Bitcoin ETF applicants "submit their papers" — the answer will be revealed in 2 days

TechFlow Selected TechFlow Selected

Bitcoin ETF applicants "submit their papers" — the answer will be revealed in 2 days

If the SEC approves, these spot Bitcoin ETFs will likely be approved all at once.

By Weilin

January 8 at 8 a.m. Eastern Time (8 p.m. Beijing Time on January 8) was the U.S. Securities and Exchange Commission (SEC)-set deadline for final filings of spot Bitcoin ETF applications. Except for Hashdex, all other ten major applicants have submitted their final S-1 forms (Grayscale filed an S-3), marking a key disclosure step in the ETF approval process.

Approval now hinges solely on the SEC’s final response. While this highly anticipated ETF has yet to be confirmed, several applicants have already initiated a fee war.

According to updated filings, BlackRock caught competitors off guard with its "flexible pricing policy." The iShares Bitcoin Trust will charge 0.20% for the first 12 months or first $5 billion in assets, then rise to 0.30%, giving it a low-fee advantage upon launch. After BlackRock revealed its rate, ARK quickly adjusted its fee from 0.80% down to 0.25%.

Another battleground is Bitcoin’s price. Influenced by various ETF-related news, BTC has swung sharply over the past week—surpassing $45,800 on January 2, briefly dropping to $42,200 the next day, consolidating between $42,000 and $43,000 in the following days, and breaking above $46,000 before climbing to $47,000 in the early hours of January 9.

With price swings often exceeding 10%, crypto market sentiment has been repeatedly shaken by ETF updates. The entire market is now watching January 10, a critical date when the SEC is scheduled to issue its final decision on ARK 21Shares’ application, according to the prior review timeline.

Analysts previously speculated that if the SEC approves one, it could greenlight all spot Bitcoin ETFs at once. Whether that prediction holds true will be revealed by the SEC on January 10, Eastern Time.

Market Sentiment Repeatedly Shaken by News Flow

As of now, fewer than 48 hours remain before the SEC’s deadline to respond to ARK’s spot Bitcoin ETF application.

In the preceding week, the crypto market led by Bitcoin saw repeated price swings that rattled investors—BTC dropped from above $45,800 to nearly $40,000 within seven days, then bounced back and forth between those levels.

High volatility also triggered massive liquidations in the futures market.

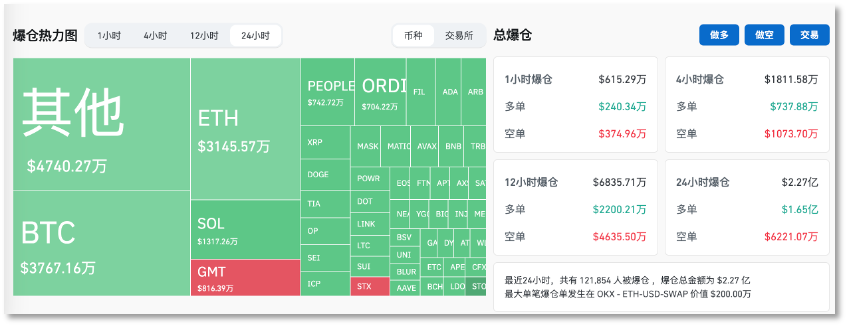

Liquidation data in crypto futures markets on the early morning of January 9, Beijing Time

Liquidation data in crypto futures markets on the early morning of January 9, Beijing Time

According to Coinglass data, as of early January 9, Beijing Time, total liquidations across the crypto futures market reached $227 million in 24 hours—$37.67 million in BTC, $31.46 million in ETH, and a staggering $47.40 million in altcoins.

The biggest factor influencing market sentiment remains the stream of news around spot Bitcoin ETFs.

Since the start of the year, various insiders have alternately predicted SEC approval or rejection. Pro-approval voices kept shifting the expected date—first pointing to last weekend, then this week’s business days, even spreading rumors with mismatched dates and weekdays. Meanwhile, skeptics insisted “none will be approved.”

These emotional swings have drawn SEC attention. On January 6, the SEC’s Office of Investor Education and Advocacy published an article titled “Resist FOMO,” warning retail investors about risks in crypto assets including meme coins, cryptocurrencies, and NFTs. Predictably, interpretations of this post quickly emerged, still centered on guessing whether approval would come.

Rather than chasing rumors, it’s better to follow the official timelines and procedural requirements set by U.S. regulators.

According to the established schedule, January 10 is the SEC’s final deadline to respond to ARK 21Shares’ application—this is why the crypto community is focused on that date. Seven other applicants, including BlackRock, face final decision deadlines in March; Global X in April; and the latest, Hashdex and Franklin Templeton, in May.

SEC final response deadlines for applicants

SEC final response deadlines for applicants

Two technical conditions must be met before spot Bitcoin ETFs can begin trading.

First, the SEC must approve the 19b-4 filing submitted by the exchange where the ETF will list. This form documents rule changes proposed by self-regulatory organizations (SROs) like regulated exchanges. When submitting, these exchanges must justify that the new rules support fair and orderly markets, protect investors, and include adequate surveillance mechanisms.

Currently, all 11 spot Bitcoin ETF applicants and their respective listing exchanges have completed this step.

Second, the SEC must approve the relevant S-1 registration statement, which contains essential business and financial information. The deadline for this was 8 a.m. Eastern Time on January 8.

At the end of last year, applicants held over 20 meetings with the SEC on S-1 filings. Most finalized their S-1 forms in December, notably switching from in-kind redemption to cash redemption to better meet regulatory standards.

So far, ten major applicants have submitted updated S-1 forms. Notably, Hashdex appears to have missed the deadline, potentially delaying its approval. Grayscale, due to product restructuring, filed an S-3 instead.

Next, the 19b-4 and S-1 filings will be reviewed by two separate SEC divisions—the Division of Corporation Finance handles S-1, while the Division of Trading and Markets oversees 19b-4. If both are approved, following historical precedent, ETF trading would commence the next business day.

Applicants Launch Fee Wars

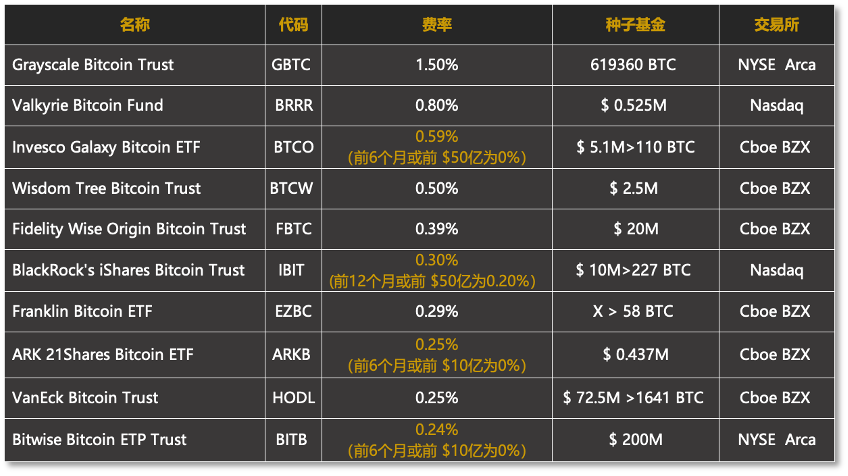

With the S-1 filing window closed, details about each applicant’s ETF trading fees and seed funding have emerged, turning fees into a competitive battlefield.

According to the latest S-1 filings, BlackRock adopted a tiered fee structure: 0.20% for the first 12 months or first $5 billion in assets, rising to 0.30% thereafter—a rate lower than analyst expectations and a direct blow to competitors.

Besides BlackRock, Invesco, ARK, and Bitwise have also introduced discounted rates for initial periods or asset thresholds. ARK/21Shares, previously charging 0.80%, slashed its fee to 0.25% after seeing rivals’ moves, even offering zero fees for the “first six months or first $1 billion” of trading volume.

Fee comparison across spot Bitcoin ETF products

Fee comparison across spot Bitcoin ETF products

In the view of Bloomberg senior analyst Eric Balchunas, fee differences among Bitcoin ETFs may not significantly impact issuer competitiveness or market share. “Advisors care more about ongoing expenses since they’re long-term investors. Given that all these ETFs do the same thing, fees might matter only if all else is equal.”

Seed fund sizes also vary widely across applicants. A seed fund is the initial investment that enables an ETF to launch and begin trading, forming the foundational units that make shares available in public markets.

Currently, aside from Grayscale—the early institutional holder of Bitcoin—Bitwise has the largest known seed fund. On December 29, the company disclosed that a buyer planned to purchase $200 million in shares, surpassing VanEck’s $72.5 million.

Latest reports indicate that U.S.-based crypto hedge fund Pantera Capital plans to invest $200 million into the potential Bitwise Bitcoin ETP Trust, likely being the undisclosed buyer hinted at earlier by Bitwise.

In terms of seed capital, excluding legacy players like Grayscale, initial funding for most spot Bitcoin ETFs stands around $300 million—less than a single day’s trading volume on major crypto exchanges. As for how much new capital these ETFs can attract, analysts have drawn comparisons with gold ETFs. Currently, U.S. gold ETFs hold total assets of $114.7 billion.

While the approval of spot Bitcoin ETFs in the U.S. still carries uncertainty, increasing disclosures from S-1 filings have once again pushed BTC prices higher. On the morning of January 9, Binance data showed BTC spiking to $47,248, surpassing previous highs and setting a new year-to-date record.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News