What's the next narrative after BTC ETF approval?

TechFlow Selected TechFlow Selected

What's the next narrative after BTC ETF approval?

The adoption and use of Bitcoin, as well as its integration with traditional financial services, will continue to be a focus of attention.

Written by: @MacroFang, PSE Trading Trader

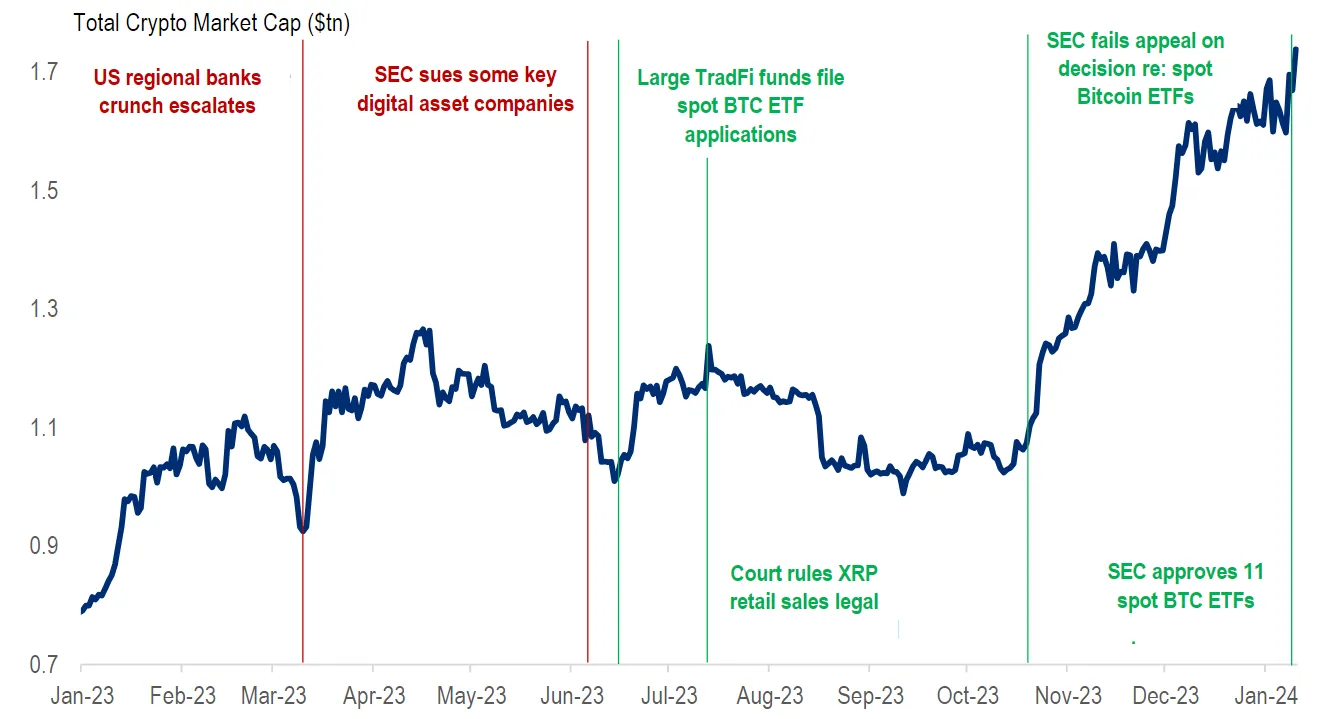

This landmark decision marks the end of a prolonged standoff between the U.S. Securities and Exchange Commission (SEC) and fund managers (such as Blackrock, Vanguard, etc.). It also represents a victory for the cryptocurrency industry. The SEC cited last year's court ruling that rejecting spot ETFs while approving futures ETFs was inconsistent, clarifying this approval does not constitute an endorsement of cryptocurrencies due to their inherent risks. The approval has drawn mixed reactions; although the broader crypto market experienced a rally, Bitcoin underperformed relative to Ethereum. This mirrors commodity price action during the initial launch of gold ETFs. Despite this groundbreaking approval, questions remain regarding ETFs for other cryptocurrencies. Analyzing what this approval means for Bitcoin inflows and its potential role in investment portfolios is critical. This approval opens the door to a massive potential market.

Trading Volume Surges After Approval

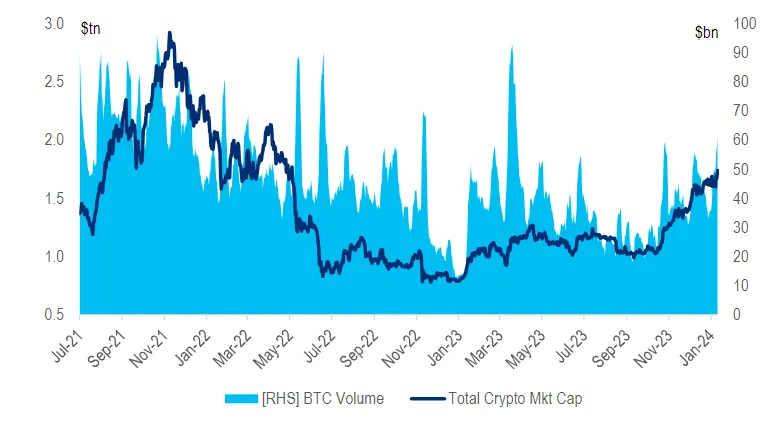

The SEC’s approval led to the launch of 11 spot Bitcoin ETFs, with trading commencing immediately. Over $2 billion changed hands on the first day alone. Anticipation of the decision drove increased trading volumes in both Bitcoin futures and spot markets, along with a surge in inflows into exchange-traded products. This highlights strong market appetite—despite Bitcoin underperforming, the broader crypto market rose significantly. The market eagerly anticipates ETF approvals for other cryptocurrencies.

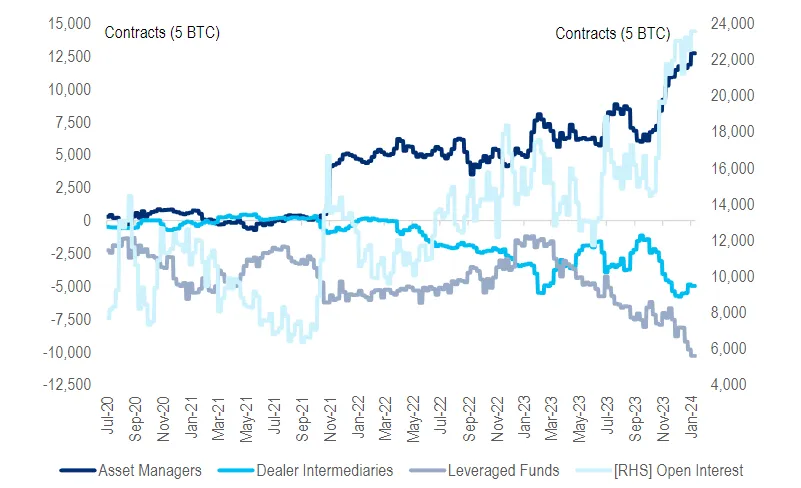

Crypto Allocation: Asset Managers Rapidly Buy BTC for Portfolios

Following approval, Bitcoin may gain greater prominence within investment portfolios. However, widespread inclusion remains a distant reality. The ETF approval facilitates Bitcoin adoption by large financial institutions. Yet, for this emerging technology to fully mature, broader applications are needed. There is strong anticipation around launching centralized investment vehicles for decentralized assets. As the crypto market continues evolving, it may remain a cyclical asset largely influenced by risk sentiment.

Despite SEC approval, widespread portfolio inclusion of Bitcoin will take time. While the approval expands Bitcoin’s potential market, a massive rush into this asset class is unlikely. Financial advisors need to conduct extensive due diligence on both the ETF instruments and cryptocurrencies as an asset class. Bitcoin’s cyclicality, and its tendency to benefit from high equity valuations and a weak dollar (low interest rates), also undermines the “digital gold” narrative. Bitcoin adoption, usage, and integration with traditional financial services will continue to be focal points. In our view, the most practical aspect of this industry lies in the fundamental use cases of blockchain technology.

Outlook for 2024: Bullish on ETH

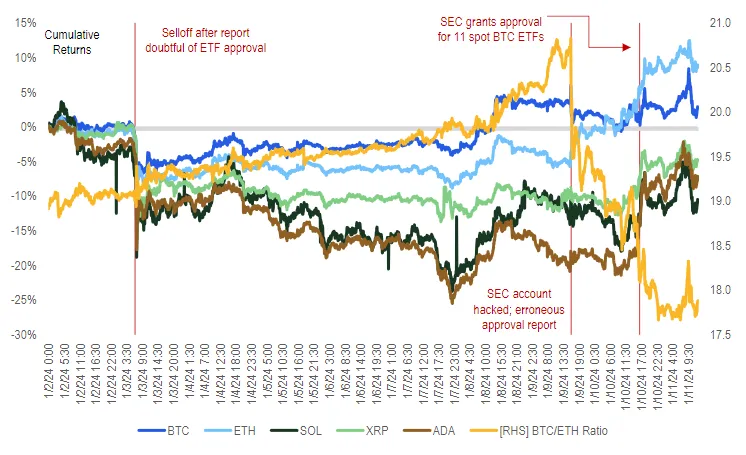

Similar to the initial launch of gold ETFs, BTC underperformed ETH despite strong overall crypto market performance. In the first week of the new year, a research report was published outlining reasons why the SEC was unlikely to approve spot ETFs, after which cryptocurrencies sold off sharply (see Figure 6). A "classic" crypto event sequence unfolded when the next market-moving news came from the SEC’s account on X (formerly Twitter), announcing that spot ETFs had been approved.

However, SEC personnel quickly stepped in to refute the claim, stating the commission’s account had been hacked. But within less than 24 hours, they re-emerged confirming the hacker’s post was accurate. Within days of the initial “erroneous” post, while Bitcoin continued to lag behind Ethereum, the broader crypto market began to rebound.

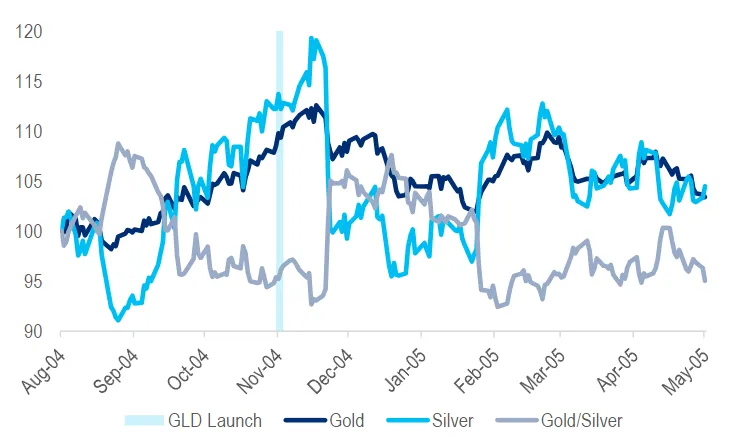

This price action resembles the behavior of precious metals during the debut of gold ETFs in 2004—though the latter played out over a longer timeframe—we have made comparisons here. In our view, the crypto market has already shifted toward the next narrative: ETH outperforming BTC, likely driven by expectations that the second-largest cryptocurrency might also receive ETF approval. Therefore, we will closely monitor ETH inflows, the performance of major altcoins relative to BTC, and delve deeper into new ETF inflows and liquidity dynamics in our biweekly reports once the dust settles.

Macroeconomic Outlook for 2024: Tailwinds for Bitcoin

Tech Stock Profit-Taking: Gold Gets Off to a Strong Start

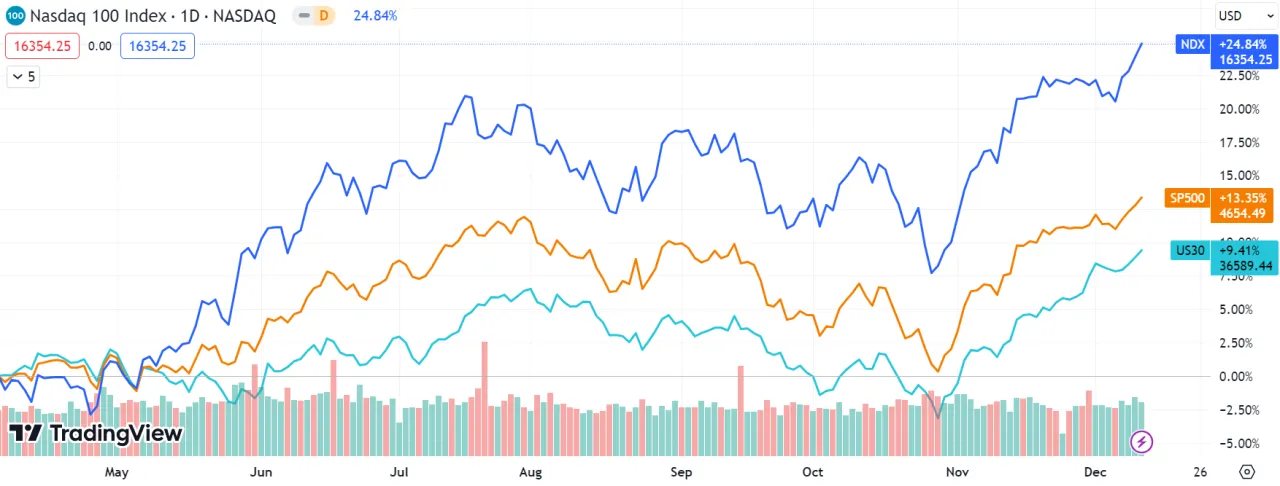

At the beginning of the year, tech stock investors began realizing profits, having delayed selling until 2024 to defer capital gains taxes incurred in 2023. This trend is evident in portfolio transactions handled by our team.

Stronger Economic Data: Neutral on Fed Rate Hikes

Last week saw a flood of data painting a positive picture for markets. The economy is advancing at a steady “Goldilocks” pace—neither strong enough to warrant Federal Reserve (Fed) tightening nor weak enough to trigger earnings slowdowns. Encouraging signs of growth emerged from robust jobless claims and favorable labor market reports. Although slightly offset by a small decline in average workweek hours—which implies reduced total hours worked—the overall impact remains constructive.

Market Reaction and Inflation

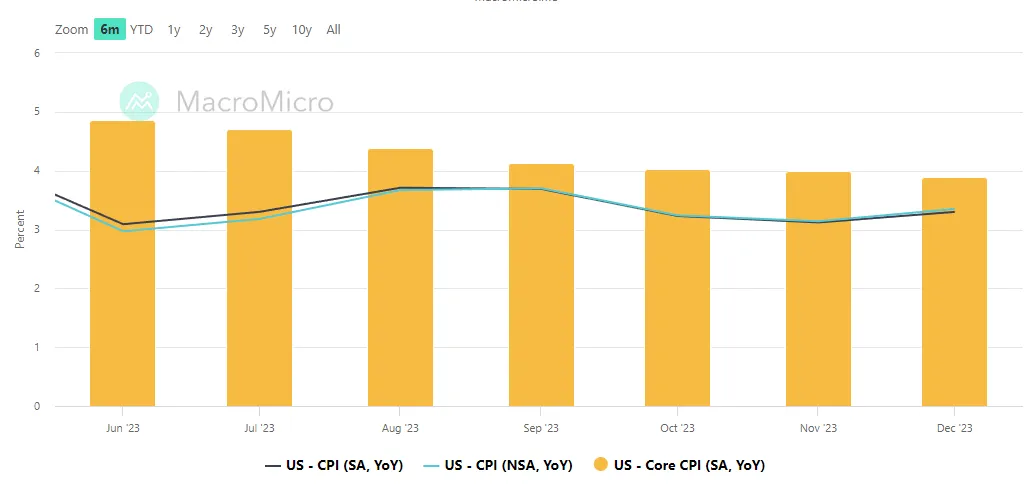

Markets initially reacted to slightly higher-than-expected average hourly wage growth with a sell-off in bonds. Wage increases are often mistakenly interpreted as inflationary signals. In reality, the gap between wages and inflation reflects productivity gains, which remain strong. Potential inflationary pressures could stem from Middle East conflicts affecting cargo ships passing through the Red Sea. Despite these concerns, impacts outside the oil sector are minimal, with other commodities remaining stable or declining. Last week’s Consumer Price Index (CPI) and Producer Price Index (PPI) reports showed inflation broadly in line with expectations—we are seeing signs of cooling.

Rate Cuts and Sustained Growth

The focus now turns to the Federal Reserve’s stance on rate cuts. The December FOMC meeting highlighted Chairman Powell’s flexibility in cutting rates if economic weakness emerges. If real economic growth remains strong, the Fed may hold rates steady, supporting a robust equity market. Given Powell’s flexibility, the likelihood of recession is low, while sustained growth or a soft landing appears more probable.

Market Outlook and Bitcoin Advantage

For 2024, we expect the S&P 500 to grow 8–10%, with small-cap stocks projected to appreciate around 15%. Beyond 2024, the long-term bond market outlook suggests the federal funds rate will stabilize at 3%–3.5%, accompanied by a positive term premium of 50–75 basis points.

Combining current market trends with Bitcoin’s potential advantages, this cryptocurrency could see significant appreciation. Economic growth may boost Bitcoin’s usage and value as more businesses and individuals adopt it for transactions. Beyond being a standalone asset, Bitcoin’s potential as an alternative to traditional fiat currencies could greatly benefit from sustained economic expansion. As education and awareness about Bitcoin increase, so too does its potential for meaningful contribution to economic growth. With growing acceptance and usage, the value of this digital currency will rise further, leading to wider adoption and deeper integration into mainstream financial markets. Thus, a scenario combining strong economic growth with increased Bitcoin usage creates a favorable environment for enhancing Bitcoin’s value.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News