Reject FOMO Mentality: Data Shows Market in Early Bull Phase, Altseason Not Yet Arrived

TechFlow Selected TechFlow Selected

Reject FOMO Mentality: Data Shows Market in Early Bull Phase, Altseason Not Yet Arrived

History doesn't repeat itself, but it often rhymes.

Written by: Jake Pahor

Compiled by: TechFlow

Crypto researcher Jake Pahor shares his views on the market. In this article, we will dive deep into multiple dimensions such as market cycles, BTC dominance, ETH/BTC ratio, stablecoin inflows, DeFi TVL, and retail enthusiasm to explore where we stand in the current market cycle and what lies ahead.

Market Cycles

“History doesn't repeat itself, but it often rhymes.”

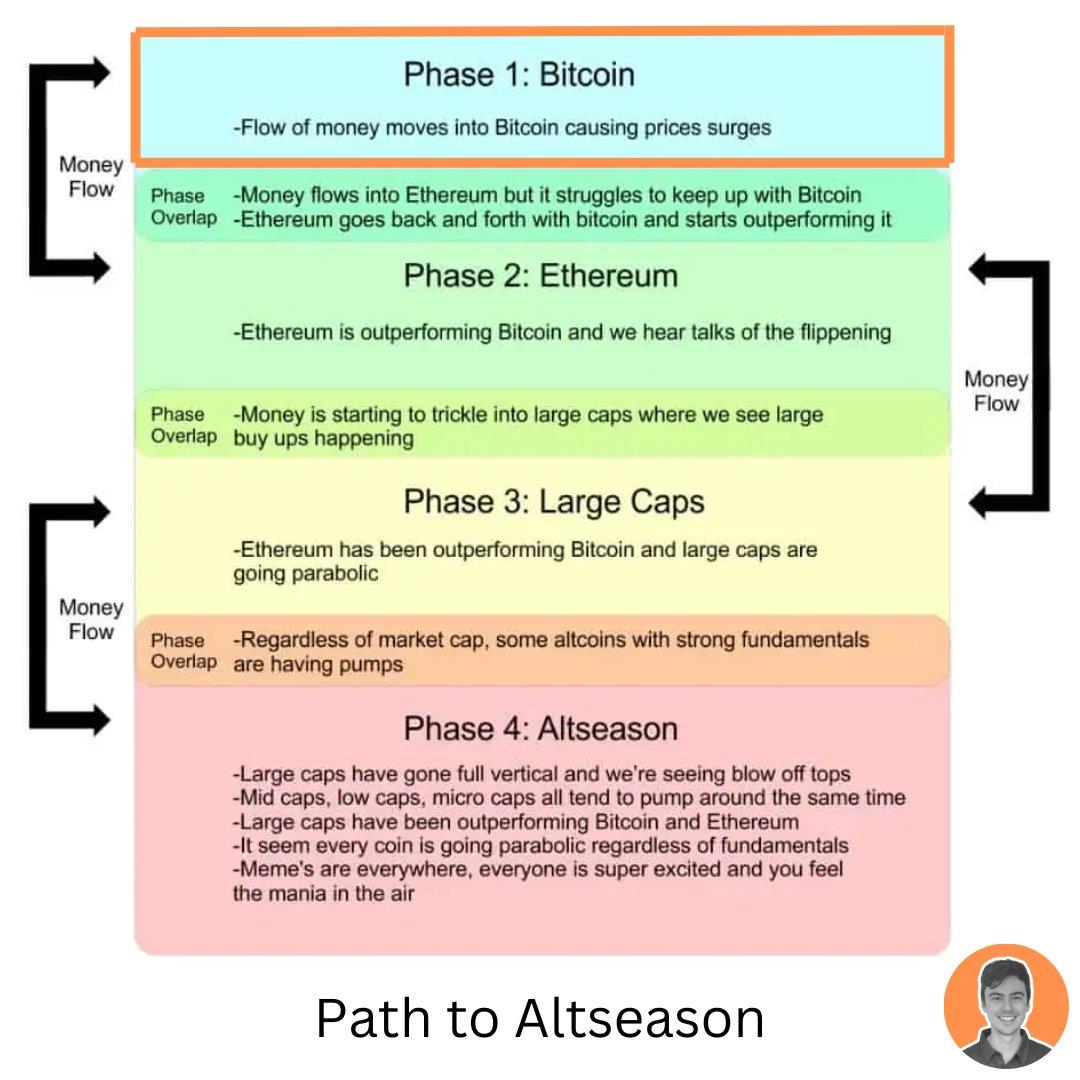

Looking back at previous cycles helps us understand what might come next. While nothing is guaranteed, it gives us insight into capital rotation patterns.

We are currently in the first phase — Bitcoin.

This is the early stage of the bull market, where all liquidity is drawn toward the safest asset — Bitcoin. Among volatile assets, BTC has the lowest downside risk and significant upside potential driven by possible ETF approval and the upcoming halving event.

BTC Dominance

We can measure and visualize this capital rotation cycle by observing the BTC dominance chart.

Since September 2022, BTC.D has been in a strong uptrend, forming a series of higher highs (HH) and higher lows (HL), indicating a bullish trend.

Current Bitcoin market share stands at 55%, reaching a multi-year high.

The next key level to watch is around 58–60%, as this range previously acted as both support and resistance.

Eventually, BTC.D will reach its cyclical peak and begin to decline. As risk appetite increases, capital will rotate into ETH → large caps → altcoins.

ETH/BTC

Another important chart to monitor is ETH/BTC.

Since December 2021, ETH has underperformed, showing a downtrend characterized by lower lows (LL) and lower highs (LH).

The second phase of the market cycle begins when ETH/BTC finds a bottom and starts to rebound.

Stablecoin Inflows

Since 2022, stablecoin market cap has been in a strong downtrend, consistent with capital exiting the space — a hallmark of bear markets.

However, we may now be seeing signs of a bottom forming.

• October 2023 = $124 billion

• December 2023 = $129 billion (+5%)

Bull markets = stablecoin inflows.

DeFi TVL

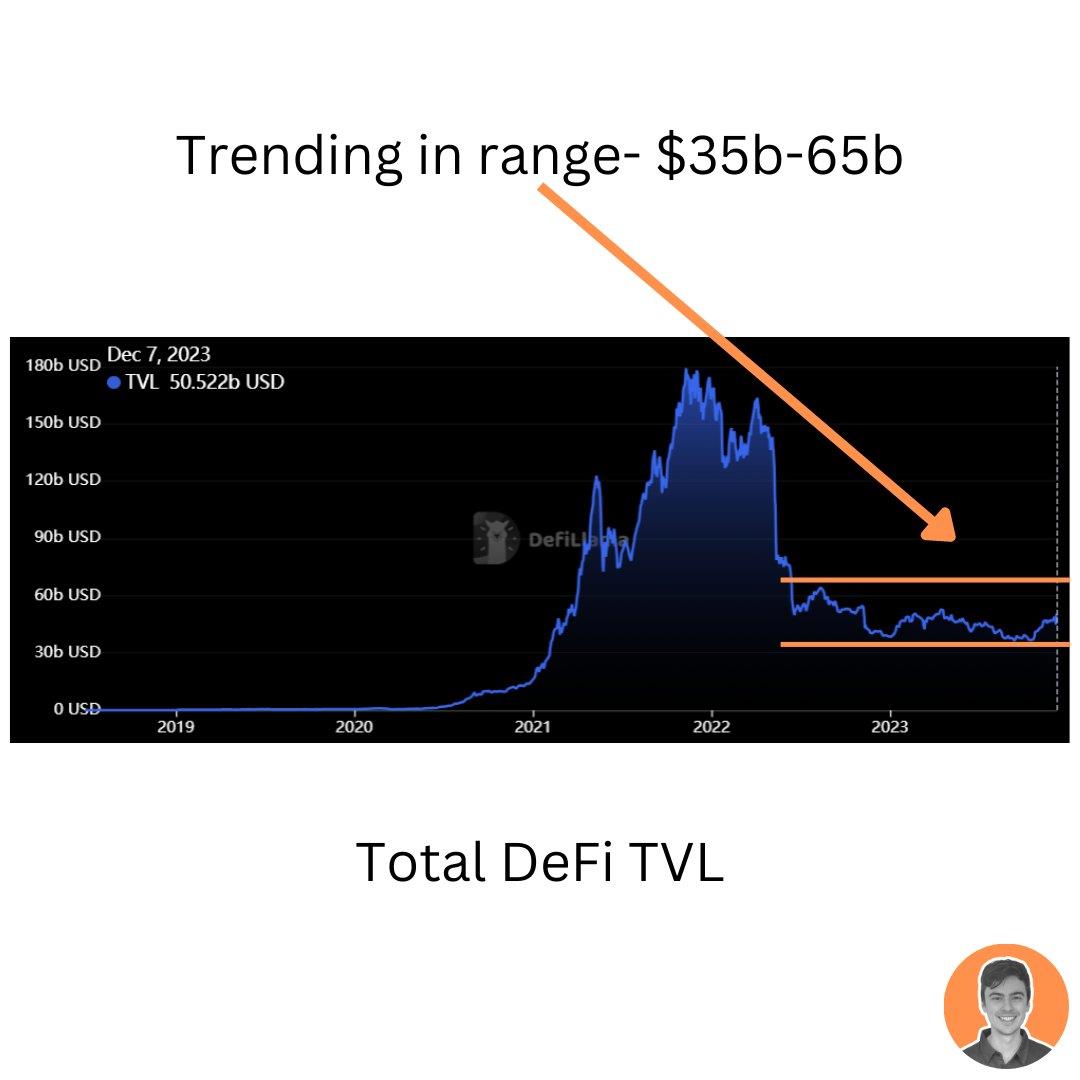

TVL is often seen as a lagging indicator. Nevertheless, it remains useful for studying and understanding overall trends.

Since June 2022, TVL has fluctuated within a certain range. However, since October, we’ve seen a solid upward trend.

• October 2023 = $36 billion

• December 2023 = $50 billion (+39%)

Retail Interest

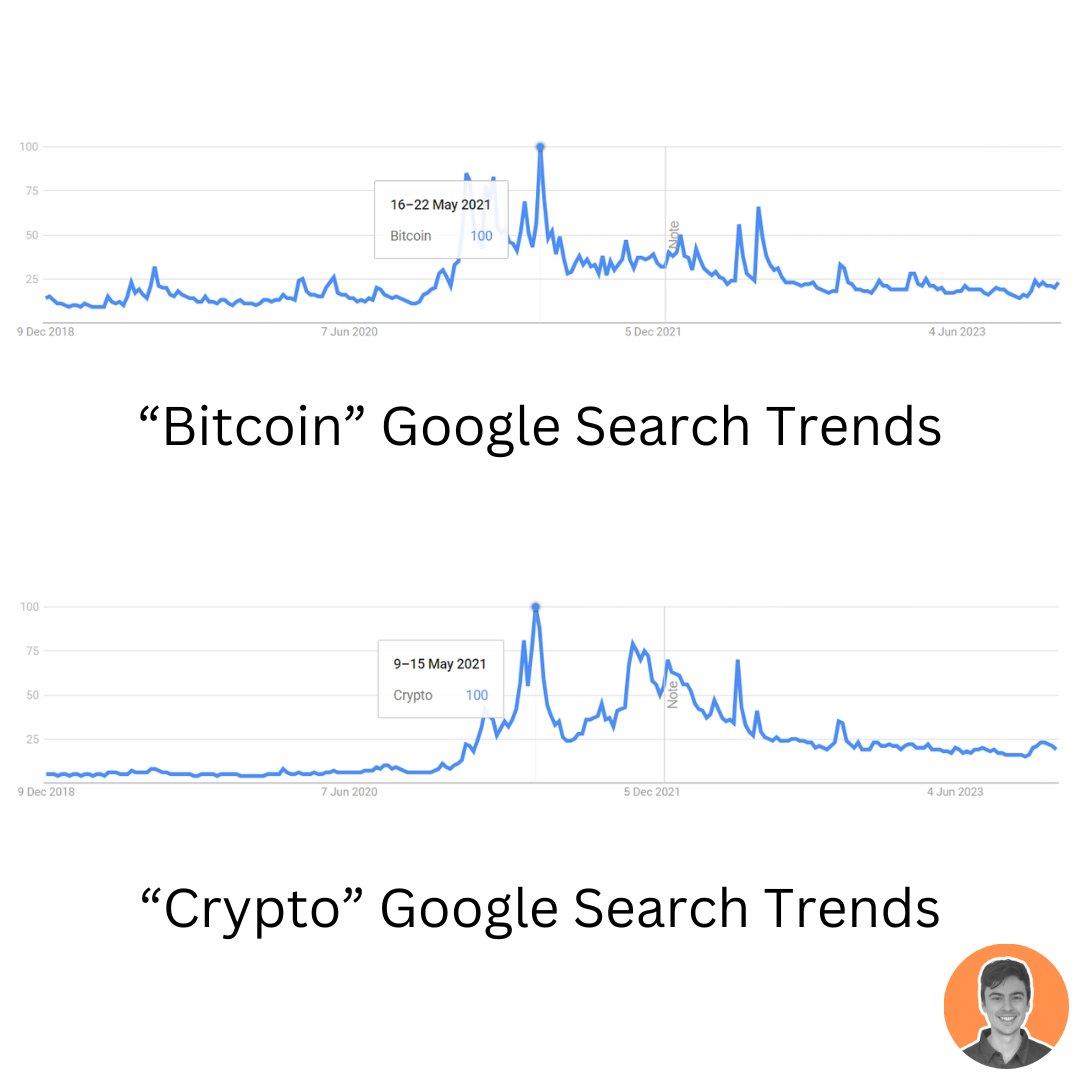

When your friends and family start asking whether they should buy crypto, that’s usually a good sign of an approaching top.

Previously, retail interest peaked in May 2021 on Google Trends after Bitcoin reached $64,000. Currently, however, retail interest in crypto remains very low.

Summary

It's easy to get caught up in recent market gains and think: “Oh no, I haven’t gotten in yet.”

FOMO kicks in, and you feel like you're already behind.

Take a breath, step back, and look at the data.

We are only in the first phase of the bull market — the Bitcoin season.

The altcoin season is still some time away.

Now is the time to focus, double down on research, and build systems and processes. Let’s work hard together — in a few years, I firmly believe the market will reward us with returns beyond our imagination.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News