Crypto Investment Guide: Quick Overview of 6 Promising Sectors to Position In

TechFlow Selected TechFlow Selected

Crypto Investment Guide: Quick Overview of 6 Promising Sectors to Position In

The current market rally is mainly driven by speculation around BTC spot ETFs, while the gains in Ethereum layer-2 public chains have been relatively modest.

Author: CRYPTO VIEW

This market rally started in mid-October, and we may call it a "compliance-driven mini bull run." The approval or rejection of ETFs is highly significant for BTC. We are now at a critical stage—though not yet officially approved. Once approved, substantial off-exchange capital will flood in.

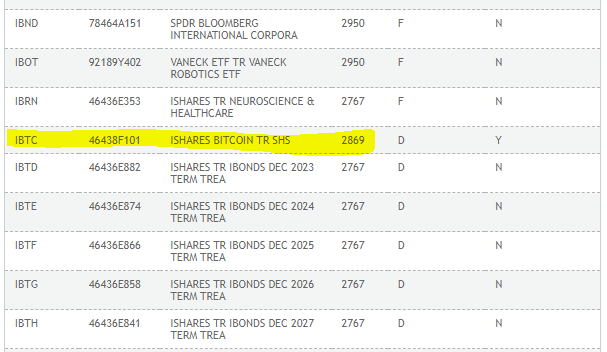

1. BlackRock's iShares Bitcoin Trust has been listed on the U.S. Depository Trust & Clearing Corporation (DTCC) under the ticker IBTC. (Note: this is a trust, not the ETF circulating on social media.)

2. A screenshot of a U.S. SEC regulatory filing indicates that the SEC has accepted Grayscale’s rule change application for the listing and trading of its Ethereum Trust (ETHE), marking a key step toward converting ETHE into an ETF.

3. Jennifer Rosenthal, spokesperson for Grayscale, stated after the conclusion of the court case on Monday: “The Grayscale team looks forward to continuing constructive collaboration with the SEC to convert GBTC into an ETF. GBTC is operationally ready, and we intend to act promptly on behalf of our investors.”

This market movement has not come easily. Regardless of whether ETF approvals ultimately go through, altcoins will experience a rotation-driven rally.

Currently, the most evident trend is the rise of blue-chip altcoins, primarily layer-1 blockchains. Almost every market cycle follows the same pattern: first BTC\ETH rise, then layer-1 chains follow, followed by broader sector catch-up rallies.

Currently strong layer-1 chains include SOL, LINK, MINA, and INJ, which have risen 28%, 35%, 89%, and 41% respectively.

Other notable performers among layer-1 chains are AAVE, FTM, APT, and MATIC, up 30%, 22%, 21%, and 20% respectively.

Newly launched chains such as Sei and Sui have shown weak performance so far, but may catch up later.

Regarding $CANTO, it currently functions similarly to $MKR and $FXS as an RWA coin. They also utilize the stablecoin $NOTE to bring treasury bill yields on-chain.

$CANTO has increased 16% over last week and 160% over the past month. TVL also grew 50% last month, reaching $61 million. Another major catalyst for Canto is its transition to becoming its own L2 using Polygon’s CDK. This could lead to a re-rating of the token. Treasury yields are expected to remain high in the foreseeable future, and projects enabling on-chain access to these yields should perform well. It has potential to be listed on Binance.

Since this rally is primarily driven by spot BTC ETF speculation, Ethereum layer-2 chains haven’t seen significant gains. In contrast, BTC layer-2 and related tokens have performed well.

RIF and STX led with increases of 83% and 30% respectively. STX saw larger gains in the previous cycle, but given its current top-50 market cap, its growth potential is more limited. RIF, ranked around #100 in market cap, offers greater upside potential. Additionally, BRC20 ecosystem tokens have also risen—ORDI and STAS, for example, gained 55% and 20% respectively. Other BRC20 tokens carry higher risk and won’t be discussed here.

The third strong sector this cycle is RWA, with POLYX leading the pack—up over 80% in the past seven days. Other tokens in this sector haven’t stood out, possibly due to few RWA projects currently listed on Binance. Established projects like MKR and SNX haven't seen large gains either. Consider monitoring RWA projects not yet listed on major exchanges, such as CFG, GFI, RIO, and CTC.

How should we position ourselves moving forward? Below are the altcoin sectors and projects we believe offer promising opportunities:

1. RWA Layer-1s: $LINK $CFG $MKR $FXS

2. AI Infrastructure: $RNDR $AKT

3. LSDfi: $EIGEN $PENDLE $HELIO

4. Modular Blockchains: $TIA (high probability of Binance launch)

5. BTC Ecosystem: RIF, STX, ORDI

6. L2s: ARB, OP

1. RWA

This year in the DeFi space, the RWA tokenization sector has performed exceptionally well, rising rapidly from 22nd to 8th place.

• Reports predict explosive growth in the RWA tokenization space, forecasting a staggering 26x increase by 2030, reinforcing this outlook.

• Building on this momentum, tokenized treasury bills are expected to play a pivotal role in shaping the stablecoin supply landscape in the coming years.

2. Artificial Intelligence Infrastructure

• The global chatbot market is projected to reach $5 billion by 2022, and large tech companies’ investments in AI further amplify this scale.

• As GPUs become essential, NVIDIA leads—but high costs drive demand for more cost-effective alternatives.

• Crypto projects offer alternative solutions with unique infrastructure and decentralized advantages.

3. LSDfi

• Of the $38B TVL in DeFi, liquid staking impressively accounts for half, accumulating a remarkable $19B.

• Binance and various venture capitalists have already recognized and highly valued the potential of LSDfi.

• Just as the "cloning" of liquidity in DeFi signaled a rapid rebound at the end of 2020 (known as DeFi Summer), LSDfi is poised to become a key driver of the next bull market.

4. Modular Blockchains

• Current rollups use a single sequencer, facing challenges related to censorship resistance, MEV, and interoperability between L2s.

• Developers are actively exploring numerous decentralized solutions, with multiple rollups emerging as leading contenders.

• Just as layer-2 solutions dominated discussions last year, the second half of this year is expected to focus on middleware addressing rollup challenges.

• Chainlink: CCIP tokenization

• Centrifuge: Coinbase’s choice

• Maker: King of Treasuries

• Frax Finance: L2 + LSD + RWA

• Render Network: Backed by OTOY

• Akash Network: AI Supercloud

• Eigenlayer: Restaking on Ethereum

• Pendle: Blue-chip LSDfi

• Helio: BNB’s chosen LSDfi infrastructure

• Celestia: King of Modularity

• Espresso Systems: Shared Sequencer

• dappOS: Intent-Centric

We believe the current market is not yet a full bull market—the environment isn’t favorable enough. However, given the current performance even within a bearish context, it’s already quite strong. Therefore, investors don’t need to chase perfect bottoms. Start positioning when the market feels dull. Trading is cyclical, and the four-year macro cycle remains unchanged. Regardless of how long this cycle lasts, a small bull market will still arrive before the halving in Q1 of next year!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News