Web3 gaming is growing fast but comes with many issues—how can users maximize their returns?

TechFlow Selected TechFlow Selected

Web3 gaming is growing fast but comes with many issues—how can users maximize their returns?

From a data trend perspective, Web3 games may be capturing market share from traditional games at an accelerating pace.

By Kasou Kazoku

Which type of game offers the most lucrative returns? Many users might immediately think of Web3 games. Indeed, the wealth effect of Web3 gaming is evident—take the prime example of Axie Infinity, whose native governance token AXS surged from $3 to $156 within just six months during the 2021 crypto bull market.

AXS price performance during the bull market

In terms of wealth generation, Axie Infinity once achieved record-breaking monthly revenues. However, when comparing it with established titles like World of Warcraft and Genshin Impact, a series of questions arise:

Will Web3 games surpass traditional games in user base and market scale in the coming years? What factors determine the overall health of the Web3 gaming industry? How can ordinary users maximize their chances of identifying high-quality projects in this immature market? And what tools or platforms can help users discover promising projects and analyze major market trends?

Below, we’ll address these questions one by one. This article serves solely as informational reference and does not constitute investment advice.

1. From data trends: Web3 games may capture traditional gaming market share at an accelerated pace

The wealth-generating potential of Web3 games needs no elaboration. But viewed from a macro perspective and compared against historical data from traditional gaming, emerging trends become even clearer.

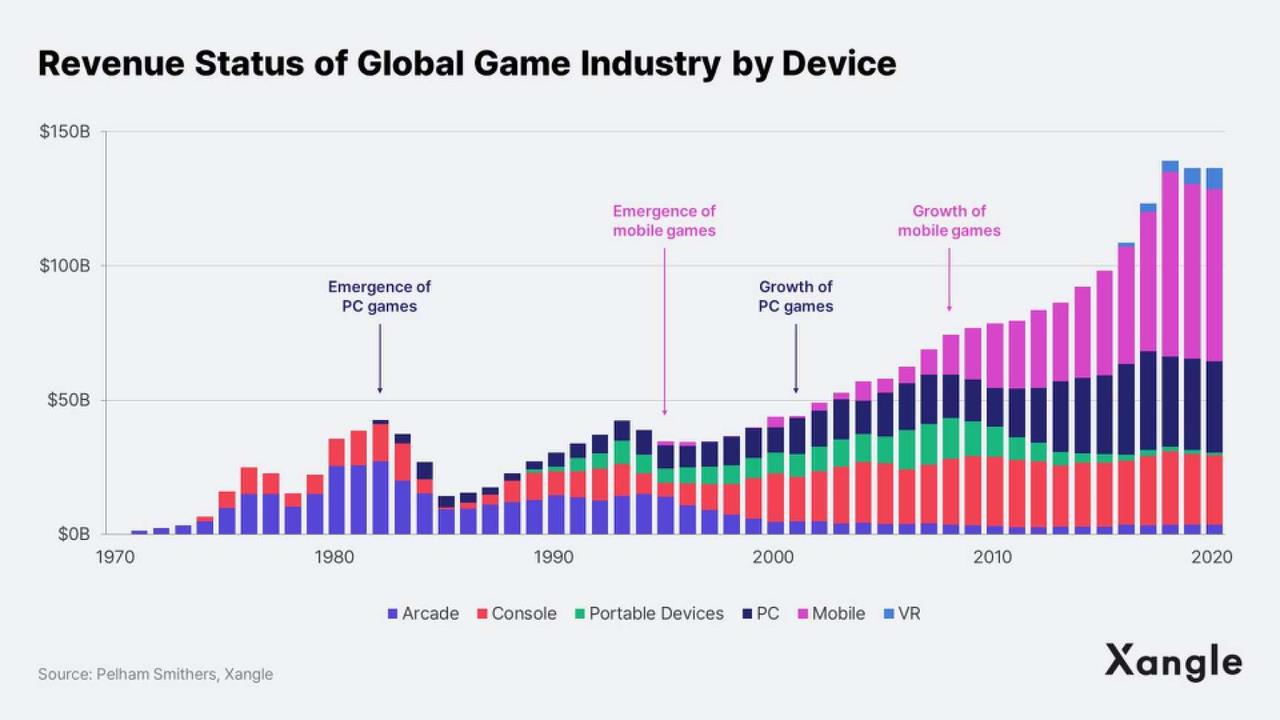

According to a recent report by Xangle, a digital asset disclosure platform, global PC game annual revenue first surpassed $1 billion around 1983, took 13 years to reach $10 billion, and another 25 years to hit $15 billion. Mobile game annual revenue crossed the $1 billion mark around 1995, reached $10 billion after 10 years, and took an additional 12 years to climb to $15 billion.

Xangle Report: Annual Revenue Growth of Global PC and Mobile Games

In contrast, Axie Infinity generated over $300 million in monthly revenue in August 2021 (launched in November 2020). By October 2022, its total annual revenue had reached $2 billion. Clearly, the cumulative industry-wide revenue that took PC and mobile gaming decades to achieve was matched by Axie Infinity alone in just a few years during the bull market.

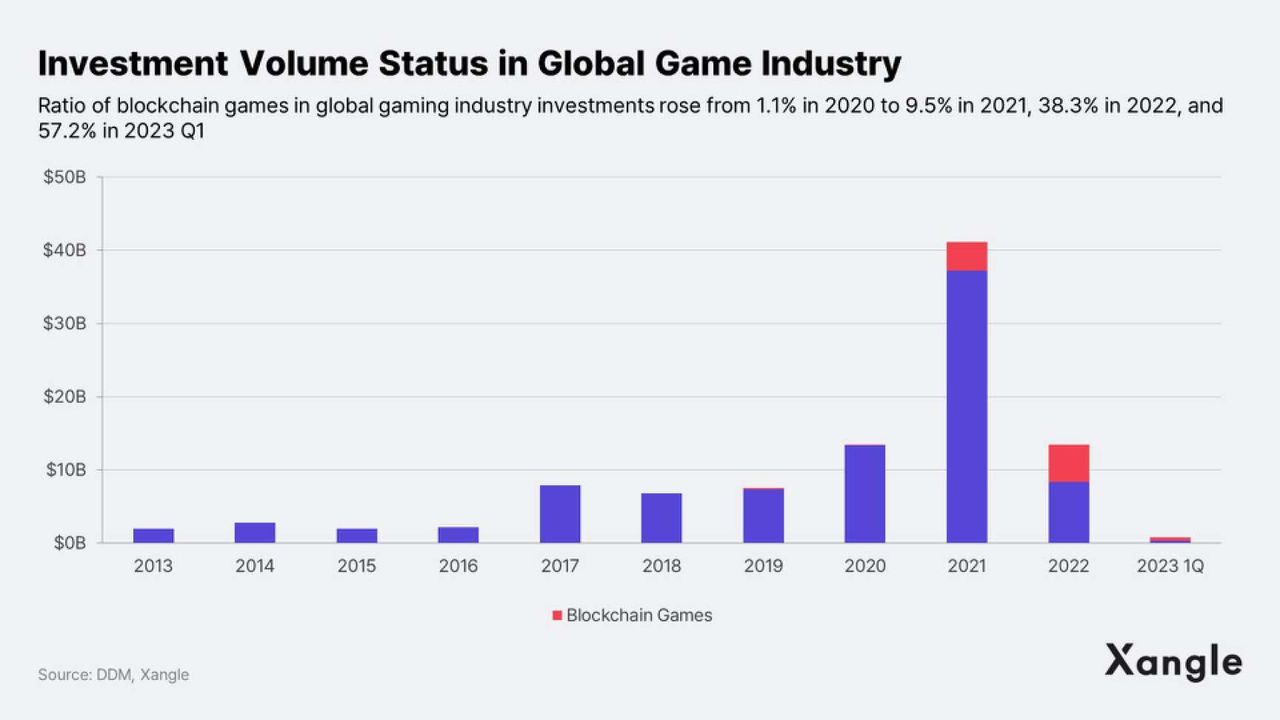

Xangle data also shows that investment in Web3 games as a share of the entire gaming industry has risen sharply—from 1.1% in 2020 to 9.5% in 2021, 38.3% in 2022, and a staggering 57.2% in Q1 2023. This indicates that even sophisticated investors are voting with their capital, rapidly shifting toward the more lucrative Web3 gaming sector, while traditional games are increasingly being left behind.

Xangle Report: Investment Share of Web3 Games in the Overall Gaming Industry

Based on these data points, Web3 games appear poised to capture market share from traditional games at an accelerating rate. In the future, the adoption and application scope of Web3 games will expand significantly.

2. Despite extremely high failure rates, Web3 game lifecycles remain closely tied to crypto market cycles

Despite favorable macro trends, Web3 gaming continues to develop in a spiral pattern, marked by downturns as well—clearly reflected in fluctuating investment data.

DappRadar’s “Q3 2023 State of Play-to-Earn” report, released in early October, revealed that Web3 gaming projects raised $600 million in funding during the quarter—a 38% drop from Q2’s $973 million. As a result, total funding for the first ten months of 2023 amounted to approximately $2.3 billion, only about 30% of last year’s full-year total.

DappRadar Data: Total industry fundraising in Q3 2023 dropped 38% from Q2

For emerging Web3 markets, external financing is critical for sustaining project lifecycles—unlike traditional games, where growth primarily depends on player experience and game quality. In comparison, the stability of both the broader Web3 gaming market and individual projects lags far behind that of traditional gaming. Even more troubling for users is the fact that Web3 game mortality rates vastly exceed those of traditional games.

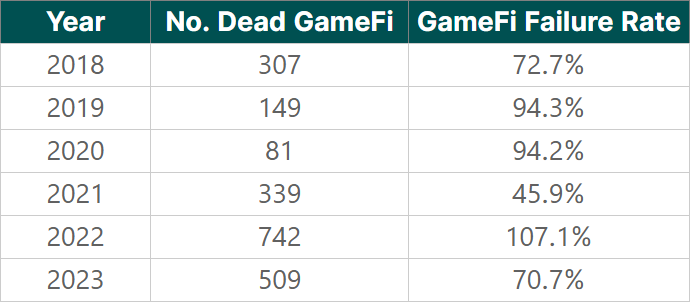

Coingecko recently published data showing that since the birth of the GameFi concept five years ago, 2,127 out of 2,817 Web3 games have failed—a failure rate of 75.5%. Coingecko defines a failed Web3 game as one experiencing a decline of over 99% in average daily active users within 14 days.

Coingecko Data: Nearly 75.5% of Web3 games have failed over the past five years

Why is the failure rate so high? Many Web3 gamers could likely give the same answer: amid rapid capital inflows, the industry environment has grown increasingly speculative. Developers show little interest in long-term development, while profit-driven users participate purely for short-term gains. Once the wealth effect fades, the economic models of Web3 games quickly collapse, leaving behind broken ecosystems. This script repeats itself over and over, and many more failures likely lie ahead. A recent industry incident aptly illustrates this point.

The SHRAP token of Web3 game Shrapnel surged over 5x shortly after listing on Bitget. The project had previously raised nearly $30 million in funding, including $20 million in a third round in October. However, this sudden windfall led to irreconcilable internal conflicts among core team members. One founder filed a lawsuit accusing two other executives of embezzling company funds. As a result, the project’s credibility and reputation suffered severe damage, and its future operations became highly uncertain. Yet for insiders familiar with the Web3 gaming space, such incidents are far from rare.

For general users, there's no need to overly blame developers—after all, human nature plays a role, especially since most users enter the Web3 gaming space primarily to earn profits. The real question we should focus on is how to identify promising projects amid information asymmetry, or how to catch explosive rallies as early as possible. Of course, risk mitigation and asset security must remain top priorities throughout this process.

3. Users cannot control industry direction—they must seek value opportunities within a highly uncertain market

Currently, the overall development of the Web3 gaming market cannot be considered mature, and the profitability of user investments remains highly random. Therefore, users cannot influence the trajectory of industry development; they can only search for value opportunities amid extreme uncertainty. But the challenge lies in how users without access to privileged information can detect such opportunities in an opaque market?

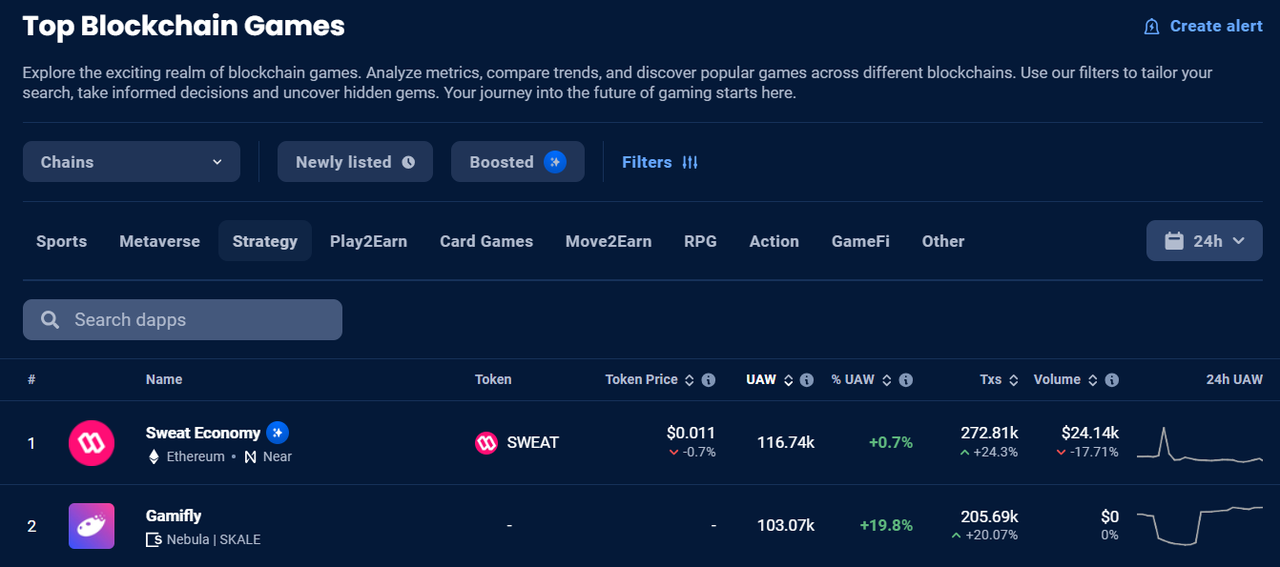

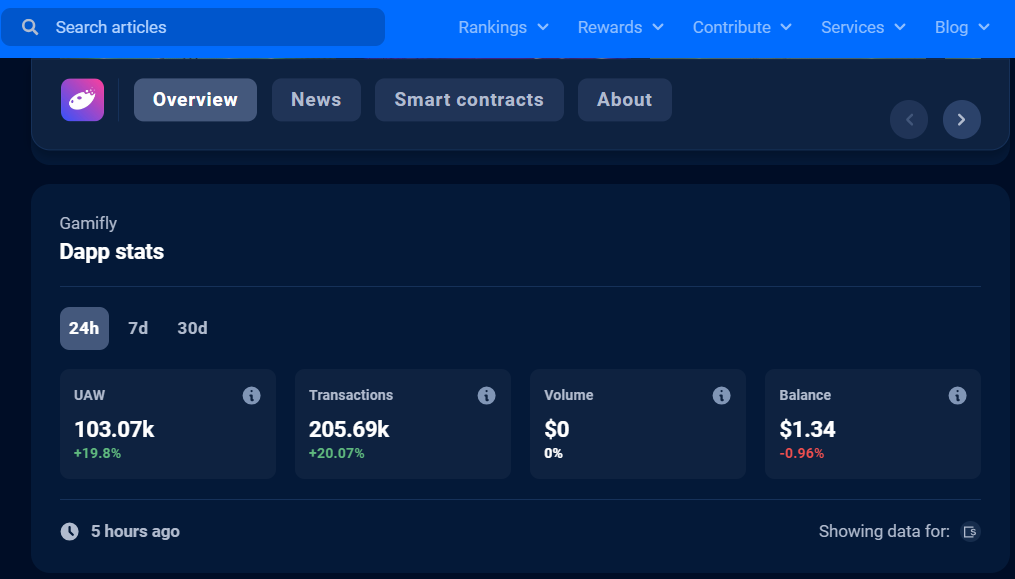

DappRadar Data: Gamifly rises to second place in overall rankings

DappRadar Data: Gamifly sees ~20% increase in unique wallet activity and transaction volume within 24 hours

Take the popular project Gamifly, which recently surged to the top tier of industry performance. According to DappRadar, as of December 1, Gamifly ranked second across the entire industry in terms of unique active wallets and number of transactions, both increasing by around 20% in the past 24 hours. Such rapid momentum may signal underlying value opportunities—but how can users identify such projects early and position themselves accordingly?

Comprehensive, feature-rich Web3 gaming data platforms can help solve this problem. At the end of this article, I’ll introduce two representative tools for your reference.

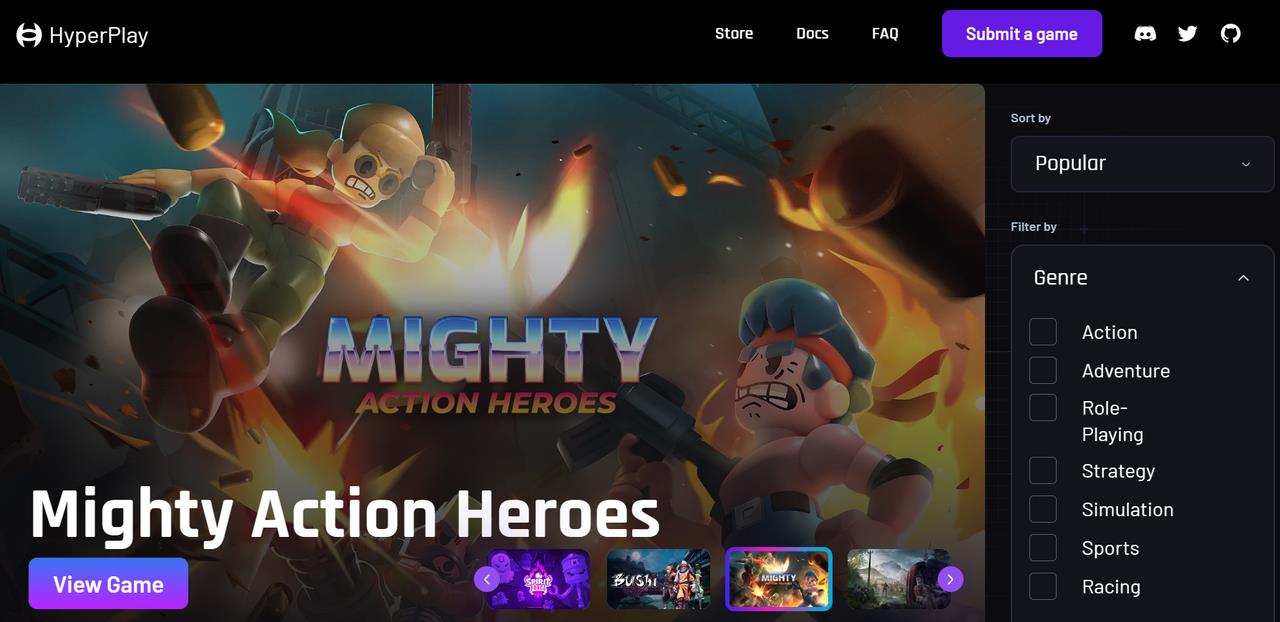

First is HyperPlay, a Web3-native game launcher and aggregator store that automatically connects users’ assets, wallets, and NFTs to every Web3 game they play. In June this year, HyperPlay secured $12 million in funding.

Visit the HyperPlay website and click the Store button at the top to access its Web3 game marketplace. With detailed categorization, users can browse and select specific Web3 games, view detailed project pages, and begin their P2E journey.

HyperPlay’s Web3 Game Store Interface

Compared to other data platforms, HyperPlay’s advantage lies in its enhanced interoperability across blockchain games. Users simply link their personal wallet to the HyperPlay site to seamlessly access various chain-based gaming projects. However, its drawbacks include a relatively limited selection of supported Web3 games and incomplete detail displays.

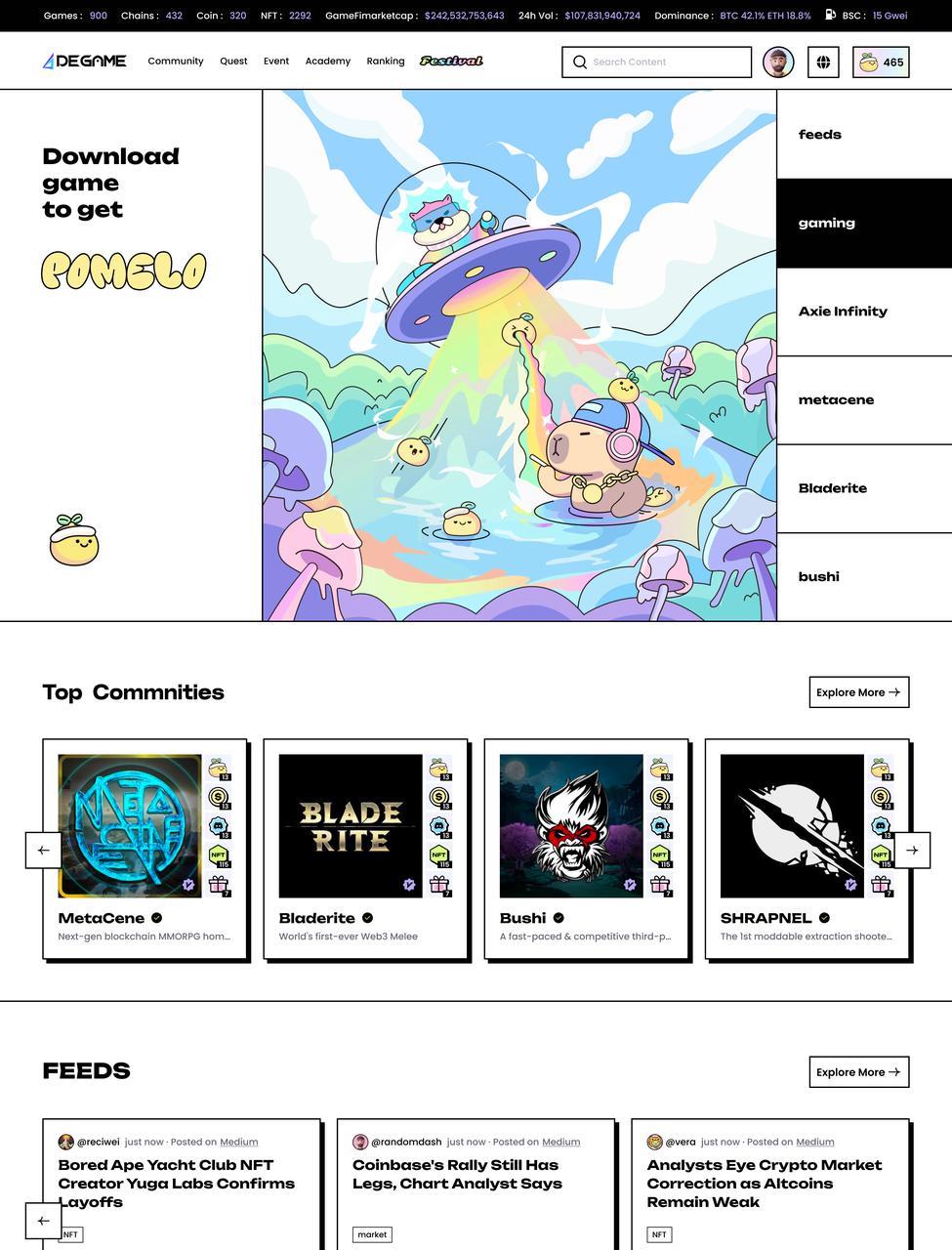

Now consider another platform: DeGame. Currently, DeGame is already the most comprehensive community and download hub for Web3 games. The latest version offers even richer functionality, better meeting users’ needs in discovering high-potential Web3 gaming projects.

Interface of DeGame’s new product

-

In terms of content aggregation, through extensive data accumulation and advanced algorithms, DeGame enables one-click aggregation of all types of Web3 sectors and projects. Users can either search by project name or navigate directly into specific category sections to seamlessly access the majority of Web3 projects;

-

From a functional standpoint, DeGame’s Top Communities, Quest, Leader Board, Gaming, and Event modules provide direct access to community spaces, reward tasks, project rankings, app downloads, and online/offline events. With simple clicks, users can interact with multiple features across different projects without constant switching;

-

In terms of information dissemination, DeGame’s Feeds and Academy features have strong UGC (user-generated content) attributes. Professional Web3 creators worldwide can share news and insights via articles and videos, enabling broad Web3 users to eliminate knowledge gaps and overcome information asymmetry—all within a single DeGame interface.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News