Will broad-based gains arrive? What are the event-driven catalysts for Uptober ("Golden October")?

TechFlow Selected TechFlow Selected

Will broad-based gains arrive? What are the event-driven catalysts for Uptober ("Golden October")?

Grayscale has submitted a new registration statement to the SEC, aiming to convert its Grayscale Bitcoin Trust into a spot bitcoin ETF.

Written by: Aurelian

Compiled by: TechFlow

The market is experiencing a broad rally, with established giants like Link seeing significant price surges, and even the meme coin season appears to be making a comeback thanks to the frenzy around Hay. Let's take a look at what’s worth watching in the market.

Brief News

-

New York Attorney General Letitia James has filed a lawsuit against Gemini, Genesis Global Capital, and Digital Currency Group, accusing them of defrauding investors out of more than $1 billion.

-

The U.S. Securities and Exchange Commission (SEC) has withdrawn charges against Ripple executives Brad Garlinghouse and Chris Larsen, though the case against Ripple itself continues.

-

Grayscale has submitted a new registration statement to the SEC aiming to convert its Grayscale Bitcoin Trust into a spot Bitcoin ETF.

-

$HAY, created five years ago by the founder of Uniswap, has surged to nearly $4 million in value after the founder burned 99.99% of the supply, leaving only 56 tokens in circulation.

-

Recipients of the Celestia airdrop will see a substantial increase in their allocations following the reallocation of unclaimed tokens.

-

Two Reddit moderators may have sold tokens before Reddit officially announced the termination of its Community Points program.

-

The U.S. Treasury plans to designate international cryptocurrency mixers as money laundering hubs due to their use by terrorist organizations such as Hamas.

Catalysts This Week

-

Monday: Ziliqa Plunder Swap launch, BNB listing on Bitbank, NvirWorld third update release.

-

Tuesday: Seedify lists Openfabric, Beefy distributes BIFI tokens, Merit Circle announcements and keynote speech.

-

Wednesday: Concordium ecosystem update, Gods Unchained releases Tides of Fate, Terra Classic proposal.

-

Thursday: Stella incentive program begins, Magic opens token claims for 2021 users, Avalanche developer community call.

-

Friday: Floki staking plan goes live, Lords BIP-15 proposal vote, JUST 31st supply mining phase.

Market Conditions

-

A recent market shift triggered by a mistaken tweet from CoinTelegraph led to a breakout, pushing BTC toward the $35,000 mark. However, the sustainability of this rebound remains uncertain.

-

Following the market rally, investors are beginning to anticipate the imminent approval of a spot Bitcoin ETF, realizing they may not have allocated enough capital to BTC. Many believe the ETF could be approved before year-end.

-

Despite recent developments, the Fear and Greed Index and other sentiment indicators still reflect a lack of bullish sentiment among investors. Many remain cautious, possibly due to skepticism about the current market surge.

-

Notably, Bitcoin's dominance is steadily increasing, indicating a significant inflow of liquidity into BTC.

-

Investors appear to favor BTC, allocating most of their funds to it while showing limited interest in other cryptocurrencies.

-

Although some altcoins have shown positive performance, overall market dynamics seem misaligned with sustained rallies in other coins over the short term.

-

Key factors that could dampen this rally include the introduction of major regulatory measures or a potential downturn at Binance.

-

Notably, market participants seem to have anticipated these events, and investors are preparing to mitigate their impact.

Industry Developments

-

The SEC has obtained a default judgment against Thor Technologies and its founder David Chin, related to allegations of conducting an unregistered offering of crypto asset securities worth $2.6 million.

-

Binance has formed partnerships with new fiat providers to enable euro transactions, including deposits and withdrawals. The new agreements aim to offer a range of fiat services to Binance users following the termination of its previous euro banking partner, Paysafe.

-

Coinbase has chosen Ireland as its European MiCA hub, allowing the exchange to serve 450 million people across 27 countries under a unified regulatory framework. Ireland’s favorable political environment and regulatory infrastructure played a key role in this decision.

-

U.S. Senator Elizabeth Warren is demanding detailed plans from senior officials to address terrorism risks posed by cryptocurrencies.

-

DCG issues a statement regarding the civil lawsuit filed by NYAG.

-

Mike Novogratz believes the SEC will approve a spot Bitcoin ETF before the end of this year.

-

Recent tweets from Van Eck appear to suggest that a spot BTC ETF is imminent.

-

A new Ethereum Improvement Proposal is being introduced to enhance tokenized vault standards for real-world assets.

-

The European Central Bank (ECB) has announced it will enter the “preparation phase” of the “digital euro project,” following a two-year investigation.

-

Finland is working on developing instant payment solutions using the digital euro.

Project Updates

-

Total value locked (TVL) on Gnosis Chain has doubled since early October, reaching $150 million, driven by a surge in network activity and fees. This growth is attributed to a $50 million stablecoin transfer to Gnosis Chain, where users are leveraging MakerDAO’s Spark lending protocol to earn yields exceeding 7%.

-

Lightning Labs has launched its Taproot Assets protocol on mainnet. The protocol enables the issuance of stablecoins and other assets on Bitcoin and the Lightning Network, providing developers with tools to expand Bitcoin into a multi-asset network while maintaining scalability and preserving Bitcoin’s core values.

-

Ethereum co-founder Joseph Lubin and ConsenSys are facing a lawsuit filed by over two dozen former employees.

-

Aptos Network experienced a five-hour outage.

-

Magic Eden temporarily suspended BRC-20 trading.

-

MultiversX (EGLD) rose nearly 10% after announcing a partnership with Google Cloud’s AI and data analytics tools at its xDay conference.

-

Coinbase has announced its intention to support the dYdX Chain validator launch.

-

According to recent reports, Infura tokens may be coming soon.

-

Gasless approvals are now available on Cow Swap.

-

SuperDao has announced its shutdown and plans to return remaining funds to investors.

Data

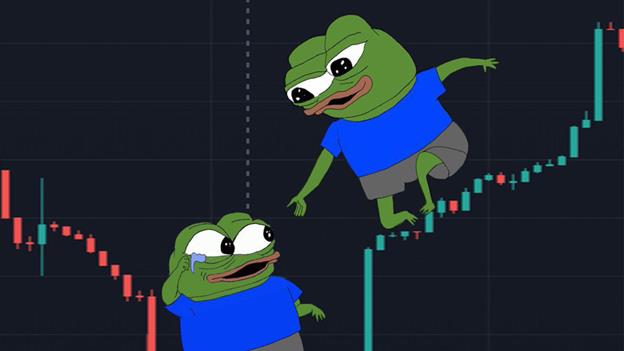

What VCs Are Doing: For the third consecutive quarter, startups in the trading, exchange, investment, and lending sectors received the largest share of venture capital funding, totaling $611 million—accounting for 32.5% of all VC investments during this period.

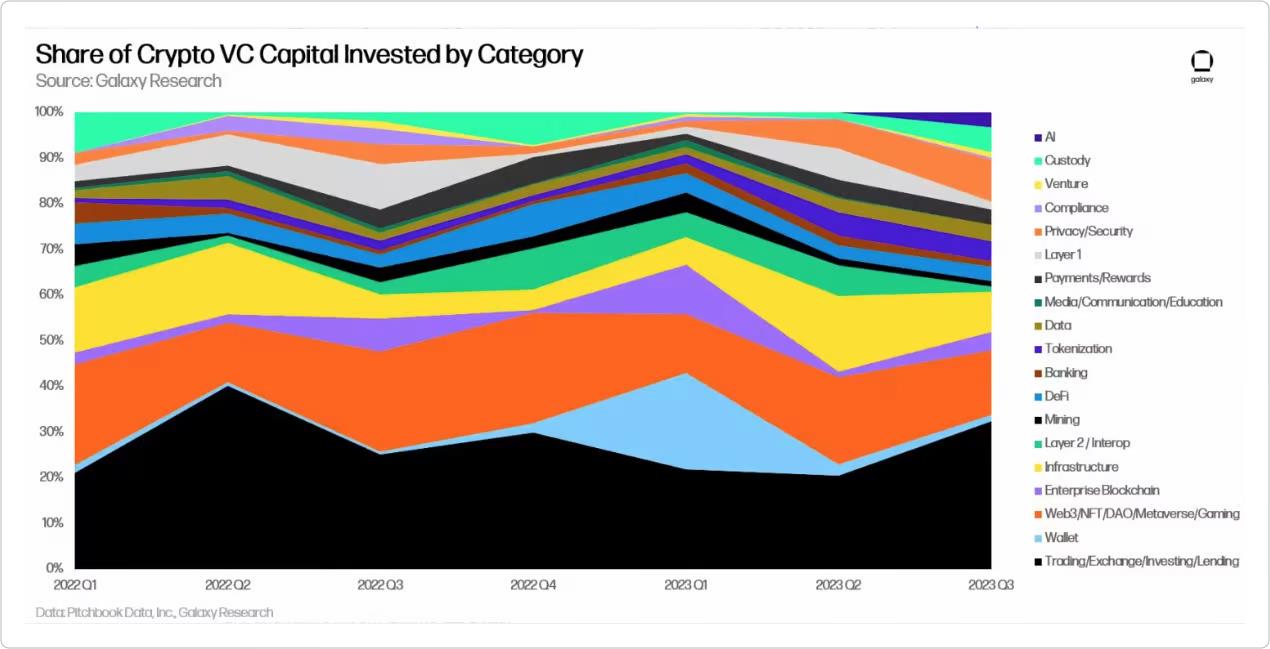

Scarce Resource: The amount of BTC untouched for over ten years is approaching 3 million, roughly 15% of BTC’s total circulating supply. This trend has been steadily rising, contrasting sharply with the amount of BTC held on exchanges, and signaling a significant future shift in BTC supply dynamics.

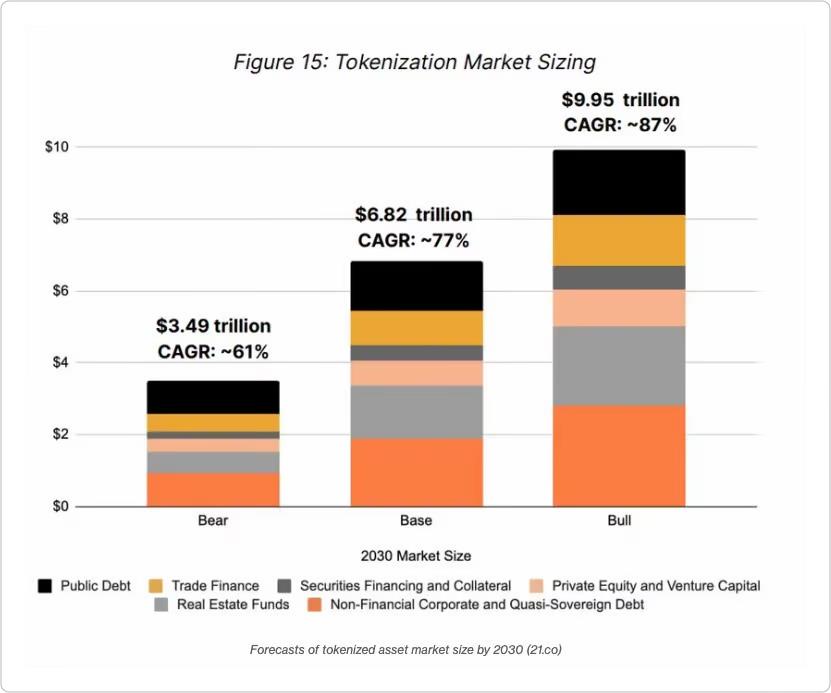

A $10 Trillion Market by 2030: According to recent research by 21.co, the tokenized assets market is projected to reach between $3.5 trillion (bear case) and $10 trillion (bull case) by 2030, driven by traditional financial institutions adopting blockchain technology.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News