Blockworks: The biggest innovation in crypto is blockspace, and L1s will be the best risk trade of the next decade

TechFlow Selected TechFlow Selected

Blockworks: The biggest innovation in crypto is blockspace, and L1s will be the best risk trade of the next decade

The past decade of cryptocurrency has been a commodity boom in block space, a trend that may continue over the next 5–10 years.

By Blockworks

Translated by TechFlow

“Most technologies tend to make workers perform trivial tasks. However, blockchain is different because its automation is decentralized. Instead of making taxi drivers unemployed, blockchain makes Uber unemployed, allowing taxi drivers to work directly with customers.”

– Vitalik

How to Explain Everything About Cryptocurrency

If you've worked in crypto long enough, you understand how painful it can be to try explaining what crypto is to a newcomer.

After six years working full-time in crypto, I still get nervous when my parents ask me to describe what it is.

Usually, I default to a Bitcoin-centric answer.

I start by describing the problem: central banks printed too much money, so Bitcoin was created as a digital currency that cannot be devalued by any central entity.

But I’ve started finding this answer unsatisfying. While factually true, today’s cryptocurrency landscape is actually much broader than this explanation suggests.

Today, many people in the crypto industry don’t interact with Bitcoin and aren’t focused on solving monetary problems at all.

Crypto evolves so rapidly that it's difficult to summarize the entire industry with one overarching theory about what it is and why it matters.

I’ve struggled with this for a while, but now I believe I finally have a unifying theory that answers the question: What is cryptocurrency?

The Innovation of Cryptocurrency: Creating a New Commodity

The fundamental innovation of cryptocurrency is the creation of a new commodity: block space.

To oversimplify the definition, block space is storage that exists in cyberspace, where any developer can run code or store data.

What makes block space unique as software is that it is not subordinate to a centralized owner of hardware.

Centralization is the status quo for all software today. Companies like Google create extremely valuable software we all use—Google Search, Gmail, Chrome, etc.

But if Google wanted to, they could unilaterally change anything. That said, this structure has proven advantages.

As a centralized organization, Google can quickly patch bugs. They can hire top talent and leverage economies of scale.

However, some software applications are unsuitable for platforms that could be controlled by a single party—especially those requiring high levels of societal trust and importance.

For example, although we trust Google, we wouldn't trust them to manage our money. Why? Because they could change balances anytime without oversight. No matter how much we trust Google, we know the incentive to cheat would simply be too strong.

These high-trust applications, where traditional software falls short, are precisely where block space becomes incredibly useful. Because it is independently verified by a global network of independent participants, it effectively reverses the existing power dynamic, making hardware operators subordinate to the software. This is why I think many in Silicon Valley fail to understand crypto—it is fundamentally opposed to their business model.

Different Flavors of Block Space

It turns out that, like any commodity, there are many ways to refine block space. For example, Bitcoin’s block space has unique properties that make it well-suited for monetary use. Ironically, these same properties limit its performance.

The Bitcoin network produces a block roughly every 10 minutes, with a maximum capacity of 4 megabytes. These constraints (among others) prevent Bitcoin from being used in many applications—high-frequency trading, gaming, etc. Yet for monetary purposes, these limitations are actually an advantage, as they force the network to avoid the complexity required by such applications.

Other block space producers—like Ethereum—have chosen a different set of trade-offs. Ethereum’s block space is more generalized, suitable for a wider range of applications. This decision expands Ethereum’s potential consumer base, but the resulting complexity reduces its strength as a monetary asset.

I could write multiple paragraphs discussing different flavors of block space—dedicated vs. general-purpose, block space that depends on another blockchain sequence like rollups, etc.

The key point to remember is that we are still in the early stages of experimenting with and refining block space. In the future, I expect a large and diverse market of block space producers and consumers, tailored to different use cases.

Why Does It Matter That Block Space Is a Commodity?

If you’re considering investing in associated tokens, understanding the nature of block space is crucial.

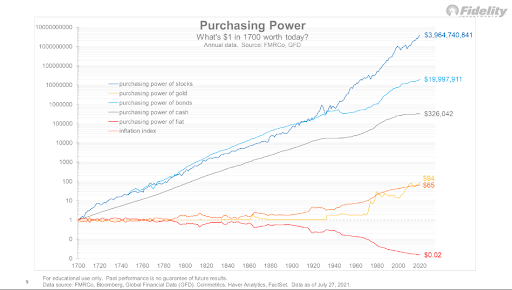

Here’s an important insight about commodities: while there are many commodity investors, nearly all are traders. Nobody buys and holds a commodity for 20 years because commodities are socially designed to remain stable—or ideally, decline in price. (Note: When I say “decline,” I mean real purchasing power decreases over time.)

The reason is clear—we rely on using commodities daily! If oil prices rise too much, policymakers will eventually do everything possible to bring them back down. The same applies to other essential commodities like steel and food.

This is essentially the opposite of equities, which are designed to appreciate. If stock markets fall for too long, policymakers begin seeking ways to push them back up.

Of course, this is a simplification—there are other reasons stocks rise (compounding, etc.)—but this captures the high-level dynamic.

But I Was Told to HODL Crypto

This means almost every newsletter reader deeply dislikes this point.

If L1 block space is a commodity, then all the assets we talk about at Blockworks—Bitcoin, Ethereum, Solana, ATOM, etc.—are not long-term investments. From the perspective outlined above, these are short-term trades, not long-term holdings.

But wait, you might say—the data doesn’t support this theory!

I acknowledge the Fat Protocols thesis.

Bitcoin and other L1 tokens like Ethereum have been the best-performing assets in crypto, far outpacing even the equity of successful companies like Coinbase. But I don’t believe this trend will last forever, for a simple reason: the incentives around block space resemble those of a commodity. If Bitcoin is to succeed as money, it cannot continue growing 100% annually. Similarly, for blockchains producing block space for applications (like Ethereum, Solana, etc.), the long-term incentive is for prices to peak at some point.

Some may argue that the block space market and token market aren’t 1:1. I understand that, but they are related—block space is priced in tokens, so they are inherently linked.

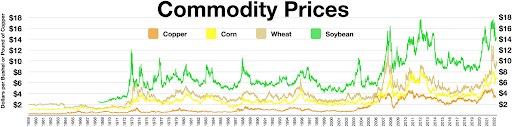

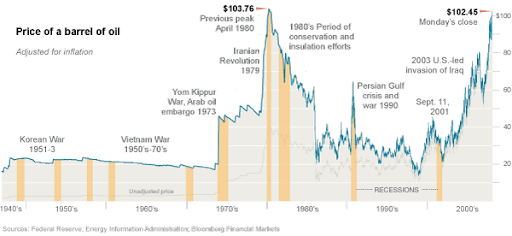

I believe the best analogy for the past decade of cryptocurrency is a traditional commodity boom.

You can look at several examples from modern history, but I find the 1970s commodity boom most relevant.

Due to similar economic and geopolitical climates, the 1970s comparison feels most fitting. The commodity boom was initially triggered by the Arab-Israeli conflict, but underlying inflationary conditions intensified it.

Around the same time, Nixon suspended the gold window, leading to rapid monetary expansion and a surge in gold prices.

Now, my point isn’t that the 1970s were identical to today—though currency devaluation and inflation are indeed contributing factors to rising crypto prices (and part of the story).

My point is that history has repeatedly misled investors into believing commodities can sustain equity-like returns over long periods.

An amusing comparison—bound to make crypto OGs laugh—is that during both the 1970s and 2000s, people began claiming we were entering a commodity supercycle. (Shoutout to Su Zhu.)

My view of the current era is that we’re in the first stage of a global digital commodity boom. Block space is a novel commodity applicable to an extremely wide range of uses—that’s why it’s expanding so rapidly.

But like all previous commodity booms, financial gravity will eventually take effect. Over time, your favorite L1 will begin trading more like corn, steel, or soybeans.

One final comparison between the 1970s commodity boom and the 2010s digital commodity boom is their psychological impact on market participants.

There’s a fascinating parallel between gold standard advocates and today’s crypto enthusiasts.

What’s interesting about goldbugs is that after the incredible price surge of the 1970s, gold underperformed nearly every other asset class for decades. Yet 40 years later, the community is more fervent than ever. If you really think about it, that’s quite remarkable.

I believe crypto is experiencing the same phenomenon. When an asset you own rises 10x or 100x, most people undergo a neurological shift that’s hard to forget.

In crypto, I think two additional underappreciated forces are fueling prevailing tribalism.

Loneliness in the internet age. Young people increasingly seek community in isolated digital worlds, and large crypto communities (e.g., Bitcoin, Solana, Ethereum) can fulfill that need.

Layer-1s require large communities to rally around roadmaps involving meaningful technical trade-offs—trade-offs that only a small fraction of engineers truly understand. So the strategy becomes building narratives around these trade-offs to win public support (see: the block size wars).

So my prediction for the foreseeable future is that tribalism in crypto will increase, not decrease, during this commodity boom.

Conclusion

To some, this outlook might sound pessimistic. To me, it isn’t.

I believe we’re still in the early stages of experimentation and expansion for L1 blockchains. So the good news is, I think we’re far from the end of this block space commodity boom. I expect it will last another 5 to 10 years.

So if you still love Ethereum, Solana, Celestia, or others,you still have plenty of time. I suspectexisting and new L1swill be the best risk-on trades for the next decade (not investment advice). But ultimately, I expect markets to adjust based on the type of block space needed and for it to become commoditized.

To some, this may sound bearish, but I disagree. I see it as a positive development. My long-term view of crypto is that it’s a foundational layer enabling entirely new use cases and businesses that were previously impossible. To build wave after wave of enterprises, we need abundant, affordable, and useful block space. And that’s exactly what’s being built today.

If you’ve made it this far, here’s a quick summary of this article:

-

The core innovation of cryptocurrency is a new commodity: block space;

-

The past decade of crypto has been a block space commodity boom, likely to continue for another 5–10 years;

-

Eventually, block space will become commoditized, and Layer-1s will begin trading sideways;

-

This will pave the way for the first generation of businesses built on block space to cross the chasm into the mainstream;

-

Equities in businesses supported by block space will begin to outperform the underlying Layer-1s;

One possible exception to this theory might be blockchains like Bitcoin, whose use case isn’t building businesses on top, but serving as money.

I consider this a valid exception, though—as I noted earlier—if Bitcoin is to function as money, its volatility and returns will diminish over time.

Therefore, I ultimately expect a very similar outcome. (Side note: I think this exception is understood within the crypto community, which is why Ethereum is attempting to rebrand itself as “ultrasound money.”)

All in all, this is incredibly exciting to me. Over the next decade, I look forward to seeing the Cambrian explosion of block space continue. Both investors and users will benefit greatly (non-financial advice). Personally, I’m most excited about what comes next: the wave of enterprises built atop this block space.

I believe that when we look back ten years from now, we’ll be amazed by the magnitude of change and everything we’ve built.

As Bill Gates famously said: “We overestimate what we can do in a year and underestimate what we can do in ten years.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News