Canadian Bitcoin Mining: Looking Back at 2023, Looking Ahead to 2024

TechFlow Selected TechFlow Selected

Canadian Bitcoin Mining: Looking Back at 2023, Looking Ahead to 2024

Although 2023 was relatively favorable, the skies for 2024 do not seem quite as bright.

By Ethan Vera

Published by Wu Shuo as the Chinese content partner of Hashrate Index

In 2023, the global Bitcoin mining industry gradually recovered from the depths of the 2022 "crypto winter." Various economic indicators showed positive shifts: Bitcoin's price rose 154%, the index of listed mining companies' stocks increased by 246%, and network transaction fees—largely dormant since mid-2021—once again became a significant component of miner revenue. In addition, costs related to energy, hosting, and hardware all declined to varying degrees.

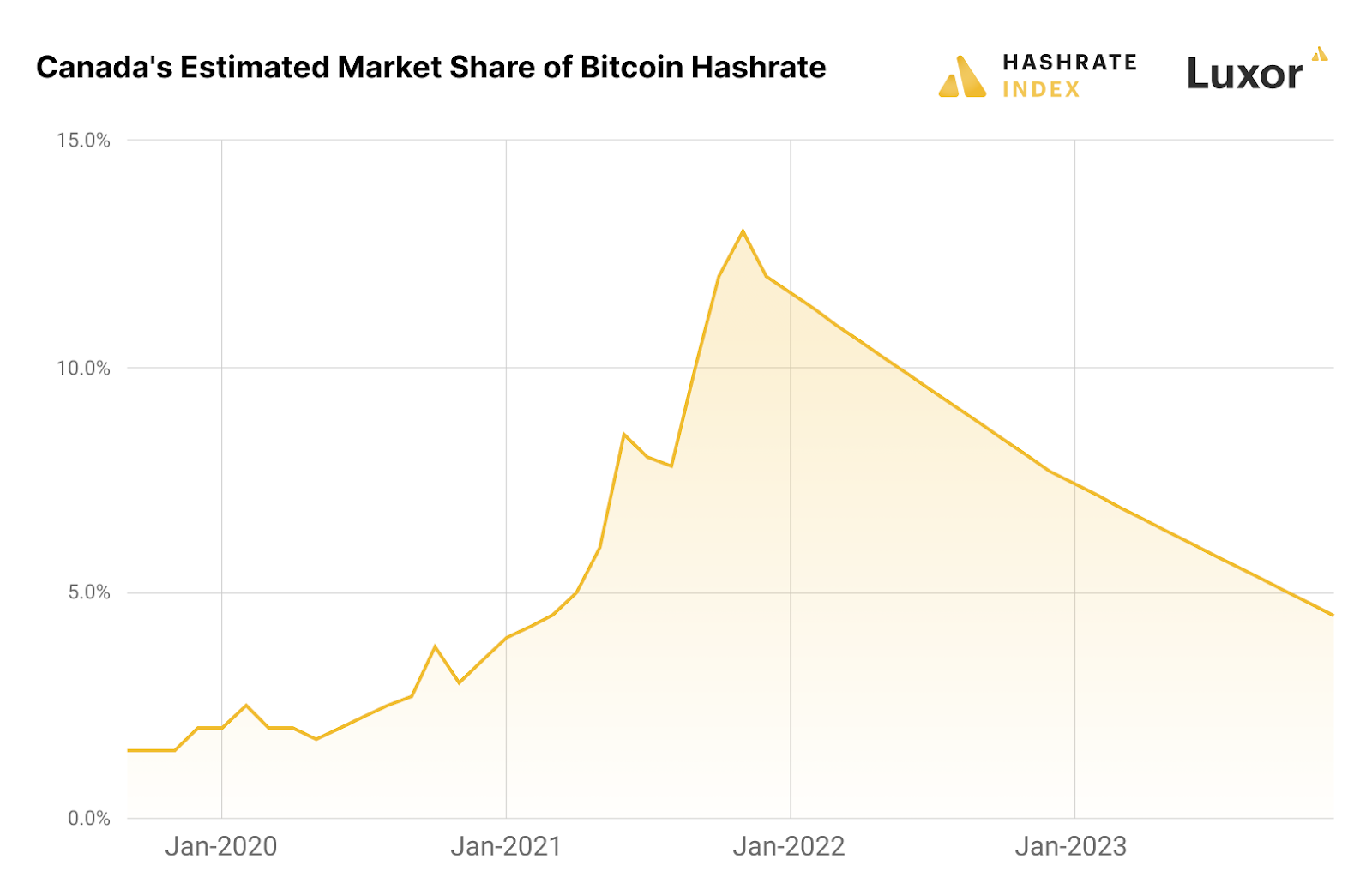

However, the situation for Bitcoin mining in Canada has been somewhat chaotic. Government pressure in 2022 led to policies explicitly targeting and discriminating against the industry, many of which remained in place throughout 2023. As a result, the sector was forced into a defensive posture nationwide—with the exception of Alberta. Consequently, major industry players began shifting their focus overseas in search of more favorable opportunities. Canada’s share of global Bitcoin network hashrate is expected to decline from 7%-8% at the end of 2022 to 4%-5%, representing a drop of as much as 13 percentage points compared to 2021.

Figure 1: Canada's share of global Bitcoin hashrate

A Strong 2023 Economic Recovery and a Gloomy Outlook for 2024

After enduring a difficult 2022, the global Bitcoin mining industry finally turned a corner in 2023. The chart below shows Bitcoin’s price rising 154%, nearly offsetting its entire annual loss from 2022.

Figure 2: Bitcoin price and mining difficulty trends

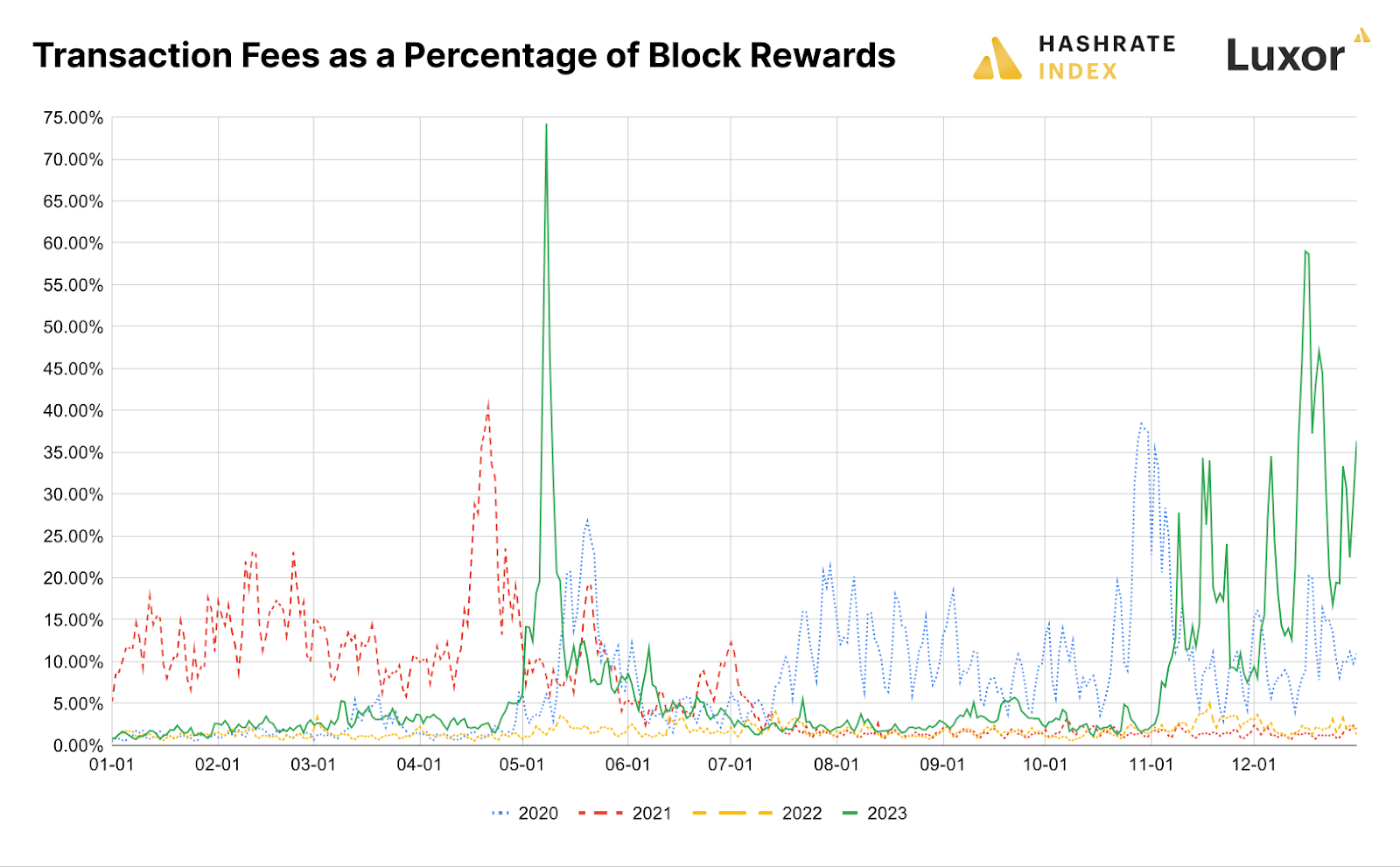

The real surprise came from the resurgence of Bitcoin network transaction fees. Due to the development of ordinals and inscriptions, miners saw significantly higher revenues from transaction fees. Data shows that transaction fees accounted for 7.6% of block rewards in 2023, up sharply from just 1.5% in 2022.

Figure 3: Transaction fees as a percentage of block rewards

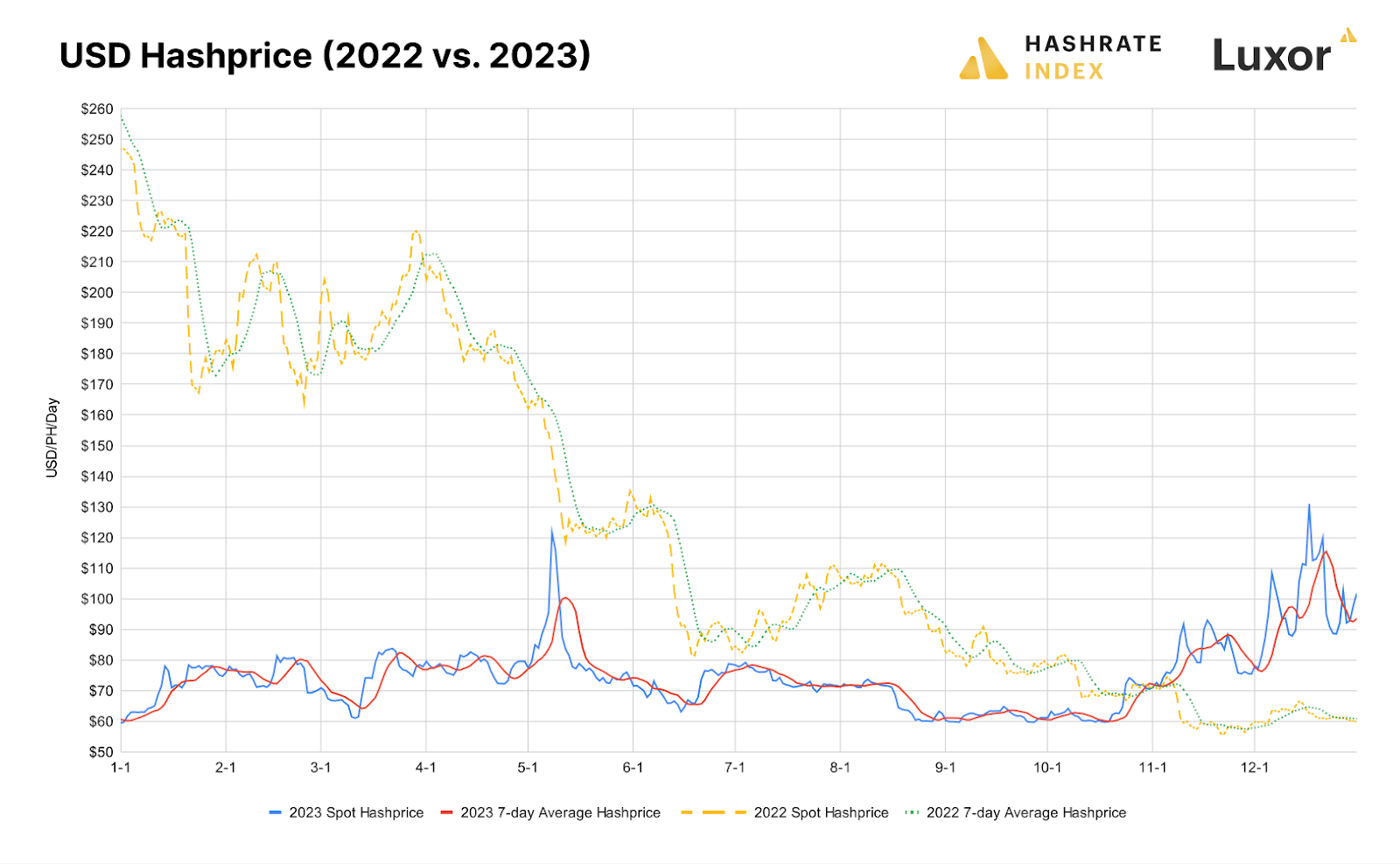

As a comprehensive measure of Bitcoin miners’ revenue per unit of hashrate, hashrate price rose from $59/Petahash/day to $101/Petahash/day—an increase of 70%—driven by notable fluctuations in transaction fees during May and December. The average hashrate price in 2023 was $75/Petahash/day.

Figure 4: Hasrate price movement in USD terms

Despite relatively favorable conditions in 2023, the outlook for 2024 appears less bright, with one ominous "black cloud" looming overhead—the Bitcoin halving. This quadrennial event directly cuts block subsidy income in half, while second-order effects remain uncertain and controversial, whether regarding Bitcoin’s price, network difficulty, or transaction fees. Some believe the halving will push prices higher; others argue that network difficulty may decrease due to lower-profit miners shutting down operations. If transaction fees remain elevated—as they were after the previous halving—they could help offset some of the revenue loss caused by the halving of block subsidies.

However, the primary impact of the halving is certain: Bitcoin miners will face a significant negative revenue shock in the short term. The halving is currently expected to occur around April 21, 2024.

Government Regulation Continues to Harm Mining; Development Stalls Across Canada

Following the 2022 trucker protests and amid the depths of the crypto winter, Canadian mining companies faced targeted and highly unfair regulatory actions. Policymakers at various levels made flawed decisions by singling out mining rigs from other computing devices, imposing specific taxes, electricity rates, and interconnection rules. As a result, in 2023, the Canadian mining industry adopted a fully defensive stance, focusing on building serious, long-term, and coordinated advocacy organizations.

Unfortunately for the Canadian economy, these poor public policies have resulted in losses of jobs, investment, and tax revenue. At the federal level, the government has demonstrated remarkable skill in creating uncertainty, thereby damaging employment and investment. In February 2022, without prior notice to the mining industry, the Department of Finance proposed a "clarification" amendment declaring that digital asset mining does not constitute a "commercial activity" in Canada. This proposal would have denied all digital asset mining firms access to input sales tax credits available to other export-oriented businesses. This unprecedented measure would have imposed an implicit tax of 5%-15% on Bitcoin mining costs in Canada, inflicting irreversible harm on Canadian companies competing in global markets.

Fortunately, thanks to efforts by the newly formed Digital Asset Business Council and member companies such as Hut8, Hive, Bitfarms, Iris Energy, Argo, and DMG, a solution emerged. Although the original proposal became law, legislators introduced amendments allowing miners to potentially qualify for input sales tax credits if the Canada Revenue Agency (CRA) determines on a case-by-case basis that they are selling computational power to overseas mining pools in a manner similar to how conventional data centers provide computing services. This should apply to nearly all industry participants in Canada. With hundreds of millions of dollars in tax credits, jobs, and investments at stake, the industry is still awaiting feedback and individual rulings from the CRA. An update is expected in early 2024.

In British Columbia, Manitoba, Quebec, New Brunswick, and Newfoundland and Labrador, the 2022 moratoriums on new interconnections remain in effect. These regions possess some of the cleanest, cheapest, and most abundant electricity resources in the world, attracting global investment from the mining industry. Yet, they have unexpectedly chosen to close this business opportunity rather than seize it by streamlining application assessments and enhancing grid flexibility. Provincial authorities cite concerns about peak electricity demand, overlooking—or failing to understand—the inherent flexibility of energy usage in mining. Notably, no such restrictions apply to any other form of computing industry.

In British Columbia, Conifex Timber sought to invest in mining and launched legal action challenging the province’s ban. In a publicly released white paper, Conifex outlined how the provincial cabinet’s actions violated laws, disrupted regulatory processes, and effectively undermined the government’s own economic, carbon reduction, and reconciliation goals.

Amid this challenging environment, Alberta stands out as a clear outlier. Provincial officials recognize the benefits of the digital asset mining industry, particularly in creating high-tech jobs—especially in rural and remote areas—and its strong potential for environmental and energy system sustainability. They are actively pursuing investment and encouraging economic development. In July, Premier Danielle Smith and Minister Dale Nally attended the Stampede Canadian Blockchain Alliance’s Bitcoin mining trade forum, while Minister Nate Glubish spoke about the benefits of mining at the “Bitcoin Rodeo.” Minister Dale Nally also participated in the Canadian Blockchain Alliance’s second annual Texas trade mission.

In Ontario, the Ministry of Energy appears to have abandoned its 2022 plan to exclude cryptocurrency miners from participating in the ICI program. ICI is an energy conservation initiative that allows participants to reduce electricity demand during five peak hours annually, lowering their Global Adjustment charges.

Canadian Miners Show Resilience and Expand Into New Markets

Poor policy management has not stopped Canadian companies from innovating and entering new markets.

Perhaps most notably, Hut8 completed the largest merger in industry history in November, merging entirely in stock with US Bitcoin Corp. The combined company, New Hut, will be based in the United States and become one of North America’s largest self-mining and high-performance computing facility operators, with approximately 825 megawatts of total generation capacity.

Other clean-energy-focused mining firms like Hive and Bitfarms expanded operations outside Canada. Bitfarms secured permits for a 100-megawatt mining facility in Argentina and signed contracts for up to 150 megawatts of hydropower in Paraguay, while Hive completed the acquisition of a hydroelectric-powered data center in Sweden by year-end.

On the hardware front, several notable collaborations emerged in 2023. After months of planning, engineering, factory process implementation, on-site testing, and global coordination, Hive deployed BuzzMiner powered by Intel’s Blockscale ASIC in January. Later in the year, Toronto-based ePIC Blockchain announced a partnership with Chain Reaction to produce its next-generation mining systems for Bitcoin mining.

Mining companies entered new revenue growth areas in 2023. DMG expanded into the inscriptions and ordinals space, becoming a leader in this market. Hut8 signed an agreement with Interior Health in southern British Columbia to provide secure colocation services, demonstrating expansion beyond Bitcoin mining. Meanwhile, Iris Energy entered the artificial intelligence market, showcasing its commitment to broadening its product offerings and expanding its high-performance computing data centers.

BlockLAB introduced an innovative system that, since piloting in 2022, uses excess heat generated during Bitcoin mining to provide an environmentally friendly and low-cost heating solution for greenhouse operations. Additionally, container manufacturers such as Upstream Data, CryptoTherm, Bit-Ram, and Intelliflex continued leading North America in innovation with their air-cooled and water-cooled systems.

Figure 5: Key events in Canada's Bitcoin mining industry in 2023

In 2024, Bitcoin Miners Must Face Challenges and Seize Opportunities

Although the rebound in Bitcoin prices and transaction fees provided much-needed relief to miners, the upcoming halving will shift industry focus squarely onto bottom-line profitability. While the directions of Bitcoin’s price, network difficulty, and transaction fees remain uncertain, the halving of block rewards is inevitable and will deliver a significant negative revenue shock. To survive, companies must reduce costs, improve efficiency, and protect margins.

On the policy front, improvements outside Alberta seem unlikely in 2024. Unfortunately, the federal Liberal Party does not view the digital asset industry as an economic opportunity but rather as a political weapon against its opposition. A rebound in Bitcoin prices might alter electoral calculations, but according to polls, Justin Trudeau and the Liberals are likely to continue attacking Pierre Poilievre and the Conservatives for supporting the digital asset industry. At the provincial level, bureaucratic inertia makes overturning existing bans improbable in 2024. It will still take considerable time and effort to educate provincial governments and grid operators about the industry’s benefits.

Nevertheless, we believe that building serious, long-term, and coordinated advocacy institutions in Canada is a worthwhile investment. Ultimately, with abundant, low-cost, and sustainable energy; a highly skilled workforce; a cold climate; underutilized industrial infrastructure—particularly in rural areas—and a relatively stable and secure political environment, Canada is naturally positioned to become a leader in cryptocurrency mining and other power-intensive computing industries.

If polling suggests any trend, it may be that political change is on the horizon. To seize this opportunity, the mining industry must continue demonstrating its value—miners should create more jobs, including roles for hardware manufacturers, infrastructure providers, and software engineers. They can bring investment to local communities, especially in rural or remote regions where opportunities are limited and industrial infrastructure remains underused. Moreover, by utilizing flared or vented waste natural gas, supporting grid stability through demand response, and enabling the construction of new renewable energy generation assets, miners enhance the efficiency and sustainability of environmental and energy systems. Perhaps most importantly, they transport Canada’s stranded energy to international markets via the internet—without requiring physical transmission lines or pipeline infrastructure—by selling computational power globally.

Canada’s success in cryptocurrency mining in 2024 and beyond will depend on the industry’s ability to generate returns by reducing costs and improving efficiency, as well as its continued efforts to educate the public and policymakers about the legitimate benefits of responsible cryptocurrency mining and gain broader acceptance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News