Why You Should Pay Attention to Meson Network Ahead of the AI and DePIN Boom?

TechFlow Selected TechFlow Selected

Why You Should Pay Attention to Meson Network Ahead of the AI and DePIN Boom?

Meson relies on numerous nodes, making product operations more stable and the business model clearer.

Author: TechFlow

At the turning point between the old and new year, reflection and outlook remain timeless themes.

If asked which sectors have been impressive and still hold growth potential next year, DePIN would certainly claim a spot.

Top-tier crypto VCs repeatedly mention DePIN in their annual outlooks. Combined with Solana's ecosystem recovery gaining momentum by year-end, DePIN concept tokens such as Helium Mobile, DIMO, and HONEY have surged. Recently, Grass announced a $3.5 million funding round, quickly capturing user interest in passive "zero-effort mining" through simple background operations...

Beyond the collective excitement across the sector, let’s apply research-driven thinking to reflect calmly:

What is the underlying logic behind DePIN’s growth? Is jumping into this trend now still a good move?

As Solana's ecosystem becomes crowded, returns for users rushing in to grab pieces of the pie are gradually declining—should we proactively look beyond the hype for other undervalued opportunities?

To uncover new opportunities within the DePIN space in the coming year, we need to look past its surface narrative and identify projects that support its core logic yet remain under the radar.

From DePIN to AI: Collecting Public Data to Raise the Sector’s Ceiling

Different perspectives on DePIN’s narrative can lead to different investment strategies and outcomes.

-

Surface-level view: DePIN equals device mining

From an end-user perspective, this isn’t wrong. The lower the device barrier and the earlier you join a project’s network, the more project tokens you earn—leading to higher short-term profits from mining and selling.

But clearly, this is a short-term profit strategy.

-

Deeper view: DePIN equals decentralized collection of public resources (data)

Have you ever thought about what exactly you’re mining?

The individual mining rewards in DePIN are actually incentives for contributing resources—whether driving data, IP addresses, location, bandwidth, etc.

Under Web3’s incentive mechanisms, vast amounts of public data can be collected in an unprecedented decentralized manner. The more distributed and diverse the data, the greater its value across industries.

In contrast, no centralized organization could efficiently gather such massive, dispersed, and varied data under traditional models.

Therefore, while the visible narrative of DePIN is device mining, its core logic lies in “efficient collection of public data.”

Let’s simplify this logic further:

You own the right to generate data → You use devices to produce data → You share ownership of that data → Contribute to others’ data needs → Finally, you receive rewards.

Which industry most needs access to large-scale public data? Undoubtedly, the clearest demand comes from AI model training.

Take the well-known GPT models: their strong performance stems from OpenAI’s training on vast volumes of publicly available internet text data.

On the flip side, who can contribute large amounts of public data? Naturally, low-barrier, low-cost, technically accessible DePIN projects.

However, in practice, the number of internet IPs directly impacts the efficiency of crawling public data for AI training. Theoretically, the richer a DePIN project’s IP resources, the more directly it contributes to AI’s access to public data.

Thus, positioning DePIN as a hardware layer collecting data for AI or other industries allows projects to achieve much higher ceilings when supported by dual narratives.

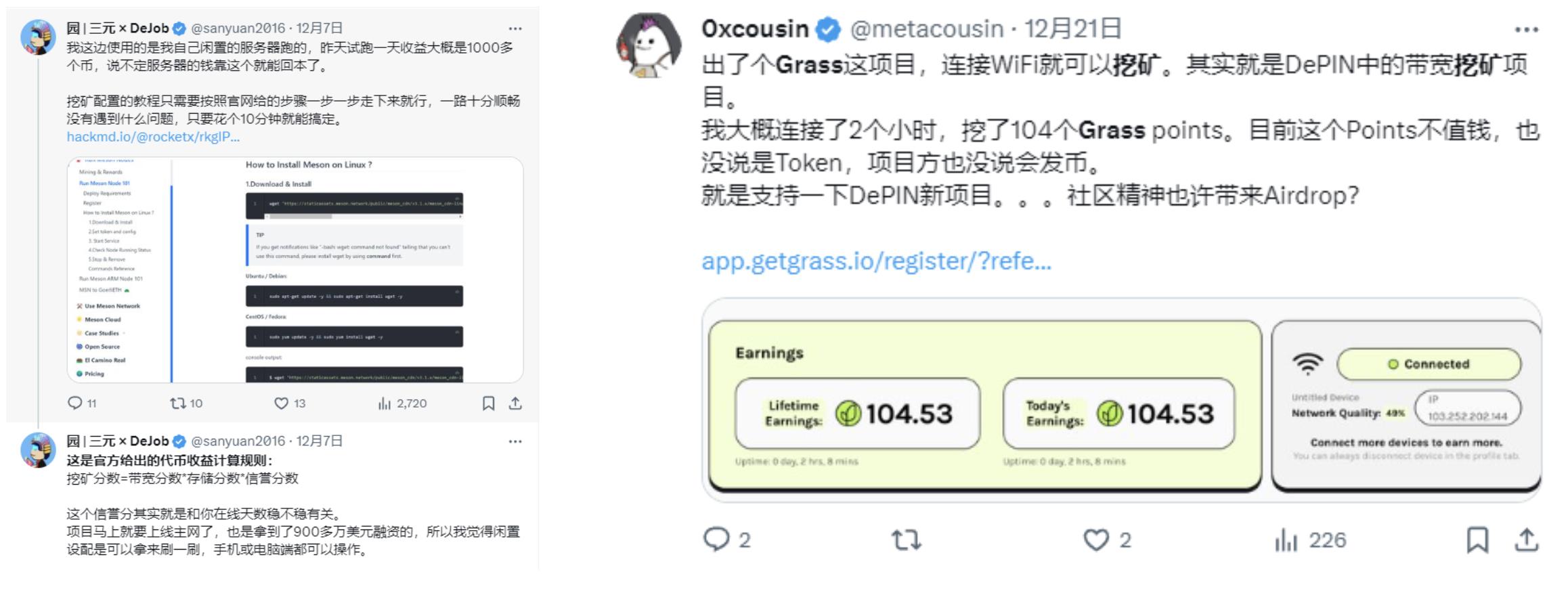

This idea has already been validated by the recent surge in popularity of Grass.

Chris Nguyen, CTO of Wynd Network, Grass’s parent company, publicly stated:

“We aim to make public web data more accessible to open-source AI projects. Decentralization is the only way to achieve this goal ethically and efficiently.”

Clearly, Grass understands its role goes beyond just the hardware layer of DePIN—it aims to become an enabler for AI data acquisition and training.

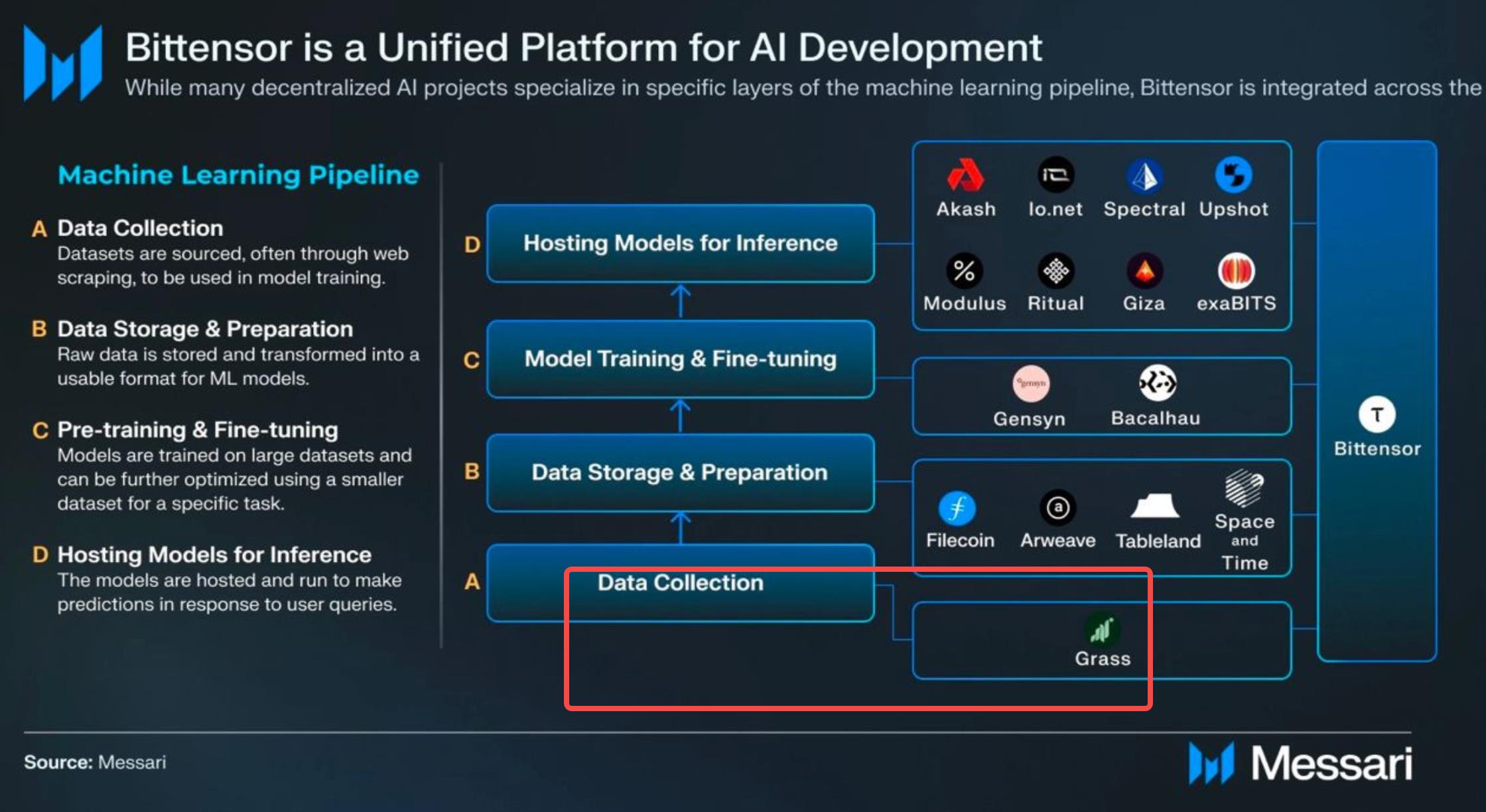

Top research firm Messari once categorized various Web3 projects in a report on AI. In the “AI Data Collection” category, Grass was the only project identified as having value.

Everyone knows about Grass now—the marginal return for joining is inevitably decreasing. With Solana bustling, it’s time to explore projects on other chains to find differentiated opportunities.

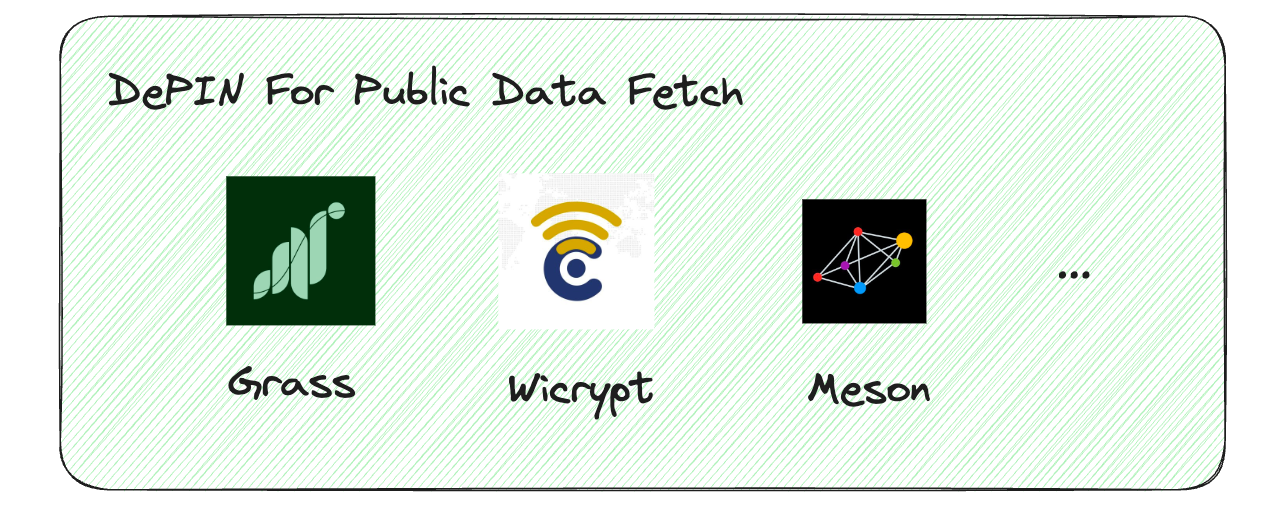

So, what other DePIN projects align with this narrative—projects thatfacilitate large-scale public data collection and play a role in AI training?

After surveying multiple crypto project funding databases and analyzing each project’s core business and development scale, we found two projects similar to Grass but with unique characteristics:

-

Wicrypt: Focuses on idle Wi-Fi resources in African markets, enabling users to contribute network resources for public data collection. However, the project has already launched its token and remains relatively niche; we’ve covered it ina previous research article;

-

Meson Network: Shares and utilizes idle bandwidth and IP resources, featuring numerous IP nodes and a proven business model, backed by Arweave and Filecoin. More importantly, it hasn't launched a token yet, making it a promising alpha opportunity worth deeper investigation.

Meson Network: Aggregating Idle IP Resources to Meet Public Data Demand

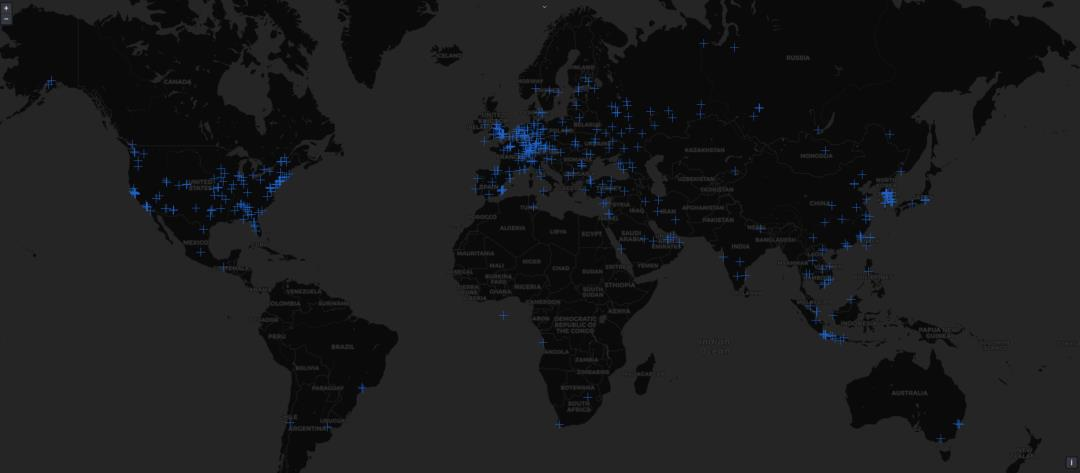

Simply put, Meson Network operates by aggregating idle IP and bandwidth resources from individuals worldwide via a long-tail and sharing economy model, allocating them according to rules to users with data needs—forming a decentralized network of IP and bandwidth resources.

Currently, any residential or commercial bandwidth (IDC/data centers) globally can join the network as contributing nodes. Even personal devices like smartphones and computers can participate, minimizing entry barriers.

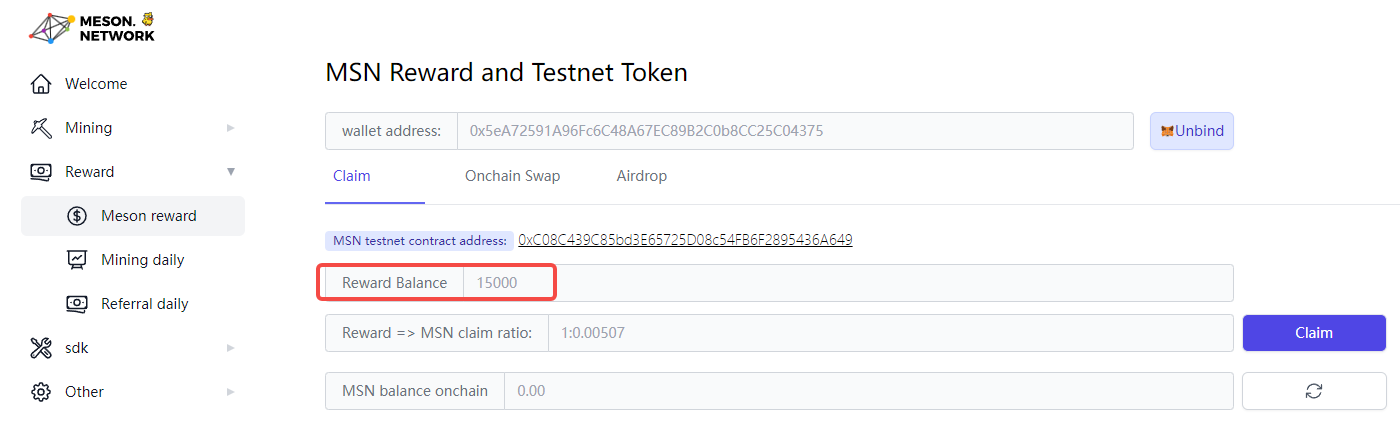

As rewards for contributing idle resources, users receive varying amounts of MESON tokens. However, according to the official product page, the project is currently on testnet, and earned tokens are issued on Ethereum’s testnet.

Before diving into specific progress and metrics, we’re more interested in narrative alignment:

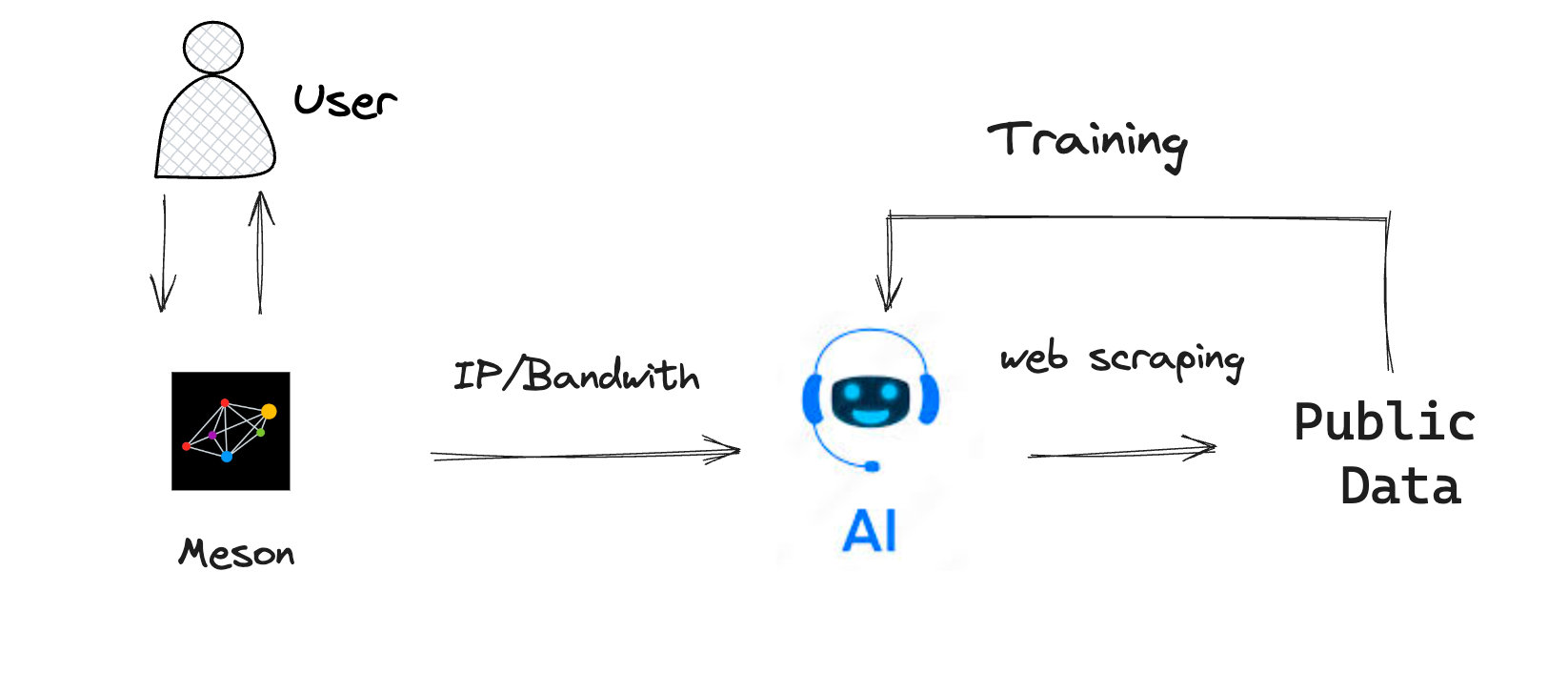

Meson aggregates idle IP and bandwidth via user-connected hardware—this fits the DePIN concept. But how do IP and bandwidth specifically relate to data collection and AI training?

Intuitively, when you connect your phone or computer to such a network, you only see an interface showing your contributed bandwidth. The app neither uploads your data nor actively reads it.

This reflects a common cognitive bias among users researching DePIN projects—the assumption that DePIN hardware directly collects data and immediately shares it with others.

Not all projects work that way. At least in Meson Network and similar cases, we observe another function of DePIN:

Not directly contributing data itself, but creating better conditions for accessing public data.

If this sounds too abstract, consider these concrete scenarios.

An HR professional is conducting background checks on job candidates, accessing public LinkedIn data to understand their employment history and network. But if you try it yourself, you’ll notice that after clicking several related pages from the same IP, access gets blocked.

Now shift to AI. Suppose an AI model needs to crawl vast numbers of Wikipedia pages for knowledge. From a single IP, repeated access to different Wikipedia pages will eventually trigger restrictions.

From small-scale background checks to large-scale AI training, such public data access patterns are extremely common. Especially for AI training, continuous crawling of vast public datasets is essential. Yet high demand for public data clashes with IP-based access limits—this pain point creates real market friction.

Thus, what Meson Network does isn’t directly collect data via DePIN hardware, but rather provide abundant IP resources to create better conditions for acquiring and using public data.

With AI needing data, users able to contribute, and Meson providing the infrastructure, the vast pool of idle IPs and bandwidth enables unrestricted access to public data, effectively unlocking demand.

This supply-demand match is key to aligning with both the DePIN and AI narratives—and one major reason we believe it holds research value.

Yet, today’s market focuses far more on short-term mining gains than on the subtler logic of enabling data access and matching IP supply with demand. While the latter is less visible, it’s more likely to drive genuine business value and sustainable revenue for a DePIN project.

Now that we understand Meson Network’s business logic, let’s examine how it works in practice.

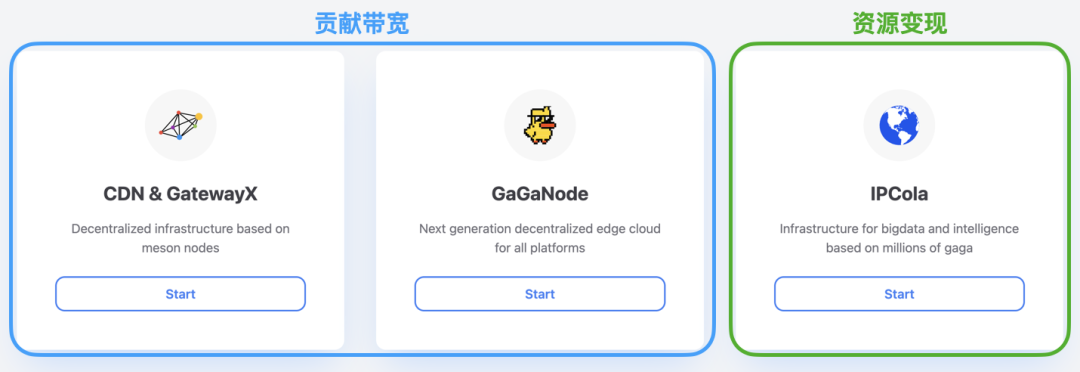

Currently, Meson offers two types of products: contributing IP and bandwidth resources, and monetizing those resources.

Unlike Grass, Meson allows both enterprises and individuals to contribute via servers, phones, or computers.

These correspond to two products: GatewayX and GagaNode. GatewayX targets commercial idle IPs and bandwidth—such as surplus capacity in enterprise data centers (IDC)—with typical use cases like CDN services: caching files at IDCs close to end-users and delivering them via local bandwidth.

However, this B2B-focused service is not our primary focus here.

GagaNode, on the other hand, allows any user’s home router, PC, smartphone, or even Raspberry Pi to contribute IP and idle bandwidth, forming a broad long-tail market and building a DePIN-powered IP and bandwidth resource network.

Meanwhile, IPCola handles the aggregation and redistribution of these resources, delivering value across regions in areas such as AI model training, data acceleration/caching, anti-ad fraud, cybersecurity, and data crawling.

This product directly supports the “efficient collection of public data” discussed earlier—you can use multiple regional IPs via IPCola to access data seamlessly.

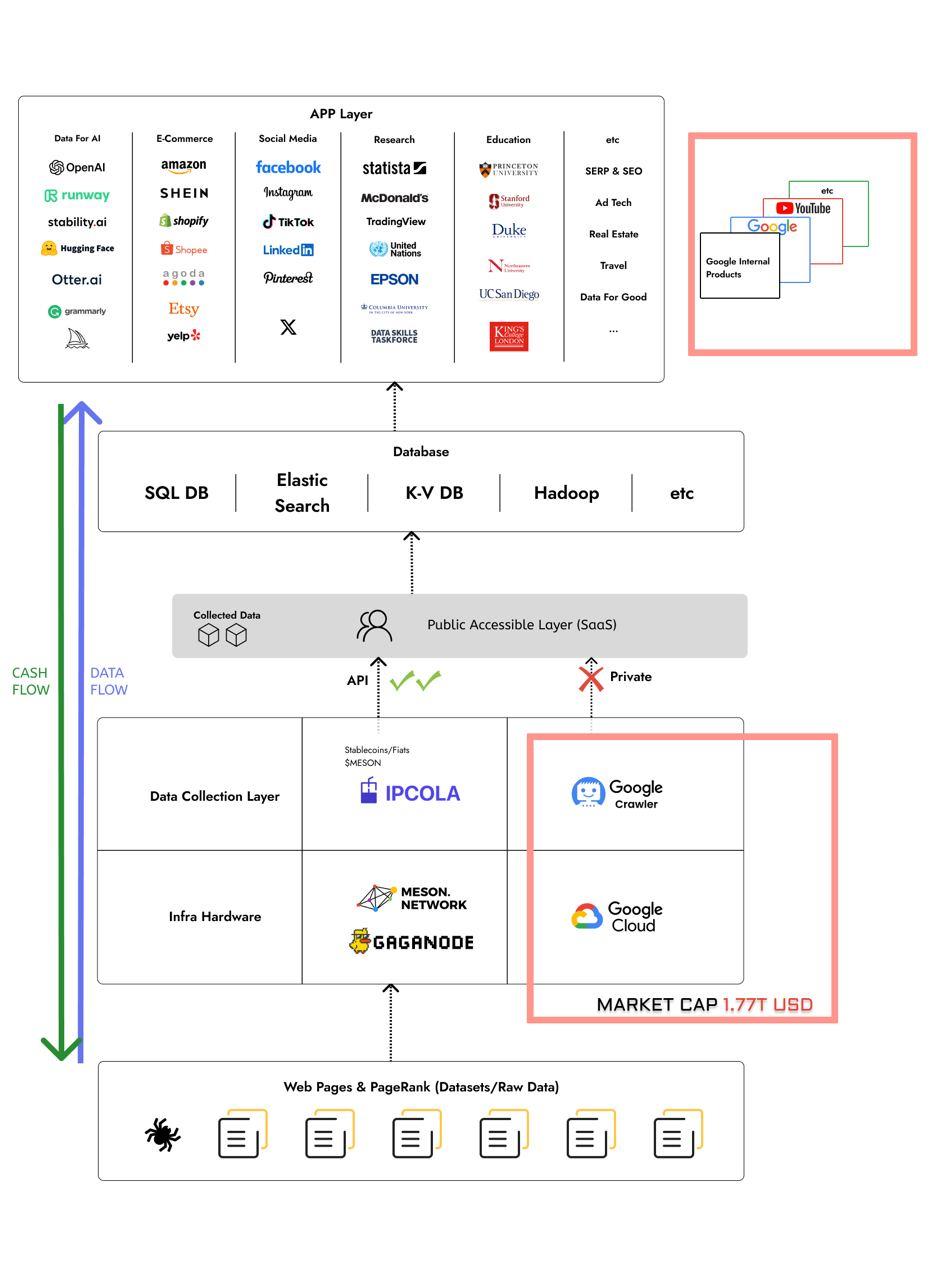

Putting Meson’s products together clarifies the full “from DePIN to AI” workflow, as shown below:

-

GagaNode acts as the physical hardware layer in DePIN, incentivizing global users to pool vast amounts of idle IP and bandwidth;

-

IPCola processes and manages these IP resources, functioning as a data access layer, exposing them via APIs;

-

Demand-side users leverage multi-IP capabilities to crawl IP-restricted public web content, generating datasets and raw data;

-

Raw data is stored in databases and used for AI model training, etc.;

-

Database data is then shared with demand-side users (AI knowledge bases, e-commerce, social media analytics, research, etc.) based on rules and needs.

This operational flow transcends conventional understandings of DePIN, instead resembling the functionality of a data infrastructure provider.

In traditional internet contexts, companies like Google monopolize this entire process:

-

Google Cloud operates massive server farms, meaning abundant IP resources that enable its own services to crawl public internet data freely;

-

Googlebot performs actual crawling, gathering vast data to power search engines, analytics, and AI products with monetization capabilities;

-

You can access these data services via API—but only by paying. Crucially, these APIs remain proprietary, not truly open.

In contrast, Meson’s workflow reveals clear differences:

-

GagaNode uses decentralized hardware to rival Google Cloud’s massive server capacity;

-

IPCola provides open APIs to make public data access easier, contrasting sharply with Google’s closed, proprietary APIs.

More importantly, this parallel comparison offers a reference point for valuation.

From a valuation standpoint, Google Cloud and Googlebot combined are worth over $1.7 trillion. As the data giant of traditional internet, Google’s massive scale justifies its value.

While a Web3 project like Meson cannot instantly reach Google’s scale, comparing against this benchmark helps clarify its business potential.

Moreover, what excites us most is that contributing IP resources requires minimal device specs, technical knowledge, or learning curve—in some ways, it’s easier to go mainstream than games or social apps.

Because users don’t need to understand anything—a regular person connecting to the network is already part of the movement.

The only thing left to refine is UI and outreach. The friendlier the interface and guidance, the higher the likelihood of downloads and connections.

Real Revenue: Completing the Missing Business Loop in DePIN

After discussing the business model, our next focus is revenue.

Most current DePIN projects remain in the “building infrastructure, stacking hardware” phase—e.g., Helium Mobile devices, Grass promoting browser plugins, Dino advertising vehicle network integrations…

It looks vibrant, but critical business questions remain undisclosed:

After collecting data via DePIN hardware, are people actually using it? How is it priced? Is there a mature business model?

You contribute data, benefiting others. This feels like a “tomorrow will be better” promise, but may lack stable current income—a common flaw among most DePIN projects.

Without real revenue, consequences include token dilution, unsustainable mining rewards, and operating losses.

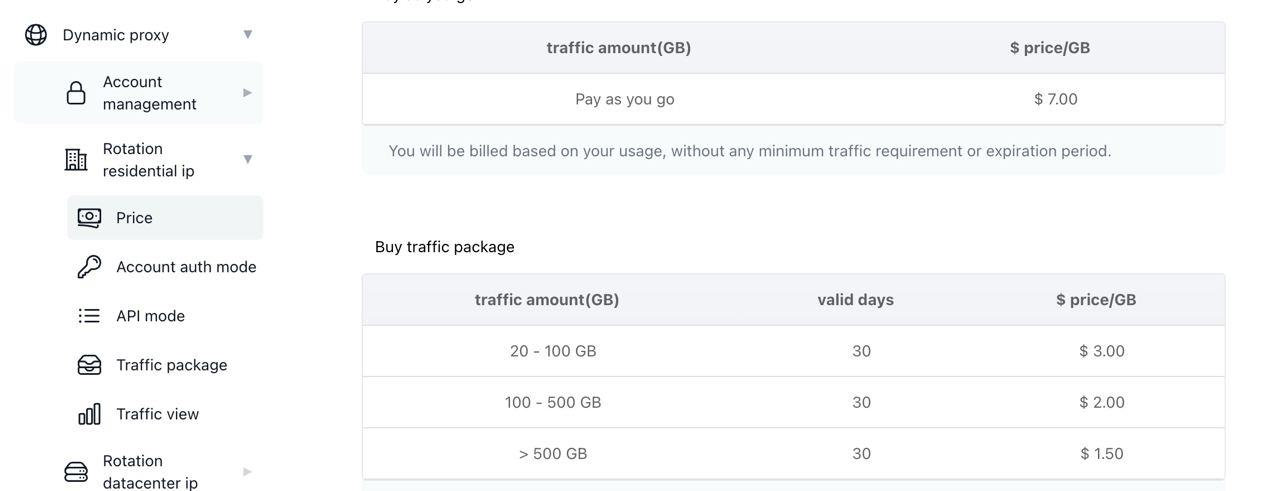

In contrast, Meson Network’s IPCola is one of the few DePIN projects already generating real pricing, mature business models, and actual revenue on the data demand side.

We reviewed IPCola’s official documentation, which shows two pricing models: pay-as-you-go and data packages.

The former costs $7/GB, while the latter offers fixed-price bundles where unit cost decreases with usage.

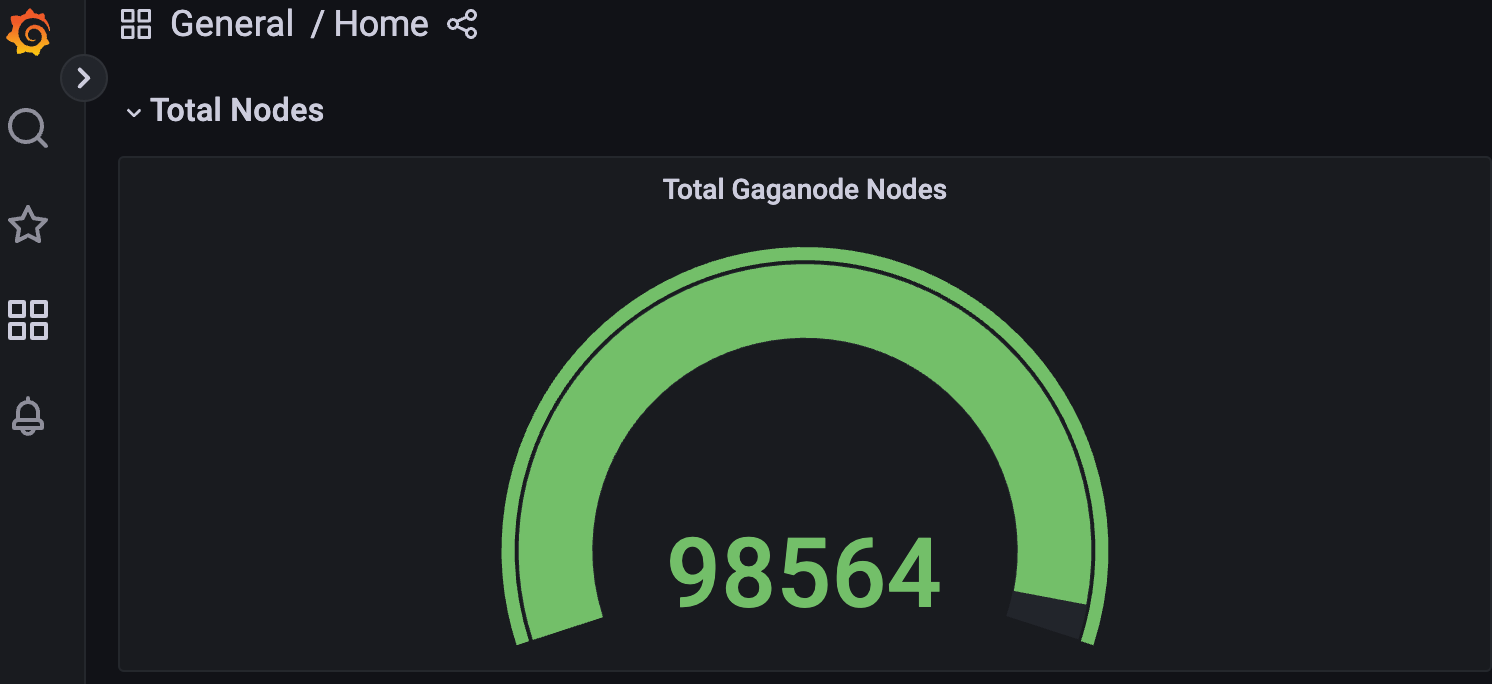

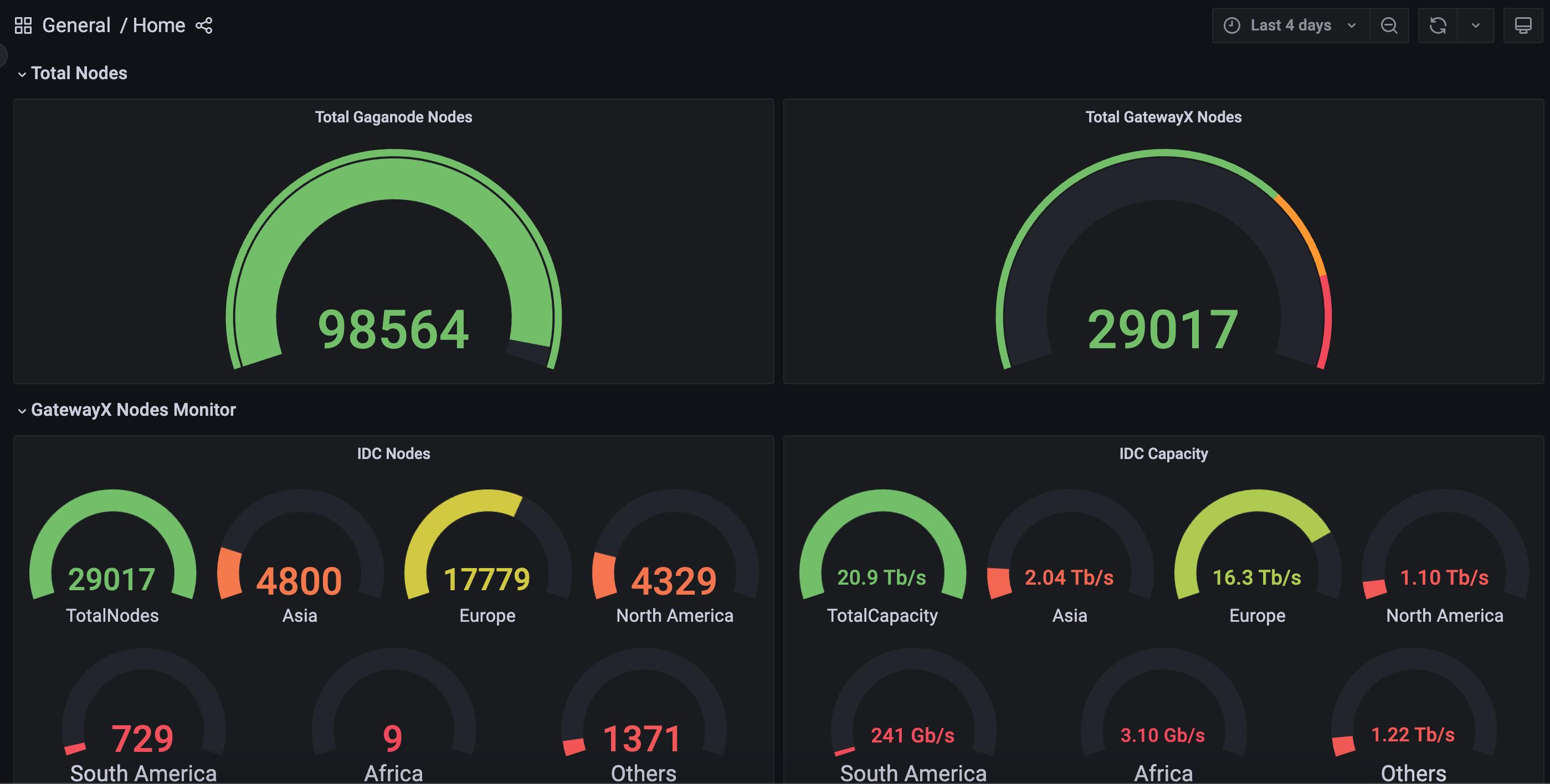

From prior research and interviews, we learned that GagaNode currently has around 96,000 nodes across 150 countries. Leveraging these resources, IPCola has achieved over $1 million in revenue in the past six months.

This revenue comes from real IP and bandwidth demand—not speculative PPT projections for VCs.

While Web3 valuations can’t fully rely on traditional financial fundamentals, sustained and healthy core operations still offer positive signals—especially when most projects lack real revenue.

We believe DePIN must not only deploy hardware on the supply side but also generate revenue on the demand side. This benefits token prices, market-making, and expectation management.

Meson Network hasn’t launched a token yet, but given its solid fundamentals, market performance is promising.

But how far can it go? Comparisons with existing peers may offer insight.

Meson vs. Grass: Which Has More Potential?

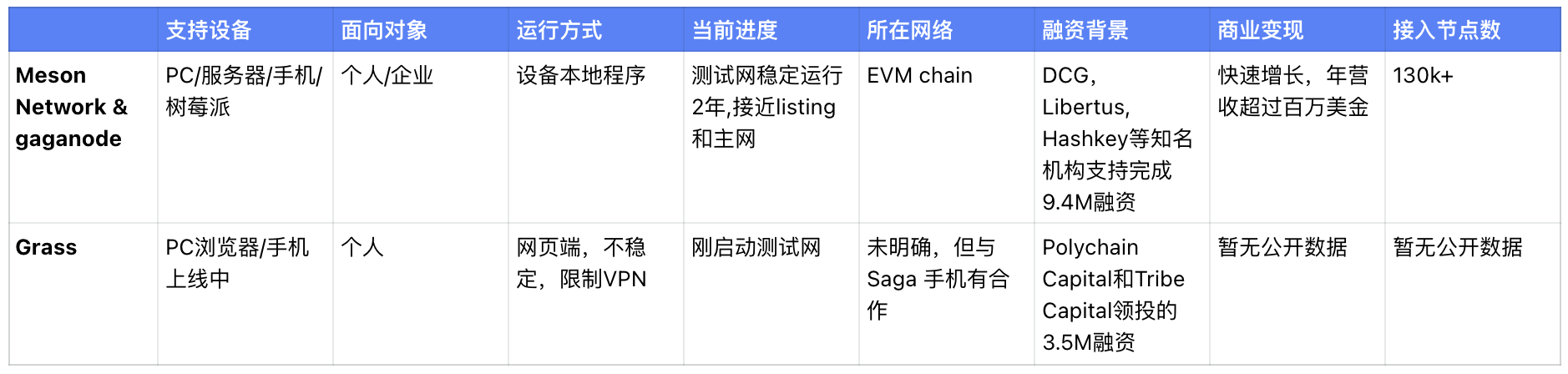

Currently, Grass and Meson Network share similar business logic. Since neither has launched a token, we can make a preliminary comparison.

For general readers, mining rewards are naturally of greatest interest. Since both are on testnet without live tokens, direct monetary comparisons aren’t possible. Here, we offer only rough quantity estimates.

-

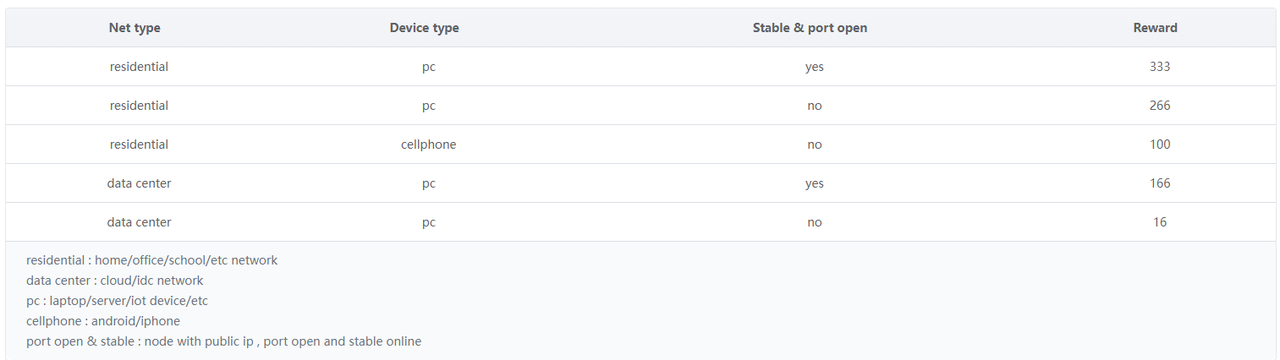

Meson’s reward calculation depends on network type, device, port status, region, and number of devices per IP. Under ideal conditions, every 15–30 minutes constitutes a reward cycle, with a single device earning up to 333 testnet tokens per cycle—though actual rewards decay based on various coefficients.

In real-world tests shared by users, a server device earns about 1,000 testnet tokens daily via Meson, while Grass yields roughly 1,000+ points per day on a personal device.

The issue is we can’t predict either project’s token price or listing conditions, so mining efficiency can only be compared by absolute test token quantities.

But as previously noted, Meson’s comparative advantages include:

-

Possibly the largest node count in the sector—nearly 130,000 nodes combining GagaNode and GatewayX. More nodes mean stronger network effects, broader IP coverage, theoretically wider market reach, and exponential growth in market share.

-

A rough valuation of Meson’s 90,000+ public IPs and 22.7 Tb/s commercial bandwidth shows resource volume far exceeding Grass—especially considering Grass only launched a few months ago.

We also conducted a comprehensive comparison across multiple dimensions between Meson and Grass, results shown in the table below:

Overall, both projects have strengths, but Meson benefits from more nodes, more stable operations, and a clearer business model.

Additionally, rumors suggest Meson Network will soon launch its token—giving early observers a first-mover advantage:

If the赛道is the same, the business is similar, and both have merits, why not consider Meson—a closer-to-reality alternative—if you’re FOMO on Grass’s zero-effort mining?

Beyond network participation for testnet tokens, Meson currently offers simple social media engagement tasks to earn additional testnet tokens.

Readers interested in these activities can followthis guide to complete tasks quickly.

DePIN vs. Google Cloud: A Future Vision

From a data access perspective, DePIN projects like Meson may not be in the hardware business—but the data business.

In traditional internet, Google Cloud leverages vast regional servers and IPs to smoothly crawl public data, organize it, and offer data services—but keeps APIs closed, forming a monopoly.

In the DePIN model, can decentralized nodes collectively contribute IP and bandwidth to form a surplus resource market, narrowing the gap with Google Cloud’s server dominance and achieving similar results—with greater openness?

When centralized servers face off against DePIN, and open APIs with incentives challenge closed APIs and traditional models, DePIN’s role as an incentive layer—creating conditions for data access—may become the sector’s next key direction.

Given Meson’s current node scale and operational experience, it may even lead standard-setting efforts within DePIN, pushing the entire sector forward.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News