Solana's Rebuilding Year After the "Disaster": What Doesn't Kill Me Makes Me Stronger

TechFlow Selected TechFlow Selected

Solana's Rebuilding Year After the "Disaster": What Doesn't Kill Me Makes Me Stronger

The Solana community has a strong sense of identity, which has enabled it to remain resilient in the face of significant setbacks.

Author: flowie, ChainCatcher

Compared to the chaotic aftermath of the FTX crisis last year, Solana has made a triumphant return at this year’s Breakpoint. Dan Albert, Executive Director of the Solana Foundation, finally announced the launch of Firedancer, the long-awaited testnet designed to solve network outages—earning praise from tech luminaries such as Georgios Konstantopoulos, CTO of Paradigm, and Raoul Pal, founder of Global Macro Investor. Even more exciting, during the conference period (October 30 to November 3), Solana’s token price surged to a high of $45, its highest level in 14 months, with over an 80% increase in the past month alone. At the time of writing, the price had pulled back to $39.60.

While many crypto users jokingly refer to Solana’s recurring price surge around every Breakpoint as market manipulation, Arthur, founder of DeFiance Capital, even quipped, “If hosting Breakpoint is so effective for SOL’s price, Solana should just do it every week.” Still, we cannot deny that Solana’s recovery owes much to a year of hard-fought post-crisis rebuilding.

Almost exactly a year ago, shortly after the previous Breakpoint concluded, ChainCatcher published an article titled “After Falling into the FTX Quagmire, How Can Solana Handle Internal and External Challenges?” documenting Solana’s state before and after that event. Back then, Solana was battered and bruised—enduring repeated network outages amid the crypto winter, facing unprecedented large-scale attacks on ecosystem projects, and being aggressively challenged by emerging competitors like Aptos and Sui. On top of these unresolved issues, Solana was further dragged down by the collapse of FTX, causing its token price to plummet below $8, teetering on the brink of survival.

Now, having fought its way back from near-collapse, Solana is returning stronger, with multiple key metrics trending upward and both technical foundations and ecosystem development showing signs of recovery—and even breakthroughs. As summarized in Messari’s Q3 report on the Solana ecosystem: “The momentum is stronger now than when the bear market began.” Perhaps more people are beginning to believe that Solana, once dubbed the “Ethereum killer,” is now writing a compelling narrative of resilience—“what doesn’t kill you makes you stronger”—as it prepares to emerge from two full market cycles.

Solana Fundamentals Through the Data

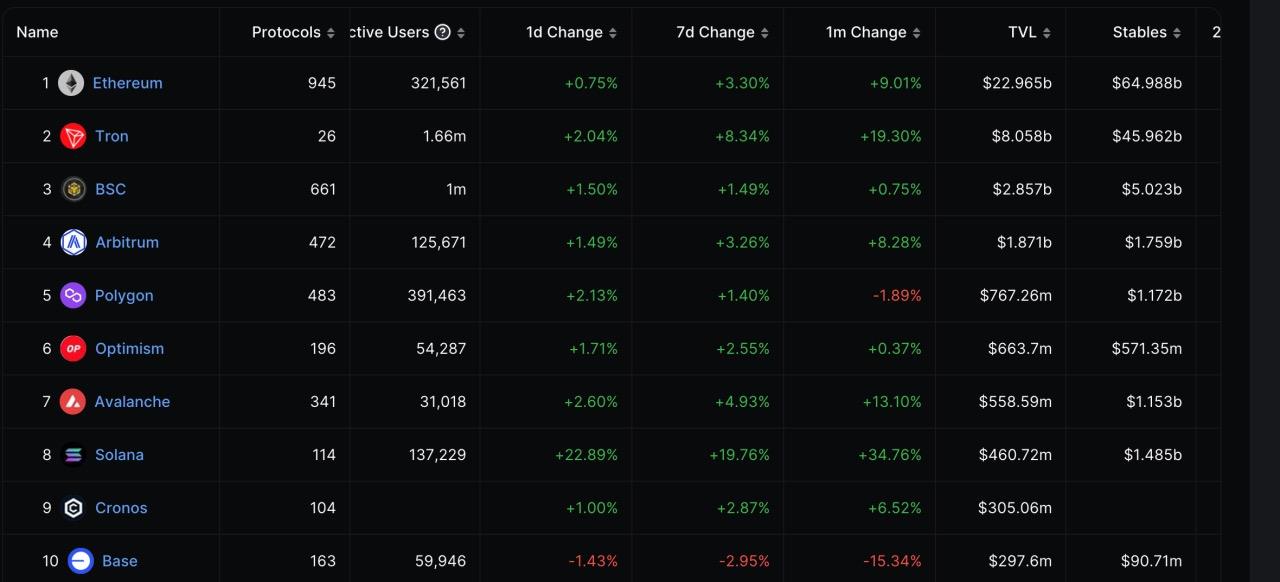

Although institutional buying likely played a role in Solana’s recent price surge, its core metrics have indeed shown clear improvement. According to DefiLlama, Solana’s TVL stands at $460 million—more than double its $210 million at the start of the year—ranking eighth among all blockchain networks.

Even more telling than TVL is Solana’s DeFi Velocity—the measure of how efficiently TVL is utilized. DeFi Velocity evaluates chain activity and adoption based on trading volume per dollar of TVL. According to Nansen’s latest data, Solana achieved a DeFi Velocity ratio of 0.71 over a seven-day period (September 26 to October 2), meaning nearly $0.71 in trading volume occurred weekly for every $1 of liquidity. This figure surpasses major chains including Arbitrum, BSC, Base, Optimism, and Ethereum.

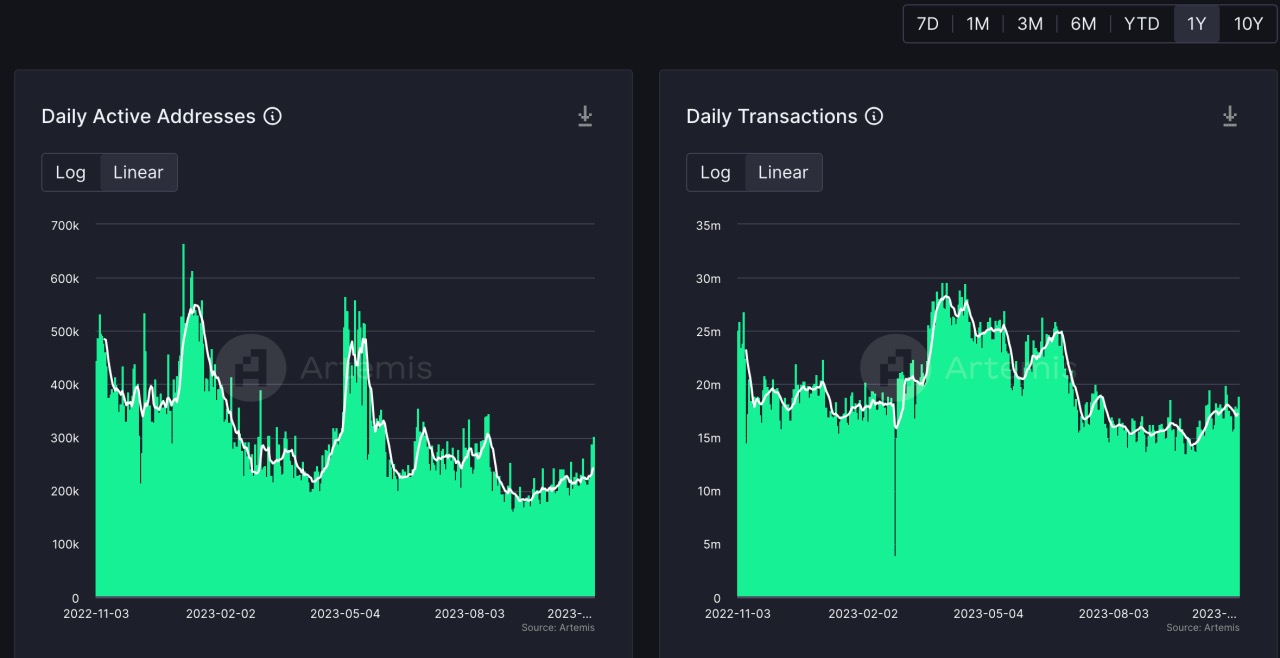

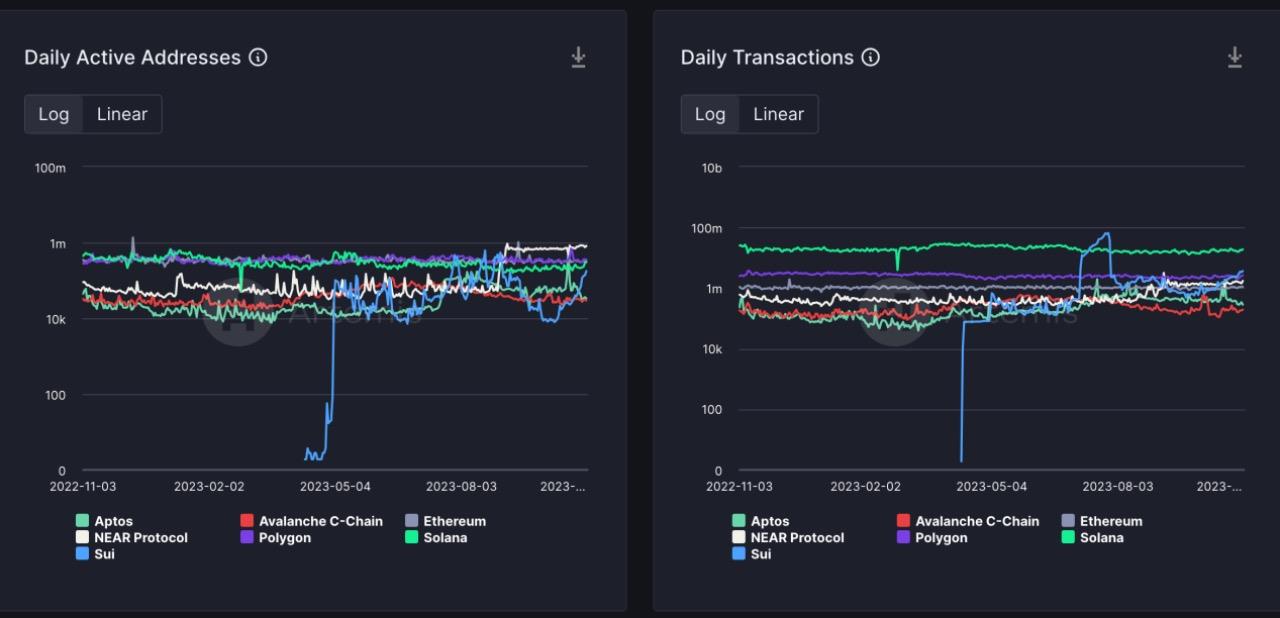

Looking at daily active addresses and transaction counts, Solana’s activity did not suffer the severe decline many expected following the FTX collapse. Daily active addresses briefly dipped for two months at the start of the year but saw a peak between May and June, exceeding 500,000. Daily transactions also hit a temporary high during that period, surpassing 25 million. Overall transaction volume has consistently outpaced Ethereum, Polygon, and Aptos. The surge coincided with heightened congestion and soaring fees on Bitcoin and Ethereum networks due to booming Bitcoin-based protocols and meme coins, prompting many developers and users to migrate to Solana for its lower transaction costs.

In terms of developer engagement, the FTX collapse did not trigger a mass exodus of developers from Solana. In November of last year, an X platform user conducted a community survey revealing that approximately 73% of developers saw no need to leave Solana, while about 67% chose to deploy exclusively on the network.

According to current data from Solana’s official website, the number of monthly active developers now exceeds 2,000—up significantly from 1,234 reported in its Q2 report (as of April)—and approaching the peak levels seen in March of this year. Data from Electric Capital’s Developer Report shows that after the FTX collapse, Solana’s developer activity rose notably in March, reaching 2,732 monthly active developers. While numbers declined slightly afterward, the drop was primarily due to fluctuations among part-time contributors, with full-time developers remaining relatively stable.

Overall, the damage inflicted by the FTX fallout did not destroy the solid foundation Solana built during the previous cycle.

Key Milestones Achieved, Technical Breakthroughs Shine

Long-discussed solutions such as addressing network outages and achieving EVM compatibility have gradually materialized this year.

First and foremost, the highly anticipated launch of the Firedancer testnet at Breakpoint drew the most attention. Firedancer is a next-generation validator client developed by Jump Crypto specifically for the Solana blockchain. As Solana’s second client, it reduces single-point failure risks associated with relying on one client, enhances client diversity, and improves network stability. It is expected to boost Solana’s throughput by 10 to 100 times.

Firedancer is arguably the most anticipated infrastructure upgrade for Solana in the coming years. Solana co-founder Anatoly Yakovenko recently described it in an interview as the long-term solution to Solana’s outage issues—an upgrade of undeniable importance. Since its 2020 launch, Solana has suffered at least five major network disruptions, three of which occurred in 2022. These frequent instabilities previously drove ecosystem projects to flee to newer chains like Aptos and Sui.

The mainnet launch of Firedancer is currently projected for 2024. However, Delphi Digital analysts noted that what debuted at Breakpoint was actually only Frankendancer—the networking component of Firedancer. The full rollout remains technically challenging and may not be completed until 2025.

Regarding network stability, Solana has already improved significantly compared to 2022 through upgrades such as QUIC, stake-weighted QoS, and localized fee markets. According to Solana’s Q2 report, there was only one network disruption—on February 25, during the previous software upgrade—and no similar incidents have occurred since the improvements were implemented.

Secondly, progress has been made toward EVM interoperability. In July, Neon, Solana’s EVM-compatible solution, launched on mainnet. Shortly after, Solang—the Solidity smart contract compiler for Solana—was released, enabling developers to build Ethereum-compatible applications on Solana more easily.

Additionally, GameFi initiatives announced at last year’s Breakpoint have advanced. This year, Solana unveiled the beta version of GameShift, a game development toolkit aimed at simplifying and reducing the complexity of building games on-chain.

Furthermore, Solana’s Web3 smartphone, Saga, went on public sale in May. Although sales performance was underwhelming, it still marked an early strategic move by Solana into mobile access points.

With long-standing challenges like network instability now being addressed, Solana has also achieved notable technical breakthroughs. In April, Solana introduced state compression—a new data storage method that reduces NFT minting costs by over 2,000x. According to a Nansen report, minting 1 million NFTs dropped from $25,300 to just $113 using state compression. By comparison, the same operation would cost $33.6 million on Ethereum and $32,800 on Polygon. Helium’s migration to Solana in April benefited greatly from this technology: nearly one million hotspots were minted as NFTs, which would have cost over $200,000 without compression—but with it, the total cost was only around $110.

Ecosystem Resilience Endures

Beyond technical strengths, Solana has always excelled in ecosystem development. Despite a brief lull following the crypto winter and the FTX collapse, Solana’s ecosystem rebounded this year with surprising support from Web2 giants like Visa and Shopify.

Around September, payment giant Visa announced it would extend USDC stablecoin settlement capabilities to the Solana blockchain. E-commerce leader Shopify also revealed integration with Solana Pay, allowing its merchants to accept USDC payments. In its report, Visa highlighted Solana’s unique technical advantages: “high throughput via parallel processing, low-cost transactions through localized fee markets, and high resilience enabled by a large number of nodes and multiple client implementations.” The involvement of Visa and Shopify marks a strong start for real-world payment use cases within Solana’s ecosystem.

Beyond Web2 giants, leading Web3 players and prominent projects have also rallied behind Solana. Notably, Rune, founder of MakerDAO, publicly criticized Vitalik Buterin, stating after evaluating numerous blockchains that Solana is the best candidate for NewChain. Eclipse, an L2 blockchain, has embedded Solana’s SVM (Solana Virtual Machine) into its architecture and noted growing network effects around SVM.

With strong backing from industry leaders, Solana has also intensified its ecosystem incentives. Throughout Q3, Solana hosted the Solana Hyperdrive hackathon featuring a million-dollar prize pool and sponsored multiple other events including OPOS Hackathon, Hacker Houses, and PlayGG. Recently, Solana launched an incubator program specifically designed to attract startup founders to build on its platform.

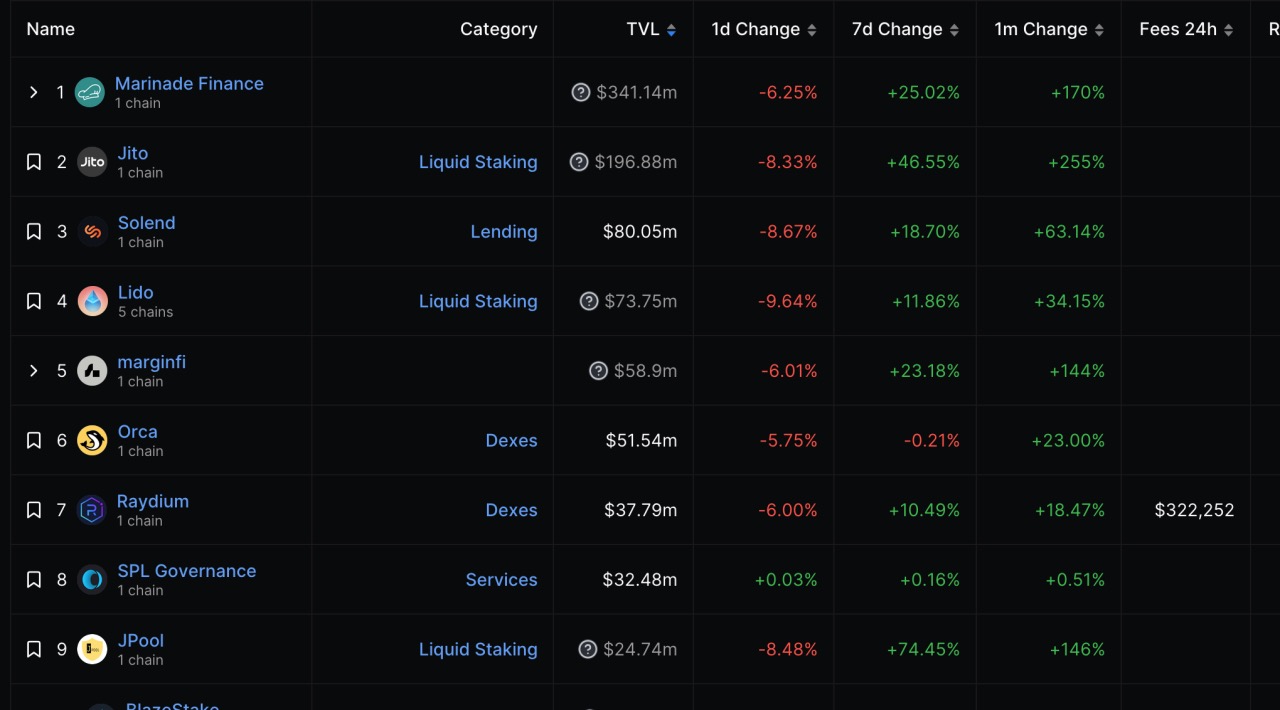

This year, established DeFi protocols like Marinade Finance, Lido, and Solend have shown strong growth, alongside rising stars such as Jito, marginfi, Ocra, Tensor, and Backpack—most of which emerged in the liquid staking sector. According to DeFiLlama, nearly all top TVL protocols on Solana saw gains over the past month, with three achieving over 100% growth and one exceeding 255%.

Jito, a liquid staking protocol launched shortly after the FTX collapse, grew its TVL from $4 million to nearly $200 million within a year, making it the second-largest protocol in the Solana ecosystem after Marinade Finance. Jito differentiates itself by offering stakers additional MEV rewards on top of standard staking yields. According to Solana’s latest figures, over 31% of Solana validators now run via the Jito Labs client. Meanwhile, marginfi, a DeFi margin lending protocol, saw its TVL grow over 700% quarter-over-quarter, pioneering the points-based reward system on Solana DeFi—later adopted by platforms like perpetuals exchange Cypher and lending protocol Solend.

More recently, Backpack—a Web3 integrated application in Solana’s ecosystem—has been particularly active and noteworthy. Backpack pioneered a novel approach to Web3 wallet design. Unlike traditional wallets, it leverages the innovative xNFT standard, allowing developers to build permissionless asset management tools on a unified interface by requesting APIs to unlock new core functionalities—delivering a smoother user experience, especially on mobile.

Recently, Backpack launched the NFT collection Mad Lads, now the highest-market-cap NFT project on Solana and ranking among the top five NFT series by 24-hour trading volume. Backpack also announced plans to launch Backpack Exchange, a regulated cryptocurrency exchange. The exchange has already obtained a VASP (Virtual Asset Service Provider) license from Dubai’s Virtual Assets Regulatory Authority (VARA) and will roll out a closed beta to existing Backpack and Mad Lads community members in November.

The Reason Behind Solana’s Strong Support

Looking back, Solana has never lacked influential supporters—even during its darkest hours. After the FTX collapse, industry thought leaders such as Vitalik Buterin, MakerDAO founder Rune, Bankless co-founders, and Placeholder VC partner Chris Burniske voiced strong support, joined by Web2 financial heavyweights like VanEck and payment giant Visa.

Digging deeper into their reasoning, most point directly to Solana’s technical capabilities and vibrant community—and many expressed increased confidence in Solana *after* the FTX downfall. Soon after the FTX implosion, Vitalik Buterin tweeted his hope that the Solana community would get a fair chance to thrive, citing advice from someone he trusts: “Solana is a serious and talented developer community, and now the toxic, opportunistic elements have been purged.”

That “trusted person” turned out to be Chris Burniske, partner at Placeholder VC, who elaborated on his reasons: Solana’s developer base is deeply committed and technically rigorous, giving its on-chain innovation greater independence compared to Ethereum or Cosmos. He added: “In terms of ecosystem dynamics, Solana’s dApp builders resemble a hybrid of Web2 and Web3—operating with crypto-native backends while maintaining frontends capable of engaging mainstream audiences.” Rune praised Solana for its “high code quality and an ecosystem that maintained resilience despite the fallout from FTX’s collapse.”

VanEck went even further, publishing a detailed research report bullish on Solana, comparing it with Ethereum across ecosystem applications, costs, and revenue. VanEck stated: “The Solana community possesses a strong sense of identity, enabling it to remain resilient through massive setbacks—setbacks that could have destroyed many other blockchain ecosystems.”

Perhaps Solana’s journey through highs and lows tells us this: in the brutal elimination game of Web3, continuous innovation and enduring resilience—refusing to exit the field even in the face of major adversity—is what transforms survival into strength. What doesn’t kill you truly makes you stronger.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News