Concept Explained: A Revolution Around Inscriptions

TechFlow Selected TechFlow Selected

Concept Explained: A Revolution Around Inscriptions

A new concept centered around Bitcoin—known as inscriptions—has also frequently appeared before investors worldwide.

Author: BlockSec

On January 10, SEC officially approved 11 spot Bitcoin ETFs in US Eastern Time! This historic moment is destined to be recorded in the annals of the crypto industry. Meanwhile, a brand-new concept centered around Bitcoin—inscriptions—has frequently come into the spotlight for global investors.

Wrapped in numerous tales of instant wealth and drawing continuous capital inflows, inscriptions—a concept touted as revolutionary for the Bitcoin ecosystem—have become increasingly hot. Recently, as Bitcoin’s market cap heats up, the popularity of inscriptions has reached boiling point.

Yet, most people remain confused, seeing only skyrocketing prices while remaining largely clueless about what inscriptions truly are. They see price surges but often overlook the underlying technical significance. This half-understood state undoubtedly increases investment uncertainty. So, what exactly are inscriptions? And how do they work? Don't worry—this article will take you approximately 10 minutes to read and provide a comprehensive explanation of inscriptions.

Origin—Bitcoin Inscriptions

In January 2023, Casey Rodarmor introduced the Ordinals protocol, marking the birth of Bitcoin inscriptions. The Ordinals protocol allows users to directly inscribe text, images, videos, and even smart contracts onto the Bitcoin blockchain.

At first glance, isn’t this just NFTs on Bitcoin? But didn’t Bitcoin Layer 2 networks like Stacks already fulfill this need? Wait! Note that Ordinals writes data directly onto the Bitcoin mainnet, not on a Layer 2 network. This change directly impacts Bitcoin—the massive financial entity—and the scale of funds affected is incomparable to that of Layer 2 solutions.

🤔️ But how does this protocol work? After all, Bitcoin lacks a full smart contract execution environment (like EVM). How can new protocols be supported on Bitcoin?

To understand this, we must revisit the design principles of the BTC network and its successive protocol upgrades. In Satoshi Nakamoto’s original design, Bitcoin has a smallest indivisible unit—the satoshi (1/100,000,000 of a bitcoin)—and each satoshi is uniquely numbered (serial number) upon being mined via PoW, inherently distinguishing one from another. This unique identifier allows tracking each satoshi back to its miner and owner. The 2021 Taproot upgrade further enabled embedding complex data into transaction notes and increased block storage capacity from 1MB to 4MB, unlocking technical potential for richer data on-chain.

The core idea behind the Ordinals protocol is extending the serial number metadata of individual satoshis. Specifically, Ordinals leverages the uniqueness of each satoshi by expanding its serial number to embed additional data such as text, images, videos, or code. This turns every satoshi into a carrier of unique information, securely stored on the Bitcoin blockchain with immutability guaranteed.

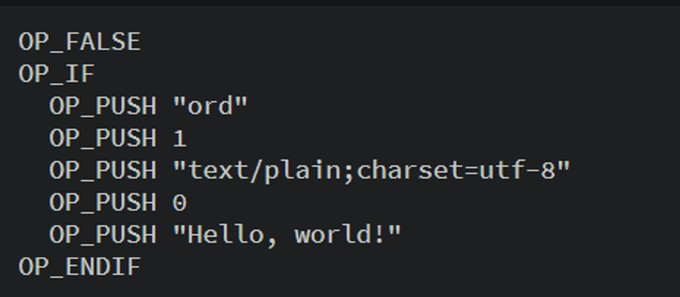

For example, suppose we take a UTXO and want to inscribe the message "hello, world!" on it. We would record the Ordinals-related data within the Taproot note field and then inscribe this data onto the first inscription of the UTXO during the transaction, thereby recording the inscription content on-chain. (Of course, this content needs to be serialized before deployment.)

If the transaction fails or lacks proper annotation, the message won’t be recognized as valid inscription data.

💡 In the early days of the Ordinals protocol, users primarily used it as an NFT carrier. However, with the introduction of the BRC-20 protocol on March 8, 2023, a fungible token standard similar to ERC-20 was built atop Ordinals, laying the foundation for a vibrant inscription market.

Let’s use a simple example from ordiscan to illustrate how BRC-20 token transactions work:

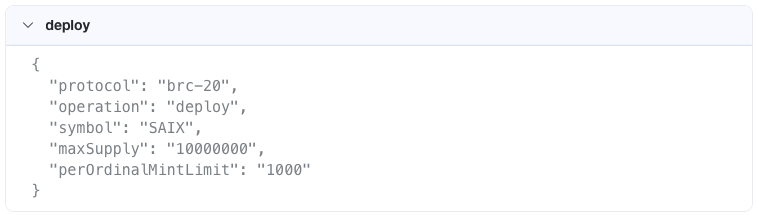

First, a project team must deploy (deploy) a series of inscription assets so others can mint tokens from this series. To do this, the team uses the Ordinals protocol to write executable code (called a "scription") conforming to BRC-20 rules onto a single satoshi, then sends this inscribed satoshi to the blockchain.

Specifically, the project deploys a token named SAIX using the BRC-20 protocol, setting maxSupply to 10,000,000. This data is what gets inscribed onto the satoshi.

Once sent to the chain, the inscribed satoshi is recorded on the Bitcoin blockchain. Off-chain servers monitoring the Ordinals protocol detect this compliant code and execute it in an off-chain virtual machine. As a result, a BRC-20 token named SAIX is deployed off-chain with all attributes configured. From this point onward, other users can begin minting their own inscription assets.

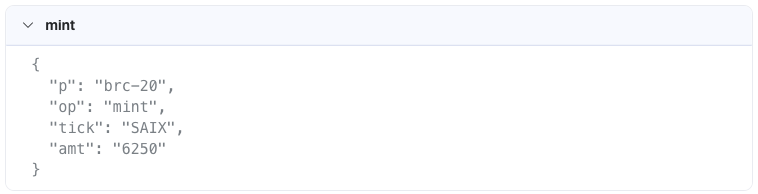

Next, users who wish to mint inscription assets can invoke the BRC-20 protocol to create their tokens. For instance, a user calls the mint function and mints 6,250 SAIX tokens. The ownership of these inscribed tokens goes to the recipient address after deducting gas fees—for example, bc1p4802...nqah89gr in the image.

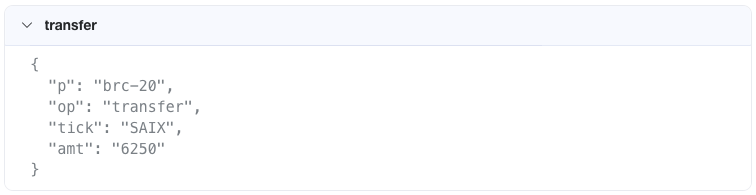

After successful minting, if a user wants to transfer their inscription assets, they can inscribe a BRC-20 transfer action onto a satoshi, sending 6,250 SAIX tokens. Naturally, the recipient of this Bitcoin transaction now owns those BRC-20 tokens.

Thus, we can summarize: Inscriptions in the Bitcoin ecosystem are virtual assets created via the Ordinals protocol and permanently recorded on the Bitcoin blockchain. Project teams inscribe data (images, web pages, token names) onto satoshis according to the protocol, and users perform financial operations like minting and transferring through special transaction codes. Compared to previous Layer 2 approaches, the significance of Bitcoin inscriptions lies in directly expanding the high-value Bitcoin mainnet, introducing diversified asset types, enhancing ecosystem flexibility, and unlocking new potential for Bitcoin.

Derivative Expansion—EVM Inscriptions

After Bitcoin inscriptions gained popularity, EVM chains also adopted the inscription concept. However, since EVM chains already support smart contracts, the functionality of storing diverse data is already well-established. Therefore, the narrative and utility of EVM inscriptions differ somewhat from Bitcoin inscriptions.

Due to Ethereum’s gas model, any successful smart contract interaction requires at least 21,000 gas, creating a heavy gas fee burden for users. EVM inscriptions bypass smart contracts by sending data payloads to externally owned accounts (EOAs), moving execution logic off-chain. When an off-chain inscription virtual machine detects a compliant data field on-chain, it executes the intended operation and links the result back to the original transaction hash, effectively saving on-chain execution costs.

Let’s consider an example using an ERC-20-style inscription protocol. A user sends 0 ETH to their own EOA, triggering the inscription monitoring mechanism. The calldata attached to this transaction contains instruction sets similar to BRC-20: p-protocol, op-operation, tick-token name, id-token ID, and amt-amount. Upon detecting this transaction, the off-chain EVM inscription server parses the calldata, mints the corresponding tokens to the sender’s EOA, and records the token state in an off-chain index.

Currently, EVM inscriptions mainly aim to reduce high transaction fees on EVM chains, making transactions significantly cheaper. While this may resemble Layer 2 solutions, Layer 2 expands scalability with full smart contract capabilities, whereas EVM inscriptions focus solely on cost reduction without supporting full on-chain execution. Thus, the primary role of EVM inscriptions today is reducing transaction costs on EVM chains.

Common Inscription Protocols

The Ordinals protocol forms the foundation of Bitcoin inscriptions, but several other popular Bitcoin inscription protocols have emerged alongside it.

Bitcoin-based - Notable Projects

-

BRC-20: Ordi, sats, rats

-

ARC-20: ATOM, Realm

-

Bitmap

-

Rune: Pipe

Ethereum-based - Notable Projects

-

Ethscription: eths, Facet

-

IERC-20: ethi

Current State of the Inscription Ecosystem

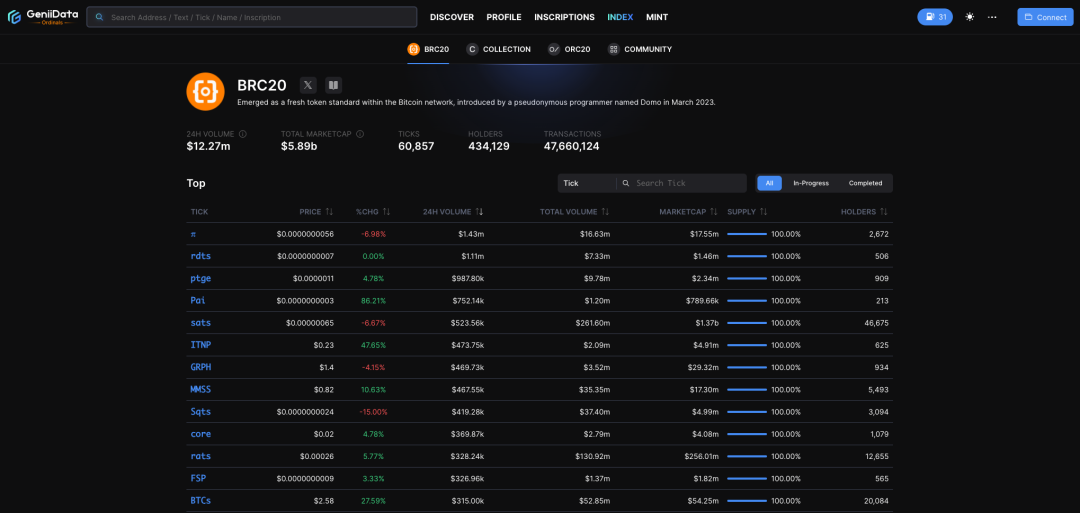

Regarding trading activity in the BRC-20 inscription ecosystem, on January 11, 2024, 24-hour volume approached $12.27M.

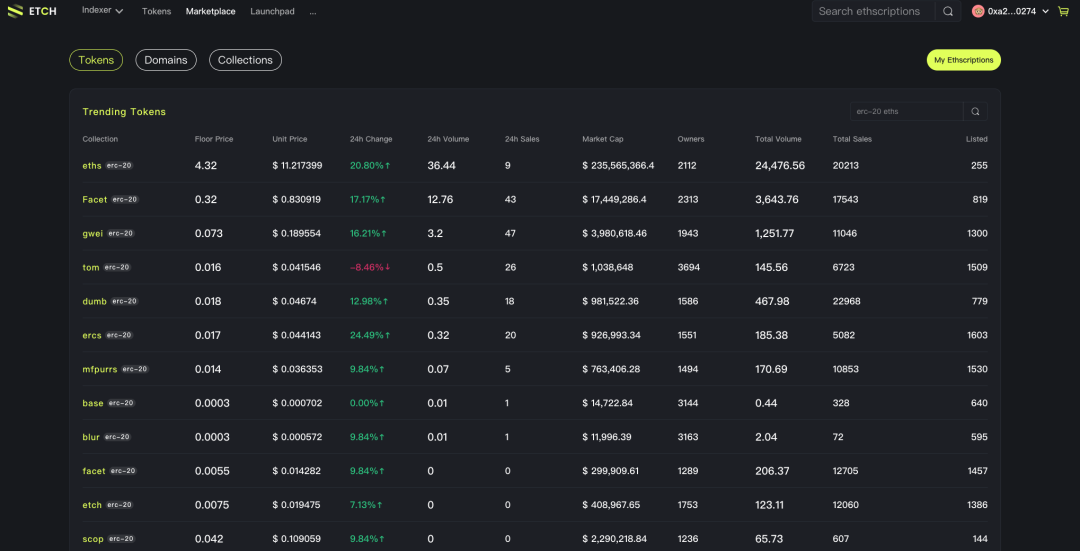

For Ethereum-based inscriptions, on January 11, 2024, 24-hour volume reached nearly 53.66 ETH (approximately 139,516 USD).

Overall, the inscription ecosystem remains dominated by Bitcoin-based projects, showing growing trading热度, large trading volumes, and significant capital inflows.

Conclusion

Through an in-depth exploration of inscription technology and its innovative role in the Bitcoin ecosystem, it becomes clear that this advancement is far more than a passing trend or minor technical update. It represents a major leap forward for the Bitcoin network in terms of security, scalability, and practical utility. The implementation of the Ordinals and BRC-20 protocols has opened up entirely new application scenarios for the Bitcoin blockchain. Nevertheless, users should remain cautious. The inscription asset market is still in its infancy, with values and trading rules continuously evolving. Therefore, understanding how these technologies work is crucial for anyone looking to invest or innovate in this space.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News