What the Binance ruling means for cryptocurrency

TechFlow Selected TechFlow Selected

What the Binance ruling means for cryptocurrency

Overall, Binance may no longer have the agility it once had in pursuing new opportunities.

Written by: Jack Inabinet, Bankless

Compiled by: TechFlow

On Tuesday afternoon U.S. time, U.S. regulators convened in Seattle and determined that the world’s largest cryptocurrency exchange violated U.S. anti-money laundering laws and the Bank Secrecy Act.

Binance has reached an agreement with federal agencies, ending a criminal investigation into the exchange that began in 2018.

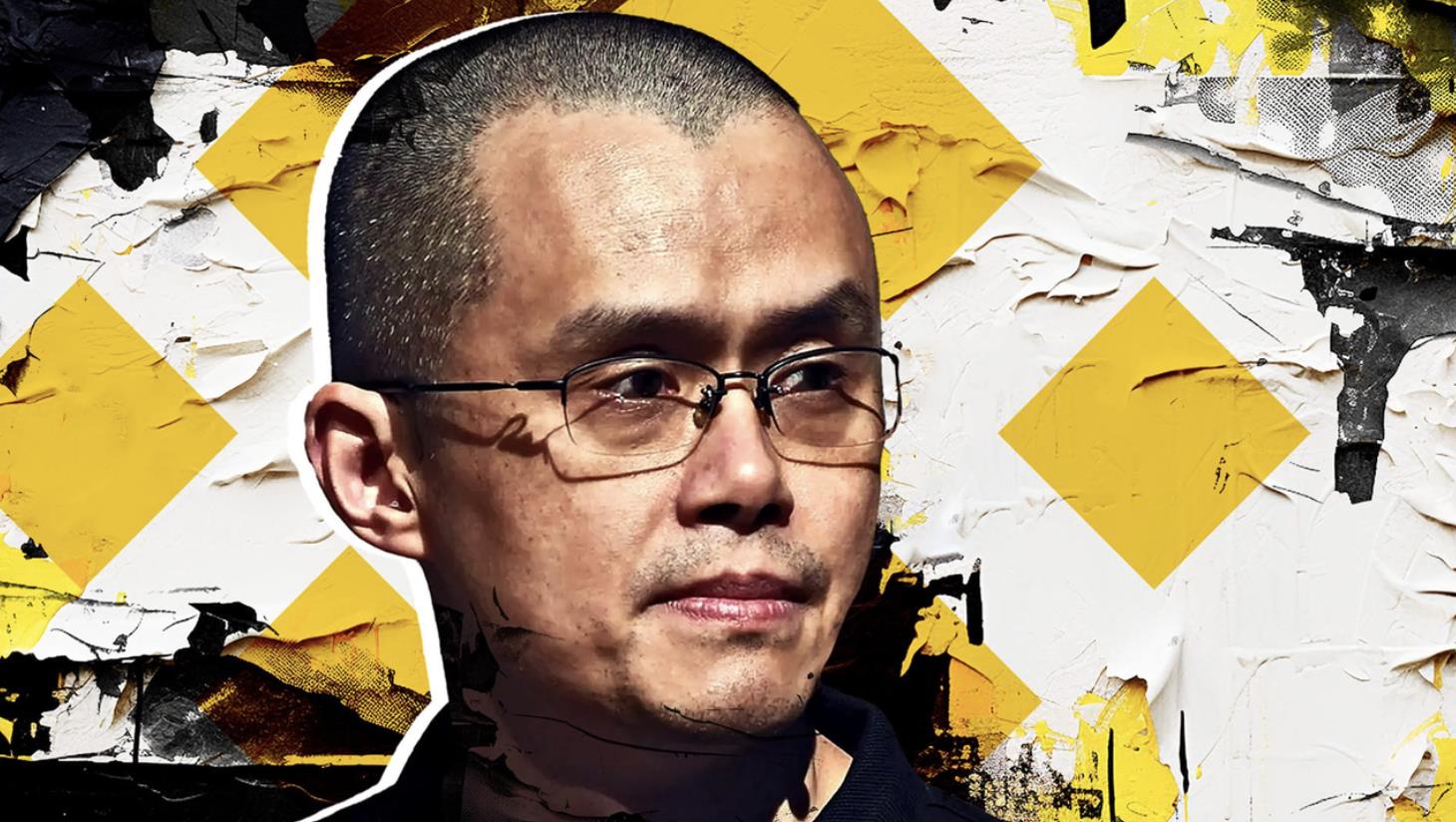

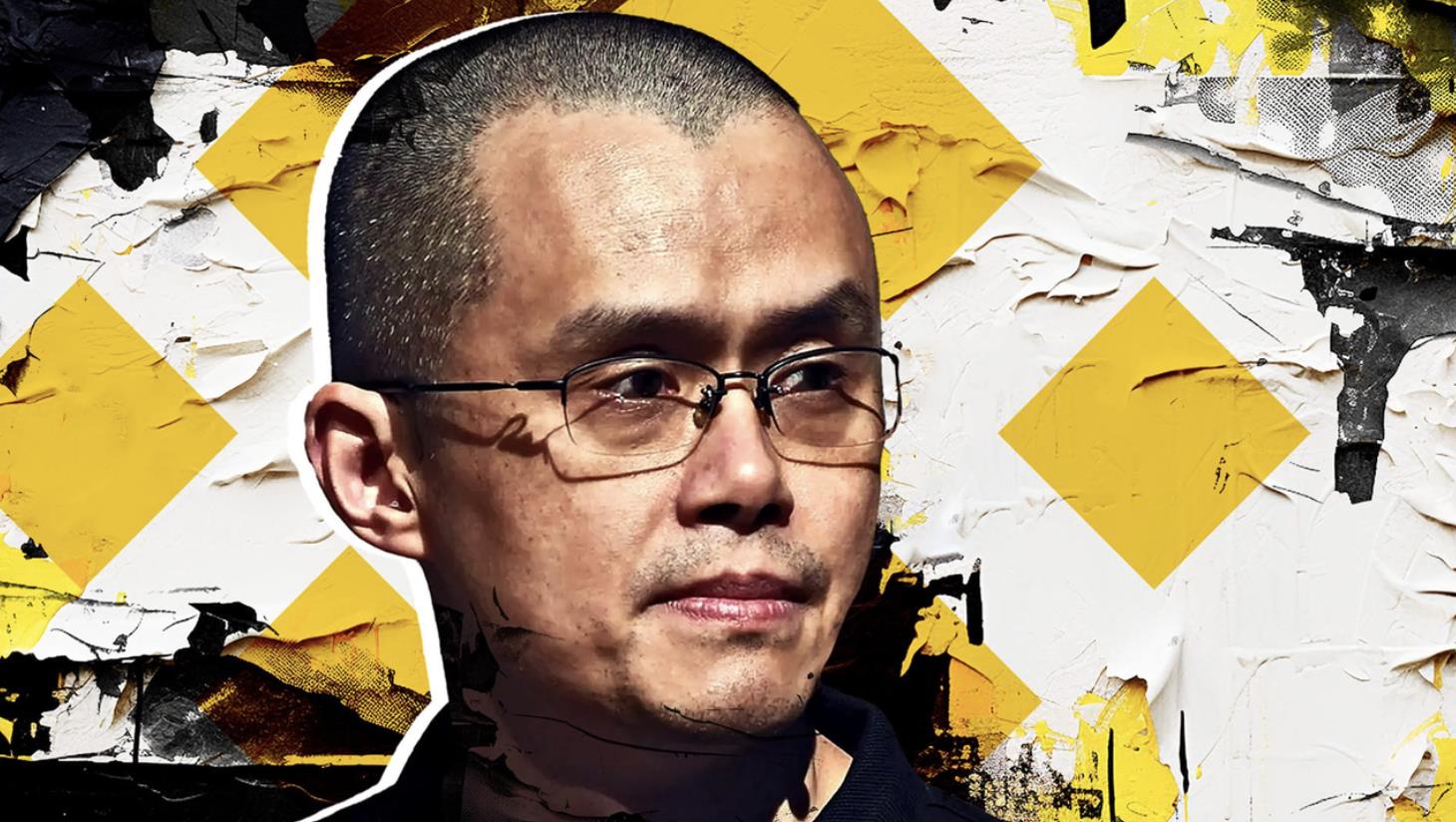

CEO Zhao Changpeng (CZ) must step down for at least three years, but the exchange he owns may continue operating. To resolve the matter, Binance will pay a massive $4.3 billion fine, marking the seventh-largest financial compliance penalty in history. However, the company appears to have sufficient assets to cover the fine without selling its crypto holdings.

Did Binance do something wrong?

Clearly, Binance and CZ violated U.S. laws. Unlike attacks on DeFi protocols or exchanges accused of failing to comply with unwritten norms, regulators are alleging deliberate disregard for established legal requirements.

The complaint against Binance cites numerous examples of compliance staff facilitating U.S. customers’ illegal access to the international platform, along with multiple transactions linked to terrorist organizations and illicit finance.

Moreover, leaked chat messages show senior executives directly acknowledging criminal conduct over many years.

What’s next for Binance?

Despite having operated for years as the largest cryptocurrency exchange, Binance’s future appears quite challenging.

Binance has already faced difficulties obtaining licenses or conducting business in multiple jurisdictions, including Australia, Austria, Belgium, Canada, Cyprus, the Netherlands, and Germany. Today’s announcement gives foreign regulators opportunities to fine the exchange or outright ban it from operating within their jurisdictions.

Additionally, although Binance will be allowed to continue operations, the settlement includes strong monitoring and oversight provisions, creating significant compliance hurdles. Binance must also carefully avoid past practices such as money laundering and illegal trading—activities that drove volume for years.

Overall, Binance may no longer possess the agility it once had in pursuing new opportunities.

Where does crypto go from here?

Markets reacted calmly to today’s news; there was no liquidity flight or immediate sell-off.

The Department of Justice conducted a full review of Binance and found no fatal flaws that could trigger bankruptcy and spark another crypto collapse. Assuming no further developments or investigations in the Binance case, we can consider this major lingering risk to crypto significantly reduced.

Although today’s regulatory actions don’t clarify the various opaque rules U.S. authorities expect crypto firms to follow, they do reveal that some actors in this space have shown greater tendencies toward intentional defiance—and short-term thinking—compared to participants in other industries.

The struggle between crypto and regulators will remain difficult, marked by unfair aggression and bureaucratic overreach. Gensler is not the only adversary. Yet the minimal price movement makes one thing clear: Binance’s exposure was well known and already priced in. Now, crypto can move forward toward clearer horizons and potentially enter another bull run.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News