Market Outlook for November: Which Projects and Catalysts Are Bullish?

TechFlow Selected TechFlow Selected

Market Outlook for November: Which Projects and Catalysts Are Bullish?

Activity has significantly increased as stablecoin market cap hits bottom and total value locked continues to rise across various sectors.

Author: THOR HARTVIGSEN

Translation: TechFlow

With breakthroughs on the charts, many market participants—especially on Twitter—have overcome the psychological lows caused by prolonged volatility and poor price action, as glimmers of hope emerge. With stablecoin market cap bottoming out and total value locked steadily increasing across sectors, activity has significantly picked up. This means teams aiming to ride this momentum will be rolling out substantial updates.

Bitcoin ETF

This topic is frequently discussed, but more often than not, media outlets are simply chasing headlines without delivering fresh, valuable insights. While we await further developments, let’s examine Galaxy Digital Research’s projected capital inflows when spot Bitcoin ETFs launch.

How much capital inflow can we expect?

This is a difficult question to answer precisely, so we must rely on assumptions. By analyzing the total addressable market and using conservative asset allocation estimates, we could anticipate approximately $79 billion in inflows over three years.

How will this affect Bitcoin's price?

Increased buying pressure clearly helps offset selling from third parties (such as the U.S. government) and/or miners. According to Galaxy Digital’s calculations, there could be a potential 74.1% price impact within the first year, based on analogies with the gold market and estimated capital inflows.

Frax

Frax has a suite of launched products and even more exciting developments on the horizon—definitely one to watch.

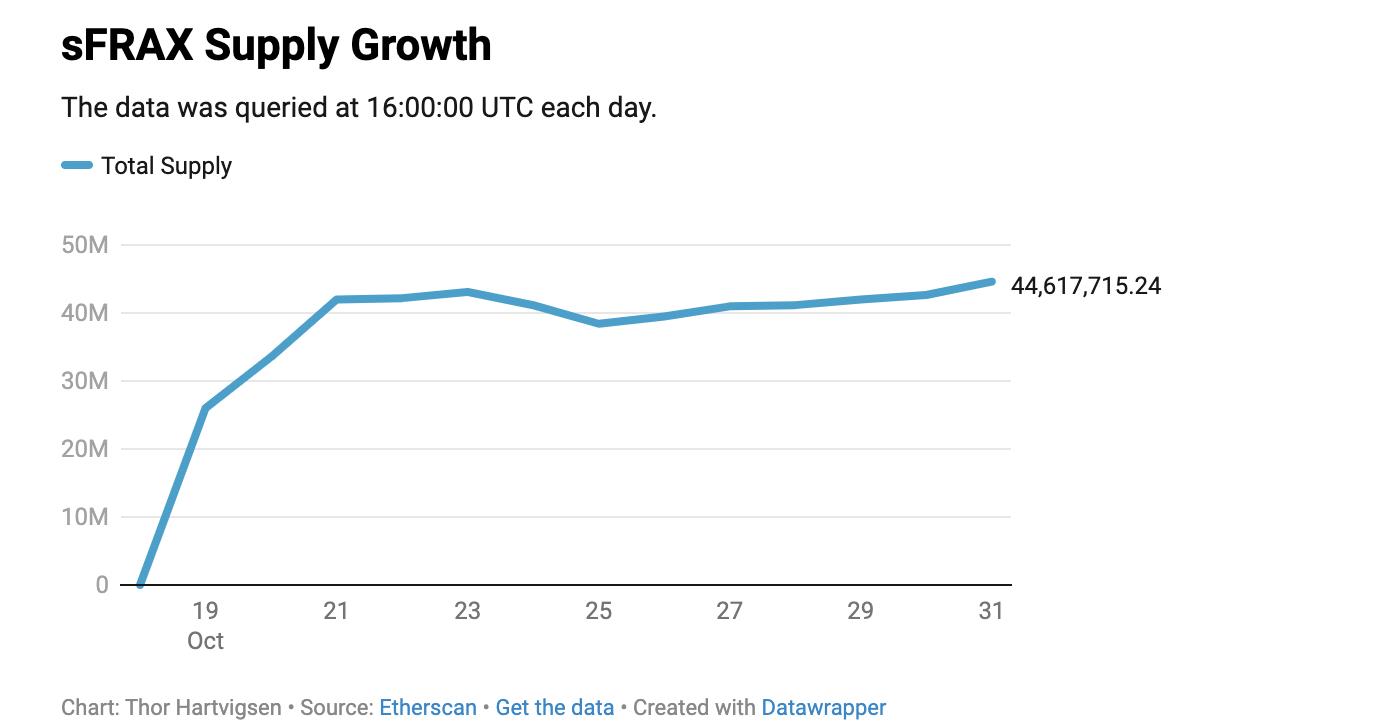

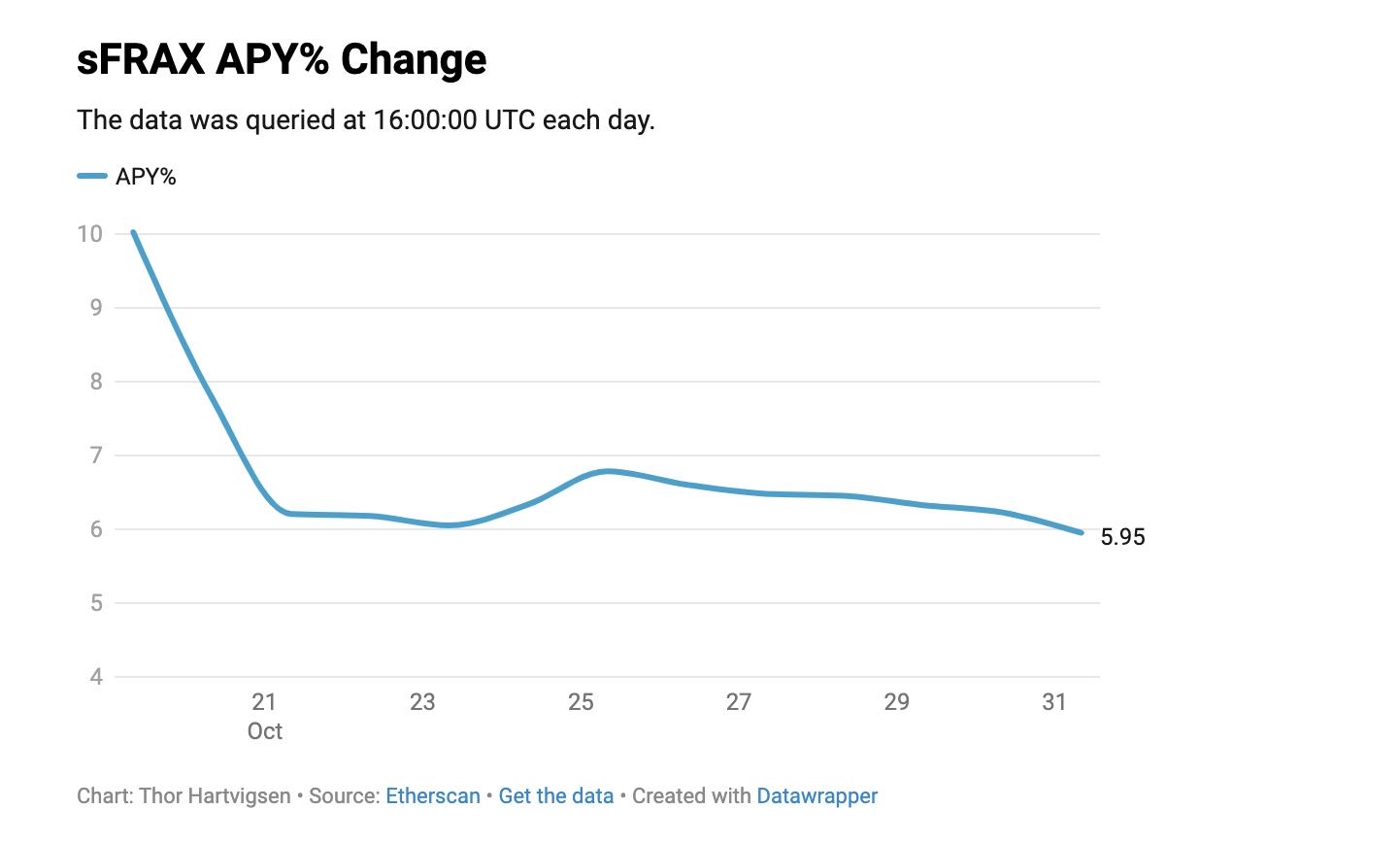

sFRAX

Successfully creating a yield mechanism for FRAX holders via real-world assets (RWAs), sFRAX enjoys comfortable growth while offering competitive returns to depositors.

frxETH v2

A highly anticipated upgrade to frxETH with novel mechanisms is about to launch. Frax aims to innovate in the LSD space—not just focusing on yield, but emphasizing validators and decentralization.

Borrowing validators instead of ETH

To enhance decentralization, nodes themselves act as borrowers—borrowers are validators. Collateral from node operators will be placed into existing validators.

Low collateral requirement

The cost to borrow a validator could be as low as 4 ETH or other collateral, with configurations determined by governance participants.

Floating interest rates

Validators will charge variable fees set by the market, rather than fixed rates dictated by protocol operators.

Utilization of idle assets

Any Ether not used for validators will be directly sent to Curve to mint LP tokens, enhancing liquidity depth and generating additional revenue. Solving centralization concerns while delivering strong yields will undoubtedly leave competitors behind.

Fraxchain

Positioned as the central hub of the Frax ecosystem, this L2 roll-up is reportedly launching by year-end.

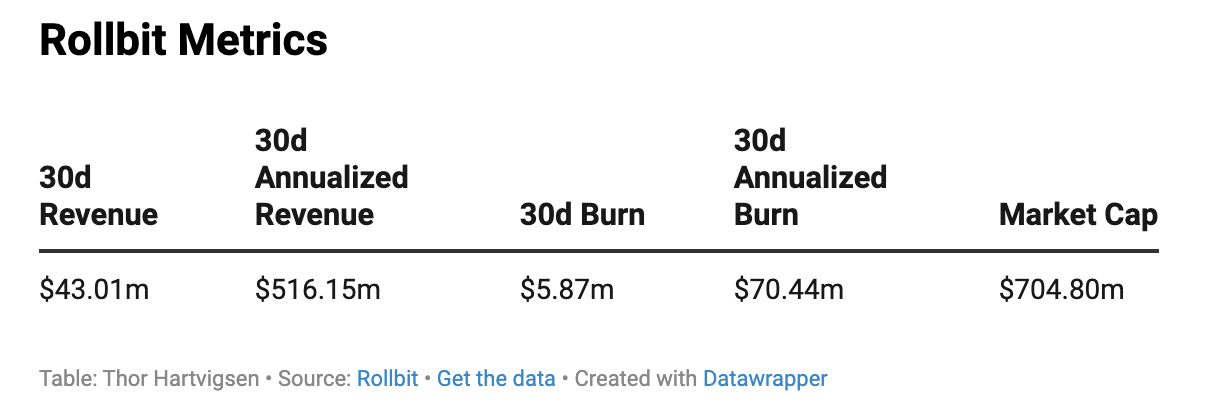

Rollbit

Rollbit, the famous DeFi money machine, reappears in this newsletter, with several interesting developments this month.

Rollbit Duel Arena

Announced by a Rollbit co-founder on Twitter, Duel Arena is said to be a 0% house-edge PvP game inspired by RuneScape’s Sand Casino, which once hosted massive wagers.

One core feature of this new addition will be a negotiation phase before matches, allowing duelists to propose their own betting terms. NFT staking for extra rewards is also promised, though exact details remain speculative.

To benefit RLB holders, the gambling platform operator will use a significant portion of its revenue to buy back and burn tokens from the open market:

-

30% of futures revenue;

-

20% of sports betting revenue;

-

10% of casino revenue.

So far, 37.87% of the total token supply has been burned.

Swell Network

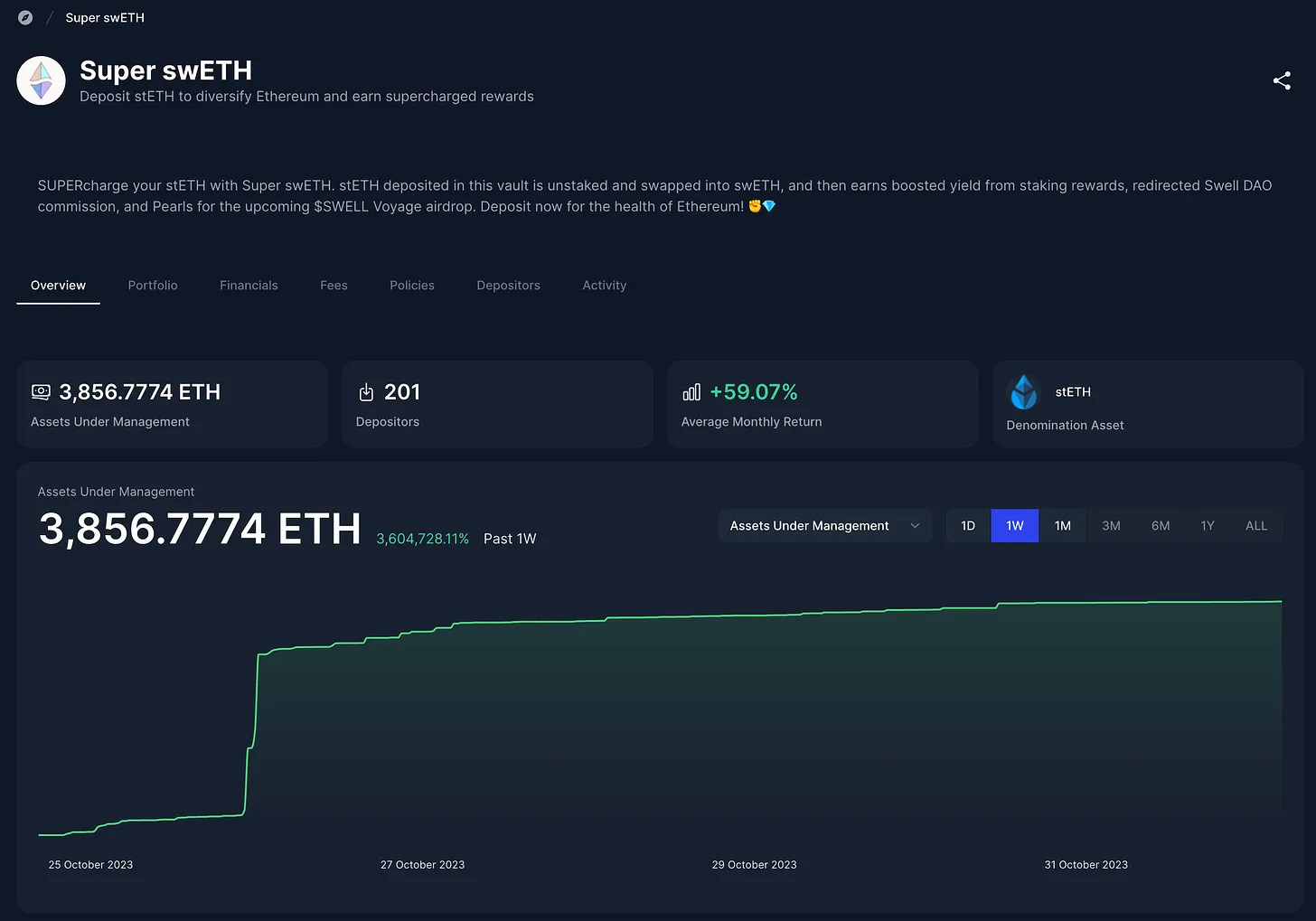

Swell is a liquid staking provider operating the native ETH LST “swETH,” with nearly 50,000 ETH ($95 million) locked. swETH holders earn competitive staking yields and receive “Pearls” that can be converted into the native $SWELL token upon its release early next year.

Swell recently launched the “Super swETH” vault, allowing users to stake stETH obtained from Lido in exchange for swETH deposited into the vault. The goal is to diversify the Ethereum liquid staking landscape, increase swETH supply, and further decentralize the Ethereum network. The vault will launch over 180 days and offer boosted Pearls and all DAO revenue throughout the period. As shown in the chart, the current yield stands at 59%.

dYdX v4

With the v4 upgrade, dYdX will transition toward full decentralization, bringing fundamental changes across the platform. Instead of relying on an L2 roll-up to host its exchange, the team has built its own independent app chain using Cosmos. This release empowers the community to participate in future protocol decisions.

This update brings numerous benefits for traders. Gas fees are eliminated, allowing traders to pay only transaction-related costs. Additionally, the dYdX chain can process up to 2,000 transactions per second—200 times faster than v3—greatly improving trade execution efficiency. DYDX token holders can now stake their tokens to earn a share of fee-generated revenue.

What kind of returns can we expect from staking?

While we lack exact figures, we can make reasonable estimates based on currently available data.

First, we need to estimate the likely staking ratio. By averaging staking ratios from similar protocols (e.g., SNX, GMX, GNS), we arrive at an estimated staking ratio of 68.33%. Using this ratio, the total value locked is approximately $271.22 million. Next, we consider the annualized exchange fees. Based on current data from Token Terminal, annual fees amount to $77.4 million. With these values, we calculate an approximate return of 28.54%, assuming all fees are distributed to stakers.

Redacted Cartel

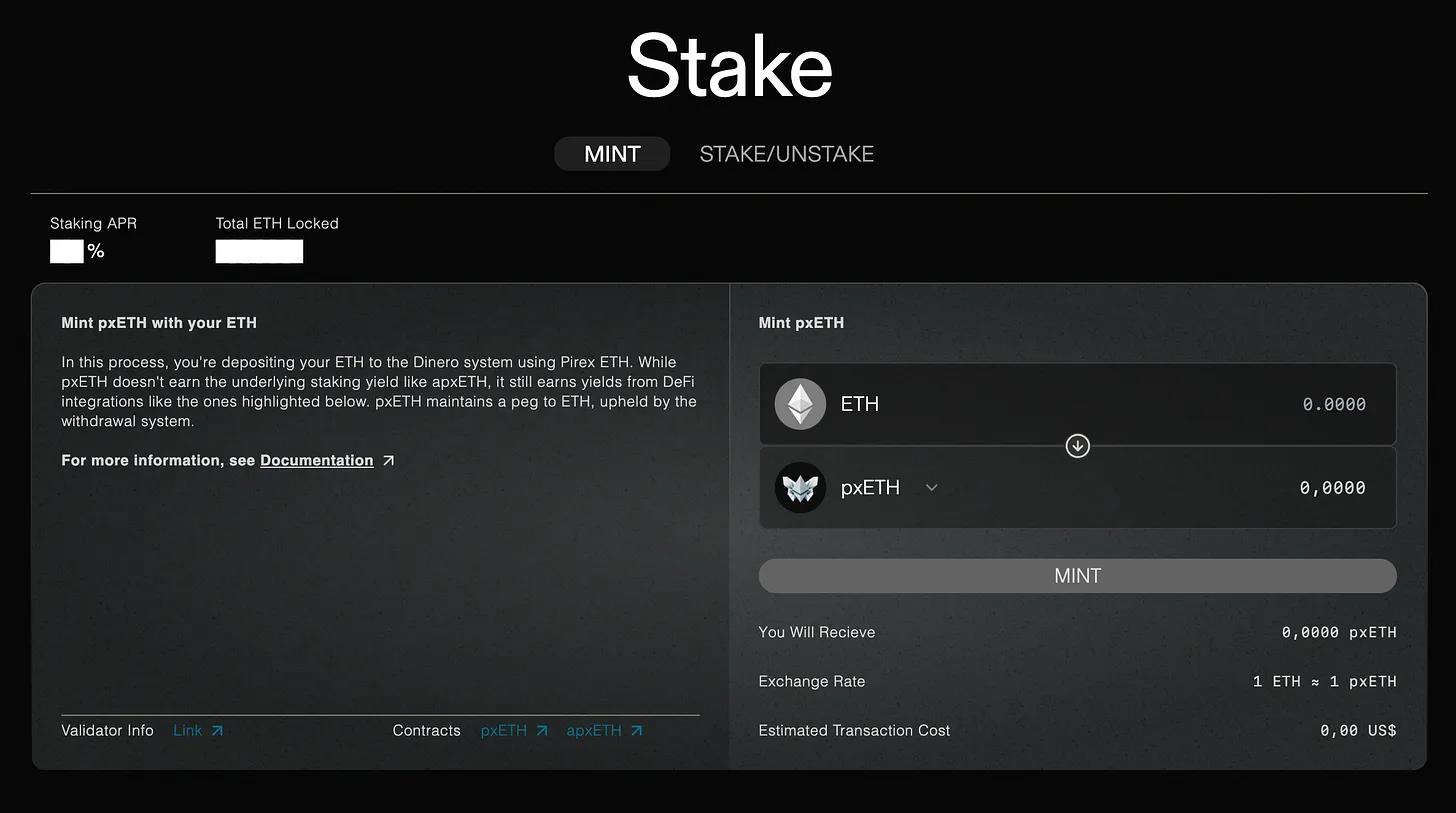

In early October, members of Redacted Cartel deployed Pirex ETH (pxETH), a liquid and tokenized representation of staked ETH on the Ethereum Goerli testnet. This marks the first step in Dinero’s phased rollout. Redacted Cartel’s approach to LSD allows users to either hold pxETH directly or deposit it into auto-compounding reward vaults to earn apxETH. Dinero’s yields will be funded from these reward vaults. Following pxETH, the next key components will be the DINERO stablecoin and a custom RPC for users.

Synthetix

The non-custodial derivatives exchange Synthetix has recently focused on overcoming DEX limitations to bridge the massive trading volume gap between DEXs and CEXs, thereby boosting DeFi adoption.

Infinex

Their solution? Infinex. By simplifying the cumbersome process of bridging assets to more scalable and efficient L2s, introducing one-click trading, and eliminating the need to sign every operation on the platform, Infinex aims to bring many of the conveniences of traditional centralized exchanges to blockchain—without the dreaded counterparty risks (e.g., insolvency, sensitive data leaks). The protocol will be hosted on Optimism; the launch date remains unconfirmed, although waitlist sign-ups are already available on their website.

This approach is undoubtedly a net positive for all of DeFi, as attracting inexperienced or new users has always been a challenge for developers trying to expand their user base.

Synthetix has consistently maintained high trading volumes, remaining a major player in the market. If Infinex launches successfully, the expected surge in trading volume should reflect clearly on activity charts.

Arbitrum Grant Recipients

In the latest stage of the recently concluded Arbitrum Foundation grant program, well-known projects such as GMX, Pendle, and Frax have successfully passed the threshold and received substantial grants. How many tokens did they actually receive, and how do they plan to use their ARB tokens?

GMX

Initially requesting 14 million tokens, later revised to 12 million, GMX is the largest recipient by value. The funding is intended to stimulate on-chain activity on Arbitrum by increasing adoption and attention to their V2 protocol. Most, if not all, of the received tokens will be used to create a series of highly liquid and capital-efficient perpetual and spot pools.

Proposed fund allocation:

-

50% (6 million ARB) – Trader incentives;

-

50% (6 million ARB) – Liquidity incentives.

Pendle

Pendle’s 2 million tokens from the Arbitrum Foundation will be used to increase yield trading volume, deepen liquidity in existing pools, and provide token incentives to users to bootstrap liquidity for newly listed Pendle markets.

Proposed fund allocation:

-

55% (1.1 million ARB) – Liquidity incentives;

-

40% (800,000 ARB) – Trader incentives;

-

5% (10,000 ARB) – Integration incentives.

Frax

Requiring the fewest tokens among the three, Frax applied for this grant to incentivize its broad Ethereum mainnet user base to explore Arbitrum’s growing DeFi ecosystem.

Proposed fund allocation:

-

100% (1.5 million ARB) – User/liquidity incentives.

Radiant Ethereum Mainnet Launch

Originally, Radiant planned to launch on October 3. However, they decided to delay deployment to the 15th to optimize gas costs and improve platform user experience. Unfortunately, this delay was followed by another postponement. As of a few hours ago (November 1), the Ethereum mainnet expansion finally launched, integrating assets like wstETH, sDAI, and rETH for borrowing and lending. Radiant is another protocol confirmed to receive a large ARB grant this month.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News