Leveraging the Seven Deadly Sins: How Should We Speculate on SocialFi?

TechFlow Selected TechFlow Selected

Leveraging the Seven Deadly Sins: How Should We Speculate on SocialFi?

As the flow of information changes, society is also transforming—media is the message.

Author: mattigags, luffistotle, long_solitude

Translation: TechFlow

This article delves into the history of human speculation, beginning with the ancient Greek philosopher Thales’ olive press speculation and spanning centuries to include diverse phenomena such as the Dutch East India Company’s stock issuance, the American Gold Rush, and Britain’s railway mania. It further examines how speculative behavior continues to evolve in the digital age and within the cryptocurrency space, particularly in the emerging field of SocialFi. Through an in-depth analysis of various innovative projects, this article reveals that speculation is not merely a pursuit of wealth but also a cultural and social phenomenon that profoundly shapes our understanding of wealth, success, and social interaction.

Background Introduction

Gordon Gekko’s infamous line “Greed is good” from the 1987 film *Wall Street* consistently provokes moral outrage. Not because it's false, but because people believe it to be true.

To understand greed (and financialization/speculation in our article), one must study the scaling of property. A passage by N.N. Taleb in *The Principle of Political Economy* best illustrates this:

Politics is not scale-free. One can be "a liberal at the federal level, a Republican at the state level, a Democrat at the county level, a socialist within communes, and a communist at the family and tribal level."

Individual greed and ambition can translate socially into desirable outcomes—capital investment, job creation, tax revenue, and welfare states. Conversely, the road to hell is paved with good intentions.

We are driven to the frontiers of invention by greedy, speculative, and self-interested individuals. Whether it’s cryptocurrency, space exploration, or cryonics, these endeavors are often dismissed as immature, speculative, and lacking practical utility.

History of Speculation

In 600 BC, the ancient Greek philosopher Thales of Miletus became the first recorded speculator in human history. Predicting favorable weather and a bountiful harvest, he secured access to all olive presses in Miletus and profited handsomely when demand surged the following season.

Since then, Thales’ form of speculation has manifested through various forms and desires. The first publicly traded company was the Dutch East India Company in the 17th century. Amsterdam locals then speculated on the effectiveness of colonial rule in East Asia. Similarly, in the 19th century, gold rushes emerged in the United States and railway manias in Britain.

Later, the 20th century saw oil drilling booms and cable TV network expansions. At the end of the century came the dot-com bubble. Throughout this period, we experienced numerous isolated frenzies and bubbles accompanying every significant technological or social advancement. To cryptocurrency’s credit, in each wave of speculation, crypto has set precedents for violating securities laws.

We emphasize that speculation is neither distasteful nor a fad that young people outgrow. While the objects change, the desire for wealth and a certain status remains constant, unaffected by age, culture, or broader trends. American speculators have long been a bellwether for the rest of the world, as Liaquat Ahamed noted:

When Charles Dickens visited America in 1842, he was struck by the local population’s speculative spirit. After the 1884 panic on the New York Stock Exchange, the London magazine *The Spectator* commented: "No matter how much the British speculate, they fear poverty. The French shoot themselves to avoid poverty. An American with a million dollars speculates to win ten million; if he loses, he calmly becomes a clerk. This freedom from squalor is commendable, but it makes the country the most degenerate gambler in the world."

Relevance of Speculative Signals in the Digital Realm

With the development of the internet, most physical assets have become digitized. The atomic world now has its counterparts in the bit world—physical goods have futures markets, brick-and-mortar stores run e-commerce, address books are replicated in the cloud, physical currency has digital representations, and so on.

We are introducing new forms of natively digital objects: blockchains and distributed consensus, ERC20 tokens, artificial intelligence, and VR. The Internet of Everything has accelerated the pace of everything. News spreads faster, beliefs form instantly (regardless of substance), capital flows quicker, transaction barriers vanish, resulting in the largest economic feast we’ve ever seen.

Because the internet lowers transaction barriers and anything can be amplified and go viral, internet-native objects are best suited for speculation. Everyone becomes a speculator because anyone can participate with just one dollar. We will never return to a hundred years ago when our grandfathers needed bank financing to dig holes in the ground to discover oil fields.

Ultimately, speculation is a filter (or sorting mechanism). Prices represent the wisdom of the crowd, extracting signals from vast information noise. As economist Friedrich A. Hayek wrote in his 1945 paper “The Use of Knowledge in Society”:

“The peculiar character of the problem of a rational economic order is determined precisely by the fact that the circumstances of which we must make use never exist in concentrated or integrated form but solely as the dispersed bits of incomplete and frequently contradictory knowledge which all the separate individuals possess… In a system where knowledge of the relevant facts is dispersed among many people, prices can act to coordinate the separate actions of different people in the same way that subjective values help the individual coordinate the parts of his plan.”

The information bottleneck method offers another path to the same conclusion. It emphasizes the need for “relevance” when using input X to successfully predict output Y. Input X is compressed (modified) into a “bottleneck,” which is then used to predict Y. Across every asset class and business context, prices have always acted as bottlenecks (signals), compressing all market participants and their individual decisions over time into a single data point.

The SocialFi Theory

The social theme of Web3 is shifting. Grand Web3 ideals like openness, composability, and ownership—ranging from decentralized social graphs to mundane features like selling your data to advertisers—are quickly being overtaken by the desire to speculate on SocialFi.

Rather than rebuilding “universal but decentralized” products or focusing on “owning your data,” SocialFi innovates with quirky new features. Instead of dictating what users should do, give them what they want. Instead of offering a poor man’s Twitter, offer a fast path to getting rich—or poor. Instead of selling ideals, immerse users in novel experiences?

A key question when evaluating new products is: does this enable new user roles? SocialFi can blur the lines between creators and fans, potentially creating many new roles in between. We hope SocialFi’s monetization capabilities will reverse the one-way flow of capital toward creators.

Contrary to popular opinion, we believe introducing asset pricing into social networks is a way to filter noise—or at least make spreading noise more costly.

With the rise of AI, the production of generic content will grow exponentially. SocialFi could serve as a filtering layer for social media, solving attribution issues.

Web2 social platforms already elevate the most successful content creators into the public eye. There’s a financial incentive: those followed by audiences earn money, thus doing the “right” thing and becoming a signal. SocialFi simply makes implicit factors (ad revenue, influencer income) explicit (price).

We join those calling friend.tech the Cryptokitties of SocialFi. This flashy, fleeting craze may spark innovation, having already inspired experimentation in this niche. Below is our personal investment thesis on this emerging SocialFi category.

SAX: Bet on Memes, Not Tokens

Anything that becomes an object of attention can also become an object of speculation. Memes are now the easiest things to capture attention—requiring minimal effort to launch and spread. Compared to other (tangible) asset classes, memes demand less cognitive load.

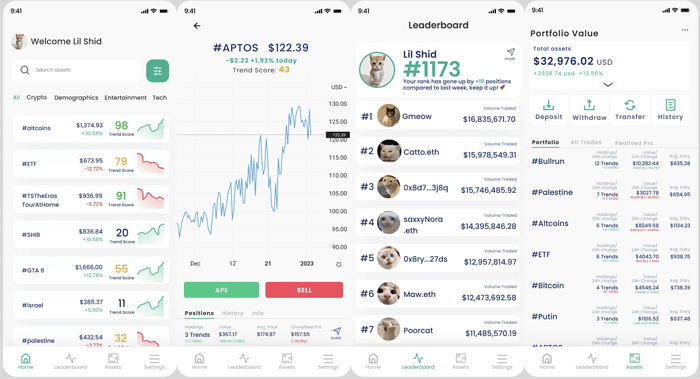

SAX is building a meta-casino that abstracts away tokens, allowing users to directly bet on memes. It defines a new user role: users cease to be token holders and become information speculators. Never before has the ability to shape public opinion been so directly converted into capital gains (or losses) on financial assets.

SAX uses a bonding curve to price memes, dynamically reshaping based on a given hashtag’s virality across social media. In other words, as a tag grows popular, its price rises—and vice versa. This bonding curve applies various coefficients to posts, likes, comments, and retweets.

While SAX initially covers only X (Twitter), its goal is to track meme propagation across every platform—including TikTok or WeChat, and protocols like Lens and Farcaster. We hope to see memes and their price discovery originate on-chain. SAX isn’t about decentralizing memes—it’s about accelerating blockchain adoption and capital formation in this new asset class.

The beauty of memes lies in their permissionless nature. We expect meme speculators to ignite trends on X and bet on their success via SAX. Likewise, manipulating memes in this context is a feature, not a bug—anyone who has traded meme coins can attest to that.

The bonding curve also eliminates capital requirements for launching a meme. Unlike ERC-20 tokens, a meme’s success isn’t limited by initial seed capital. Regardless of wealth, anyone can become a trendsetter.

Financial engineering in crypto has produced numerous zero-to-one innovations in DeFi and other verticals. Now, SAX leverages financial engineering to let ordinary people bet on cultural trends. Those who set or spot these trends will be directly rewarded—unlike past indirect methods like ads, sponsorships, or subscriptions.

AlphaClub: Derivatives Market for X Spaces

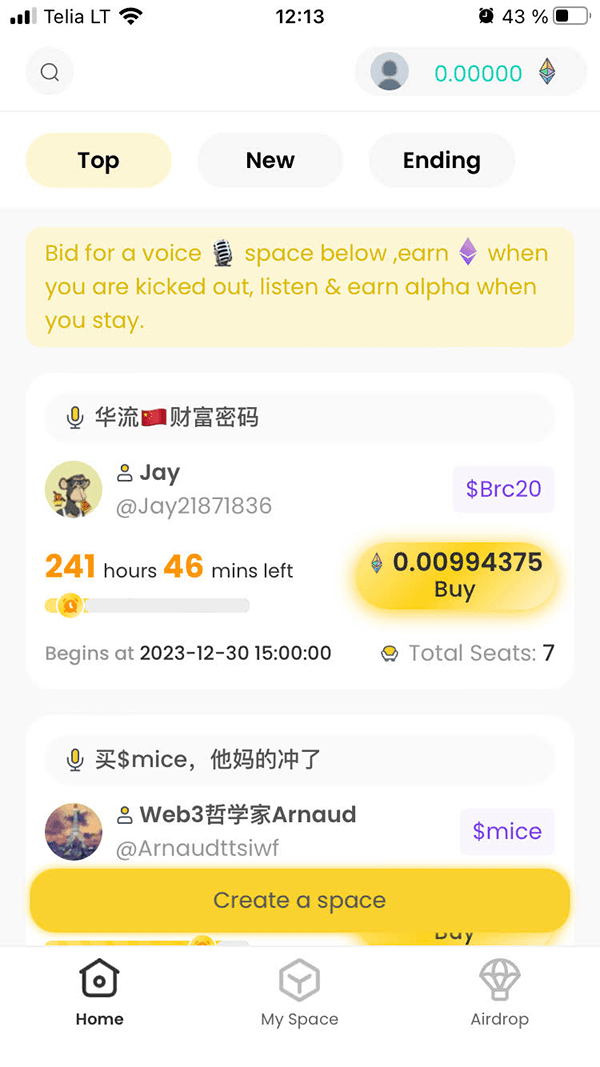

When speaking with founders, we sometimes discuss Clubhouse as a social product that failed due to weakening exclusivity and commoditized content. When access is based on status, expanding group size dilutes that status. The more people hear and know, the less alpha (advantageous information) there is.

AlphaClub is building a gamified, audio-based social platform where a bonding curve sets the price for entering voice rooms. Users bid competitively for speaker slots. With limited seats, new bidders can displace existing speakers to claim their spots. If an eighth person enters a full seven-person room, the first entrant gets kicked out—profiting early. Exclusivity is maintained through price.

The value of AlphaClub rooms lies in crypto alpha during bull markets—users pay to access rooms for investment insights. Similarly, those who early identify crypto narratives or anticipate specific speakers/influencers in a room are rewarded for being the first to bid their way in.

An open question for the AlphaClub model is balancing participant utility and status. While early entrants gain utility (financial capital) and status, latecomers ultimately provide exit liquidity and must receive incentives to return.

Like SAX, AlphaClub rewards those who spot trends early and allows them to monetize while remaining socially included. Unlike Twitter, AlphaClub participants always know they’re in the same boat—and this could be reinforced by letting room participants connect their wallets.

Polymarket: UGP (User-Generated Predictions)

“Prediction markets have been tried many times and always failed!”—We agree, much like pre-MySpace social media attempts. We intermittently abandoned the idea, thinking markets don’t need prediction markets. But since real-world events are spectacles and permissionless market deployment can now scale, why not try again?

Despite its niche audience, Polymarket has captured market share, and 2024 promises many events. This is the perfect moment to test the thesis: either prediction markets go mainstream this year, or fade back into obscurity. We believe betting before events unfold may prove more profitable than reacting afterward.

Some may argue prediction markets aren’t part of SocialFi, but we believe embedding them into larger trends could be a path to mainstream relevance. We loosely link prediction markets to the SocialFi trend for two reasons: first, they are financial; second, they lack social features needed for wider adoption.

Polymarket has already become a social product for viewing event odds and discussing them with friends. Although discussions happen outside Polymarket, the goal is clearly to convert these latent users into active participants through built-in social features (chat, forums, Q&A, etc.).

Polymarket’s web traffic exceeds most DeFi apps, without relying on token incentives or paid ads. Because Polymarket is unique, it doesn’t compete with commoditized businesses like casinos or sports betting.

Anyone can launch a market—Polymarket’s team no longer acts as the sole gatekeeper deciding what’s interesting enough to trade. This enables liquidity to impact specific events, much like Uniswap enabled liquidity for long-tail tokens.

If you believe price is the arbiter of truth, another social angle on Polymarket is sponsors launching prediction markets with a few thousand dollars to obtain high-signal, real-time forecasts.

Indeed, some Zee Prime team members have long used Polymarket, placing bets on the 2020 U.S. presidential election. Recently, we predicted Sam Altman would return as CEO during the OpenAI incident. Over the years, we’ve watched Polymarket continuously improve, growing into one of the most useful crypto-native products.

We’re betting on a team that’s existed for a considerable time (by crypto standards), well-positioned for expansion, and hasn’t prematurely optimized the LTV/CAC (lifetime value vs. customer acquisition cost) game. Building a prediction market engine is complex—comparable to building an exchange. In fact, it is an exchange, just in a different format.

Ryzz: Capital Formation for Creators, Skin in the Game for Fans

Can speculation unlock additional capital for creators and drive stronger fan engagement? That’s Ryzz’s proposition. As a platform, Ryzz offers typical streaming features but introduces speculation as a core function, allowing streamers to monetize their influence through keys, with prices reflecting the channel’s intrinsic value.

From the fan’s perspective, a financial “skin in the game” is a powerful motivator. Since purely financial participants enter the market solely for monetary gain, trading tools in this new asset class gives loyal fans a massive advantage in spotting unknown talent early. This skill set cannot be internalized by latecomers—it must be outsourced.

From the creator’s standpoint, early access to capital formation (in the form of creator keys, partially sold to fans) could accelerate growth, while liquidity from tokenized participation helps elevate content quality. In many ways, creators must view themselves as venture-backed founders, trading portions of their creative output for financial resources.

In principle, the market has already signaled its approval. MrBeast, the world’s biggest YouTuber, has consistently sold video royalties to fund future content, enabling him to rapidly produce videos unlike any others.

Although Ryzz’s founder capital formation (and broader speculation) is its flagship feature, it will also offer competitive streaming experiences compared to other platforms, including mini-games for earning via platform tokens, filters, and creator tools. This crypto-native approach will continue fueling a new era of content innovation.

Kizzy: DraftKings of Social Media

While we observe experimentation around speculating on memes, streaming, and dreams, another segment involves betting markets built atop existing social platforms—what we call the “DraftKings of social media.”

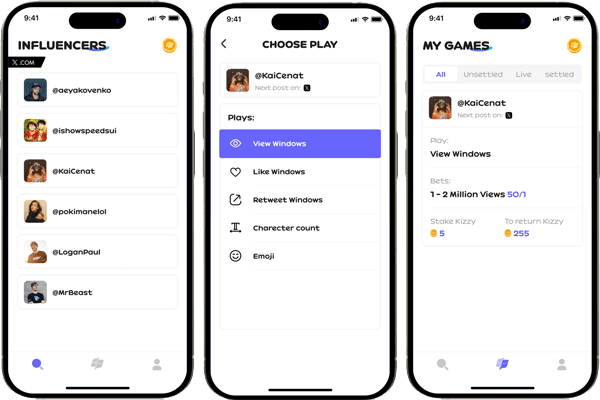

Kizzy is a Solana-based SocialFi project enabling bets on various social media metrics of popular influencers’ posts—views, likes, retweets, emoji usage, etc. Users are presented with odds similar to sports betting.

Although sports leagues face generational challenges and potential impacts on the $40+ billion sports betting industry, we believe the appetite for speculation will never disappear. All it needs is a different medium or context.

Returning to MrBeast, his average video views far exceed 100 million (matching the Super Bowl), while a typical NFL game draws about 16 million. There’s a clue here. Beyond what they’re already passionate about, what else will Gen Z speculate on? The digital Olympics are faster, subtler, and more entertaining.

Finally

Technology is foundational to social existence. Technology determines the frequency and magnitude of information flows. As information flows change, society transforms—media is the message.

Social media turned reality shows into real-life shows. Reality has become spectacle, and people want to participate—one way being through speculation. After all, speculation is a form of coordination.

Price is the arbiter of truth, the signal guiding us toward wealth and prosperity. Dissatisfaction with traditional social media won’t resolve itself. In fact, with the flood of AI-generated content, it’s become even noisier.

We don’t aim for normative judgments but wish to explore shifts in information flows and uncover possibilities unlocked by novel incentives. Let’s avoid orthodox thinking—about what crypto use cases must exist or what user profiles must look like.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News