Popular L1 Performance Comparison: Beyond Solana, Which Ecosystems Still Have Room for Growth?

TechFlow Selected TechFlow Selected

Popular L1 Performance Comparison: Beyond Solana, Which Ecosystems Still Have Room for Growth?

Is the current price's extraordinary performance related to an improvement in fundamentals, or is it simply the same old pattern seen in the previous market cycle?

Author: THOR HARTVIGSEN

Translation: TechFlow

During the last bull market, L1s such as Solana, Avalanche, Fantom, and Polygon performed exceptionally well in terms of price appreciation. One might argue that this infrastructure dominance is a characteristic of an industry still in its early stages.

So, from 2021 to today, has there been any significant change? Judging by the price performance below, it appears not much has changed.

L1s + L2s + DeFi 30-Day Performance

This raises a question: Is the current abnormal price performance linked to improved fundamentals, or is it simply the same pattern we saw in the previous market cycle? This article analyzes eight top-performing L1s to answer this question.

Solana (SOL)

What sets Solana apart from most L1s is its use of parallel processing to validate and execute transactions without requiring additional scaling layers. This makes it a platform with low user interaction costs and high capital efficiency.

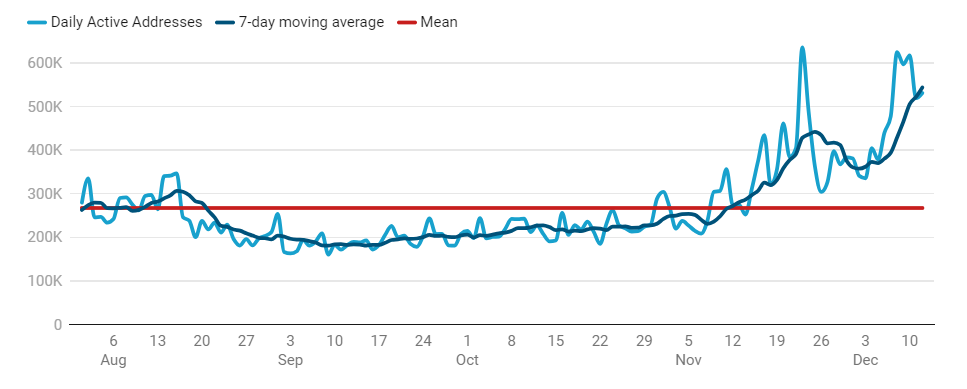

Daily Active Addresses on Solana

In terms of user activity, Solana is currently one of the most popular blockchains in the space, largely due to emerging protocols airdropping tokens to early users. Growing interest exists in leveraging the capabilities of the Solana Virtual Machine—for example, Eclipse uses it to expand Ethereum’s current capabilities. A factor contributing to Solana’s rise is the annual decline in issuance of its native token, as SOL’s inflation rate continues to decrease.

Below are some projects within Solana's ecosystem that could see strong token price appreciation if the ecosystem continues to thrive:

-

Jito ($JTO: $3B FDV)

As Solana’s leading liquid staking protocol, Jito gained significant popularity in the crypto community after conducting an airdrop to over 10,000 users.

-

Bonk ($BONK: $1.4B FDV)

$BONK, the most popular community coin on the Solana blockchain, has seen its market cap surge, with approximately 400% price growth over the past 30 days as more people join and participate in the network.

-

Marginfi ($MRGN: Not yet launched)

Marginfi is a decentralized lending protocol with over $240 million in total value locked (TVL). It currently rewards user engagement through points, which will later be used for an airdrop of their upcoming token. If you're interested in the airdrop, check out the recently released airdrop eligibility rules.

Avalanche (AVAX);

Avalanche is a fast and scalable platform enabling developers to build custom blockchains or use existing subnets (partitioned sections of a blockchain). The Avalanche mainnet actively utilizes three blockchains, shown in the figure below.

Most of us are familiar with the C-chain, where DeFi applications reside. The Avalanche mainnet itself is a special subnet. Currently, various projects are deploying their own subnets on the system, including notable examples such as:

-

Beam (Gaming): Aims to empower developers and grow through community-driven methods

-

UPTN (Web3): Piloting in South Korea to integrate blockchain technology into real-world businesses

-

DFK (Gaming): GameFi platform, Defi Kingdoms

Avalanche’s TVL

With AVAX breaking out of its long-term consolidation range and TVL growing significantly, the Avalanche ecosystem is gradually gaining more attention. Importantly, this growth is driven by AVAX’s price appreciation rather than new token inflows.

The bullish case for Avalanche lies in increasing numbers of platforms choosing to deploy subnets—opting for this approach over currently available L2 solutions—to meet their specific application needs.

If the ecosystem shows sustained upward momentum, some Avalanche-based projects may perform well:

-

Trader Joe (JOE: $307.81M FDV)

The chain’s top DEX and a key component of the ecosystem, Trader Joe has been actively rolling out updates and generating substantial fees amid surging trading volume.

-

Benqi (QI: $182.74M FDV)

Benqi offers a suite of DeFi products, including lending, liquid staking, and validator leasing. Alongside massive TVL growth in its liquid staking segment, QI’s price has risen approximately 250% over the past two weeks.

Near (NEAR)

Near is a blockchain also known as an operating system, providing interoperability across any blockchain. Its core focus is scalability, achieved through "sharding"—dividing the network into smaller parts to process transactions more efficiently while maintaining speed, low cost, and decentralization.

Near Daily Active Addresses

Through collaboration with EigenLayer, Near’s upcoming “Fast Finality Layer” will offer faster and cheaper transactions for Ethereum rollups. The testnet is expected to launch in Q1 2024. Additionally, real-time market data provider Pyth has joined Near, offering its oracle solution, enabling on-chain applications to easily access stock, commodity, and market data.

If the ecosystem continues to grow, some Near-based applications may perform well:

-

Meta Pool (META: $2.27M FDV)

A multi-chain liquidity-based ecosystem offering a range of products, including LSTs, liquidity provision, launchpad, and bonds. Meta Pool’s cumulative TVL is $42.56 million, with 97% of that value on Near;

-

Ref Finance (REF: $9.39M FDV)

With $16.87 million in TVL, Ref is Near’s largest AMM, where users can trade spot or perps at low transaction costs.

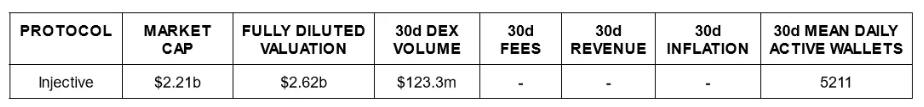

Injective (INJ)

Built on the Cosmos SDK, Injective is a blockchain designed for financial applications, offering fast transaction processing and low gas fees, along with strong interoperability across various other chains (e.g., Ethereum, Solana).

Year-to-Date INJ Price Movement

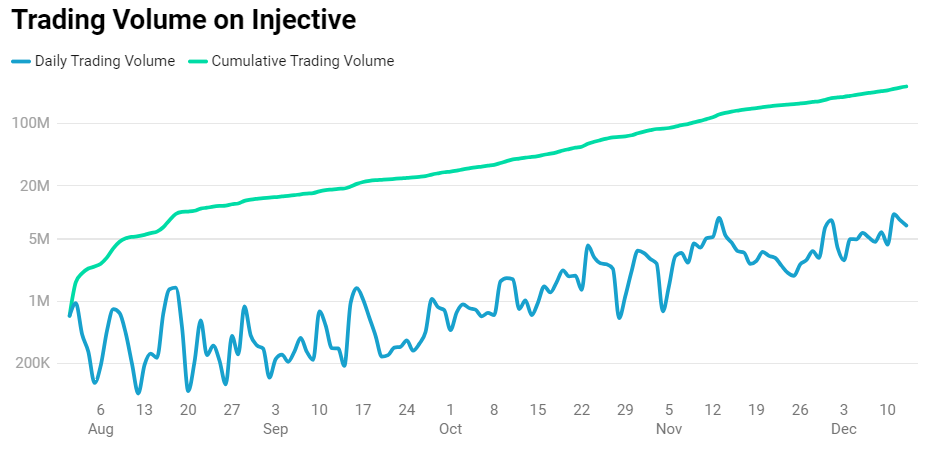

INJ Trading Volume

The project has received funding from numerous prominent tech and crypto investors. Despite its large market cap, on-chain activity remains limited beyond staking, though there are significant efforts underway to attract builders to the platform. Earlier this year, a $150 million ecosystem fund was established to accelerate interoperability infrastructure and DeFi adoption. Although trading volume has trended upward over recent months, daily volumes of $5–7 million are modest for a project with a $3 billion market cap.

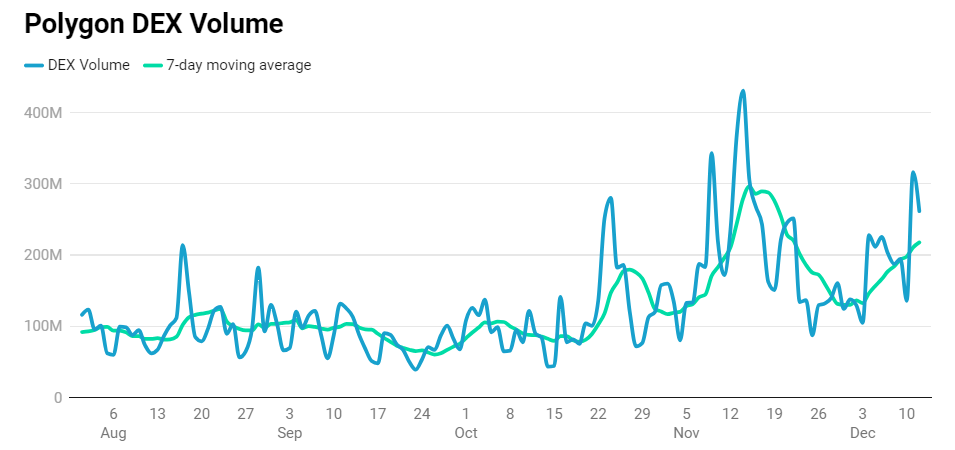

Polygon (MATIC)

Polygon (PoS) is an EVM-compatible sidechain designed for low-cost, fast transactions.

Polygon DEX Trading Volume

Over recent months, DEX trading volume on Polygon has increased slightly, but not at the pace seen on Solana or Avalanche.

In a blog post released in July, Polygon announced its 2.0 upgrade. Polygon is building a modular stack featuring components such as “Supernets” (application-specific chains), private rollups, and the recently launched Polygon zkEVM.

Key highlights of the update include:

-

Redesigned protocol architecture;

-

Token rebranding from MATIC to POL;

-

Optimized ecosystem benefits:

-

Enhanced security;

-

Increased scalability;

-

These factors could drive POL token appreciation in 2024. If MATIC rebounds, applications worth watching include:

-

Quickswap (QUICK: $45.02M FDV) deployed across multiple Polygon layers, with $125.65M TVL mostly on the PoS chain, allowing users to swap tokens and trade perpetual contracts while accessing a wide range of products and services beyond DeFi. QuickSwap has generated $10.3M in fees and approximately $11.1B in cumulative trading volume this year.

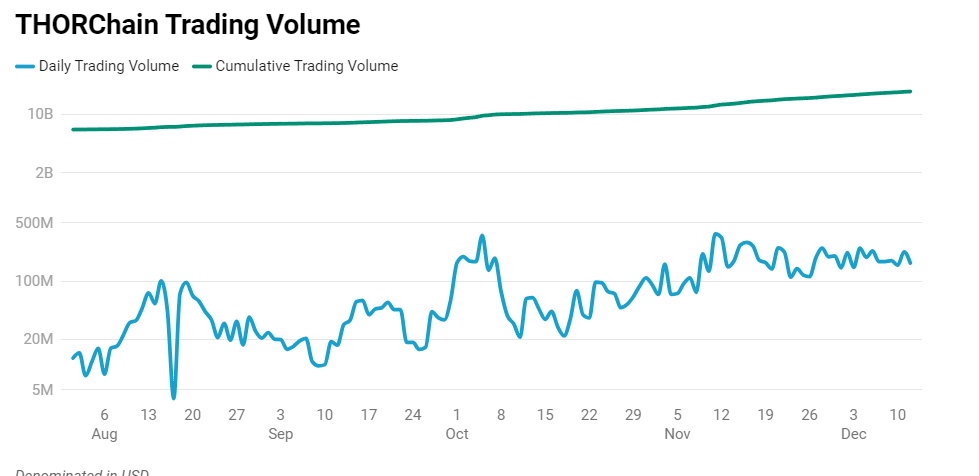

THORChain (RUNE)

THORChain operates as an independent cross-chain L1 AMM, allowing users to exchange native assets across multiple chains without relying on wrapped or pegged assets.

THORChain Trading Volume

From trading volume metrics, it is evident that the protocol’s underlying technology is being effectively utilized for on-chain transactions. Loan protocols integrated with THORChain are actively burning a significant portion of RUNE supply. Its lending model allows users to borrow BTC or ETH with zero interest and no risk of liquidation, using various collateral options. However, depending on market conditions, these loans require higher minimum collateral ratios ranging from 200% to 500%.

If the ecosystem continues to grow, promising projects include:

-

THORSwap (THOR: $129.54M FDV) This DEX aggregator enables one-click swaps across 10 chains and over 5,000 assets, sharing 75% of revenue with users who stake their tokens. The protocol is currently conducting monthly token burns based on trading volume and recently reached $1B in TVL.

-

Maya (CACAO: $73.03M FDV)

As a fork of THORChain, Maya is a cross-chain DEX aiming to directly compete with centralized exchanges by reducing associated risks while offering deep liquidity and low fees.

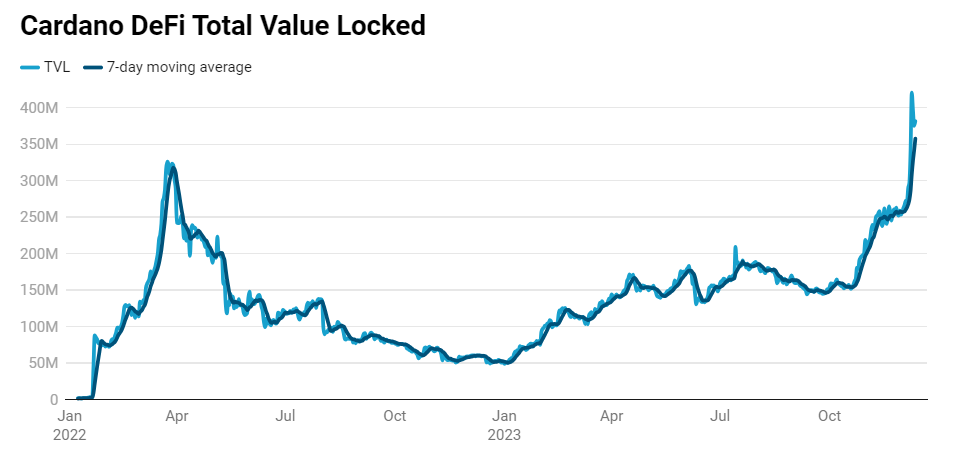

Fantom (FTM)

Fantom was a high-performance blockchain during the previous cycle, hosting one of the largest DeFi ecosystems. However, activity declined sharply following the Terra collapse, Tomb depeg, and Multichain bridge hack.

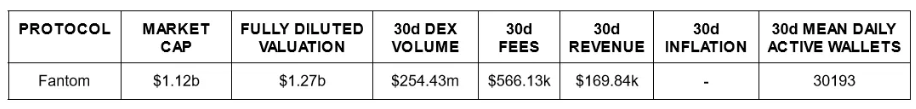

FTM’s TVL

Despite a difficult period, the team remains actively engaged and plans to soon launch entirely new blockchain technology to stay competitive. Leveraging a new virtual machine and enhanced storage capabilities, their upcoming version called “Sonic” is expected to achieve over 2,000 TPS. The upgrade is slated for release in spring 2024.

If the ecosystem regains momentum, promising applications include:

-

SpookySwap (BOO: $11.33M FDV); Fantom’s leading DEX offering native and cross-chain token swaps, distributing part of trading fees to stakers.

-

BeethovenX (BEETS: $4.43M FDV); Forked from Balancer V2, BeethovenX is an AMM offering users optimal swap rates, minimal slippage, and stable yield opportunities. Token holders receive a share of the platform’s generated swap fees.

-

WigoSwap (WIGO: $14.12M); Offering a suite from trading to gaming, Wigo aims to become central to the Fantom ecosystem.

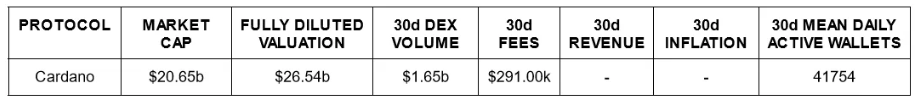

Cardano (ADA)

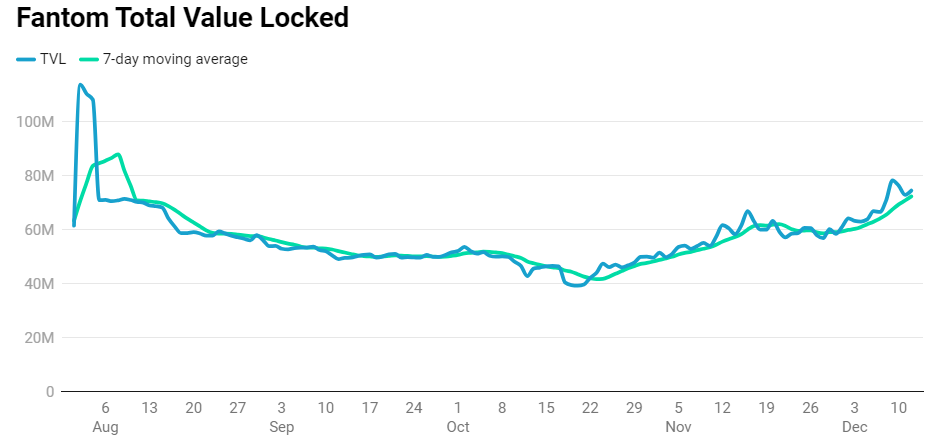

Cardano is a PoS blockchain that emerged during the last cycle and became highly favored among retail investors. Although ADA has evolved into a significant meme in many people’s minds, the ecosystem continues to grow, indicating increasing adoption.

Cardano’s TVL

Though not renowned for its DeFi scene, Cardano has demonstrated strong growth in on-chain value and activity, driven by its loyal community. To further boost usage and network efficiency, scalability bottlenecks are being addressed via a Layer 2 solution called “Hydra.” Defined as a homogenous off-chain processing L2, each Hydra “head” can handle 1,000 TPS.

Some notable Cardano-based ecosystem applications:

-

Indigo (INDY: $114.91M FDV) Cardano’s preferred CDP platform, enabling users to create fully collateralized synthetic assets such as BTC, ETH, and USD.

-

Minswap (MIN: $174.28M FDV) A community-focused protocol and DEX leader in the ecosystem, Minswap remains dominant in both TVL and trading volume despite a vulnerability incident earlier this year.

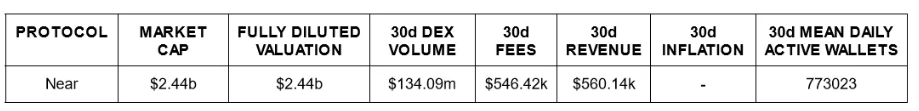

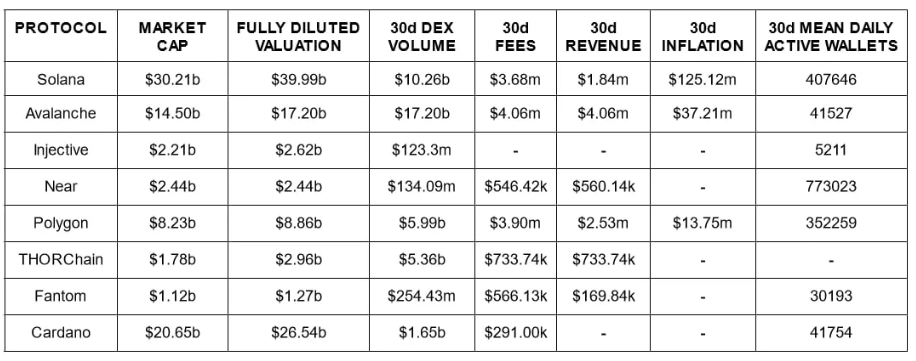

Below is a summary of the key metrics for each L1 discussed in today’s research report.

In conclusion, it is clear that some of these L1s have experienced growth in fundamental metrics such as daily users, TVL, and trading volume. However, even more apparent is that recent price appreciation for many of these tokens far exceeds their fundamental growth. We believe these tokens should be viewed more as narrative-driven trades rather than long-term fundamental investments.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News