Web3 Project Expansion Dilemma: Why Traditional User Retention Strategies Don't Work?

TechFlow Selected TechFlow Selected

Web3 Project Expansion Dilemma: Why Traditional User Retention Strategies Don't Work?

In Web3, skillfully designed token incentive mechanisms can enable newcomers to surpass market leaders.

Written by: DeFi Cheetah

Translated by: TechFlow

This article aims to explain how first principles of Web3 operate differently from Web2 business models. It will be helpful if you're a builder or come from a Web3 VC.

How do successful Web3 models differ from Web2 models?

i. Trust-minimized setups reduce switching costs and loyalty for Web3 users, making it difficult for Web3 projects to scale.

ii. Industry-wide open source leads to product homogenization and weak network effects.

iii. Lack of economies of scale: current Dapp users' costs do not decrease significantly with each additional user.

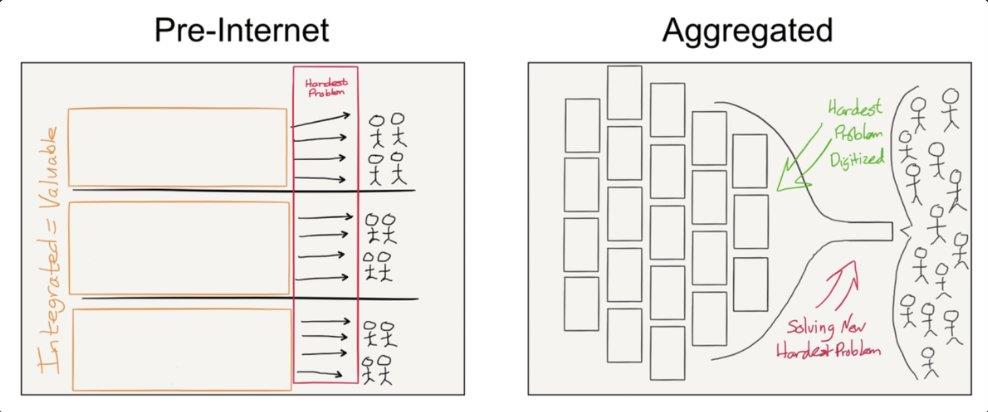

Many Web3 projects attempt to replicate successful Web2 business models by aggregating suppliers, distributors, and users onto a single platform. This pays homage to aggregation theory, where most successful Web2 companies simplified consumer markets—such as Facebook and Amazon.

Why are Web2 aggregators so successful?

a. User stickiness is a powerful weapon against competition.

b. Strong network effects reduce user acquisition costs.

c. Economies of scale: more users mean lower per-user costs.

None of this holds true in Web3.

For (a), as aggregators grow, Web2 users become more sticky due to greater service customization and stronger brand recognition. Aggregators have more data to optimize user experience during operations. Users also perceive risk in building trust and confidence in unknown new platforms.

In other words, in Web2, users must trust the aggregator to provide excellent service discovery and curation through effective quality control over service providers. As a result, platform stickiness is strong, and "winner-takes-all" dynamics are evident.

For example, online shopping lacks guaranteed delivery, so most people choose Amazon because its quality control and rating system ensure sellers are legitimate. Combined with Amazon's brand reputation, default risk is far lower than with sellers on an unknown platform. Thus, more consumers prefer shopping on Amazon rather than easily switching to another new platform.

However, in Web3, protocols run via smart contracts as trust-minimized systems, where operations are transparent, predetermined by rules in code, and automated by smart contracts. Therefore, switching costs are much lower in Web3, and brand recognition is significantly weaker.

For instance, Uniswap does not take a cut from LP fees. Some argue this is due to regulatory concerns, but that explanation is unconvincing. A more plausible reason is that the Uniswap team understands fee changes could severely impact trading volume.

Instead of profiting directly from order flow, Uniswap prefers to leverage its first-mover advantage to expand horizontally—launching the intent-centric Uniswap X architecture to challenge existing liquidity aggregators like 1inch and CoWSwap.

Beyond the fact that most trading volume doesn't come from natural individuals, trusting new Web3 platforms isn't costly because operations are publicly visible through code—so anyone can verify whether a new protocol actually works. In contrast, Web2 aggregators hide their backend operations. Some Web2 service providers require custody of user assets, demanding renewed trust from users, whereas in Web3, users interact with aggregators non-custodially. All these factors reduce switching costs.

Meanwhile, well-designed token incentive mechanisms in Web3 allow new entrants to surpass market leaders. This is precisely how most successful protocols bootstrap initial Total Value Locked (TVL) and users, solving the cold-start problem in Web3. Before Blur’s airdrop, OpenSea was the NFT marketplace leader. But as widely known, Blur’s token incentives overturned OpenSea’s dominance, forcing OpenSea to make significant adjustments due to declining market share. Such a scenario—where newcomers surpass established leaders—is unprecedented in Web2.

Due to lower user loyalty in Web3, the relationship between aggregators and users is more dynamic, making it harder for protocols to scale. Competitors can execute "vampire attacks" or lower fees to remain competitive.

For (b), as Web2 aggregators grow their user base, they attract more service providers, which in turn draws even more users since the platform becomes more valuable. Consequently, user acquisition costs decline over time. But the dynamics in Web3 are entirely different.

In other words, Web2 aggregators create more value for users when integrating more service providers, enabling differentiation through product heterogeneity in the market.

For example, as more small property owners join Airbnb, more travelers sign up because it offers them more vacation apartment/housing options. Once network effects begin delivering greater value, Airbnb doesn’t need to spend heavily on user acquisition.

By contrast, even when Web3 aggregators integrate more service providers, the network effect flywheel doesn't easily spin in Web3 due to permissionless nature causing product homogenization: most supply-side dApps are open-source and universally accessible to aggregators, offering similar value to users.

In practice, unless they continuously innovate and offer advanced features, market leaders cannot provide distinctly different product suites—and newcomers can easily copy them. Ongoing development and maintenance costs thus become a form of user acquisition cost for Web3 aggregators.

For cross-chain bridges, they must constantly add support for new blockchains whenever a new blockchain ecosystem emerges. Not to mention token incentives acting as another recurring cost for user retention. These recurring expenses greatly diminish the network effects Web3 aggregators can enjoy.

Users in Web2 benefit from economies of scale—more users mean lower average costs per user—because fixed costs constitute a significant portion of aggregator spending. Netflix is an illustrative example of economies of scale.

On Netflix, even with the same volume of on-demand video content, more users mean lower per-user costs since expenses are already fixed. More users thus reduce costs. Again, this is not the case in Web3.

Despite ongoing R&D and maintenance overheads, users in Web3 still bear substantial variable costs independent of economies of scale—the decentralization cost of paying validator fees for consensus on blockchain state.

EIP-4844 can help reduce DA layer fees, but congestion fees caused by limited block space are unrelated to economies of scale, weakening the dominance and moats of aggregators. No matter how cheap 1inch is, users still pay high fees during network congestion.

One exception: L2s. The more users there are, the less each user pays.

L2 fees typically include a fixed cost and a variable cost: (i) the cost of publishing blocks on Ethereum, and (ii) the cost of running the sequencer.

Take Optimism as an example:

Assume gas price on Ethereum is 25 gwei, 1 ETH = $2k:

-

One-time cost to deploy OP Stack on mainnet ≈ 1 $ETH

-

Fixed cost of OP Stack, even with zero transactions, (ii): ~0.5 $ETH per day

-

Variable cost (DA), (i): ~0.000075 $ETH per transaction

After EIP-4844, assume (i) drops tenfold—about $0.015 per Tx + (ii) fixed cost. Adding a markup of ~0.00001 $ETH (~$0.02) per Tx to cover fixed costs requires ~50k daily transactions to break even on (i)+(ii). (Pre-EIP-4844 Tx price was ~$0.17, post-EIP-4844 ~$0.03)

Assuming a positive correlation between number of users and transactions, more users mean more transactions, lowering the Tx markup needed to cover L2 costs. But for most Web3 aggregators, economies of scale don't easily materialize with increasing user numbers.

Therefore, by applying first principles to reduce the nature of the Web3 industry down to its simplest dimensions and reasoning from there, what Web2 aggregators enjoy—user stickiness, network effects, or economies of scale—cannot be directly applied to Web3. Token incentives, trust minimization, and permissionlessness are some of the foundational principles reshaping Web3 business models.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News