Tech Shuffle: The Evolution from Internet Bubble to Cryptocurrency

TechFlow Selected TechFlow Selected

Tech Shuffle: The Evolution from Internet Bubble to Cryptocurrency

First comes the bubble phase, then creative destruction, and finally value creation—what stage are we in now?

My dad has a rather exceptional perspective on the entire internet technology ecosystem — after all, he was there from the very beginning.

What does this have to do with crypto? Give me a moment to explain:

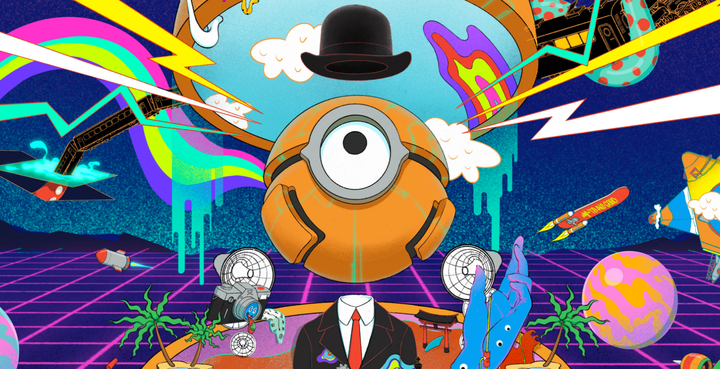

When my dad began his bachelor’s degree in computer science in 1979, he didn’t even directly interact with computers; his coursework was entirely theoretical (based on textbooks and lectures) or involved programming using punch cards. There was no internet, no HTML, and no standardized protocols back then.

The world was completely different, primarily because computers didn't really impact our daily lives.

Punch cards were these things (Photo credit: DullHunk on Flickr)

Eventually, my dad's career took a winding path—from computer-aided manufacturing (one of the earliest use cases for business computing) to teaching systems administration at a technical college during the last decade of his professional life. He’s now retired, but that’s another story.

Do you remember the early internet?

- Yes

- No

The other day, I called him up to talk about business computing, the early days of the internet, and how they compare to crypto. Here’s what he said:

1. The Internet Is Very Similar to Blockchain

I never thought the idea of a cohesive 'internet' would be truly defined until the mid-to-late 1980s. Before that, there were corporate computer networks, interbank networks, and academic networks. Meanwhile, a permissionless, 'self-hosted' network—the internet—was steadily growing and gaining attention.

What exactly is the internet? It's a series of interconnected servers linked together in an elastic, permissionless, and open way. What does that mean?

-

Open: There is no single gatekeeper that internet users must go through.

-

Elastic: If one 'node' in the network goes down, the network remains active.

-

Distributed: The internet isn’t a single entity or source.

-

Permissionless: Anyone can participate in the network.

These characteristics sound remarkably similar to something else we know and love: cryptocurrencies and their underlying cryptographic ledgers. Of course, there are differences—the internet has no native token. Still, it's worth examining their similarities.

Notably, none of these features were guaranteed—they were all hard-won. Major corporations (Microsoft, IBM, etc.) wanted to create their own 'closed' versions of the internet, ones they could control and charge users for. Other networks were restricted to specific industries.

As an interesting side note, the U.S. federal government is the undeniable original source of internet technology and its underlying ideas—a fact often overlooked by the cryptocurrency and tech industries.

Conclusion: Blockchains show incredible metaphorical similarity to the internet. This analogy extends in many ways; thus, we can use the internet and its evolution to inform our thinking about the world of crypto.

2. Protocols, Version 2.0

In the early stages of the internet, standards had not yet been established. A variety of 'standard' protocols for applications emerged—mostly a mix of incompatible or non-functional solutions.

Slowly, single-purpose protocols became standardized, bringing consolidation to the field—most notably TCP/IP. But it never accumulated value; those who built the internet technology stack kept it open and never charged rent.

Who profited from TCP/IP?

-

Applications built on top: Facebook, Google;

-

Infrastructure supporting its operation: Cisco, Alcatel;

-

Tools enabling the protocol: NVIDIA, TSMC, Apple;

There are two ways to view this paradigm:

-

Crypto is different because it allows protocols to accumulate value.

-

Crypto protocols will ultimately prove worthless, and the most valuable layer will eventually be applications. This idea was expanded upon in an article by Placeholder Ventures partner Joel Monegro. You can read it here.

Personally, I believe both protocols and applications can accrue value: Ethereum needs to have value to securely custody assets, otherwise it becomes economically insecure. Similarly, applications can charge based on utility. The shift post-merge toward a net-inflationary 'monetary' model on Ethereum—through fee burning—is indeed a major step in changing the 'fat applications, thin (valueless) protocols' paradigm.

Conclusion: While many in the crypto space envision a multi-chain future, TCP/IP actually stands as an example of convergence toward a single, dominant protocol—an interesting data point. Can its equivalents (Ethereum, other L1s) accumulate value? Or will applications ultimately become the most valuable assets in crypto?

3. A Shakeout Will Happen

During the incredible tech boom of the late 1990s, which helped generate one of the few budget surpluses in U.S. history as the internet drove banks and stock markets, the so-called "dot-com bubble" burst when valuations detached from reality.

Capital evaporated, the weak players exited: investments, companies, projects, retail investors—all those without commitment left, creating a consolidation effect. My dad calls this process “creative destruction,” because although painful, it leads to stronger competitors that genuinely create value for the world (and investors), while the initial rise (the bubble) was merely about how capital markets create space for speculation.

Conclusion: Are we currently in the midst of such a shakeout? Or will there be another upswing before the real shakeout occurs? Either way, the weak will exit (are already exiting).

4. It Will Take Much Longer Than Expected

How does my dad view today’s crypto entrepreneurs? He says: “They’re children. When they start looking like adults, that’s when we’ll see crypto change the world.”

It’s hard to judge whether crypto is advancing faster or slower than Web 1.0 and 2.0, and even harder to predict exactly how this progress will unfold—but one thing is certain: it will take longer and be more difficult than anticipated.

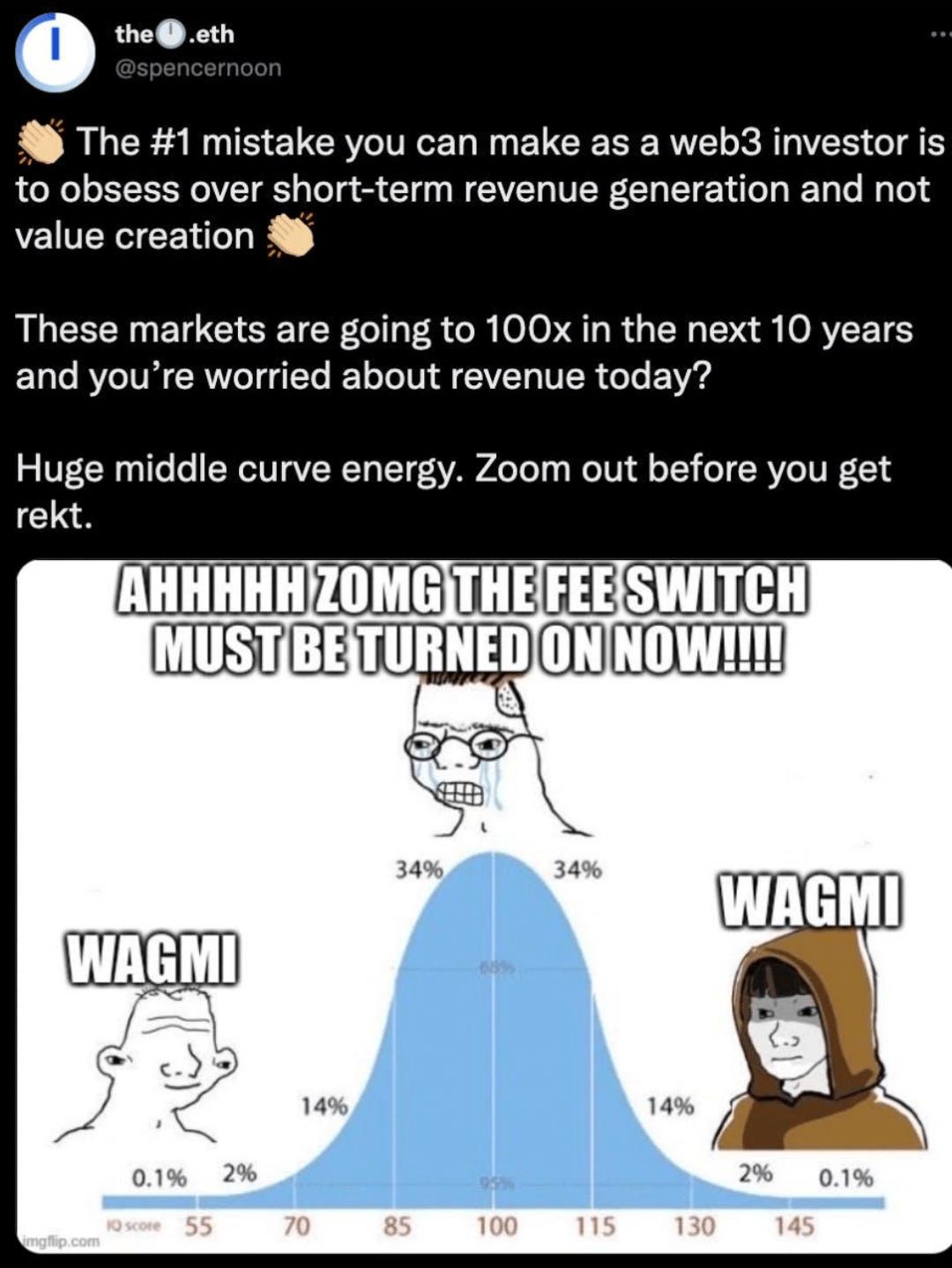

I really like this tweet that puts things into perspective:

The trivial details of specific projects and daily noise are ultimately meaningless—we need to focus on epoch-defining, generational shifts.

Conclusion: Patience is crucial.

5. Marc Andreessen Is Right—Until Proven Otherwise

One of the central figures bridging the Web2 and Web3 worlds? Marc Andreessen, co-founder of venture capital firm A16Z. While the firm has developed a certain reputation in crypto (spray-and-pray investing, never selling), in Web2 it holds another distinction: being considered one of the greatest technology investors in history.

Seriously: CBInsights, Forbes, and InvestorRank all agree. Their average annual returns tell a similar story.

People in crypto may not fully appreciate that Marc Andreessen has come full circle—first as the creator of the first web browser (Mosaic, later Netscape), then as one of the greatest tech investors of the Web era, and now focusing heavily on crypto. His views carry weight, and his belief in ownership via the internet should not be dismissed.

Although the recent generation of Web2 founders tends to criticize Web3, it feels like many early internet OGs (original gangsters) can appreciate what's happening.

Conclusion: The older generation largely stands with us. Overall, critics mostly come from the newest generation of tech founders—or those who were never true internet enthusiasts to begin with!

Will Things Really Change?

Although technological cycles accelerate and transform in unpredictable ways, our models for how specific innovations develop and spread have remained consistent. Power-law distributions combined with exponential growth generate billions in economic value for founders, employees, investors—and yes, customers too (remember, crypto needs this as well).

Conclusion: The older generation largely stands with us. Overall, critics mostly come from the newest generation of tech founders—or those who were never true internet enthusiasts to begin with!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News