Bull Market Investment Guide: How to Leverage Traffic to Identify High-Potential Projects?

TechFlow Selected TechFlow Selected

Bull Market Investment Guide: How to Leverage Traffic to Identify High-Potential Projects?

In the past history of Web3, it's almost impossible to find a project that lacked traffic yet quietly emerged as a wealth-creation myth.

Author: Liu Ye Jinghong

In the Web3 space, a full cycle typically revolves around the Bitcoin halving event—every four years. Out of these four years, more than three are bear markets, with only about one year being a bull market. And within that bull market, price peaks are often reached in just one or two months. Therefore, investment strategies during bear and bull markets are fundamentally different. Having navigated the Web3 world for six to seven years, I’d like to share my two core insights.

Invest in technology-driven, revenue-generating projects during bear markets. Only projects with direct income can survive prolonged bear markets. Projects without revenue are most likely to face slow death.

Invest in marketing- and market-driven projects during bull markets. Bull runs are too short for technically strong projects to fully mature. Exchanges prioritize traffic above all, and traffic-focused projects require quick entry and exit.

Now let me explain the logic behind this. What defines a technology-driven project? These are projects oriented toward technical advancement and continuous expansion of their ecosystem. Take a single protocol as an example: Uniswap constantly rolls out new versions, striving for improved AMM mechanisms. In contrast, non-technology-driven competitors may simply fork Uniswap V2 and never update again, focusing solely on tokenomics. At the ecosystem level, consider Cosmos, which uses the IBC protocol as infrastructure to enable customizable blockchains. Many recently listed Binance projects such as Neutron and Celestia are Layer1 chains built on Cosmos IBC.

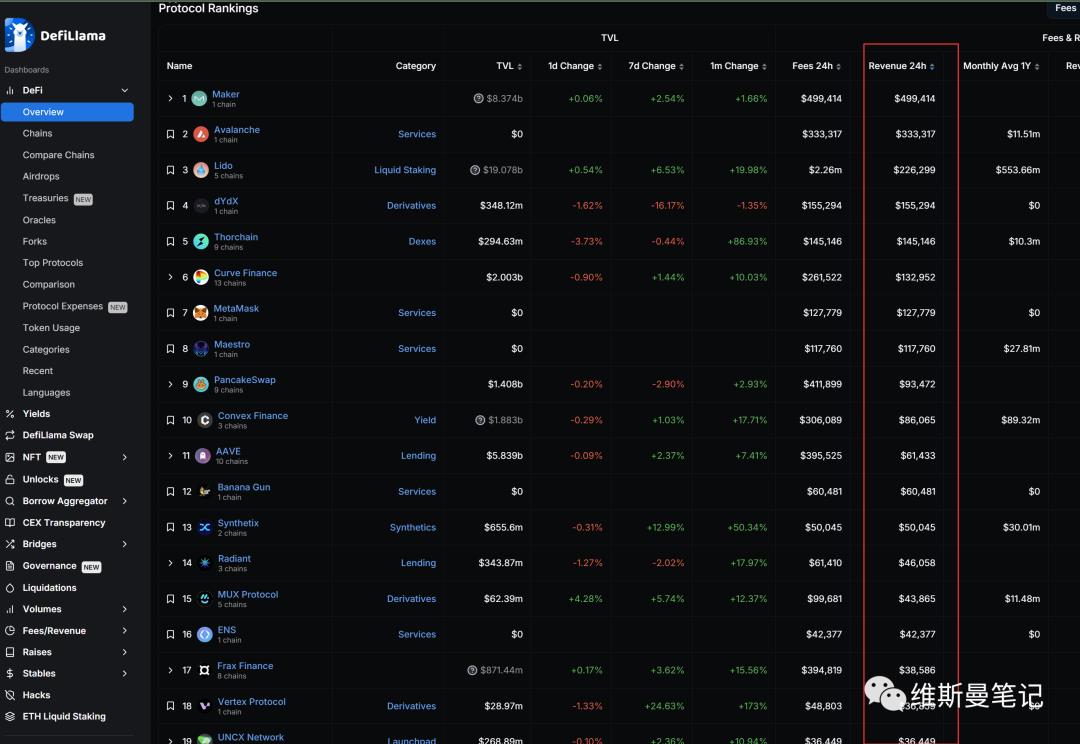

Revenue-generating projects are easier to understand—they earn direct income. Ideally, their income covers expenses. Using DefiLlama, you can view the protocol revenue of numerous projects. Currently ranked first is MakerDAO, generating $500,000 in protocol revenue over the past 24 hours. If you have experience in stock investing, you’ll understand how crucial revenue is for valuation. During a bear market, if a project generates zero revenue while its token continues to unlock and circulate, it will inevitably spiral into a slow death. Of course, teams might actively seek VC "white knights" through fundraising to survive.

During bull markets, focus shifts to marketing- and market-driven projects—the core principle remains traffic dominance. Whether memes or inscriptions, any project with massive traffic will be aggressively listed by exchanges. An exchange’s most valuable asset is its user base; user numbers determine an exchange’s future. Hence, during bull markets, set aside biases and pay attention to projects excelling in marketing.

Filtering projects in bull markets does follow patterns. A bull market is simply defined by frequent wealth creation events. Such wealth effects are inherently tied to traffic—you won’t find a project in Web3 history that achieved legendary wealth status without significant traffic.

Therefore, the key criterion in filtering bull market projects must revolve around “traffic.” With this in mind, we can trace early signs of promising bull-run projects.

Clue One: Low participation barrier and simple access. This is currently being validated—the Bitcoin inscription trend is booming. Unlike traditional investments requiring OTC purchases, private allocations, or proxy subscriptions, Bitcoin inscriptions can be minted and distributed directly. In previous bull markets, similar dynamics appeared in different forms: Launchpads played this role during DeFi Summer, and ICOs during the earlier wave. While the form changes each cycle, the essence remains the same—lowering entry barriers to capture traffic.

Clue Two: Exchanges begin racing to list. Normally, exchanges are cautious with new listings. But during bull markets, competition drives them to rush listings—launching innovation zones, seed areas, or high-risk sections. Regardless of label, the underlying motive is clear: avoiding user attrition by not missing out on traffic. Once multiple exchanges start rushing to list a project, its sector peers are likely to become contested as well.

Clue Three: Cross-language marketing surges. This might be a blind spot for many. Due to language barriers, most only follow Chinese-language (CN) news, which often consists of recycled information with significant time lags. By the time a trending project in the U.S. reaches CN audiences, it could already be days or weeks old. Similarly, regional trends such as AVAX’s popularity in Turkey were unknown to many before Istanbul Blockchain Week. The sector rotation in mid-November actually followed the momentum driven by Korean retail traders. Thus, Clue Three emphasizes leveraging information asymmetry—identifying projects already gaining traction abroad but not yet widely known in the Chinese-speaking community.

Finally, what I’ve shared isn’t a get-rich-quick formula, but rather experience-based insights to improve your odds of wealth accumulation. Actual investment decisions should still align with your personal understanding. That’s all for today. If you found this helpful, please like, follow, and share.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News