Crypto Market Review 2023: Regulatory Pressure, Deeper Applications, and an Optimistic Outlook

TechFlow Selected TechFlow Selected

Crypto Market Review 2023: Regulatory Pressure, Deeper Applications, and an Optimistic Outlook

This article will summarize the key events and developments that occurred in the cryptocurrency space over the past 12 months.

Author: M6 Labs

As we close out 2023, let's take a moment to reflect on the dynamic and event-filled year in the cryptocurrency space. This article summarizes the key events and developments that shaped the crypto landscape over the past 12 months.

January: A Volatile Start

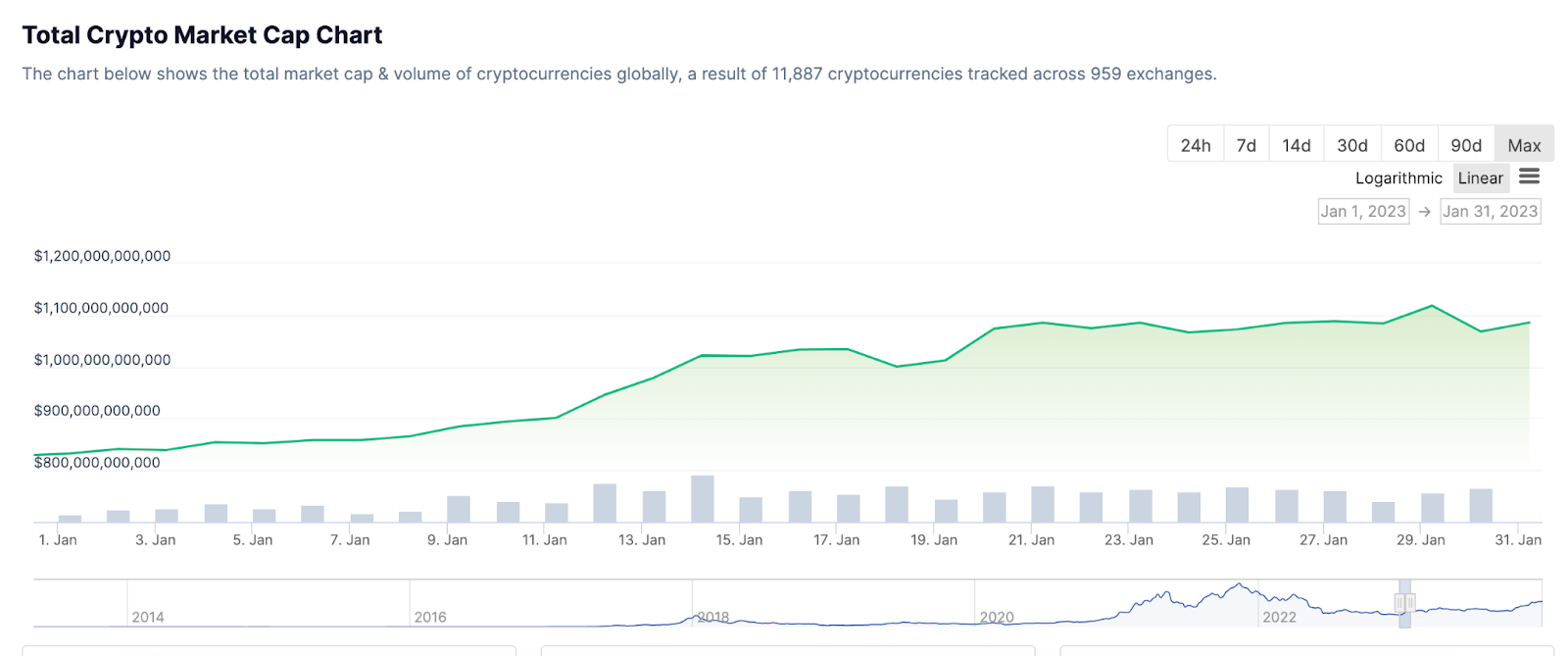

Bitcoin’s price dropped to its yearly low of $16,800 at the beginning of the year before recovering to around $23,800 by month-end. By mid-January, the total market capitalization of cryptocurrencies surpassed $1 trillion.

February: Kraken vs. SEC

Regulatory actions took center stage in February. The SEC intervened in Kraken’s staking operations, ultimately resulting in a $30 million fine—a significant milestone. The SEC claimed Kraken failed to register its staking program. This marked the first major enforcement action by the SEC against a staking service.

SEC Chair Gary Gensler emphasized the necessity for proper disclosure by staking service providers. According to him, these services should comply with federal securities laws, regardless of whether they are labeled as “lending,” “earning,” “rewards,” “APY,” or “staking.”

As a result, Kraken paid the penalty and shut down its staking services in the U.S. The outcome of this case could lead to significant changes in how crypto staking services operate in the country, potentially impacting the broader cryptocurrency market and its stakeholders.

March: Silvergate Capital Shuts Down

Silvergate, a prominent lender in the crypto industry, ceased operations and liquidated its bank, which held over $11 billion in assets. This decision followed the shutdown of its flagship Silvergate Exchange Network (SEN) and amid ongoing regulatory investigations.

April: EU and MiCA

The European Union passed a groundbreaking regulation known as Markets in Crypto-Assets (MiCA), setting a model for global crypto regulation. MiCA aims to provide a unified regulatory framework for crypto assets, focusing on enhancing investor protection and promoting market stability.

May: Mastercard’s Web3 Ambitions

Mastercard partnered with various blockchain and wallet providers to create the "Crypto Credential," a standard designed to establish trust for individuals, businesses, and governments within blockchain ecosystems. Mastercard aims to deliver seamless user experiences in Web3, highlighting its growing involvement and confidence in the crypto industry.

June: Escalating Regulatory Pressure

In June, regulatory scrutiny intensified as the SEC reviewed major players like Coinbase. The SEC alleged that since 2019, Coinbase had failed to make proper disclosures and had listed at least 13 crypto assets deemed unregistered securities, including Solana, Cardano, and Polygon. This legal action significantly impacted Coinbase financially, leading to a net customer outflow of $12.8 billion and a sharp decline in its stock price. By month-end, Coinbase challenged the SEC’s authority in court, arguing that the traded assets were not securities.

July: Legal Battles and New Ventures

The SEC lost its long-running lawsuit against XRP. The judge ruled that while Ripple violated federal securities laws by selling XRP directly to institutional investors, it did not violate those laws when programmatically selling XRP to retail customers.

Additionally, WorldCoin, launched by Sam Altman, attracted significant attention for its innovative approach to addressing income inequality.

August: Rise of SocialFi

The social platform Friend.tech launched, allowing users to purchase "shares" in X account holders, quickly gaining popularity. The platform granted buyers specific privileges, and within less than two weeks of its August 10 launch, its user base grew to over 100,000 addresses. This surge in popularity fueled the rise of the SocialFi phenomenon and inspired several similar platforms.

September: Mt. Gox Delays

According to Mt. Gox’s trustee, the repayment deadline for creditors was extended by one year. The new repayment date for the now-defunct exchange is set for October 31, 2024. Since the 2014 hack that resulted in the theft of 850,000 BTC, Mt. Gox creditors have been seeking compensation. The exchange eventually recovered approximately 20% of the stolen tokens.

October: SBF Trial Drama

At the start of October, former FTX CEO Sam Bankman-Fried faced serious fraud and money laundering charges in a federal trial. During the proceedings, his former close associates testified against him. The jury reached a swift verdict, convicting Bankman-Fried on multiple counts, including wire fraud against FTX customers and Alameda Research lenders, securities and commodities fraud against FTX investors, and conspiracy to commit money laundering.

November: CZ Steps Down from Binance

In November, the crypto landscape shifted further as Binance, one of the world’s largest cryptocurrency exchanges, reached a $4.3 billion settlement over violations related to sanctions and unlawful fund transfers. The settlement also included a personal fine for CEO CZ and his subsequent stepping down from leadership.

December: An Uplifting Finish

As the year drew to a close, Bitcoin’s value began to rise, sparking optimism about the imminent approval of ETFs and positive market trends. Anticipation for the 2024 Bitcoin halving and an early bullish market drove renewed enthusiasm. Passion for multiple EVM chains reached new highs.

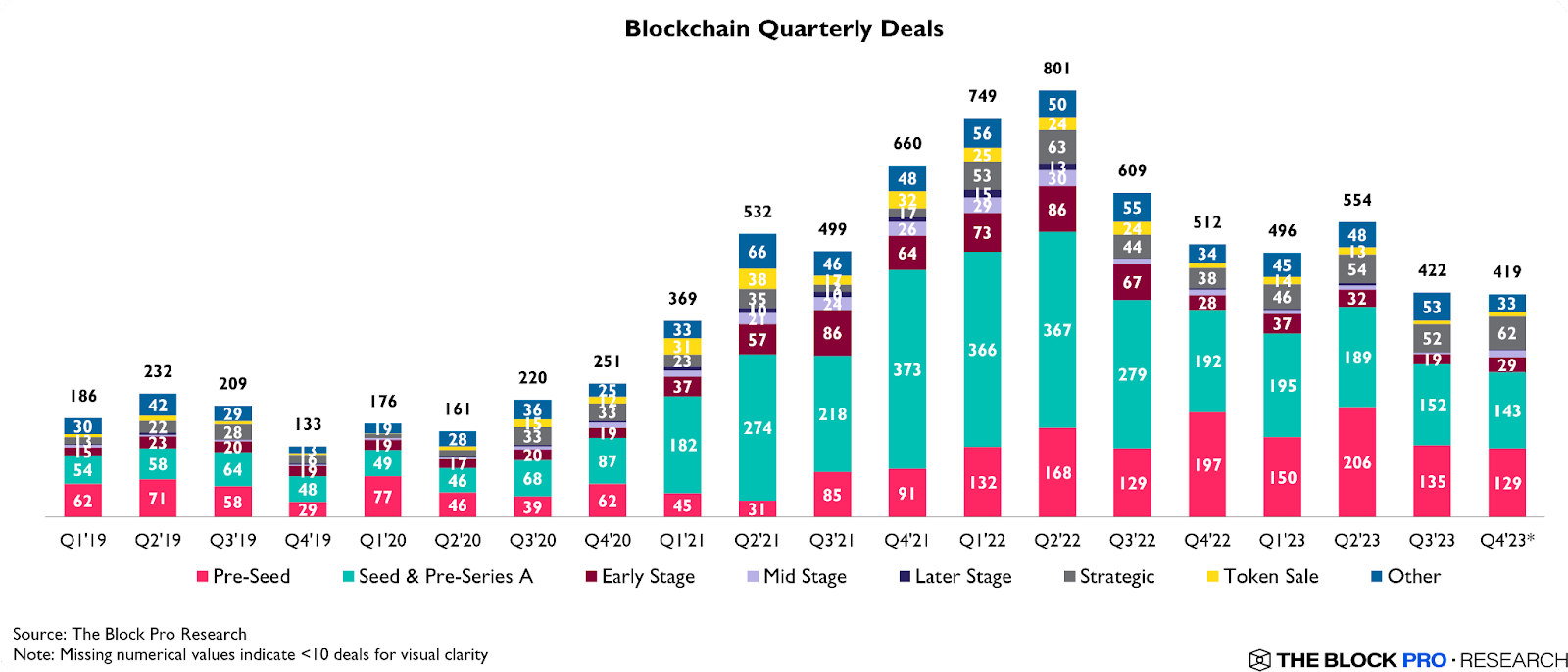

Venture Capital Insights

Despite a 68% decrease in total investment since 2022, venture capital funding for crypto and blockchain startups remained robust in 2023, reaching $10.7 billion. This trend favored early-stage ventures, with a significant portion of investments going toward pre-seed, seed, and Series A startups. NFT/gaming, infrastructure, and Web3 continued to dominate the investment landscape, reflecting the enduring appeal and growth potential of these sectors.

On-Chain Analysis

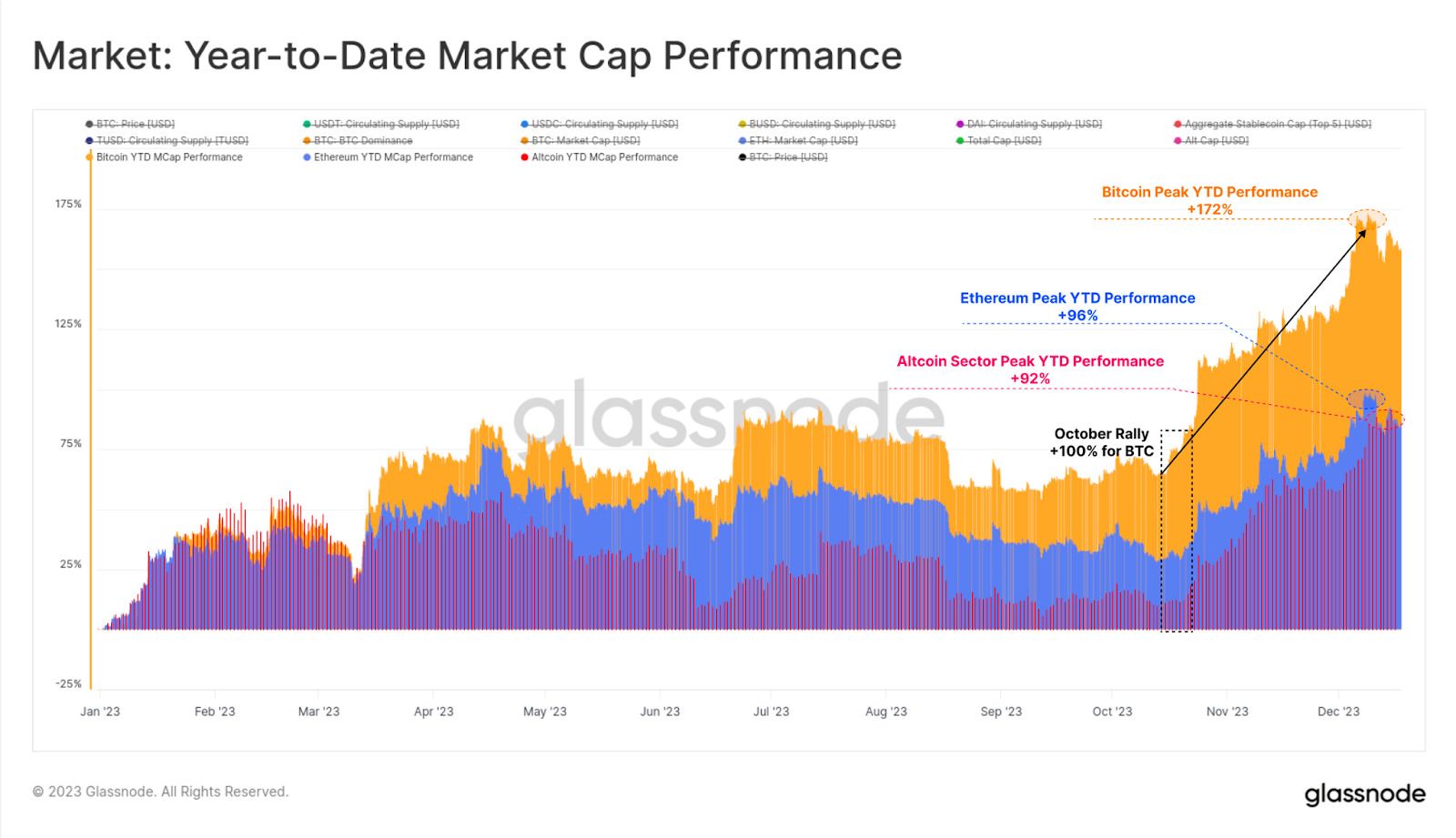

Digital assets experienced a remarkable year in 2023, with Bitcoin’s market cap growing by 172%. The entire digital asset ecosystem, including Ethereum and altcoins, also achieved substantial gains, with market capitalization increasing by over 90%.

This growth highlights the rising dominance of Bitcoin, a common phenomenon during market recoveries from prolonged bear markets like 2021–22. Despite Ethereum’s relatively slow start and the ETH/BTC ratio falling to multi-year lows, it made progress through the successful implementation of the Shanghai upgrade and expansion of its Layer 2 ecosystem.

Overall, digital assets outperformed traditional assets such as equities, bonds, and precious metals throughout the year, with a significant portion of gains realized during a late rally in October. This surge was triggered by Bitcoin breaking key resistance levels above $30,000 and other important price thresholds.

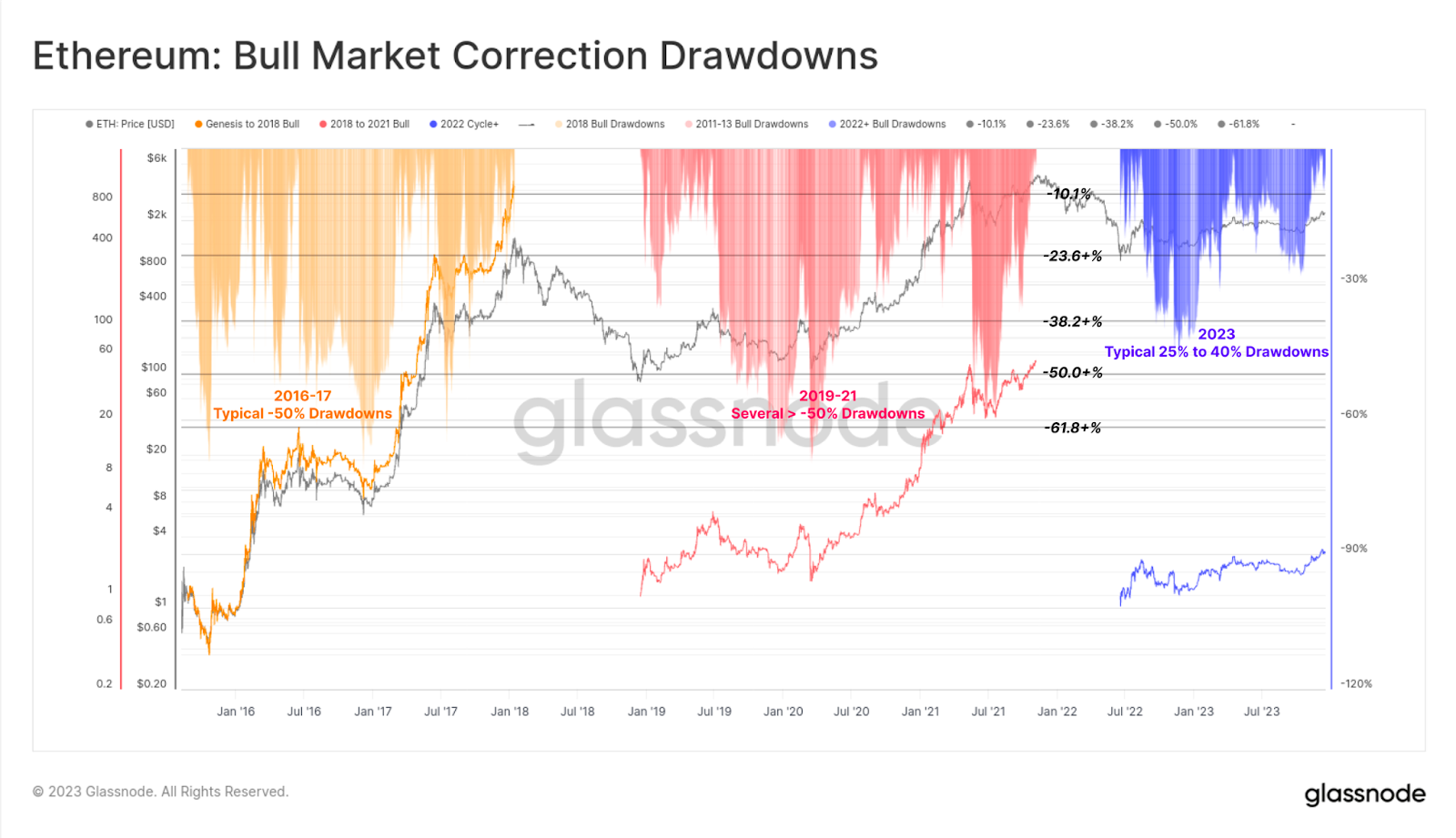

A notable feature of the 2023 market was the limited depth of price pullbacks and corrections in digital assets. Unlike historical patterns where Bitcoin’s recovery from bear markets and bull runs often experienced drawdowns of at least -25%, sometimes exceeding -50%, the largest correction in 2023 was only -20% from recent highs.

This indicates strong buyer support and favorable supply-demand dynamics throughout the year.

Ethereum also experienced relatively modest corrections, with its largest drawdown occurring in early January at -40%, reflecting market resilience driven by reduced issuance post-Merge and stable demand.

Conclusion

Despite regulatory challenges, market volatility, and major corporate developments, the industry demonstrated resilience and adaptability in 2023. Looking ahead to 2024, the lessons and experiences from the past year will shape the trajectory of digital assets, signaling an exciting and promising future for the cryptocurrency space. As we enter this new year, the following are the most anticipated major events:

-

Launch of spot Bitcoin and Ethereum ETFs

-

Further development of Layer 2 networks such as Base and Blast

-

Bitcoin halving and its subsequent impact on price

-

Further rise of the Inscriptions market

-

Accelerated growth in sectors such as DePIN and RWA.

Which one are you most looking forward to?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News