M6 Labs Market Watch: Kyber Hacker Attempts Hostile Takeover?

TechFlow Selected TechFlow Selected

M6 Labs Market Watch: Kyber Hacker Attempts Hostile Takeover?

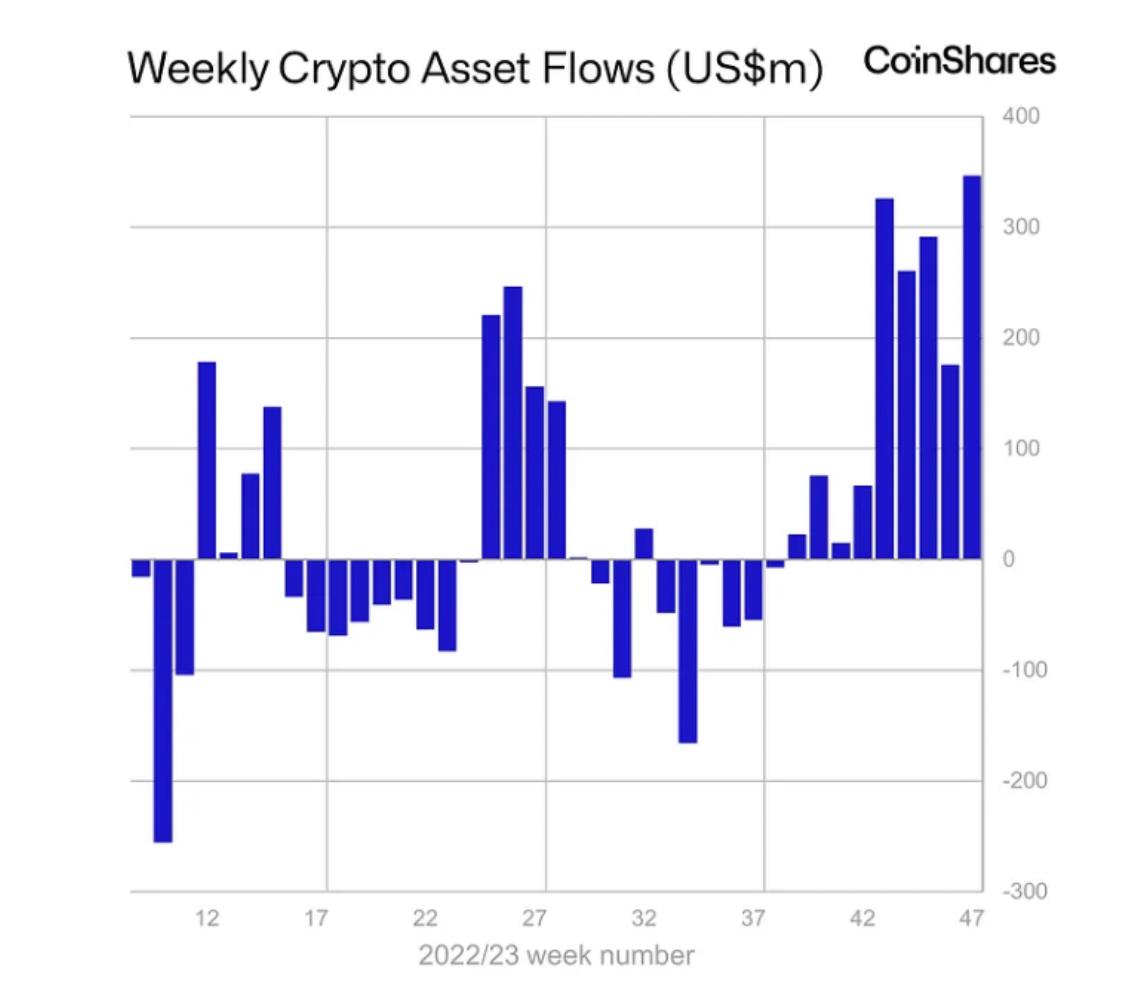

Last week, inflows into digital asset investment products rose for the ninth consecutive week, reaching $346 million.

Author: M6 Labs

The past few weeks have been nothing short of dramatic in the world of cryptocurrency. The market has seen continuous volatility, with major cryptocurrencies experiencing sharp price swings, while significant security breaches at multiple crypto exchanges have further heightened concerns about cybersecurity in the digital asset space. Let’s dive deeper!

Layer 1, Layer 2, and DeFi

Market Overview: A Crypto Circus

These times are filled with challenges and breakthroughs. For enthusiasts and investors alike, it's a constantly evolving field, ensuring that the cryptocurrency world never becomes dull!

In short:

-

Hacks have impacted the crypto space, with prominent platforms such as Poloniex, Kronos Research, Velodrome, Aerodrome, Heco Bridge, and notably Kyber facing security issues.

-

Digital asset investment products saw $346 million in inflows.

-

Arbitrum has seen increased activity and capital inflow, outpacing other Layer 2 solutions.

-

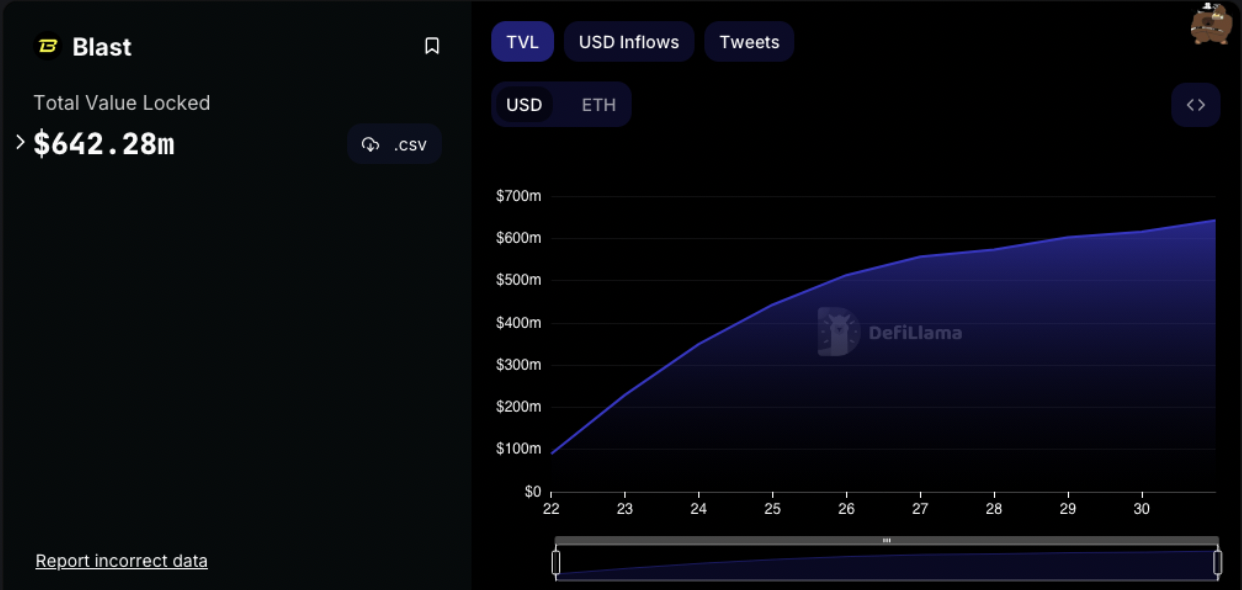

Ethereum-based Layer 2 network Blast attracted $621 million in total value locked (TVL) within just 10 days of launch.

Security Breaches

In recent developments, the digital asset sector continues to face severe security vulnerabilities. Notably, Poloniex suffered a major hack, losing approximately $114 million. Additionally, Kronos Research, known for algorithmic trading and market making, experienced a security breach resulting in a loss of $26 million.

The incidents also involved Velodrome and Aerodrome, whose front-end systems were compromised. These events highlight the ongoing infrastructure fragility of digital asset platforms. Furthermore, the cross-chain interoperability platform Heco Bridge was hacked, suffering an astonishing loss of $115 million.

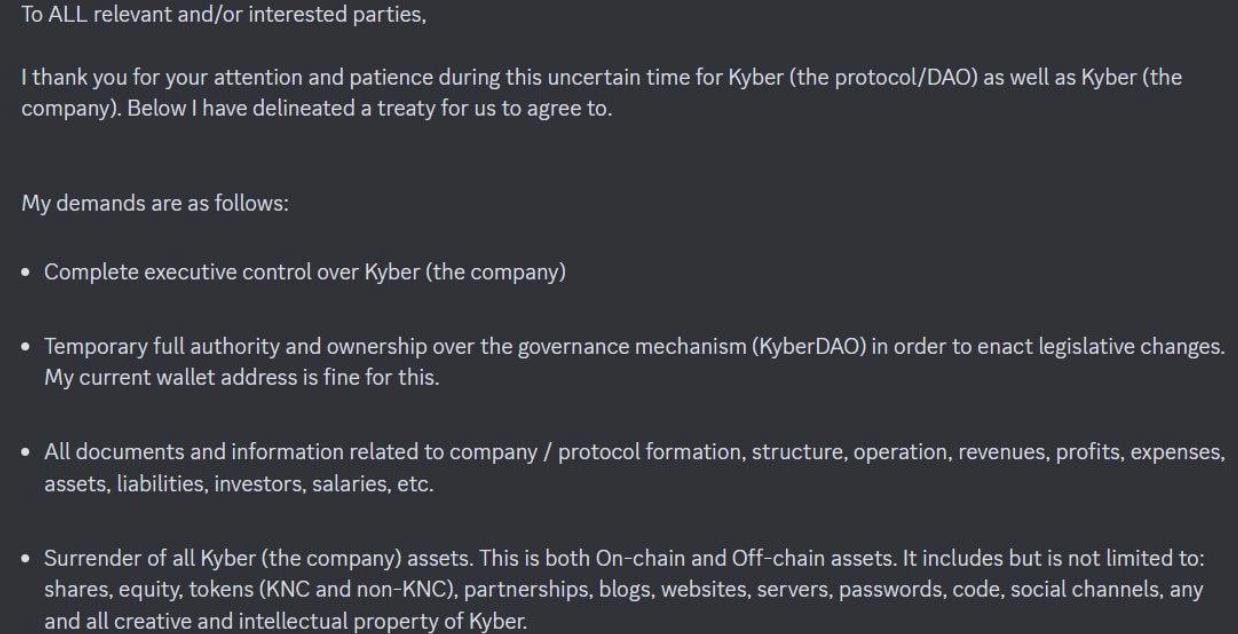

These incidents are not isolated but part of a broader series of major vulnerabilities in the digital asset space. The most notable event this week involved Kyber Network, where hackers issued specific demands, sparking considerable attention within the community. Below are some of the hacker demands.

The cumulative impact of these hacks is multifaceted. On one hand, they undermine trust in the digital asset space, raising concerns among investors and users. On the other hand, some analysts believe that these ongoing attacks help strengthen the ecosystem by exposing and addressing vulnerabilities, effectively stress-testing the infrastructure.

Despite the sector demonstrating strong resilience, the persistent nature of these attacks presents a critical challenge. The path toward building a more secure and robust digital asset environment depends on effectively resolving and mitigating these security flaws.

This evolution is essential for the advancement and mainstream adoption of digital assets and blockchain technology. This situation often prompts regulators to consider—and potentially implement—stricter regulations to protect investors and maintain market integrity, ultimately creating headwinds for the crypto industry.

Capital Inflows

Last week, inflows into digital asset investment products marked nine consecutive weeks of growth, reaching $346 million, primarily driven by anticipation surrounding the launch of U.S. spot exchange-traded funds (ETFs). This surge in inflows pushed total assets under management to $45 billion, surpassing the highest level seen in over a year and a half.

Canada and Germany accounted for 87% of total inflows, while the U.S., awaiting ETF approvals, saw only $30 million in inflows. Additionally, other cryptocurrencies like Solana, Polkadot, and Chainlink received inflows of $3.5 million, $800,000, and $600,000 respectively.

Source: Coinshares.

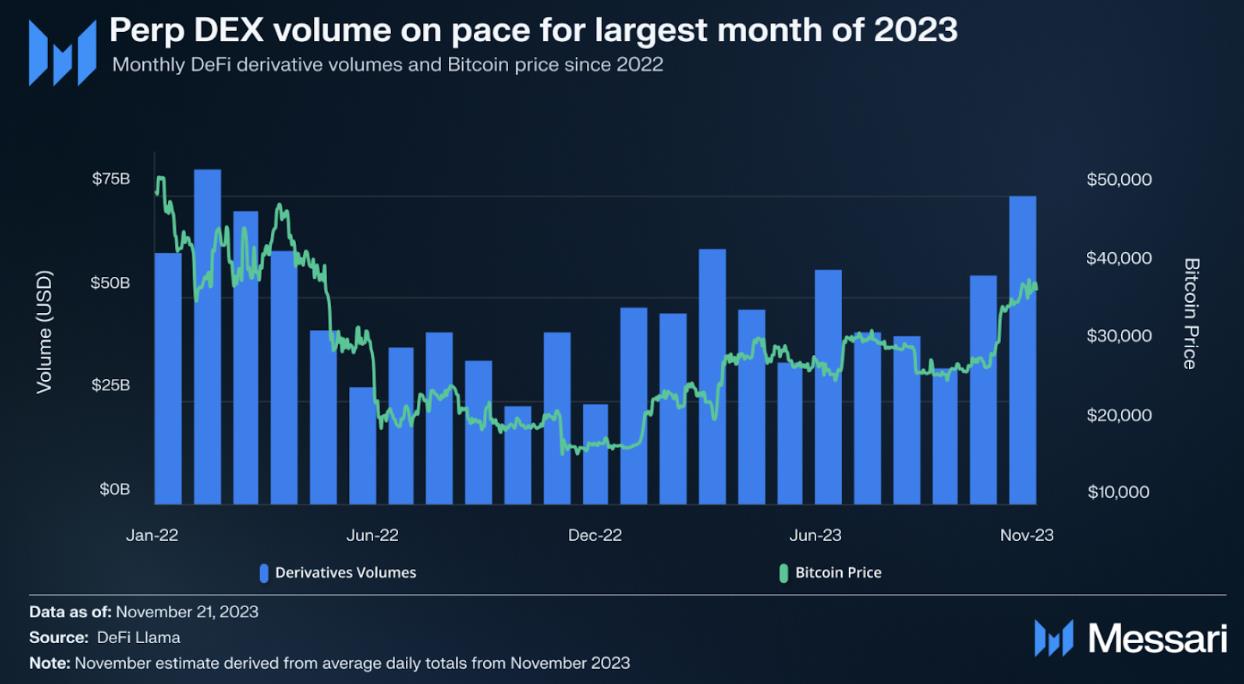

Activity in the derivatives market has significantly increased, with DEX trading volume poised to exceed $7.5 billion—the highest monthly total since February 2022. DYdX has emerged as a standout in the perpetual contracts ecosystem. Currently, it firmly holds its position with a robust daily trading volume of around $1 billion.

Source: Messari.

Arbitrum has recently become increasingly active, primarily due to the introduction of new short-term incentive programs. Launched in September 2023, the initiative aims to distribute up to 50 million ARB tokens from the Arbitrum DAO Treasury to support its ecosystem, particularly decentralized applications and DeFi projects.

Currently, Arbitrum is attracting more capital than any other L2. Source: DefiLlama.

Blast, a new Ethereum-based Layer 2 network, reached $621 million in total value locked (TVL) within 10 days of launch—nearly matching Solana’s TVL. Blast was founded by Tieshun "Pacman" Roquerre, who is also the creator of the NFT marketplace Blur.

In summary: Despite recent challenges and security breaches, the crypto market remains healthy and on a positive trajectory. Major exchanges face regulatory scrutiny, yet the market stays stable. Hacks have occurred, raising security concerns, but the market continues to show resilience. The $346 million inflow into digital asset investment products reflects strong investor confidence. Layer 2 solutions like Arbitrum are growing, while new networks like Blast are gaining attention.

Blue-Chip and Major Asset Overview

Source: Tradingview.

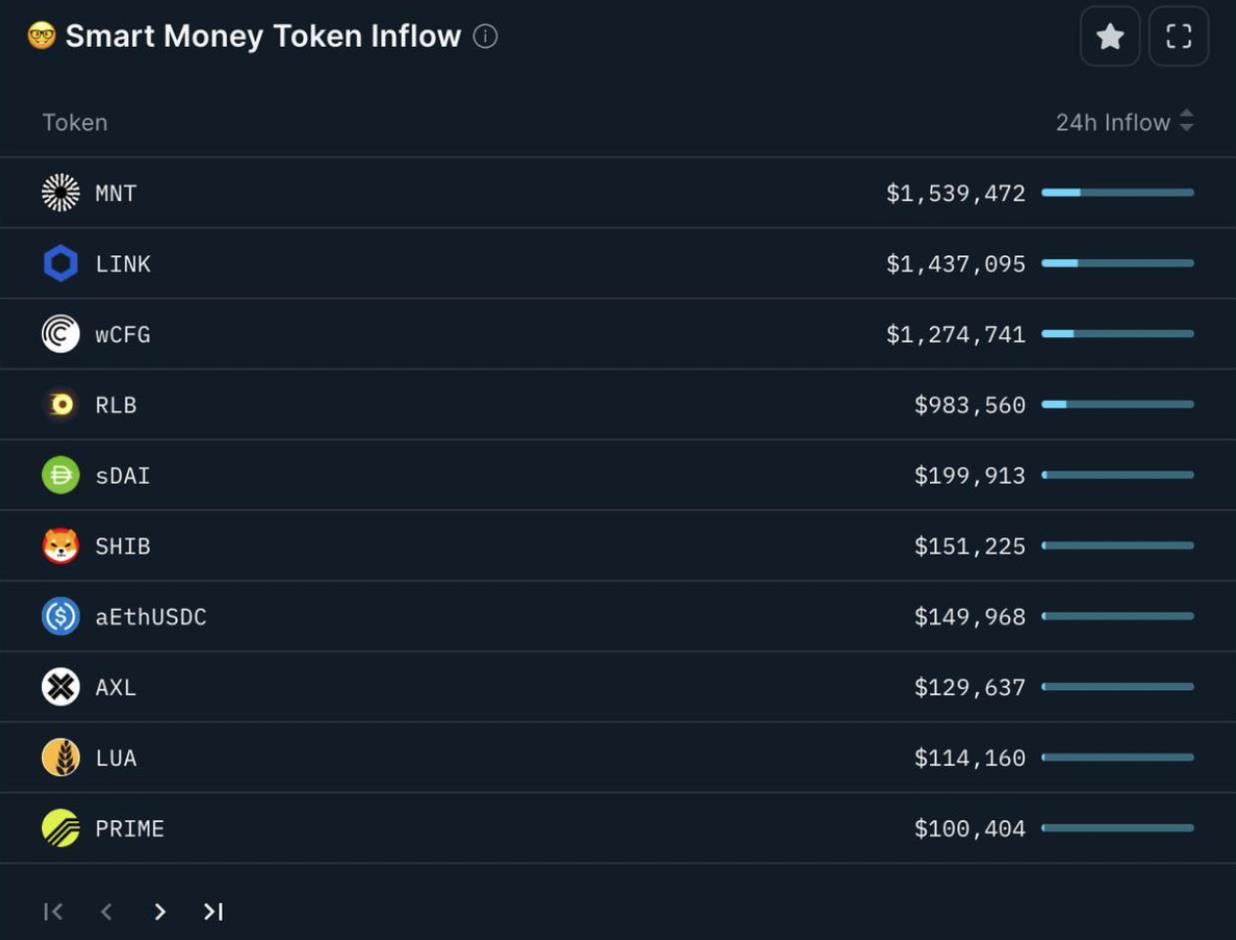

Mantle performed strongly over the past week, rising 13%. In fact, since October 19, 2023, MNT has been on an upward trend, delivering an impressive return of 62.5%. Mantle is now the world’s sixth-largest Layer 2 platform, with a total value locked of $218 million.

Source: Nansen.

-

dYdX saw an 8.5% drop ahead of the highly anticipated token launch scheduled for December. This event will introduce a $5 billion token into the market, drawing close attention from investors and market analysts.

-

Terra Luna Classic (LUNC) experienced a significant surge, increasing in valuation by 60% last week. Since October 20, LUNC’s valuation has risen an astonishing 111.4%.

-

BNB declined by 4% over the past week due to ongoing legal challenges involving former CEO Changpeng Zhao. The situation escalated further after Zhao was formally designated a flight risk during legal proceedings.

-

UNI rose from $4.90 to $6.35 between November 22 and 28, driven by increased liquidity following Binance-related events. However, the price later dropped to $5.90.

-

TORN dropped 57% following its delisting from Binance since November 27.

-

SOL rose 5% this week, partly due to strong performance from Solana-based memecoin BONK, which surged 600% over the past 30 days.

-

XRP dipped below the $0.60 support level after whales sold over 57 million XRP tokens, but later recovered.

Smart Money Movements

Tokens

-

BitStable ($BSSB) has attracted smart money interest, offering a mechanism to generate stablecoins using Bitcoin ecosystem assets as collateral—an approach generating considerable interest.

-

Recently, smart money also acquired some $Auction, possibly influenced by $BSSB’s launch on its platform, Bounce Finance.

-

Another notable development is smart money bidding on $BYPASS this week—a bot enabling users to trade on centralized exchanges like Binance without logging in.

-

$PLANET has also drawn smart money attention, performing well within the real-world assets narrative.

-

Over the past week, several smart money addresses accumulated $RVF.

Liquidity Mining

-

Smart farmers are farming ETH and stablecoins on Ambient Finance’s Scroll, awaiting potential $Ambient airdrops, and possibly soon $Scroll as well :)

-

Lybra Finance remains a top choice among large investors.

-

Smart farmers are actively engaging with Prisma Finance, participating in various pools offering solid APYs, including the base pool mkUSD/USDC - Convex with an unboosted APY of 29.37% and a TVL of $3.67 million!

-

Some smart farmers have purchased $BLUR and deposited it into blur.io to earn $BLUR S3 points.

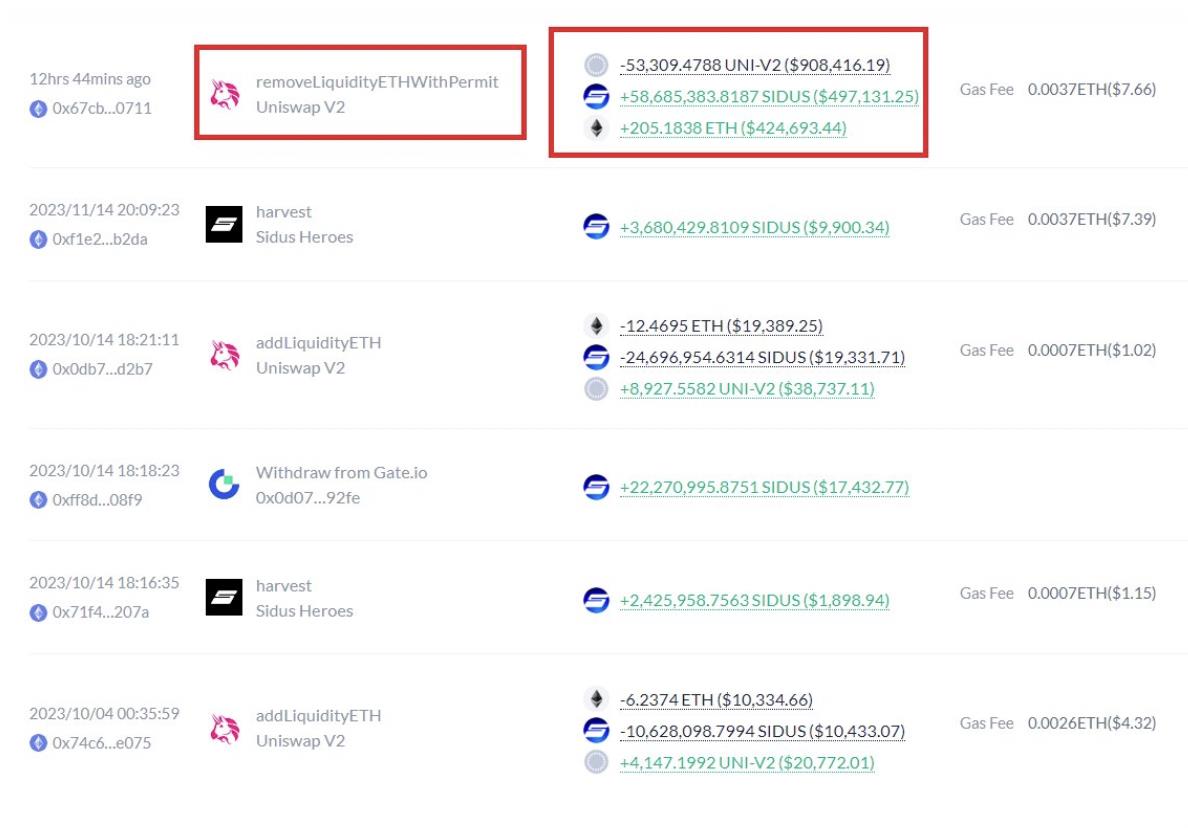

Key On-Chain Moves

GSR made a significant acquisition, purchasing $2.5 million worth of $HFT—nearly 5% of circulating supply—and depositing it into newly created addresses.

Recently, a whale (0xd5) removed 35% of $Sidus’ on-chain liquidity. Check their Debank profile.

NFTs and Gaming

Project Updates

-

ReadON and MOBOX announced a strategic partnership aimed at unifying Web3 gaming communities.

-

Ubisoft’s “NFT Champions Tactics” game will enter Animoca’s “Mocaverse.”

-

Japanese giant SquareEnix will launch NFT auctions for its new Web3 games on Ethereum and Polygon.

-

Azuki DAO rebranded as “Bean” and dropped its lawsuit against founder Zagabond.

-

Pudgy Penguins released an exclusive Walmart product called the “Influencer Gift Box.”

-

A game studio behind an NFT mobile shooter game raised $10 million.

-

Magic Eden launched a wallet supporting Bitcoin, Ethereum, Solana, and Polygon. Users can apply via waitlist linked to their Twitter account.

-

According to CoinGecko Research, 2,127 Web3 games have failed over the past five years, representing 75.5% of all projects, with an average failure rate of 80.8%.

-

Blast, the new L2 platform built by Blur founder Pacman, reached $600 million in total value locked within 10 days.

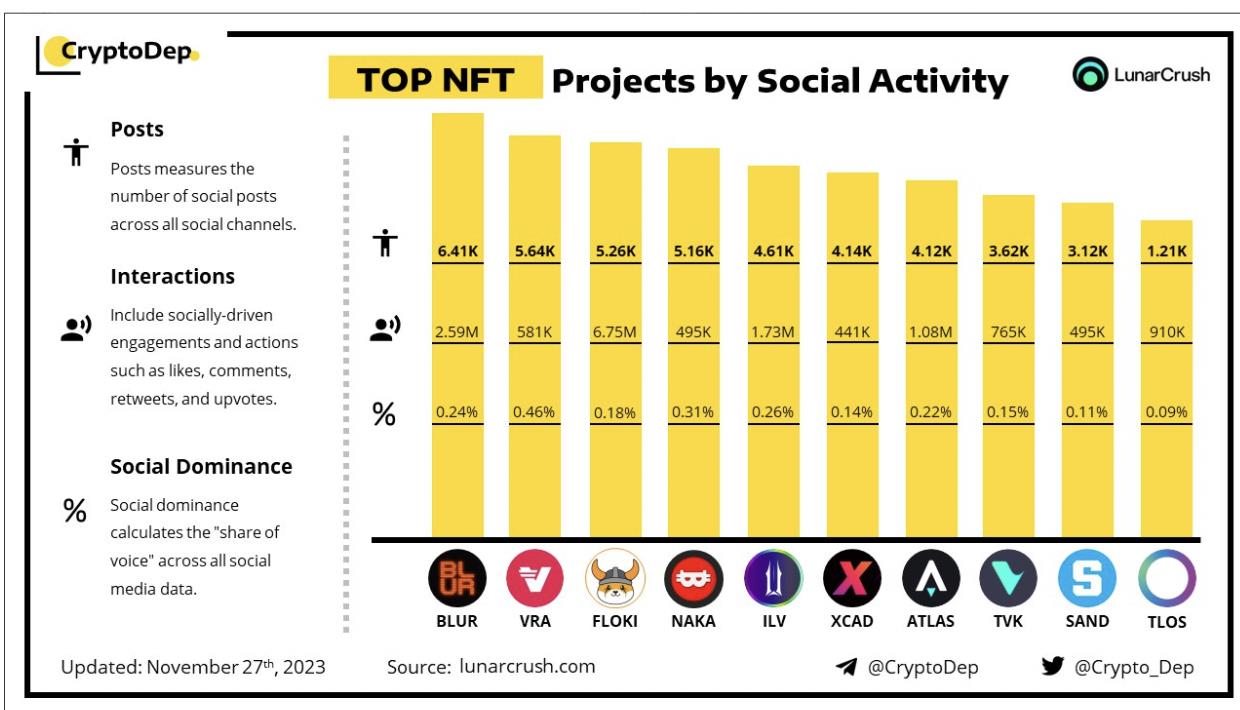

Social engagement across multiple projects continues to hit new highs. Blur was expected, but the inclusion of Floki, Naka, and VRA is also noteworthy.

Source: LunarCrush.

Blue-Chip Overview

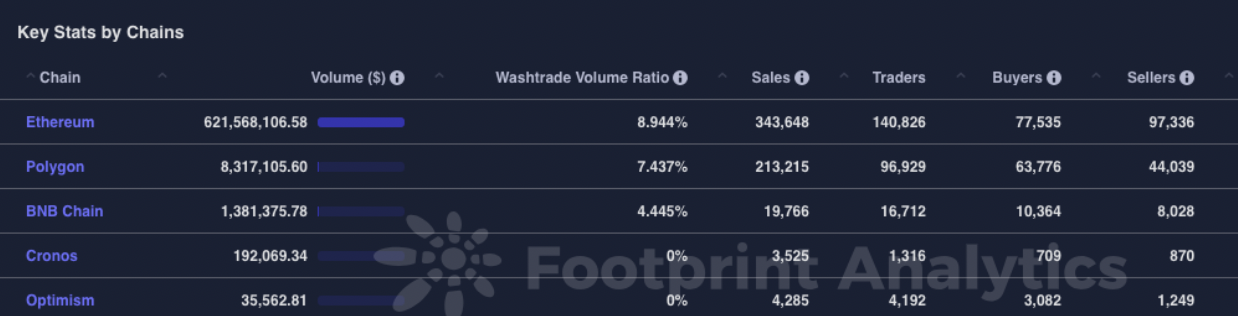

NFT trading volume continues to rise, indicating sustained user interest in traditional NFTs. Despite concerns about bearish impacts on NFTs, the popularity of these digital collectibles remains high, with users recognizing their value.

Established blue-chip NFT collections are expected to maintain their significance and value in the future. Notably, while CryptoPunks held the top sales position over the past 7 days, this original blue-chip series has either declined in ranking or shifted toward lower-tier positioning. Additionally, Ordinals are showing substantial trading volume on platforms like OKX, suggesting this trend is becoming a permanent feature within the Bitcoin ecosystem.

Top 10 Collections Over Past 7 Days. Source: DappRadar.

In terms of NFT trading volume, Blur continues to lead, surpassing OpenSea and proving that well-designed incentive mechanisms can overcome first-mover advantages in this space.

However, users should note that Blur has been flagged for higher levels of wash trading. OKX’s NFT marketplace recently launched successfully, seeing a significant increase in trading volume, largely driven by BTC Ordinals. Meanwhile, Magic Eden has established itself as the go-to marketplace for NFTs on Solana.

In NFT trading volume, Blur continues to lead, surpassing OpenSea, proving that well-designed incentive mechanisms can overcome first-mover advantages in this space.

However, users should note that Blur has been flagged for higher levels of wash trading. OKX’s NFT marketplace recently launched successfully, seeing a significant increase in trading volume, largely driven by BTC Ordinals. Meanwhile, Magic Eden has established itself as the go-to marketplace for NFTs on Solana.

Top 5 NFT Marketplaces Over Past 30 Days, Including Non-EVM Metrics. Source: Footprint Analytics.

The Ethereum mainnet remains the primary hub for NFT trading, with many users preferring to transact directly on the main chain. Despite the growing success of NFT platforms on Layer 2 solutions like Arbitrum and Optimism, NFT trading on these networks has yet to gain significant traction.

Interestingly, even as trading volume and liquidity grow within the Arbitrum ecosystem, NFTs appear to remain a secondary focus for Arbitrum traders, while Polygon continues to be the preferred destination for NFTs on Layer 2 networks.

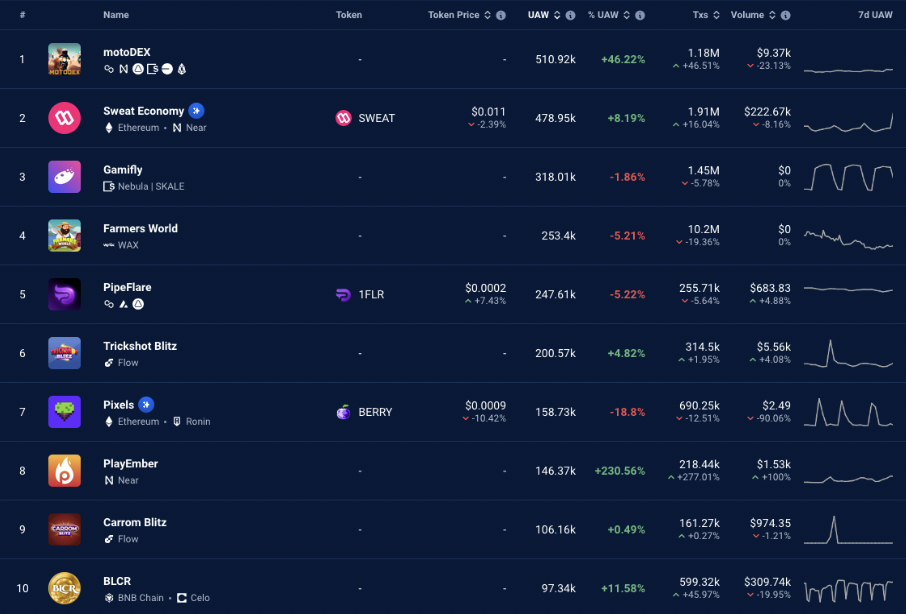

Top 10 NFT Games Over Past 7 Days. Source: DappRadar.

Degen Corner

-

DeFimons continues to make significant progress. The game is currently free-to-play, with important blockchain integration coming soon. Try it here.

-

Pixels, a casual farming game gaining popularity on Ronin—the Axie Infinity ecosystem’s chain—centers around resource gathering, farm building, and social interaction. Check it out here.

-

Duel Arena is a one-on-one dueling game for ETH prizes, integrated into Cambria. In this mini-game, players stake ETH into an on-chain escrow system and battle to win the staked ETH. The game is currently live and rapidly growing, with duels already staking over $1 million in ETH.

-

Kamigotchi, a blockchain pet RPG developed on Canto, is now planning a release on the Optimism Layer 2 (L2). The game features mechanics similar to Pokémon and includes an on-chain room system. While no exact release date has been set, it’s expected in the first half of 2024. Keep an eye on this one.

-

Game-related tokens saw notable gains over the past week: $MAGIC (+16%), $ILV (+8.3%), $RON (+28.2%), $WILD (+32.9%), $RARE (+76.4%), TLM (+16.9%), and $GENE (+48.1%).

-

Leading NFT sector tokens like $IMX (-9.3%) and $BLUR (-2.3%) pulled back after recent gains.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News