A (3,3) for the New Cycle? The "Ponzi Expectation" Behind TIA Airdrop Model via Staking

TechFlow Selected TechFlow Selected

A (3,3) for the New Cycle? The "Ponzi Expectation" Behind TIA Airdrop Model via Staking

The price of TIA doesn't matter because airdrops can make up for it.

Author: @TaikiMaeda2

Translation: Luccy, BlockBeats

Editor's Note:

The restaking of TIA and DYM’s airdrop are undoubtedly among the hottest topics in this bull market cycle, drawing attention to various projects within the restaking sector. Missing out on DYM has left many investors FOMOing and actively searching for potential airdrops through restaking opportunities. In response, Taiki Maeda (@TaikiMaeda2), founder and CEO of cryptocurrency research firm HFAresearch, shared his thoughts on TIA in a lengthy social media thread.

@TaikiMaeda2 argues that the narrative around TIA’s restaking and bearish expectations mirrors that of OHM. Due to strong airdrop expectations causing buyers to become increasingly price-insensitive, TIA may eventually fall into a (3,3) scenario. He points out that one day, staking TIA will become meaningless—but he also believes we haven’t reached that point yet. BlockBeats translates the full article below:

Why TIA Will Be the (3,3) of This Cycle?

This will be a long thread, but I hope it serves as an interesting read for those studying Ponzi economics in crypto, human greed, and the laws of market bubbles. So let’s get started.

This piece is divided into four parts:

-

What is Celestia?

-

What is the narrative surrounding TIA?

-

How is TIA similar to (3,3)?

-

What am I doing to prepare for this?

Before you get mad at me, let me clarify: I’m not saying Celestia is a Ponzi scheme. In fact, I believe it’s one of the most significant technological advancements we’ve seen in a long time.

TLDR: Celestia makes it easier—and cheaper—for new projects to deploy new rollups and blockchains.

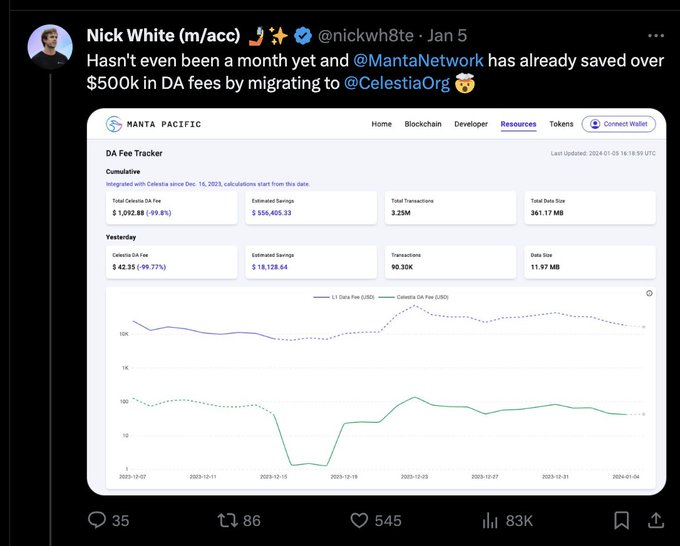

For example, @MantaNetwork saved over 99% in fees by using Celestia for data availability (DA) instead of Ethereum. These massive cost savings translate into real benefits for users.

Here’s another resource to help you better understand it. Since I don’t want this article to get too long, I’ll move on to discuss the narrative behind the TIA token and what has driven its insane price surge since the TGE in November.

I believe TIA offers the purest way to understand the airdrop story of 2024–25. We already know about two airdrops received by TIA stakers (@Sagaxyz__ and @dymension), with more confirmed, such as @MantaNetwork.

Celestia makes launching new rollups easier. Some of these rollups will airdrop to TIA stakers, and L1/L2 tokens carry a premium in the market.

Thus, a narrative begins to form: “The price of TIA doesn’t matter because the airdrops will make up for it.”

For instance, my DYM airdrop already covered my cost basis for TIA purchased at $4 on @aevoxyz. So if I chose to sell off my airdropped tokens, this position would have paid for itself. But I don’t plan to do so—though that’s a separate discussion.

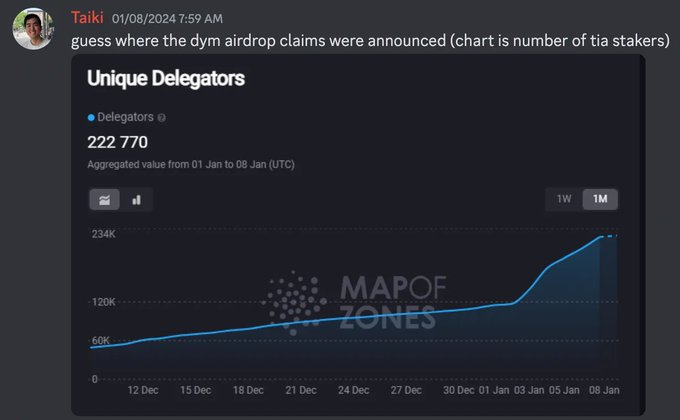

You can see how this could become a reflexive loop. As more airdrops occur, we should expect increased demand to buy and stake TIA for future airdrops. We’ve already seen growth in the number of delegators, closely correlated with TIA’s price.

Staking TIA also aligns with my view on trading returns from highly anticipated alt-L1s. Instead of trying to pick winning L1/L2 tokens in the upcoming cycle, why not simply stake TIA and passively collect airdrops?

For most people, this is a psychologically more comfortable narrative.

I’ve also observed some similarities with views on Solana and Cosmos. Throughout the bear market, many teams have been building and raising large amounts of funding from VCs. Some of these teams will likely airdrop to stakers of ATOM, OSMO, and TIA, further reinforcing this narrative.

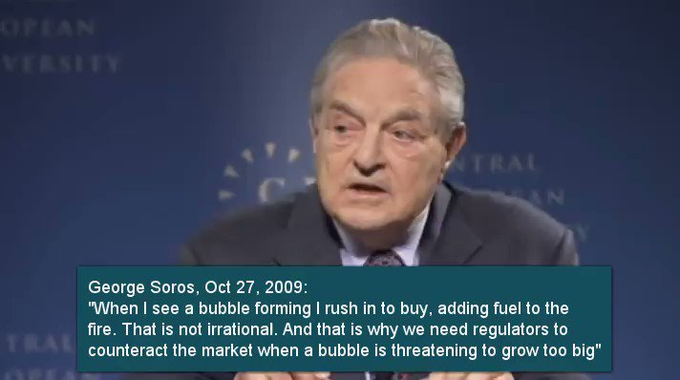

But what makes it the (3,3) of this cycle? Here’s how it unfolds:

A major airdrop hits the market (e.g., DYM) → Market expects more airdrops → People dream about the scale of these airdrops → Buyers become increasingly insensitive to price due to airdrop expectations.

We can simplify TIA’s market pricing into this general function: TIA valuation = Future value of DA layer + meme + narrative + expected future airdrops to TIA stakers. But honestly, no one knows how to properly value this.

So naturally, our brains default to the airdrop narrative. If we can stake $1,000 and receive over $1,000 in airdrops, who cares about TIA’s valuation, right?

Does this sound familiar?

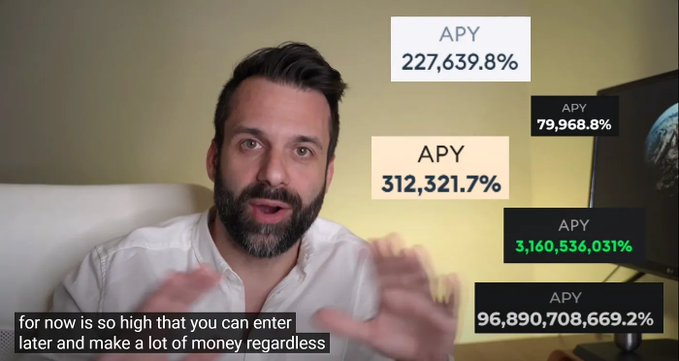

“OHM’s price could drop 99%, but you’ll be fine because the APY will make up for it.”

“TIA’s price doesn’t matter because the airdrops will cover it.”

These are two completely different projects, but the narratives share striking similarities. It bears the hallmarks of a future bubble.

Moreover, other industries love airdrops too—why wouldn’t they?

After all, the promise of turning $100 into $100,000 sounds incredible. Look at these thumbnails and view counts! People crave these videos, which in turn incentivizes YouTubers and TikTokers to keep making them.

“But Taiki, you’re making these videos too!”

Yes, but Celestia only launched two months ago, and we’ve had just two airdrop snapshots so far. I expect many more between 2024 and 2025. There will come a day when staking TIA becomes meaningless—but I don’t think we’re there yet.

A profit-driven person recognizes this and chooses to participate while still “early enough.” That’s not unreasonable. I believe TIA is one of the most important innovations of this cycle, but that doesn’t mean it’s immune to bubbles.

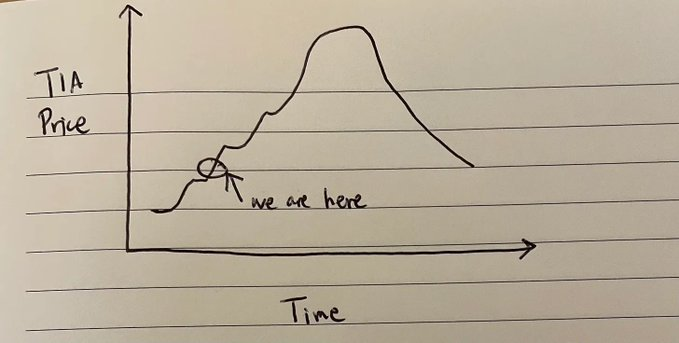

I’m writing this also as a reminder to myself to take humble profits in the future, even when the narrative feels unbreakable. Below is my view on where TIA’s price might go in the next cycle (I drew this in 30 seconds):

I believe TIA will be an amazing asset during the bull market, but an extremely painful one during the bear market. Once people realize valuations are unjustifiable and airdrops are diluted, they’ll start exiting positions. The 21-day unbonding period will make this reality even harsher.

So, what’s the plan?

I’m staking TIA, holding some airdrops, and selling others. When will I sell TIA? Honestly, I don’t know. My current plan is to begin unwinding my TIA position once Coinbase ranks #1 in the Apple App Store, or when major companies start hitting ATHs.

This article was written on January 13, 2024. If you’re reading it in the future, my views may have changed. I might also be wildly wrong—but that’s the risk of putting your thoughts on the internet.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News