ORDI, a game of attention

TechFlow Selected TechFlow Selected

ORDI, a game of attention

ORDI has no technology, is completely useless, and is merely a speculative tool.

By 0xEdwardyw

Inscriptions have sparked the rise of Bitcoin's ecosystem and paved the way for solving Bitcoin’s security budget issue. The primary criticism—that inscriptions cause node size bloat and thus harm decentralization—is unconvincing.

ORDI is a useless token—no technology, no functionality. If serious project tokens need to capture value to attract investors, meme tokens must instead capture attention.

"Meaning" is assigned by humans. Compared to memes like Pepe, Harry Potter, Obama, or Sonic, ORDI can be imbued with more—and higher-quality—"meaning."

ORDI belongs to the top tier of memes, yet it still faces the challenge of sustaining attention.

What Are Bitcoin Inscriptions and BRC-20?

In December 2022, Bitcoin developer Casey Rodarmor released an open-source software called ORD, which runs on top of Bitcoin Core. ORD allows users to mint Bitcoin inscriptions in two steps: 1) embed arbitrary data—such as text or an image ("inscription")—onto the Bitcoin blockchain, and 2) link that inscription to a specific satoshi. A satoshi is the smallest unit of Bitcoin: 1 BTC = 100,000,000 satoshis. The final product is a satoshi with an inscription, known as a Bitcoin inscription.

Learn more: What Are Ordinals?

Depending on whether the embedded data is text or an image, Bitcoin inscriptions fall into two categories. Text-based inscriptions are primarily used to create tokens, such as those following the BRC-20 token standard. Image-based inscriptions are mainly used for NFTs, such as various cartoon characters.

It's important to note that while NFTs and BRC-20 tokens based on inscriptions are fully stored on the Bitcoin blockchain, the linkage between an inscription and a specific satoshi relies on the Ordinals theory. Each Bitcoin consists of 100 million indistinguishable satoshis. Ordinals introduces an off-chain numbering scheme to differentiate individual satoshis. In other words, the existence of Ordinals depends on community consensus and widespread adoption. Without the Ordinals theory, inscriptions cannot be tracked or traded because they do not automatically point to a specific satoshi. From the blockchain’s perspective, every satoshi is identical.

So What Is ORDI?

ORDI is the first BRC-20 token issued on the Bitcoin blockchain, with a total supply of 21,000,000. ORDI was initially created as an experiment to test whether fungible tokens similar to Ethereum’s ERC-20 could be deployed using the Ordinals theory.

Unlike Ethereum’s ERC-20 token standard, Bitcoin does not support smart contracts. BRC-20 tokens are not smart contract-based—they lack underlying technology, founding teams, real-world projects, or practical use cases. Their price movements depend entirely on community consensus and market sentiment. BRC-20 tokens leverage the Ordinals theory to enable basic functions such as issuance, supply setting, and transfers on the Bitcoin network.

ORDI is a pure meme; therefore, evaluating its worth requires shifting from assessing it as a project to judging it as a meme. ORDI exists because of the Ordinals theory. Before discussing ORDI further, let’s examine what the Ordinals protocol means for Bitcoin.

The Ordinals Protocol: Paving the Way for Bitcoin’s Security Budget

Some critics argue that the Ordinals protocol burdens the network by writing large amounts of inscription data onto the blockchain, increasing transaction fees and hindering regular users. They also claim that rapid growth in transaction data increases the storage requirements for running Bitcoin nodes, raising hardware barriers and potentially reducing the number of full nodes—thereby harming decentralization.

However, institutions including Grayscale have pointed out that the Ordinals protocol positively impacts Bitcoin’s security and miner revenues.

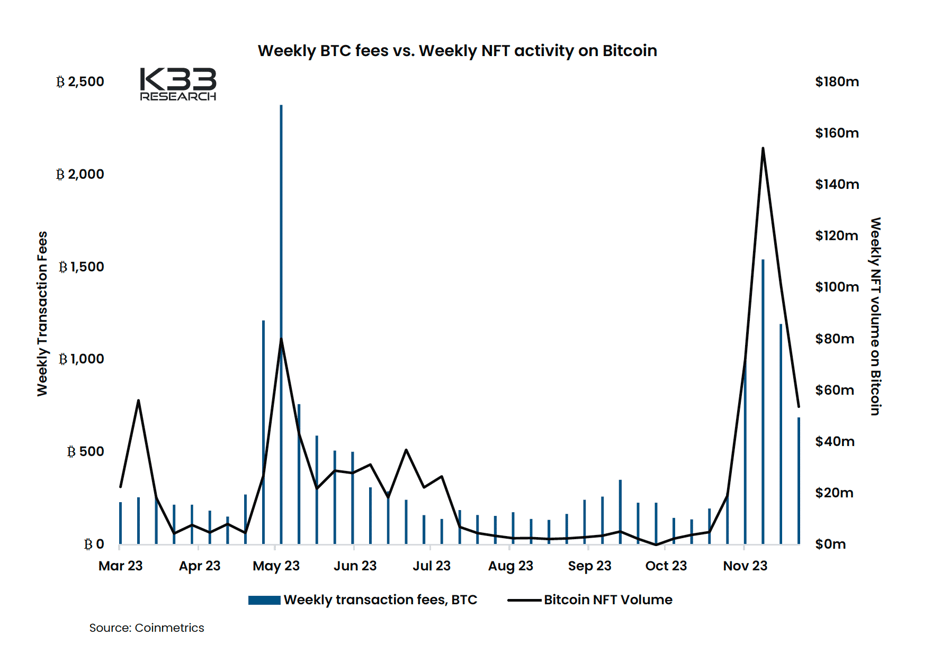

First, the Ordinals protocol has increased transaction fees earned by Bitcoin miners. Bitcoin network fees surged three times this year—in March, May, and November—corresponding to the three major waves of Ordinals activity. According to research firm K33, miners earned an average of 973 BTC per day in 2023, exceeding the projected 900 BTC. Additional fees from Ordinals boosted miner income by approximately 8%.

Transaction fee revenue is clearly driven by Ordinals

Transaction fee revenue is crucial—it will help fill Bitcoin’s security budget gap as block rewards decline over time. Miners play a vital role in securing the Bitcoin network. Currently, their income largely comes from block rewards (newly minted BTC for each block mined), but these rewards halve roughly every four years. As block rewards shrink, miner income drops, risking miner attrition and reduced network hash power. While not an immediate threat, this poses a serious long-term challenge for Bitcoin.

Second, increased miner revenue attracts more miners, expanding Bitcoin’s overall hash power and enhancing security. Higher hash power means attackers must invest significantly more resources to achieve a 51% attack.

But is the main criticism valid—do inscriptions really pose a problem by increasing node storage requirements?

In the Bitcoin world, miners use computational power to mine new blocks, nodes running Bitcoin clients (like Bitcoin Core) validate block validity, and developers maintain the client software. Miners, node operators, and developers form a complex balance of power, with no single party able to control the network. For deeper insight into this dynamic, read *The Blocksize War: The Battle Over Who Controls Bitcoin’s Protocol Rules*.

Thus, concerns arise that rapid growth in ordinals could inflate the Bitcoin blockchain, raise hardware requirements for running nodes, reduce node count, weaken decentralization, and disrupt the delicate balance among miners, nodes, and developers.

While this concern is reasonable, current Bitcoin clients like Bitcoin Core require only about 500GB of storage. Even if every block were fully filled due to Ordinals, the blockchain would grow by roughly 1TB every four years (source). Given that 1TB or even 2TB hard drives are now commonplace, worrying about blockchain size seems premature. Moreover, consumer-accessible storage capacity continues to grow rapidly with technological advances.

ORDI – A Powerful Meme

The term "meme" was first introduced by British evolutionary biologist Richard Dawkins in his 1976 book *The Selfish Gene*. Like genes, memes are the smallest units of culture and information, capable of spreading and evolving between people. The value and popularity of meme tokens depend on virality and community participation.

Meme tokens may seem purposeless, but they fulfill a real and significant demand in the crypto market: a speculative asset full of imagination and fairness.

Not every meme token offers infinite imaginative potential, nor does every meme provide fair betting opportunities for speculators.

Many compare BRC-20’s fair launch model to VC-backed projects, but I believe this comparison is flawed. VCs invest early in projects, providing capital when product success is uncertain, taking on enormous risk. Given this risk, they deserve cheaper allocations and larger returns upon success.

But memes have no products, no technical development, and no upfront investment. Therefore, a good meme should have no investors and no team holding large token supplies. While this seems obvious, reality often differs—take the once-popular meme token Pepe, which in August was exposed for team members stealing and dumping large quantities of tokens.

Tokeninsight News

The fair launch mechanism of BRC-20 tokens ensures participants can only obtain tokens through minting, eliminating early investors and project-owned reserves. Additionally, since BRC-20 tokens aren’t built on smart contracts and offer limited functionality, they avoid smart contract risks such as team theft or blacklisting. These traits make BRC-20 tokens natural speculative assets.

The Meaning and Imagination Behind Memes

The value and popularity of meme coins depend on reach and community engagement—the ability to capture widespread attention. If serious project tokens must capture value to attract investors, meme tokens must capture attention.

For example, after Terra’s collapse, numerous memecoins emerged around its CEO, with JAIL KWON surging temporarily when Do Kwon was arrested. When a South Korean lab claimed to develop a room-temperature superconductor LK-99, related meme coin LK99 experienced multiple price swings in the crypto market.

Creating a new meme coin costs nothing, and each one competes endlessly with others for attention. Some take crude approaches—naming themselves things like “HarryPotterObamaSonic” and assigning the ticker symbol BITCOIN.

HarryPotterObamaSonic10Inu

So what is ORDI’s narrative? What attention can it capture? ORDI is the first BRC-20 token deployed via the Ordinals protocol and the first BRC-20 token to surpass a $1 billion market cap. ORDI represents the Ordinals protocol, which symbolizes Bitcoin’s evolution, solves Bitcoin’s security budget problem, unlocks Bitcoin’s ecosystem, makes Bitcoin more interesting, and brings more people into the Bitcoin space.

"Meaning" is human-assigned. Compared to Pepe or HarryPotterObamaSonic, ORDI can carry more—and higher-quality—"meaning." Thus, ORDI ranks among the top-tier memes, comparable to Dogecoin ($13 billion market cap) and SHIBA Inu ($57 billion market cap).

ORDI’s Greatest Challenge: Sustaining Attention

Of course, this is a meme—creating one costs nothing. ORDI faces competition from memes with stronger cultural resonance and greater potential for meaning-making. One notable contender is another BRC-20 token: SATS.

Each Bitcoin consists of 100 million satoshis (sats). This BRC-20 token named SATS has a total supply of 2.1 quadrillion, matching the maximum possible number of sats in the Bitcoin network. SATS listed on Binance on December 12, pushing its market cap close to $1 billion.

Bitcoin’s ecosystem will inevitably produce a Doge-like meme coin surpassing tens of billions in market cap—but whether it will be ORDI or SATS remains unpredictable. Projects with real utility require continuous development and value creation by their teams; memes rely on holders and communities constantly promoting them, creating noise and attention across social platforms.

This—this is how the meme game should be played.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News