Three Major Events in 2024 Heat Up the Web3 Sector

TechFlow Selected TechFlow Selected

Three Major Events in 2024 Heat Up the Web3 Sector

A new round of cryptocurrency bull market has begun.

Author: Weilin

With the Bitcoin ETF decision approaching, the Ethereum Cancun upgrade set to activate, and the quadrennial Bitcoin block reward halving drawing near, the Web3 industry in 2024 will open a new chapter driven by these three major events.

The approval of a Bitcoin ETF will provide new assurances for Bitcoin's liquidity and investment accessibility, attracting more investors into the Bitcoin market. The Ethereum Cancun upgrade will significantly enhance Ethereum’s scalability, providing stronger underlying infrastructure for the development of Web3 applications. The Bitcoin halving will reduce the supply of new Bitcoin, theoretically driving up its price.

Industry analysts predict that these three events will serve as key turning points marking the transition of the crypto market from bearish to bullish.

Bitcoin ETF

On December 29, 2023, Reuters reported a major update: the U.S. Securities and Exchange Commission (SEC) may inform applicants on January 2 or January 3 (U.S. time) whether they are approved to launch spot Bitcoin ETFs (exchange-traded funds), giving them time to prepare for a potential launch on January 10.

To date, 13 issuers have submitted applications for spot Bitcoin ETFs to the SEC, including Grayscale, BlackRock, Fidelity, VanEck, ARK+21Shares, and Bitwise. These firms plan to offer spot Bitcoin ETFs on exchanges such as Nasdaq, Cboe BZX, and NYSE Arca.

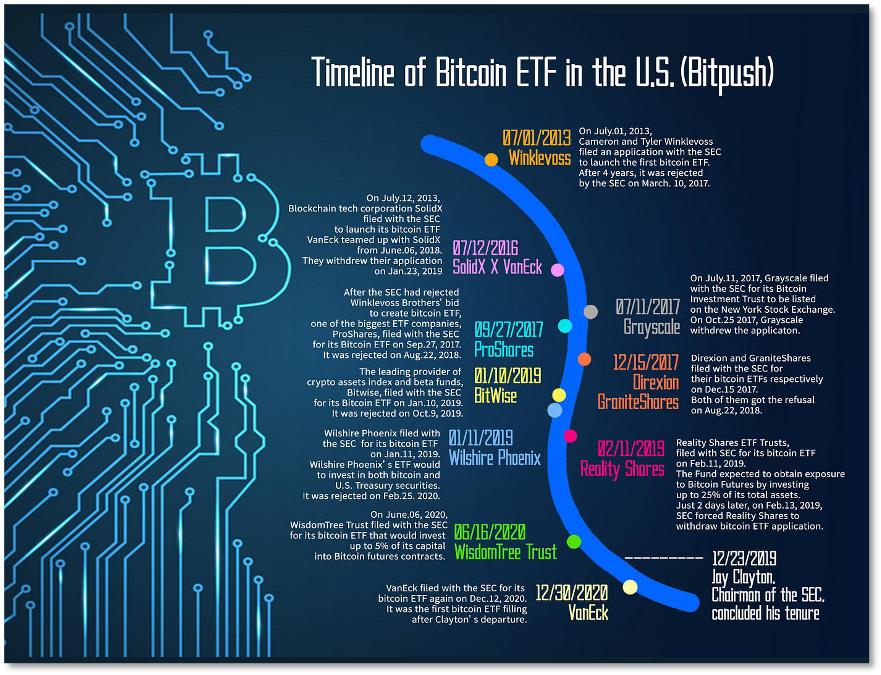

Image source: BitPush

On December 29, multiple companies filed amendments; earlier, on December 21, several applicants participated in a rare joint phone call with the SEC.

By no later than January 10, the SEC must respond to the spot Bitcoin ETF applications. The industry widely believes that approval is highly likely.

Investment research firm Fundstrat predicts that once spot Bitcoin ETFs are approved, Bitcoin’s price could surge more than fivefold from current levels—exceeding $150,000 and potentially reaching $180,000. Over $2.4 billion is expected to flow into newly approved U.S. spot Bitcoin ETFs in the first quarter of 2024 alone.

Ethereum Cancun Upgrade

For a long time, amid fierce competition with other blockchains, Ethereum has not held a dominant position. Its design is relatively complex, and upgrades require lengthy preparation periods. Compared to Bitcoin, Ethereum lacks advantages in terms of asset perception, while against competing chains, the Ethereum network often suffers congestion due to sudden surges in popular applications, leading to transaction delays and high fees, along with limited scalability.

However, the upcoming Cancun upgrade, anticipated in the first quarter of this year, will bring significant performance improvements to the Ethereum network. By introducing sharding technology, the Cancun upgrade will enable Ethereum to process multiple shards simultaneously, greatly increasing transaction throughput. This will allow the network to meet growing user demand and support more decentralized applications and transactions. Additionally, the upgrade will reduce transaction fees on the Ethereum network.

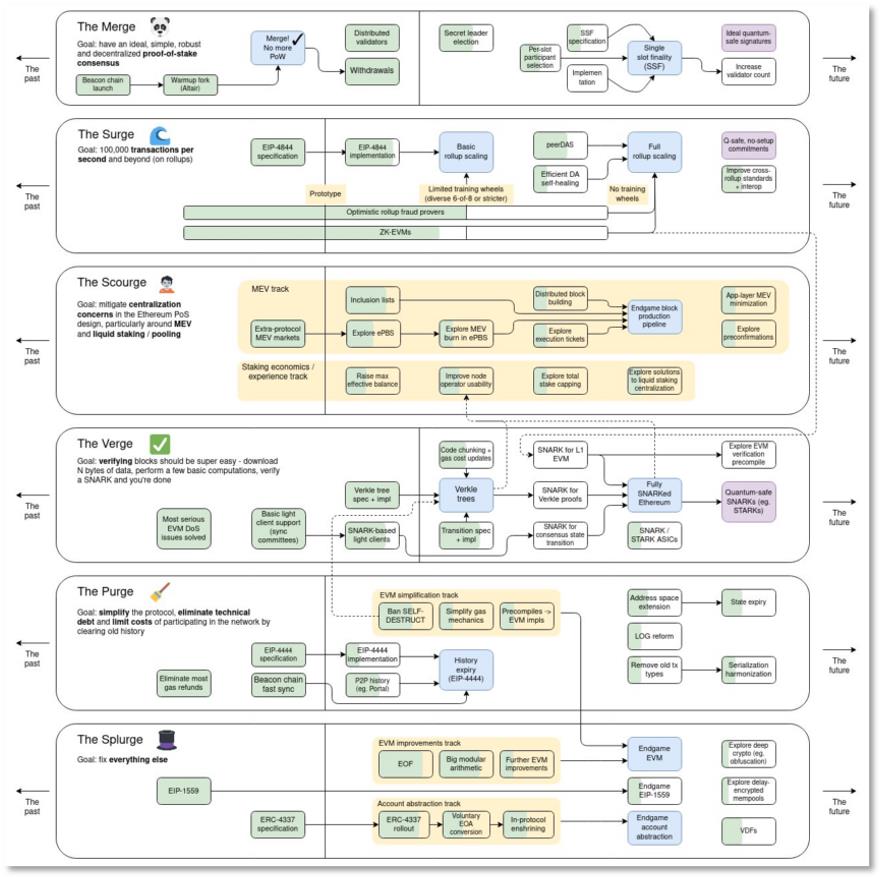

Ethereum co-founder Vitalik Buterin recently shared an updated roadmap, demonstrating a commitment to continuous improvement and innovation.

One key update involves implementing Single Slot Finality (SSF) within post-merge Proof-of-Stake (PoS) enhancements. SSF aims to address many of the current shortcomings in Ethereum’s PoS design, enabling faster and more secure transactions.

Developers have also made substantial progress in other areas like Surge, including advancements in EIP-4844 and rollups. These improvements enhance Ethereum’s scalability and efficiency—critical factors for its long-term success.

Buterin’s roadmap also addresses economic centralization challenges in PoS through initiatives like Scourge. This redesign focuses on mitigating Maximum Extractable Value (MEV) and general staking pool concentration, which are crucial for maintaining network integrity and decentralization.

Analysts remain optimistic about Ethereum’s future, with some predicting that after the Cancun upgrade, Ethereum’s price could surpass $5,000, while Layer 2 solutions will dominate the Ethereum ecosystem, bringing foundational advancements for decentralized applications across various chains.

Bitcoin Block Reward Halving

The Bitcoin block reward halving is expected in April 2024. This cyclical event will further reduce Bitcoin’s supply, theoretically pushing its price upward.

Bitcoin halving is a predetermined event where the block reward for mining new bitcoins is cut in half. The initial reward was 50 BTC in 2012, reduced to 25 BTC in 2016, then to 12.5 BTC in 2020. The next halving is expected in April 2024, reducing the mining reward per block to 6.25 BTC.

This year, protocols like Ordinals have led a new wave in the Bitcoin ecosystem, reshaping Bitcoin’s image. In particular, the novel inscriptions experiment based on the Ordinals protocol has introduced fresh variables into Bitcoin—a cryptocurrency that had evolved over more than a decade primarily as a "payment currency"—even beginning to show early signs reminiscent of the Ethereum ecosystem.

Not only have NFTs emerged on the Bitcoin network, but fungible token assets can now also be issued via protocols. At the same time, debates around innovations like BRC20 continue to spark heated discussions. Following the rise of inscriptions, the emergence and development of Bitcoin Layer 2 networks could alleviate the pressure that new asset issuance places on the Bitcoin mainnet.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News