Bing Ventures: A 10,000-Word Guide to the Cosmos DeFi Landscape

TechFlow Selected TechFlow Selected

Bing Ventures: A 10,000-Word Guide to the Cosmos DeFi Landscape

While multiple blockchain projects are fighting for dominance, each trying to become the "next Ethereum" or "Blockchain 3.0," Cosmos has chosen a different path.

Author: Bing Ventures

Key Takeaways:

-

Liquidity Concentration Comparison: The Cosmos ecosystem shows high dependency on its native asset Atom for liquidity, making it more centralized compared to ecosystems like Polkadot. This concentration plays a positive role in initial development and ensuring ecosystem

-

health, but may pose long-term risks, especially when facing external market volatility.

-

Cross-chain Trading Activity: Osmosis demonstrates higher cross-chain trading activity and attractiveness compared to Injective and KAVA, highlighting its strategic advantages and technological strengths in cross-chain interoperability.

-

Native Asset-Centric Development: While native assets bring stability to the Cosmos ecosystem, the low liquidity of BTC and ETH indicates room for improvement in integrating cross-chain assets.

-

Lending Market Health: Umee and Kava Lend within the Cosmos ecosystem show limitations in lending. Compared with mainstream platforms like Aave and Compound, they clearly lack liquidity and competitiveness in major assets.

While multiple blockchain projects compete for dominance—each striving to become the “next Ethereum” or “Blockchain 3.0”—Cosmos has chosen a different path.

It all started with a simple idea: How can we create a decentralized, interoperable network of blockchains instead of a single, isolated ecosystem? Cosmos was designed precisely to solve this challenge. Its vision goes beyond creating another blockchain—it aims to build an “internet of blockchains,” a network that allows various blockchains to freely communicate and interact. Although the concept of “linking blockchains” is widely used among cross-chain projects and mainnets, Cosmos stands out as the most successful so far, offering stronger connectivity and greater developer freedom.

From Concept to Practice

Design Philosophy

As a public chain based on Tendermint consensus, Cosmos differs from most blockchain projects at the time. Instead of providing a traditional execution engine (virtual machine), Cosmos offers developers consensus mechanisms and application development tools (SDK). This innovative model gives developers greater freedom, allowing them to customize the runtime environment and transaction types of application-specific chains according to their own specifications.

Interestingly, during its early development phase, Cosmos competed fiercely with Polkadot over core cross-chain technology. As both evolved, they took completely different technical paths. Polkadot leverages its Cross-Consensus Message Format (XCM) to create a frictionless infrastructure for cross-chain information flow. Additionally, through its relay chain and parachain design, Polkadot shares security—each parachain gains built-in security directly from the relay chain via a dedicated protocol. In contrast, the Cosmos ecosystem and its individual chains do not fully rely on the Cosmos Hub for inter-chain communication or security. Cosmos adopts a mesh architecture where each application chain must ensure its own security. This design grants DeFi projects in the Cosmos ecosystem greater flexibility and autonomy.

The core components of Cosmos include the Cosmos SDK, IBC protocol, and the Tendermint consensus engine. The Cosmos SDK, as an open-source framework and toolkit for building public chains, significantly lowers the barrier for developers to create blockchains and related applications. The IBC protocol enables information exchange and interoperability between different blockchains, allowing various chains within the Cosmos ecosystem to form a connected network. The Tendermint consensus engine provides an efficient and reliable mechanism for nodes in the blockchain network to quickly and fairly reach consensus.

By leveraging the powerful toolset provided by the Cosmos SDK, DeFi developers can more easily build and operate their applications. Specifically, its advantages are reflected in the following aspects.

-

Modular Design: The most notable feature of the Cosmos SDK is its modularity. It provides a series of pre-built modules such as authentication, banking, and governance, which developers can use directly to rapidly build applications. For DeFi projects, this means they can focus more on optimizing user experience without reinventing the wheel.

-

Flexibility: The Cosmos SDK allows developers to write custom modules in Go, giving DeFi projects tremendous flexibility. Developers can create new financial instruments, transaction types, or other functionalities tailored to their needs—an essential advantage for innovation in DeFi.

-

Cross-chain Interaction: The Cosmos SDK supports the Inter-Blockchain Communication (IBC) protocol, enabling chains within the Cosmos network to interact and transfer data. For DeFi projects, this opens access to a wider variety of assets, increasing their application’s appeal.

-

Security: While application chains in Cosmos are responsible for their own security, the SDK provides built-in solutions such as staking and slashing mechanisms to protect network integrity. For DeFi projects, this reduces the complexity involved in securing their networks.

Overall, the Cosmos SDK enables DeFi developers to rapidly build high-performance, innovative, and secure applications while leveraging the cross-chain capabilities of the Cosmos network to expand their reach.

Market Overview

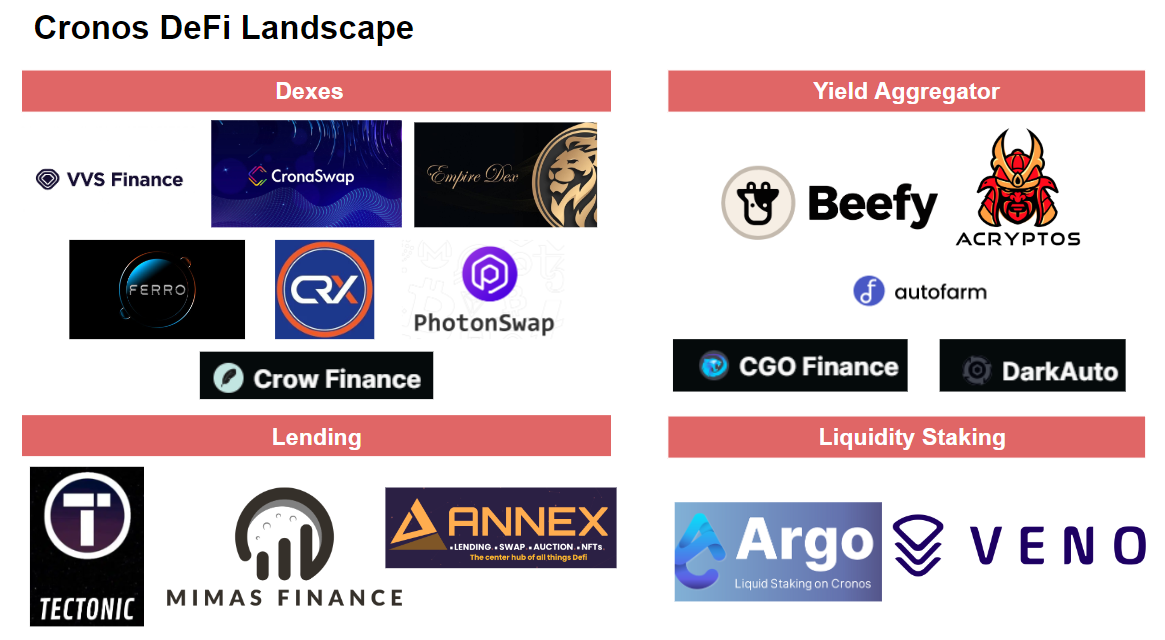

The DeFi market in Cosmos can be broadly categorized into five sectors:

* Given that every project on the Cosmos ecosystem essentially operates as an independent public chain, this classification is based primarily on their main functions. The "Infrastructure" category includes foundational projects due to the ecosystem's vast scale and diversity.

Infrastructure

Cosmos is a project dedicated to providing modular blockchain solutions, enabling developers to create public chains tailored to their specific applications. Through its Inter-Blockchain Communication (IBC) protocol, Cosmos allows applications and protocols within the ecosystem to connect seamlessly, facilitating free exchange of cross-chain assets and data. The widespread adoption of the Cosmos SDK has enabled many public chains to establish their own ecosystems, including several DeFi applications.

Liquidity Staking

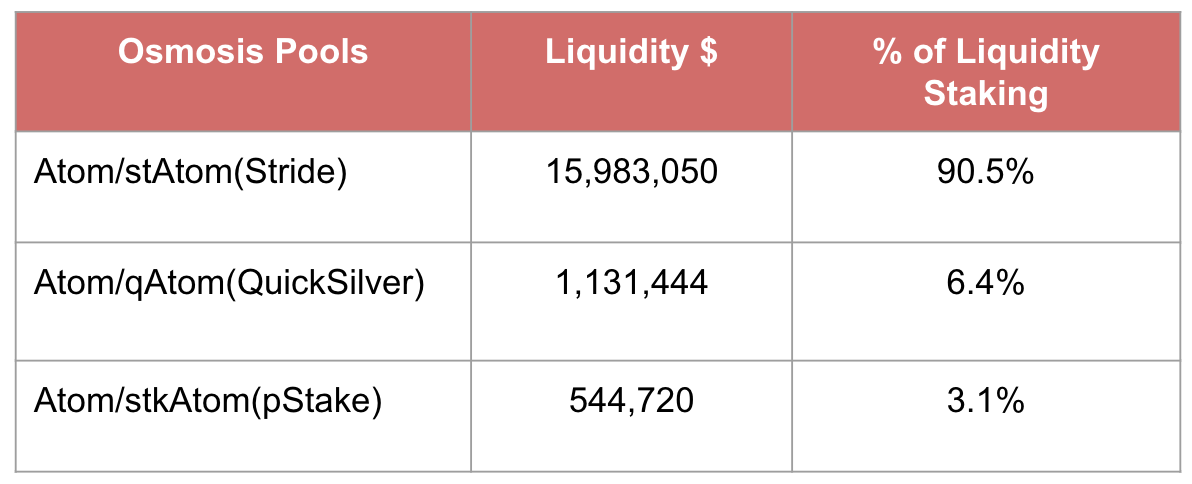

The liquid staking market in Cosmos is currently dominated by two projects: Stride and pStake, both offering PoS staking derivatives. Stride allows users to earn PoS staking rewards while maintaining asset liquidity. Similarly, pStake enables users to stake assets for staking returns and simultaneously utilize staked representative tokens in DeFi for additional yields, along with transferring them across networks via the IBC protocol. Currently, staking derivative tokens have limited utility within relevant DeFi protocols after participation. Compared to the extensive use cases of ETH staking derivatives, the Cosmos staking market still requires significant development.

Vaults

The vault market in Cosmos is evolving toward more complex and adaptive strategies, moving beyond simple funds and basic approaches. Sommelier’s “smart vaults” exemplify this shift. Traditional methods such as investing in index portfolios or specific pools and reinvesting earnings over time are becoming outdated. Instead, the focus is shifting to intelligent vaults capable of adjusting their composition based on current market conditions or predefined metrics. This transition marks a significant advancement in the Cosmos vault market, offering DeFi users more flexible, agile, and potentially more profitable solutions.

Lending & Borrowing

The lending market in Cosmos is currently developing, with Umee as the leading protocol. It offers general-purpose cross-chain lending functionality and introduces fundamental principles from traditional debt markets.

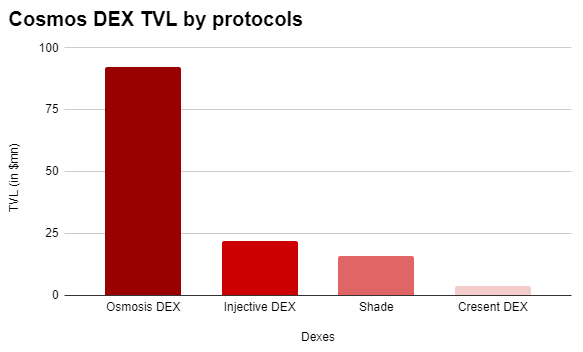

DEXes

The decentralized exchange (DEX) market in Cosmos is rapidly expanding. Crescent and Osmosis are two DEX platforms aiming to deliver efficient capital utilization and liquidity. Decentralized exchanges on Cosmos, such as Osmosis, achieve high interoperability through the Cosmos Inter-Blockchain Communication (IBC) protocol, supporting integration with different blockchains to expand their ecosystems and communities. Capital providers can efficiently deploy their capital on DEXs like Osmosis by earning trading fees through liquidity provision and receiving additional incentives via liquidity mining, thereby enhancing liquidity depth and reducing slippage.

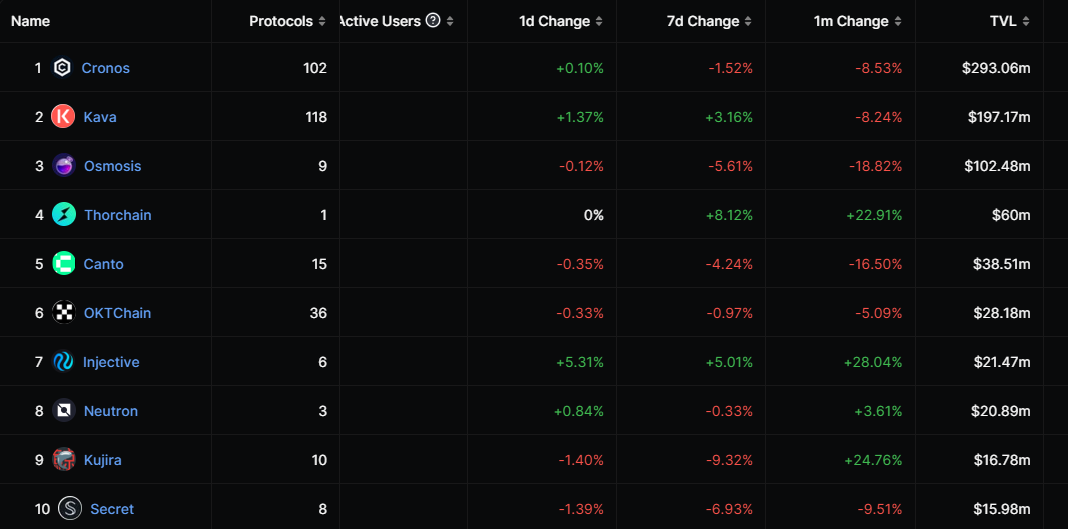

Among Cosmos-based chains, Cronos and Kava are the most mature, each hosting over 100 protocols and significantly outpacing other projects.

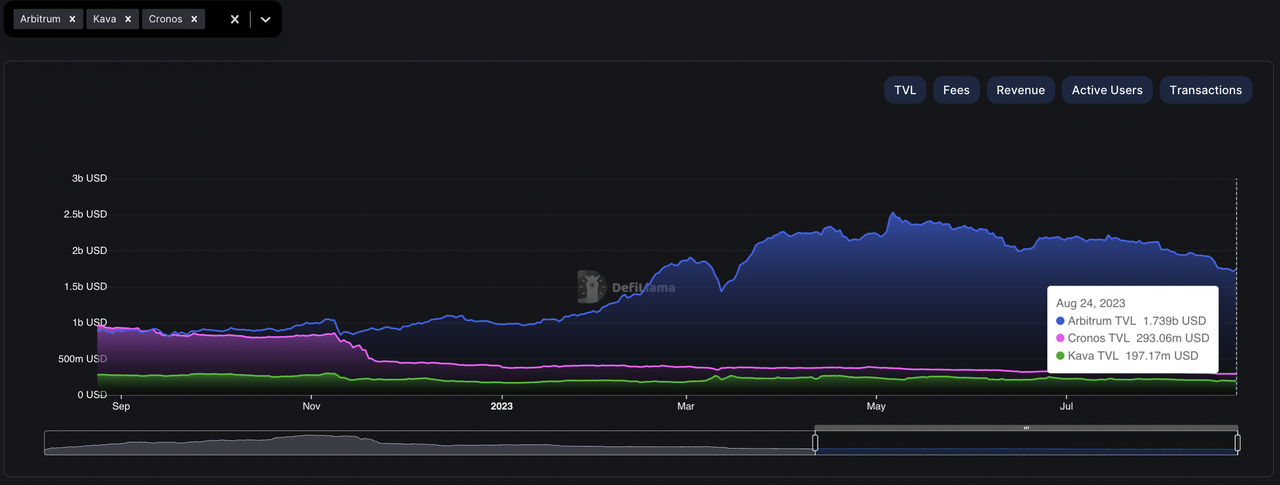

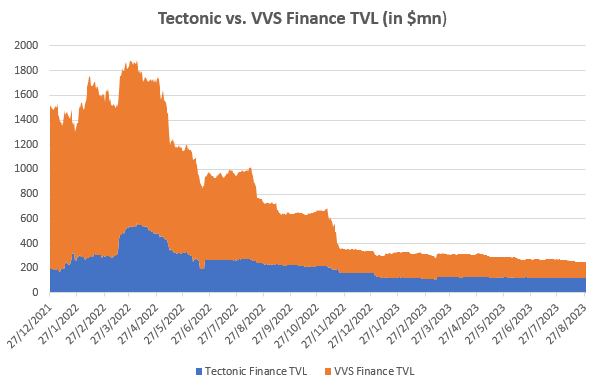

However, compared to other Layer 2 projects like Arbitrum, their TVLs are negligible—Arbitrum’s TVL is nearly 5 to 10 times larger. Moreover, they lack flagship projects to drive momentum. As shown in the chart above, their TVLs have remained relatively flat since the beginning of the year.

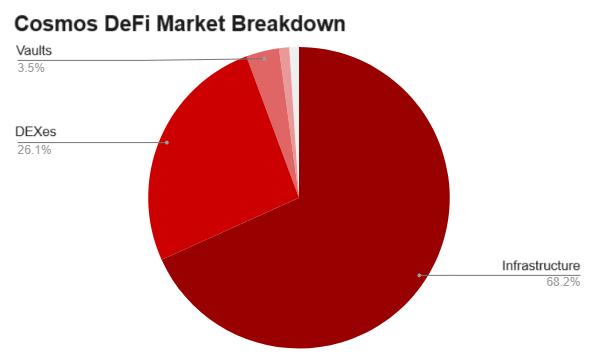

The pie chart above illustrates the composition of the Cosmos DeFi market, with data only covering protocols built directly on the Cosmos SDK. Some projects built atop Cosmos SDK-based chains are excluded.

As shown, Infrastructure accounts for the largest share of locked value, primarily because it includes many public chain projects, each hosting its own DeFi ecosystem. For example, Cronos hosts 108 projects, while Kava has established a complete set of DeFi infrastructure—Kava Mint, Kava Lend, and Kava Swap—with a combined TVL reaching $200 million. These services work synergistically to close the loop in Kava’s DeFi business scenarios.

DEXes rank second in terms of TVL, primarily driven by Osmosis and Thorchain, which together support the DEX segment of Cosmos. Osmosis’ Superfluid Staking feature has successfully solidified its position by allowing users to provide liquidity in Liquidity Pools and simultaneously stake earned crypto assets on the same blockchain, maximizing returns by combining liquidity provision and staking.

The biggest selling point of the Cosmos DeFi ecosystem is its product diversity—there are nearly 400 protocols derived from the Cosmos SDK alone. Combined with the ease of technical development, this attracts numerous builders. Although segments like lending & borrowing and vaults appear small in proportion, many projects are actually built on top of Cosmos-based public chains and also engage in these product categories. We will analyze them in greater detail below.

Mapping the Ecosystem: A Thunderclap Needed in a Quiet Landscape

Infrastructure: Major Projects Face TVL Setbacks, Future Growth Uncertain

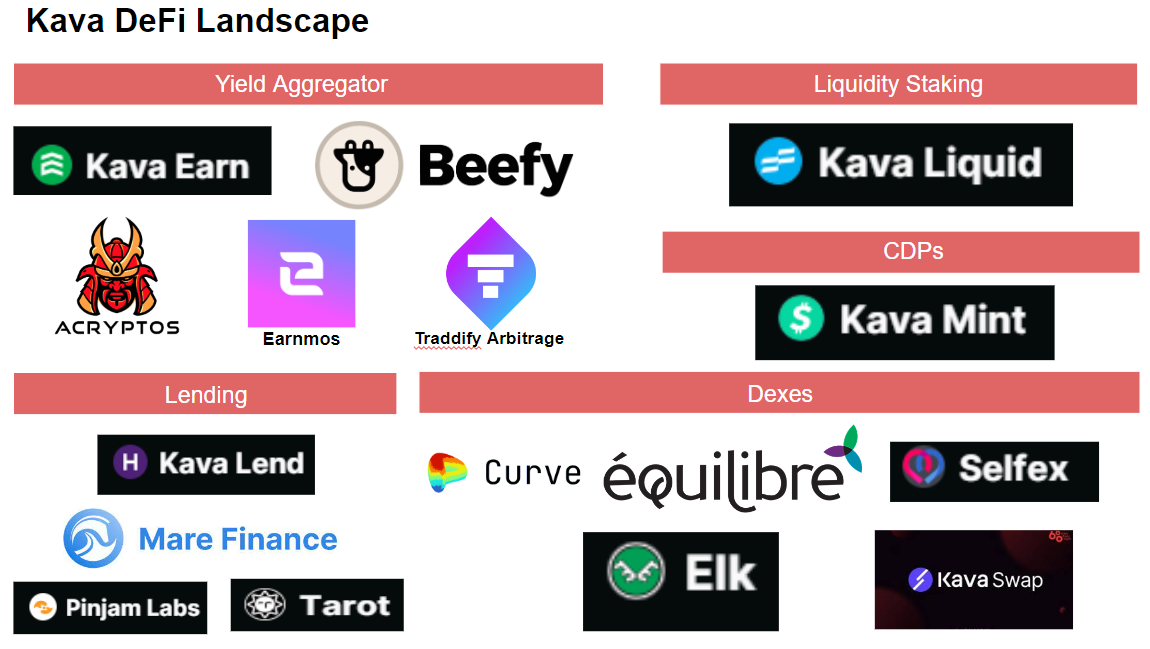

Kava

1. Overview:

-

Built on the Cosmos SDK—a popular framework for building blockchain applications in Go—Kava benefits from modularity and interoperability.

-

It uses a Tendermint-based PoS consensus mechanism. Tendermint is known for its Byzantine fault tolerance, ensuring network security and minimizing double-spending attacks.

2. Key Applications:

-

Kava Mint: Allows users to collateralize assets to borrow USDX loans. Similar to MakerDAO’s system but with unique features, particularly regarding accepted collateral.

-

Kava Lend: A money market where users can supply and borrow assets to earn rewards. The rebranding reflects deeper integration with the broader Kava ecosystem.

-

Kava Swap: Facilitates buying and selling tokens on the Kava chain. It uses an automated market maker model to ensure liquidity and competitive pricing for traders.

3. Token Ecosystem:

-

KAVA: Native token of the Kava blockchain. Plays a critical role in platform security, governance, and various mechanical functions. Its PoS mechanism also allows KAVA holders to stake tokens to validate transactions and earn rewards.

-

USDX: Kava’s stablecoin, minted by users pledging crypto assets. Provides a stable medium of exchange within the Kava ecosystem.

-

HARD: Governance token for Kava Lend. Used to incentivize early participants and guide ongoing product development and governance.

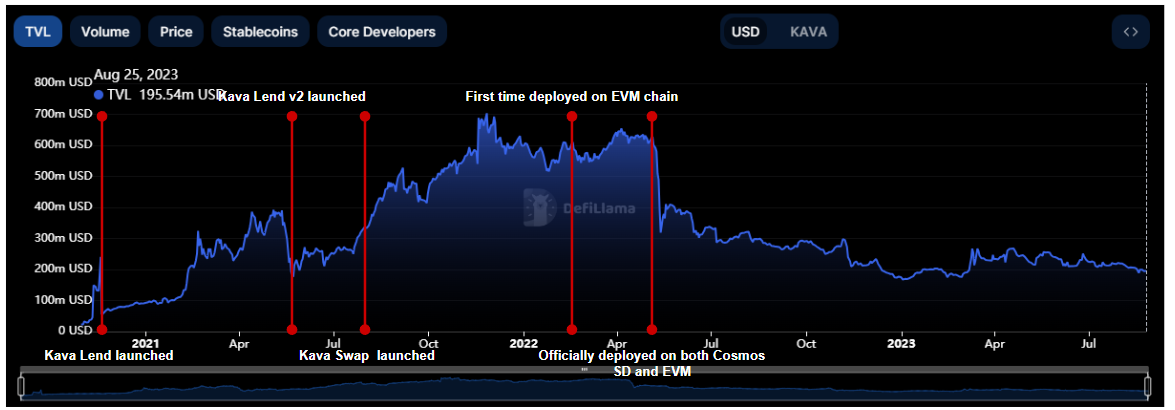

The chart above narrates Kava’s historical development. The early launch of its three core applications (Mint, Lend, Swap) positively impacted ecosystem growth. Later, as the Kava network formally completed and fully launched, it achieved a co-chain architecture linking Ethereum and Cosmos, enabling developers to seamlessly build across both EVM and Cosmos SDK execution environments. Unfortunately, amid a series of events in 2022—including Terra’s collapse and Celsius’ inability to repay users—Kava suffered severe TVL declines due to macroeconomic headwinds, from which it has yet to recover.

Persistence

Persistence aims to advance institutional open finance by enabling seamless cross-chain interoperability for global value flows. Its ecosystem includes cutting-edge financial products such as pStake and Dexter.

pStake

1. Background:

-

In 2021, pSTAKE became the first liquid staking solution for $ATOM with the launch of stkATOM on Ethereum.

-

In 2023, stkATOM returned to Persistence Chain via a new IBC-native version.

2. Core Features:

-

Liquid Staking: pSTAKE resolves the staking dilemma for PoS asset holders by allowing them to earn staking rewards while using their assets in DeFi.

-

How It Works: Users securely stake PoS assets (e.g., $ATOM) via pSTAKE to earn staking rewards and receive representative tokens (e.g., $stkATOM), which can then generate additional yield in DeFi.

-

Supported Chains: Currently supports liquid staking on Binance Chain, Cosmos, Persistence, and Ethereum.

3. Features:

-

stkATOM Mechanics: Operates under an exchange rate model—the value of stkATOM increases as underlying ATOM accumulates staking rewards.

-

Fees: pSTAKE maintains low fees for optimal user experience—0% deposit/withdrawal fees, 5% protocol fee, and 0.5% instant redemption fee.

-

Security: Fully audited by Halborn Security and Oak Security. Since April 2023, pSTAKE has hosted a $100,000 bug bounty program on Immunefi.

-

Unique Feature: Offers an “instant redemption” function, allowing users to bypass the typical 21–25 day unlocking period.

-

Wallet Support: Initially supports Keplr and Ledger, with plans to add more software and hardware wallets soon.

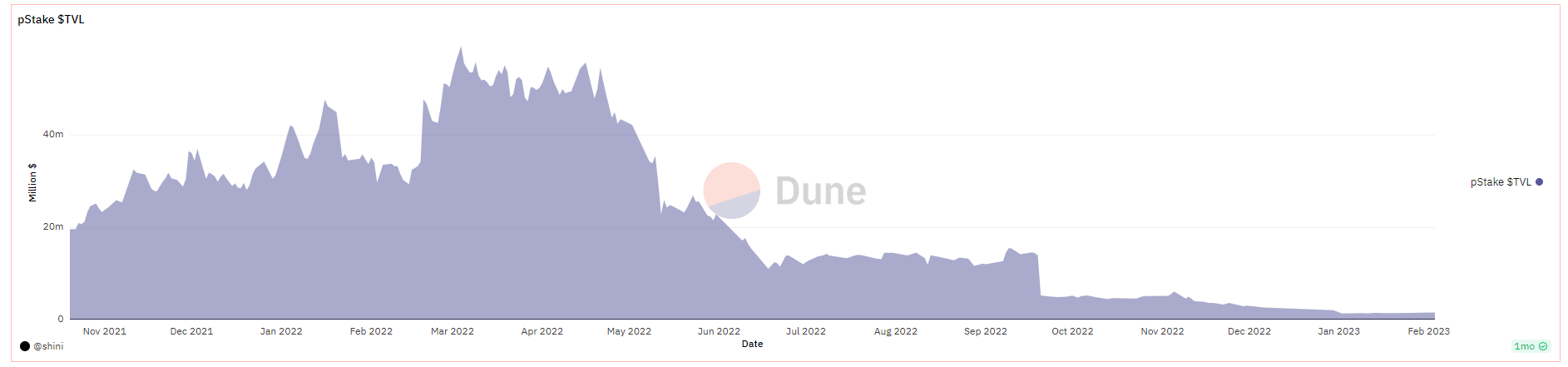

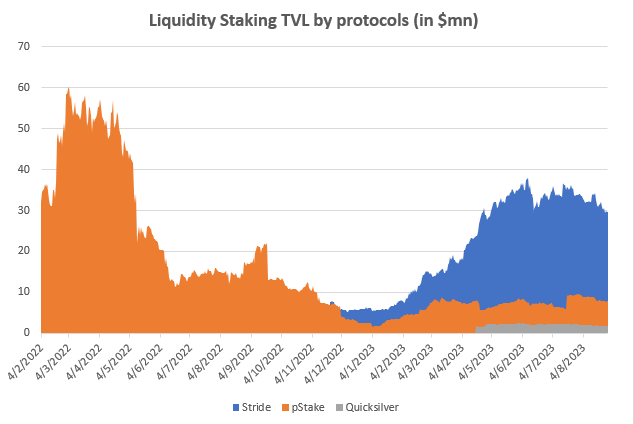

Liquid staking is crucial for a network’s economic efficiency and staking incentives. pStake attempts to fulfill this role. However, due to limited capital inflows into the Cosmos DeFi ecosystem—where liquid staking funds are often drawn to Ethereum—and the relatively weaker performance of the Atom price, pStake’s TVL remains unremarkable and lacks strong user adoption.

Cronos

Crypto.orgChain launched in March 2021 as a public blockchain developed by Crypto.com, designed for fast, secure, and low-cost transactions. The Cronos sidechain is Ethereum EVM-compatible, enabling rapid migration of Ethereum dApps and the DeFi ecosystem.

VVS Finance

VVS Finance is the first native AMM-based decentralized exchange built on the Cronos blockchain. The project leverages proven and audited protocols. Unlike others, VVS Finance offers a comprehensive rewards program tailored for different participants, supported by its governance token VVS.

-

Two-thirds of the platform’s swap fees are distributed to liquidity providers (LPs) in the corresponding liquidity pool.

-

Staking VVS earns rewards in VVS or partner tokens.

-

Trading Rewards: Users receive rewards for swapping tokens on the VVS Finance platform.

-

Referral Program: Users who refer traders to the platform earn rewards.

Tectonic

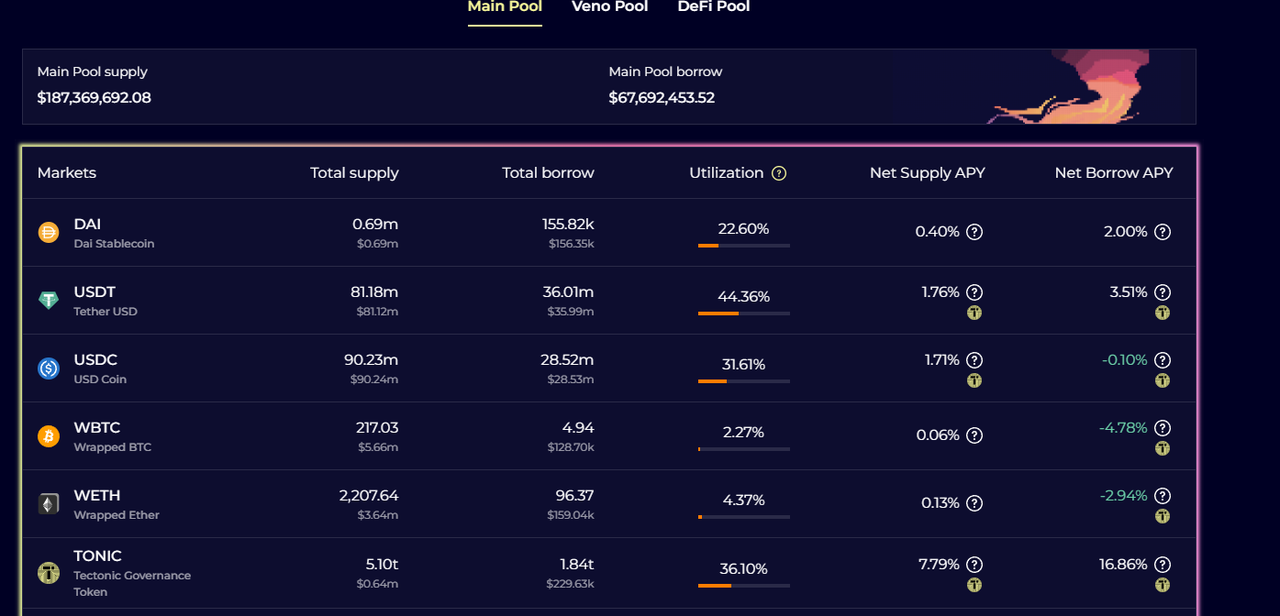

Tectonic is a lending protocol on the Cronos chain, comparable in stature to VVS Finance. It is a fork of the Compound protocol.

Tectonic allows users to supply cryptocurrencies to the platform, earning interest and TONIC token rewards as liquidity providers. Each asset has a corresponding collateral factor (loan-to-value ratio), indicating how much can be borrowed against each collateral type. For instance, a 75% collateral factor means users can borrow up to 75% of the value of their collateral in other cryptocurrencies. If the value of collateral drops or the value of borrowed assets rises, outstanding loans may be liquidated at a discount relative to market prices.

Both Tectonic and VVS Finance are key pillars of the Cronos DeFi ecosystem. As shown above, although VVS Finance initially had a TVL far exceeding Tectonic’s—peaking at seven times higher—the gap has narrowed to about two times as both settled into lower, stable levels following a series of DeFi/CeFi crises. Together, they reflect the broader state of the Cronos DeFi ecosystem, which will require sufficient catalysts—consistent and standout project developments—to revive its低迷 TVL.

Liquidity Staking: The Huge Potential of Liquid Staking and Innovation in Economic Mechanisms

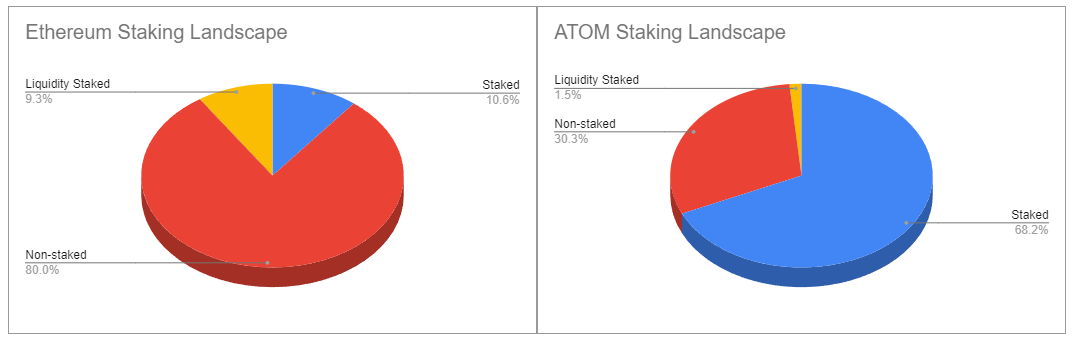

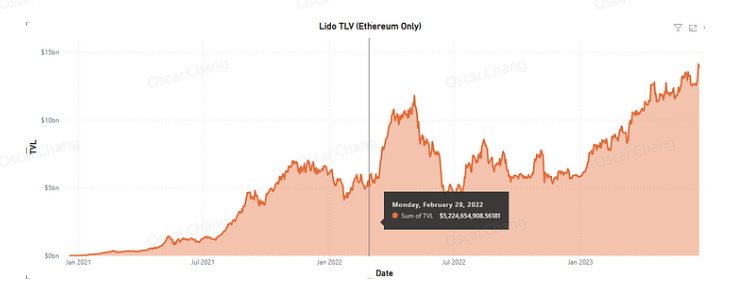

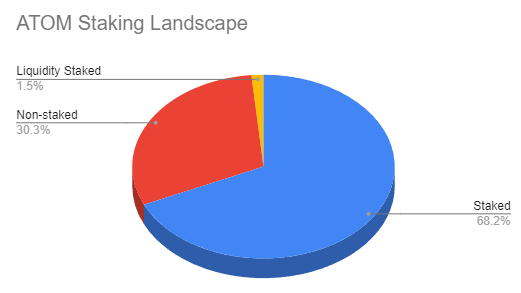

Macroscopically, approximately 20% of Ethereum’s total supply is staked, whereas Cosmos Hub reaches nearly 70%. However, of this 70% staked ATOM, only 1.5% is liquid-staked, compared to 9.3% for ETH. From an economic standpoint, ETH’s liquid staking is clearly more advanced and mature—partly explaining why Ethereum’s DeFi leads over Cosmos.

Yet this very gap highlights the immense growth potential for Cosmos DeFi. With a 70% staking ratio, Cosmos already has the foundation for liquid staking. Proper development of related protocols could unlock massive opportunities and bring substantial value to the Cosmos DeFi ecosystem. Within the current Cosmos liquid staking market, Stride dominates with a TVL share of around 75%, while pStake, once the leader, now holds second place at approximately 20%.

Stride

Driven by the adoption of its liquid staking token stATOM, the Cosmos DeFi ecosystem is experiencing a surge. A key unique value proposition of Stride is its direct distribution of protocol revenue to stakers via $STRD. Additionally, Stride will benefit from Cosmos Hub’s Interchain Security (ICS) mechanism, further enhancing its security. As the ecosystem grows, demand for $STRD is expected to rise, fueling further adoption of stATOM.

stATOM Liquidity and Adoption:

-

stATOM solves the dilemma between liquidity and staking rewards. With over 70% market share and a TVL approaching $30 million, its dominance is evident. Upcoming features like liquid governance and instant redemption will further enhance its appeal.

-

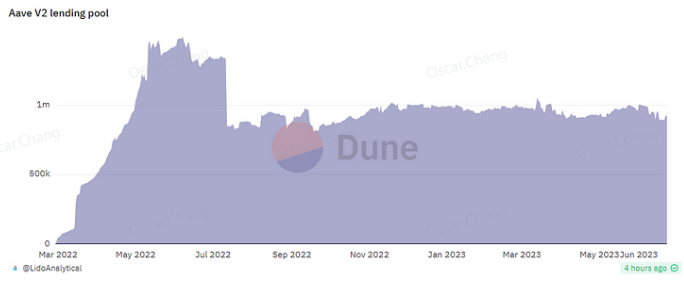

Comparison with stETH: stETH adoption is driven by users seeking leveraged ETH trading strategies via platforms like Uniswap and Aave. For example, the chart below shows stETH adoption surged with the launch of Aave V2, indicating a clear correlation. stATOM focuses on converting already staked funds (70%) into liquid-staked forms, whereas most stETH converts non-staked funds into liquid staking.

$STRD Tokenomics vs. $LDO:

-

Stride directly rewards stakers with protocol revenue, while Lido charges a 10% fee on staking rewards deposited into its treasury. Therefore, $STRD stakers are relatively better off.

-

Recent governance votes on Lido’s Snapshot indicate a participation rate of only about 1.5% of token holders, suggesting that much of $LDO’s high trading volume is not driven by governance engagement.

Interchain Security (ICS):

-

Unique Value Proposition: ICS allows the security of the ATOM validator set to be replicated across different application chains. Stride’s alliance with ATOM ensures income and value accrual for ATOM stakers, strengthening the overall cryptographic-economic security of the Cosmos Hub.

-

Liquid Staking Module (LSM): LSM caps the amount of ATOM eligible for liquid staking at 25% of total staked ATOM, mitigating associated risks. It also enables immediate entry into liquid staking without enduring the 21-day unbonding period. This framework regulates liquid staking adoption, preventing any single provider from controlling over one-third of total staked ATOM, thus avoiding validator corruption and limiting potential cascading liquidation risks.

As the broader Cosmos ecosystem embraces liquid staking, the combination of liquid staking and LSM will drive stATOM usage across the Cosmos DeFi ecosystem, increasing TVL on lending markets and DEXs. As Stride’s market penetration strengthens and more fees are paid to stakers, demand for $STRD may increase.

DEXes: Osmosis and Injective’s Dominance, and the Future of Liquidity

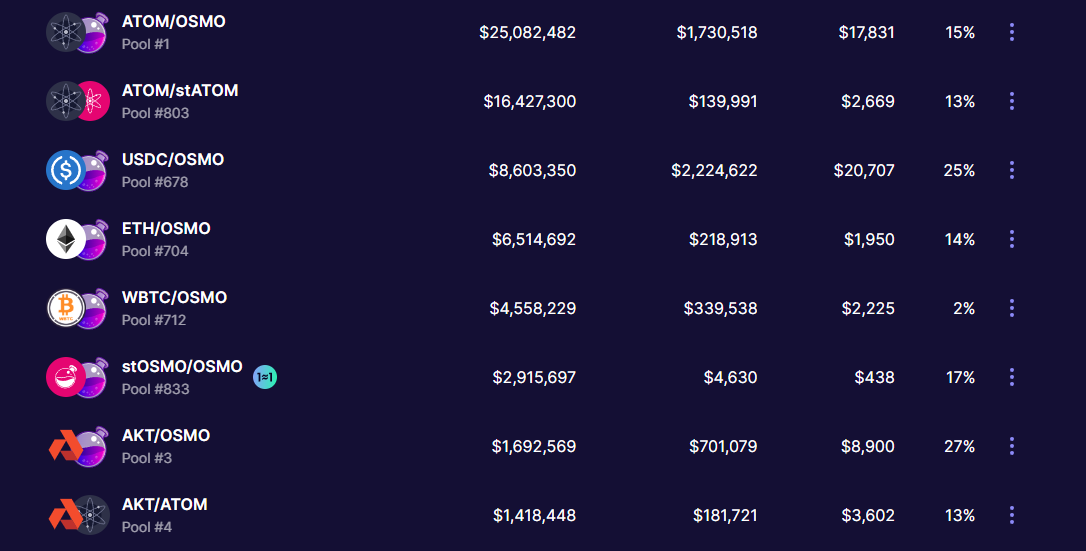

Among Cosmos DEXs, Osmosis is undoubtedly the leading protocol. Most staked ATOM mentioned earlier is deployed as LP on Osmosis, making it a cornerstone of Cosmos DeFi. As shown above, other projects have relatively low TVL—averaging around $25 million—while most capital concentrates on Osmosis.

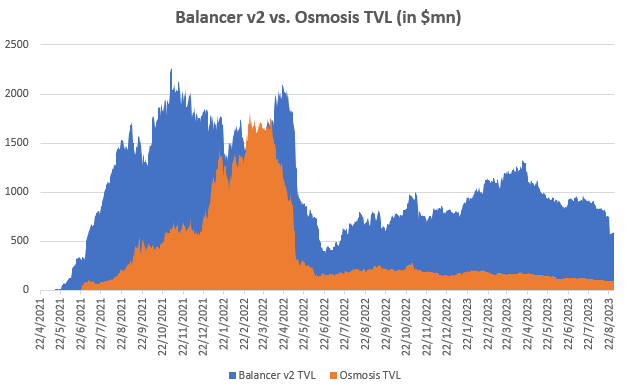

Despite Osmosis’ leadership within Cosmos, its liquidity and usage remain relatively low compared to the broader DEX market. The chart above compares Balancer v2 and Osmosis TVL. Before the series of DeFi/CeFi crises (pre-summer 2022), Osmosis barely kept pace with Balancer v2. However, later, due to massive liquidity withdrawals and the fact that $ATOM was not seen as a desirable holding during bear markets, Osmosis’ TVL has stagnated at low levels since mid-2022.

Osmosis

Osmosis is a DEX built on an Automated Market Maker (AMM) mechanism specifically designed for the Cosmos ecosystem. By integrating the IBC protocol, it supports cross-chain trading while offering strong flexibility and composability.

1. Foundations:

-

Osmosis combines the benefits of staking and liquidity provision, enabling investors to maximize returns. Unlike traditional DEXs requiring a choice between staking and providing liquidity, Osmosis integrates both.

-

By serving as a platform for staked ATOM as LP, Osmosis laid the foundation for Cosmos LSDFi and explains its prominence among Cosmos DEXs.

2. Osmosis Advantages as a DEX:

-

Superfluid Staking: Osmosis introduced a novel mechanism allowing investors to benefit from both liquidity provision and staking simultaneously. This dual-income system enables users to leverage both profit streams without choosing between them.

-

Customizable Liquidity Pools: Osmosis allows users to adjust parameters of their own liquidity pools, such as fees. This decentralized AMM framework lets market participants find the optimal balance between fees and liquidity rather than adhering to rigid, predefined protocol settings.

3. Considerations and Challenges:

-

Market Competition: The DEX market is highly competitive. Osmosis must continuously innovate to maintain its unique value proposition and attract users.

-

Security: As with all DEXs, security is paramount. Ensuring fund safety and vulnerability-free smart contracts is critical.

-

Adoption: Osmosis’ success also depends on broader Cosmos ecosystem adoption. If Cosmos gains more traction, Osmosis is likely to benefit.

Injective Protocol

Injective is a DEX offering cross-chain margin trading, derivatives, and forex futures. It leverages a Cosmos-based Layer-2 sidechain technology to achieve zero gas fees, high-speed trading, and full decentralization.

1. Core Components of Injective Protocol:

-

Injective Chain: A fully decentralized sidechain based on Cosmos Tendermint, acting as a Layer-2 derivatives platform, trade execution coordinator, and decentralized order book.

-

Layer-2 High-Speed Protocol: Achieves strong cross-chain compatibility and liquidity through bidirectional pegging with Ethereum.

-

Decentralized Order Book: Injective provides a decentralized order book, enabling on-chain trade matching and settlement.

-

Free Market Trading: Injective allows users to create their own derivatives markets, offering a fully decentralized peer-to-peer derivatives trading environment.

2. Technical Components of Injective Protocol:

-

Injective Exchange Client: Frontend interface for users.

-

Injective API: Middleware connecting the Injective Exchange client to the Cosmos layer.

-

Cosmos Layer: Tendermint-based blockchain supporting instant finality.

-

Ethereum Layer: Composed of Injective Bridge smart contracts, enabling bidirectional pegging with Ethereum.

3. Smart Contracts of Injective Protocol:

-

Injective Coordinator Contract: Coordinates derivatives trading between Ethereum and Injective Chain.

-

Staking Contract: Manages core staking functions on Injective Protocol.

-

Injective Derivatives Contract: Enables traders to create and use decentralized perpetual contracts.

-

Injective Bridge Contract: Manages bidirectional pegging between Ethereum and Injective Chain.

-

Injective Token Contract: ERC-20 contract designed for INJ.

Outlook for DEXes

-

Dependent on the Development of Staked Assets in Cosmos

DEX growth largely depends on LST asset adoption. LSDFi will become a new revenue frontier. For example, the LSDFi market on Ethereum has already reached a market cap of $1.9 billion. If Cosmos successfully develops its own LSDFi ecosystem, DEXes will be the most direct beneficiaries. Additionally, LSTFi can attract more users to DEXes. In the LSTFi ecosystem, users can earn returns not only through trading but also through liquidity provision. This new income model will attract more users to DEXes, further driving their development.

-

Ecosystem Limitations

Cosmos' strength lies in creating an interconnected ecosystem of protocols via Inter-Blockchain Communication (IBC) technology. However, this is also a double-edged sword: many Cosmos DEXes primarily revolve around Cosmos-native assets.

On these DEXes, the main traded tokens are platform tokens from projects built on the Cosmos SDK, such as Osmosis and Shade Protocol. Many liquidity provider (LP) assets—such as stATOM, SHD, AKT, INJ—are Cosmos-native tokens. This results in a lack of LP positions in popular non-Cosmos assets, somewhat limiting liquidity growth and usage on these DEXes.

To grow, a possible strategy is promoting Cosmos-based tokens for wider trading. However, this strategy is inherently limited, as it depends on the growth and development of the Cosmos ecosystem itself.

Alternatively, Cosmos and its DEXes could consider introducing popular external assets. This could be achieved through cross-chain bridges or partnerships with other blockchain platforms. Bringing in more external assets would not only increase DEX liquidity but also attract more users, driving further growth.

Lending: Waiting for the Singularity in Cross-Chain Lending

Umee

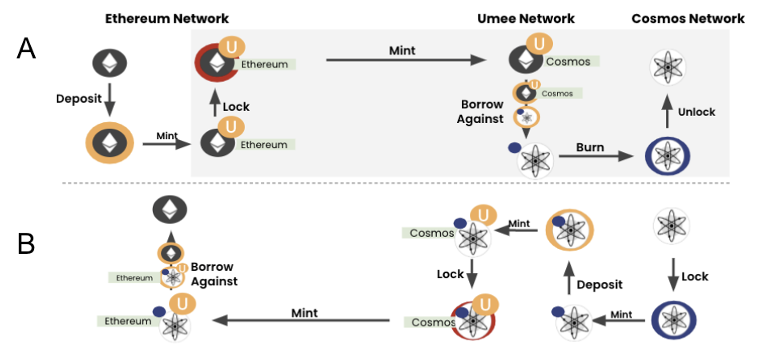

Umee is a primary lending platform designed to connect various blockchains, allowing users to pledge assets on one chain and borrow on another. This interoperability is a key feature, especially in a landscape where assets and liquidity are often confined within specific ecosystems.

1. Unique Value Proposition

-

Cross-chain Interoperability: Umee enables seamless interaction between different blockchains (e.g., Ethereum and Cosmos). This means users aren’t confined to a single ecosystem but can leverage assets and opportunities across multiple chains.

-

Staked Proof-of-Stake Assets: A unique feature of Umee is allowing staked assets from PoS blockchains to be used as collateral. This means users can pledge their staked assets without forfeiting potential staking rewards—a dual benefit of earning yield while gaining liquidity.

-

Algorithmic Interest Rates: Umee uses algorithmically determined rates that adjust based on market conditions, ensuring fair and dynamic borrowing and lending rates.

-

Security and Efficiency: By leveraging bridge solutions like Gravity Bridge, Umee ensures secure and efficient cross-chain interactions—critical for trust in DeFi.

2. Boosting the Cosmos Lending Market:

-

Influx of Liquidity: By enabling assets from other chains—especially popular ones like Ethereum—to be used within the Cosmos ecosystem, there could be a massive influx of liquidity. More liquidity generally means a stronger lending market. The chart above shows assets supported by Umee from other chains.

-

Increased Utility of Staked Assets: Nearly 70% of assets in Cosmos are staked. Umee’s model of using these staked assets as collateral can unlock significant value, driving more activity and growth in the Cosmos lending market.

-

Attracting New Users: Cross-chain functionality can draw users from other ecosystems into Cosmos. Reduced friction in moving and using assets across chains lowers the barrier to entering the Cosmos DeFi space.

-

Innovative Lending Mechanisms: Umee’s Universal Capital Facility, designed to facilitate cross-chain lending, could introduce new financial products and services, further enriching the Cosmos lending ecosystem.

Outlook for the Lending Market

Essentially faces the same challenges as DEXes—dependent on the development of staked assets in Cosmos and constrained by ecosystem limitations. Simply put, staked assets will continue to be a key factor in releasing lending market value. The market is similarly restricted by its focus on Cosmos-native assets. Although protocols like Umee and Tectonic offer borrowing services involving assets from other chains, these are not users’ primary lending choices.

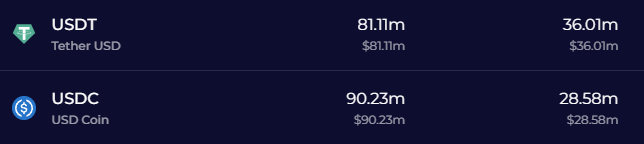

As shown above, the two main lending protocols primarily serve stablecoins and Cosmos-native assets (stATOM, OSMO), with no significant trading volume observed for assets from other chains. This limitation may hinder further market development.

Vaults: Smart Vaults and Cross-Chain Technology Driving Growth in Liquidity and Diversity

Sommelier

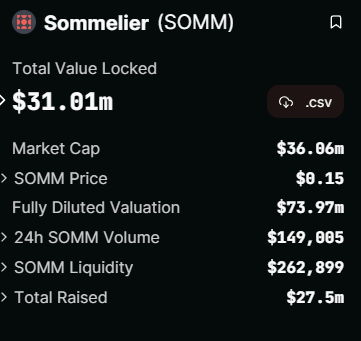

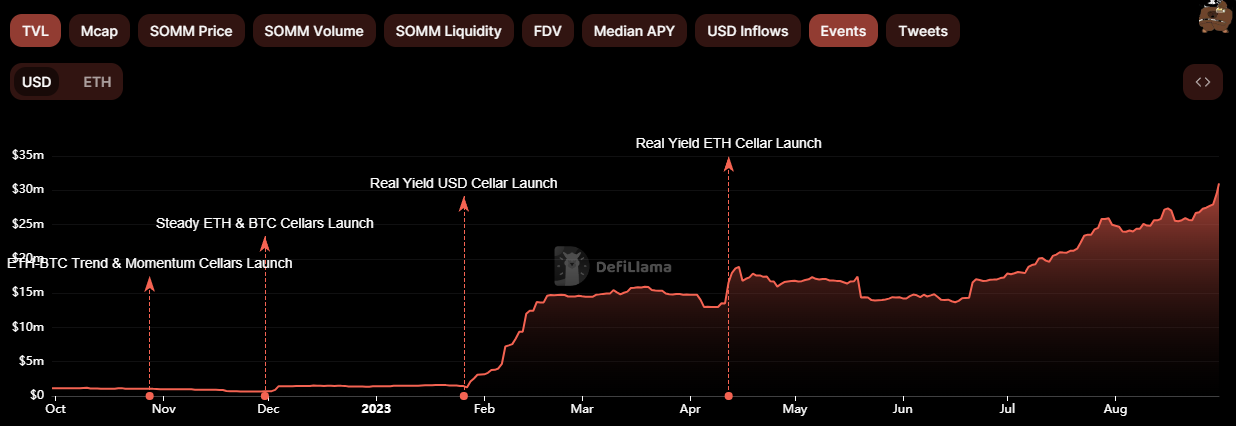

Sommelier is a decentralized asset management protocol introducing the concept of “smart vaults” to DeFi. Unlike traditional static strategies that may become obsolete due to market changes, Sommelier’s vaults aim to predict, react, optimize, and evolve based on real-time DeFi market conditions. Built on the Cosmos SDK and bridged to high-value EVM networks, it enables seamless integration across different blockchain ecosystems. Its TVL has steadily increased since the launch of the Real Yield ETH Cellar, making it an essential bridge connecting the Cosmos ecosystem with external yield-generating protocols.

1. Sommelier’s Value Proposition:

-

Smart Vaults: Sommelier vaults are characterized by adaptability:

-

Predict: Estimate future yields using predictive modeling.

-

React: Adjust positions and leverage ratios in response to major market shifts to prevent potential liquidations.

-

Optimize: Implement efficient leverage solutions to minimize associated fees.

-

Evolve: Mine new yield opportunities by updating algorithms and protocols.

-

Off-chain Computation: Sommelier’s architecture enables off-chain rebalancing calculations. This ensures strategy privacy while allowing the use of sophisticated data modeling techniques similar to those in traditional finance.

-

Bridgeless Asset Access: Sommelier offers multi-chain access without requiring asset bridging, reducing complexity and potential risks associated with bridges.

-

Decentralized Governance: Transactions and operations on Sommelier are managed by a validator set, ensuring both security and responsiveness to user preferences. This decentralized approach keeps the platform censorship-resistant.

2. Boosting the Cosmos Lending Market:

-

Increased Liquidity: By bridging to high-value EVM networks and introducing smart vaults, Sommelier could bring more liquidity into the Cosmos ecosystem—crucial for a thriving lending market.

-

Innovative Lending Mechanisms: The adaptability of Sommelier vaults means they can respond to market conditions, potentially introducing new lending strategies and enriching the Cosmos lending ecosystem.

-

Cost Reduction: Aggregation and batch processing of transactions by Sommelier can reduce gas fees, making lending on Cosmos more economically efficient.

Outlook for the Vault Market

Sommelier’s smart vaults and cross-chain capabilities not only provide users with advanced asset management tools but also bring broader liquidity and diversity to the Cosmos ecosystem.

Sommelier’s unique architecture—particularly its off-chain computation and bridgeless asset access—offers a more efficient, secure, and cost-effective solution for DeFi. This model could attract more developers and projects to the Cosmos platform by providing a more flexible and scalable environment for building and optimizing DeFi applications.

Moreover, Sommelier’s decentralized governance and validator set ensure transparency and security, further enhancing user trust in the Cosmos DeFi ecosystem.

In summary, as Sommelier continues to develop and refine its offerings, it is poised to make significant contributions to the prosperity and growth of Cosmos DeFi, opening new opportunities and possibilities for the broader cryptocurrency space.

Deep Dive Analysis

Liquidity Concentration: Heavy Reliance on ATOM Further Increases Narrative Pressure on the Token

Correlation Between Liquidity Concentration and Protocol Value

In blockchain and decentralized finance (DeFi), liquidity is a key metric reflecting a protocol or platform’s health and attractiveness. Higher liquidity means lower transaction costs and faster execution for users.

The native asset ATOM of the Cosmos mainnet is widely used across multiple DeFi protocols. If a protocol has a high proportion of ATOM liquidity, it indicates heavy reliance on Cosmos’ native assets. In other words, if ATOM is significantly withdrawn from a protocol, its value could be severely impacted.

Relationship Between ATOM and Protocol Value

If most of a protocol’s value is concentrated in ATOM, then its value is heavily dependent on ATOM. This means any factor affecting ATOM’s value—market dynamics, technical upgrades, or governance decisions—could indirectly impact the protocol.

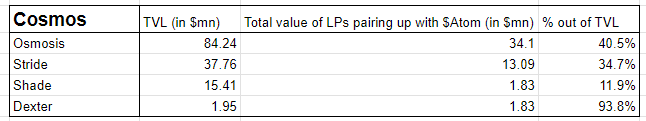

Liquidity concentration in the Cosmos ecosystem reveals its high dependence on the native asset ATOM. Data shows that liquidity pools composed of ATOM assets (including stATOM, qATOM, and other staked variants) account for an average of around 40%. This indicates that protocols in the Cosmos ecosystem are relatively concentrated in ATOM liquidity, unlike mainstream liquidity providers on Uniswap or Balancer, which focus on diverse asset offerings.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News