Exploring Mint Cash: Reviving Terra's Corpse, A Brilliant Airdrop Marketing Campaign

TechFlow Selected TechFlow Selected

Exploring Mint Cash: Reviving Terra's Corpse, A Brilliant Airdrop Marketing Campaign

The Mint Cash team has been very clear—they are not an algorithmic stablecoin and will not follow the path of algorithmic stablecoins. They are more akin to DAI than UST.

Written by TechFlow

Yesterday, the entire Luna ecosystem surged dramatically. USTC rose 154% in just one day—achieving in hours what other projects have taken weeks to accomplish during this mini bull run. Meanwhile, rumors spread like wildfire about the secret behind the surge:

What’s the real story?

Mint Cash: Rising from the Ashes

On November 24, Daniel Hong, former Terra research architect, announced via Twitter that he and Junho would carry forward Terra's legacy and revive the glory of LUNA and Anchor.

Rather than patching up the broken remnants of the old LUNA ecosystem, they are launching an entirely new stablecoin system called Mint Cash—to fulfill the mission Terra left unfinished.

Mint Cash is built on the original Terra Classic codebase—meaning it still runs on the Cosmos SDK. Unlike Terra’s algorithmic stability model, Mint Cash is a fully Bitcoin-collateralized stablecoin system, requiring users to lock up Bitcoin to mint new Cash stablecoins.

According to Daniel Hong, this means Mint Cash retains most of Terra’s advantages while incorporating a market-making mechanism backed by collateral—similar to LFG—to ensure sufficient buying power for Cash buybacks.

Moreover, Daniel Hong remains deeply attached to Anchor, arguing that "Anchor never failed on its own—the reason Anchor stopped working was because the Terra stablecoin collapsed, not the other way around. If there were an effective mechanism to maintain stable yield reserves—such as those backed by liquid staking tokens—then the system could function."

Thus, they’ve decided to revive Anchor under Mint Cash, introducing a new version called Anchor Sail.

The masterstroke? Daniel stated that as compensation for the collapse of the Terra ecosystem, Mint Cash will launch an airdrop campaign:

(1) Holders of $UST or $LUNA before May 10, 2022—the date of LUNA’s collapse

(2) Lock and burn a specified amount of $USTC through Mint Cash’s airdrop contract

This clever move instantly transformed $USTC into a tool for IDO participation—a shovel during the initial offering frenzy. Team member Shin further amplified the excitement: "We will airdrop an equivalent amount of tokens at a valuation of 1 $USTC = $1 USD (exact details may vary), representing up to a 99% discount."

In effect, this told everyone: “Buy USTC now at $0.05, and you’ll get $1 worth of airdropped tokens.” Market sentiment exploded.

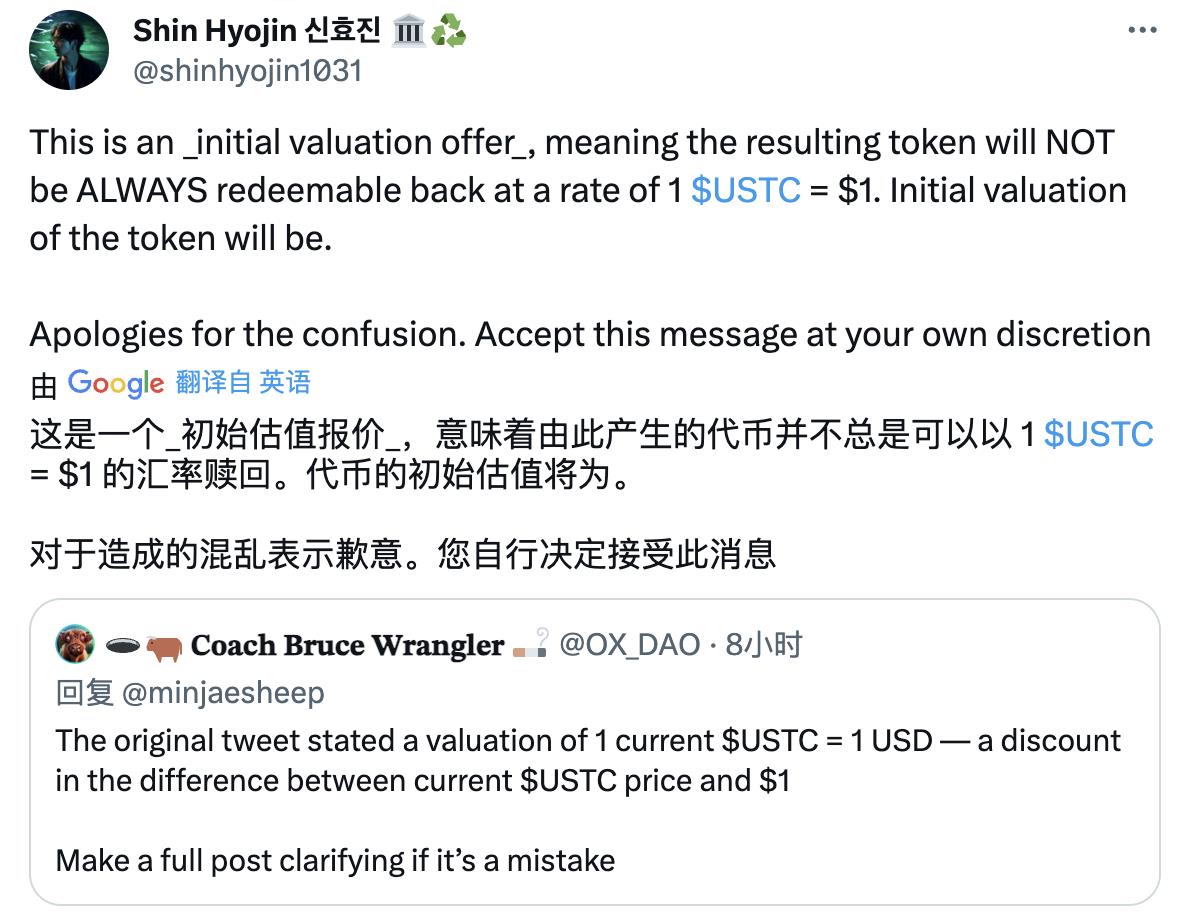

However, after the initial frenzy, Shin clarified that this was only an *initial valuation quote* and did not mean the token could always be redeemed at a 1:1 rate with USD.

Currently, over 9 billion USTC tokens are in circulation. Given these promises, it’s easy to imagine the project’s nominal initial valuation soaring—potentially reaching several billion dollars.

How Is It Different From MakerDAO?

By abandoning algorithmic stablecoins and instead using Bitcoin as collateral for stablecoin issuance, Mint Cash naturally invites comparisons to MakerDAO’s over-collateralization model.

Does Mint Cash offer any unique innovations?

Based on Shin’s tweets and the whitepaper released by Mint Cash, there are indeed key differences from MakerDAO in terms of collateral assets, stability, and capital efficiency:

-

Collateral Assets: MakerDAO enables users to generate DAI by depositing crypto assets (like ETH) as over-collateralized loans. Mint Cash takes a different approach—its stablecoin is fully backed by Bitcoin via a synthetic swap mechanism. This avoids traditional loan positions, allowing users to directly use Bitcoin as collateral to obtain an equivalent value of Mint Cash stablecoins.

-

Stability: DAI’s stability heavily depends on the performance of its collateral assets and broader crypto market volatility. Mint Cash strengthens decentralization by relying directly on Bitcoin as collateral. While this reduces dependence on traditional financial systems and centralized stablecoins, it may increase exposure to Bitcoin’s own price volatility.

-

Capital Efficiency: MakerDAO’s over-collateralization requires users to lock up more capital than the DAI they borrow, reducing capital efficiency. Mint Cash’s so-called “synthetic swap” theoretically allows direct Bitcoin-backed minting without additional capital input, improving capital utilization.

Overall, Mint Cash and MakerDAO represent two distinct philosophies in stablecoin design. MakerDAO’s DAI emphasizes stability through over-collateralization and partial reliance on centralized assets, whereas Mint Cash focuses on leveraging Bitcoin’s decentralized nature through a synthetic swap mechanism.

A Brilliant Marketing Campaign?

To some members of the LUNA community, Mint Cash represents a masterclass in marketing—elevating the concept of “airdrops” to new heights. It’s dancing on Terra’s grave, leveraging the existing LUNA and UST communities, their lingering热度 (momentum), and even liquidity still present on Binance to achieve a low-cost cold start.

The Mint Cash team is clear: They are not an algorithmic stablecoin, nor are they following the old algorithmic path—they’re more like DAI than UST.

In response to accusations of “riding coattails,” founding members admitted candidly that saving both $LUNC and $USTC simultaneously is impossible due to the original design of the Terra system. One must die. They chose to save USTC: All USTC entering the airdrop contract will be permanently burned.

Both LUNC and USTC have long since become meme coins—but they still hold immense speculative value. Countless people still nostalgically remember the days when LUNA spiraled upward and Anchor paid daily yields, even though it was all built on a Ponzi-like foundation.

Just as the ZEPH community promotes ZEPH as the “next LUNA” (despite significant differences), Mint Cash uses $USTC as a springboard for cold-start traction and imbues it with utility. The result? People are still buying into the LUNA narrative. Perhaps this is what we call “collective consensus fueled by memories of past rallies.” The same goes for FTT—also now a meme coin, yet potentially capable of returning to the spotlight should FTX restart or another catalyst emerge.

After all, even after the Qing Dynasty fell, there are still those who miss it.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News