M6 Labs Market Watch: Is the Biggest Bull Market in History About to Begin?

TechFlow Selected TechFlow Selected

M6 Labs Market Watch: Is the Biggest Bull Market in History About to Begin?

Spot trading is not the only cryptocurrency trading method that has recently achieved success.

Written by: Kadeem Clarke

Compiled by: TechFlow

Crypto is waking up again, and the largest bull market in history seems to be on the horizon. In this comprehensive analysis, we will dive deep into the key developments, market trends, and promising opportunities currently shaping this major event.

-

After a long and challenging period, the crypto space appears to be regaining vitality. With ETF expectations, we may see prices rise to $40,000 or higher.

-

During the recent market rally, NFTs have experienced a noticeable increase in trading activity and price appreciation. However, they still clearly lag behind overall market performance.

-

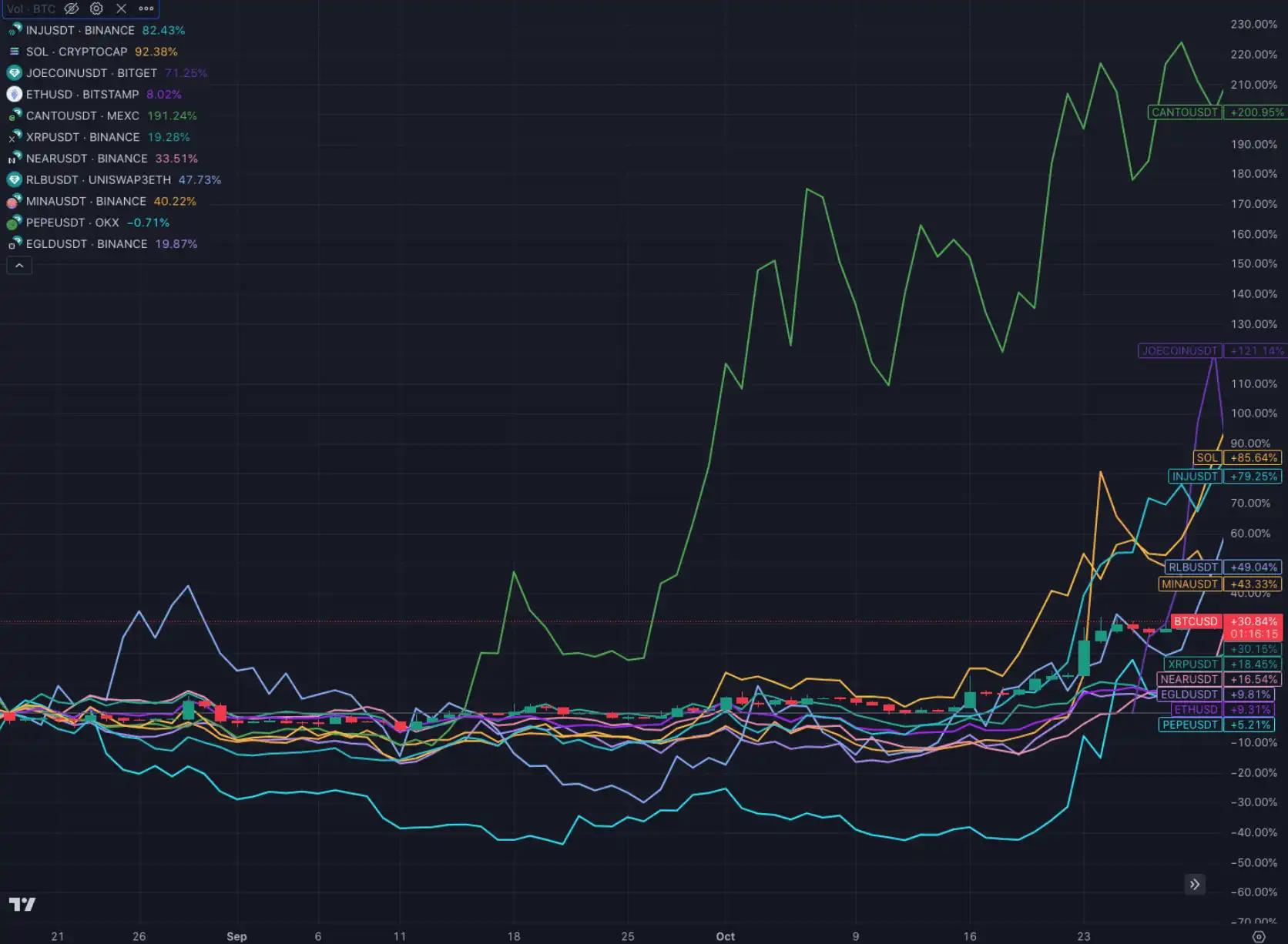

The cryptocurrency market is currently experiencing significant growth, with major projects such as Solana, Injective, and Rollbit surging by 76%, 75%, and 65% respectively. This indicates that capital is flowing into projects perceived as high-risk but with high-return potential.

-

Spot trading is not the only method of crypto trading recently achieving success. Derivatives, particularly Bitcoin options, are also heating up. The total open interest in Bitcoin options across exchanges has reached a record high of $15.37 billion.

-

Stablecoins have stopped declining and have not hit new lows for over three months, suggesting a possible reversal in market sentiment.

-

The DeFi market has rebounded significantly, reaching its highest level in three months with a total value locked (TVL) of $42 billion. This recovery follows the low point in February 2021 when TVL stood at just $35.8 billion.

This Week's Narrative: How Will This Year End?

In financial markets, money is probability—the key lies in stacking these probabilities together with effective risk management. From this perspective, let’s examine the probabilities for the near future. First, let’s focus on the center of attention: spot Bitcoin ETFs, which have recently made significant progress.

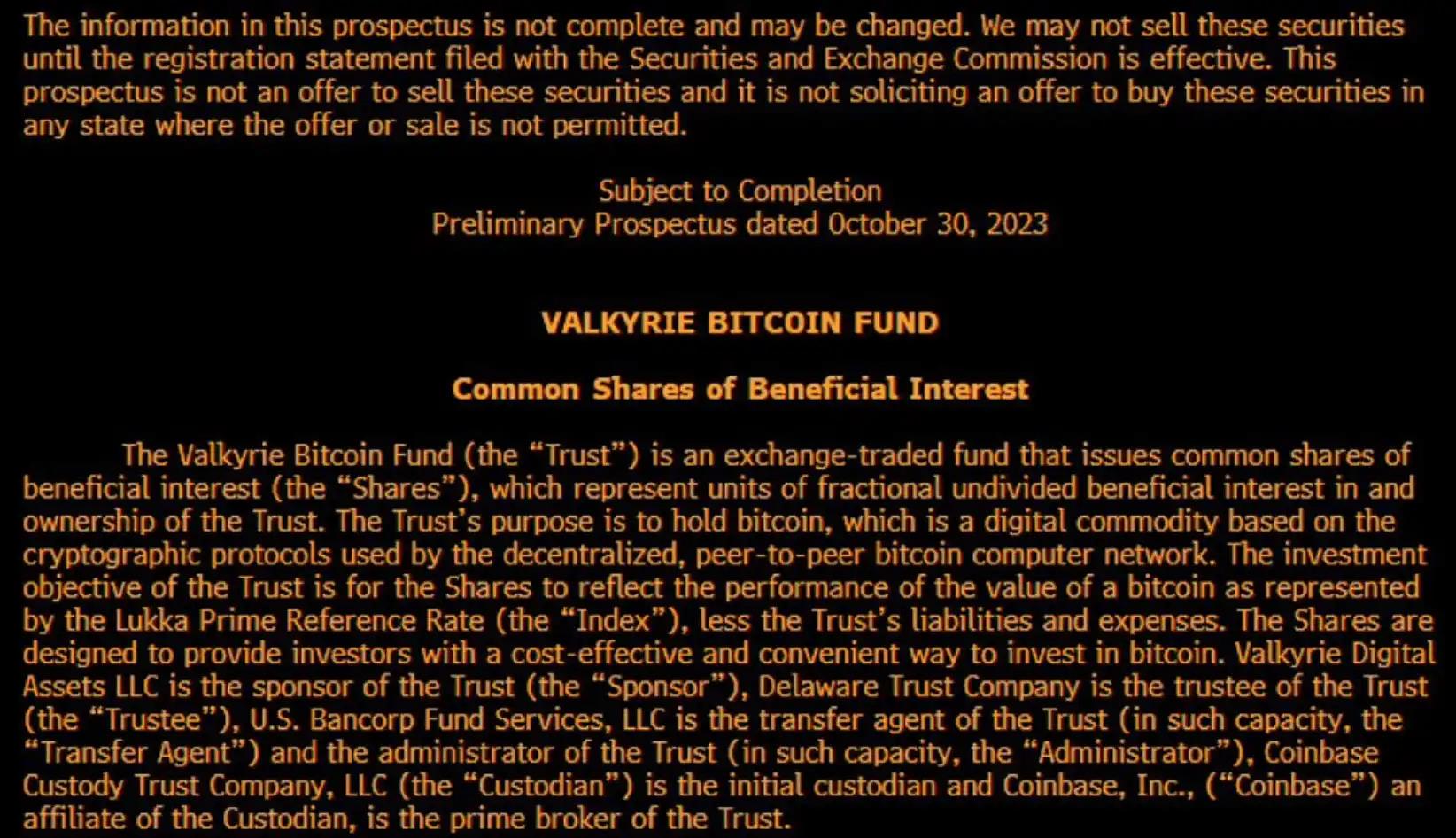

In addition to Blackrock, Ark, and Van Eck, Valkyrie has recently updated their spot Bitcoin ETF filing.

Bernstein Research, the research division of AllianceBernstein, believes the probability is very high that the SEC will approve the first spot Bitcoin ETF by January 10, as the SEC has been actively engaged and responsive to amendments and comments regarding ETF applications.

This anticipation for approval has been partly influenced by the SEC’s decision not to appeal the ruling against Grayscale, which mandates a re-evaluation of its application to convert its Bitcoin Trust (GBTC) into a spot Bitcoin ETF.

SEC Chair Gary Gensler revealed that the SEC is reviewing 8 to 10 spot ETF applications, while public records show 12 pending applications, including well-known firms such as Cathie Wood’s ARK Investment Management, Blackrock, Bitwise, WisdomTree, Fidelity, VanEck, and Invesco.

The ETF is coming—this long-anticipated event is finally arriving. How investors react to the news post-announcement remains to be seen. Will it trigger a "sell-the-news" event, or propel prices to new all-time highs? Most likely, investors will build positions ahead of the event, pushing Bitcoin to recent historical highs.

Moreover, charts suggest significant changes are underway. Bitcoin’s market dominance has risen to 54%, indicating a preference for Bitcoin over other altcoins ahead of the ETF approval. Interestingly, the current rise in Bitcoin’s market share resembles the increases observed in 2018 and 2019, which paved the way for the 2021 bull run.

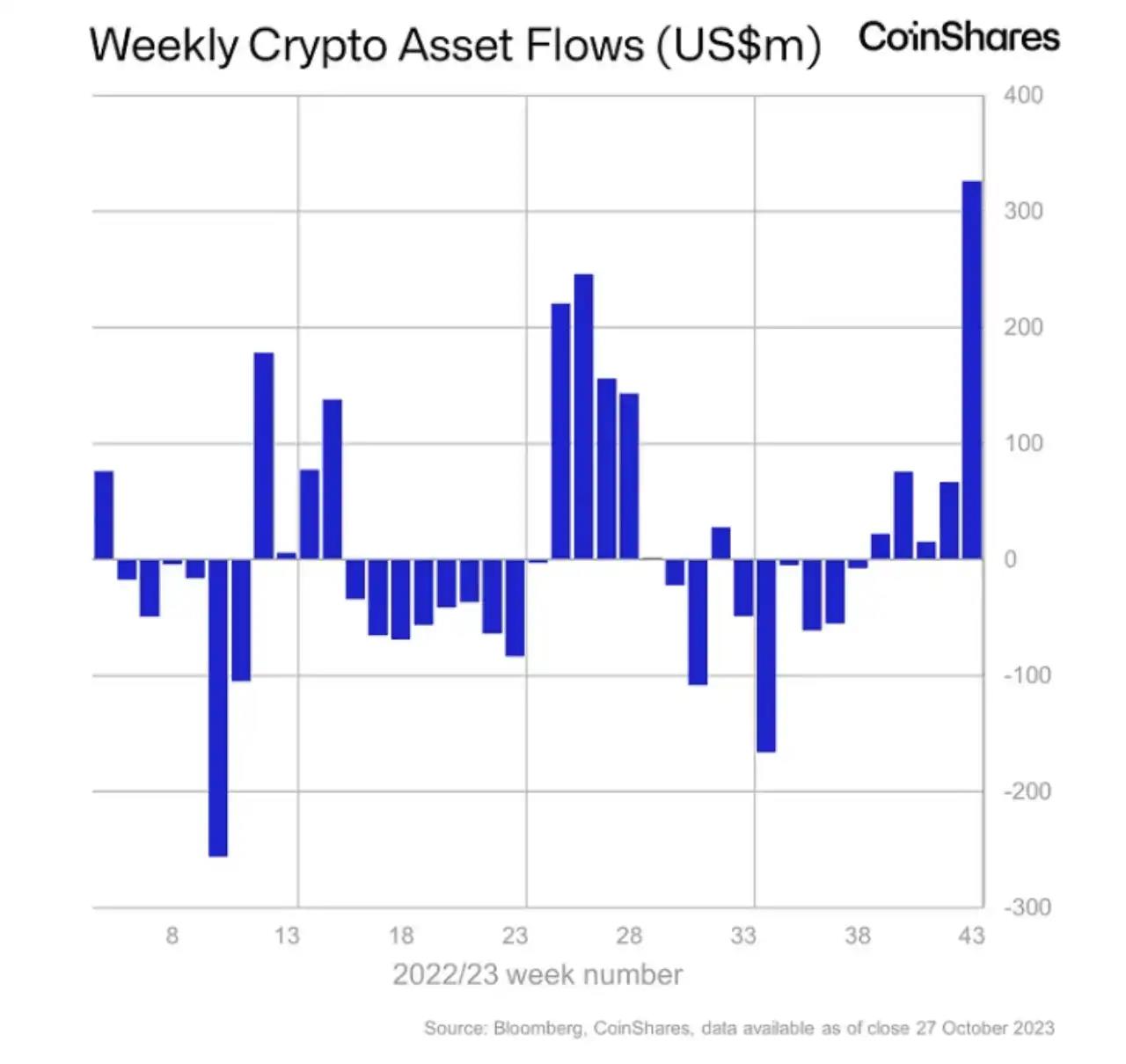

Capital inflows: Investment products related to digital assets have recorded massive inflows totaling $326 million—the largest weekly inflow since July 2022. Bitcoin led this surge, capturing the vast majority with $296 million, while the recent rise in Bitcoin’s value also attracted an additional $15 million into short-Bitcoin investment products.

Growing optimism in the market further catalyzed large-scale investments into Solana, cumulatively attracting $24 million in inflows. However, this optimism did not extend to Ethereum, which saw $6 million in outflows, bucking the broader market trend.

From monitoring fund flows, capital appears to be returning to the crypto space. The primary focus has remained on Bitcoin, while surprisingly, Ethereum has underperformed. However, this trend could reverse following the ETF announcement. Typically, capital flows from Bitcoin to Ethereum and then to altcoins after Bitcoin establishes dominance and reaches relative or absolute highs.

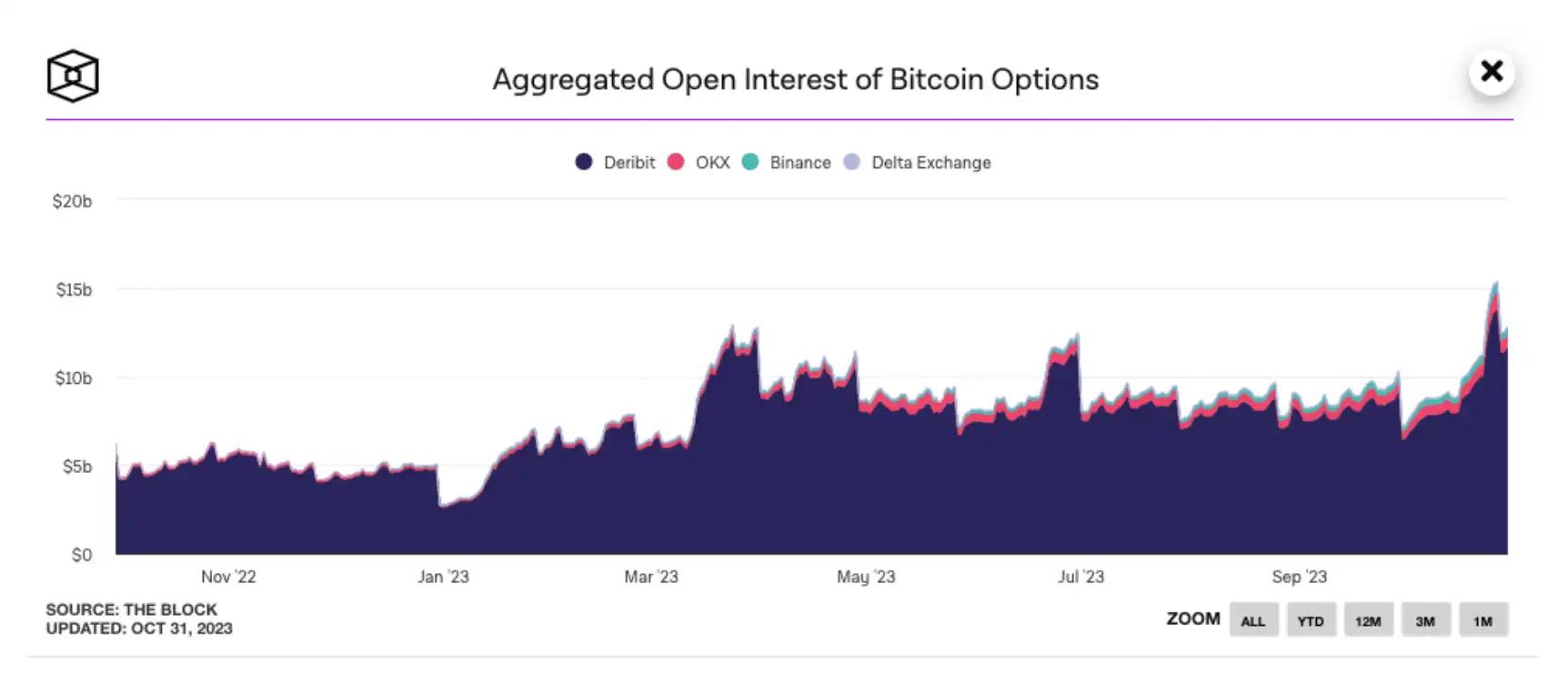

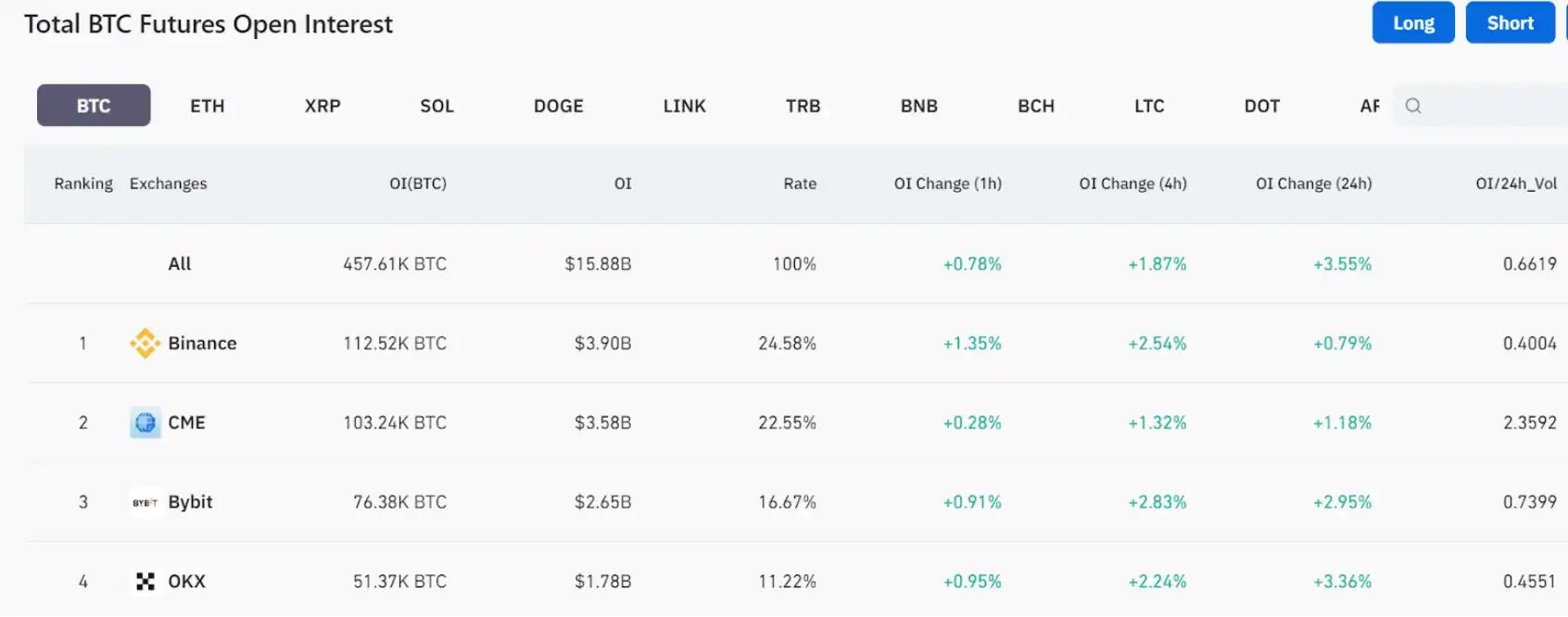

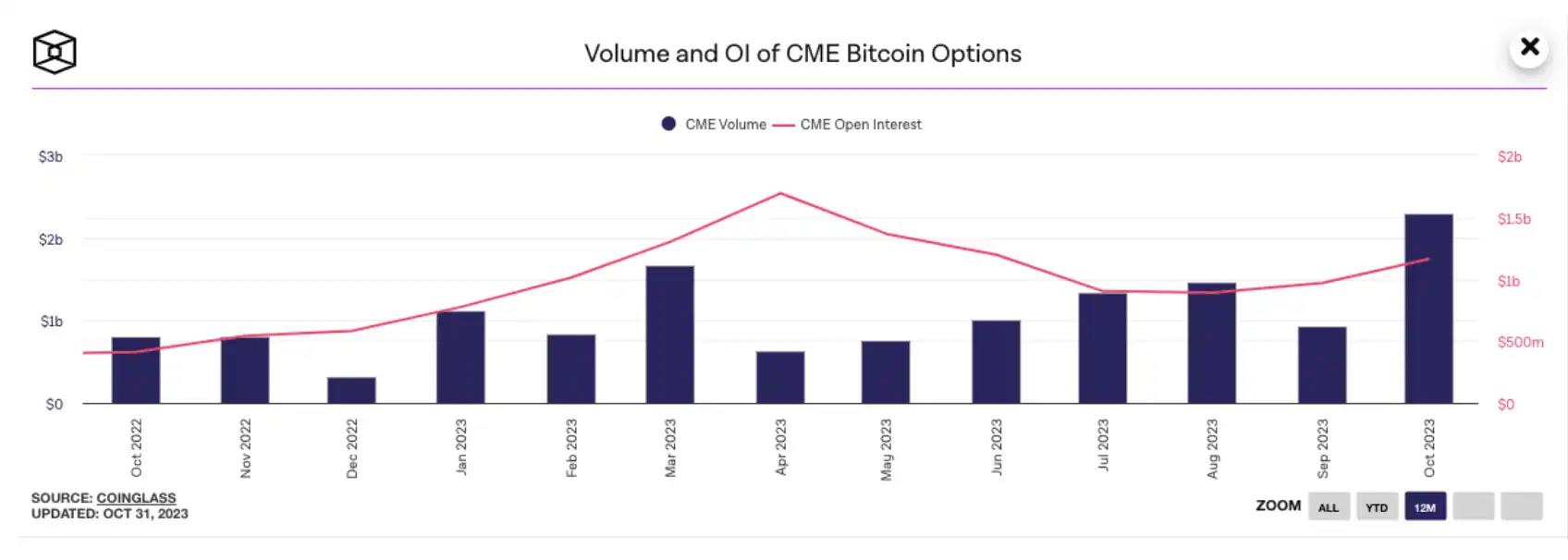

Derivatives and Open Interest: Spot trading is not the only form of crypto trading recently achieving success. Derivatives, especially Bitcoin options, are also surging. Total open interest in Bitcoin options across exchanges has reached a record $15.37 billion. OKX alone saw its open interest surge past $1 billion. A similar trend emerged on Deribit. Mirroring the growth in spot trading volume, the spike in Bitcoin options activity likely stems from increased market participation. Monthly Bitcoin options trading volume across exchanges is also nearing all-time highs.

Furthermore, the Chicago Mercantile Exchange (CME) has rapidly risen to become the second-largest Bitcoin futures exchange by open interest, reaching $3.54 billion. This significant rise highlights the growing influence of traditional financial institutions in the crypto space and underscores CME’s important role in the crypto derivatives market. The growth in CME’s open interest, particularly in cash-settled futures contracts, reflects strong institutional interest in Bitcoin futures, coinciding with a 27% rise in Bitcoin’s price this month.

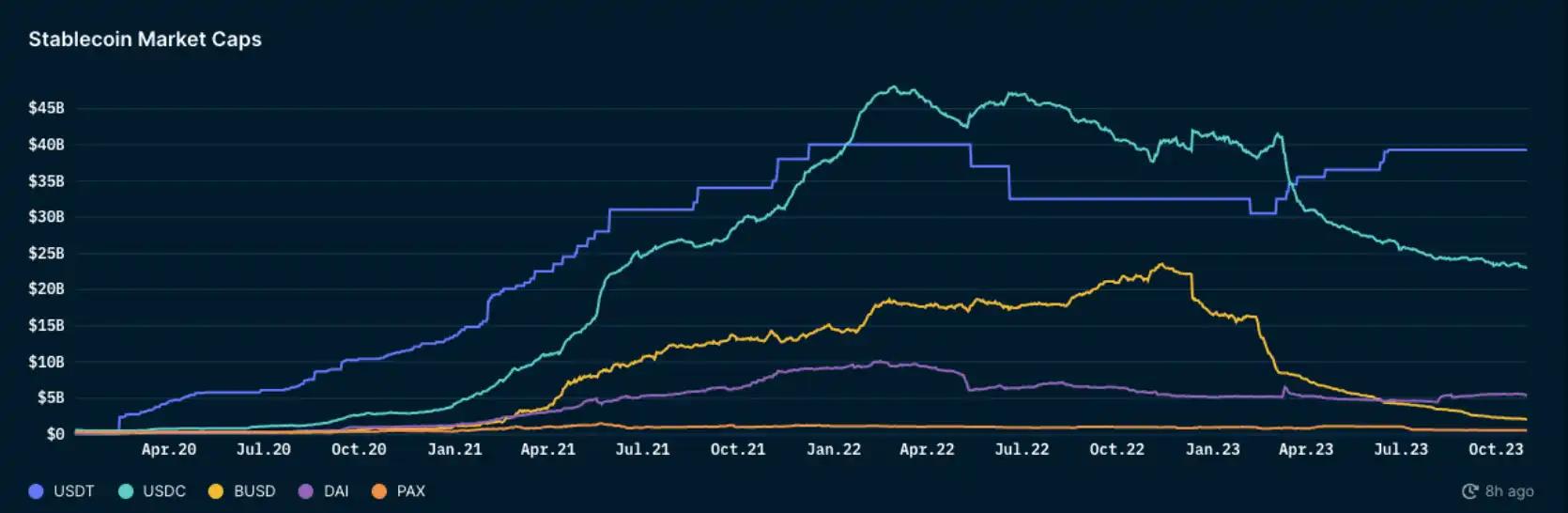

Stablecoins: One encouraging sign is that stablecoins have stopped declining and have not hit new lows for over three months, suggesting a possible reversal in market sentiment.

Where Is DeFi?

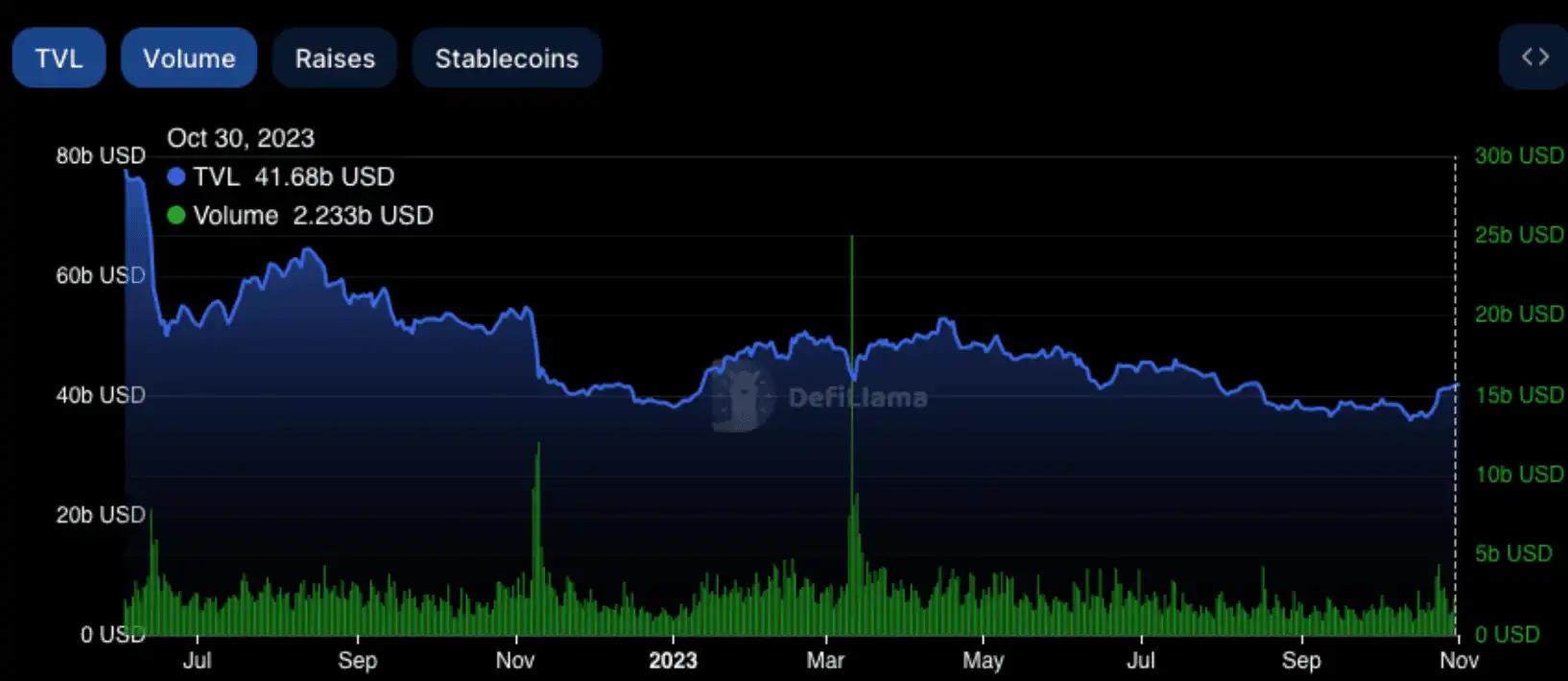

The DeFi market has rebounded substantially, reaching its highest level in three months with a total value locked (TVL) of $42 billion. This recovery comes after the low point in February 2021 when TVL was only $35.8 billion.

-

The recovery of the DeFi market can be attributed to two key factors. First, rising asset prices—including a notable increase in Ethereum’s price. Over the past two weeks, Ethereum rose from $1,590 to approximately $1,873, contributing to the market’s rebound. As previously mentioned, new capital inflows seeking yield through staking and lending have also played a role in the recovery.

-

Trading volume within DeFi protocols has reached its highest level since March, hitting $4.4 billion in October.

-

Solana’s prominent lending protocol Marinade experienced significant TVL growth this month, rising 120%. This growth is attributed to Marinade launching a native staking product offering competitive returns. During the same period, rival protocol Jito also saw a substantial 190% increase, reaching a TVL of $168 million.

-

On the Ethereum network, capital inflows into platforms such as Enzyme Finance, Spark, and Stader grew by 37% to 55%. These inflows exceeded asset price gains, indicating increased participation in DeFi activities.

In summary, the DeFi market’s recovery is driven by a combination of rising asset prices, increased trading volume, and new capital inflows, with notable growth observed across various blockchain protocols.

Summary: Life appears to be returning to the crypto space after a long and challenging period. We are likely to see prices rise above $40,000, with expected ETF approvals supporting this trend. Additionally, the Bitcoin halving, though its impact is gradually diminishing, remains the next major event on many people’s radar. Time will ultimately reveal how the market reacts in the medium to long term, but conditions appear highly favorable in the short term.

Project Spotlight: Marinade Finance

Solana has undoubtedly stood out during the recent crypto rally. Therefore, let’s explore the options available to SOL holders looking to stake their tokens for attractive returns. Previously, Lido was a popular choice among users. However, with the end of Solana staking on Lido, users now have the opportunity to leverage protocols like Marinade Finance. It should be noted that due to regulatory concerns, Marinade has restricted access for UK users.

Marinade Finance continued steadfastly developing throughout the bear market, introducing notable upgrades and features such as liquid staking. As the Solana ecosystem continues to expand and solidify its crucial position in the upcoming bull market, understanding protocols like Marinade could lead to profitable opportunities.

mSOL: Liquid Staking Token

-

Staking: Marinade enables users to stake SOL tokens and receive “marinated SOL” (mSOL) in return, representing their share of staked SOL and providing access to the broader DeFi ecosystem.

-

Multi-functional utility: mSOL serves as a liquid staking token granting users flexibility when interacting with the Marinade protocol. It confirms ownership of staked SOL, allows conversion back to staked SOL at any time, and enables claiming accumulated rewards. Crucially, these tokens remain fully fungible within the DeFi space while appreciating in value as SOL staking rewards accrue.

-

Value appreciation: The value of mSOL steadily increases each cycle due to SOL staking rewards within the protocol. Holding mSOL for a year can deliver remarkable value appreciation, offering an appealing avenue for passive income.

Benefits of Staking SOL with Marinade

-

The protocol operates as a non-custodial solution, ensuring users retain full control over their assets and associated accounts.

-

The protocol allows users to freely stake and delay unstake without additional fees.

-

Marinade’s governance framework prioritizes active community participation and contribution.

DeFi, L1s, and L2s

News

-

VanEck predicts Solana will rise to $3,000

-

ProShares launches first short ETH futures ETF

-

Unibot exploited

-

Taho Wallet opens beta waitlist

-

Avalaunch terminates partnership with Starsarena

-

Fuse launches Solana’s first smart wallet

-

Solana partners with Amazon Web Services

-

Arkham introduces chat rooms

-

Andreessen Horowitz plans to raise $3.4 billion for its next early-stage fund

-

Neo plans to launch an Ethereum-compatible sidechain for N3 mainnet interoperability

-

Solana expands incubator to drive growth and attract founders from competing chains

-

Shuffle conducts airdrop

-

Renzo announces mechanism enabling everyone to restake via Eigenlayer

-

Layer N launches Nord, Layer N’s first exchange-focused rollup, with testnet coming soon

-

Floki ventures into the trillion-dollar RWA market, launching TokenFi to position itself as a serious DeFi player

-

Starknet to distribute 50 million tokens

-

Goldman Sachs views Ethereum’s Dencun upgrade, expected in Q1 2024, as a critical step toward transforming the blockchain into a scalable settlement layer

-

Polygon’s POL token upgrade now live on Ethereum mainnet

-

Astrid Finance exploited; will refund users

-

Snowtrace to cease operations due to Ethereum scan fees

-

UK Treasury releases final proposal for crypto asset regulation

-

Stars Arena CEO resigns

-

Blockchain startup Etherfuse launches tokenized bonds in Mexico for retail investors

-

BNB launches BNB Safe wallet

-

Stelo Labs to shut down

-

Timeless launches V2

-

Nym to launch NymVPN

-

Argent to prioritize Starknet, discontinue zkSync Era.

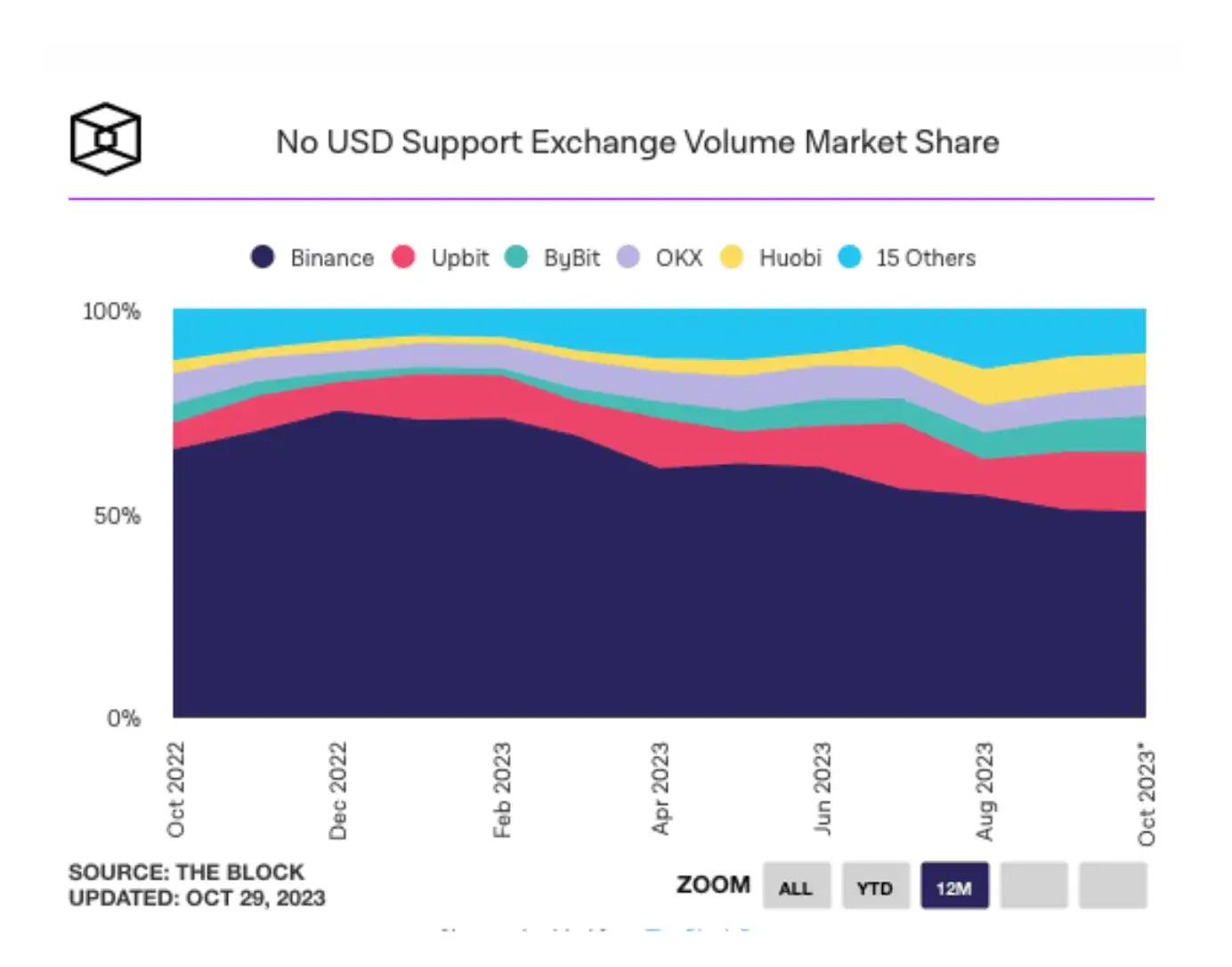

Despite the recent crypto rally, Binance’s market share has sharply declined, falling from 74% in December 2022 to 50% this month. Multiple factors, including executive departures, regulatory challenges, and legal allegations, have contributed to Binance’s shrinking market share.

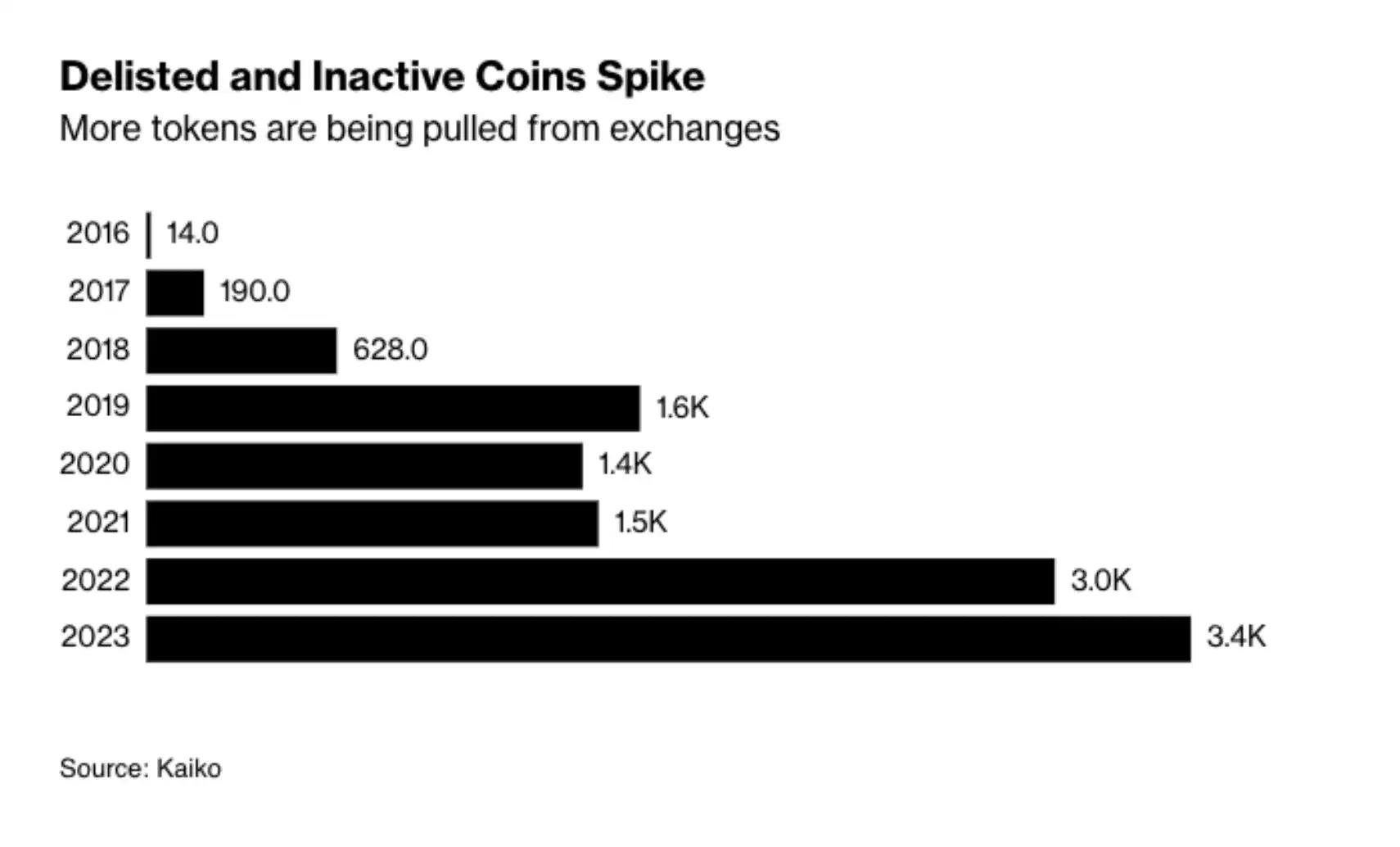

Delistings on crypto exchanges are rising: Over 3,400 tokens have already been delisted this year, setting a record pace. Major exchanges like Coinbase and Binance have been actively removing tokens, with Coinbase delisting 80 trading pairs in October—the most since at least 2021.

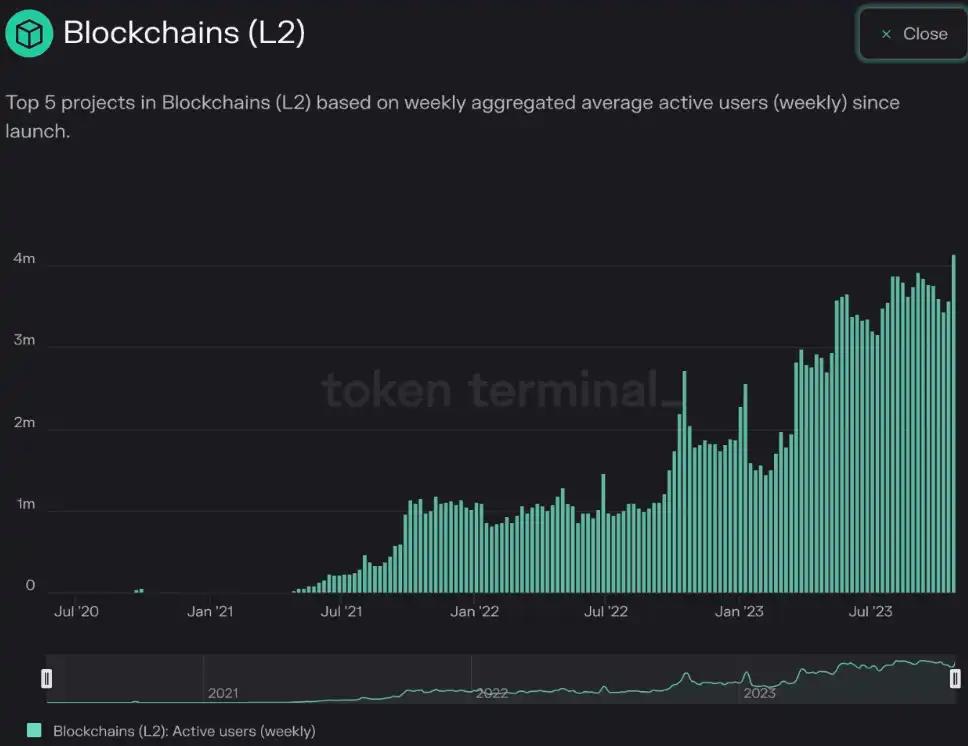

Increased activity: On Layer 2 networks (L2s), weekly active wallets continue to set new all-time highs. This suggests that most protocols are migrating or deploying their products onto L2s, and user activity is increasing.

Blue-Chip Overview

The cryptocurrency market is currently experiencing significant growth, with major projects like Solana, Injective, and Rollbit surging 76%, 75%, and 65% respectively. This indicates that capital is flowing into projects perceived as high-risk but with high-return potential.

Additionally, other tokens such as CANTO, MINA, and NEAR continue to perform strongly, while gains in tokens like RLB, PEPE, and MANA indicate investor willingness to take on more risk in pursuit of higher returns.

Moreover, multi-chain RWA project Hashnote saw its total value locked (TVL) grow by 373.51%, suggesting that new bull cycles may bring forth emerging major and blue-chip protocols that could fiercely compete with established giants like Maker, Compound, and Aave.

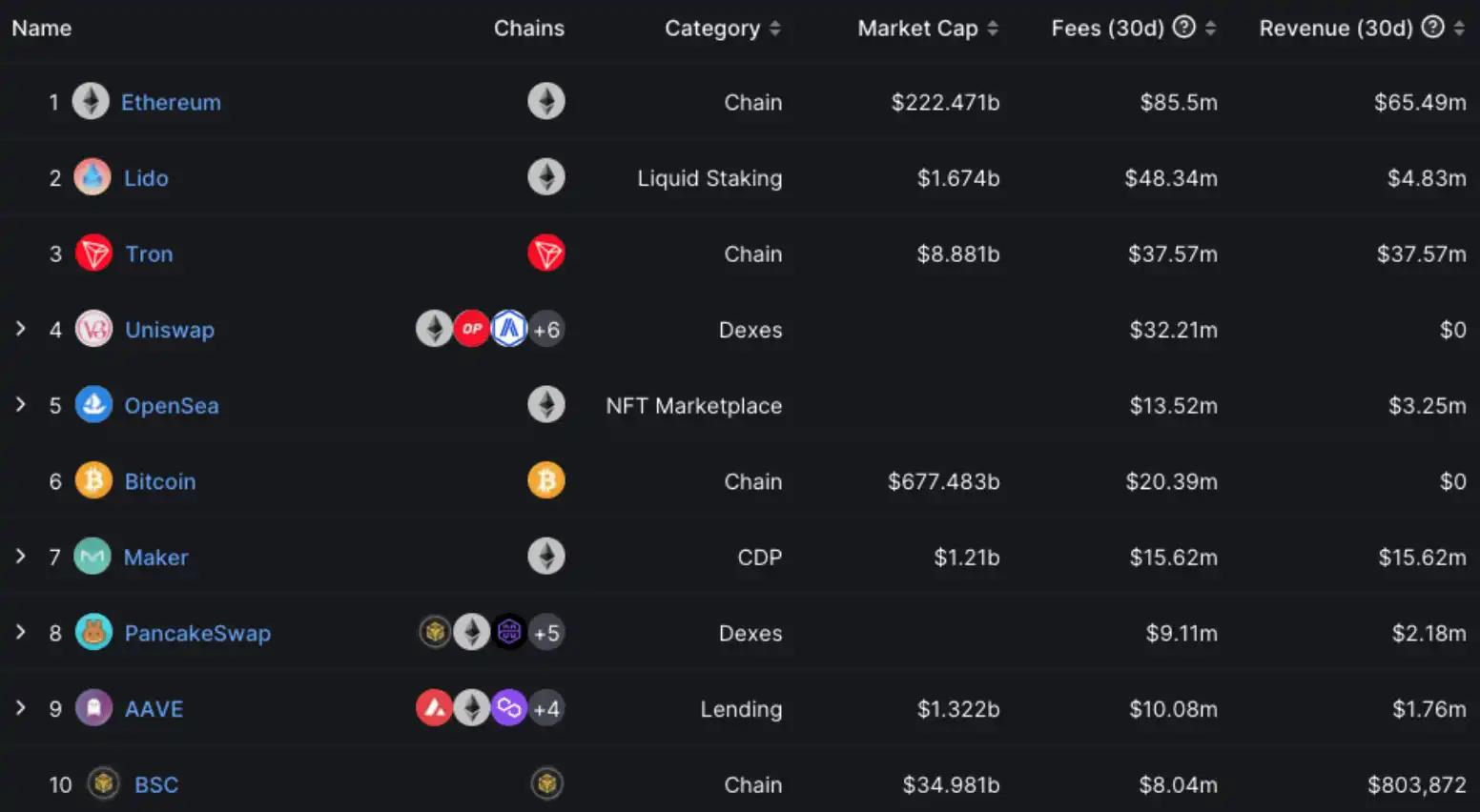

Revisiting protocol revenue: A key indicator of protocol vitality lies in the fees it generates, especially if this aligns with its intended revenue model. As expected, Ethereum leads, but Tron and OpenSea stand out in this context.

ETH/BTC: Ethereum continues to weaken against Bitcoin. A broad altcoin season is unlikely until this trend reverses.

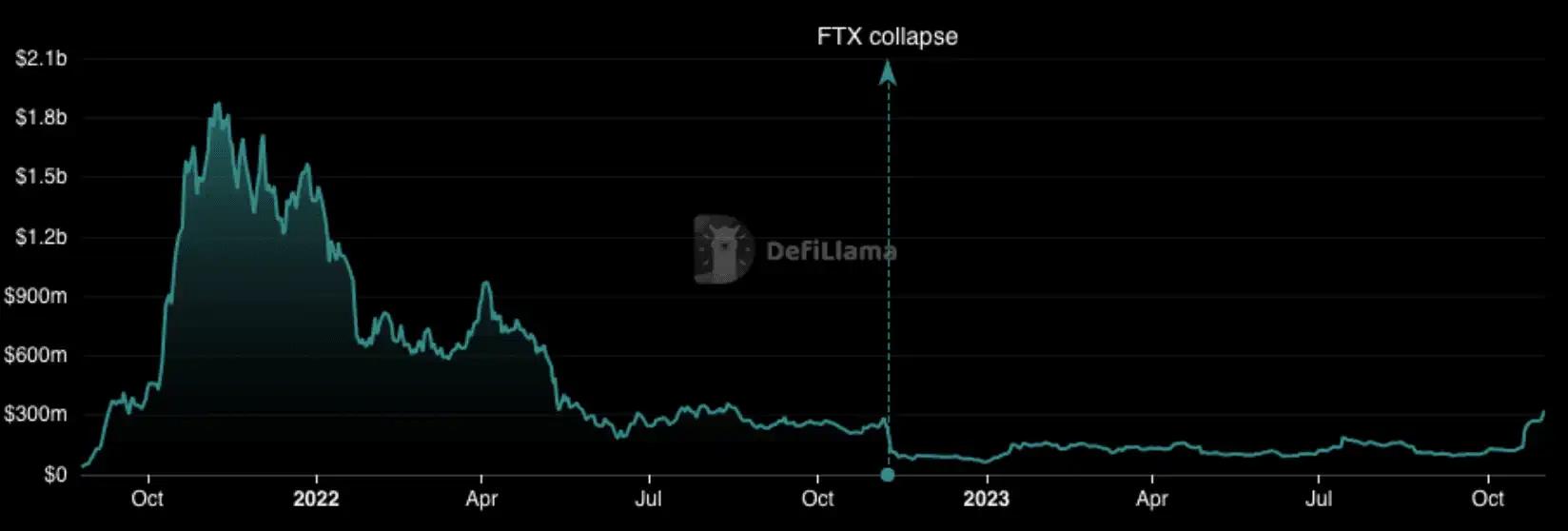

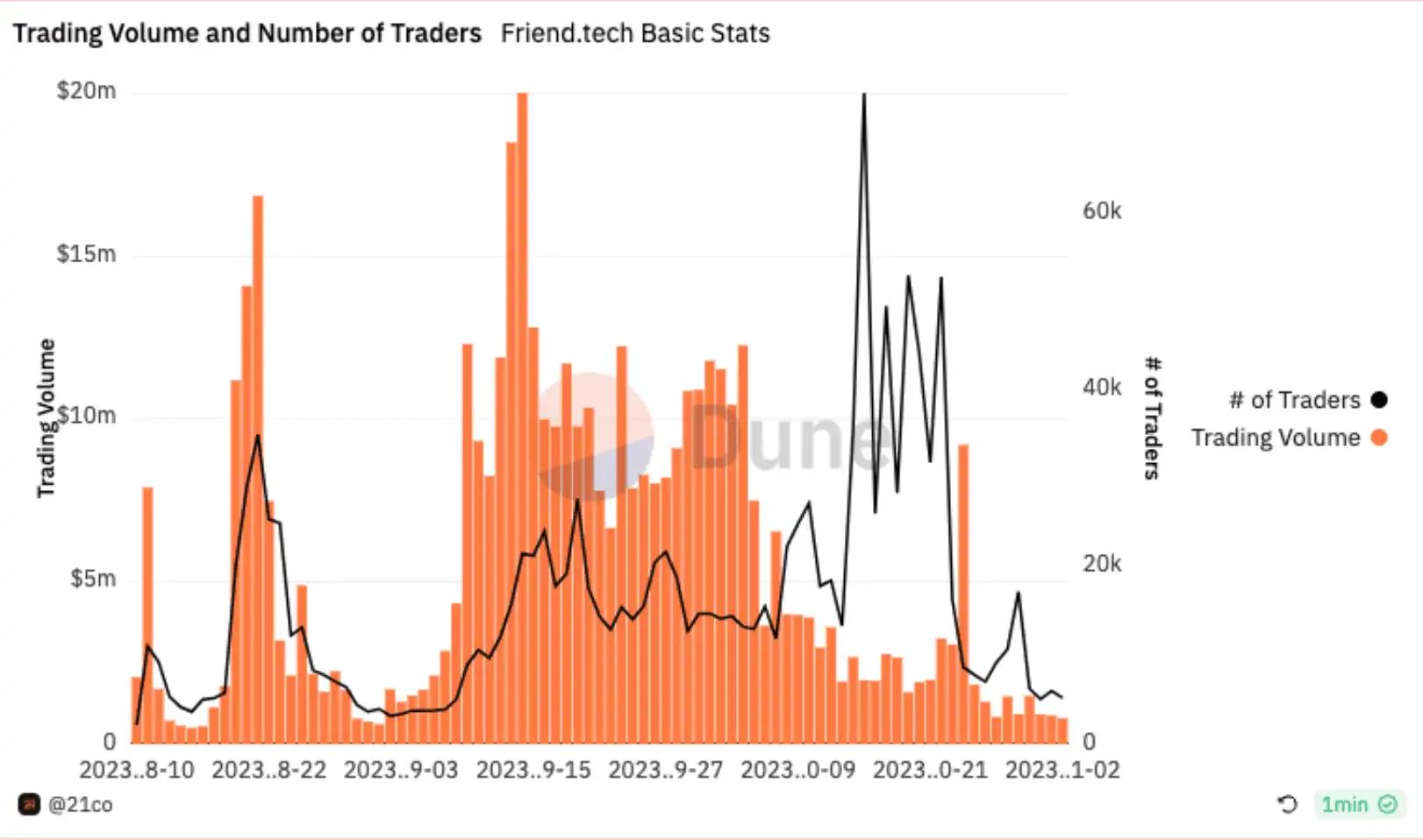

SocialFi update: Over recent months, Friendtech and Starsarena were key protocols in the SocialFi space. However, this narrative and trend appear to be fading, with user activity and trading volume experiencing sharp declines.

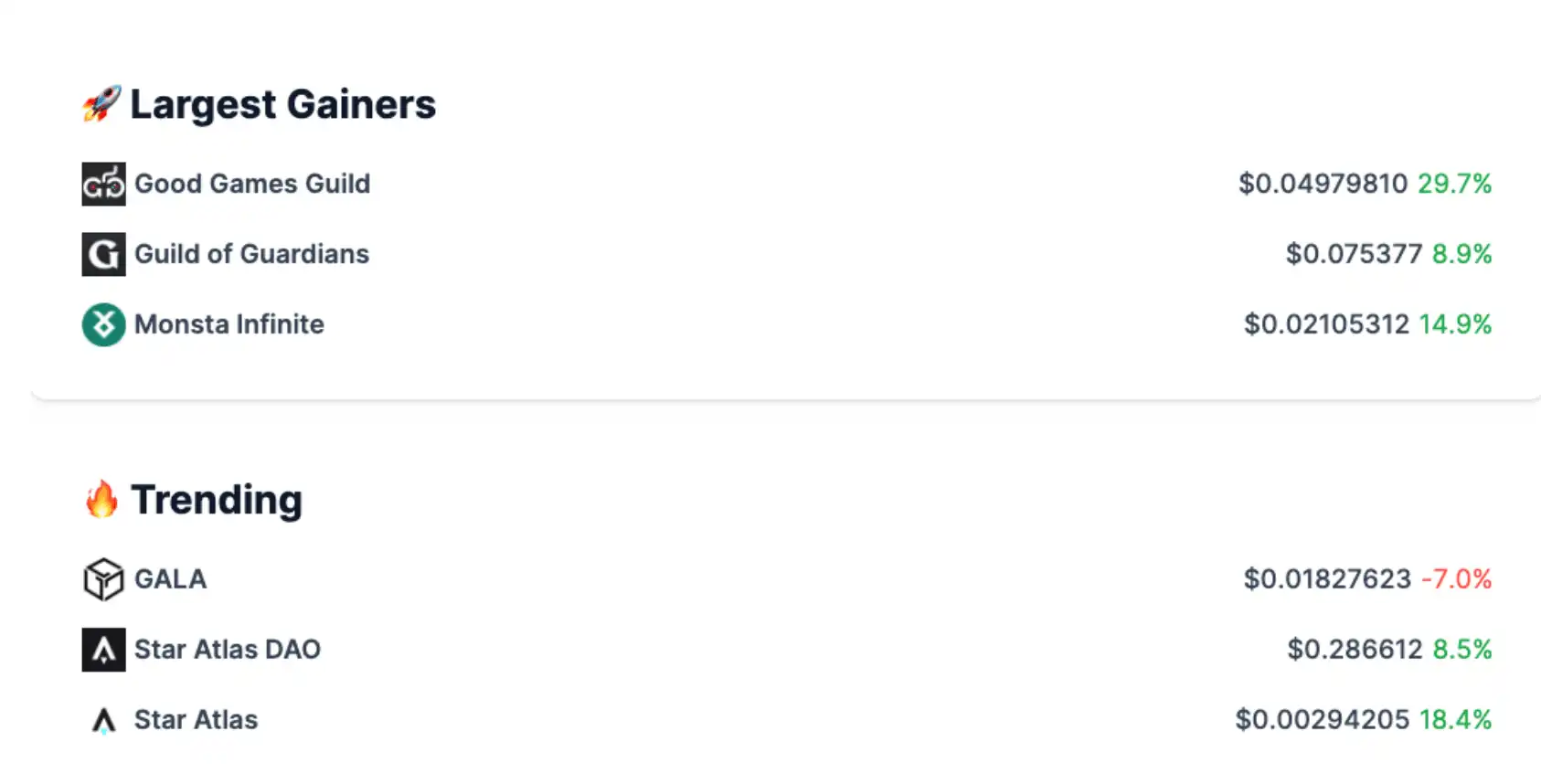

Token Degen Watch

Many recently launched tokens, including Aardvark, CAESAR, MOG, BITCOIN, CRESO, MLP, and REKT, have accumulated significant degen smart money holdings.

Although older memecoins like Floki and Pepe have recently seen notable price increases, they still remain far below their all-time highs. This recovery indicates renewed interest in these highly speculative assets.

Ether.fi is introducing native Ethereum restaking via EigenLayer, allowing users to earn points by staking eETH, participating in protocols, and completing tasks. EigenLayer will distribute points to native stakers, with all rewards distributed at a 100% rate to eETH stakers, no deductions.

Aevo, a layer-2 appchain for options and perpetuals trading, has merged with Ribbon following DAO approval. $RBN token holders can convert to $AEVO, which will serve as the governance token. A token generation event is planned for January 2024, with benefits such as discounts, reward multipliers, and early access for holding $AEVO for three months.

Be sure to mint the latest free NFT on Scroll to increase chances of qualifying for future airdrops.

Hyperliquid’s points program began on November 1.

Nerbbot introduced a useful feature to effectively track whale movements of any token.

Real Smurf Cat has experienced both inflows and outflows, with significant degen smart money holding positions.

JOE hit a new all-time high, considered a favorite among degen smart money.

SPX has emerged as one of the new meme trifecta alongside JOE and Real Smurf Cat, attracting degen smart money purchases and widespread attention.

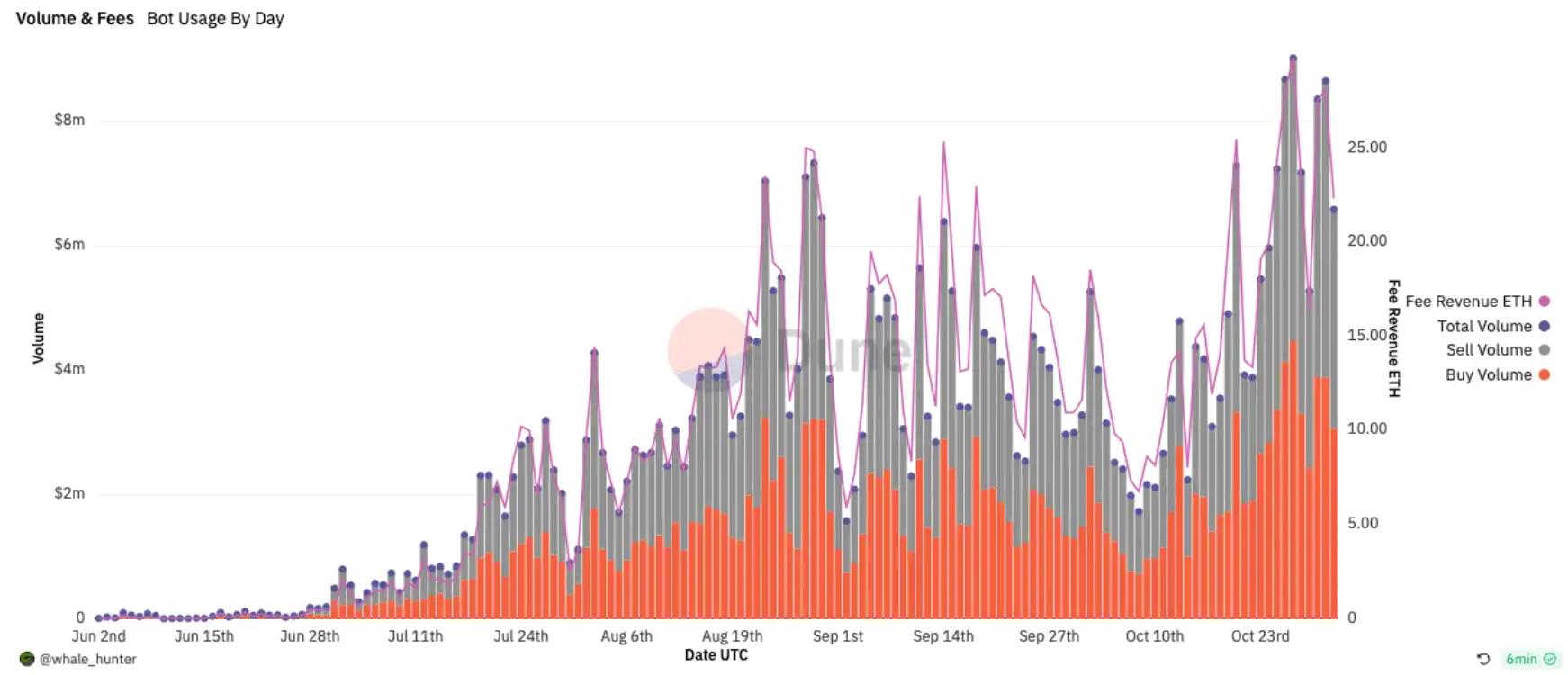

Banana Gun Bot continues to climb in usage, trading volume, and fees generated. Many expect this Telegram bot to surpass its competitors’ market position. Many are accumulating this token, hoping for a substantial price surge.

NFT and Gaming

News

-

Frame announces it will be powered by Arbitrum’s Nitro Stack

-

OpenSea launches Shipyard, a collection of Solidity smart contracts for NFT creators

-

Sup comic enters stores, Bitmap: Fragments of the Machine

-

Steve Aoki to release Stepn digital sneakers

-

Axie Infinity’s Sky Smash integrates Axie Experience Points

-

ArcadeDao launches

-

Chain of Alliance’s Alpha 3.0 game update redefines blockchain RPG gaming with season-based leaderboards and exciting new content

-

Async Art gradually winding down

-

NFT Paris launches loyalty token

-

Acolytes, Oxmons derivative, launching soon

-

Animoca Brands acquires Azarus, bringing live streaming to Web3 gaming

-

Blockchain will become standard in gaming in Asia: Bandai Namco executive

-

Innovative gaming NFT Gaul conducts public test this week

-

NEOM investment fund proposes $50 million investment in Animoca Brands

-

GameShift beta goes live

-

Nearcon23 to be held from the 7th to the 10th.

NFT Status

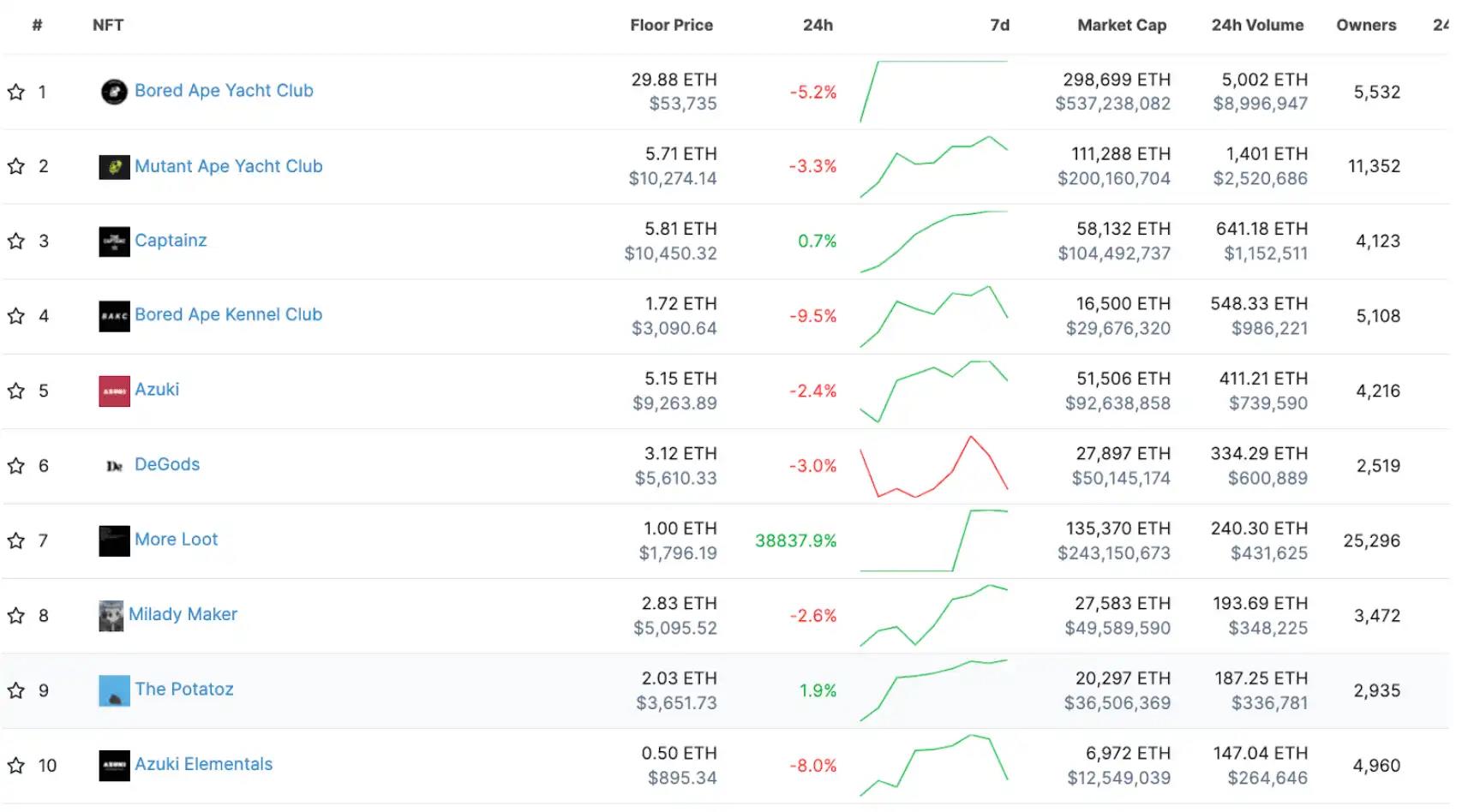

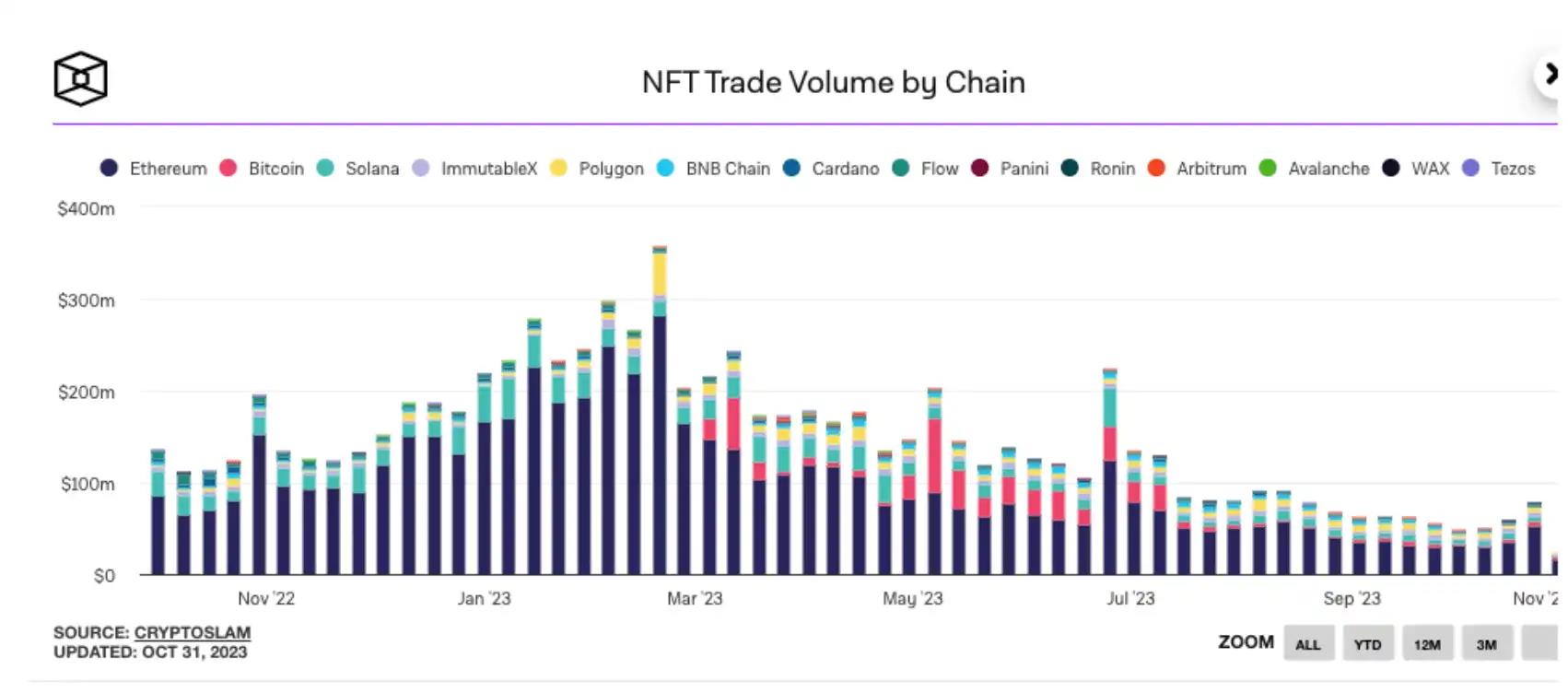

The recent market rally has brought a noticeable increase in NFT trading activity and price appreciation. However, they still clearly lag behind overall market performance. Many projects and companies seem to be reevaluating their strategies and long-term goals in anticipation of the next bull market. The concept of traditional NFTs and their practical applications is expected to undergo significant expansion to provide enhanced benefits to users. A prominent emerging trend is the integration of traditional NFTs with the gaming industry.

Volume: Since early October, weekly trading volume for art and collectibles NFTs on Ethereum has been rising, aligning with Ethereum’s price uptrend, indicating renewed interest. However, weekly volume remains not significantly higher than late August levels, suggesting NFTs are primarily benefiting from the rising value of their underlying assets rather than a major revival in activity.

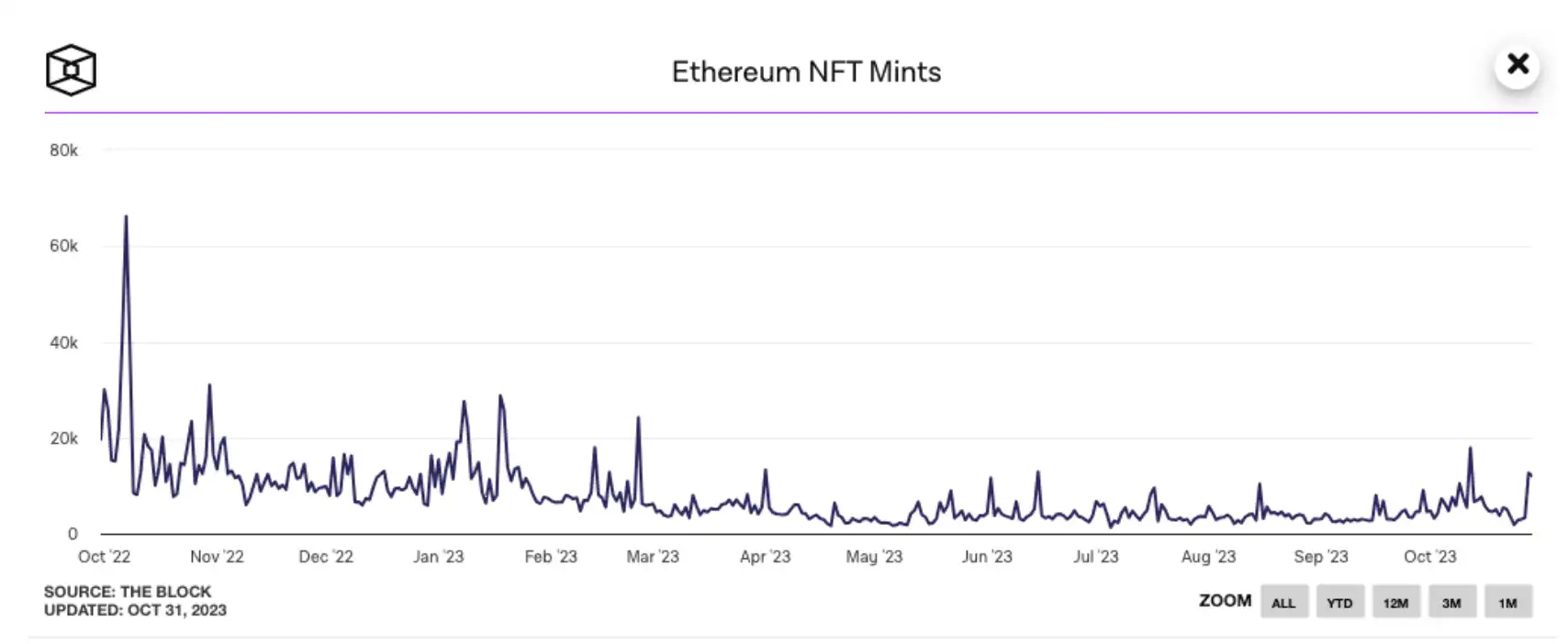

Minting: Aligning with the recent surge in trading volume and transactions, the number of NFT mints on Ethereum has increased.

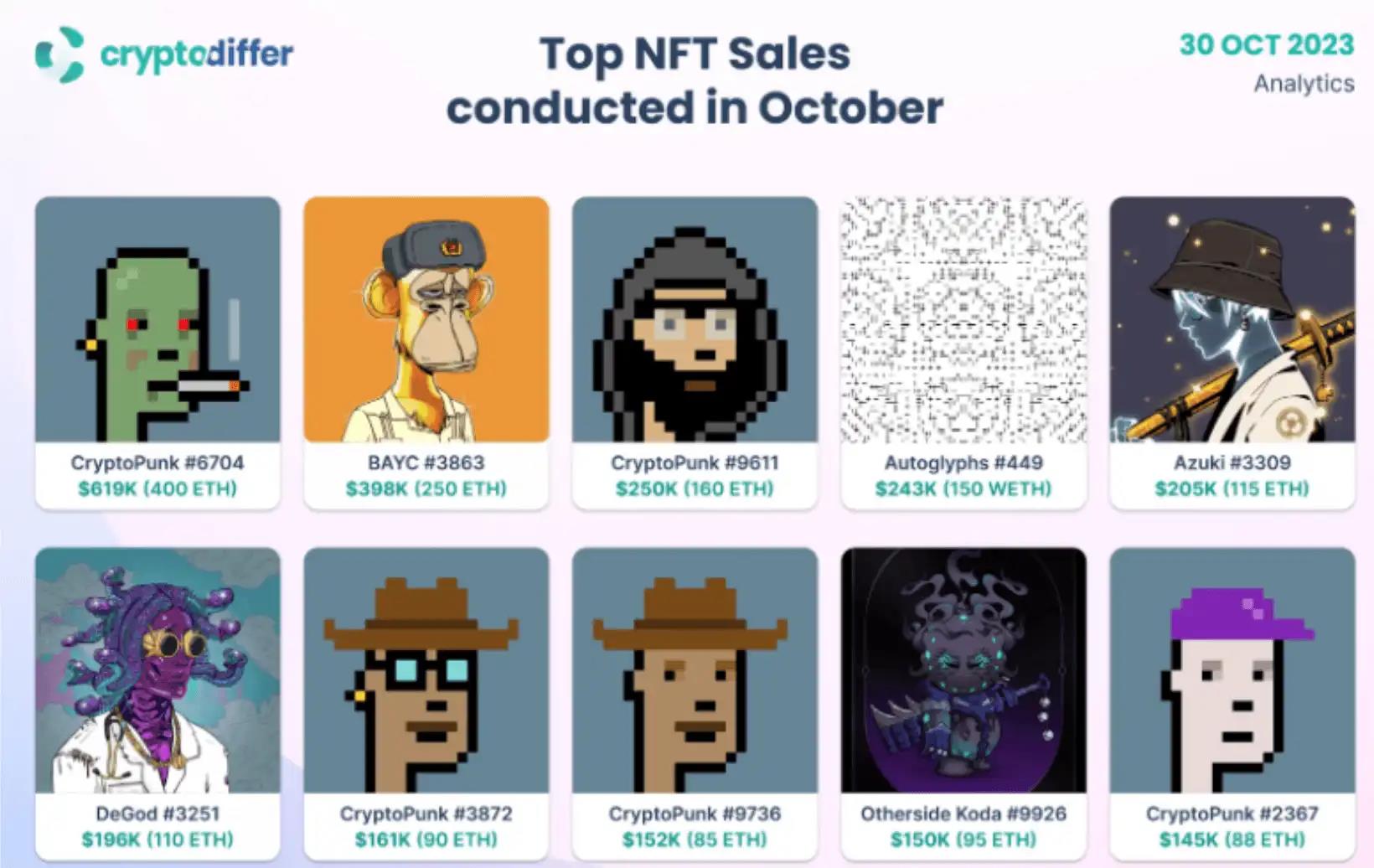

Notably, some significant sales this month: Clearly, blue-chip collections still hold substantial value for NFT collectors.

Project Highlight: Wreck League

Wreck League presents a unique concept where players use NFT-minted parts to build mechs for real-time PvP combat matches. Unlike predefined characters, each mech is created and owned by its builder, allowing for over 1.5 quadrillion possible combinations.

-

Players can freely assemble, disassemble, and customize mechs using 10 distinct NFT parts. This customization gives each mech a unique appearance and gameplay style across various in-game events and competitions, enhancing their in-game performance.

-

Wreck League’s Season 1, in collaboration with Yuga Labs, integrates Bored Ape Yacht Club, Mutant Ape Yacht Club, Bored Ape Kennel Club, and Kodas into the game. Owners of these collections can claim founder mechs for free.

-

Wreck League offers a AAA-quality real-time PvP fighting game experience with cross-platform play on mobile and PC. Players can use their customized mechs in various events and competitions, with opportunities to win valuable on-chain rewards.

NFT Degen News

Embed Zora’s mint page into your own website or platform to earn referral rewards for mints.

ImgnAI, a crypto-based project enabling users to create AI-generated art, has joined Nvidia’s Inception program. Following the announcement, the project’s native token $IMGNAI responded positively, surging 34% in value.

Maison Margiela offers a free Web3 multiplayer minting game—players enter a code, confirm, and begin playing, attempting to mint different digits, restarting after each successful mint.

The collectibles market is projected to reach $1 trillion by 2033, with stamps accounting for 8% of that share. On Thursday, Deutsche Post released its first stamp with a digital twin. Click this post to learn how to participate in this trend.

Farcana is a blockchain-based gaming metaverse allowing players to earn Bitcoin through a unique Game-fi format called Play to Hash (P2H).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News