo ranks among the top 10 DeFi protocols on Sui and is a top 3 liquid staking protocol, capturing nearly 30% of Sui’s LSTFi market share. The combination of two leading ecosystem players creates strong synergies, benefiting both projects and the entire Sui ecosystem.

Additionally, NAVI stated that post-merger, it will focus on developing an integrated suite of solutions to better meet evolving user demands. This not only fosters greater interoperability across Sui’s DeFi segments but also offers users superior experiences through deeper liquidity, enhanced composability, lower staking fees, and diverse incentives—all while supporting sustainable, positive growth for the Sui ecosystem via advanced yield strategies.

Second, the vast potential of the LSTFi sector gives NAVI—and Sui—an edge heading into this bull market: Since Ethereum’s Shanghai upgrade, LSTFi has flourished by delivering innovations in liquidity, capital efficiency, yield strategies, and risk management. Yet despite its rapid growth, there’s broad consensus that LSTFi—despite being a billion-dollar opportunity—is still in its infancy. In the coming bull market, it could unlock 50x+ growth for DeFi, depending on which chains seize the moment. This is evident in Avalanche’s BENQI, a top DeFi protocol that recently saw its TVL surpass $530 million with over 50% growth in 30 days, driven by its focus on liquid staking solutions.

Given this backdrop, Sui—already a frontrunner in the new public chain race—has strategically chosen LST as a core development priority. Volo, the target of this acquisition, was the winner of Sui Foundation’s Liquid Staking Hackathon. Undoubtedly, acquiring Volo signals NAVI’s deep commitment to LSTFi. With continued efforts in both lending and LSTFi, combined with the sector’s immense potential and Sui’s strong institutional backing, NAVI could follow in BENQI’s footsteps to establish itself as a dominant force in LSTFi—accelerating its own growth while unlocking new possibilities for Sui.

Image source: Twitter @navi_protocol

Beyond the acquisition, the most anticipated item on NAVI’s Q1 roadmap is the launch of its native token.

In the current bull market environment, identifying potential alpha opportunities is a top priority for users. As the undisputed leading project in the highly watched Sui ecosystem—and the only top-tier project without competitors announcing token launches—NAVI, as the TVL leader, is set to become the sole major Sui-native project launching a token, drawing intense attention from across the Sui ecosystem and the wider new-chain DeFi community.

The utility of NAVI’s native token is another major reason for excitement: token holders can stake NAVI to earn yield, receive fee discounts, and participate in governance. Moreover, NAVI adopts Curve’s ve-token model with veNAVI, encouraging long-term staking and governance participation—giving supporters confidence in NAVI’s long-term sustainability.

Notably, in line with standard practices, NAVI’s marketing team is expected to roll out promotional campaigns around the token launch, with early users likely receiving airdrops. This anticipation further fuels interest and participation in the project.

In addition to the token launch, another major Q1 milestone is the activation of DAO and community governance functions—key steps in empowering users to shape the project’s long-term future.

Image source: naviprotocol.io

Looking ahead, NAVI’s focus will center on feature upgrades and UX improvements: The team plans to enable staking of NAVI tokens within liquidity protocols and integrate with Sui Foundation’s Deepbook to leverage deep order book liquidity, ensuring optimal trading experiences. Additional features will be iteratively developed based on market and community feedback to deliver increasingly efficient, secure, convenient, and seamless DeFi experiences. Meanwhile, NAVI will expand its reach by supporting more chains, integrating with other projects, launching new user-centric features, and conducting educational and engagement initiatives to drive deeper user involvement.

As the clear DeFi leader on Sui, NAVI’s strong momentum and positive outlook have led many to bet on Sui emerging as a front-runner in the new public chain race during this bull market.

Sui ⇄ NAVI: A Cycle of Mutual Empowerment, Achieving Greatness Together

With NAVI’s TVL surging 84.99% in seven days, Sui’s overall TVL has surpassed $370 million (including lending), up over 55% in the same period. Compared to Aptos, its fellow “Move twin,” Sui’s TVL is now nearly three times larger.

Image source: defillama.com

This parallel surge highlights a growing virtuous cycle between Sui and NAVI—a symbiotic relationship where the chain and the project mutually reinforce each other.

On one hand, Sui’s inherent strength provides NAVI with a powerful foundation—like standing on the shoulders of giants:

From day one, Sui has been a star among public chains. Dissatisfied with restrictive work environments at Meta (formerly Facebook), several key engineers—including Evan Cheng, former head of Meta’s crypto wallet, and Sam Blackshear, creator of the Move language—left to form Mysten Labs, soon launching Sui.

Technical innovation is one of Sui’s standout strengths. Built on the native Move programming language—originally developed for Meta’s Diem stablecoin project—Sui offers robust asset handling and access control, simplifying digital asset and transaction management while prioritizing security. Sui allows validators to dynamically scale computing resources, greatly enhancing horizontal scalability. Its “Byzantine Fault Tolerant” consensus mechanism enables high throughput and low latency, supporting large-scale transaction processing with near-instant finality and strong security.

Combined with a stellar founding team, Sui’s finance-tailored innovations quickly captured global attention and attracted top-tier investors. On September 8, 2022, Mysten Labs raised $300 million in a funding round backed by industry leaders including Binance Labs, Coinbase Ventures, and Andreessen Horowitz (a16z).

As the leading DeFi project on Sui, NAVI benefits not only from Sui’s technological edge to deliver seamless, secure user experiences but also receives direct support in funding, technology, and marketing: Mysten Labs invested in NAVI, and the Sui Foundation co-launched user incentive campaigns with NAVI.

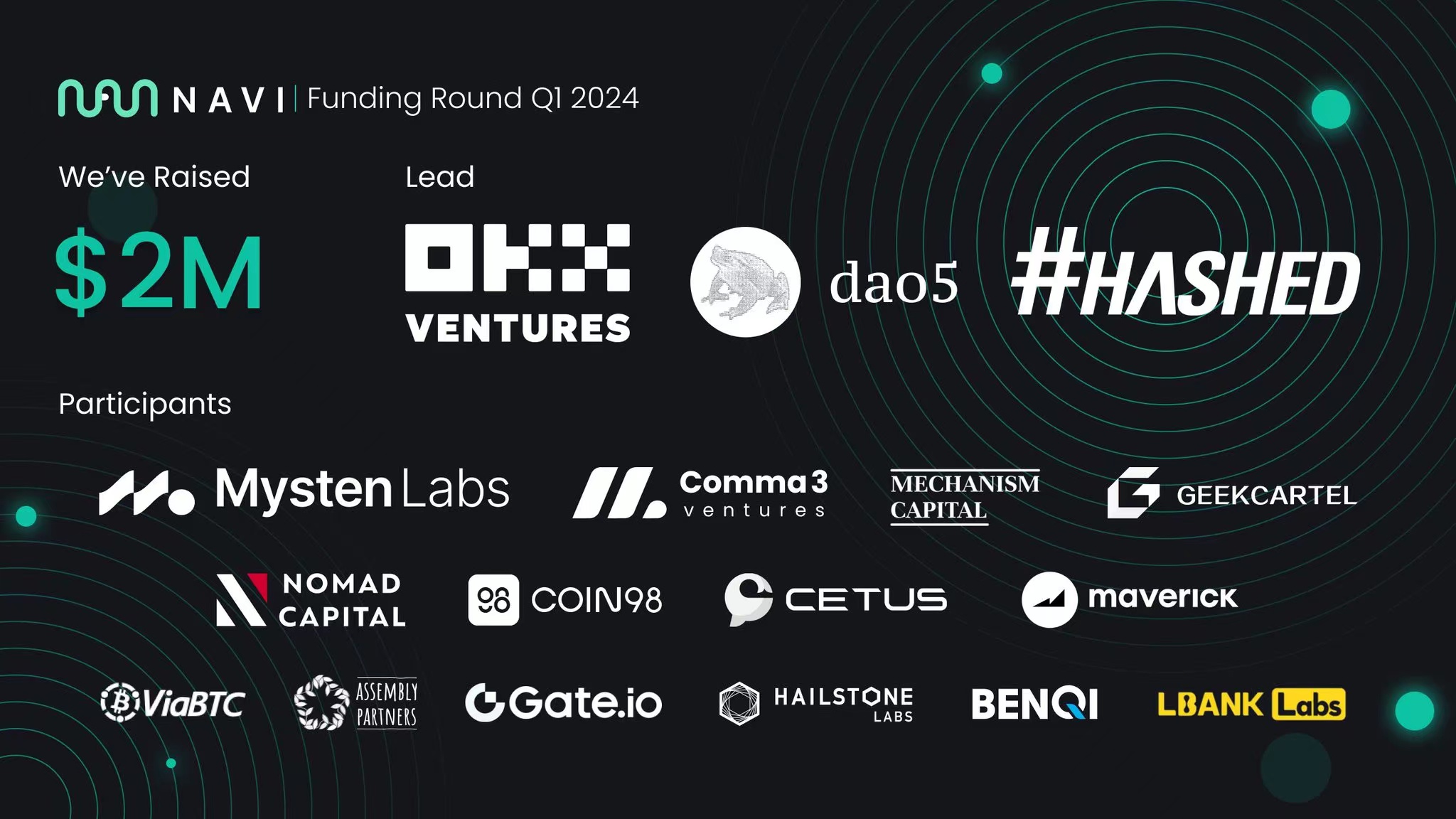

Recently, NAVI raised $2 million to expand its innovative integrated lending, borrowing, and LSDeFi platform.

The round was co-led by OKX Ventures, dao5, and Hashed, with participation from Mysten Labs, Comma3 Ventures, Mechanism Capital, GeekCartel Capital, Nomad Capital, Coin98 Ventures, Cetus Protocol, Maverick, Viabtc, Assembly Partners, Gate.io, Hailstone Labs, Benqi, and LBank Labs.

Image source: naviprotocol.io

Image source: naviprotocol.io

Indeed, Sui’s pre-existing advantages in funding, technology, and user traffic are now accelerating in this bull market—not just in DeFi, but across its entire ecosystem. Surveying Sui’s landscape, a rich Web3 network spanning NFTs, GameFi, AI, and social applications is rapidly taking shape.

Image source: Twitter @SuiEcoNews

It’s clear that Sui, already a highly anticipated new chain, has gained early momentum in the upcoming new-chain battle. As the bull market draws in more users, developers, and capital, NAVI—as the top DeFi project—will continue to benefit from Sui’s expanding ecosystem.

While Sui’s support has undoubtedly accelerated NAVI’s growth, NAVI in turn delivers substantial returns to Sui across capital, users, and reputation:

On-chain data shows a strong positive correlation between NAVI’s growth and Sui’s metrics—both in address count and TVL. NAVI’s success has helped validate Sui’s ability to support robust DeFi infrastructure. Thanks to NAVI’s strong performance, more people now believe Sui can sustain a high-liquidity, top-tier DeFi ecosystem over the long term.

Once established, this mutual empowerment loop creates a self-reinforcing cycle of capital and traffic within the ecosystem, driving both chain and project toward upward spirals of growth.

Looking ahead, thanks to this “chain ⇄ project” symbiosis, both NAVI and Sui stand to gain continuously. This dynamic will not only propel NAVI toward becoming a top-tier DeFi player but also help Sui secure a pivotal position in the new public chain landscape.

Conclusion

Currently, according to Defillama, NAVI Protocol is already the #1 DeFi project on Sui—but community expectations go far beyond that.

Keep in mind, NAVI’s current TVL hovers around $100 million—solid but mid-tier in the broader DeFi space. Yet given its team, innovation, product quality, and future outlook, barring unforeseen issues, NAVI is fully capable of pushing toward $1 billion, $2 billion in TVL, and competing among the top DeFi projects globally.

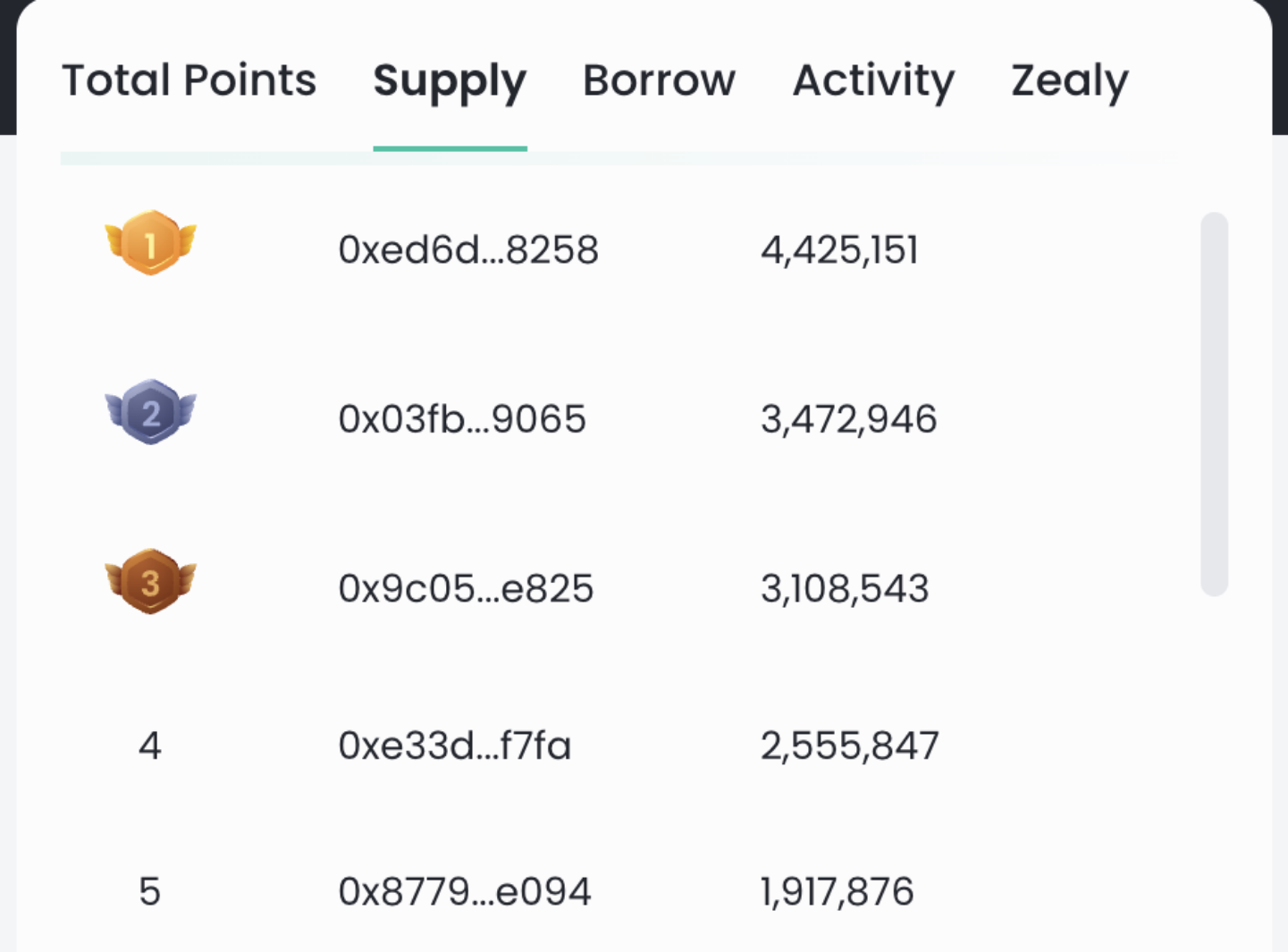

Community confidence is also reinforced by NAVI’s healthy liquidity structure:

According to NAVI’s points leaderboard, 50% of liquidity providers fall within the $5,000–$80,000 range, while the top 15 large depositors contribute just over $1 million in liquidity. Across $100 million in total liquidity, the average provider contributes nearly $1,000—indicating highly distributed participation, low systemic risk, and a solid foundation for NAVI’s long-term stability.

Image source: NAVI Protocol

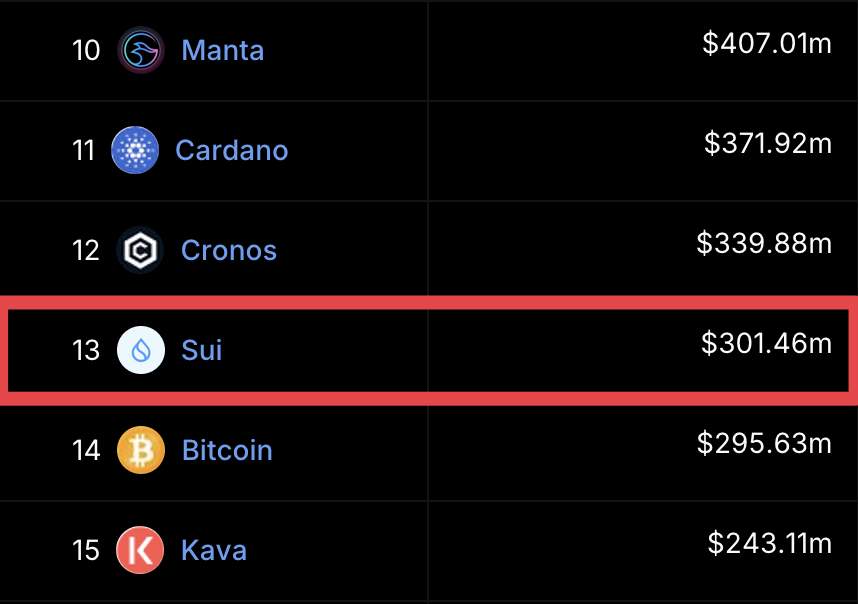

As for Sui, currently ranked 13th among new public chains, this position leaves ample room for imagination. Why? Because across technology, funding, and community momentum, Sui possesses all the traits of a top-tier new chain—and its recent momentum is undeniable, with minimal gap to those just above it.

Image source: Twitter @SuiNetwork

Whether NAVI—with its imminent token launch—can make waves in DeFi, or whether Sui—with its maturing ecosystem—can break through in the new chain race, both will be forces to watch in 2024. The market eagerly anticipates this model of chain-project collaboration, hoping to see a new paradigm of healthy, sustainable ecosystem growth emerge through their shared journey.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News