Let the Data Speak: How Influential Is a16z on Compound?

TechFlow Selected TechFlow Selected

Let the Data Speak: How Influential Is a16z on Compound?

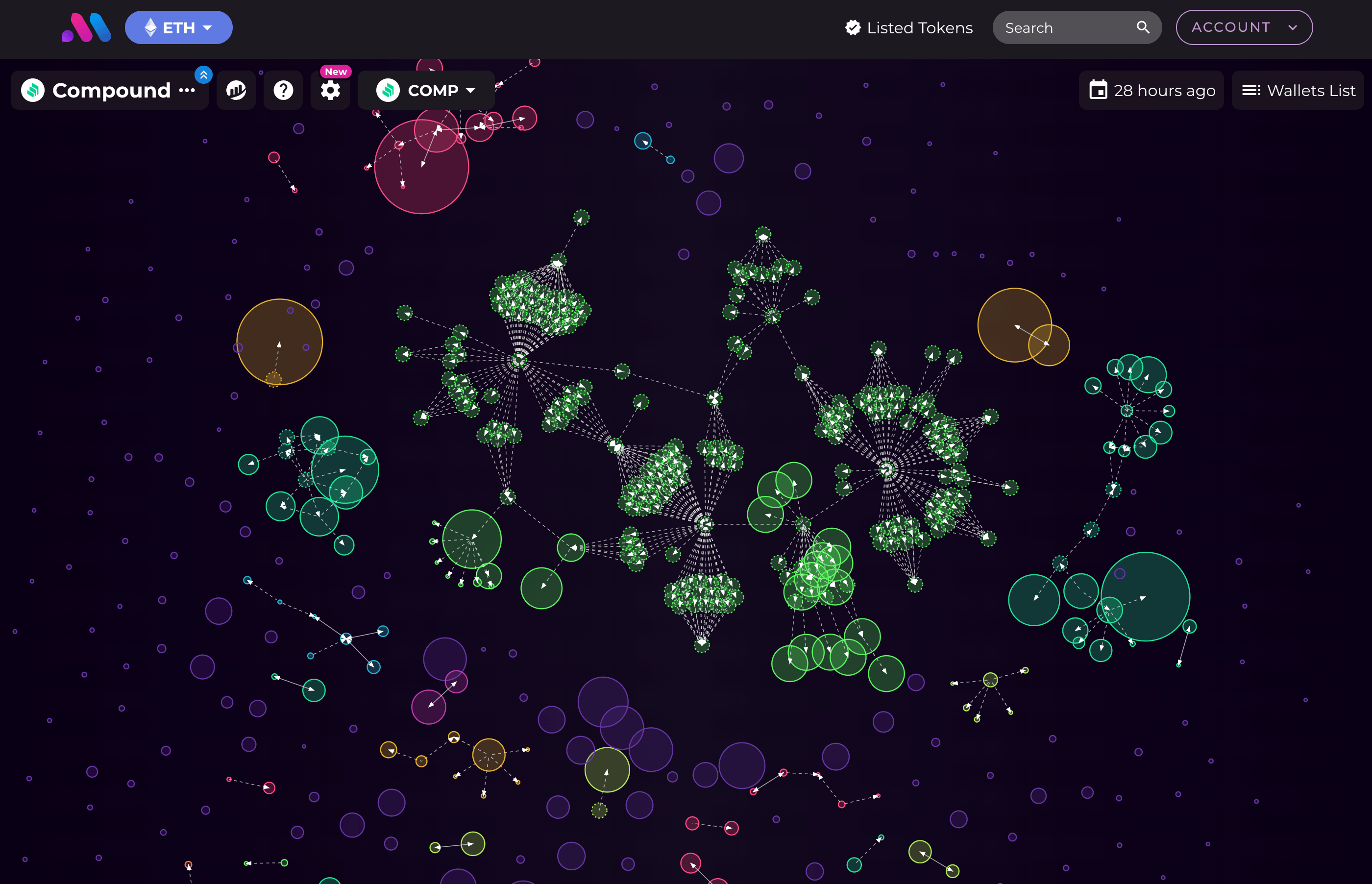

a16z holds more than 10% of the total supply of COMP.

Author: Bubblemaps

Translation: 1912212.eth, Foresight News

According to our research:

-

a16z holds over 10% of COMP tokens

-

The voting quorum reaches 4%, indicating significant influence.

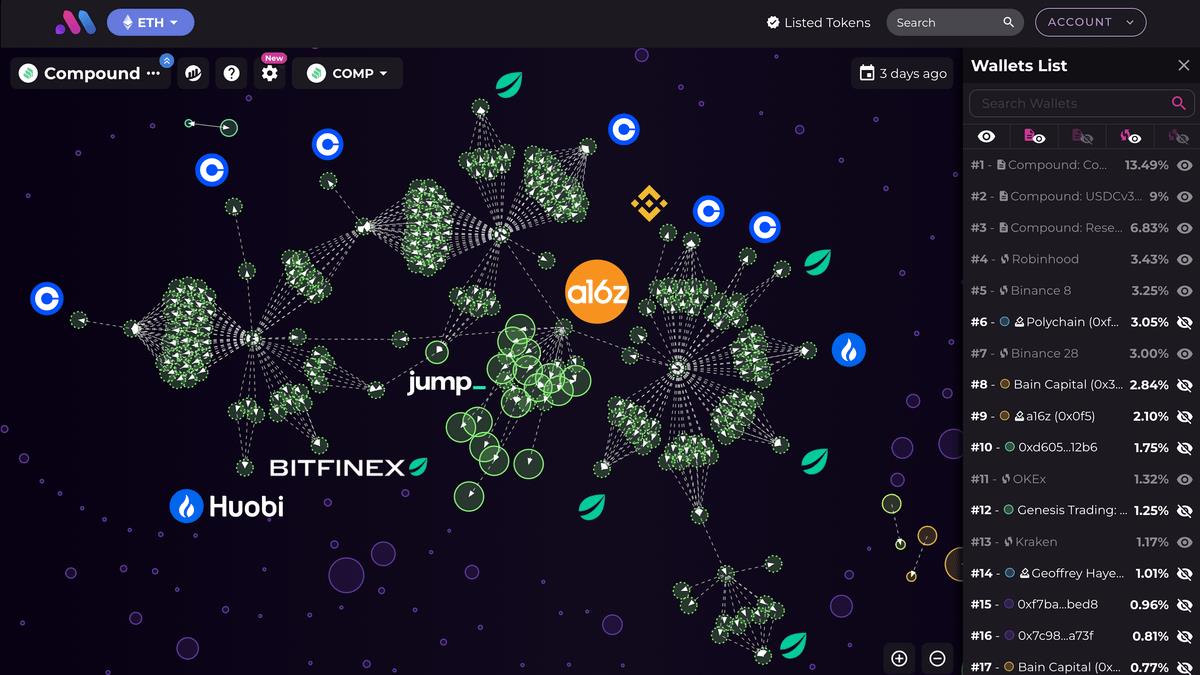

Compound raised over $30 million in its seed and Series A funding rounds, both led by a16z. Other notable investors include Paradigm, Bain Capital, and Polychain.

Compound operates on a governance token: COMP

Holders can:

-

Propose changes to the protocol

-

Vote to implement these changes

Due to Compound's substantial funding, 2,400,000 COMP (24% of total supply) were allocated to private investors.

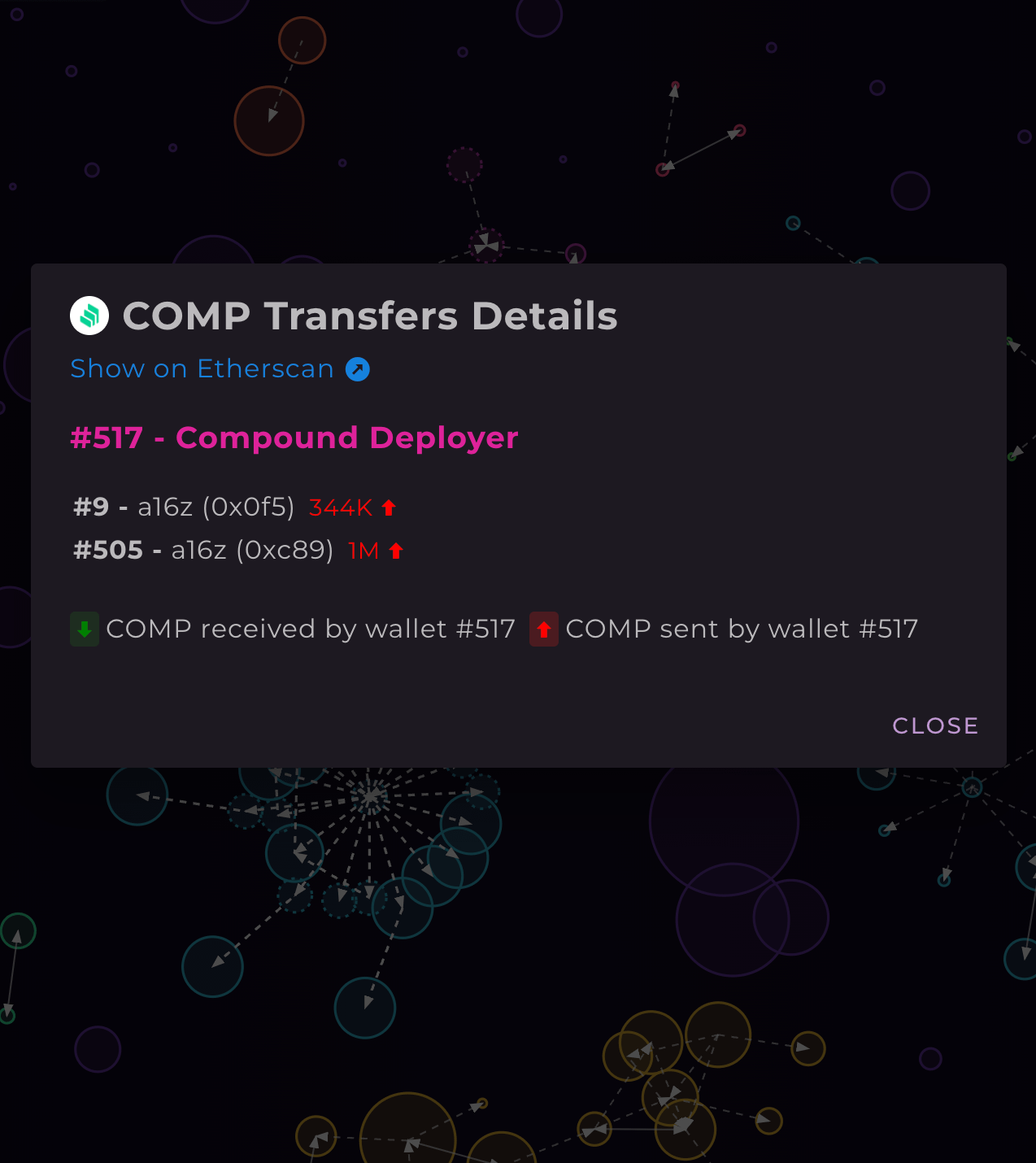

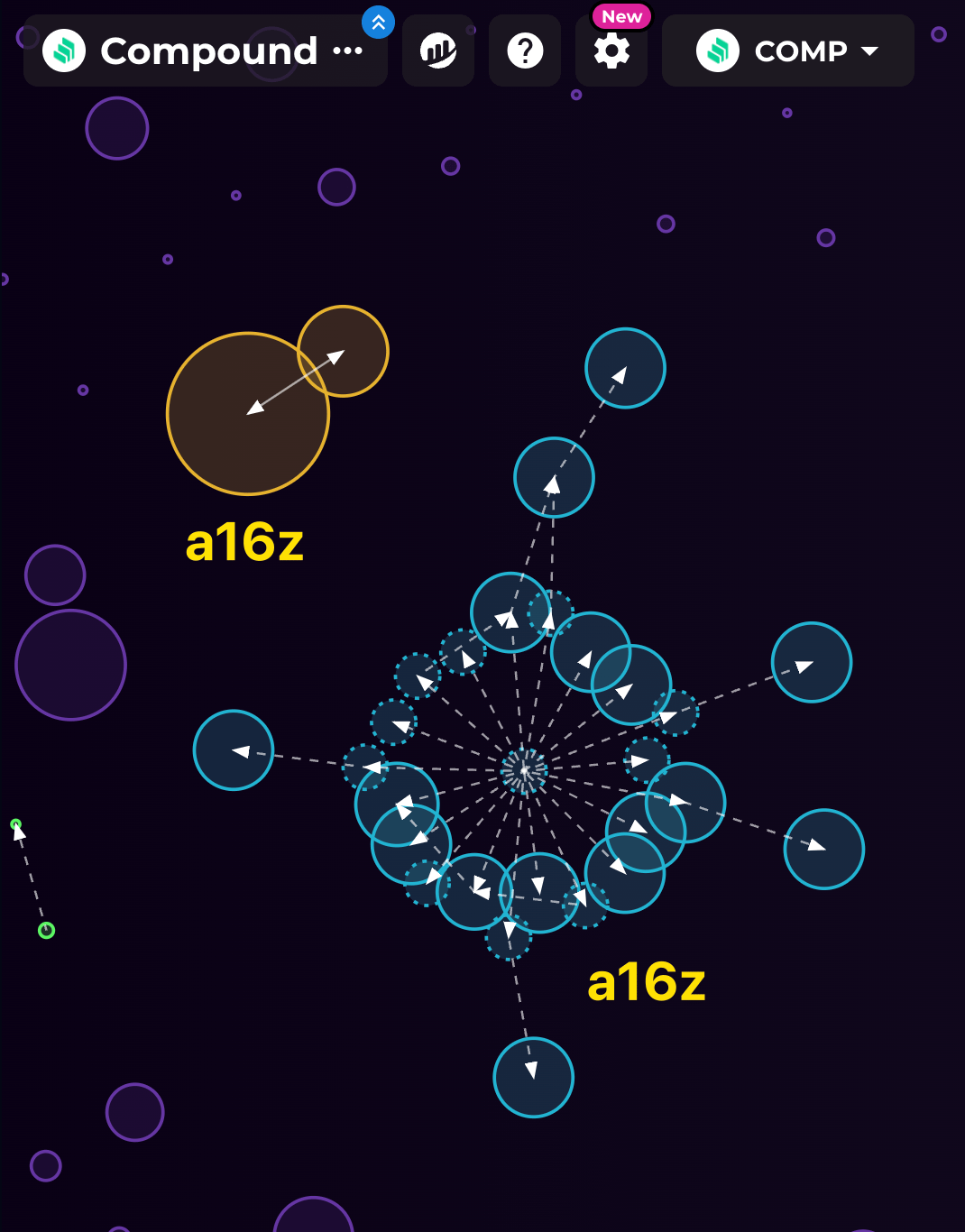

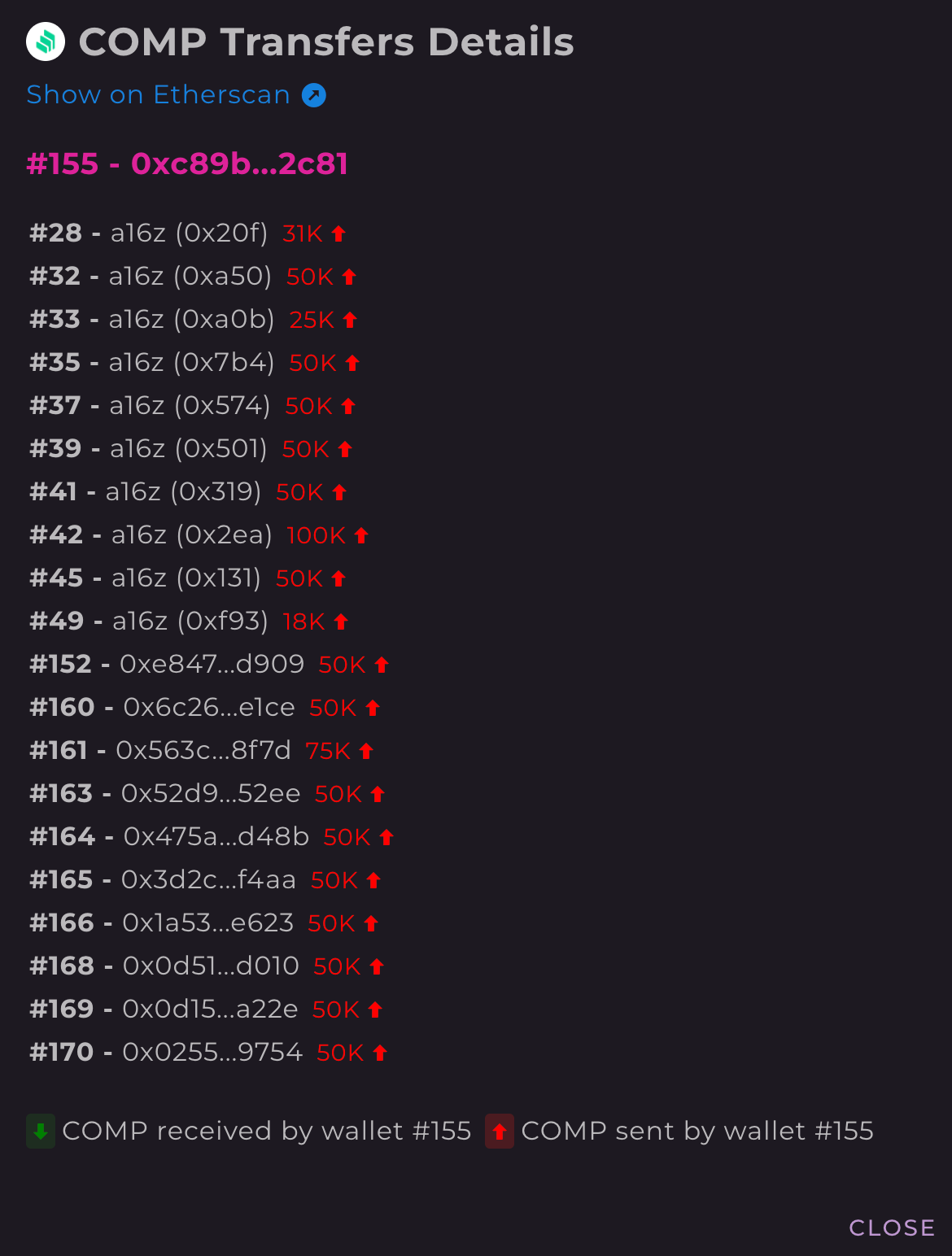

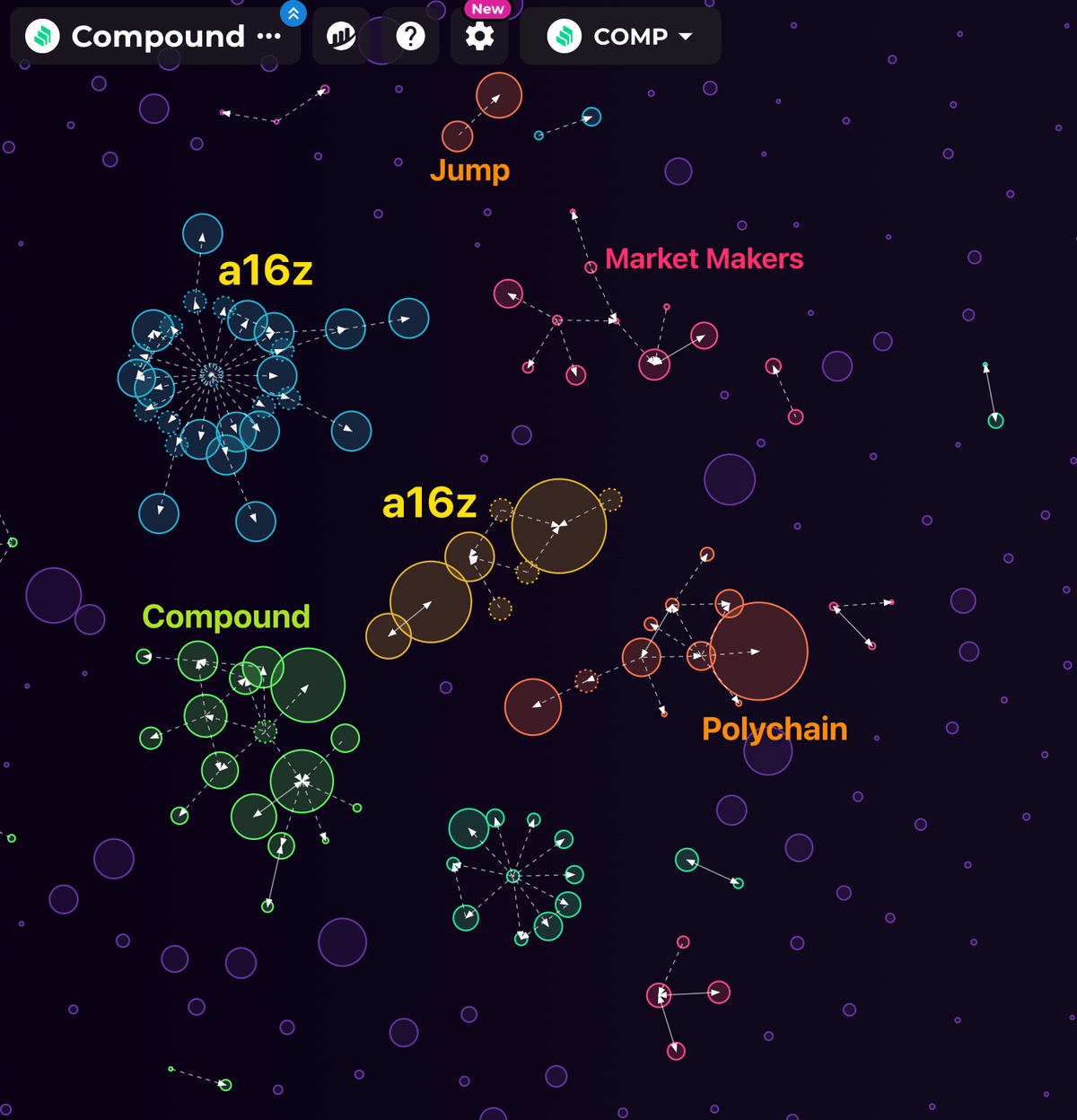

a16z initially received 1.34 million COMP (13.4% of total supply), distributed by the deployer to two wallets:

Address 0xc89 received 1 million COMP.

Address 0x0f5 received 340,000 COMP.

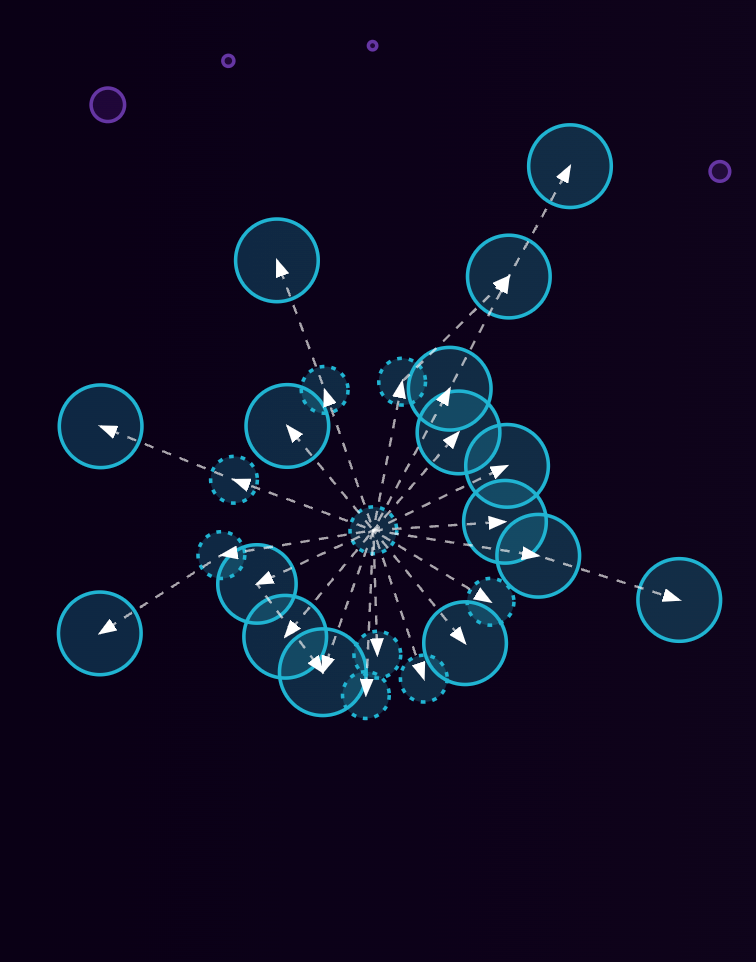

0xc89b delegated 800,000 COMP to multiple wallets, including Gauntlet, UCLA, GFX Labs, etc.

However, 2 million COMP went missing.

We tracked the remaining 200,000 COMP as it passed through multiple wallets before being transferred to CEXs. This amounts to over $10 million.

a16z still holds approximately 1.1 million COMP, worth around $55 million. a16z owns 11% of the supply. Other major holders of COMP include:

-

MM ~ 2%

-

Polychain ~ 3%

-

Bain Capital ~ 4%

-

Compound team ~ 10%

[Disclaimer] The market involves risks, and investment should be approached with caution. This article does not constitute investment advice. Readers should consider whether any opinions, viewpoints, or conclusions expressed herein are suitable for their particular circumstances. Investment decisions made based on this information are at the reader's own risk.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News