Op: Superchain is impressive, but currently lacks alpha opportunities

TechFlow Selected TechFlow Selected

Op: Superchain is impressive, but currently lacks alpha opportunities

A good project does not necessarily mean rapid price increases.

Author: BITWU.ETH

Although I currently hold $OP, and OP has been surging strongly, I feel obliged to pour some cold water on OP holders—especially those hoping to achieve 100x returns from OP: OP can make you money, but not a lot of money!

From my investment perspective, $OP can generate profits during its explosive phase. Thus, when the Cancun upgrade was approaching and L2 narratives started gaining traction, both OP and ARB were excellent picks. However, if you're chasing imagined 100x returns or aiming to be a long-term holder banking on time-to-space conversion for high returns, OP offers poor cost-performance and lacks alpha opportunities—you should consider switching your position!

1. A Fundamental Truth in Crypto: Great Projects ≠ Alpha Opportunities

This article mainly shares my views on OP’s future. Personally, I believe OP is indeed impressive, but purely from the standpoint of the OP token, it lacks potential for exponential growth. This is interesting because many assume that a great project must mean a great token, yet sometimes these two go in opposite directions.

Take early DYDX as an example—it was a top-tier DEX at the time, but without strong utility or incentives tied to its token, the token's value remained stagnant. Similarly, ARB faces the same issue today!

Therefore, a great project does not necessarily translate into rapid price appreciation! This is a crucial lesson every crypto investor must understand.

Here are my personal thoughts:

In investing, we often fall into a cognitive trap—the belief that a good project equals a good investment. Recently, OP has become wildly popular, and I think it falls precisely into this category: it's a solid project, but OP is not a compelling investment.

2. Six Key Aspects Behind OP’s Fundamentals

1. The Foundation of OP’s Superchain

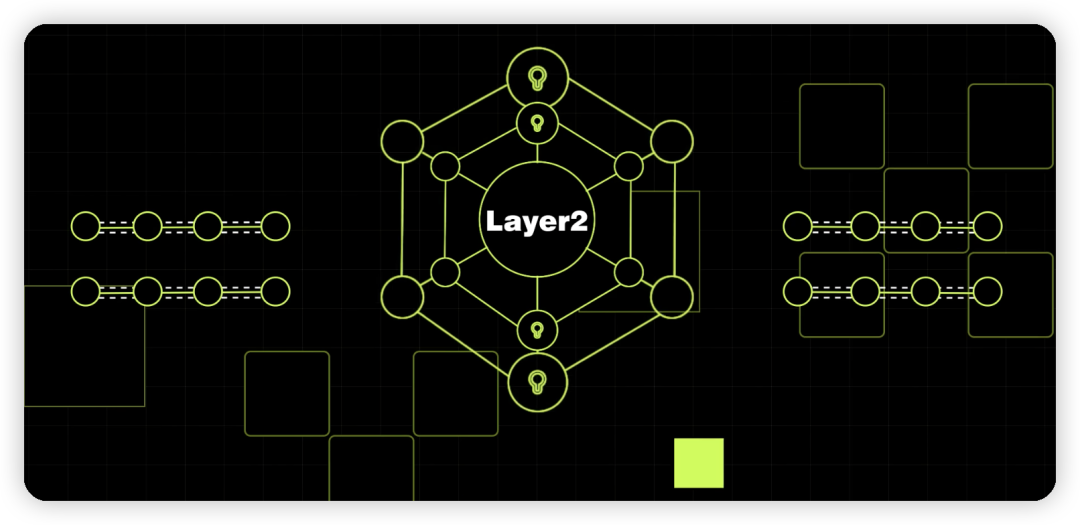

Let me first help everyone understand the concept of the superchain via this OK video.

OP’s native chain itself has developed somewhat awkwardly—far less impressive than Arbitrum (ARB), merely average in performance. However, the development of OP Stack reveals OP’s unique strategic vision. In terms of technical execution ("shu"), ARB leads OP by a large margin; but in terms of philosophy and long-term strategy ("dao"), OP is streets ahead of ARB.

Think of OP Stack as a toolkit enabling one-click L2 deployment, dramatically simplifying the process of building new L2 chains. These decentralized L2s built on OP Stack share security, communication layers, and open-source technology stacks, forming the vision of the OP Superchain.

2. OP Superchain Inherits Cosmos’ Vision

Those familiar with the Cosmos ecosystem will recognize this feeling—Cosmos’ original vision is now being realized through the OP Superchain. Cosmos pioneered one-click chain deployment using standardized frameworks, with IBC enabling seamless cross-chain interoperability.

Cosmos achieved all this early on, but lacked market momentum. Eventually, Ethereum-based L2s absorbed its innovations—a testament to ETH’s dominance. The innovation efforts of other chains come at extremely high trial-and-error costs. Once proven successful, their fruits are inevitably co-opted by the Ethereum ecosystem. In essence, other chains serve as experimental fields for ETH.

3. OP Superchain and BASE

Currently, the development of the OP Superchain has exceeded expectations—particularly Base. The cumulative number of unique addresses on Base even surpasses that of the OP mainnet. The summer meme coin frenzy and the massive success of http://Friend.tech both originated on Base. In terms of momentum, Base’s rise could be described as “killing the mother”—developing beyond its parent chain OP despite being built on OP Stack.

4. The "Killing-the-Mother" Phenomenon in L2s

The “killing-the-mother” phenomenon first appeared in the Cosmos ecosystem—Luna’s market cap once surpassed ATOM’s, even though Luna was a chain built on Cosmos while ATOM represented the Cosmos Hub. This phenomenon isn’t negative—in fact, it reflects a vibrant ecosystem where participants compete fiercely, each capable of overtaking the original leader. Base shows early signs of such disruptive potential, which ironically validates the strategic success of the OP Superchain. By offering a one-click L2 platform with full infrastructure, OP enables child chains to focus entirely on business innovation and differentiation, resulting in a flourishing, diverse ecosystem.

Beyond Base, the OP Superchain includes Zora, PGN, Mode, DeBank, and more. As additional players join, the strategic richness of the OP Superchain will grow, ultimately creating powerful network effects.

5. Network Effects of the OP Superchain

OP provides L2 deployment services and foundational infrastructure, attracting various teams to launch their own L2s. As more projects join, capital and talent flow in, further improving the underlying services, which in turn attracts even more participants—forming a powerful network effect. This is OP Superchain’s true moat. Once established, this dynamic may signal the end of the L2 race, with OP Superchain dominating the entire L2 landscape. Building network effects, creating defensible moats, and monopolizing the L2 ecosystem might well be OP Superchain’s ultimate strategic goal.

All the above points highlight OP’s strengths. Now let’s dive into the core reasons why OP lacks high-growth potential:

3. Why Does the OP Token Lack Alpha Potential?

Of course, as an investment, OP should comfortably outperform inflation over time. But here, by “alpha opportunity,” I mean outsized returns—like 10x gains in traditional markets, or 100x+ returns akin to ETH or AXS in crypto.

To state my conclusion upfront: relative to ETH as a benchmark, OP offers only slightly above Beta returns (market-average gains), with no real excess return. Here’s the detailed reasoning—two key factors:

1. The Token Utility Dilemma of OP

This is a common challenge across all L2 tokens. First, the security layer captures most of the value—and for OP Superchain, that layer is ETH. Since L2s rely fundamentally on L1 security, no matter how clever the economic model, the lion’s share of value (accruing to ETH) cannot be altered. This leaves only a limited portion of value capture available for the L2 token itself. It’s unavoidable—the inherent condition of being an L2. The utility of L2 tokens is like a child born undernourished; no amount of postnatal nutrition can fully compensate for that initial deficit.

Having discussed the congenital issues, let’s examine postnatal optimization—divided into asset attributes and functional attributes:

-

On the asset side, OP currently lacks meaningful adoption. Look at DEX liquidity pools—they’re primarily paired with ETH and stablecoins. In this regard, OP even lags behind ATOM. Although ATOM also struggles with utility within Cosmos, ATOM remains a core asset in sub-chains’ DEXs, with very high LP pairing volumes.

-

Functionally, it’s unlikely that OP will ever become the gas token for L2 chains. Not due to technical barriers, but user experience concerns. Forcing OP as gas would give competitors a field day and might even provoke backlash from the ETH community.

-

Uncertainty around shared sequencer utility. Then there’s the much-discussed shared sequencer model—where users stake OP tokens to become sequencers and earn fees. This is currently the best proposed utility for the OP token, but it comes with too many uncertainties.

First, conflict of interest. OP has talked about decentralized sequencers since 2021—why hasn’t it materialized? Technical difficulty may play a role, but likely secondary to economic incentives. With centralized sequencers, all revenue goes to the core team. Why would they voluntarily give up that golden goose?

Second, whether OP gets utility or not has little direct impact on ecosystem growth. The ecosystem grows regardless. Look at Base—it clearly doesn’t need a token (ouch). The primary reason for launching tokens remains early-stage fundraising. Most teams don’t seriously consider tokenomics or utility design after the initial launch.

When will decentralized sequencers finally launch? Only under two scenarios: 1) A major incident caused directly by centralized sequencers; or 2) Other L2s roll out decentralized sequencers first, forcing OP’s hand. Otherwise, expecting OP’s team to voluntarily relinquish control over such a lucrative revenue stream is unrealistic—and goes against human nature.

2. OP’s Valuation Has Been Over-Extracted by Early Investors

Take a close look at OP’s circulating market cap growth versus its price chart this year—you’ll be surprised. Despite OP rolling out numerous major initiatives, its token performance has been lackluster. Partly due to macro conditions, but examining the circulating supply reveals the truth: OP’s circulating market cap has increased fivefold this year. Despite this rapid expansion in circulating value, the token price remains weak—indicating a flood of newly released tokens entering the market at multiples of existing supply.

This is another lesser-known secret about OP. That’s why analyzing FDV (fully diluted valuation) is critical. Currently, OP’s FDV stands at $5.4 billion, while its circulating market cap is only $1.1 billion.

In the short term, you can ignore FDV. But if you plan to hold OP long-term, you must pay attention to FDV—not just circulating supply—because the majority of OP tokens are still locked and waiting to enter the market. This naturally suppresses long-term price appreciation. And this dilution happens slowly, subtly, almost imperceptibly. Therefore, long-term holders aiming for ultra-high returns should carefully assess OP’s FDV. If, even after accounting for FDV, you still believe OP offers outsized return potential, then by all means bet on it. Otherwise, accept that you’re only entitled to Beta-level returns—you’ve simply picked the wrong battlefield.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News