MT Capital Research Report: Nakamoto Upgrade Approaching, Stacks Will Become a True Bitcoin Layer 2

TechFlow Selected TechFlow Selected

MT Capital Research Report: Nakamoto Upgrade Approaching, Stacks Will Become a True Bitcoin Layer 2

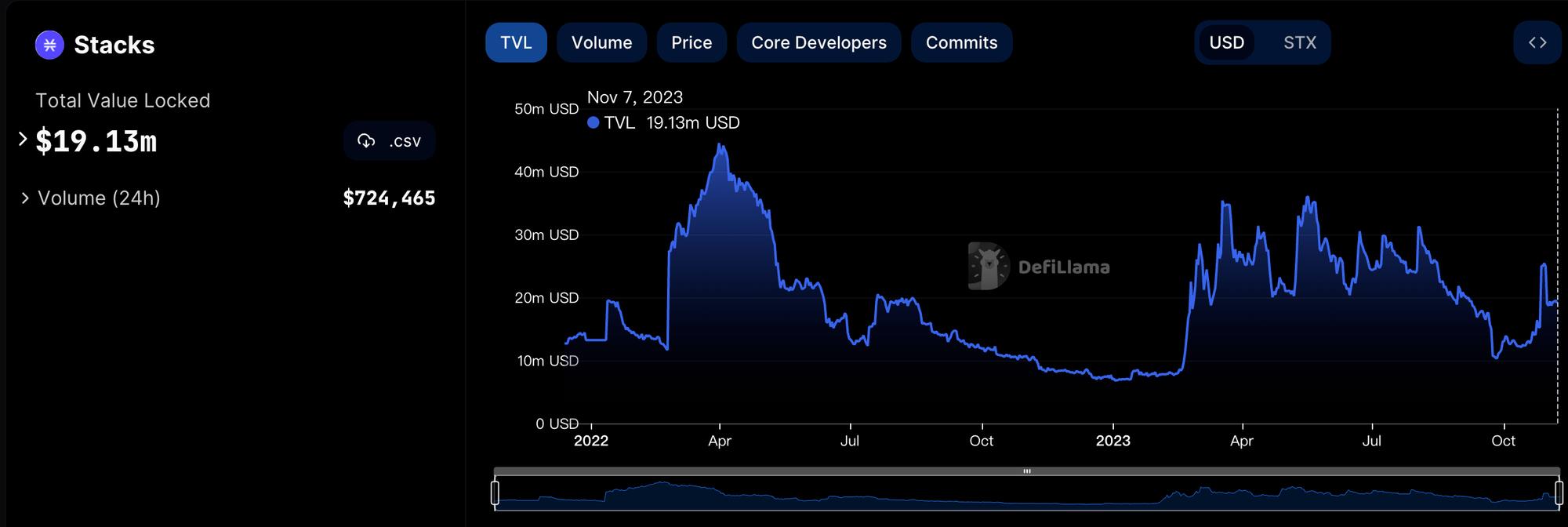

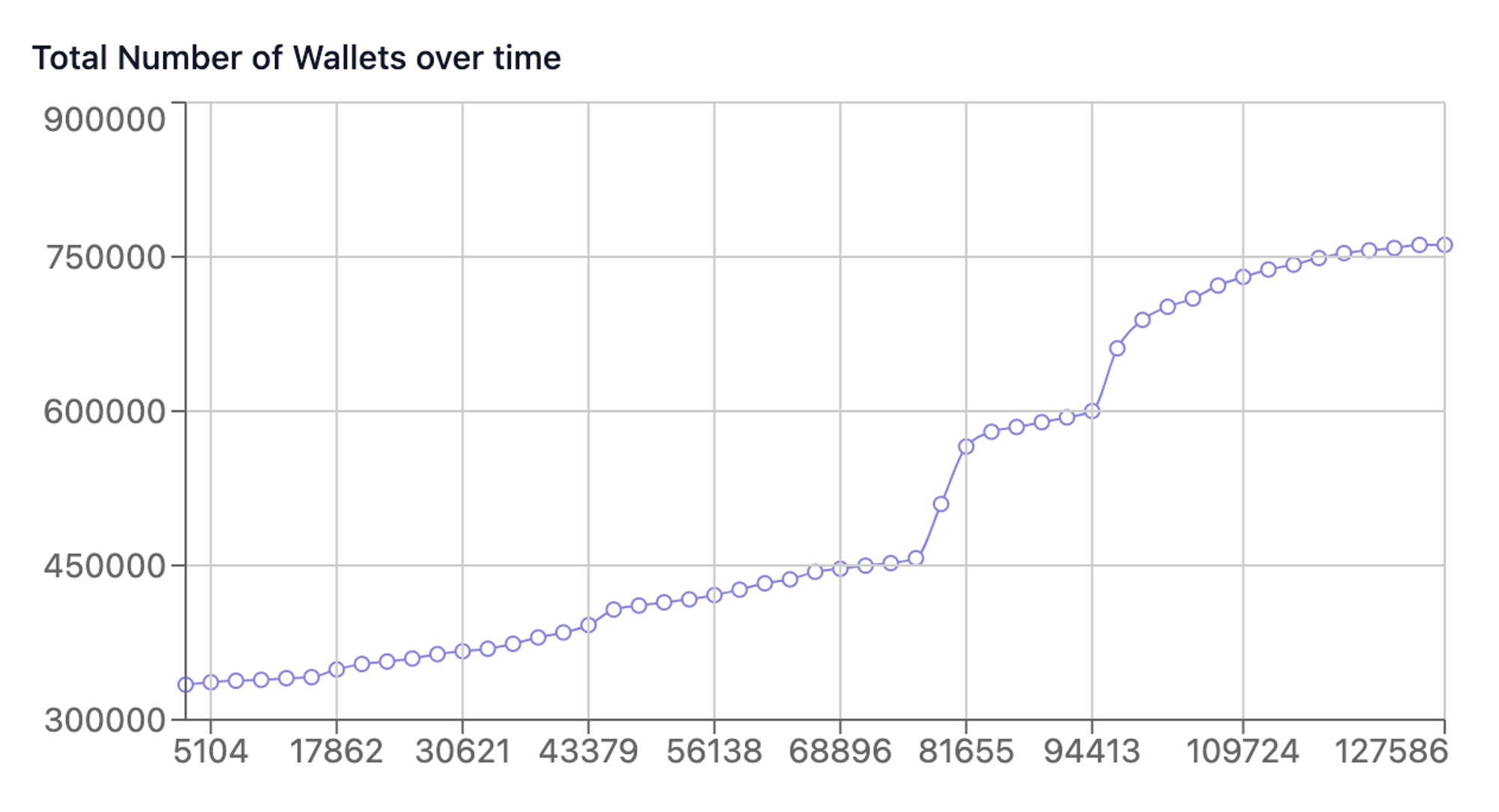

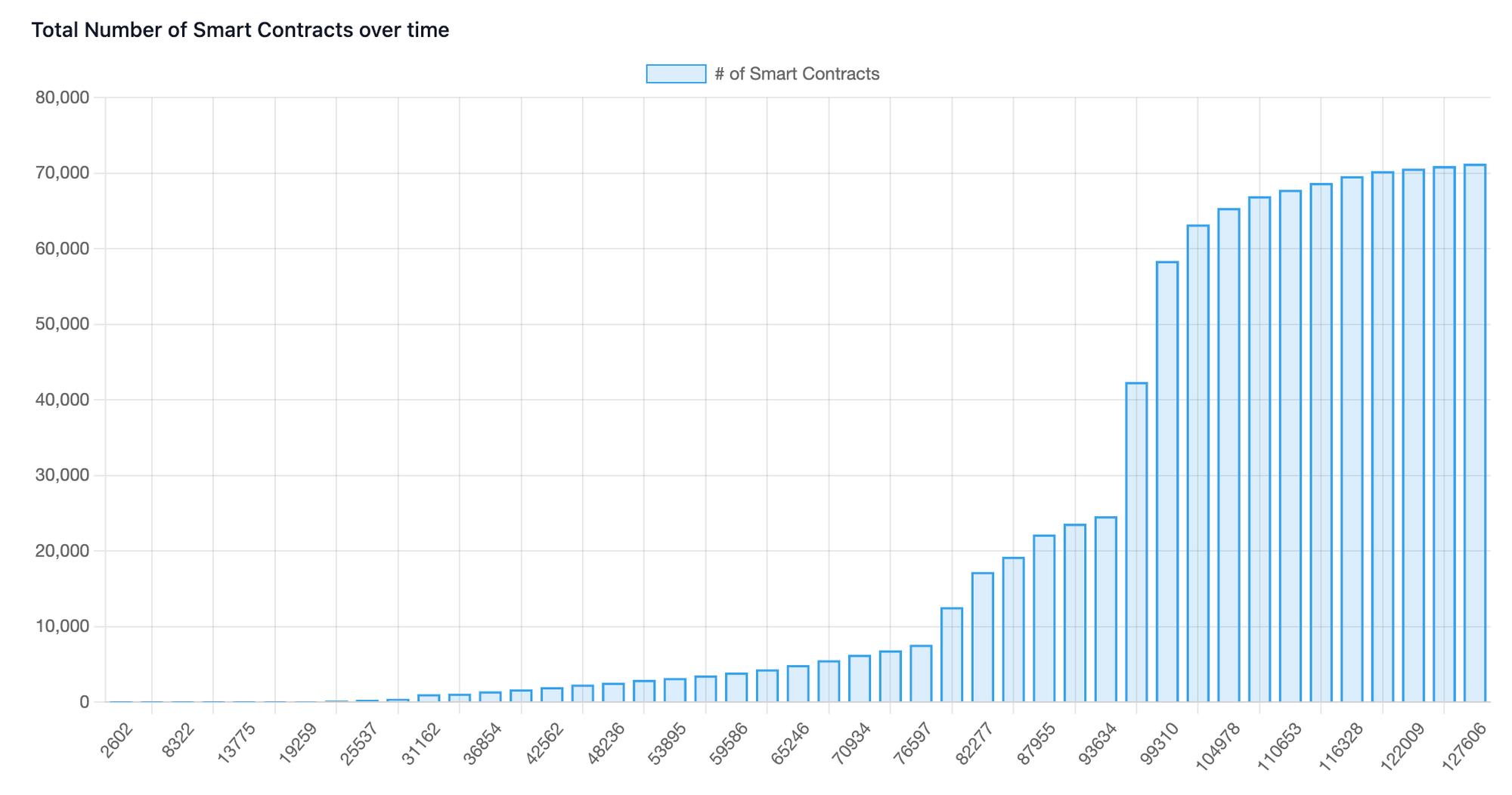

The Stacks ecosystem currently has a TVL exceeding $19 million, over 120,000 deployed smart contracts, more than 760,000 wallets, and a relatively comprehensive ecosystem project landscape.

Authors: Yimu & Xinwei

TL;DR

-

Observing historical price trends, STX always lags behind BTC and exhibits higher volatility than BTC. It also shows relative strength compared to other assets within the BTC ecosystem.

-

With Bitcoin's halving approaching, interest in BTC ecosystem concepts continues to rise. Stacks, as a leading project in the BTC ecosystem, will undergo its Nakamoto upgrade in Q4. With 5-second block times and trustless sBTC, it will unlock DeFi possibilities for Bitcoin, likely driving further growth of the Stacks ecosystem.

-

Among BTC ecosystem tokens, STX has the highest exchange listing coverage—including Upbit—and is the most liquid asset, making it a key indicator for observing the entire BTC ecosystem.

-

Stacks uses the Proof of Transfer (PoX) consensus mechanism to build smart contracts and decentralized applications on top of Bitcoin’s security using the Clarity language. Users lock up Bitcoin to mine STX and strengthen Stacks' role as a Bitcoin Layer-2, enabling fast transaction processing while preserving Bitcoin's finality.

-

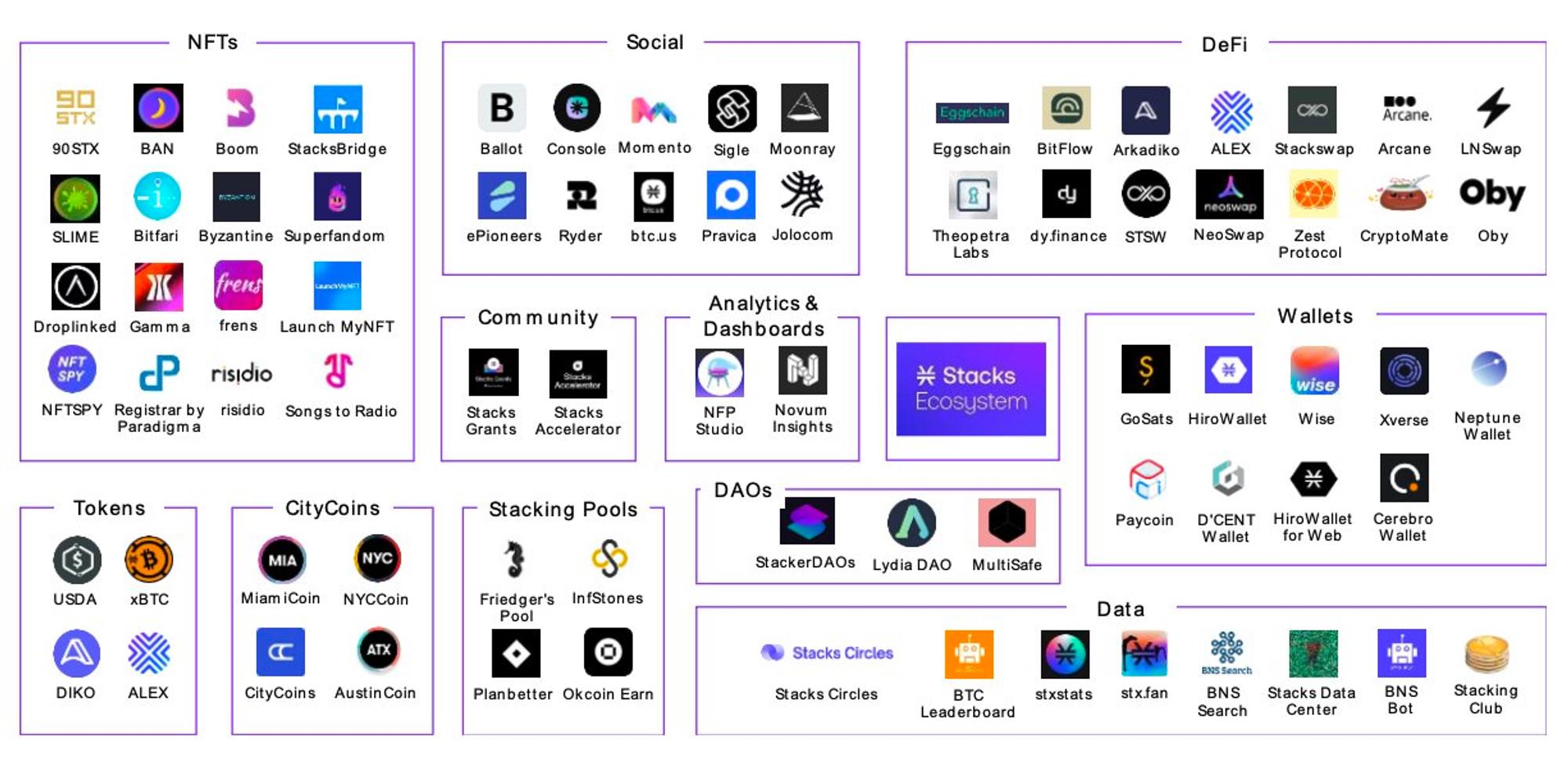

The Stacks ecosystem currently has over $19 million in TVL, more than 120,000 deployed smart contracts, and over 760,000 wallet addresses. The ecosystem is well-developed with projects spanning wallets, DeFi, NFTs, DAOs, DID, social platforms, and more.

Introduction

Stacks (STX) is a smart contract layer built on Bitcoin, designed to extend Bitcoin's functionality by enabling smart contracts and decentralized applications (DApps).

-

Goal: The primary goal of Stacks is to bring smart contract capabilities to the Bitcoin blockchain, allowing developers to build DApps and smart contracts that expand Bitcoin’s utility.

-

PoX Consensus: Stacks 2.0 uses the PoX (Proof of Transfer) consensus mechanism. Participants are rewarded with a more stable base-layer cryptocurrency (Bitcoin), which incentivizes early participation better than rewarding with the new chain’s native token—leading to stronger network effects and broader adoption.

-

Empowering BTC: By transforming BTC into an asset usable for building DApps and smart contracts, Stacks enhances the vitality of the Bitcoin economy.

-

Ecosystem: The Stacks ecosystem currently includes 79 projects with a TVL of $24.95M.

1. Team Background

Image Source: LinkedIn

Stacks is a project composed of multiple independent entities and a vibrant community. Initially led by Blockstack PBC, it was later renamed Hiro Systems PBC. According to the latest LinkedIn data, the team is headquartered in NYC and consists of 49 members.

Key People and Roles:

Muneeb Ali: Co-founder of Stacks and CEO of Hiro. He holds a Ph.D. in Computer Science from Princeton University, focusing on distributed application research and development. He has delivered talks at forums such as TEDx on cryptocurrency and blockchain, and authored numerous academic papers and whitepapers. Muneeb is also the CEO of Trust Machines.

Jude Nelson: Research Scientist at the Stacks Foundation and former Engineering Partner at Hiro. He holds a Ph.D. in Computer Science from Princeton University and was a core member of PlanetLab, which received the ACM Test of Time Award for enabling planetary-scale experiments and deployments.

Aaron Blankstein: Engineer who joined the Blockstack engineering team after earning his Ph.D. in 2017. He studied computer science at Princeton and MIT. His research spans web application performance, caching algorithms, compilers, and applied cryptography. His work on CONIKS won the Caspar Bowden Award for Privacy Enhancing Technologies in 2017. He has been using Emacs for over ten years.

Mike Freedman: Technical Advisor at Hiro and Professor of Distributed Systems at Princeton University, providing technical guidance to the project. He is a recipient of the Presidential Early Career (PECASE) Award and Sloan Fellowship. His research has led to several commercial products and systems serving millions of daily users.

Albert Wenger: Board member at Hiro and Managing Partner at Union Square Ventures (USV). Before joining USV, he served as President of del.icio.us and was an active angel investor, backing companies like Etsy and Tumblr. Albert graduated from Harvard with degrees in Economics and Computer Science and holds a Ph.D. in Information Technology from MIT.

JP Singh: Board member at Hiro, Professor and Undergraduate Chair at Princeton University, specializing in parallel computing systems and applications. He is a recipient of the Presidential Early Career (PECASE) Award and Sloan Fellowship, and co-founded the business analytics company FirstRain Inc. He earned his undergraduate degree from Princeton and holds graduate and doctoral degrees in Electrical Engineering from Stanford. He is also a co-founder of Trust Machines.

Beyond Hiro, the Stacks ecosystem includes several other independent entities: the Stacks Foundation, Daemon Technologies, Freehold, New Internet Labs, and Secret Key Labs.

Image Source: stackschina

Hiro: Focuses on developing and maintaining developer tools for the Stacks ecosystem.

Stacks Foundation: Supports the growth of the Stacks ecosystem through governance, R&D, education, and grants.

Daemon Technologies: Specializes in supporting Stacks mining and staking operations.

Secret Key Labs: Develops Chinese-language mobile wallets that support direct participation in Stacking.

2. Funding and Capital Structure

Stacks has completed five funding rounds totaling $88 million.

Source: Rootdata

Specific funding rounds and investors:

Source: Rootdata

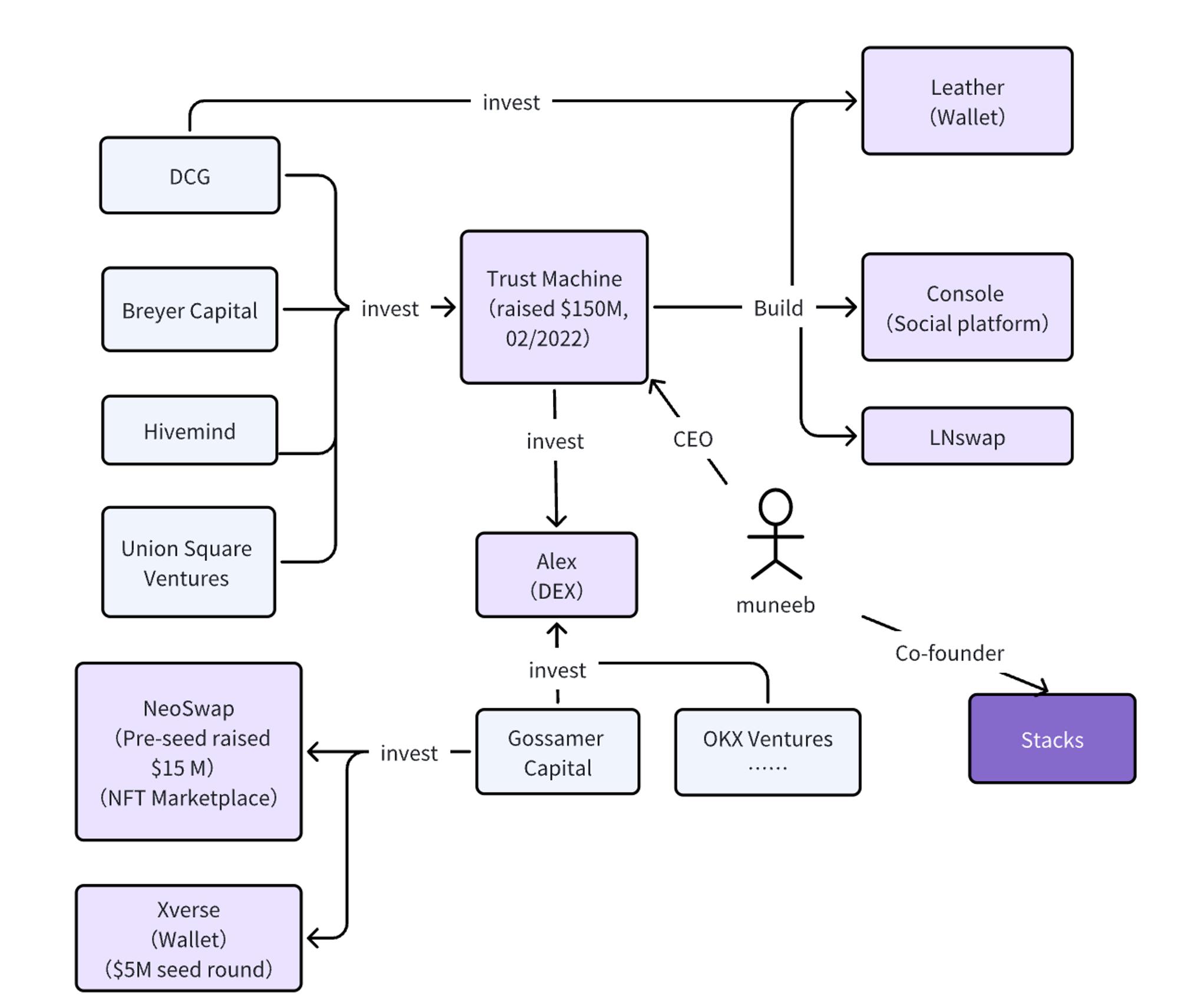

Trust Machines:

Trust Machines was founded by two Princeton computer scientists—Muneeb Ali (co-founder of Stacks) and JP Singh (executive director at Hiro)—both staunch believers in Bitcoin. They believe Bitcoin’s layer can unlock a wide range of new use cases. Muneeb Ali and JP Singh jointly founded Trust Machines.

Trust Machines has three main products: Leather (wallet, formerly Hiro Wallet), Console (social platform), and LNswap.

In April 2022, Breyer Capital, Digital Currency Group, GoldenTree, Hivemind, and Union Square Venture announced a **$150M** investment in Trust Machines [1].

Additionally, in March 2023, Trust Machines and Gossamer Capital announced a $2.5 million investment in Alex, the largest DEX on Stacks.

Image Source: Compiled by the authors

3. Development Timeline and Current Status

Development Timeline

Source: Compiled from public information

-

Current Status

Stacks completed its latest v2.1 network upgrade in Q1 2023, introducing improvements such as enhanced Stacking functionality, upgrades to the Clarity programming language, internal blockchain optimizations, and improved reliability. Additionally, the Hiro Developer Platform was launched, enabling developers to build and deploy smart contracts on Stacks via a hosted experience.

Currently, the community is actively preparing for the upcoming Nakamoto upgrade expected in Q4 2023.

The Nakamoto upgrade introduces a series of technological advancements. Combined with the introduction of sBTC—a 1:1 Bitcoin-backed asset—Stacks will soon enable fully decentralized writing to Bitcoin. sBTC enables trust-minimized movement of Bitcoin between L1 and L2. Unlike earlier sidechain approaches, the threshold wallet is managed by a permissionless, dynamically changing set of entities economically incentivized to maintain the peg—they can freely join or exit the peg maintenance process. This mechanism allows issuance of an asset on the Bitcoin layer that maintains a permanent 1:1 peg with Bitcoin. Furthermore, the Nakamoto upgrade drastically reduces execution time from minutes down to seconds.

The community has already opened trial access to sBTC for developers and is actively organizing educational sessions around the upgrade’s features and use cases.

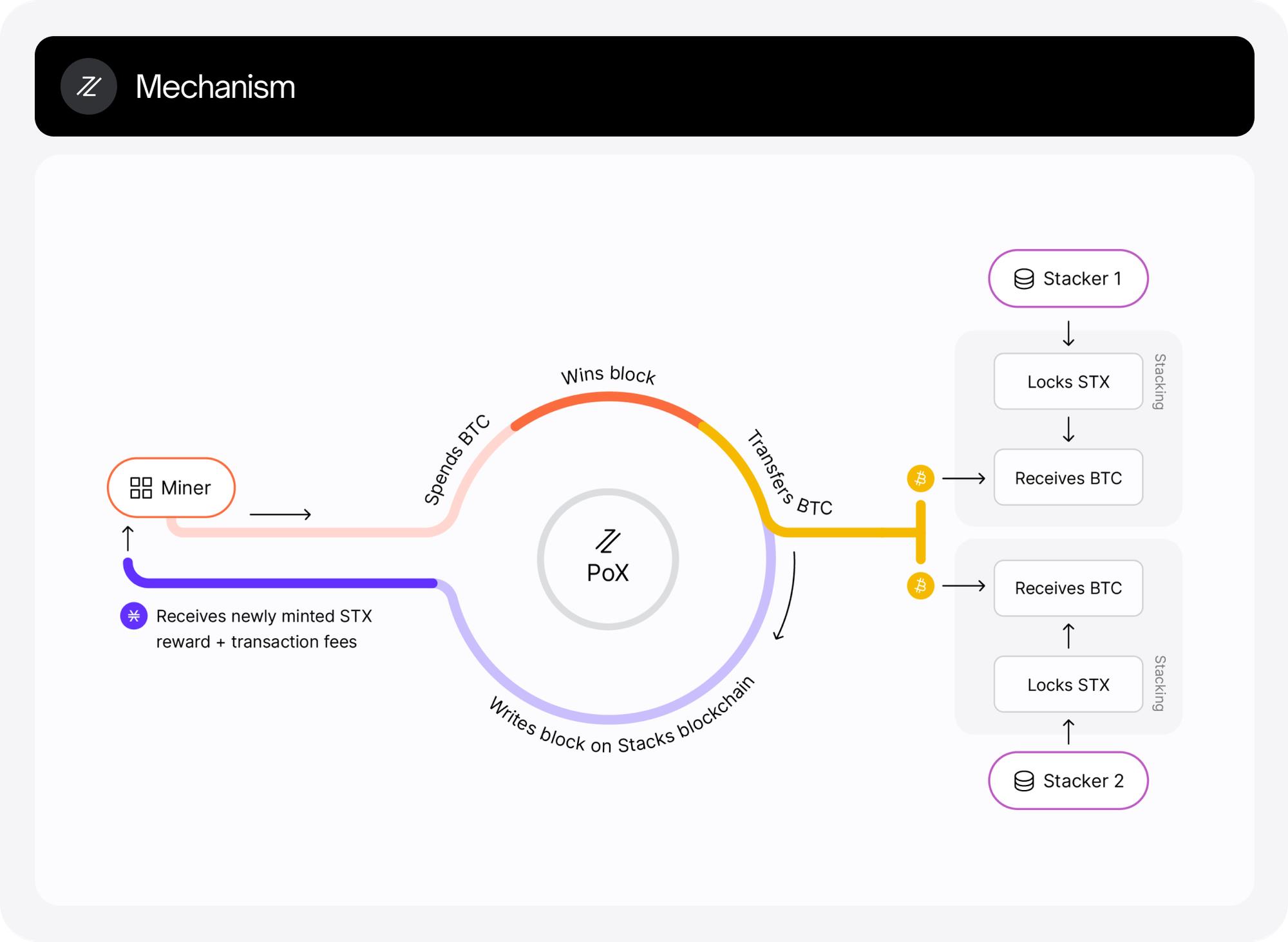

4. Consensus Mechanism: PoX

Stacks’ original consensus mechanism was Proof-of-Burn (PoB), proposed by Jude Nelson and Aaron Blankstein in late 2018.

PoB allows Stacks miners to compete by burning cryptocurrency instead of consuming electricity. Compared to traditional proof-of-work blockchains, PoB does not require specialized hardware and offers greater transparency to participants. However, like PoW, PoB is destructive—requiring miners to destroy value to secure the blockchain.

Unlike PoS, PoB requires users to permanently burn tokens to gain mining rights. This is done by sending tokens to an unrecoverable address.

Mining rights are allocated via a randomized selection process—even if a user burns tokens, there is no guarantee they will be selected to mine.

This process may reduce token supply for holders but creates competitive opportunities among miners.

Since burning BTC under PoB is equivalent to permanent destruction, and to better balance incentives between miners and token holders while minimizing impact on the Bitcoin network, Stacks transitioned from PoB to PoX.

PoX (Proof of Transfer)

PoX (Proof of Transfer) is an evolution of the Proof-of-Burn mechanism. PoX uses the established proof-of-work cryptocurrency of a base blockchain to secure a new blockchain. Unlike PoB, where miners burn crypto, PoX transfers committed cryptocurrency to other participants in the network.

-

Key Features and Advantages of PoX

-

Base-chain token rewards: Participants receive rewards in a stable base-layer cryptocurrency. Compared to rewarding with the new chain’s native token, this better incentivizes early adopters and strengthens consensus.

-

Initial value anchoring: Because the new token is pegged to the base-chain cryptocurrency, it has a clear reference point for initial valuation.

-

Solves dependency/value spiral problem: By offering base-chain crypto incentives, PoX helps prevent the “value spiral” often seen in new blockchains lacking intrinsic value.

-

Developer fund creation: PoX can also be used to establish a developer fund denominated in another cryptocurrency (e.g., Bitcoin), supporting ecosystem development without diluting the new token’s value.

-

PoX Design

-

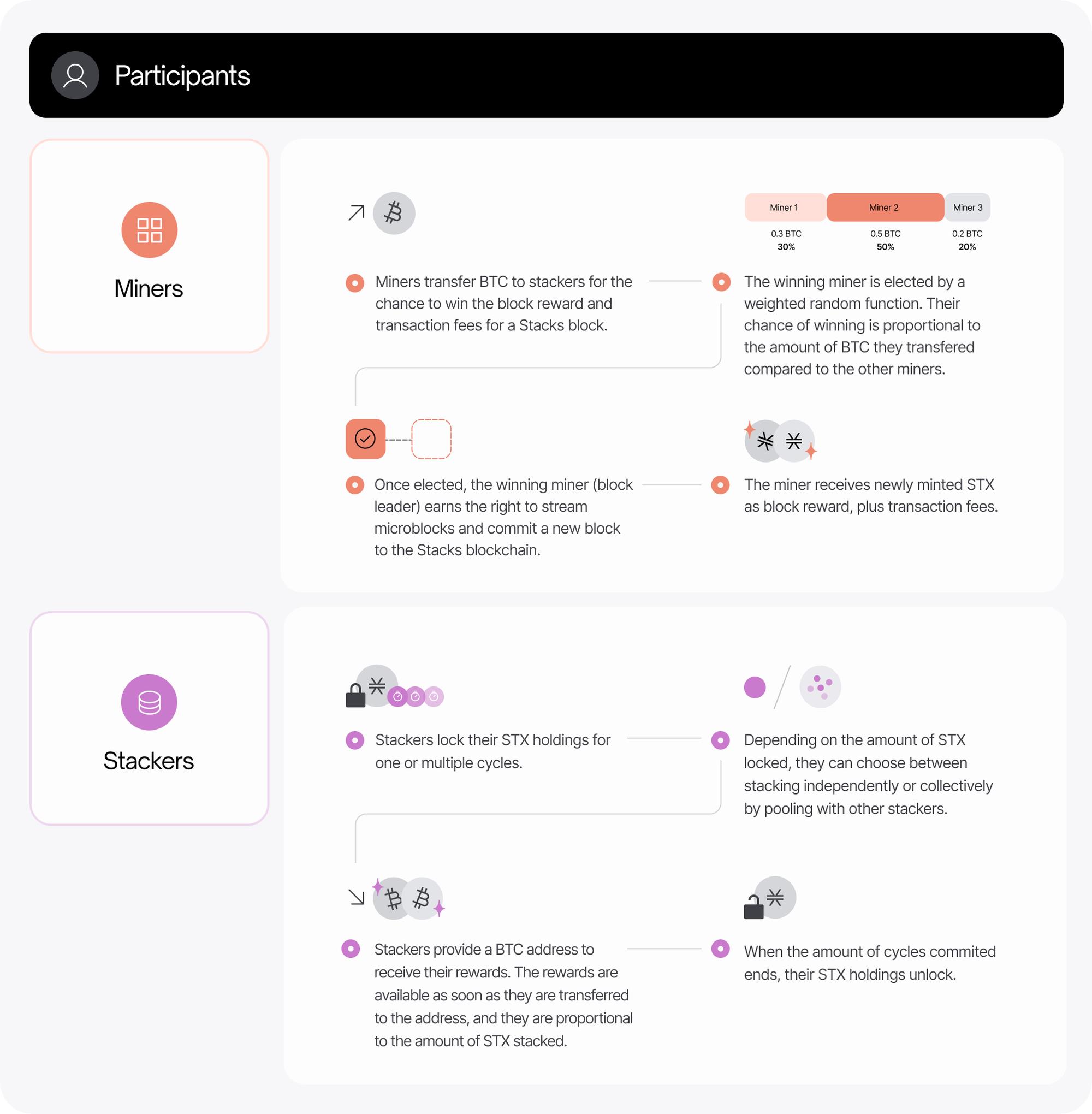

Participants

-

Miners: Bid by staking BTC to gain the right to mine the next block → Mine → Earn newly minted STX tokens + high transaction fees;

-

Stackers: Users who lock up a certain amount of STX for a fixed period. Set up staking pools (self-hosted or joined) → Specify a reward-receiving address → Earn BTC rewards proportional to their staked STX amount.

-

-

Miner Mining Mechanism – Image Source: Stacks Whitepaper

Participant (Network Maintainer) Incentives – Image Source: Stacks Whitepaper

-

Reward Cycle: During each reward cycle, miners transfer funds to designated reward addresses. Each reward address receives only one Bitcoin transfer from miners per cycle.

-

Eligibility Requirements:

-

A Stacks wallet must hold at least 0.02% of the total unlocked STX supply—the threshold adjusts based on participation levels in the Stacking protocol;

-

Broadcast a signed message before the start of the reward cycle, including the protocol-specified STX lock-up duration, the designated Bitcoin address for receiving rewards, and a vote supporting a specific block on the Stacks chain.

-

Address Validity: Participants must verify the validity of the reward address, as each cycle’s reward address must be confirmed valid.

-

Preparation Phase and Reward Consensus: Prior to each reward cycle, there is a preparation phase determining two critical elements:

-

1) Anchor Block: There exists an anchor block during the reward cycle, to which miners must transfer their funds. This anchor block remains valid throughout the cycle.

-

2) Reward Set: The reward set is the collection of Bitcoin addresses eligible to receive funds during the cycle. This set is determined by the state of the Stacks chain at the anchor block.

-

Reward Address Selection Rules: Different rules apply depending on whether a miner’s blockchain tip is a descendant of the anchor block. If a miner’s tip is not a descendant of the anchor block, all committed funds must be destroyed. If it is a descendant, the miner must send committed funds to two addresses within the reward set.

-

5. Technical Architecture

-

L1 or L2?

Stacks is described as a smart contract layer built on top of Bitcoin.

The initial version (released in 2021) had a separate security budget from Bitcoin L1, positioning it as an intermediate layer (L1.5).

Future versions, starting with Nakamoto, aim to fully rely on Bitcoin’s hash power, making Stacks a true Layer-2 extension of Bitcoin—meaning transaction finality on Stacks will be secured by Bitcoin’s own consensus.

-

Sidechain?

While Stacks interoperate with Bitcoin to some extent, it does not meet the traditional definition of a sidechain. Stacks’ consensus runs on Bitcoin L1 and is tightly coupled with Bitcoin’s finality. Data and transactions on Stacks are automatically hashed and permanently stored on the Bitcoin blockchain. This differs from traditional sidechains, whose consensus operates independently and do not store data on Bitcoin L1. Therefore, Stacks does not qualify as a traditional sidechain.

-

Smart Contract Language — Clarity

Clarity is a decidable smart contract programming language specifically designed for the Stacks blockchain, featuring the following characteristics:

1) Security-First Design: Clarity prioritizes security and predictability, preventing common vulnerabilities and attacks found in Solidity contracts. It is explicitly designed to avoid typical pitfalls in smart contract development.

2) Interpreted Execution: Clarity code is interpreted, meaning it executes line-by-line when submitted to the chain—unlike languages such as Solidity, which require compilation into bytecode. This eliminates compiler-introduced bugs and preserves code readability, as the written code is exactly what gets executed—no compiled bytecode intermediaries.

3) Decidability: Clarity is a decidable language, meaning you can precisely determine what a program will do just by reading its code. This avoids issues like the “halting problem.” Clarity ensures programs never run out of gas mid-execution because it guarantees finite-step termination.

4) Recursion Prohibited: Clarity disallows recursive calls, a common source of contract vulnerabilities where one contract calls another, which then callbacks the original, potentially triggering multiple withdrawals.

5) Overflow and Underflow Protection: Clarity prevents integer overflow and underflow, common vulnerability types that could lead to unexpected contract behavior.

6) Built-in Support for Custom Tokens: Clarity natively supports creating custom fungible and non-fungible tokens—one of the most popular use cases for smart contracts. Developers don’t need to manage internal asset tracking, supply control, or event emissions, as these are built into the language.

7) Post-condition Transaction Safeguards: Clarity allows attaching post-conditions to transactions, ensuring the blockchain state changes as expected after execution. If post-condition checks fail, the transaction is reverted.

8) Mandatory Response Handling: Public function calls in Clarity contracts must return a response indicating success or failure, ensuring errors aren't silently ignored and improving overall contract safety.

9) Composition Over Inheritance: Clarity favors composition over inheritance, unlike Solidity. Developers define traits that different smart contracts can implement, offering greater flexibility.

10) Access to Bitcoin Base Chain: Clarity smart contracts can read the state of the Bitcoin base chain, enabling Bitcoin transactions to act as triggers within contracts. Clarity also provides built-in functions to verify secp256k1 signatures and recover keys.

-

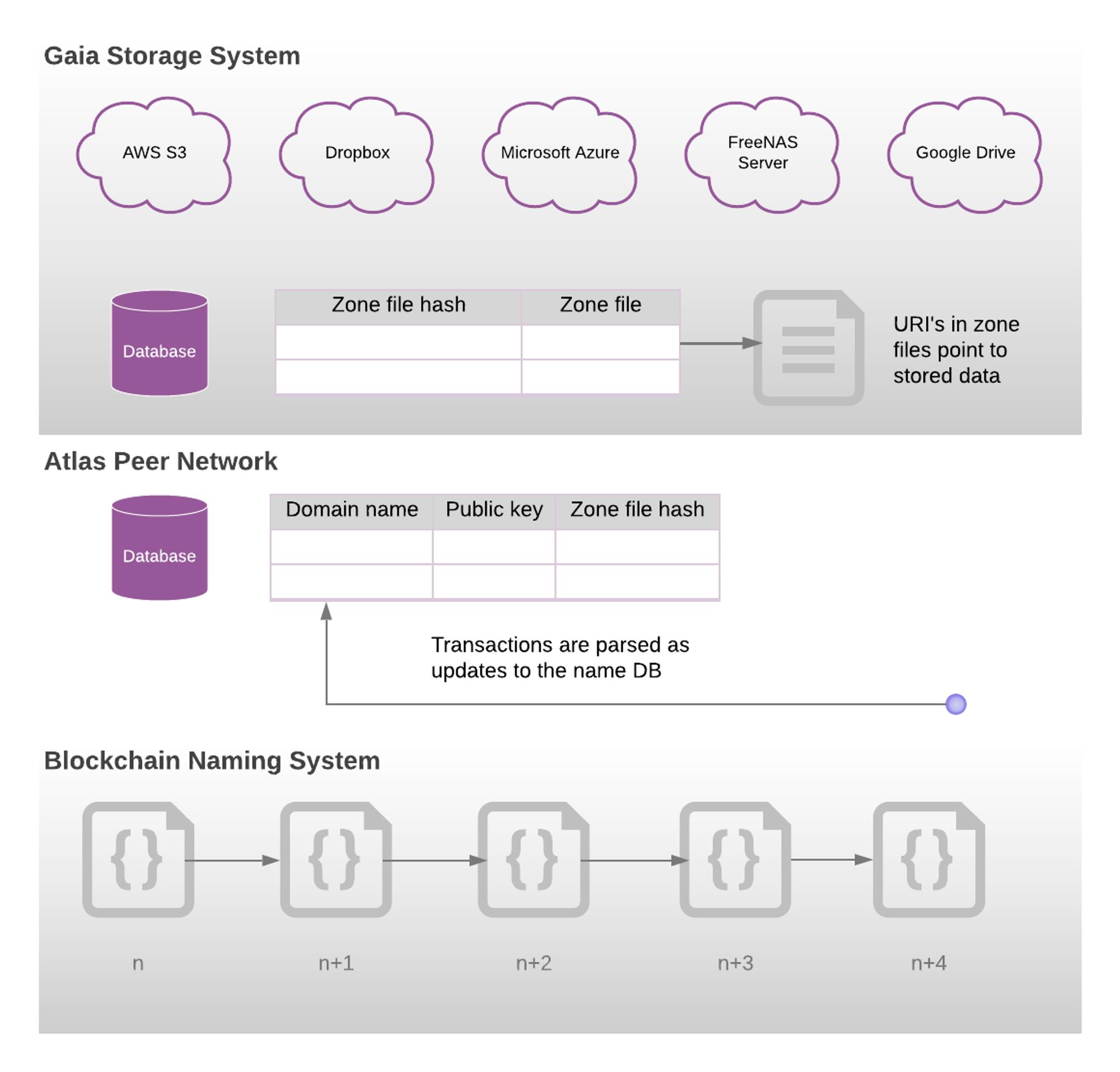

Gaia Storage System

Gaia is a unique decentralized storage system within the Stacks blockchain, emphasizing user ownership and control over data. Unlike immutable storage solutions such as IPFS and Arweave, Gaia emphasizes user control rather than immutability.

The Gaia storage system consists of Hub services hosted by cloud providers and associated storage resources. Storage providers can be any commercial service, such as Azure, DigitalOcean, Amazon EC2, etc. Gaia currently supports S3, Azure Blob Storage, Google Cloud Platform, and local disk, with a driver model enabling future backend integrations.

Gaia stores data as a simple key-value store. When an identity is created, its corresponding data storage is linked on Gaia. When a user logs into a decentralized app (dApp), the authentication process provides the dApp with the URL of the user’s Gaia hub, allowing the app to perform storage operations on behalf of the user. A "pointer" to this storage location is recorded on the Blockstack chain and Atlas subsystem. When users log into apps using the Blockstack authentication protocol, this pointer is passed to the app, which then interacts with the specified Gaia storage—ensuring cloud providers cannot see raw user data, only encrypted blocks.

The Stacks blockchain only stores identity data, while application-generated data is stored in the Gaia system. Each user has profile data, and when interacting with dApps, the app stores application-specific data in Gaia on the user’s behalf. Since Gaia stores user and app data off-chain, Stacks dApps typically achieve higher performance than those on other blockchains.

Image Source: Stacks Whitepaper

Key features of Gaia include:

1) User Ownership and Control: Gaia is designed with user ownership and control at its core. Users decide where their data is stored and can modify or delete it—unlike some immutable blockchain storage solutions.

2) Integration with Stacks Identity: Gaia links data access to a user’s identity on the Stacks blockchain, enabling better data management and access tied to digital identity.

3) High Performance and Availability: By storing application data off-chain, Gaia enables faster read/write operations unaffected by blockchain throughput limitations.

6. Major Upgrade

-

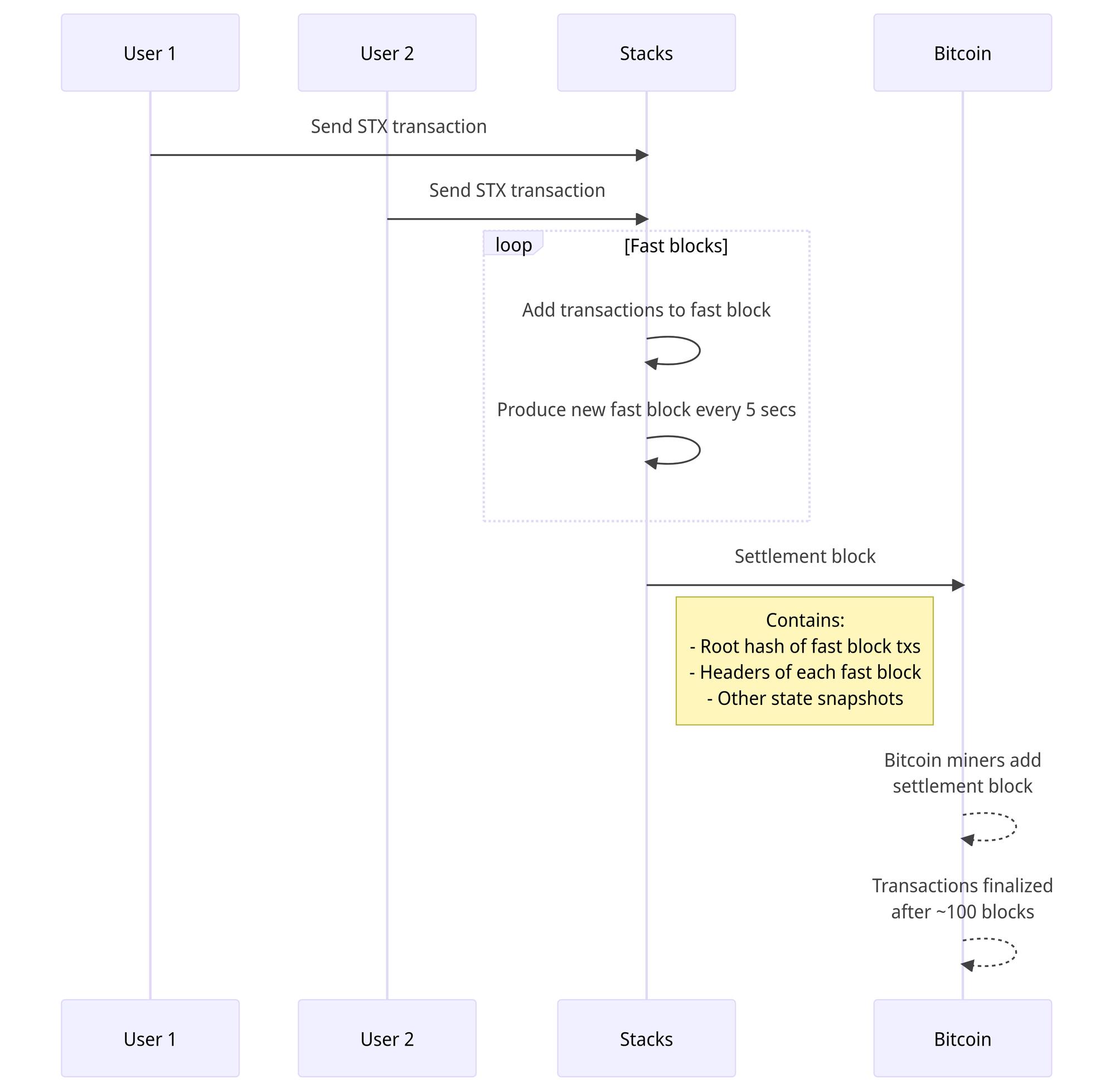

Stacks Nakamoto Upgrade

-

Upgrade Highlights

The Nakamoto upgrade introduces a suite of technological enhancements. Combined with the launch of sBTC—a 1:1 Bitcoin-backed asset—Stacks will soon enable fully decentralized writing to Bitcoin. sBTC enables trust-minimized movement of Bitcoin between L1 and L2. Unlike earlier sidechain models, the threshold wallet is managed by a permissionless, dynamic group of entities economically incentivized to maintain the peg, who can freely join or exit. This mechanism enables issuing an asset on Bitcoin that maintains a permanent 1:1 peg. Additionally, the Nakamoto upgrade drastically reduces execution time from minutes to seconds.

-

sBTC: Provides a trustless, decentralized two-way peg, bringing BTC liquidity into smart contracts.

-

Bitcoin Finality: Transactions on the Stacks blockchain are considered irreversible once confirmed under a PoX (Proof of Transfer) block.

-

Faster Blocks: The Stacks blockchain achieves faster block confirmation times, with a new block every 5 seconds.

-

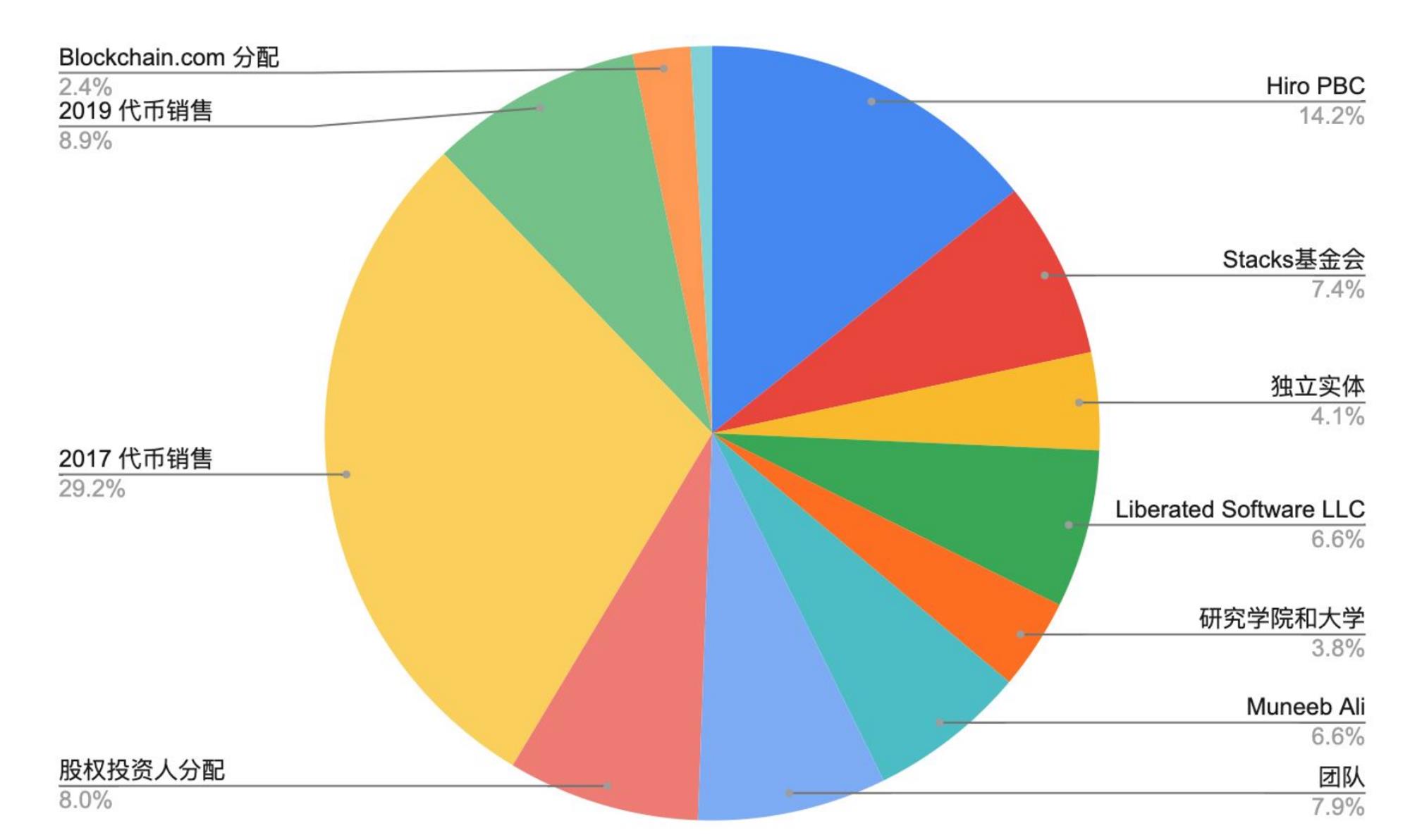

7. Tokenomics

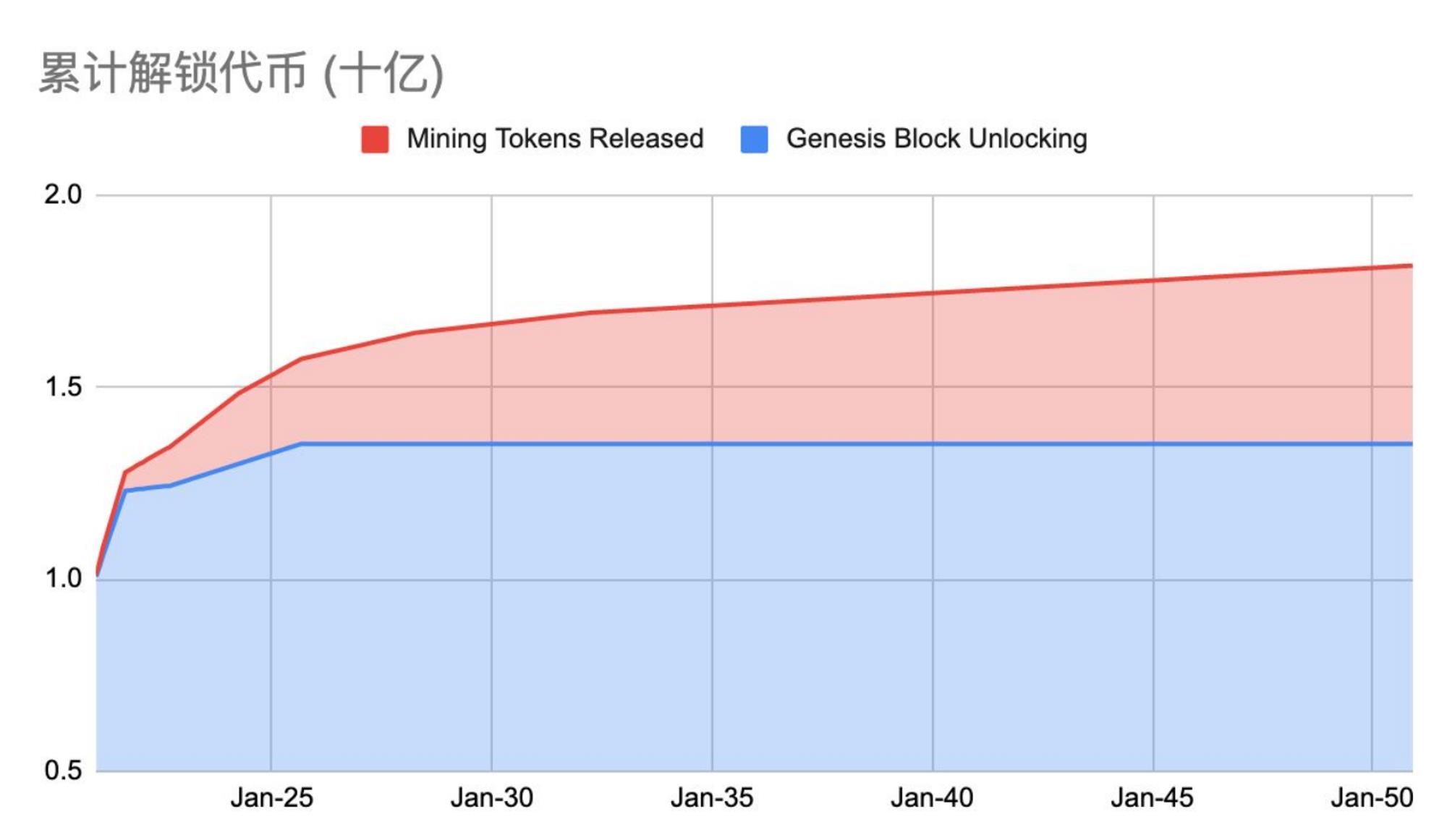

The total supply of STX tokens is capped at 1.818 billion, with a current circulating supply of approximately 1.42 billion.

The Stacks genesis block contained 1.32 billion STX tokens. These were distributed through multiple offerings in 2017 and 2019. The 2017 sale price was $0.12 per STX, rising to $0.25 in 2019, and $0.30 per STX for a SEC-compliant offering in 2019.

Mining rewards are distributed as follows: 1,000 STX per block for the first 4 years, 500 STX per block for the next 4 years, 250 STX per block for the following 4 years, and 125 STX per block indefinitely thereafter. STX allocated to founders and employees follows a 3-year vesting schedule.

In October 2020, Stacks changed its STX minting and burning mechanism. Instead of minting and burning STX, it reduced the issuance rate. The total supply will reach approximately 1.818 billion by 2050.

8. Ecosystem Overview

TVL Trends

Wallet Growth Trend

Smart Contract Deployment Trend

Ecosystem Map

Wallets

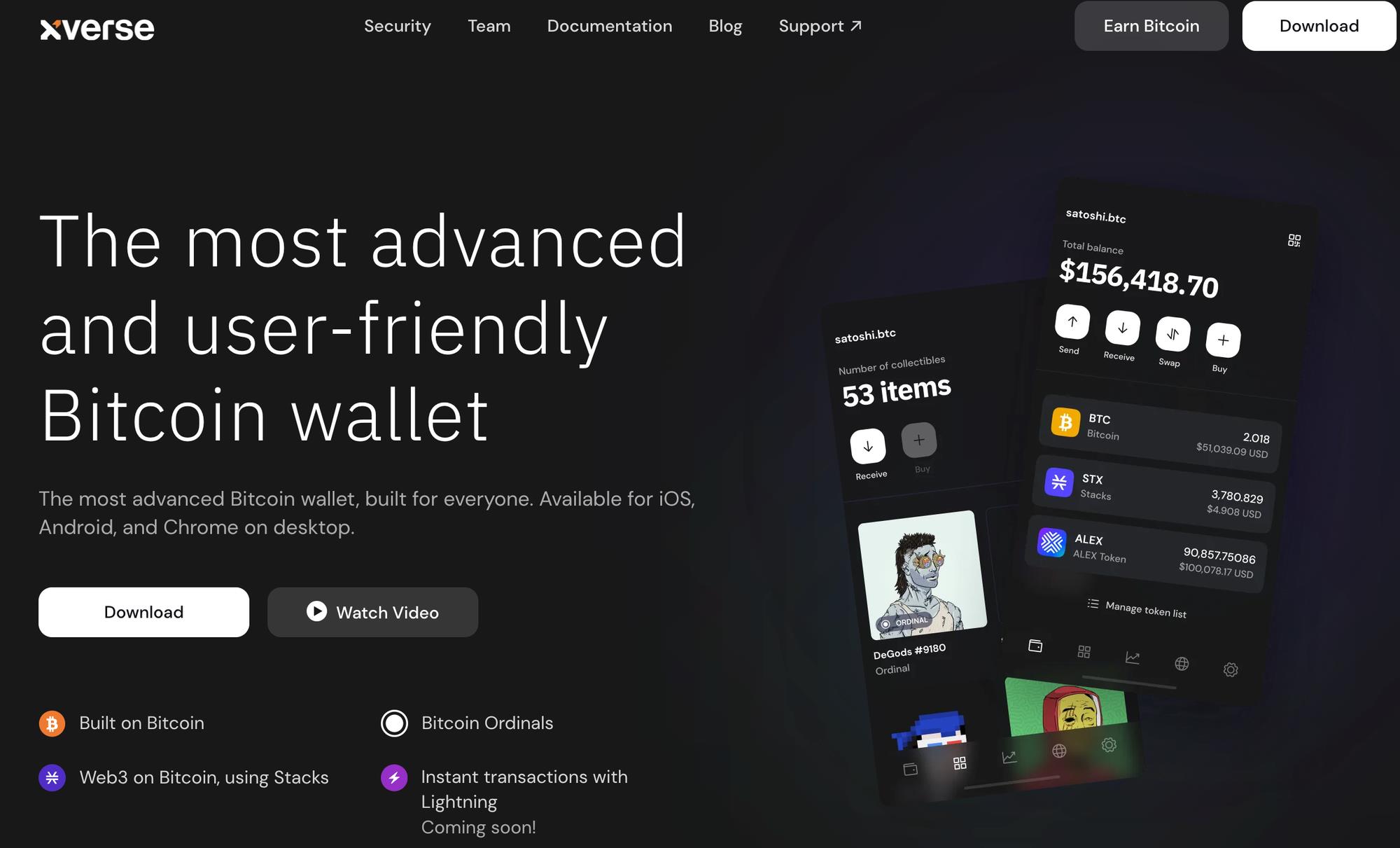

Xverse

Xverse is a cryptocurrency wallet built on Stacks that supports the Ordinals protocol. Users can manage both Bitcoin assets (including BTC and Bitcoin NFTs) and Stacks-based assets within the same wallet. It also includes built-in stacking functionality, allowing users to earn Bitcoin rewards by staking STX.

The wallet features a clean UI and a setup process similar to many EVM-compatible wallets, using mnemonic phrases for backup and recovery—lowering the barrier for users familiar with MetaMask. Upon creation, two addresses are generated: a Bitcoin address for BTC and Bitcoin NFT transactions, and a Stacks network address for managing Stacks-based assets.

Leather

Leather was formerly known as Hiro Wallet. Hiro is a developer tools company supporting developers on the Stacks blockchain. Leather is a Bitcoin-based wallet application that now supports Ordinals and will soon support the Lightning Network. Leather includes convenient built-in features, allowing users to directly purchase STX with credit/debit cards or bank transfers and stake them within the wallet.

Currently available as browser extensions for Chrome, Firefox, and Brave, as well as desktop apps for macOS, Windows, and Linux.

Browser extensions support connecting to dApps, buying STX, minting and purchasing NFTs, and using Ledger hardware wallets. Desktop versions support staking to earn Bitcoin and securing assets with Ledger.

DeFi

ALEX

ALEX is a DeFi protocol built on Bitcoin via Stacks smart contracts, drawing design inspiration from Balancer V2. Its mainnet currently supports Swap, lending, staking, yield farming, and Launchpad. Amid the BRC20 boom, ALEX has also launched a BRC20 orderbook exchange.

Arkadiko

Arkadiko is an open-source, non-custodial liquidity protocol built on Stacks smart contracts. Users can collateralize assets to mint the stablecoin USDA, earn deposit interest, and borrow assets on Stacks. Arkadiko’s governance token is DIKO, which can be obtained by providing liquidity to pools.

LNSwap

LNSwap is an atomic swap protocol that embodies Bitcoin’s foundational principles—security, decentralization, and stability.

LNSwap consists of three parties: users, liquidity providers, and aggregators.

Users are individuals who want to swap assets. Their funds are locked only temporarily in a basic Hash Time-Locked Contract (HTLC), enabling direct peer-to-peer trades via smart contracts without third-party custody.

Liquidity providers contribute their assets to the LNSwap protocol to facilitate swaps. In return, they earn a share of the trading fees generated on the platform.

Aggregators collect and consolidate swap data from across the protocol for easier access. Currently, LNSwap’s aggregator acts as a router forwarding swap requests between users and liquidity providers. In the future, it will become an on-chain contract, allowing anyone with a frontend to operate as an aggregator. Liquidity providers will also be able to register with multiple aggregators.

NFT

Gamma

Gamma, formerly known as STXNFT, rebranded on April 27, 2022. Gamma is the third letter of the Greek alphabet, symbolizing the third phase of the internet: Web 1.0, Web 2.0, and now Web3.

The platform aims to bring collectors, creators, and investors together within the Bitcoin ecosystem to explore, trade, and showcase NFTs. Gamma comprises three core products: an NFT marketplace, a Launchpad, and a social platform. Gamma.io supports both primary and secondary markets for Bitcoin NFTs.

Users can mint unique digital works via the Gamma bot. With a no-code Bitcoin NFT creation tool, users can create NFTs within minutes. Gamma.io solves the pain point of high technical complexity and time consumption when creating NFTs on Bitcoin. However, secondary market sales still dominate platform volume. Each sale includes artist royalties and marketplace fees, varying by artist and collection.

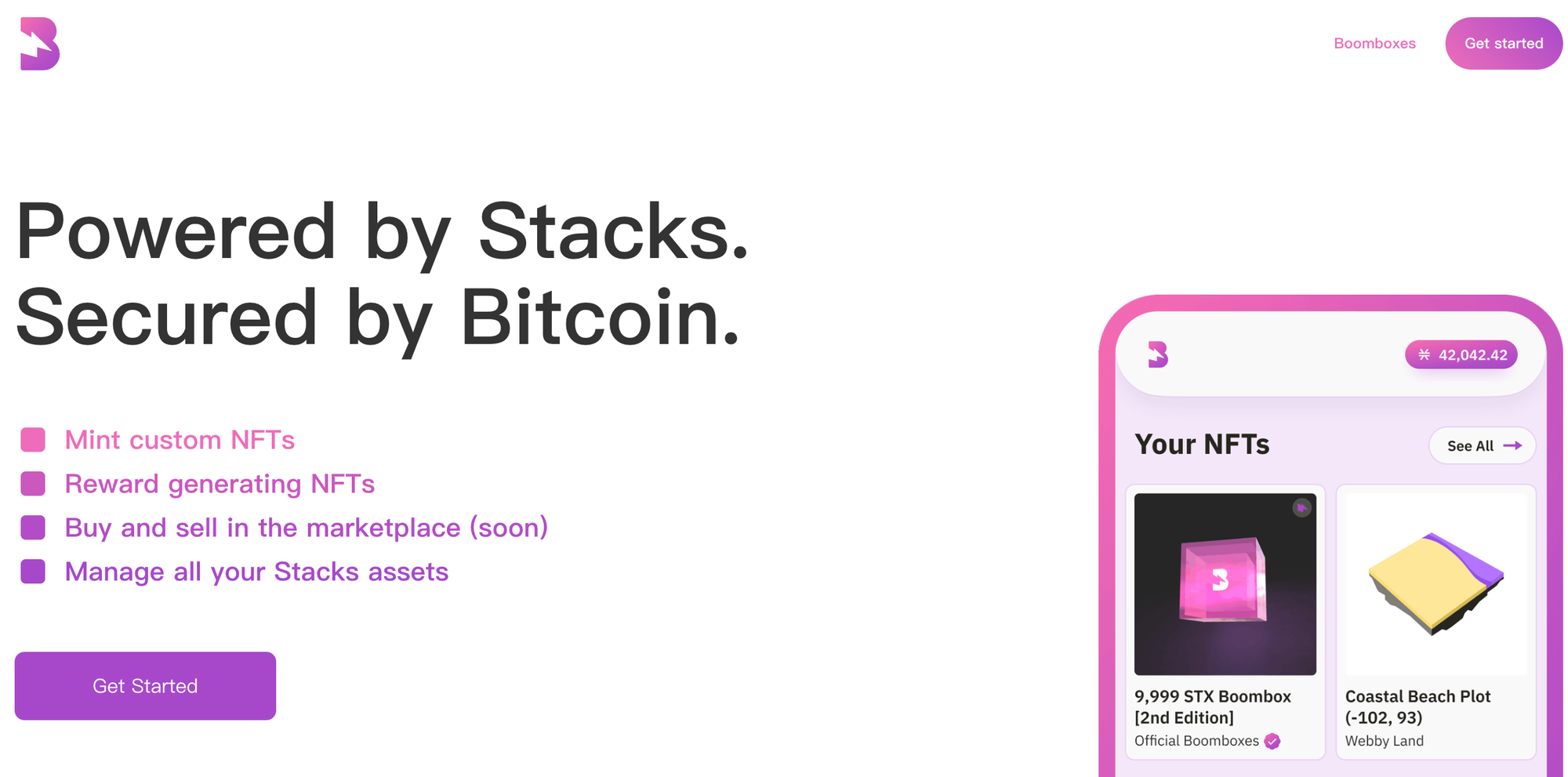

Boom

Boom is a native NFT platform on Stacks, supporting transfers of Stacks-based tokens, with plans to support Stacks NFT trading in the future.

9. Competitors

Unlike the Lightning Network, which focuses on improving Bitcoin’s scalability, Stacks focuses on introducing new smart contract capabilities. Unlike RSK, which relies on Bitcoin miners, Stacks has its own miners and mining process. Unlike Liquid, which is focused on financial applications, Stacks is an open, decentralized network. Unlike Rollups, Stacks is a solution built directly on Bitcoin, not a separate network outside of it.

Why has the Bitcoin ecosystem suddenly gained attention this year?

This brings us to two major technical upgrades:

First, the 2017 Segregated Witness (SegWit) upgrade effectively expanded Bitcoin’s block size from 1MB to 4MB—though this extra space could only store signature data. It wasn’t until the Taproot upgrade at the end of 2021 that advanced scripts could be written into the SegWit space, allowing complex data to be inscribed on Bitcoin. This marked a massive leap in Bitcoin’s programmability and scalability, enabling protocols with complex logic and marking a new milestone for the Bitcoin ecosystem—the key catalyst behind the 2023 BTC ecosystem boom.

Ordinals & BRC20

The Ordinals protocol ignited the Bitcoin ecosystem, and its rapid growth has mutually reinforced the adoption of Taproot. Users can encode NFT data and write it into the

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News