How can crypto gaming reverse the crypto winter?

TechFlow Selected TechFlow Selected

How can crypto gaming reverse the crypto winter?

The trend of crypto gaming is on the rise, with forecasts indicating this momentum will continue into the upcoming bull market.

Author: Crypto Ramesses

Amid an ongoing crypto winter, token prices have plummeted, triggering significant panic across the industry. Liquidity has drained from markets, projects have collapsed, and pessimism dominates. In this cold period, a new hero has emerged in the form of crypto gaming. According to on-chain metrics, blockchain gaming is quietly thawing the chill of the crypto winter. In 2023, GameFi has shown an upward trend, with forecasts indicating this momentum will carry into the upcoming bull market. This article dives deep into the state of crypto gaming.

TL;DR

-

GameFi is one of the key verticals driving substantial user activity within the blockchain ecosystem;

-

Ecosystems hosting gaming projects sustained user demand throughout the bear market;

-

Several gaming projects have attracted massive investments, signaling growing institutional interest;

-

Crypto games have the potential to onboard millions of users into Web3, given that the traditional gaming industry already serves hundreds of millions;

The Gaming Industry Is Currently Thriving

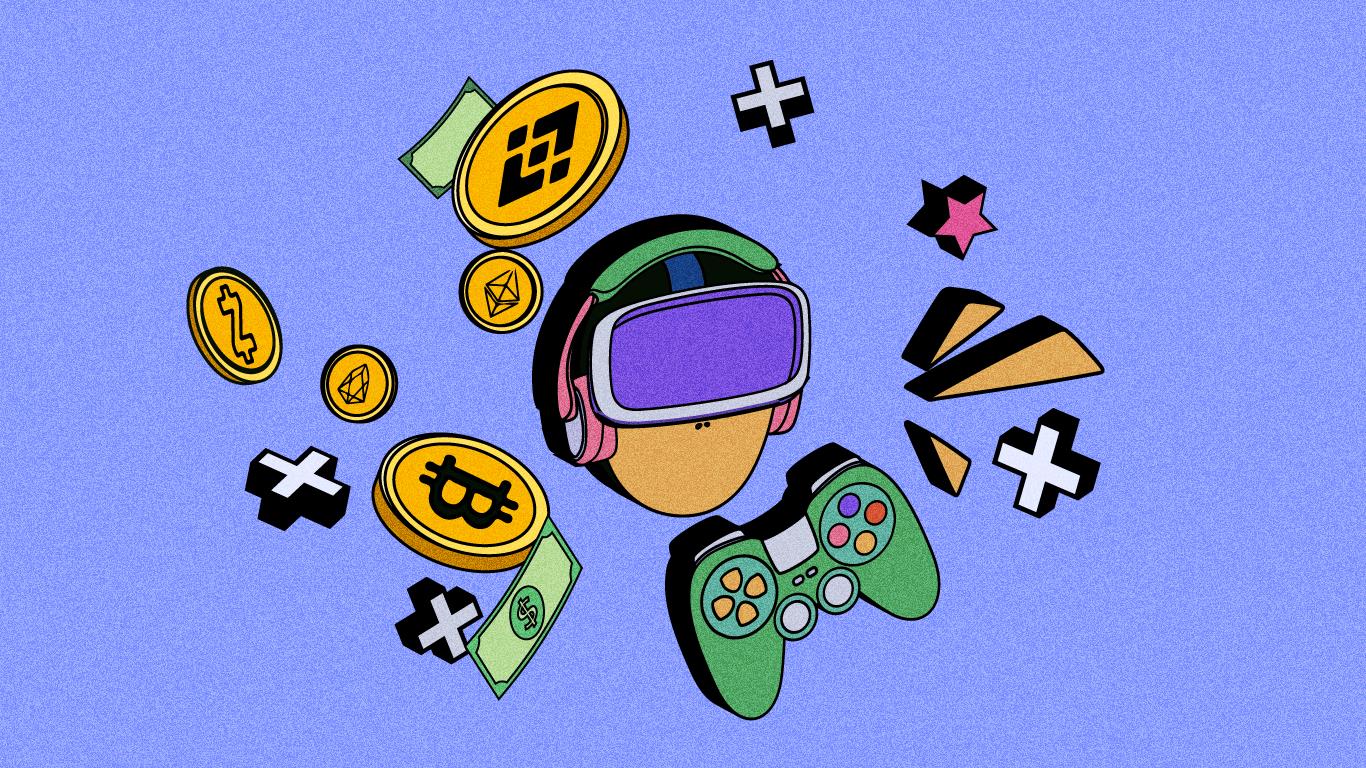

At the time of writing, GameFi’s market capitalization has reached $13 billion. On-chain analytics show consistently high transaction volumes and active wallet counts throughout much of the year.

Credit: DappRadar

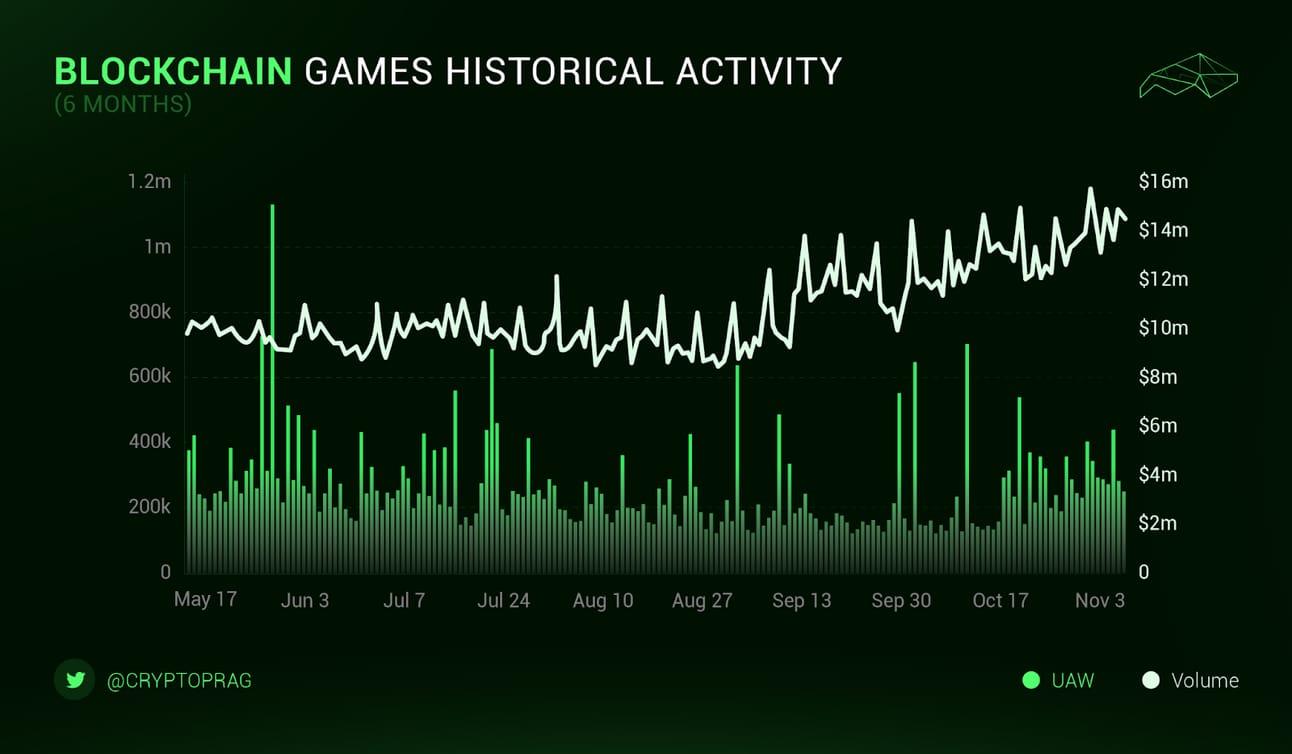

In terms of wallet count, gaming dApps continue to outperform other verticals. Blockchains supporting numerous game projects benefit significantly from this growth.

Credit: DappRadar

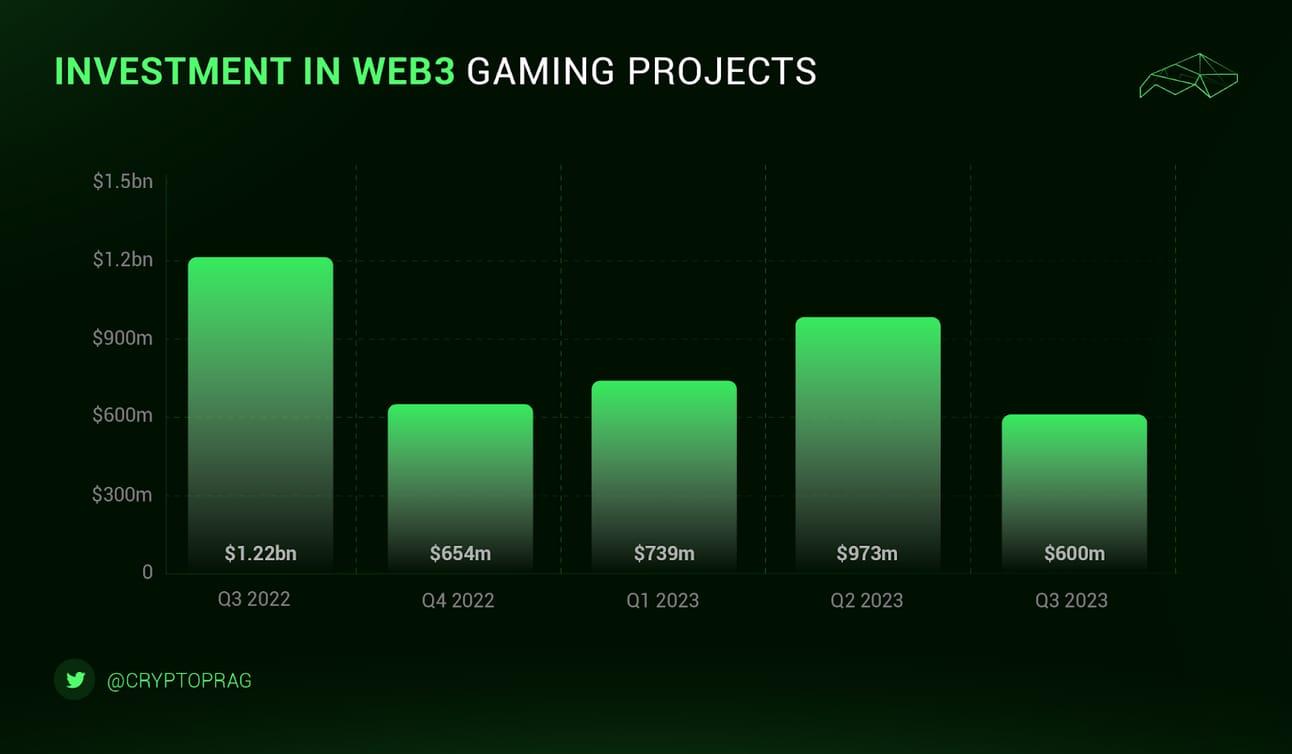

Over the past period, funding flowing into gaming projects has also increased. In 2023, gaming investment peaked at around $2.3 billion, with $1.5 billion entering in just the first half of the year. As mainstream media increasingly spotlight the potential of GameFi (gaming finance), many retail and institutional investors are considering including GameFi projects in their portfolios.

Credit: DappRadar

Multiple leading projects have achieved double-digit growth rates in recent weeks. Most of the top ten GameFi projects rose over 10% in the past week alone. GameFi infrastructure providers such as ImmutableX, Illuvium, and Sandbox also saw notable gains during this period.

Despite this rapid growth, most gaming projects are still trading at discounts greater than 90% compared to their previous all-time highs. However, this is likely to change in a rising market.

Although the number of fully on-chain games is increasing, only about 5% of games currently operate entirely on-chain. Instead, developers typically choose to put only select game assets—such as non-fungible tokens (NFTs)—on the blockchain, while the rest runs on traditional gaming technology. This trend is expected to shift as on-chain gaming infrastructure matures.

The importance and potential of GameFi in the broader gaming industry cannot be underestimated.

What Changes Are Happening in Crypto Gaming?

The gaming industry is undergoing rapid transformation. Developers have moved from Ethereum to more scalable chains such as Solana, Polygon, Arbitrum, and Immutable—driven by the need for superior technical capabilities.

The "GameFi" trend has also shifted toward casual gaming. Casual games continue to attract users and investment because they appeal to a vast global base of non-hardcore gamers.

Casual games like "Vulcan Runners" and "Rollercoin" have already built large communities. Experts predict that casual gaming will become the next major trend in the industry.

Established projects like "Axie Infinity" and "Alien Worlds" are also seeing rapidly growing dominance. Currently, "Alien Worlds" boasts over 200,000 unique wallet addresses daily. New entrants like "TreasureDAO" are also thriving.

What Challenges Does Crypto Gaming Face?

Blockchain gaming presents new opportunities for developers and players worldwide. Yet despite its vast potential, it faces several deeply rooted challenges that could hinder its progress.

Historically, token economic models in games have been problematic. Token designs like those in "Axie Infinity" saw sharp declines in value after initial hype faded. Developers struggle to design non-inflationary tokens without compromising their ability to incentivize participation.

Crypto gaming also faces numerous security risks inherent to blockchains. The $600 million hack of "Axie Infinity" remains fresh in many minds. Storing game assets on-chain exposes them to various threats, and developers often find existing security standards inadequate against evolving hacking techniques.

Another challenge is poor user experience (UX). Even experienced players may struggle with blockchain integration, increasing complexity and slowing new user adoption. UX issues remain a persistent problem across blockchain applications—and GameFi is no exception.

Beyond UX and tokenomics, navigating the regulatory landscape poses additional hurdles. As GameFi introduces novel economic models, integrating them within existing legal frameworks is challenging, especially since current laws are not mature enough to accommodate the dynamic nature of blockchain technology.

Which Are the Top Gaming Projects?

The sector is rapidly evolving, giving rise to many distinctive projects—including both infrastructure platforms and engaging crypto games.

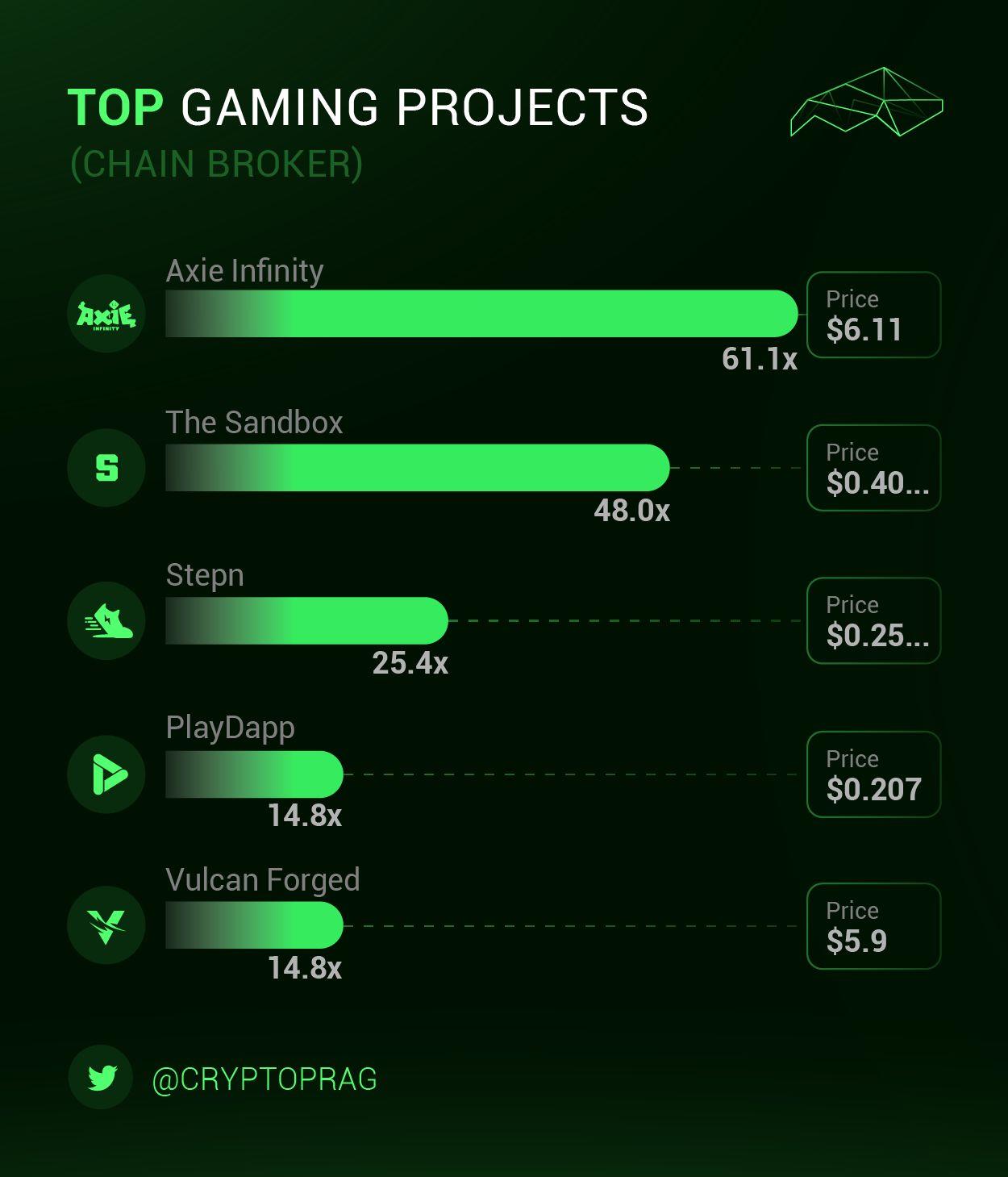

Axie Infinity remains a leading contender among crypto games, backed by a vibrant community.

Top GameFi projects ranked by return on investment

Credit: DappRadar

However, rising competitors like Battle Infinity, Tamadoge, and Alien Worlds are intensifying competition. Casual games such as Vulcan Runner, Benji Bananas, and Shatterpoint have also built strong user bases. Platforms like Sandbox, Illuvium, ImmutableX, and Enjin continue to attract game developers. Meanwhile, established infrastructure blockchains like Solana and Avalanche are offering incentives and rapidly expanding their gaming ecosystems.

Next-generation gaming platforms like Nakamoto Games have performed well even during the bear market, providing much-needed momentum and visibility for the sector.

Final Take

Ultimately, crypto gaming is a critical vertical for sustaining user demand within the blockchain ecosystem. It holds immense potential to bring millions of new users into Web3—a fact reflected in the growing user numbers within established game ecosystems.

The future of crypto gaming remains bright. As more companies explore the new economic models enabled by blockchain, we expect to see an increasing number of games built on-chain. Players, too, will gravitate toward the tokenized gaming environments offered by GameFi projects.

Based on metrics, economic models, and user demographics, all indicators point to a positive growth trajectory for crypto gaming. Therefore, gaming tokens could be among the biggest winners in the upcoming bull market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News