100 Days Countdown: What's Changed and Unchanged in Bitcoin's "Halving Narrative"

TechFlow Selected TechFlow Selected

100 Days Countdown: What's Changed and Unchanged in Bitcoin's "Halving Narrative"

Some positive potential variables, previously unseen in earlier halving cycles, are rapidly emerging and could impact the evolution of the next market cycle.

Author: Terry, Baicai Blockchain

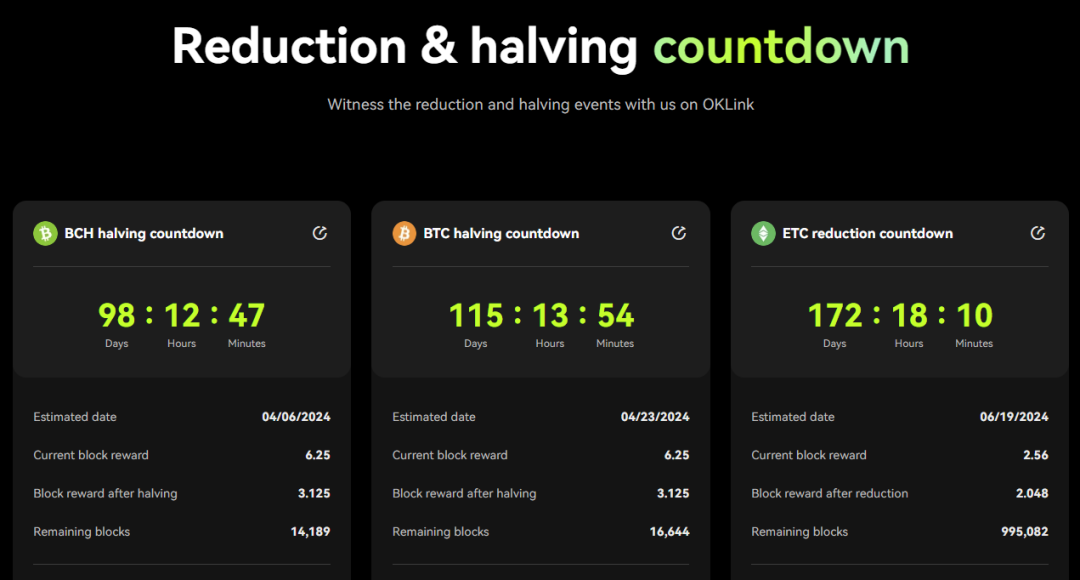

There are now fewer than four months remaining until the fourth Bitcoin halving, expected on April 23, 2024, when the block reward will drop from 6.25 BTC to 3.125 BTC.

As one of the most significant narratives in the crypto industry, the "Bitcoin halving" has always been a major market event filled with anticipation. With a new halving cycle nearing its end, what should we expect this time, and what new variables have emerged in the market?

Source: OKLink

What impact does the halving have on the crypto market?

For the crypto industry, each halving is a major event. In particular, during the first two Bitcoin halving cycles, prices surged by tens of times (in the short term, after each halving there was a brief pullback as bullish sentiment was exhausted, but afterward, following adjustments, long-term bull markets emerged).

However, starting from the third halving in 2020, the number of industry participants, market attention, and infrastructure maturity significantly improved compared to earlier cycles. Bitcoin was no longer limited to a niche product among tech enthusiasts but began interacting with more external factors.

To summarize briefly:

-

Before the first halving, insiders were mainly interested in Bitcoin’s potential as electronic cash;

-

During the second halving cycle, focus shifted toward Bitcoin’s use as a payment tool, sparking intense debates (the subsequent BCH fork became nearly the top event within the community);

-

In the third halving cycle, Bitcoin had evolved into an alternative asset, with institutional and capital moves becoming the central theme;

Therefore, compared to the first two halvings, the third attracted unprecedented attention. At the same time, the global political and economic environment also influenced its performance:

Under macroeconomic pressures, just two months before the May 11 halving—on March 12 to 13—Bitcoin fell from $7,600, initially dropping to $5,500 and then breaking support levels all the way down to a low of $3,600. The total market cap instantly erased $55 billion, with over 20 billion RMB in liquidations across the network, achieving a precise “price halving.”

However, shortly after the May halving, the DeFi summer kicked off a new bull market cycle, pushing Bitcoin up to $60,000—an almost 20-fold increase from its pre-halving low.

Overall, based on historical patterns, a new bull market cycle is highly likely after each halving. While today’s larger market size may make gains exceeding 10x difficult, surpassing the previous cycle's peak of $60,000 remains quite promising.

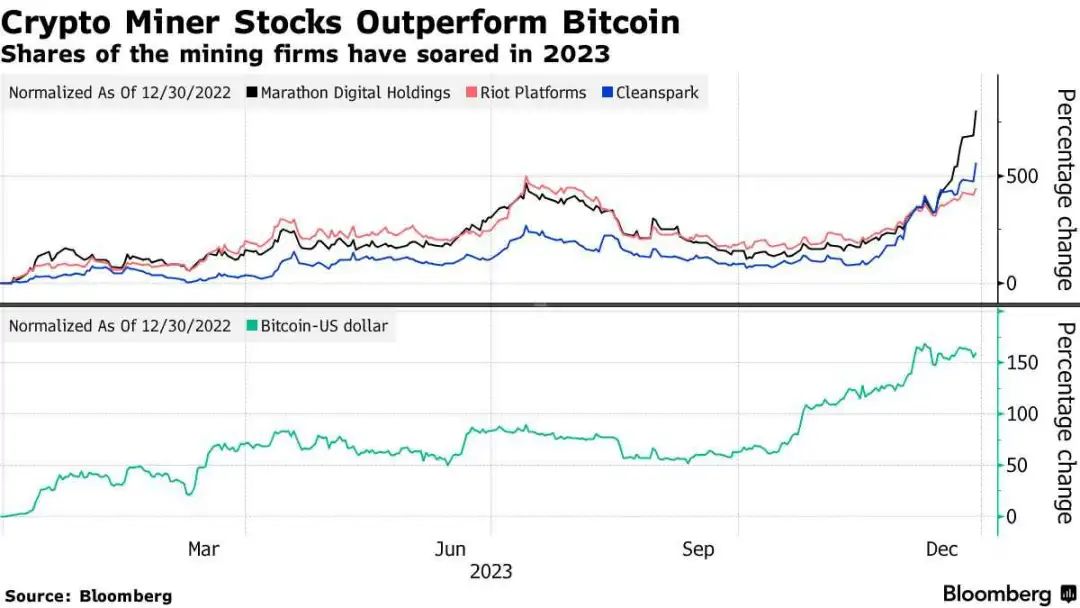

Additionally, it’s worth noting that ahead of every Bitcoin halving, publicly listed mining companies become optimal leveraged proxy assets:

Currently, 15 mining firms are listed on Nasdaq and the Toronto Stock Exchange. Market leader MARA has seen 11 consecutive days of gains, rising over 100%, with an annual gain exceeding 800%. Riot has gained over 400% year-to-date, while Bitcoin itself rose only about 160% during the same period.

New Variables Beyond the Halving

At the same time, after three previous halvings, with block rewards now at 6.25 BTC and over 19 million Bitcoins already mined, many aspects deserve reevaluation from a fresh perspective.

Especially since both the broader industry and Bitcoin itself have developed notable new variables compared to earlier halving cycles.

1) Impact of Spot ETFs’ Incremental Capital

The core driver behind the recent two-month market rally has been expectations surrounding the approval of spot Bitcoin ETFs.

According to the current schedule, the closest decision date for spot Bitcoin ETF applications is January 10, 2024: ARK 21Shares Bitcoin ETF, which has already faced two delays, will receive its final ruling.

Additionally, between January 14 and 17, 2024, decisions on seven other spot Bitcoin ETF applications are scheduled. However, following past precedent, these are likely to be delayed again until mid-March—the final possible window.

Even if postponed to mid-March, the final decisions will still be made before the Bitcoin halving in late April, meaning the ETF outcome will precede the halving event.

If approved, combined with the halving, Bitcoin could enter a new cycle driven by dual catalysts. Even if outcomes fall short of expectations, ETF approval would still provide some hedging effect.

Moreover, there is already a growing “quasi-Bitcoin ETF” in the market today. Excluding custodial exchanges, among corporate entities holding over 100,000 BTC, after Block.one and the defunct Mt.Gox, the third-largest holder is MicroStrategy.

As a long-time Bitcoin accumulator, MicroStrategy’s aggressive buying strategy has long been transparent, with its first public Bitcoin purchase announced on August 11, 2020. This month, MicroStrategy and its subsidiaries purchased approximately 14,620 BTC for about $615.7 million in cash:

at an average price of $42,110. As of December 26, 2023, MicroStrategy holds 189,150 BTC, with an average acquisition cost of $31,168.

Notably, MicroStrategy’s total market cap is only around $9 billion, yet its Bitcoin holdings are valued at $6 billion—meaning two-thirds of its net assets are effectively tied to Bitcoin’s value. This has led many investors to treat MicroStrategy as a “quasi-Bitcoin ETF” in their portfolios.

2) Internal Evolution of the Bitcoin Ecosystem

According to Bitcoin’s halving rules, the initial block reward was 50 BTC, halving every four years. After three halvings, it now stands at 6.25 BTC. This process continues until around 2140, when block rewards will cease entirely;

Transaction fees, however, will persist. Thus, as halvings continue, block rewards will gradually diminish toward zero, leaving transaction fees as the sole source of miner income.

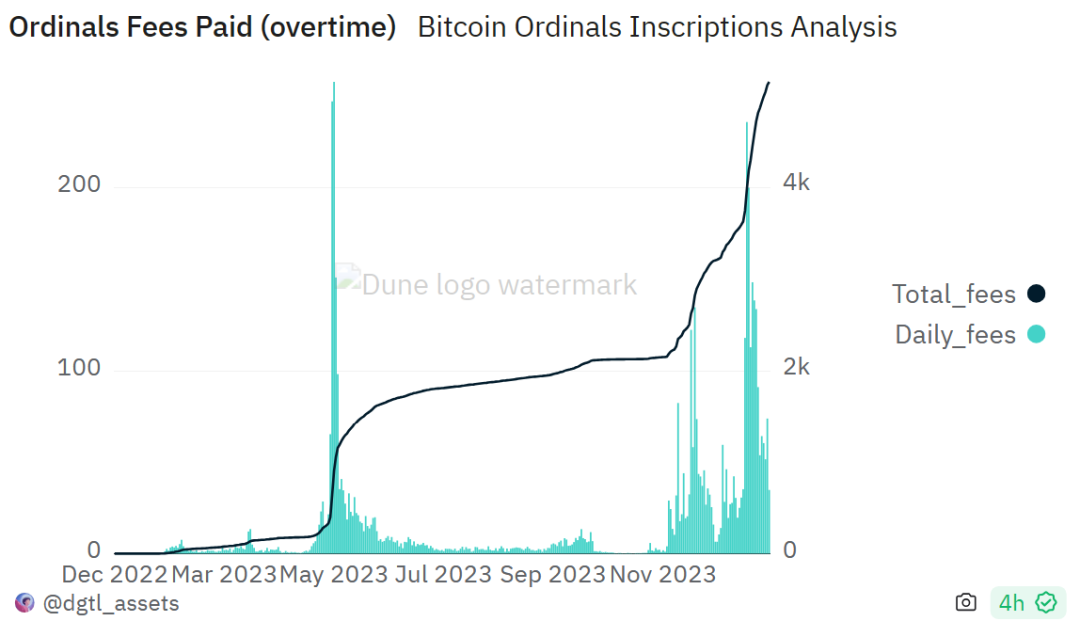

This year, the rise of the Bitcoin ecosystem—especially BRC-20 tokens—has sparked a new wave known as “BitcoinFi,” driving internal transaction activity to record highs and dramatically increasing fee revenue.

Against this backdrop, protocol innovations like Ordinals, along with leading projects such as ORDI and SATS, have profoundly reshaped Bitcoin’s fee model—most directly altering Bitcoin’s economic and incentive structures.

According to the latest Dune data, as of December 29, cumulative fees from Ordinals inscription minting exceeded 5,135 BTC, worth over $200 million.

This surge has pushed Bitcoin mining fee revenues to their highest level in nearly five years. Historically, miners earned only about 2% of their income from fees, but over the past three months, this average has reached approximately 8%, setting a new record.

As block rewards continue to decline toward zero, the importance of transaction fees will grow increasingly critical, eventually becoming the sole revenue stream for miners.

Thus, the BRC-20 trend has essentially served as a rehearsal—regardless of its ultimate success, future halvings will ensure that developments along this path profoundly reshape Bitcoin’s overall fee model.

Summary

Beyond the two primary external and internal variables—ETFs and the Ordinals wave—several previously unseen positive developments are rapidly advancing and could influence the next market evolution.

First, the “Volcano Bond,” a Bitcoin-focused government bond, has been approved by El Salvador’s Digital Assets Committee and is expected to launch in Q1 2024.

This will be the first national bond centered on Bitcoin. Half of the proceeds will be used to purchase and hold Bitcoin for five years, while the remainder will fund Bitcoin-related infrastructure projects. The ripple effects of this initiative remain to be seen.

Second, the Ordinals wave has funneled massive amounts of capital, users, and developers into the Bitcoin ecosystem through inscriptions:

If Bitcoin previously held advantages only in ideological recognition and market cap dominance, the inscription boom has dramatically enriched its ecosystem with new assets. Human demand for novel assets is endless, and this trend has indirectly boosted developer participation and user base growth.

Meanwhile, innovations such as the RGB protocol, Slashtags (providing identity, contacts, messaging, and payments for Bitcoin’s Lightning Network), the Impervious browser integrating multiple P2P services, Taro (a Taproot-based asset protocol), and OmniBOLT (Lightning Tokens) are all highly promising.

Overall, although the sound of the upcoming halving grows louder, Bitcoin’s expansion across multiple dimensions has introduced significant new variables—some even overshadowing the halving itself. Where these emerging forces will ultimately lead Bitcoin remains to be seen—and worth watching closely.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News