Mobile Money + Web3 = Borderless, Diversified Open Inclusive Finance?

TechFlow Selected TechFlow Selected

Mobile Money + Web3 = Borderless, Diversified Open Inclusive Finance?

Bringing in appropriate regulatory and financial institutions to assist Web3 open networks may well be the future of Web3.

Author: Liu Ye Jinghong, Weisman Notes

What Is Mobile Money

Mobile money is not equivalent to mobile payment. According to the definition by the African Development Bank, mobile money differs from funds held in traditional bank accounts in that it refers to money stored on a user's SIM card, where the SIM card replaces the bank account number as the identifier for the user’s identity.

Therefore, mobile money represents a financial services innovation that leverages information and communication technologies along with non-bank physical networks to extend financial services to regions and populations underserved by traditional banking systems. It has two main characteristics: first, customers perform deposit and withdrawal operations through a network outside the traditional banking system; second, transactions are conducted via a mobile phone interface.

The way a mobile money account works is somewhat similar to Venmo, but with one key difference: it does not require a bank account. To deposit or withdraw cash from the application, mobile money systems use human agents who carry cash and phones and operate at key locations across the country—including remote rural areas. Mobile money can also be used for cashless transactions such as purchasing goods or paying bills.

The Market for Mobile Money

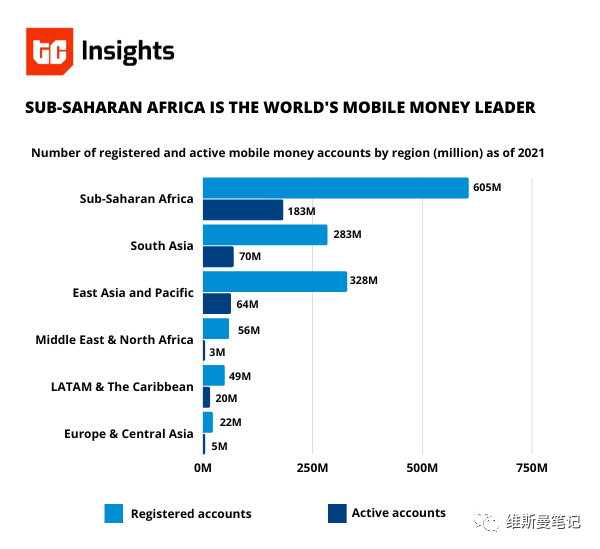

According to a 2021 report by the Global System for Mobile Communications Association (GSMA), $697.7 billion—representing a 40% year-on-year increase—was processed through mobile money options in Sub-Saharan Africa. This region accounted for nearly 70% of global transaction volume ($1 trillion) last year, far exceeding South Asia ($156.3 billion).

Additional data from the GSMA report indicates that Africa already has more than 184 million active mobile money wallets, up from 161 million just over a year earlier. It is expected that the latest figures in 2023 will show even greater growth trends.

Why Is There Demand for Mobile Money?

To most people, modern mobile payments, digital currencies, and even cryptocurrencies seem widely adopted—so why does demand still exist for mobile money? The core reasons are threefold:

1. Low Financial Inclusion in Remote and Underdeveloped Areas

Globally, there remain vast remote and underdeveloped regions—African countries being typical examples—where people's financial needs go unmet. According to the World Bank's 2023 annual report, only 28% of the population in African countries uses the internet, meaning over 70% lack access to modern, convenient financial services.

Citing data from The Global Findex Database 2021, the global personal account ownership rate stands at 76%, implying that 24% of the world’s population still lacks access to an individual account.

2. High Operating Costs of Traditional Bank Branches and ATMs

In sparsely populated remote areas and economically underdeveloped regions, establishing traditional bank branches involves high operational costs and low profitability. Using an ATM typically requires opening a personal account and obtaining a bank card at a branch first—creating a "chicken-and-egg" problem. Mobile money, by contrast, expands financial service coverage with minimal infrastructure investment, offering stronger inclusivity.

3. High Barriers to Mobile Banking and Third-Party Payment Services

Existing mobile banking and third-party payment services can be operated via mobile phones, but they all require users to have a personal bank account and linked debit or credit card. In economically underdeveloped regions, local communities may lack traditional bank branches altogether, making it impossible to access these services.

Given these three points, it becomes clear why seemingly outdated mobile money technology continues to serve large populations. Mobile money remains nearly the only inclusive financial service available in underdeveloped and remote areas.

Case Study: MTN MobileMoney

Before introducing Web3, I need to briefly explain the current operating model of mobile money.

MTN is Africa’s largest telecommunications operator, a multinational group providing services across 22 countries in Africa and the Middle East, serving 219 million users. Its mobile money service, MTN MobileMoney, is the most widely adopted mobile money platform in Africa, deployed in East and West African nations including Uganda, Cameroon, Ghana, Côte d’Ivoire, Rwanda, Benin, Nigeria, and Zambia.

Users register using their phone number, creating a mobile money account hosted by the telecom provider. Depositing cash at authorized agent outlets increases the balance of their mobile money account. Users can send money via their phones, and recipients receive an SMS from MTN enabling them to withdraw cash at an agent outlet after account verification. Users can also store funds in their accounts and use mobile money to pay bills or purchase goods at MTN partner institutions.

In terms of revenue, MTN primarily earns income from remittance transaction fees. When both sender and receiver are MTN MobileMoney users, the maximum fee is capped at $1. Agent outlets themselves cannot charge additional fees and earn only commissions paid by MTN based on deposit and withdrawal volumes.

Operationally, MTN’s network consists of three roles: custodian banks, super agents, and retail agents. Custodian banks hold customer funds, super agents (financial institutions or partners) manage and distribute mobile money liquidity to retail agents, while retail agents interact directly with users, assisting them with transactions and cash deposits/withdrawals.

Deficiencies of MTN MobileMoney

While mobile money fills a critical gap in financial inclusion for underdeveloped regions, there remains significant room for improvement. Three major shortcomings are evident:

1.Complex Processes and Heavy Reliance on Agents. Both account registration and deposit/withdrawal transactions require visiting retail agents, which are not as widespread as convenience stores like 7-Eleven. Without nearby agents or partner institutions, users cannot access services.

2.High Maintenance Costs. MTN currently operates over 20,000 retail agent outlets, many relying on manual processes. The high operational cost of maintaining this extensive network is itself a drawback in economically disadvantaged regions.

3.Supports Only Local Currency. Currently, MTN supports only local currency transactions and a very limited range of financial services such as basic insurance. Broader inclusive financial offerings remain inadequate—there are no savings accounts (current or fixed-term), nor advanced wealth management products.

Integrating Mobile Money with Web3

So what could integrating mobile money with Web3 bring? The advantages remain threefold:

1.Permissionless Inclusive Financial Network. Web3 eliminates the need for account applications and documentation. By binding a SIM card to a Web3 wallet address, users gain direct access to a decentralized account. They can connect seamlessly to the open financial ecosystem of Web3, accessing inclusive financial services through protocols like MakerDAO. Funds do not require centralized custodians—trust is achieved through open protocols.

2.Extremely Low-Cost Decentralized Ledger. Unlike MTN’s network of over 20,000 retail agents, integrating mobile money with Web3 allows ledger recording directly on blockchain, enabling fully decentralized inclusive financial services over the internet. With Layer2 technologies, transaction fees can be reduced well below $1.

3.Open Cross-Currency Financial Network. Supporting only local currency within existing mobile money systems is insufficient for true financial inclusion. In economically fragile environments—even facing regional financial collapse (e.g., Greece’s bankruptcy)—holding local currency can be disastrous for low-income individuals. Integrating Web3 into mobile money enables people to use compliant dollar-denominated digital currencies like USDC to hedge against local currency depreciation. Alternatively, they can invest in compliant RWA (Real World Assets) to preserve and grow their wealth.

Web3’s open finance offers borderless, diversified solutions for inclusive finance, yet it also brings challenges such as scams, rug pulls, and hacking—the so-called “dark forest” of Web3. Addressing these risks requires centralized oversight and curation. I do not believe Web3 should aim for a completely unregulated, fully decentralized utopia. Instead, involving appropriate regulatory bodies and financial institutions to support the Web3 open network may represent its true future—a balanced vision of Web3’s open financial ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News