BiB Exchange: Staying true to our original mission in the new year, starting with the blockchain trilemma

TechFlow Selected TechFlow Selected

BiB Exchange: Staying true to our original mission in the new year, starting with the blockchain trilemma

In any case, I examine myself three times a day; perhaps we should really pause and do some deep reflection.

Author: BiB Exchange

Introduction

2023 has passed, and 2024 has arrived. Amid the bustling crowd, have you noticed that the crypto space has changed its tone recently? It’s not the dazzling fireworks of a new year celebration, but rather a desperate, melodious chant singing of illusory prosperity.

Recently, with various projects being launched nonstop and KOLs promoting them in increasingly creative ways, wave after wave of stories about hundred- or thousand-fold returns have been swirling around us. Survivorship bias is being amplified endlessly, causing many ordinary investors to grow restless. Phrases like “You don’t understand this project—if you don’t get involved now, you’ll be left behind,” or “Forget technology—market consensus is the only consensus”… Some regard these as golden words of wisdom, while others see them as alarmist nonsense. Amidst all the noise, who is right and who is wrong?

The higher someone stands, the more cautious they tend to be in speech. Many people express opinions casually or with ulterior motives. Even if such statements aren’t malicious, due to limited understanding (or perhaps feigned emotional ignorance), they might influence you—and even lead you into the abyss. However, given these individuals’ influence or the collective power of prevailing narratives, your investment style may drift off course. Once you make trading mistakes in this process, you may begin deeply doubting your own principles, becoming confused, anxious, and fearful.

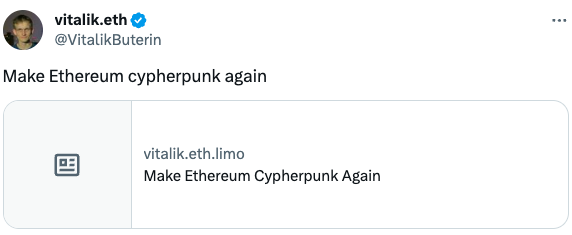

Regardless, we must reflect on ourselves daily. Perhaps it's time for us to pause and engage in deep thinking. Even Vitalik Buterin, the most influential individual in the crypto world, declared on social media at the end of 2023 his intention to return to blockchain’s original applications.

Main Body

In the field of digital currencies, staying true to our original mission fuels our progress, and returning to the essence of crypto’s "impossible trinity" forms the foundation for sustained advancement. We must always remember the初心 of cryptocurrencies and blockchain technology—to build an open, transparent, and decentralized value transfer network. At the same time, we must recognize the "impossible trinity" dilemma in the crypto space: a system cannot simultaneously achieve full decentralization, absolute security, and high efficiency.

With continuous technological advancements, the cryptocurrency market is entering a new wave of transformation. This article by BiB Exchange will delve into the latest developments across the overall cryptocurrency ecosystem, providing detailed analysis and summaries of ten key sectors: traditional finance and Bitcoin evolution, ETH and Layer 2 development, public chains, cross-chain bridges, oracles, inscriptions, DePIN, GameFi, SocialFi, and AI-integrated blockchains.

Part One: Traditional Finance and Bitcoin Evolution

For Bitcoin, 2024 promises to be a year of great turbulence and imminent takeoff. A major milestone marking traditional finance entering a new era is the expected launch of spot Bitcoin ETFs in January 2024. Although initial attempts may fail, strong signals indicate that within the first half of the year, spot Bitcoin ETFs will become one of the most successful ETF launches in history. According to BiB Exchange’s analysis, this landmark event could draw at least 1% of U.S. equity ETF market share—over $72 billion—into BTC spot ETFs, bringing unprecedented market recognition to Bitcoin.

In April 2024, Bitcoin underwent its fourth halving—a mechanism traditionally seen as triggering bull markets. History has repeatedly shown that Bitcoin prices surge significantly after halvings, and this time should be no exception. Market analysts predict Bitcoin could surpass $100,000, delivering substantial returns to investors. For further insights, readers can refer to BiB Exchange’s previous column article, “From Worst to First? 2024 Bitcoin Halving & Cycle Analysis,” which offers an in-depth examination of the halving phenomenon and deeper analytical perspectives.

The U.S. presidential election concludes on November 5, 2024. The two parties’ approaches to national debt and Federal Reserve policies will impact market regulatory mechanisms. It is anticipated that the winning party will gradually reduce market constraints, creating a more favorable environment for industry growth. This shift is widely viewed as a positive factor for the market, laying a solid foundation for steady development across industries.

Circle, the parent company of USDC, plans to go public in April 2024—an emblematic moment signaling digital finance integrating into traditional finance. This marks broader acceptance of the digital currency sector within traditional financial markets, injecting fresh vitality into the industry and providing robust support for the promotion and development of digital currencies.

Finally, in the second half of 2024, expectations of Federal Reserve rate cuts could unleash liquidity, lowering capital costs and boosting investment and purchasing power. While rate cuts are not guaranteed, this optimistic outlook provides investors with confidence, highlighting Bitcoin’s strong momentum under multiple favorable conditions. Indeed, 2024 will be a vibrant and opportunity-rich year for Bitcoin and the broader digital currency landscape.

The evolution of traditional finance, in a sense, represents complete centralization of crypto assets—the best pathway from niche circles to mainstream participation, breaking away from the isolated corner once occupied solely by crypto enthusiasts.

Part Two: The Rise of ETH and Layer 2 Technology

In 2024, Ethereum (ETH) may undergo significant transformation, starting with upgrades. January 17, 2024, is tentatively scheduled for the deployment of the first testnet for the upcoming "Dencun" upgrade. Ethereum’s revenue is expected to rise sharply in 2024—potentially several times that of 2023. This surge stems primarily from the growing number of on-chain applications and ongoing improvements from ETH’s Cancun upgrade. BiB Exchange believes the Cancun upgrade will drastically reduce gas fees on Layer 2 (L2), lowering transaction costs and benefiting the entire Ethereum ecosystem. Originally planned for Q4 2023, the delayed Cancun upgrade remains highly anticipated, with expectations set for Q1 2024. While further delays remain possible, they are unlikely to be prolonged.

Breakthroughs in L2 technology will also profoundly impact Ethereum’s future. The core idea of L2 is building second-layer solutions atop blockchains to enhance transaction speed and lower fees. Solutions like Optimistic Rollup and ZK-Rollup have greatly improved blockchain performance and scalability. By constructing independent blockchain networks above the main chain, L2 significantly boosts transaction speed and throughput. Readers interested in deeper technical details can refer to BiB Exchange’s earlier piece, “BiB Exchange: Unveiling the Speed and Thrill of Blockchain—Layer 2.”

Currently, ARB and OP use Optimistic Rollup, which many tech experts consider relatively low-tech. ZK-based protocols are their true faith. Thus, zkSync and StarkNet are among the most anticipated projects in the L2 space. zkSync is a Layer 2 scaling solution based on zk-rollups, using zero-knowledge proofs to verify transactions. Meanwhile, StarkNet, another major zk project, leverages STARK protocols and different technical paths to achieve Layer 2 scaling, showcasing distinct design philosophies.

Beyond established zk-L2 players, RWA-focused projects Metis and Manta Network are gaining attention. Under RWA leadership, stablecoins may become preferred options in more products—even replacing credit cards in some scenarios. Built on Optimistic Rollup, Metis aims to solve the impossible trinity challenge involving decentralization, security, and scalability. Manta Pacific is a modular L2 ecosystem ideal for EVM-native ZK applications and dApps seeking minimal cost and optimal user experience.

Both projects tie into traditional finance. JPMorgan plans to issue an RWA fund on-chain, tokenizing real-world assets and opening new avenues for blockchain-traditional finance integration. Together, these developments suggest Ethereum will see comprehensive technological and ecological enhancement in 2024, laying a stronger foundation for the future of digital currencies.

Part Three: Flourishing Public Chains

In 2024, public chain technology will make significant strides. BiB Exchange predicts that first-generation public chains like Bitcoin and Ethereum will continue expanding and optimizing performance. Bitcoin may achieve better scalability, while Ethereum fully transitions to PoS consensus and sharding technology. Meanwhile, emerging public chain projects such as Solana and Avalanche—representing third-generation chains—will attract more decentralized applications and form mature ecosystems.

In December, SOL surged more than any other public chain, even outshining ETH. This was driven largely by Jito, a liquid staking protocol in the Solana ecosystem, launching its governance token JTO. Notably, core contributors did not participate in the airdrop, allowing the community to capture most benefits. Another standout story was Silly in the SOL ecosystem, whose wealth-generation narrative spread rapidly, with price increases reaching tens of thousands of times—evoking tears of regret from those who hadn’t invested. Following this, the number of ecosystem projects skyrocketed.

These high-speed, low-cost public chains will improve metrics such as transaction speed and network capacity. For example, Avalanche supports over 4,500 TPS and more than 100,000 validator nodes. Its collaboration with Chainlink brings high-quality external data onto the Avalanche network. Additionally, its subnet functionality has officially launched, enabling customized sub-chains tailored to diverse dApp needs.

December also saw rapid price surges in LUNA/LUNC/INJ, with Cosmos ecosystem tokens averaging over 300% gains, despite ATOM, the native token, performing modestly. BiB Exchange pays close attention to the Cosmos ecosystem—not only because exchanges like dYdX chose Cosmos as their primary chain, but also due to recent proposals granting liquid staking capabilities to staked ATOM, suggesting bright prospects ahead.

Turning to the Polkadot ecosystem, one immediately noticeable feature is its exceptionally high staking yield of 16%, far exceeding ETH’s ~4%. This makes DOT highly attractive, especially under new governance rules introducing roles for holders and technical associations. Compared to the original model, the updated governance structure is more decentralized, strengthening the relationship between Polkadot and its token holders.

Part Four: Innovation in Cross-Chain Bridges

Multi-chain interoperability is an inevitable trend driving industry progress, with cross-chain bridge technology serving as the key enabler. BiB Exchange believes next-generation cross-chain bridges will not only enable seamless interactions between digital currencies but also connect disparate blockchain networks, further fueling the prosperity of the broader crypto ecosystem. As previously mentioned, cross-chain interoperability represents a new direction in public chain development.

Projects like Cosmos and Polkadot will continue refining cross-chain bridging and asset transfer processes, making cross-chain calls more convenient and helping build open networks connecting multiple chains. New public chain models will emerge—for instance, homogeneous chains sharing security across multiple blockchains, or zero-knowledge proof consensus enhancing privacy protection. These innovations will push public chains to new heights in security and performance. For example, Cosmos now supports CCTP-enabled native USDC, forming a cross-chain ecosystem dedicated to bridging different blockchains.

Even cross-chain bridge projects like SOBB between SOL and BTC have drawn tens of thousands of users holding BRC-20 and SOL ecosystem assets, eager to secure whitelist spots. To win one of just 1,350 whitelist allocations, massive gas fees were burned. With four tasks each attracting at least 3,000 participants but awarding only five whitelists total, the intensity surrounding such a bridge project becomes evident.

We should also pay attention to controversial cross-chain bridge projects. Despite being embroiled in litigation, the FTX Foundation sued LayerZero Labs back in September 2023. Yet this hasn’t diminished LayerZero’s market influence or utility across various public chains. The project has long had the capability to incorporate a native token, and the community has now explicitly announced plans to launch the LayerZero token, expected in the first half of 2024.

Part Five: Intelligent Applications of Oracles

Many have witnessed TRB’s explosive price rally. Some call it a pump-and-dump scheme orchestrated by a small group, possibly Korean whales; others claim 20 addresses control 95% of TRB tokens. Regardless, at its core, this project is simply an oracle. Even at such elevated token prices, its market cap remains under $600 million.

Oracles are receiving increasing attention in the digital currency domain. Recent developments show oracles are evolving beyond mere data transmission tools—they are becoming essential components of smart contracts. Their integration makes smart contract execution more reliable and efficient, offering stronger support for the adoption and application of digital currencies.

BiB previously published “BiB Exchange: Exploring the Hidden Corners of Oracles,” offering a comprehensive and in-depth look at Chainlink, which connects blockchain systems with real-world data. Oracles extract data from external sources and bring it onto the blockchain for smart contracts to invoke and utilize.

Another notable project is Pyth, whose data providers include Vela Exchange, Unidex, HMX, and Synthetix. Some argue Pyth only delivers price data, limiting its data volume compared to competitors. However, Pyth ensures resistance against manipulation by aggregating data from multiple sources and providing confidence intervals alongside price feeds.

Part Six: Breakthroughs in Inscription Technology

This wave of popularity has benefited many, particularly projects like ORDI, SATS, and RATS, which sparked market excitement. Bitcoin inscriptions refer to the technique of engraving text or data onto the Bitcoin blockchain—content ranging from images, videos, audio, and text. NFTs via inscriptions continue rapid growth, finding widespread use in art and gaming. NFT standards are also continuously improving, enabling representation of more types of digital assets and collectibles. Major brands are launching their own NFT series, making NFT marketing a new trend.

Inscription technology represents an innovative advancement in digital currencies, introducing cryptographic algorithms into transactions to enhance privacy and security. The latest inscription technologies not only protect user privacy but also offer better compliance-friendly solutions, supporting sustainable development in the digital currency industry.

Part Seven: The Rise of GameFi

Many believe GameFi will act as a catalyst for the 2024 bull market, with GameFi project tokens poised for explosive growth. In BiB Exchange’s article “From Poverty and Confusion to Passion: BiB Exchange Explores the World’s Largest GameFi Market—The Philippines,” it was highlighted how GameFi can even impact a nation’s industrial landscape.

Play-to-Earn (P2E) was GameFi’s initial value proposition, rapidly growing through game models that reward players with cryptocurrencies or NFTs. Many traditional gaming companies are now entering this space, attempting to redefine business models using blockchain technology. However, challenges remain regarding sustainability and scalability. While P2E has limitations, newer models have emerged, including Move-to-Earn, Play-and-Develop, social games, decentralized games, metaverse games, NFT interoperable games, and Games-as-a-Service.

The gaming sector extends beyond entertainment into areas like gambling. For instance, in December 2023 alone, over $1 billion flowed into prediction markets for gambling, establishing itself as a new killer app in the crypto space.

Ultimately, what drives gaming is massive markets and user bases. Consider the trajectories of classic online games like *Fantasy Westward Journey*, *Legend of Mir*, *DNF*, *DOTA*, *League of Legends*, and mobile hits like *Honor of Kings* and *PUBG Mobile*. The transition of these mobile games into Web3 gaming is undoubtedly promising and worthy of investment.

Part Eight: Frontier Exploration in DePin

Recently, the DePin sector has gained tremendous traction. With the rise of various inscriptions, people are realizing that mining groups have quietly become hidden wealth accumulators. When discussing mining, many think of Filecoin. Viewed rationally, the miners from the 2021 bull run appear to be returning—having started positioning themselves in mining tokens from 2019 to 2020. Are they now preparing again ahead of the 2024 bull market? Especially noteworthy is that major stakeholders behind FIL and ICP—Wanxiang Blockchain Lab and HashKey Capital—have jointly launched Future 3 Campus, a Web3 innovation incubation platform focusing on Web3 mass adoption, DePIN, and AI. Is everyone gearing up to start “mining” again? Something worth pondering.

DePin stands for Decentralized Physical Infrastructure Networks. Its core concept is using tokens to incentivize users to deploy real-world hardware devices to provide goods, services, or digital resources.

DePin can be divided into two categories:

-

Physical Resource Networks (PRN): Users provide WiFi, 5G, VPN, and similar services through distributed hardware devices.

-

Digital Resource Networks (DRN): Hardware infrastructure provides digital resource networks, including broadband, storage, and computing power.

DePin leverages hardware and resources, using token incentives to decentralize and lighten heavy-asset services, solving cold-start problems. It employs a spiral-up mechanism allowing users, providers, and platforms to participate with minimal risk. DePin enhances the security and credibility of digital currencies through decentralized identity verification.

According to BiB Exchange, a representative project is Helium. Helium Mobile, a blockchain-based decentralized network company, focuses on IoT infrastructure and DePIN (Decentralized IoT Protocol) technology development. Its core product is a blockchain-powered distributed IoT network, driving the convergence of blockchain and IoT in infrastructure.

Helium Mobile reduces network construction and maintenance costs by incentivizing users to provide coverage and transmission services. Users pay only a small device fee to join the network and earn token rewards. Key competitors include DIMO and Hivemapper—blockchain-based decentralized networks and data platforms competing for data transmission and analytics in IoT and autonomous vehicles.

Other hot projects worth investor research include LoRaWAN routers, Shiba Inu partner Bells' mining initiative, Mynd, and others—all actively promoted.

Part Nine: SocialFi

SocialFi is nothing new—it refers to decentralized social applications combining social features with blockchain and cryptocurrency technologies. After DeFi and GameFi, it’s another rising sector in blockchain. During the last bull market, some predicted it would become a hotspot favored by investors, yet actual market performance often fell short.

The SocialFi ecosystem is rapidly expanding, forming unique product ecosystems across networking, storage, data, social infrastructure, and application layers:

-

Social Tokens: Represent membership in online communities or grant privileges such as access rights, voting power, or influence—examples include Rally (RLY), Friends With Benefits (FWB), and BitClout for content creation.

-

Social Wallets: Designed for social connections, tipping, and transactions, enabling seamless crypto transfers within social contexts—e.g., Phantom, Solana Wallet, MetaMask.

-

Social NFT Platforms: Platforms where users buy, sell, trade NFTs while interacting—such as Blur, OpenSea, LooksRare, and Solanart.

-

Social DAOs: Platforms for launching DAOs with built-in profiles, chat, and forum functions—e.g., Collab.Land, Prime DAO, Snapshot for proposal voting.

-

Social Platforms: Combine social networking with crowdfunding to raise funds—like BitClout and Cluster—or emphasize social interaction in virtual worlds such as Cryptovoxels and Decentraland.

-

Social Gaming Platforms: Blockchain games emphasizing social interaction and community—e.g., Axie Infinity, The Sandbox.

Additional applications include investor-focused social networks, content creation platforms, infrastructure tools, donation/charity platforms, blogs/text publishing, and more.

Traditional metaverse projects like Sandbox and MANA pioneered social experiences in virtual worlds. With the rise of the Metaverse concept, new integrations between SocialFi and GameFi are foreseeable, opening vast imaginative possibilities for SocialFi applications. As a fusion of social networks and crypto economies, users can earn crypto tokens by sharing content and building communities. BiB Exchange believes SocialFi eliminates the exploitation inherent in centralized social media, allowing creators to capture more value. This is why many in the industry see promise in SocialFi as a seamless bridge from Web2 to Web3. If SocialFi applications successfully penetrate mainstream markets, their potential to reshape social and content industries is enormous.

Part Ten: Integration of AI and Blockchain

From ChatGPT to large tech firms launching Wenyan, Google’s Bard, Amazon’s Claude, and Musk’s GROK—conversational AI systems—we can see rapid iteration and progress in this field, with compelling projects and their backing capital unfolding before the public eye.

In digital currency development, AI projects have also become focal points. AI applications will deliver smarter, more personalized services, pushing the industry forward. First, in market analysis and forecasting, machine learning algorithms can analyze vast datasets to detect trends and patterns, helping investors make wiser decisions—especially critical in the highly volatile crypto market.

Second, trading strategies: Using AI to predict market trends and user behavior can improve automation efficiency in DeFi products. AI enables intelligent trading strategies. Machine-learning algorithms can continuously optimize and adapt to changing markets, helping investors better manage risks and generate returns. Hedge funds and professional trading firms are already adopting these technologies. If AI models evolve into decentralized autonomous agents, they could disruptively transform existing economic systems.

Third, fraud detection: AI can identify suspicious transaction patterns by monitoring account activities, helping prevent fraudulent behavior. Conversely, AI can also simulate adversarial actors. Lastly, AI integration with blockchain and smart contracts may enable more efficient and intelligent execution and management of smart contracts.

Image source: Foresight News:https://foresightnews.pro/article/detail/49670

The above covers recent developments in AI-blockchain integration, with numerous projects emerging. These technologies are not only reshaping financial systems but influencing all aspects of human society, bringing new economic models, cultural forms, and organizational structures—while also posing risks and uncertainties. Nevertheless, BiB Exchange believes this technological revolution is unstoppable. We are all witnesses—and participants—in this historic transformation.

Conclusion

Stay true to our original mission and return to the essence of crypto’s “impossible trinity.” Seamless linkage from Web2 to Web3 will be the easiest path forward. Web3, as a new wave of blockchain application in the internet realm, realizes decentralized networks and applications powered by blockchain and crypto economics—including decentralized identity, data ownership, and communication payments—with potential expansion into new domains like the metaverse. BiB Exchange believes the development of digital currencies is endless. Ordinary participants in the crypto space must keep learning and innovating, seize opportunities in technological advancement, and drive the industry toward a more prosperous future. Only by constantly returning to our初心 and preserving the spirit of innovation can we move forward and transcend limits in the ever-evolving tide of digital currencies.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News