Friend.Tech Revelation: The Success of Crypto Applications Doesn't Necessarily Depend on Crypto Infrastructure

TechFlow Selected TechFlow Selected

Friend.Tech Revelation: The Success of Crypto Applications Doesn't Necessarily Depend on Crypto Infrastructure

The value of the crypto community may exceed the foundational value of the cryptographic infrastructure on which it relies.

Written by: Jack Niewold

Compiled by: TechFlow

Even those passively observing crypto have likely seen the recent explosion of the social Web3 app friend.tech. The mobile-based app is simple— you buy a Key to enter a specific chat room. Room owners are typically content creators, influencers, traders, or other prominent community members. When people buy a creator's Key, the price of that Key goes up.

Likewise, if people sell Keys, the price of a given Key drops. Below are some of the top creators on the platform—you might recognize a few. The largest creator on the platform is Twitter user Vombatus, with a market cap of around $1.6 million: an astonishing figure for a chat app.

friend.tech’s success stems partly from its viral social nature and partly from its Ponzi-like mechanics where early adopters win the most. The team incentivized growth through airdrops and by distributing "points" to traders, which are theoretically redeemable for free tokens—further fueling platform expansion.

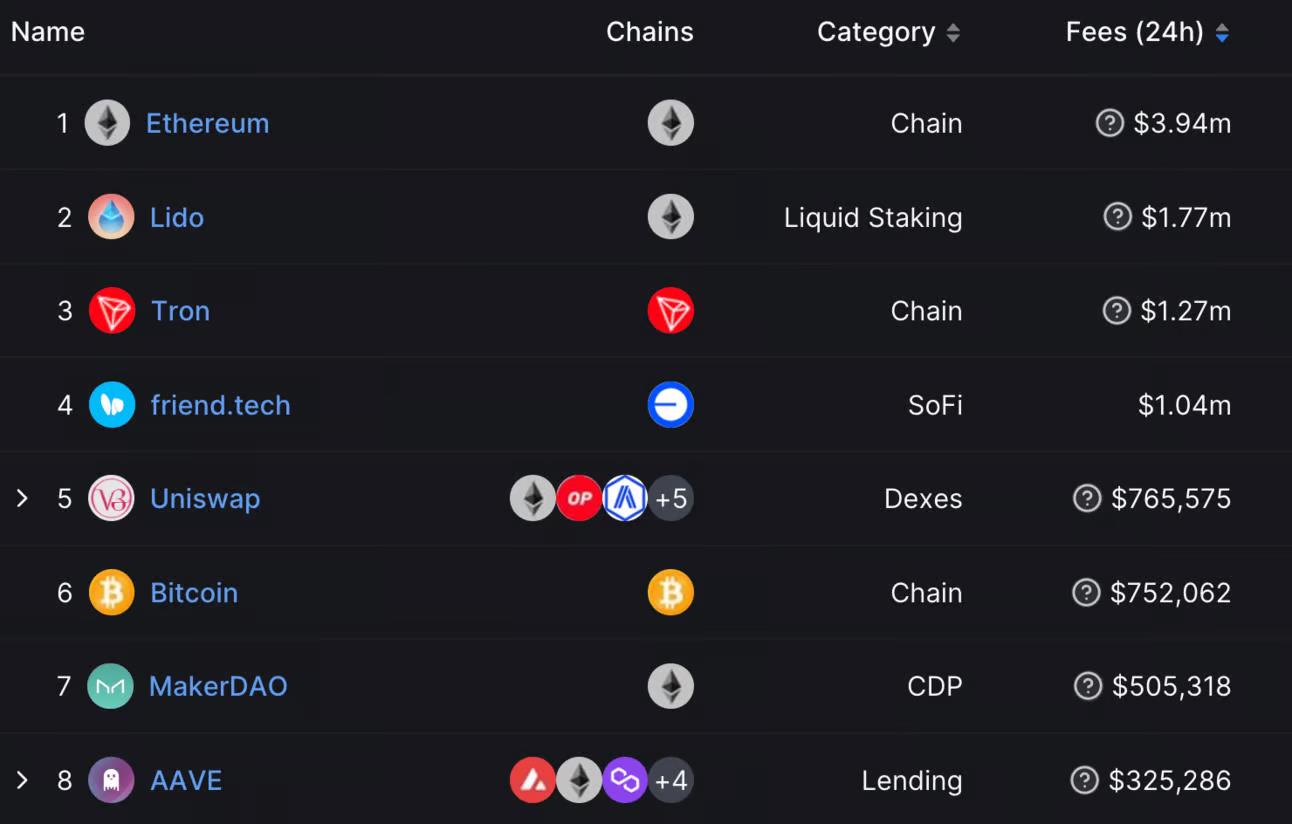

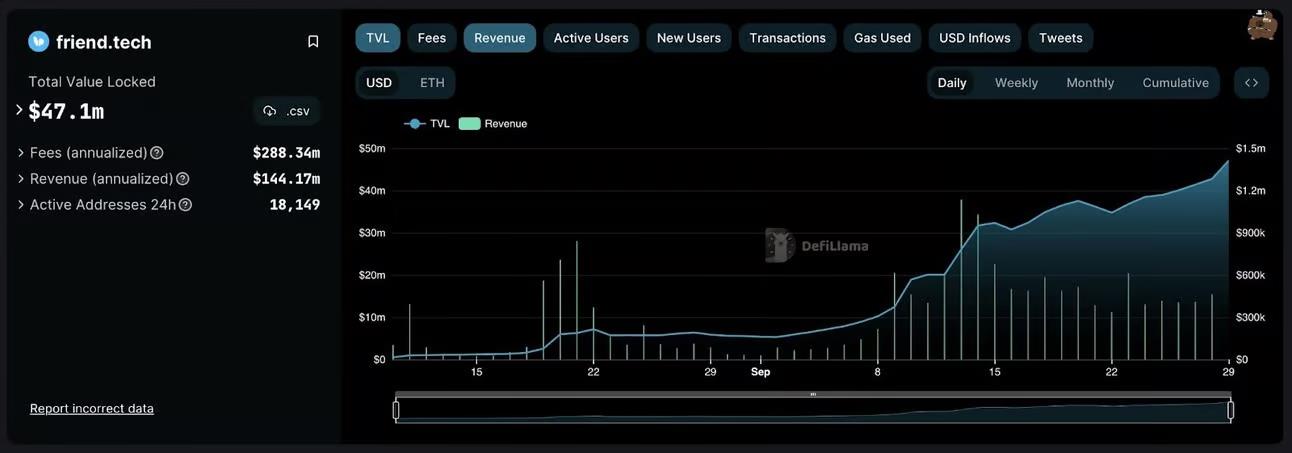

Compared to blue-chip decentralized platforms like Aave and Uniswap, friend.tech’s fundamentals look impressive. In the past 24 hours, friend.tech outperformed all decentralized applications in fees except Lido; it also surpassed all Layer 1 networks except Ethereum and TRON.

Yet when I step back, one question arises: friend.tech doesn’t need to rely on crypto infrastructure. Why? A savvy team could quickly build the same infrastructure on a mobile app using Stripe for payments, with Keys circulating between buyers and sellers just like in-game economies.

Of course, you could argue factors like regulation, securities laws, or anonymous founders.

But undeniable fact remains: friend.tech achieved wild, viral success. Is there a contradiction here? Do crypto applications really need crypto infrastructure?

I believe friend.tech’s success can be summarized as:

The value of the crypto community may exceed the foundational value of the crypto infrastructure itself.

What unlocks value in friend.tech isn’t immutable blockchains, NFTs generating $50 million in fees, sovereign ownership, or anonymity—it’s the direct value provided by users and creators on the app. Cryptocurrency merely provides a foundation.

And that’s okay: we can move beyond blockchain’s “hard” value propositions and acknowledge the hundreds of billions in social capital present within the crypto space. Many sharp technologists and investors advise young people to work in industries that attract massive human capital—and crypto is certainly one of them.

The value proposition of the crypto ecosystem has evolved: initially, crypto relied on “hard” values—stateless money, permissionless finance, self-custody. This attracted early technical experts and financial hardliners who brought layers of intellectual and social capital.

Today, value has shifted toward crypto’s social layer—the ability to access an ecosystem of millions of smart individuals drawn in by those original hard value propositions. At launch, friend.tech was built precisely for such a community. As a crypto-native app, it came pre-equipped with payment structures, digital infrastructure, distribution, go-to-market strategy, and an entire content plan. It’s hard to imagine friend.tech achieving its current success without the support of the crypto community.

But crypto’s ultimate value extends far beyond this: I believe, eventually, crypto will evolve into a broad platform hosting tools similar to Wordpress, Stripe, YouTube, and Shopify.

Analogous but crypto-native versions of these tools can all be built atop crypto infrastructure—as the infrastructure improves and people begin to realize that crypto is a strong platform beyond its “hard” utilities, I expect a whole suite of consumer-facing applications to emerge in the space.

Meanwhile, as we see with friend.tech, the utility of these apps has little to do with original crypto functionalities, and much more in common with the large consumer-facing applications that generate trillions in value within traditional financial markets.

Ideally, these users would eventually embrace crypto’s core value propositions themselves. But as friend.tech demonstrates, we don’t need to leverage crypto’s specific features to bring crypto into the mainstream.

We just need good products—crypto provides the launchpad.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News