2023 Public Blockchain Development Report: Regulatory Standards Improve, Layer2 Flourishes

TechFlow Selected TechFlow Selected

2023 Public Blockchain Development Report: Regulatory Standards Improve, Layer2 Flourishes

In 2023, the public blockchain sector demonstrated strong resilience and continuous innovation.

Written by: stella@footprint.network

In 2023, the public blockchain sector demonstrated strong resilience and continuous innovation. This year, Bitcoin's strong comeback, Ethereum’s steady growth, and Solana’s remarkable rise collectively painted a vivid picture of market recovery. Against this backdrop, the market capitalization of public blockchain cryptocurrencies reached $1.3 trillion, revealing intense competition among leading blockchains and highlighting the vast potential of Layer 2 solutions.

Public Blockchain Overview

Key Metrics Overview

This year marked the initial recovery of the cryptocurrency market following the "crypto winter." Led by Bitcoin, prices and market cap surged over 150%. Ethereum followed closely with an 80% increase. After its downturn in 2022, Solana also achieved a significant rebound.

As critical infrastructure for cryptocurrencies, public blockchains have profound implications for the entire industry. According to data from Footprint Analytics, the total market cap of public blockchain cryptocurrencies reached $1.3 trillion in 2023. Bitcoin accounted for 62.2%, Ethereum for 20.6%, while BNB Chain and Solana held 3.6% and 3.3%, respectively. Notably, Solana, Avalanche, ICP, Bitcoin, and Cardano all saw market cap growth exceeding 100% this year, demonstrating robust momentum.

Data source: Chain Overview

In terms of Total Value Locked (TVL), Ethereum maintained its lead with $55 billion in TVL, capturing 72.4% of the $76 billion market. Tron ranked second with $7.6 billion, followed by BNB Chain and Solana at $3.4 billion and $2.1 billion, respectively. Compared to 2022, Solana, Bitcoin Arbitrum, and Tron saw TVL growth exceeding 80%, whereas Polygon and BNB Chain experienced declines of more than 20%.

Data source: Chain Overview

Layer 2 Overview

Among Ethereum’s Layer 2 solutions, Arbitrum led the market with a 50.8% share and $8.5 billion in TVL. Optimism followed with 32.1% market share and $5.4 billion in TVL. Notably, the newcomer Blast achieved $1.1 billion in TVL within just 40 days, capturing 6.7% market share. Other well-known projects such as Base and zkSync Era held 3.7% and 3.4% shares, respectively. In this diverse ecosystem, the gap between smaller players and traditional giants continues to narrow—much like a vibrant coral reef: diverse, competitive, and ever-evolving. (Here, “TVL” refers to the cumulative amount deposited and locked in Layer 2 smart contracts.)

In Layer 2 development, user-centric strategies began to surpass purely technology-driven approaches. Once-leading platforms like zkSync Era, Starknet, and Polygon zkEVM fell behind in both TVL and growth pace during 2023.

Data source: Layer 2 Overview

Funding

Funding activity remained cyclical—In 2023, public blockchain projects raised $539 million across 70 funding rounds, representing an 85.5% annual decline from the 2022 peak of $3.7 billion. However, amid wavering confidence, investors continued to show strong interest in Layer 2 infrastructure. Layer 2 projects accounted for 41.4% of funding rounds in 2023, up from 34.5% in 2022. The average funding size for Layer 2 projects in 2023 was 15% higher than that of Layer 1s. These figures suggest that even during a crypto winter, investors are increasingly prioritizing skilled builders and technological innovation over short-term hype and speculation.

Top 10 funded projects by amount raised (Data source: crypto-fundraising.info)

Blockchain Gaming and NFTs

Blockchain Gaming

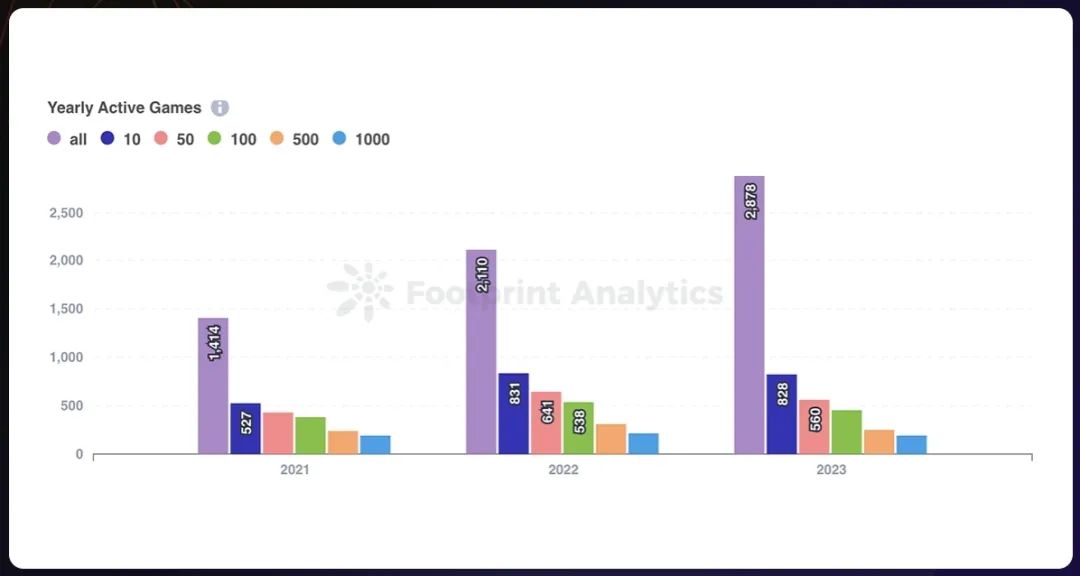

In 2023, the blockchain gaming market continued expanding, growing from 2,110 to 2,878 games. However, only 6.4% of games had monthly active users (wallets) exceeding 1,000—a decline from 10% in 2022. Among active games, dominant blockchains such as BNB Chain, Polygon, and Ethereum captured over 80% of the market, exerting significant influence.

Data source: Yearly Active Games - Blockchain Game Annual Report

Moreover, Layer 2 solutions made notable progress in blockchain gaming. For instance, SUI achieved throughput breakthroughs, reaching 20 million daily transactions with SUI 8192. Base integrated social and entertainment elements through friend.tech, attracting market attention. Ronin Network also experienced rapid growth in November, driven by integration with games Axie Infinity and Pixels.

NFTs

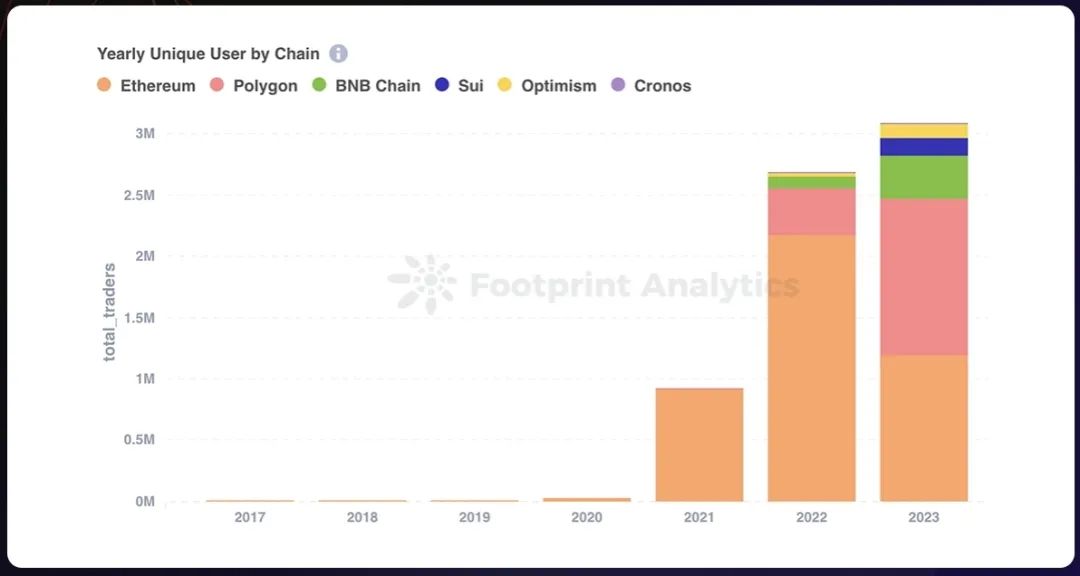

In the NFT space, despite a transaction volume of $13.1 billion, the market declined from previous highs. Ethereum still dominated with a 97.8% market share, though slightly down, indicating increasing diversification. Polygon’s user base grew by 231.0% to 1.3 million, while Ethereum’s user count dropped by 45.2%. Meanwhile, BNB Chain saw user growth of 280.7%, reaching 353,000 users. Significant shifts occurred this year due to increased Ordinals trading on Bitcoin and rising NFT volumes on Solana.

Data source: Yearly Unique User by Chain - NFT Research

Highlights of 2023

As the cryptocurrency industry matures, 2023 brought both challenges and new opportunities. Speculation across sectors is shifting, while real-world adoption accelerates. As markets enter a pragmatist cycle led by skeptics, several key trends defined the year.

Regulatory normalization after industry shocks

The collapse of FTX and its $8 billion financial shortfall sent ripples across the globe in early 2023, prompting policymakers worldwide to enhance coordination and close regulatory gaps. Following this, Binance paid $4.3 billion to settle U.S. regulatory investigations into its anti-money laundering procedures. After years of crypto booms turning to busts, consecutive shocks triggered responses aimed at balancing greater protection without stifling innovation. With clearer and improved regulation, barriers are being lowered, enabling mainstream users to access more user-friendly Web3 experiences.

Layer 2 moves to the forefront

In 2023, Layer 2 solutions rose to prominence, with chains like Base, Linea, and Blast gaining popularity. Rollups, particularly zero-knowledge (ZK) rollup technologies, gained widespread recognition by reducing user costs. However, despite heightened attention, Layer 2 still faces challenges. Scalability remains more slogan than reality, as most chains fail to achieve their advertised throughput. Seamless interoperability between Layer 2 networks remains an ideal rather than the norm. Additionally, many hyped Layer 2 projects lack breakthrough dApps or vibrant, diverse ecosystems.

Mass adoption accelerates across sectors

Cryptocurrency and blockchain technology are seeing broader real-world applications across finance, media, gaming, and other fields. In finance, Visa expanded support for stablecoins in September 2023 by integrating Solana blockchain capabilities for transaction settlements. Previously, Visa had already integrated USDC, offering easier ways to use cryptocurrencies. In gaming, player-focused platforms delivering Web3 experiences—such as virtual worlds and true asset ownership—are bringing new users into Web3. However, despite promising technology, consumer skepticism toward crashing token prices persists due to poor market conditions, resulting in slower-than-expected mass adoption.

Bitcoin discovers a new narrative

In 2023, Bitcoin’s narrative evolved beyond its traditional role as digital gold. The emergence of unique digital collectibles called Ordinals on the Bitcoin blockchain reshaped discussions about Bitcoin’s utility. This innovation established Bitcoin as a foundational layer for emerging applications, boosting its relevance in volatile markets. Driven by Ordinals transactions, December saw record-breaking transaction volumes, signaling an expansion of Bitcoin’s market scope. This trend positions Bitcoin not merely as a store of value but as a versatile asset with an ever-widening range of applications.

Outlook for 2024

In 2024, Bitcoin will be central to the crypto narrative, especially with the upcoming halving event. Additionally, other key themes such as Ethereum’s Dencun upgrade, decentralization efforts, and advancements in artificial intelligence (AI) will attract significant attention.

Layer 2 will continue to thrive

In 2024, Ethereum and its Layer 2 tokens are expected to surge, driven by reduced fees and renewed focus on scalability following the implementation of EIP-4844. Key topics include decentralization of Sequencers, debates over modular versus monolithic architectures, and interoperability. This growth won’t be limited to Ethereum; Layer 2 solutions on Bitcoin and BNB Chain are also expected to experience a surge, reflecting market interest in comprehensive scaling strategies.

Gaming-focused blockchains will further develop

In 2024, gaming NFTs are expected to surpass art and collectible NFTs in popularity. The crypto gaming industry is poised to mature, intermittently capturing mainstream interest while primarily solidifying its position among dedicated gamers. Supported by advances in AI-generated content, Web3 gaming will make positive strides. Continued improvements in gaming blockchain platforms like ImmutableX, Ronin Network, and Oasys—dedicated to enhancing the blockchain gaming experience—will further fuel this growth.

Integration of AI and blockchain

In 2024, the convergence of artificial intelligence and blockchain will emerge as a highly disruptive field. Although core infrastructure around computing power and reliable data needs further maturation for large-scale deployment, the growing incentives to trade AI resources via crypto tokens are expected to drive strong growth. Regulatory hurdles and product-market fit issues in this domain are temporary rather than fundamental barriers. With substantial speculation and investment, the foundation for blockchain-based AI is now solid, paving the way for increasingly sophisticated blockchain-AI applications.

Conclusion

This year, despite potentially moderate price fluctuations, the public blockchain sector has made significant progress in practical applications. Strengthened infrastructure is paving the way for broader adoption, while novel use cases in gaming, NFTs, AI, and other domains signal an impending wave of industry disruption. These transformations lay the groundwork for technological advancement and evolving market dynamics across various blockchain platforms.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News